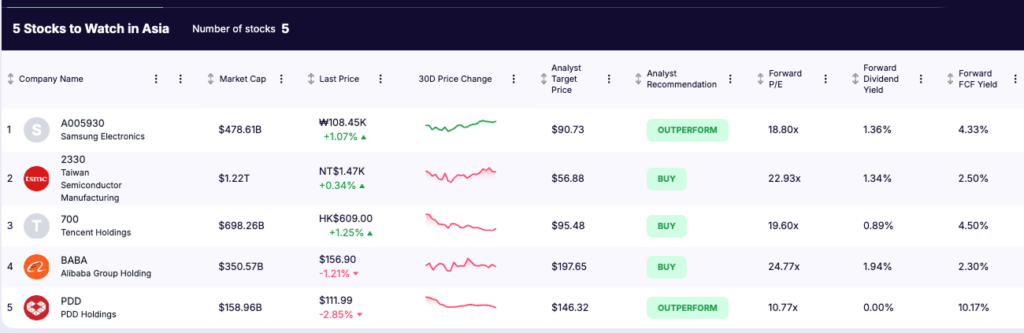

Asia’s technology and consumer sectors are moving into a new stage of growth as AI adoption accelerates, semiconductor capabilities expand, and digital platforms strengthen their hold on everyday economic activity. The region’s progress is no longer driven only by manufacturing or broad internet penetration. It is increasingly shaped by companies that provide the compute power, cloud infrastructure, payment systems and commerce networks that modern digital economies depend on.

The most compelling opportunities for 2026 come from businesses that enable this shift. These companies benefit from structural demand that tends to grow through cycles: the need for more advanced chips, faster memory, higher-quality digital services and more efficient e-commerce logistics. Their competitive edges are built on technology leadership, massive user ecosystems and the ability to turn data and scale into recurring revenue.

Against this backdrop, five companies stand out as central to Asia’s next phase of development. They supply the hardware that powers AI, the platforms that shape consumer behavior and the commerce models redefining global retail. These are the stocks to watch in 2026.

Key Takeaways

- Asia’s technology foundation is shifting toward AI-intensive workloads, strengthening demand for leaders in advanced semiconductors and memory such as TSMC and Samsung Electronics.

- Digital platforms are consolidating user engagement, payments and cloud services, which supports long-term monetization for ecosystem operators like Tencent and Alibaba.

- E-commerce is becoming increasingly logistics- and data-driven, creating advantages for efficiency-focused models such as PDD Holdings, which continue to gain global scale.

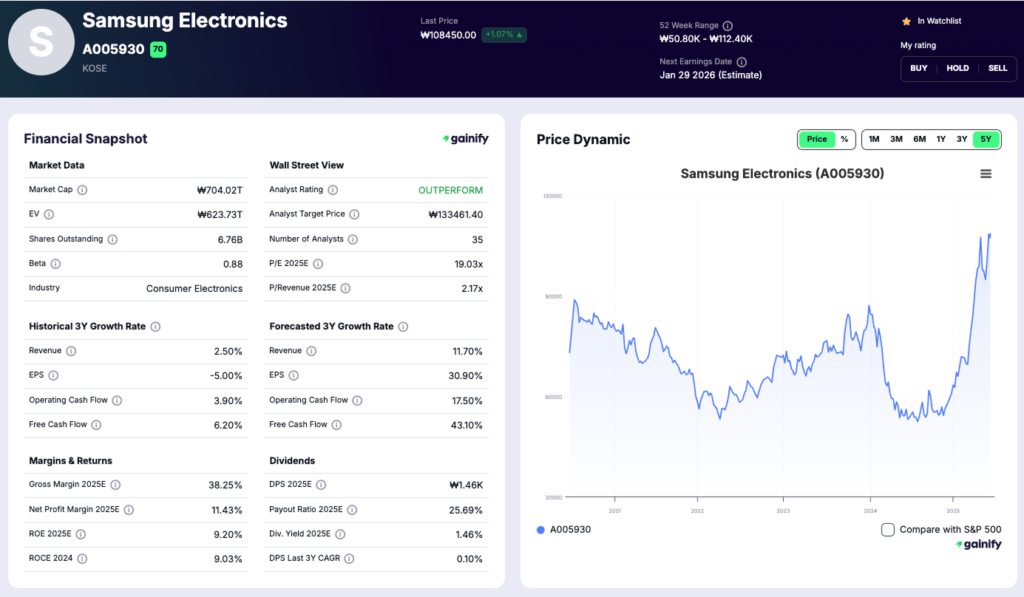

1. Samsung Electronics (A005930)

Market Cap: 478.61 billion USD

Forward P/E: 18.80x

Forward Dividend Yield: 1.36%

Forward FCF Yield: 4.33%

Theme: AI memory, foundry scale, premium devices

Samsung remains one of the most strategically important hardware suppliers in Asia’s technology ecosystem. Its memory division reported record-high quarterly results, supported by strong demand for HBM3E and DDR5 server products tied to expanding AI workloads. Profitability improved as pricing strengthened and earlier inventory adjustments diminished, creating a more stable earnings base heading into 2026.

Beyond memory, Samsung advanced its foundry roadmap by moving its first generation 2 nm GAA process into mass production. This step enhances its positioning in advanced-node manufacturing at a time when global compute requirements are accelerating. The company also benefits from a diversified product portfolio, with premium mobile devices, OLED displays, consumer electronics and automotive technology (including Harman) contributing additional stability and long-term relevance.

Samsung Highlights

- Record-high quarterly memory revenue supported by AI server demand

- Clear improvement in memory profitability with stronger pricing and improved mix

- First generation 2 nm GAA process moved into mass production

Investment Thesis

Samsung offers direct exposure to the global build-out of AI compute capacity. Its leadership in advanced memory and progress in next-generation foundry technology support a multi-year earnings expansion opportunity. The breadth of the company’s product ecosystem provides diversified revenue streams that reinforce long-term resilience.

Risks

Memory pricing is inherently cyclical and can create meaningful variability in quarterly profitability. Execution in advanced-node foundry manufacturing must remain strong to compete effectively with leading peers. Consumer electronics demand, including smartphones and displays, can soften during global downturns and pressure results.

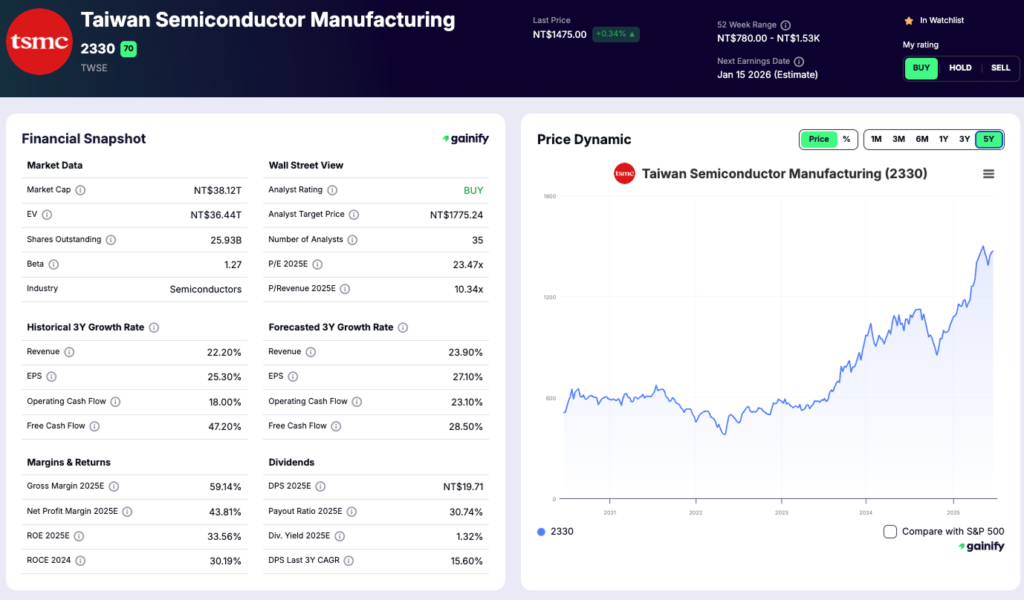

2. Taiwan Semiconductor Manufacturing Company (2330)

Market Cap: 1.22 trillion USD

Forward P/E: 22.93x

Forward Dividend Yield: 1.34%

Forward FCF Yield: 2.50%

Theme: advanced-node leadership, AI compute, semiconductor scaling

TSMC remains the most important manufacturer in the global semiconductor supply chain. Its performance is increasingly driven by high-performance computing, with advanced nodes sustaining strong demand from AI accelerators, cloud infrastructure and leading-edge smartphone platforms. Management highlighted robust momentum in its 3 nm and 5 nm technologies, supported by a broad base of committed customers and healthy utilization rates across advanced lines. Recent financial disclosures show that revenue mix continues shifting toward AI-related workloads, reinforcing TSMC’s central role in enabling global compute expansion.

The company’s operational consistency stands out. Gross margins have benefited from a higher contribution of advanced processes, while disciplined cost control and process efficiencies have strengthened overall profitability. With capacity expansions aligned to multi-year customer roadmaps, TSMC enters 2026 with strong visibility in both volume and pricing across its most advanced technologies. Its scale, yield reliability and manufacturing depth remain unmatched within the industry.

TSMC Highlights

- High-performance computing maintained strong growth with advanced nodes supporting AI demand

- 3 nm and 5 nm technologies continued to ramp with solid customer commitments and healthy utilization

- Margin performance improved, supported by advanced-node mix and operational efficiency

Investment Thesis

TSMC offers the clearest and most durable exposure to the global shift toward AI-intensive computing. Its leadership in advanced process technology, strong customer alignment and manufacturing scale create a competitive moat that remains extremely difficult to replicate. As AI workloads deepen and diversify, TSMC is positioned to capture substantial value across multiple generations of compute.

Risks

The company faces concentrated geographic exposure, which could amplify operational or geopolitical disruptions. Execution in advancing beyond 3 nm and sustaining yield leadership is critical to maintaining pricing power. Demand fluctuations from major customers can influence utilization and near-term margin performance.

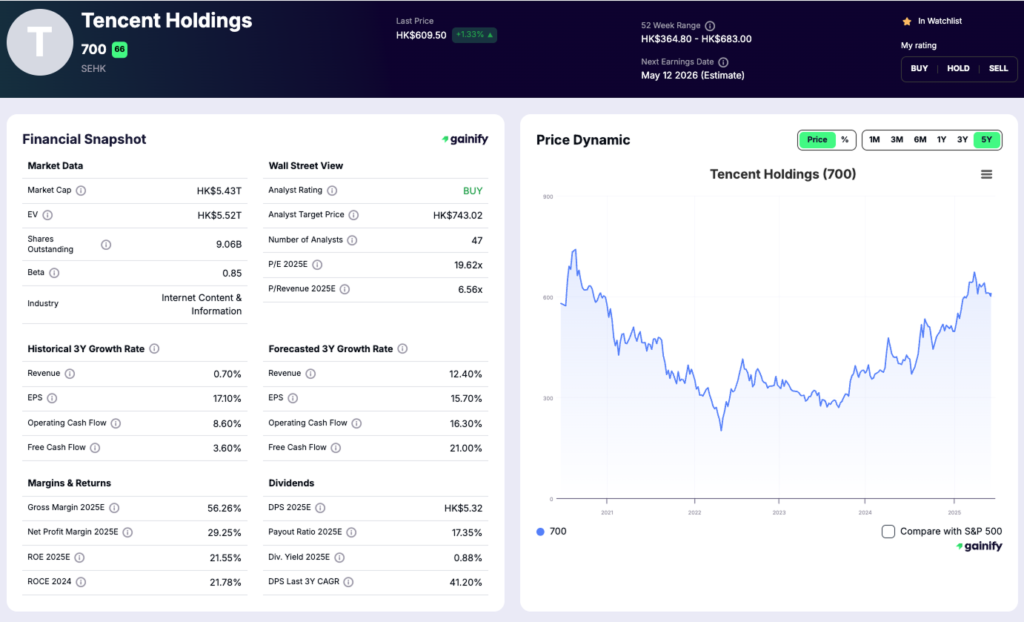

3. Tencent Holdings (700)

Market Cap: 698.3 billion USD

Forward P/E: 19.60x

Forward Dividend Yield: 0.89%

Forward FCF Yield: 4.50%

Theme: AI-enhanced digital ecosystem, gaming strength, payments and cloud scale

Tencent remains one of Asia’s most influential digital platforms, with an ecosystem that spans communication, entertainment, payments and cloud services. In the most recent quarter, the company delivered broad-based revenue growth supported by stronger engagement across Weixin, improved advertising performance and continued momentum in domestic and international gaming. Management emphasized the rapid integration of AI capabilities across Video Accounts, Mini Shops and content services, which is improving discovery, conversion and overall user activity inside the Weixin ecosystem.

Gaming remained a major driver, with key franchises sustaining strong activity levels. Honor of Kings benefited from successful IP collaborations, while Delta Force and Valorant delivered solid growth, supported by new content releases and expanding user participation. Internationally, Tencent recorded higher receipts from Supercell titles and new console and PC launches, reinforcing the strength of its global portfolio.

Tencent Highlights

- Mid-teens revenue growth supported by domestic and international gaming, advertising and fintech activity

- Weixin ecosystem enhanced by AI-driven recommendation, summarization and search features that increased engagement and GMV

- International gaming portfolio strengthened by new releases and expanded Supercell contributions

Investment Thesis

Tencent offers diversified exposure to Asia’s digital economy through social engagement, gaming, advertising, payments and cloud services. The company’s scale and data depth provide a strong foundation for deploying AI across content surfaces, commerce flows and service interactions. As these capabilities expand, Tencent is positioned to reinforce monetization while maintaining stable cash generation and a resilient multi-segment growth profile into 2026.

Risks

Regulatory oversight in China can affect gaming approvals, fintech operations and content policies. Competition in video, cloud and short-form entertainment markets may pressure user time and monetization. Consumer and advertising businesses remain sensitive to macro conditions, which can create periods of earnings volatility.

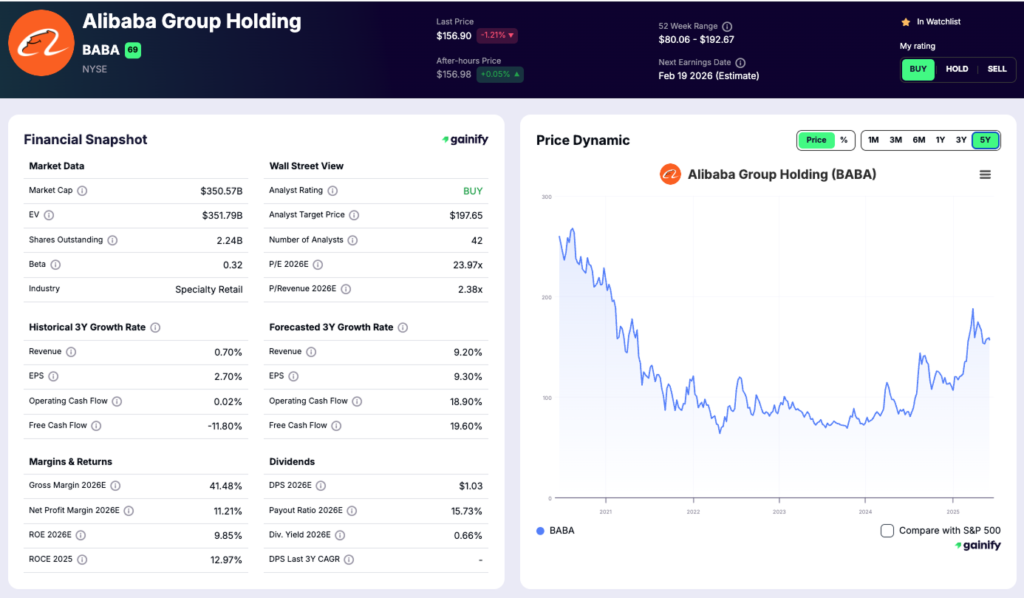

4. Alibaba Group (BABA)

Market Cap: 192.45 billion USD

Forward P/E: 12.32x

Forward Dividend Yield: 1.22%

Forward FCF Yield: 10.40%

Theme: AI-enabled cloud, scaled commerce, logistics and ecosystem monetization

Alibaba enters 2026 with renewed strategic clarity across its two strongest engines: AI cloud infrastructure and consumer commerce. In the most recent quarter, the Cloud Intelligence Group delivered rapid expansion, with revenue growth accelerating and AI-related products achieving triple-digit year-over-year performance. Management highlighted a significant increase in demand from external customers as enterprises adopt AI computing, model training and industry-specific cloud solutions. On the consumption side, Alibaba reported solid revenue progress across its e-commerce businesses, supported by higher take rates, improved user experience and stronger engagement on Taobao and Tmall.

The company also made notable advances in its quick commerce strategy. Order volume increased sharply following the rollout of Taobao Instant Commerce, while logistics efficiency and customer retention improved unit economics across the platform. Growth in customer management revenue reflected improved merchant tools and marketing capabilities, and Alibaba continued to expand its high-value consumer base, with the 88VIP segment growing at a double-digit rate. This combination of stronger cloud momentum, healthier commerce economics and improved cost discipline positions Alibaba for a more durable earnings foundation heading into 2026.

Alibaba Highlights

- Cloud Intelligence revenue grew rapidly, supported by significant AI-product demand and stronger external customer adoption

- Quick commerce achieved substantial order growth with improving fulfillment efficiency and unit economics

- Customer management revenue increased, driven by higher take rates and improved engagement across Taobao and Tmall

Investment Thesis

Alibaba provides a balanced mix of structural cloud growth and scaled commerce monetization, supported by one of the deepest logistics and data ecosystems in Asia. The company’s AI cloud offerings give it strategic exposure to enterprise digital transformation, while improved platform efficiency strengthens the core e-commerce business. With a discounted valuation and visible earnings levers across cloud, commerce and logistics, Alibaba enters 2026 with multiple catalysts for margin recovery and long-term growth.

Risks

Competition in China’s e-commerce market remains intense and requires ongoing investment to protect user engagement and merchant relationships. Cloud demand can fluctuate with enterprise spending cycles and may create short-term variability in revenue growth. Regulatory or policy developments in China’s digital and data sectors may affect operational flexibility.

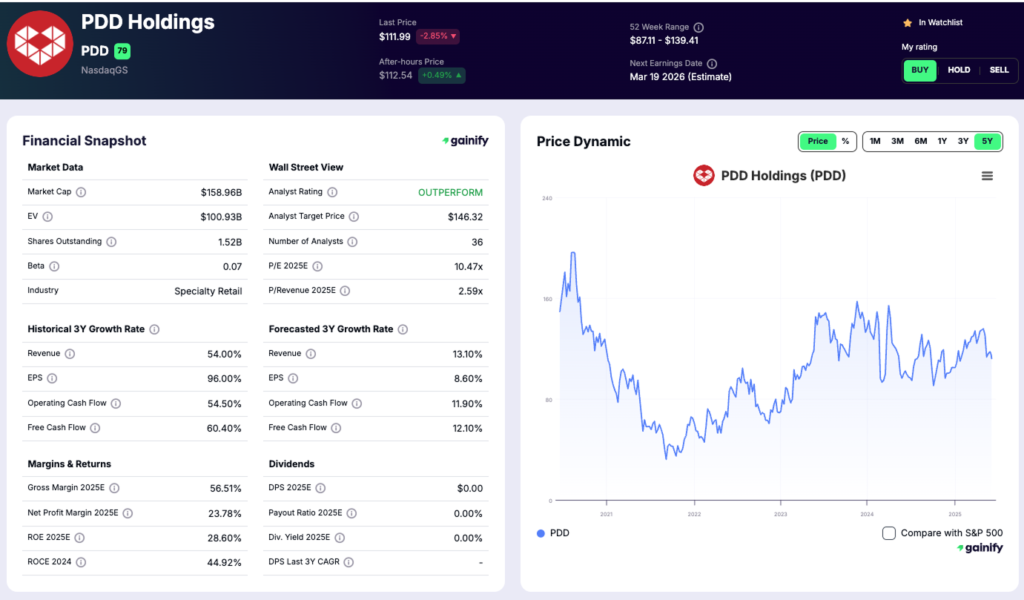

5. PDD Holdings (PDD)

Market Cap: 310.52 billion USD

Forward P/E: 25.93x

Forward Dividend Yield: No dividend is expected

Forward FCF Yield: 4.23%

Theme: efficiency-led commerce, global expansion, supply-chain scale

PDD has emerged as one of Asia’s most structurally advantaged commerce platforms, defined by its rigorous focus on cost efficiency, supply-chain integration and consumer value. In the most recent quarter, the company delivered steady topline growth and a meaningful increase in net income, reflecting disciplined operating expenses and strong marketing and transaction-service performance. Management emphasized continued reinvestment in ecosystem capabilities, including merchant tools, logistics coordination and platform trust, all designed to sustain long-term user engagement and global scalability.

Temu remained a central growth engine as PDD expanded its global footprint and strengthened cross-border fulfillment networks. The platform continued to benefit from its data-driven merchandising model, which improves matching between buyers and suppliers while lowering transaction friction across markets. Combined with strong operating cash flow and a consistent reinvestment philosophy, PDD enters 2026 with significant competitive momentum both in China and abroad.

PDD Highlights

- Revenue growth supported by strong performance in marketing and transaction services

- Net income increased year over year, reflecting disciplined cost execution and higher operating leverage

- Temu’s global expansion advanced, supported by improvements in supply-chain coordination and platform efficiency

Investment Thesis

PDD offers one of the clearest expressions of efficiency-led commerce in Asia. Its data-centric operating model, integrated supplier relationships and global logistics development create a scalable advantage that supports sustained growth. As the company broadens its international presence and strengthens merchant infrastructure, PDD has the potential to remain one of the region’s highest-growth large-cap platforms heading into 2026.

Risks

International expansion exposes the company to regulatory and policy uncertainty, particularly in developed markets. Competitive intensity in both domestic and global e-commerce may require elevated reinvestment to maintain share. Consumer sentiment and discretionary spending patterns can influence order volumes and margin trends.