Warren Buffett’s six-decade career has redefined value investing and shaped how generations of investors think about risk, reward, and patience. As chairman and CEO of Berkshire Hathaway, he has transformed a struggling textile mill into a global holding company with interests in insurance, railroads, utilities, manufacturing, retail, and an equity portfolio worth hundreds of billions of dollars.

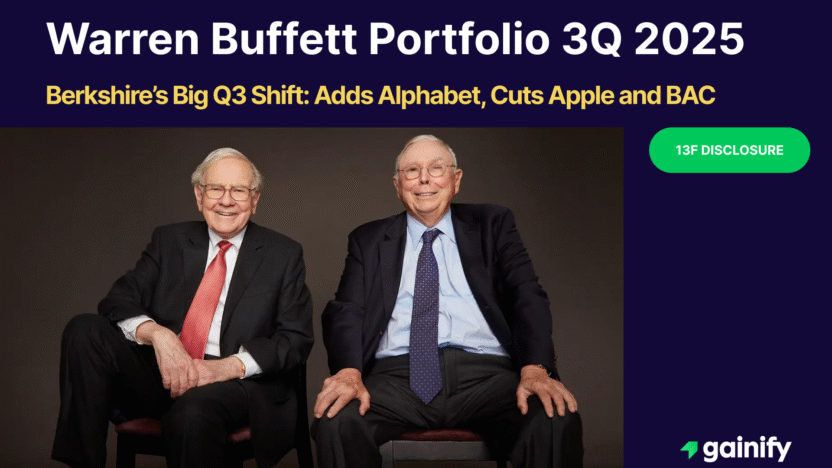

The Q3 2025 13F filing shows that even at 94 years old, Buffett is still making decisive moves. This quarter he added a major new position in Google, trimmed long-held stakes in Apple and Bank of America, and fully exited D.R. Horton. Smaller reductions in names like VeriSign underline the same cautious approach.

The bigger picture is even clearer. Berkshire’s equity allocation has fallen toward multi-year lows, while cash and short-term investments have surged past 381 billion dollars. It is a classic Buffett posture: stay patient, hold liquidity, and wait to act only when the odds are unmistakably in his favor.

Buffett has announced that he will step down as CEO at the end of 2025. This transition marks the close of a defining chapter in modern capitalism. His influence on Berkshire’s culture, from capital allocation discipline to long-term thinking, ensures that his investment approach will continue to guide the company long after his departure.

Who Is Warren Buffett

Warren Buffett was born in 1930 in Omaha, Nebraska, the city that has remained his lifelong home. His interest in business began early. At age 11, he bought his first stock, Cities Service Preferred, and learned a lesson he would carry throughout his career: patience matters. By age 16, he had built a small fortune running paper routes and investing in pinball machines.

After graduating from the University of Nebraska, Buffett earned his graduate degree in economics from Columbia Business School, studying under Benjamin Graham, author of The Intelligent Investor. Graham’s value investing principles left a lasting mark, but Buffett added his own twist. While Graham looked for undervalued companies regardless of quality, Buffett sought businesses that were not only underpriced but also had durable competitive advantages.

In 1965, Buffett took control of Berkshire Hathaway. Over the next six decades, he used it as a vehicle to acquire outstanding companies such as GEICO, BNSF Railway, and Dairy Queen, and to make strategic equity investments in giants like Apple, Coca-Cola, and American Express. His plainspoken style and knack for simplifying complex financial concepts made him both an elite capital allocator and a trusted public voice. As he often says, “You don’t have to be smarter than the rest, you have to be more disciplined than the rest.”

Buffett’s Investment Philosophy

Buffett’s philosophy rests on a few core beliefs. The first is to treat stock ownership as owning part of a real business rather than a trading chip. This mindset shifts the focus from short-term price swings to long-term business performance. The second is to buy companies with a sustainable competitive edge, or what he calls a “moat,” that protects them from competition. The third is to purchase those companies at a fair or undervalued price to build in a margin of safety.

He is famously patient, saying, “The stock market is designed to transfer money from the active to the patient.” If a stock does not meet his criteria, he is willing to wait years for the right opportunity. That patience is matched by discipline in capital allocation. When markets are expensive, Buffett prefers to hold cash rather than stretch for returns, even if it means Berkshire’s equity exposure falls well below historical averages.

Buffett also avoids complexity he cannot fully understand. He focuses on sectors where he can reasonably predict long-term outcomes, such as consumer goods, financial services, and select technology companies. Once he invests, he prefers to hold indefinitely, provided the business continues to perform and the management remains capable. This explains why Berkshire’s top holdings often remain in place for decades.

Q3 2025 Changes in Detail: Berkshire’s Equity Portfolio

Berkshire Hathaway’s Q2 2025 SEC Form 13F shows the following key moves:

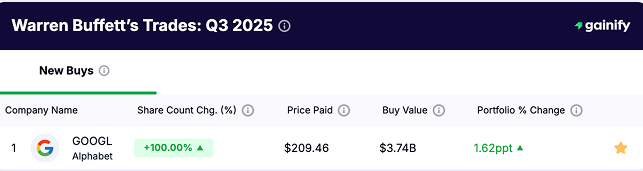

1. New Buy: Alphabet (GOOGL) — A Rare Buffett Tech Addition

- Shares purchased: 100 percent increase (new position)

- Buy value: 3.74 billion dollars

- Price paid: 209.46 dollars

- Portfolio weight change: +1.62 percentage points

Alphabet becomes Berkshire’s most significant new technology investment since Apple.

Why Google?

• Enormous free cash flow engine

• High return on capital

• Dominant market share in search

• AI scale advantages

• Attractive valuation earlier in the year (P/E was below 22 in July)

Buffett has long admired Google but historically avoided it because he felt he missed the early opportunity. This new position suggests Berkshire sees Google as undervalued relative to its competitive durability.

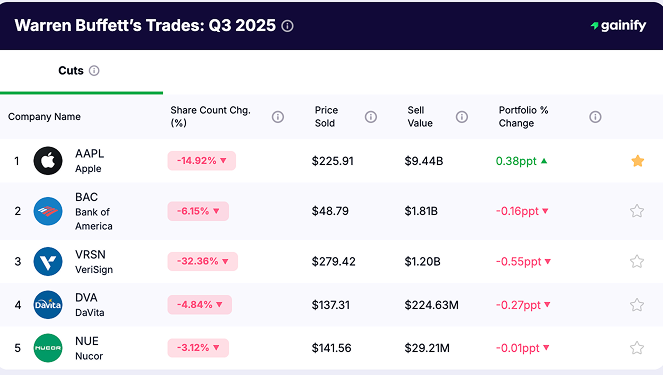

2. Trims to Core Holdings

- Apple (AAPL)

- Share count reduced by 14.92%

- 9.44 billion dollars in stock sold

- Portfolio weight increased by +0.38ppt (due to price appreciation)

- Bank of America (BAC)

- Share count reduced by6.15%

- 1.81 billion dollars in stock sold

- Portfolio weight decreased by 0.16ppt percentage points

- VeriSign (VRSN)

- Share count change: –32.36%

- Sell value: 1.20 billion dollars

- Portfolio % change: –0.55ppt

- DaVita (DVA)

• Share count change: –4.84%

• Sell value: 224.63 million dollars

• Portfolio % change: –0.27ppt

The adjustments reduce exposure to two of Berkshire’s most valuable holdings while realizing substantial profits. Despite the trims, both Apple and Bank of America remain cornerstones of the portfolio, reflecting continued long-term confidence in their fundamentals.

3. Complete Exit: D.R. Horton (DHI)

- Share count change: –100%

- Sell value: 233.59 million dollars

- Portfolio % impact: –0.07ppt

Buffett fully closed out the homebuilder trade he initiated in 2023, likely capturing significant gains.

Top 10 Holdings: Q3 2025 Equity Portfolio

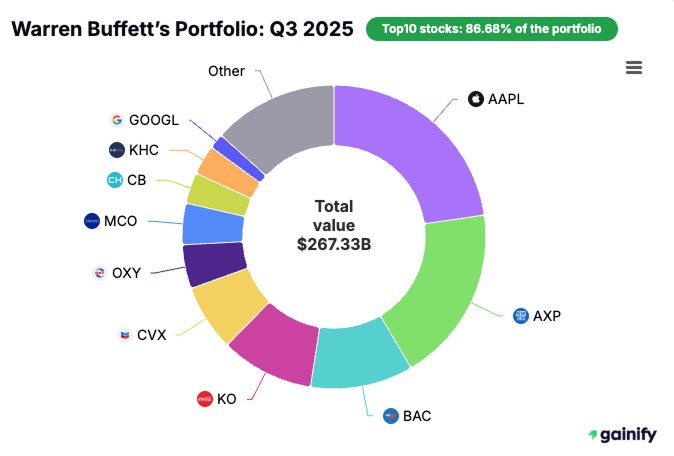

As of September 30, 2025, Berkshire’s equity portfolio was worth 267.33 billion dollars spread across 41 holdings. The top ten account for 86.68 percent of the total:

- Apple (AAPL) | 60.66B | 22.69%

- American Express (AXP) | 50.36B | 18.84%

- Bank of America (BAC) | 29.31B | 10.96%

- Coca-Cola (KO) | 26.53B | 9.92%

- Chevron (CVX) | 18.96B | 7.09%

- Occidental Petroleum (OXY) | 12.52B | 4.68%

- Moody’s (MCO) | 11.75B | 4.40%

- Chubb (CB) | 8.84B | 3.31%

- Kraft Heinz (KHC) | 8.48B | 3.17%

- Alphabet (GOOGL) | 4.34B | 1.62%

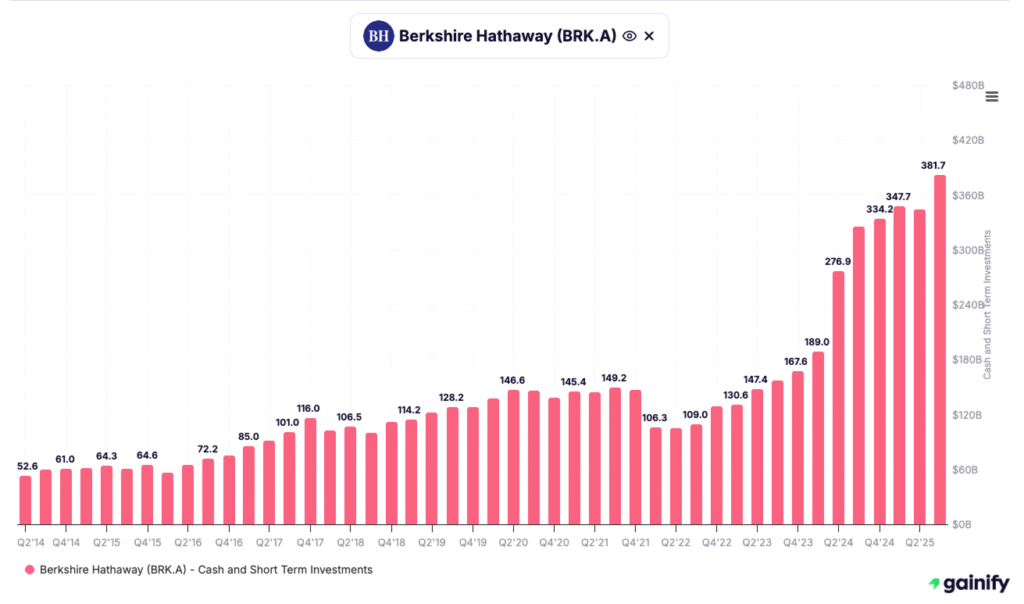

Lower Equity Exposure and Record Cash Holdings

Berkshire’s cash position is the single most important takeaway from the entire Q3 2025 filing.

Your chart shows just how dramatic the buildup has been:

Cash and short-term Treasuries

- Q3 2025: 381.7 billion dollars

- Up from roughly 344.1 billion earlier this year (Q2 2025)

- Up from 276 billion in 2024

- Nearly triple pre-pandemic levels

This is not an accident. It is a deliberate, strategic decision.

Buffett is choosing liquidity because the math makes sense:

- Risk-free yields of 4–5 percent compensate Berkshire while it waits

- Equity valuations remain stretched, with fewer obvious bargains

- Large cash reserves give Berkshire maximum optionality in a downturn

- Berkshire can move instantly when assets reprice and competitors are forced to retreat

In other words, cash is not a defensive posture. It is a strategic weapon.

Key Takeaways – Berkshire’s Q3 2025 Equity Portfolio

- Large Google move: New 3.74 billion dollar position in Alphabet

- Core trims: Apple and Bank of America remain major holdings despite reductions

- Concentration: Top ten holdings represent over 87 percent of the portfolio’s value

- Caution: Low equity exposure and record cash reserves prepare Berkshire for future opportunities

- Leadership change: Buffett will step down as CEO at the end of 2025, closing an era but leaving a lasting philosophy within Berkshire