Bruce Berkowitz, the founder and chief investment officer of Fairholme Capital Management, is one of the most fascinating and unconventional investors of the modern era. Over the course of more than two decades, he has built a reputation as both a visionary and a contrarian, someone willing to make massive bets on a small number of companies that most of Wall Street has written off. His willingness to endure volatility, ignore market consensus, and concentrate heavily in just a few stocks has made him one of the most closely followed value investors of his generation.

Named Morningstar’s Domestic Stock Fund Manager of the Decade (2000–2009), Berkowitz first rose to national prominence by steering Fairholme through the aftermath of the dot-com bust and later the global financial crisis. While many funds collapsed during these at moments when fear was overwhelming the market. These contrarian moves generated enormous returns for Fairholme investors and cemented Berkowitz’s reputation as a disciplined risk taker with a sharp eye for undervalued assets.

Yet Berkowitz’s approach has also been controversial. Unlike most portfolio managers who favor diversification across dozens of companies and sectors, he rejects the idea of spreading risk too thinly. Instead, his philosophy centers on the belief that true outperformance comes from a handful of high-conviction ideas executed with patience and scale. He is comfortable allocating more than 70 percent of his fund’s capital into a single stock if he believes the long-term value is compelling enough. This level of concentration is rare among large investors and has often sparked debate about whether Berkowitz’s style is brilliant or reckless.

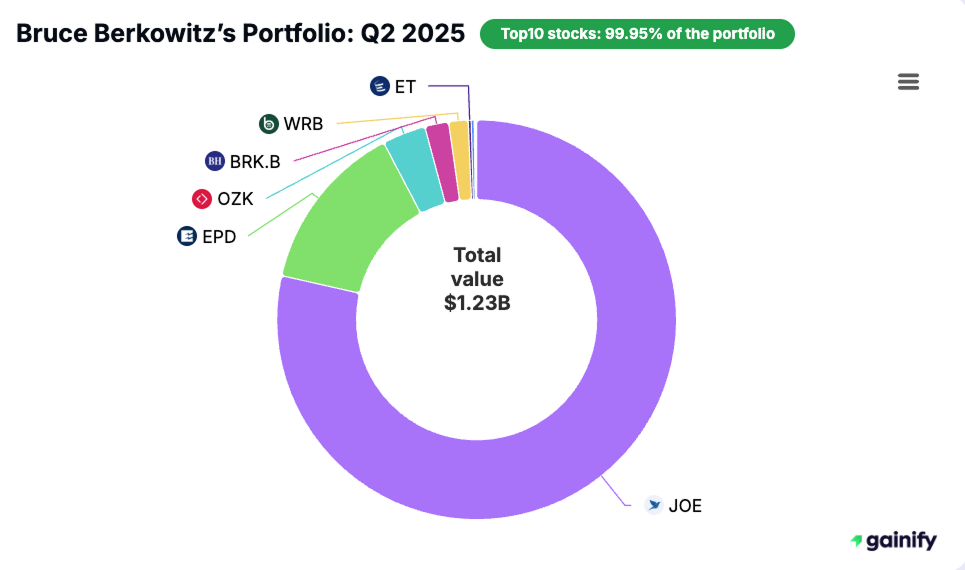

Today, Berkowitz continues to apply this philosophy at Fairholme. His Q2 2025 portfolio, valued at $1.23 billion, contains only 12 stocks, with one position, St. Joe (JOE), representing nearly 80 percent of total assets. This extreme concentration highlights his enduring conviction in the long-term potential of Florida land development, while secondary allocations to energy infrastructure, insurance, and regional banks round out the strategy. For investors and market watchers, Berkowitz’s portfolio offers a rare glimpse into a pure value investing mindset, highly focused, unapologetically contrarian, and willing to bet big on a few names that he believes will stand the test of time.

Bruce Berkowitz’s Investment Philosophy

At its core, Berkowitz’s philosophy is simple but radical in execution:

- Concentration over diversification: He believes that too much diversification dilutes returns. A few great ideas, sized aggressively, are more powerful than dozens of average ones.

- Contrarianism: Berkowitz thrives in moments of panic. Fairholme became famous for buying AIG and Bank of America during the financial crisis when others were running for the exits.

- Asset-based investing: He seeks companies with tangible value such as land, infrastructure, or steady cash flows that provide downside protection.

- Patience: He is willing to hold investments for years or even decades. His position in St. Joe has now exceeded 15 years.

- Margin of safety: Following Benjamin Graham and Warren Buffett, Berkowitz insists on buying at a discount to intrinsic value.

This philosophy has led to periods of both triumph and disappointment. It produced world-class gains in the 2000s but also left Fairholme vulnerable when concentrated positions went against him. Regardless, Berkowitz has remained consistent in his discipline.

Recent Portfolio Changes: Q2 2025

The second quarter of 2025 brought no new positions and no exits, a testament to Berkowitz’s patience and long-term focus. Instead, the adjustments were selective and reveal where his conviction is increasing.

- Bank OZK (OZK): Berkowitz expanded this regional bank position by 45.15 percent, making it a more meaningful allocation. In a sector many investors fear because of interest rate volatility, he sees deep value and strong long-term lending potential.

- Occidental Petroleum (OXY): The fund added 27.26 percent to this oil and gas company. With stable crude prices and Buffett’s Berkshire Hathaway as a major backer, Berkowitz clearly views OXY as undervalued with solid free cash flow.

- St. Joe (JOE): Trimmed by only 0.01 percent, a housekeeping move rather than a change in conviction. The stock remains the overwhelming anchor of the portfolio.

- Berkshire Hathaway (BRK.B): Reduced by 0.25 percent, a small adjustment that does not alter its role as a reliable, defensive holding.

The pattern is clear. Berkowitz is doubling down on financials and energy, sectors trading at discounts compared to the broader market, while making only negligible changes to his core holdings.

Bruce Berkowitz’s Portfolio (Q2 2025)

Rank | Company | Industry | Market Value | Portfolio Weight | Shares Held | Holding Period |

1 | St. Joe (JOE) | Land Subdividers | $963.74M | 78.54% | 20.20M | 62 Quarters |

2 | Enterprise Products Partners (EPD) | Natural Gas Transmission | $169.02M | 13.77% | 5.45M | 19 Quarters |

3 | Bank OZK (OZK) | Regional Banks | $43.14M | 3.52% | 916.8K | 8 Quarters |

4 | Berkshire Hathaway (BRK.B) | Casualty Insurance | $23.61M | 1.92% | 48.6K | 28 Quarters |

5 | W. R. Berkley (WRB) | Casualty Insurance | $19.21M | 1.57% | 261.5K | 9 Quarters |

6 | Energy Transfer (ET) | Natural Gas Transmission | $3.02M | 0.25% | 166.6K | 3 Quarters |

7 | Occidental Petroleum (OXY) | Crude Oil & Gas | $2.90M | 0.24% | 69.1K | 3 Quarters |

8 | Berkshire Hathaway (BRK.A) | Casualty Insurance | $728.8K | 0.06% | 1.0 | 21 Quarters |

9 | Diamondback Energy (FANG) | Crude Oil & Gas | $549.6K | 0.04% | 4.0K | 2 Quarters |

10 | Apple (AAPL) | Electronic Computers | $495.2K | 0.04% | 2.4K | 20 Quarters |

11 | Core Natural Resources (CNR) | Prefabricated Metal Buildings | $348.7K | 0.03% | 5.0K | 2 Quarters |

12 | EOG Resources (EOG) | Crude Oil & Gas | $239.2K | 0.02% | 2.0K | 3 Quarters |

Why So Much Concentration in St. Joe?

The most defining feature of Berkowitz’s portfolio is the massive allocation to St. Joe (JOE), which makes up 78.54 percent of total assets. St. Joe is not a typical company.

Incorporated in Florida in 1936, St. Joe is a diversified real estate development, asset management, and operating company. As of December 31, 2024, it owned 167,000 acres of land in Northwest Florida, down slightly from 168,000 acres in 2023 and 169,000 acres in 2022. A large portion of this land is within the Bay-Walton Sector Plan, which entitles the company to develop over 170,000 residential dwelling units, 22 million square feet of retail, commercial, and industrial space, and more than 3,000 hotel rooms. Approximately 87 percent of its real estate is located in Bay, Gulf, and Walton counties, with 90 percent of land holdings situated within 15 miles of the Gulf of Mexico.

For Berkowitz, this represents a generational opportunity. Land near the Gulf Coast of Florida has been appreciating steadily as population growth and migration fuel demand for housing, resorts, and infrastructure. By holding 34.8 percent of the company’s stock, Berkowitz has positioned Fairholme to benefit from long-term development of one of the most attractive real estate markets in the country.

His rationale rests on four pillars:

- Scarcity value: Florida coastal land is limited, and demand continues to rise.

- Long-term entitlement rights: The Bay-Walton Sector Plan gives JOE legal rights to decades of future development.

- Proximity advantage: Nearly all of JOE’s land sits within a short drive of the Gulf, making it uniquely positioned for residential and commercial demand.

- Control: Berkowitz’s large stake ensures influence over the company’s governance and strategic direction.

This degree of concentration is unusual and carries significant risk, but it also embodies Berkowitz’s belief that wealth is built through a small number of extraordinary ideas, not broad diversification.

Key Takeaways

- Berkowitz’s $1.23B portfolio is among the most concentrated of any billionaire investor.

- St. Joe alone represents nearly 80 percent of assets, reflecting a decades-long bet on Florida land development.

- Secondary positions in energy infrastructure, insurance, and regional banks provide some balance but remain small.

- Q2 2025 adjustments show conviction in financials and energy, with Bank OZK and OXY both increased.

- No new positions or exits confirm Berkowitz’s preference for patience and long holding periods.

Final Thoughts

Bruce Berkowitz’s portfolio is a masterclass in conviction. It is extreme in concentration, unapologetically contrarian, and dependent on just a handful of ideas. For many investors, such concentration would be unthinkable, but for Berkowitz it is the only way to achieve extraordinary results.

His strategy raises important questions for investors. Would you be comfortable putting 80 percent of your capital into a single company? Do you believe undervalued assets eventually converge with intrinsic value, even if it takes decades? Are you willing to endure years of underperformance to potentially reap long-term outsized gains?

For those who answer yes, Berkowitz’s $1.23 billion portfolio is both a source of inspiration and a cautionary tale. It demonstrates the rewards and risks of concentration, the discipline required for true value investing, and the patience needed to let bold ideas play out.

👉 Follow Bruce Berkowitz’s latest portfolio updates and real-time 13F filings at Gainify.io to see how his high-conviction strategy continues to evolve.