Li Lu has built a career on patient, focused investing, taking a page from mentors Warren Buffett and Charlie Munger while shaping his own distinct discipline. As founder of Himalaya Capital, he manages billions with a conviction-driven approach that often runs counter to market trends. Rather than spreading capital across dozens of positions, he concentrates on a few high-quality companies he believes will compound value over decades. This style has rewarded investors with strong long-term gains, while demanding resilience during periods of volatility.

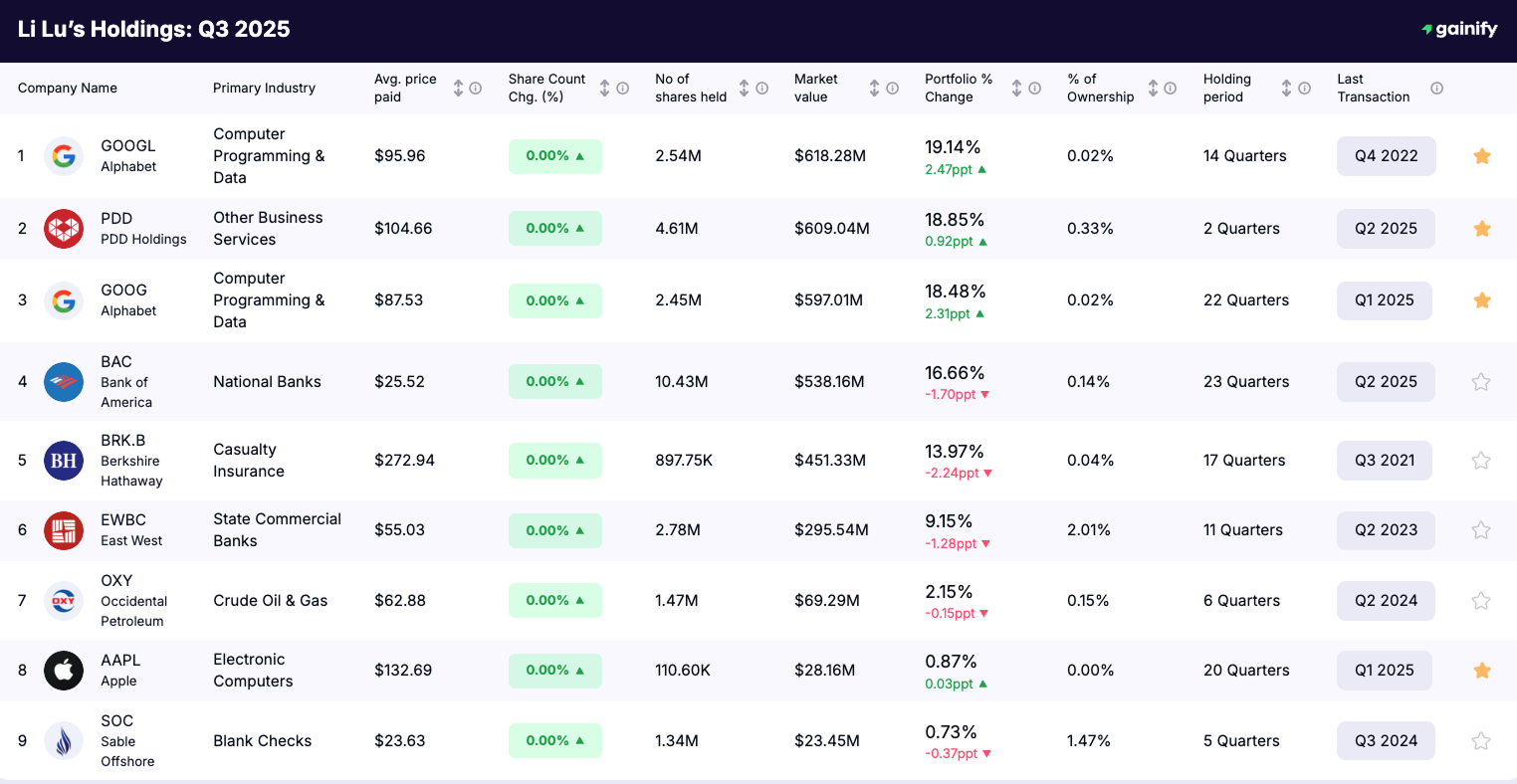

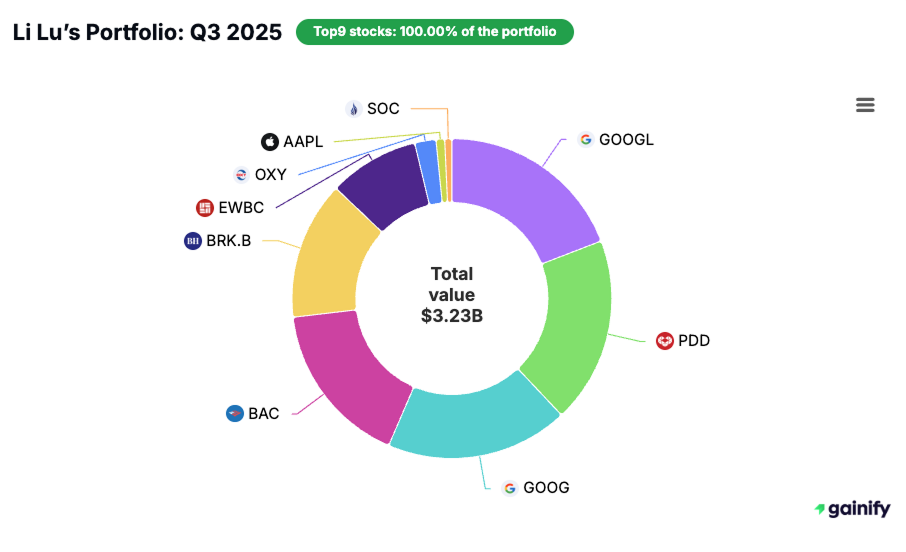

In the third quarter of 2025, Himalaya Capital reported a 13F portfolio valued at $3.23 billion, spread across only nine holdings. The average holding period sits at 13 quarters, highlighting Li’s preference for letting positions grow rather than trading frequently. The portfolio shows dominant exposure to technology and financial services, with computer programming and data stocks making up 32.34% of assets.

In Q3 2025, Himalaya Capital DID NOT ADD ANY NEW POSITIONS at all. This complete lack of buying activity makes Li Lu’s long-term discipline especially clear. Rather than reacting to short-term market movements, he held firmly to the companies he already believes in.

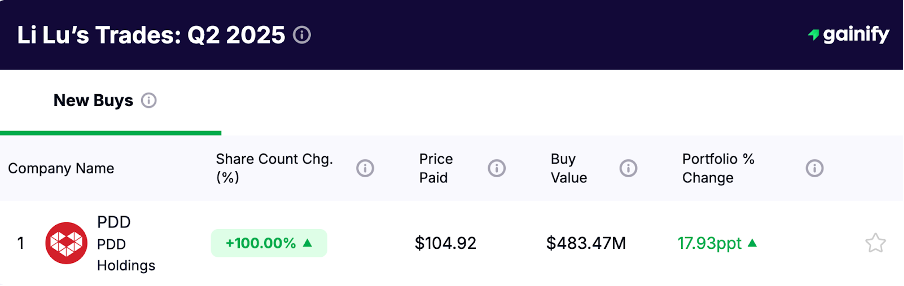

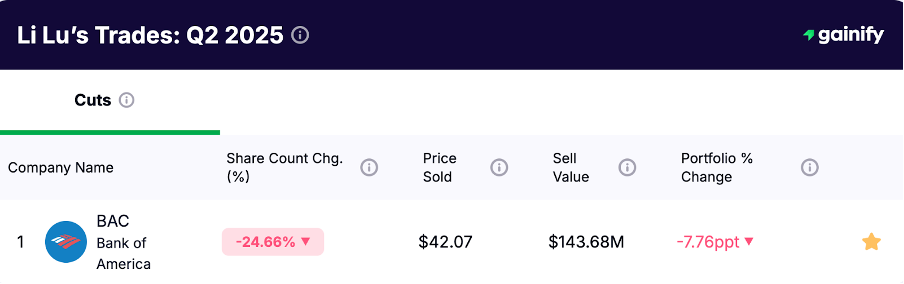

The Q2 2025 filing revealed one major new position and a meaningful reduction to an existing core holding. The largest move was the initiation of PDD Holdings, a decision that immediately placed it among his top two positions. In contrast, Li trimmed his long-standing stake in Bank of America by nearly a quarter. These shifts show how even a steadfast value investor will adjust capital allocation when opportunities and risks evolve.

In the sections ahead, we will explore Li Lu’s investing background, his guiding principles, and how those ideas translate into his current portfolio decisions. You’ll see a detailed breakdown of Himalaya Capital’s Q3 2025 holdings, the biggest buys and cuts over the last couple of quarters, and how they fit into his broader strategy of concentrated, high-conviction investing.

Who Is Li Lu

Li Lu’s journey into finance is remarkable. Born in China and educated in the United States, he became known not only as a skilled investor but also as a respected thinker on capital allocation and corporate quality. In 1997, he founded Himalaya Capital Management, managing money for institutions and high-net-worth clients. His approach blends classic value principles with a focus on understanding the integrity and capability of company leadership.

Over the decades, Li Lu has built a reputation for in-depth research, sometimes traveling to see operations firsthand or to meet key executives. He believes in knowing a business so well that market swings become opportunities rather than threats. That philosophy has produced portfolios that often hold fewer than ten stocks, each chosen for durability and compounding potential.

Li Lu’s Investment Philosophy

At the heart of Li Lu’s strategy is a belief in owning exceptional companies for the long term. He seeks businesses with strong moats, capable management, and predictable earnings power. Valuation discipline is critical – paying the right price is as important as picking the right company.

Rather than diversifying widely to reduce risk, Li reduces risk by knowing his holdings intimately. This leads to high concentration, where his top five positions typically account for over 90% of the portfolio’s value. While this can magnify short-term volatility, it also allows the best ideas to have the greatest impact on performance.

He is willing to hold through market downturns if his original thesis remains intact. Patience, thorough analysis, and alignment with trustworthy leaders are hallmarks of his method.

Q3 2025 Overview: No Portfolio Changes and Clear Evidence of Li Lu’s Discipline

In the second quarter of 2025, Himalaya Capital made NO ADJUSMENTS to its equity portfolio. There were no new positions, no additions to existing holdings, and no trims or exits of any kind.

This complete lack of activity reflects Li Lu’s long-standing belief that meaningful investing is rooted in patience, not constant trading.

When he is confident in the long-term prospects of the businesses he owns, he prefers to let time and compounding work rather than chase short-term price movements. The unchanged Q3 Li Lu’s portfolio is a direct expression of his philosophy that inactivity can be the most rational decision when the market offers no opportunities that meet his standards.

Q2 2025 Changes in Detail: Li Lu’s Equity Portfolio

Himalaya Capital’s Q2 2025 SEC filing shows two significant changes: a major new buy and a notable trim.

1. New Buy: PDD Holdings

- Shares purchased: +100% (new position)

- Buy value: $483.47 million

- Price paid: $104.92

- Portfolio weight change: +17.93 percentage points

This bold purchase placed PDD Holdings (PDD) immediately as the second-largest holding in the portfolio at 17.93% of assets. The move signals confidence in the company’s growth trajectory in e-commerce and technology-enabled retail.

2. Reduction: Bank of America

- Share count change: -24.66%

- Value sold: $143.68 million

- Price sold: $42.07

- Portfolio weight change: -7.76 percentage points

Despite the trim, Bank of America (BAC) remains the largest holding at 18.36% of the portfolio, reflecting continued faith in U.S. banking but with slightly moderated exposure.

Top 9 Holdings: Q3 2025 Equity Portfolio

As of September 30, 2025, Himalaya Capital’s equity portfolio was valued at $3.23 billion. The nine holdings are:

- Alphabet Class C (GOOGL) | $618.28M | 19.14%

- PDD Holdings (PDD) | $609.04M | 18.85%

- Alphabet Class C (GOOG) | $597.01M | 18.48%

- Alphabet Class A (GOOGL) | $448.21M | 16.67%

- Bank of America (BAC) | $538.16M | 16.66%

- Berkshire Hathaway Class B (BRK.B) | $451.33M | 13.97%

- East West Bancorp (EWBC) | $295.54M | 9.15%

- Occidental Petroleum (OXY) | $69.29M | 2.15%

- Apple (AAPL) | $28.16M | 0.87%

- Sable Offshore (SOC) | $23.45M | 10.73%

Combined, the top five positions represent over 85% of total portfolio value, underscoring Li Lu’s commitment to concentration.

A Different Perspective

While the concentrated portfolio reflects high conviction, it also means results are heavily dependent on a small group of companies. This magnifies potential gains when picks perform well, but it also exposes the portfolio to sharper swings if one or two holdings face headwinds.

Some investors prefer broader diversification to reduce such risks, yet Li Lu chooses a different path. His philosophy is that real safety comes from knowing what you own, not from spreading capital thinly. This requires uncommon discipline, patience, and a tolerance for short-term volatility.

Key Takeaways — Li Lu’s Q3 2025 and Q2 2025 Portfolio

- No changes in Q3: $3.23B, held in only nine stocks.

- High concentration: Top five holdings account for over 85% of value.

- Major new buy in Q2: Initiated $483M position in PDD Holdings at $104.92 per share.

- Trimmed core holding in Q2: Reduced Bank of America stake by 24.66%, though it remains the largest holding.

- Long-term orientation: Average holding period of 13 quarters reflects patience and conviction.

FAQ

Q: Why did Li Lu add PDD Holdings?

A: While specific reasoning isn’t disclosed, PDD’s growth in tech-enabled retail likely fits his preference for scalable, moat-protected businesses.

Q: Is Bank of America still a core position?

A: Yes. Even after the reduction, it is the largest single holding at 19.14% of the portfolio.

Q: How risky is this portfolio?

A: High concentration can amplify both gains and losses, so performance is more volatile than a diversified index.

Q: How long does Li Lu typically hold a stock?

A: The average holding period is 13 quarters, or roughly three years.

Q: Has this approach worked?

A: Over the past five years, the portfolio’s performance is up 134.01%, reflecting strong long-term results.