Few names in modern investing carry as much weight as David Einhorn. For nearly three decades, Einhorn has been one of Wall Street’s most closely watched hedge fund managers – a man known equally for his brilliant long-term bets on undervalued companies and his fearless short positions that exposed corporate weaknesses. Today, Einhorn oversees DME Capital Management, the successor to his original firm Greenlight Capital, and his latest portfolio update reveals a disciplined yet opportunistic approach to value investing in 2025.

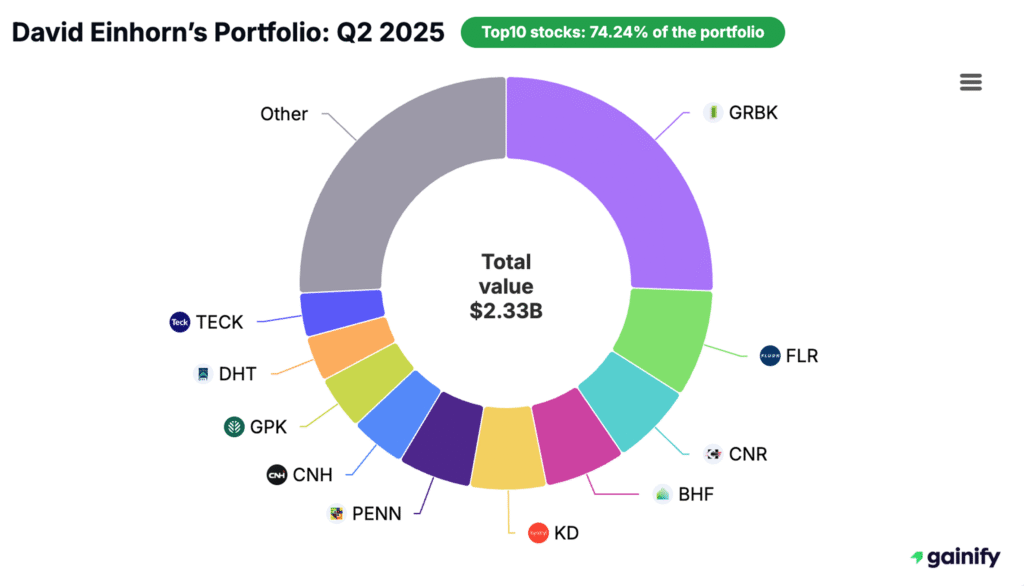

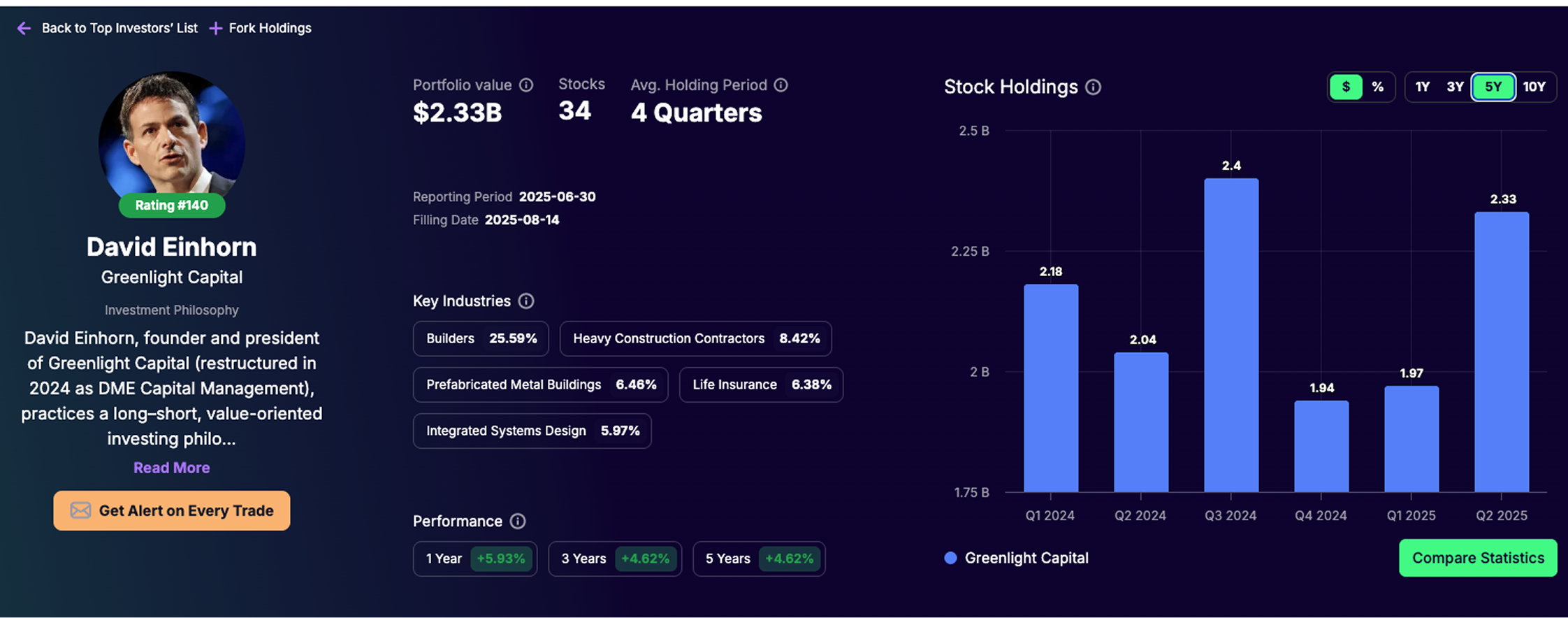

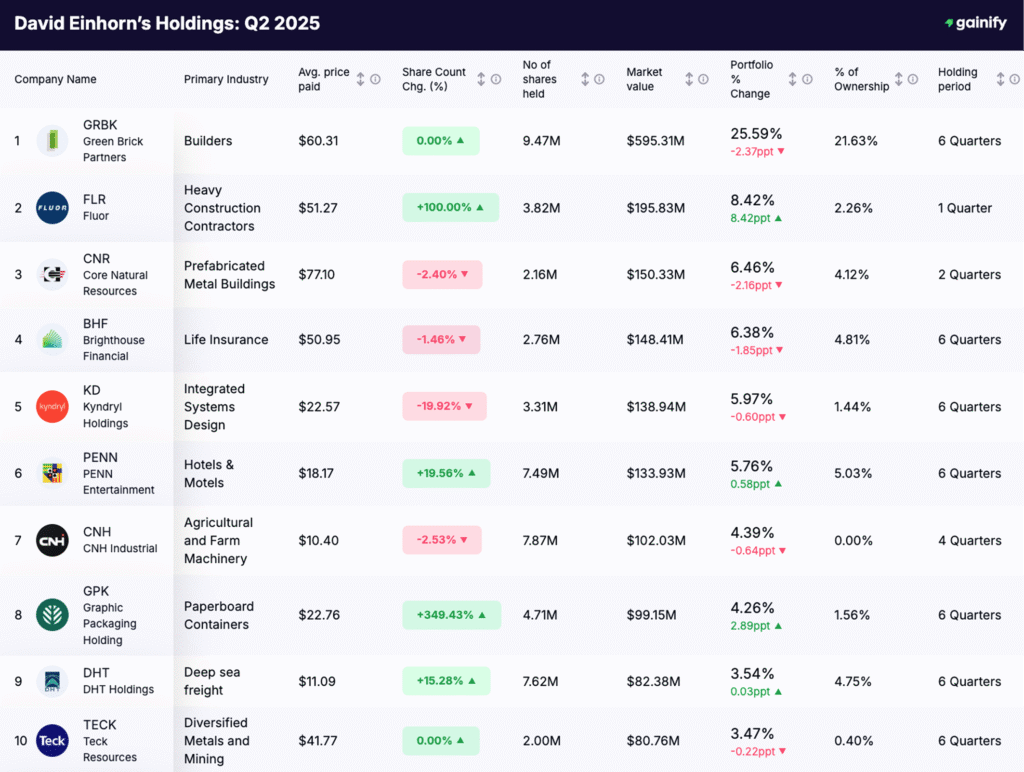

As of Q2 2025, DME Capital manages $2.33 billion across 34 holdings, a portfolio shaped by Einhorn’s trademark conviction-driven style. At the very top sits Green Brick Partners (GRBK), which makes up an astonishing 25.6% of the fund’s value, worth nearly $600 million. Other heavyweight positions include Fluor Corp (FLR) at 8.4%, Core Natural Resources (CNR) at 6.5%, Brighthouse Financial (BHF) at 6.4%, and Kyndryl Holdings (KD) at just under 6%. Together, the top 10 holdings represent more than two-thirds of the entire portfolio, underscoring Einhorn’s belief in concentration over diversification.

This quarter also brought some notable changes. Einhorn initiated new stakes in Fluor and Cigna (CI), while aggressively adding to Graphic Packaging (GPK), Teva Pharmaceutical (TEVA), and Weatherford International (WFRD). At the same time, he exited Viatris (VTRS) and Dollar Tree (DLTR) completely, slashed his Peloton (PTON) position by more than 96%, and trimmed holdings in Kyndryl (KD) and Roivant Sciences (ROIV). Taken together, the moves reflect a renewed focus on infrastructure, industrials, healthcare, and energy while pulling back from struggling consumer and speculative plays.

Einhorn’s portfolio today is a reflection of both his history and his adaptability. To fully appreciate the significance of these positions, it’s worth stepping back to understand who David Einhorn is, the philosophy that guides his investments, and the evolution of his firm over time.

Who Is David Einhorn?

David Einhorn, born in 1968, is one of the most recognized names in value investing. He founded Greenlight Capital in 1996 with just under $1 million in seed money, quickly building a reputation for deep fundamental research, sharp analysis, and bold public calls.

Some of his most famous moments include:

- 2002: Allied Capital short – Einhorn accused the company of aggressive accounting. The fight lasted years and earned him both admirers and enemies.

- 2007: Lehman Brothers short – His early and vocal warnings about Lehman’s balance sheet ahead of the 2008 financial crisis proved prescient and cemented his status as one of the sharpest short-sellers of his era.

- The Einhorn Effect – His public critiques became so influential that they often caused immediate moves in stock prices, a rare phenomenon in the hedge fund world.

For years, Einhorn delivered exceptional performance. Between inception and the early 2000s, Greenlight Capital returned around 26% annually, vastly outpacing the broader market. Over the full history of the fund, annualized returns have been closer to 13%, still ahead of the S&P 500.

But like many value investors, Einhorn faced difficult years when growth stocks and passive index funds dominated markets. Starting in 2015, performance weakened, culminating in a -34% loss in 2018, which triggered investor redemptions and a shrinking asset base. Despite setbacks, Einhorn never abandoned his principles of long-short, value-oriented investing grounded in fundamental research and risk awareness.

The 2024 Restructuring: From Greenlight to DME Capital

By 2024, Greenlight Capital went through a major restructuring and emerged as DME Capital Management. The rebrand was more than cosmetic. It symbolized a shift to a leaner, more focused structure while carrying forward Einhorn’s investment DNA:

- Long-short strategy targeting undervalued equities and corporate debt.

- Concentration in high-conviction positions rather than broad diversification.

- Activism when necessary, pushing companies to unlock shareholder value.

- Risk-aware structuring, reflecting Einhorn’s experience in managing through crises like 2008.

The new chapter also marked a recognition of changing market dynamics. With technology-driven strategies and passive investing continuing to dominate, Einhorn repositioned DME to double down on contrarian value opportunities and special situations that many larger, index-driven funds ignore.

Einhorn’s Portfolio in Q2 2025

David Einhorn’s DME Capital entered Q2 2025 with a $2.33 billion portfolio spread across 34 positions, but as always, it remains highly concentrated. His top 10 holdings account for 74% of the portfolio’s value, reflecting a strategy of taking large, conviction-driven stakes rather than diversifying broadly.

The portfolio composition highlights Einhorn’s long-standing playbook: deep-value bets in housing and infrastructure, contrarian healthcare exposures, and selective energy/resource positions that hedge against inflation and global uncertainty.

Top Holdings and Their Significance

- Green Brick Partners (GRBK) – $595.3M (25.6% of portfolio)

This remains Einhorn’s crown jewel. As chairman of the Texas-based homebuilder, he has both operational influence and long-term conviction. Housing remains a secular theme for Einhorn, despite interest rate headwinds, signaling his belief that structural U.S. housing demand outweighs cyclical risks. - Fluor Corp (FLR) – $195.8M (8.4%)

A new top holding and the standout addition of the quarter. Fluor is a major engineering and construction firm positioned to benefit from U.S. infrastructure spending and large-scale energy projects. Einhorn’s $152M new buy here signals a strong shift toward industrial and infrastructure demand. - Core Natural Resources (CNR) – $150.3M (6.5%)

Commodity exposure remains a hedge against supply shocks and inflationary pressures. Einhorn trimmed slightly but continues to view natural resources as a durable value play. - Brighthouse Financial (BHF) – $148.4M (6.4%)

Insurance and annuities fit Einhorn’s higher-for-longer interest rate thesis. While slightly trimmed, it remains one of his biggest financial holdings. - Kyndryl Holdings (KD) – $138.9M (6.0%)

Once a turnaround darling, Einhorn cut nearly 20% this quarter, reducing exposure by almost $30M. He isn’t exiting, but it reflects caution as the restructuring story matures. - PENN Entertainment (PENN) – $133.9M (5.8%)

Einhorn boosted this gaming and entertainment stake by nearly $20M (+19.6%). The move suggests he sees consumer discretionary value at compressed multiples.

Biggest Conviction Moves

- Massive Additions

- Teva Pharmaceutical (TEVA) – $63.3M (+565%): A bold contrarian bet, with Einhorn adding $52M to his position in a much-maligned generic drugmaker.

- Graphic Packaging (GPK) – $99.2M (+349%): Added $85M, showing confidence in steady packaging demand despite slowing global growth.

- Weatherford (WFRD) – $48.3M (+110%): Oilfield services remain a winner in the energy transition narrative.

- Acadia Healthcare (ACHC) – $19.6M (+616%): A healthcare specialist, boosted by nearly $18M.

- Centene (CNC) – $45.6M (+53%): Increased by $17M, signaling faith in managed care despite political noise.

- New Buys

- Fluor (FLR) – $195.8M: The single most important portfolio addition.

- Cigna (CI) – $31.0M: Anchoring healthcare exposure with a blue-chip name.

- Victoria’s Secret (VSCO) – $16.4M: A contrarian consumer play.

- Sotera Health (SHC) – $2.6M: A smaller niche healthcare bet.

- Sold-Out Positions

- Einhorn completely exited Viatris ($50.8M), Dollar Tree ($37.7M), and Alight ($5.4M). Each was a meaningful stake, and the clean exits show he’s reallocating into higher-conviction areas.

- Biggest Cut

- Peloton (PTON) was slashed by 96%, from over $31M to just $1.25M — essentially waving the white flag on a once-popular growth story.

Conclusion: Einhorn’s Next Chapter

David Einhorn’s journey from Greenlight to DME Capital reflects both the challenges and the resilience of a legendary investor. While his performance has seen highs and lows, his philosophy remains consistent: value first, risk-aware structuring, and patience in conviction bets.

The Q2 2025 portfolio shows Einhorn adapting to today’s markets by leaning into housing, infrastructure, and healthcare while exiting weaker consumer names and speculative plays. His willingness to hold concentrated positions like GRBK alongside contrarian bets like TEVA demonstrates that he continues to embrace both discipline and courage in his investing.

For students of investing, Einhorn’s portfolio remains a masterclass in how to balance conviction with adaptability. Even after decades in the spotlight, his positions still reflect the same deep research and bold thinking that defined his rise.