For years, the world of investing seemed to be dominated by charismatic figures, the so-called “star fund managers” who helmed actively managed funds. These portfolio managers tried to beat the market with their brilliant insights and timely buying and selling of company shares. They meticulously analyzed companies, sought out hidden gems, and navigated volatile market conditions, all in pursuit of superior returns. This active approach, while captivating, often came with a hefty price tag, including substantial management fees and the inherent uncertainty of whether their expertise would consistently translate into outperformance, especially after accounting for investment charges.

Then, a fundamental shift began to gain momentum: passive investing. This strategy, which at first glance seemed counter-intuitive to the traditional investment narrative embraced by active investors and proponents of active managed funds, suggested a different path. Instead of attempting to outperform the market through skilled stock selection, the core tenet of passive management became to simply mirror its performance.

The allure of this approach was immediate and clear: unparalleled simplicity, inherent broad diversification across various market sectors and asset classes, and significantly lower costs due to reduced investment charges and minimal capital gains taxes from infrequent trading. But if the very essence of index investing is not to have a portfolio manager actively picking individual company shares or bonds, if the goal is merely to meticulously track an established market benchmark like the Standard & Poor’s 500, the Dow Jones Industrial Average, or even an international benchmark such as the FTSE 100, who exactly oversees these immense pools of capital?

The transparent truth is that passive management, a cornerstone of passively managed funds and other collective investment schemes like mutual funds and unit trusts, means these investment funds are indeed overseen by highly sophisticated registered investment advisers. These are typically global powerhouses in the financial industry, such as Vanguard, BlackRock (renowned for its extensive suite of iShares ETFs), and State Street Global Advisors. These formidable firms are not only legally responsible for the fund’s day-to-day operations and meticulous risk management, but also for ensuring its unwavering adherence to its stated investment objectives and the precise replication of its chosen index.

This question, often pondered by those new to the passive world, touches upon a critical aspect of how these funds operate. While the essence of passive investing lies in its systematic, rules-based approach, it is important to understand that there are indeed dedicated professionals overseeing these portfolios. Their role, however, differs significantly from that of their active managed funds counterparts, emphasizing precision, efficiency, and unwavering adherence to the fund’s stated objective.

We will try to demystify this often-misunderstood aspect of passive investing. Let us uncover the subtle yet crucial responsibilities of those who ensure your passive investments remain on track, diligently mirroring the market’s pulse without the fanfare of active management.

The Index Architect: Guiding the Passive Path

In passive investing, particularly with index funds and Exchange Traded Funds (ETFs), the role of management is less about making discretionary investment decisions and more about replication and oversight. Think of it this way: the “fund manager” in passive investing is akin to an architect diligently following a detailed blueprint, rather than a painter creating an original masterpiece.

The primary task of these fund managers and their teams, who work for the investment adviser firm, is to ensure the fund’s investment portfolio accurately tracks its benchmark index. For instance, a Vanguard 500 Index Fund Admiral Shares aims to hold the same stocks, in the same proportions, as the Standard & Poor’s 500 index itself. This involves:

- Portfolio Construction and Rebalancing: When an index changes its constituents (for example, a company is added or removed, or its weighting changes due to market prices or market trends), the passive fund’s team is responsible for making the corresponding adjustments to the portfolio. This is a systematic process, not a speculative one. They buy or sell securities to maintain alignment with the index’s composition and weightings. This meticulous investment process is critical for achieving desired market returns and long-term growth.

- Minimizing Tracking Error: This is a key measure of success for a passive fund. Tracking error refers to the difference between the fund’s performance and the performance of its underlying index. The investment managers’ objective is to keep this difference as small as possible. This involves efficient trading strategies to minimize transaction costs and market impact, and managing cash flows from investor inflows and outflows. While less common for plain vanilla index funds (like those tracking the S&P 500 or Dow Jones Industrial Average), some passive funds tracking complex, illiquid, or non-traditional indices (such as certain commodity, smart beta, or international index like the MSCI World Index) may judiciously use derivatives like futures contracts, options on index futures contracts, or stock market index swaps to efficiently manage tracking error or gain exposure.

- Corporate Actions and Dividends: Passive fund managers also handle corporate actions, such as stock splits, mergers, and acquisitions, for the underlying holdings. They also manage the collection and distribution of dividends to fund investors.

- Regulatory Compliance and Operations: Like all investment vehicles, passive funds are subject to strict regulatory requirements U.S. Securities and Exchange Commission (SEC). The fund management team ensures the fund operates within these guidelines, handles compliance reporting, and manages the operational aspects of the fund. his is handled internally by the fund’s operations and compliance teams, and does not involve collaboration with individual financial advisers for fund management.

- Securities Lending: Many passive funds engage in securities lending, where they lend out some of their holdings to short sellers in exchange for a fee. This income can help offset the fund’s expense ratios, further reducing costs for investors, though it may complicate tax reporting due to substitute payments in lieu of dividends.

While the decisions are rules-based and driven by the index, the skill, scale, and sophistication of the investment adviser in executing these tasks efficiently can still significantly impact the investor’s experience, especially in minimizing costs and maximizing tracking accuracy. The largest passive asset managers, such as BlackRock (iShares), Vanguard, and State Street, leverage their immense scale and technological prowess to achieve this efficiency.

What Many Investors Miss About Passive Fund Management

Despite its widespread popularity, several aspects of passive fund management remain misunderstood by many market participants:

1. Not Truly “Hands-Off”

One of the most common misconceptions is that passive funds run on autopilot. While passive investing removes the need for discretionary stock picking, managing these funds still involves detailed execution and oversight. Teams of portfolio managers, traders, technologists, and compliance professionals work behind the scenes to track index changes, process corporate actions, manage fund flows, and meet regulatory obligations. It’s “hands-off” for the investor, but very “hands-on” for the fund provider to maintain precise alignment with the benchmark.

2. The Importance of Scale

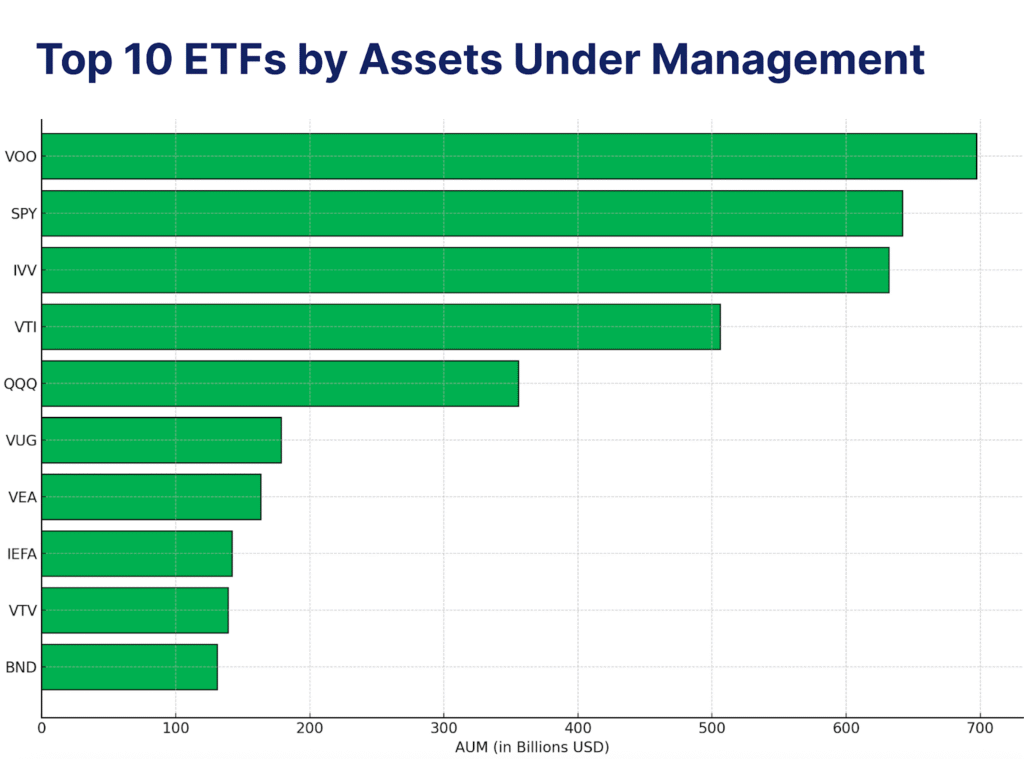

The ability of large firms like Vanguard, BlackRock, and State Street to offer extremely low expense ratios stems from their massive scale. Managing trillions in assets allows them to reduce transaction costs, negotiate favorable trading terms, operate more efficiently, and spread fixed costs across a vast asset base. This creates cost advantages that are structurally difficult for smaller providers to replicate, reinforcing the dominance of the top passive managers.

3. Beyond Just Stocks

Many associate passive investing primarily with stock market exposure — particularly flagship funds like the Vanguard 500 Index Fund. In reality, passive strategies now extend across virtually every major asset class. This includes fixed income (e.g., Bloomberg U.S. Aggregate Bond Index), international equities, emerging markets, commodities, and even multi-asset portfolios. Replicating these benchmarks requires specific expertise, particularly in less liquid markets or indices with complex rebalancing methodologies.

4. Behavioral Benefits

Beyond cost efficiency and diversification, passive investing offers meaningful behavioral advantages. A rules-based strategy reduces the temptation to time the market, react emotionally to volatility, or chase short-term trends — behaviors that have been shown to harm long-term returns. While passive investing isn’t rooted directly in Behavioral Finance theory, it aligns with key insights from the field: minimizing human error and emotional interference can significantly improve investment outcomes over time.

5. Professional Oversight Still Matters

Even though passive funds do not involve active security selection, they are still tightly managed. Monitoring index changes, handling cash flows, ensuring compliance, minimizing tracking error, and implementing trades efficiently are complex and continuous tasks. Investors benefit not only from low fees but also from institutional-grade infrastructure and expertise behind the scenes.

Key Risks in Passive Investing

While often praised for their simplicity, transparency, and lower costs, passively managed funds are not without risk. Understanding these risks is essential for aligning investment choices with your financial goals and risk tolerance.

1. Market Risk (Systematic Risk)

This is the most significant and unavoidable risk in passive investing. Since passive funds are designed to mirror the performance of a broad market or specific index (e.g., the S&P 500), they will decline in value if the market drops due to economic downturns, geopolitical instability, or rising volatility. Passive strategies do not involve discretionary security selection, so there is no manager actively avoiding underperforming sectors or stocks during downturns. Investors are fully exposed to the systematic risk of the index.

2. Tracking Error

Tracking error refers to the difference between a fund’s returns and the performance of its benchmark index. While it is typically minimal for well-run passive funds, it can arise from trading costs, cash drag from investor flows, dividend timing mismatches, or difficulties in replicating illiquid securities. Skilled management and scale can reduce tracking error, but it cannot be eliminated entirely. Over long periods, even small discrepancies can compound.

3. Concentration Risk (in Some Indices)

Market-capitalization-weighted indices can become increasingly concentrated in a handful of large companies or sectors. For example, the S&P 500 today has a significant allocation to large technology firms. If one or more of these dominant stocks or sectors underperform, it can disproportionately impact the index’s performance. While the fund itself is diversified by number of holdings, the effective risk exposure may be concentrated.

4. Liquidity Risk (in Specialized Indices)

While major passive funds that track large, well-known indices are highly liquid, funds tracking niche, thematic, or emerging market indices may face liquidity challenges. In stressed market conditions, buying or selling these securities can lead to wider spreads, higher transaction costs, or price impact. This risk is more pronounced in smaller ETFs or those holding thinly traded assets.

5. Operational and Compliance Risk

Even with automation and standardized processes, passive funds are not immune to operational failures. Risks can include human error, trading system outages, custodial issues, or cybersecurity breaches. Additionally, fund providers must comply with complex and evolving regulations enforced by agencies such as the U.S. Securities and Exchange Commission (SEC). Strong internal controls and infrastructure are essential to mitigate these risks.

Smart Beta: A Blend of Active Design and Passive Tracking

While the core principle of passive investing is strict adherence to an index, it’s important to acknowledge that the process is not entirely devoid of human involvement. In certain contexts, there is even a subtle form of “active” decision-making, although it occurs at a different level than in traditional actively managed funds. Strategies like “smart beta” or “factor-based” ETFs illustrate this nuance clearly.

These funds remain rules-based, but the rules themselves are meticulously designed by humans to target specific investment factors such as value, momentum, quality, or low volatility. For example, a “value” smart beta ETF aims to track an index composed of companies identified as undervalued based on specific financial metrics, offering exposure to a different risk-return profile than traditional cap-weighted indices.

In this context, the fund management team’s role involves ensuring the ETF accurately tracks this specially constructed index. The index itself is a product of human design and is typically rebalanced on a periodic, pre-set schedule defined by the index provider, rather than through day-to-day discretion.

Many financial experts, including academics and practitioners across leading institutions, view smart beta as existing on a spectrum between traditional passive and active investing. It is undeniably rules-based and systematic.

However, it involves active decisions in the design and periodic rebalancing of its factor exposures. Some refer to this approach as “systematic active” because human judgment is applied during the development of the index methodology rather than through ongoing discretionary stock selection, which is a characteristic of a typical active portfolio manager.

This offers a distinct avenue for investors with specific risk preferences or particular views on market behavior. It allows for a targeted, rules-based approach without engaging in traditional stock picking, a method often associated with legendary investors like Warren Buffett.

Your Essential Questions Answered

Here are some frequently asked questions about who manages funds in passive investing.

Question No. 1: Who is ultimately responsible for a passive fund?

Answer: The investment adviser firm (such as Vanguard, BlackRock, or State Street) is legally responsible for the passively managed fund. While a team of individuals handles the fund’s day-to-day operations, the firm itself holds ultimate accountability under regulatory frameworks. When you invest in an index-tracking fund through a brokerage platform like TD Direct Investing, you are transacting with a regulated intermediary. However, the management of the fund remains the responsibility of the registered investment adviser that sponsors it.

Question No. 2: Do passive funds have human managers, or is it all done by computers?

Answer: Passively managed funds have human oversight and teams of professionals responsible for operations. While the investment process is rules-based and heavily reliant on technology for execution and rebalancing, human expertise plays a critical role in designing the tracking methodology, managing corporate actions, ensuring regulatory compliance, and minimizing tracking error. These professionals may respond operationally to major changes in the economy or political environment, such as managing liquidity or capital flows, but they do not make discretionary investment calls based on those events.

Question No. 3: What is the main difference between an active and passive fund manager?

Answer: The primary difference lies in investment philosophy and decision-making authority. An active fund manager aims to outperform the market by researching, selecting, and trading securities based on judgment and market outlook, often focused on company-specific factors. A passive fund manager, on the other hand, does not attempt to beat the market. Instead, their goal is to replicate the performance of a specific market benchmark by following a predefined set of rules. This distinction aligns with the Efficient Market Hypothesis, which holds that markets reflect available information efficiently, making it difficult to consistently outperform through active stock picking.

Question No. 4: Are the fees lower in passive funds because there is less management?

Answer: Fees are lower primarily because passive funds do not require large research teams or frequent trading based on market speculation. This significantly reduces operational costs. However, passive funds still incur expenses related to oversight, compliance, technology infrastructure, and administration. Many passive ETFs are also designed to be tax-efficient, particularly through mechanisms like in-kind redemptions. This contributes to their appeal when compared to actively managed mutual funds.

Question No. 5: What are the biggest risks related to passive fund management?

Answer: Like all investment vehicles, passive funds carry market risk. This means the value of the fund can decline if the broader market or index it tracks falls due to volatility or economic conditions. A key risk specific to passive management is tracking error, which occurs when the fund’s performance deviates from its benchmark index. Causes of tracking error can include trading costs, liquidity constraints, or structural limitations in replicating complex indices. Operational risks and potential regulatory changes also apply. Investors should consider their own risk tolerance and consult a tax professional or financial advisor for personal tax considerations related to fund investing.

The Steadfast Hand of Prudence

In the dynamic world of finance, passive investing has emerged as a compelling strategy, offering broad market exposure at a remarkably low cost. While often labeled as “hands-off” the idea that these funds are entirely unmanaged is a misconception. In reality, they are overseen by dedicated professionals whose expertise lies not in forecasting market movements, but in efficiently implementing a predefined, rules-based investment mandate.

This process emphasizes systematic execution, precision, and cost efficiency. Although passive strategies help mitigate behavioral biases by reducing the temptation to time the market or chase performance. Instead, they reflect the belief that markets are generally efficient and that consistent outperformance through active management is difficult to achieve over the long term.

The management of a passive fund highlights the power of disciplined processes and rigorous oversight. It demonstrates the long-term value of minimizing costs and capturing the performance of broad market indexes. For investors, understanding the role of passive fund managers offers insight into how even simple-seeming strategies benefit from professional stewardship and operational excellence.