Every investor shares one goal: to beat the market.

Making money is not enough; the real goal is to outperform everyone else who is trying to do the same.

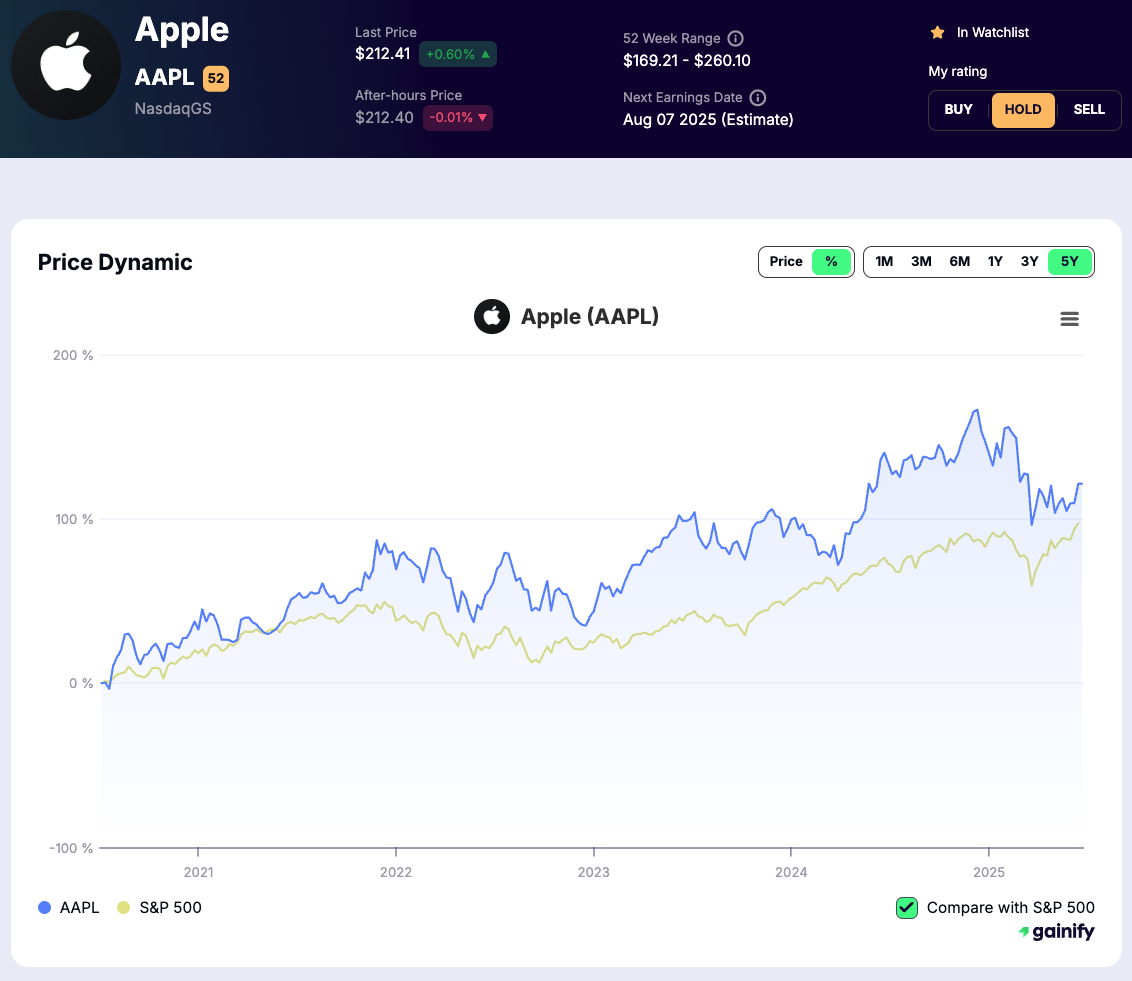

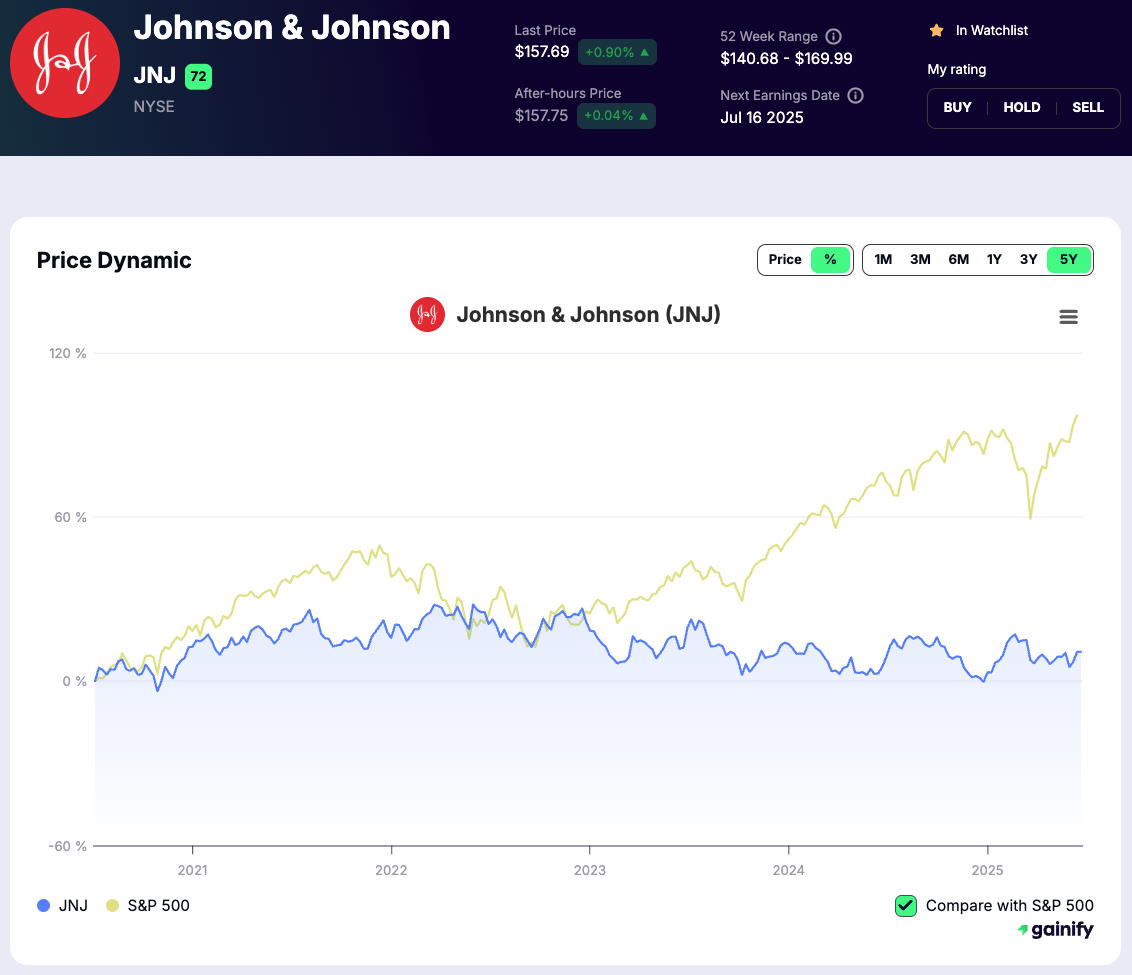

Outperforming in stocks means beating a benchmark. If your stock, fund, or portfolio delivers a higher return than its reference index over the same period, you have outperformed. If it delivers less, you have underperformed.

This distinction matters because investment performance is always relative, not absolute. A 12% return may look strong on its own, but it is only meaningful when compared to what the broader market during the same time frame.

This article explains what outperform means in stocks, how professionals measure it, which benchmarks are commonly used, and why consistently outperforming the market is far more difficult than it appears.

30 Second Summary

- What it means: You outperform when your investment earns a higher return than its benchmark over the same period.

- The benchmark: This is usually a market index like the S&P 500, Nasdaq 100, or a relevant sector index.

- What counts: Performance should include price gains and dividends, measured after fees when possible.

- The time frame: Outperformance only matters over a defined period, such as one year, five years, or longer.

- Why it’s hard: Most investors and active funds fail to outperform consistently after costs.

What Does Outperform Mean in Stocks?

To outperform means that a stock, mutual fund, ETF (exchange-traded fund), or an entire investment portfolio generates a higher investment return over a specific time horizon compared to a chosen benchmark index or a relevant peer group.

Outperformance only has meaning when it is measured against the right benchmark.

It is a relative measure of success, not an absolute one. Without a point of comparison, simply making money does not qualify as outperformance.

The core of understanding outperformance lies in the benchmark index. This is a hypothetical portfolio of investments that represents a specific market or asset class. It serves as the standard against which an investment’s performance is measured.

A benchmark should reflect the asset class, strategy, and risk profile of the investment being evaluated. Comparing against an unrelated index distorts results and makes performance conclusions unreliable.

For example, if a large-cap U.S. equity fund generates an annualized return of 12% in a year, but the S&P 500 index (its chosen benchmark) generates 10% in the same year, then the fund has outperformed the market by 2 percentage points.

Conversely, if it only returned 8%, it would have underperformed.

Key elements in defining outperformance include:

- Benchmark Selection: Choosing the appropriate benchmark index is crucial. You would not compare a small stocks fund to the Dow Jones Industrial Average, for instance. The benchmark should reflect the investment strategy and investment objectives of the asset being evaluated.

- Time Horizon: Outperformance is always measured over a specific time horizon. A stock might outperform its benchmark in one quarter but underperform over five years. Long-term investors are typically concerned with outperformance over extended periods (e.g., 5, 10, or 20 years), not just short-term market movements.

- Investment Return Calculation: This typically involves total return, which includes both capital appreciation (the increase in share price) and any income generated (like dividends). This ensures a comprehensive comparison.

Why Most Investors Underperform

Consistently outperforming the market is difficult not because investors lack information, but because of structural and behavioral challenges that compound over time.

Costs and Fees Add Up

Active strategies often involve higher management fees, trading costs, and taxes. Even small annual costs can materially reduce returns over long periods, making it harder to beat low-cost benchmark indices.

Timing Errors

Many investors buy after strong performance and sell during periods of volatility. These timing decisions, driven by emotion rather than process, often lead to returns that lag the market over full cycles.

Overtrading

Frequent buying and selling increases transaction costs and raises the likelihood of poor entry and exit decisions. Studies consistently show that higher turnover correlates with lower long-term performance.

Behavioral Biases

Fear, overconfidence, and recency bias play a major role in underperformance. Investors tend to extrapolate recent trends and react to headlines, even when fundamentals have not changed.

Benchmark Mismatch

Some investors unknowingly compare their results to inappropriate benchmarks, creating the illusion of underperformance or false success. Without the right benchmark, performance cannot be evaluated accurately.

Strategies to Outperform

The desire to outperform the financial markets is the primary driver behind active management. This is where fund managers and individual stock pickers attempt to generate returns greater than their chosen benchmark index through strategic investment decisions.

Common strategies employed in the pursuit of outperformance include:

- Fundamental Analysis: This involves deep dives into a company’s financial statements (annual and quarterly reports), management quality, profit margins (Gross Margins), earnings per share, revenue growth, financial health, financial history, competitive positioning, and economic moat to identify undervalued stocks or those with strong growth prospects and a durable competitive advantage. This involves using valuation metrics like price-to-earnings (P/E) ratios and discounted cash flow.

- Technical Analysis: Investors using this method study historical share price patterns, trading volume, and industry trends to predict future performance and market movements.

- Analyst Ratings: Many financial analysts from investment banks and brokerage firms issue stock ratings (e.g., strong buy, market perform, strong sell) on a rating scale. These analyst-issued ratings or research reports can influence market sentiment, though their effectiveness in predicting future performance is debated. A strong buy rating implies a significant outperform stock expectation.

- Sector Rotation: This investment strategy involves shifting investment portfolios into market sectors or industries that are expected to outperform the broader stock market in the near future, often driven by growth catalysts.

- Market Timing: An attempt to predict market cycles or market changes, buying before price increases and selling before market drops. This is notoriously difficult to execute consistently.

- Stock Picking: Directly selecting individual corporate stocks believed to have the potential to outperform their peers or the market, such as discerning between Tesla (a common growth stock example) and Coca-Cola Co. (often considered a stable value investing example).

However, consistently achieving outperformance is exceedingly challenging. The efficient-market hypothesis suggests that all available information is already reflected in share price, making it difficult to find undervalued assets. Furthermore, active management typically incurs higher management fees and transaction costs (from frequent buying and selling), which can erode any potential above average investment return.

This inherent investment risk means many actively managed mutual funds or ETFs (exchange-traded funds) end up underperforming their benchmarks after fees. This is why a financial regulator like the U.S. Securities and Exchange Commission (SEC) emphasizes transparency in reporting performance. The ultimate goal is to generate alpha, which is the investment return generated by an investment portfolio or strategy in excess of the return expected from its benchmark index or market segment.

Common Benchmarks for Outperformance

The choice of benchmark index is paramount, as it sets the standard for what it means to outperform. Different benchmarks represent different segments of the financial markets, catering to various investment goals. These market indices provide a vital context for evaluating performance potential.

Here are some widely recognized market indices used as benchmarks:

- S&P 500 index: The most common benchmark for large-cap U.S. equities. Comprising 500 of the largest U.S. publicly traded companies, it represents approximately 80% of the total U.S. stock market capitalization. Many long-term investors consider simply matching the S&P 500 index a successful outcome. An S&P 500 ETF can be used to track this performance.

- Dow Jones Industrial Average (DJIA): A price-weighted index of 30 significant domestic corporations often considered a proxy for the broader U.S. economy. While widely cited in financial news media, its narrow scope makes it less suitable as a benchmark for diversified investment portfolios.

- Russell 1000 Index: Represents the largest 1,000 U.S. companies by market capitalization. It’s a popular benchmark for large and mid-cap U.S. equity funds.

- Russell 2000 Index: Tracks the performance of 2,000 small stocks (small-cap U.S. companies). It is the most common benchmark for small-cap mutual funds and ETFs, representing a different investment risk profile.

- MSCI World Index: A broad global equity index that represents large and mid-cap equity performance across developed markets worldwide. It’s a common benchmark for global investment portfolios.

- FTSE 100: The benchmark for the UK’s stock market, representing the 100 largest companies listed on the London Stock Exchange.

- Specific Industry or Sector Benchmarks: For specialized investment portfolios, benchmarks might be tailored to particular market sectors, such as a healthcare index for healthcare firms, or a technology index for technology-related stocks.

Selecting an appropriate benchmark index is a fundamental step in evaluating any investment strategy and making informed investment choices.

Matching the Market vs. Chasing Outperformance

While the allure of outperformance is strong, a significant school of thought, supported by extensive investment analytics and academic research, argues that consistently achieving it is exceedingly difficult for most market participants. Behavioral economists highlight how the constant pursuit of outperformance can lead to detrimental investor behavior, such as excessive stock trading, chasing hot stocks, or succumbing to market swings driven by financial news media headlines.

This perspective champions passive investing, which advocates for building an investment portfolio that aims to match the investment return of a broad benchmark index rather than trying to outperform it. Index funds are the primary vehicle for this investment strategy. Their proponents argue that for the average long-term investor, a passive investing approach, often utilizing an S&P 500 ETF, often leads to better net investment return over time due to significantly lower management fees and transaction costs. This approach relies on the underlying belief in market efficiency over the long run.

The wisdom of matching the market lies in its simplicity, diversification, and cost-effectiveness. Rather than bearing the investment risk of trying to pick winners or time market entries, investors benefit from the overall growth of the financial markets.

For many, achieving the investment return of the S&P 500 index (or another broad market index) is considered a highly successful outcome for their retirement fund or other investment goals, freeing them from the constant pressure of attempting to outperform. This viewpoint does not deny that some fund managers do outperform their benchmarks, but rather emphasizes the statistical improbability of consistently picking such managers, particularly after accounting for all fees and taxes.

This contrasts with the principles of value investing, which seeks to outperform by finding undervalued assets. A smart portfolio might combine elements of both.

Frequently Asked Questions about Outperformance

Q: What is a benchmark index?

A: A benchmark index is a standard against which the performance potential of a stock, mutual fund, or investment portfolio is measured. Common examples include the S&P 500 index for large U.S. stocks, or the Russell 2000 for small stocks.

Q:Is it possible to consistently outperform the market?

A: Consistently outperforming the financial markets is exceptionally challenging. While some fund managers and investment strategies may outperform over short periods, very few manage to do so consistently over extended time horizons, especially after accounting for management fees and transaction costs. The effectiveness of analyst ratings in predicting future performance over the long term is also a subject of ongoing debate among trading analysts and investment advisors.

Q:How do fund managers try to outperform?

A: Fund managers employ various active management strategies to outperform, including stock picking based on fundamental analysis (examining earnings per share, profit margins, revenue growth), technical analysis, sector rotation, and market timing. Their goal is to identify investment options that will generate higher investment return than their benchmark index. They also look for growth catalysts to boost future performance.

Q:Does outperformance mean high investment risk?

A: The pursuit of outperformance often involves taking on higher investment risk. Strategies like concentrated stock picking or market timing can lead to significant gains but also come with a greater potential for maximum loss and underperformance if investment decisions prove incorrect. An outperform stock typically implies higher risk than a market-matching index fund.

Q:What is the difference between outperform and underperform?

A: To outperform means to achieve a better investment return than your chosen benchmark index over a specified time horizon. To underperform means to achieve a lower investment return than that same benchmark.

Q:What is Alpha in investing?

A: Alpha is a measure of an investment portfolio or investment strategy’s performance relative to its benchmark index. Positive alpha indicates outperformance (the portfolio returned more than expected given its market risk), while negative alpha indicates underperformance. This is the ultimate goal of active management.

Q:Why do some investors choose not to aim for outperformance?

A: Many long-term investors choose passive investing by using index funds because they believe that consistent outperformance is rare and costly. They aim to match the market’s return through broad diversification and low management fees, which has historically proven to be a highly effective investment strategy for long-term gains. This reflects a more conservative approach to investment choices.

How to Think About Outperformance as an Investor

Understanding what does outperform mean in stocks is fundamental to setting realistic expectations and crafting a sound investment strategy. It is not merely about achieving a positive investment return, but about demonstrating superior performance potential relative to a chosen standard within the financial markets.

Key Takeaways:

- Relative Success: Outperformance means achieving a higher investment return than a defined benchmark index or peer group over a specific time horizon.

- Requires a Benchmark: Success in outperforming cannot be measured without a clear benchmark index, such as the S&P 500 index or Russell 2000.

- Active Pursuit: It is the goal of active management and strategies like stock picking and market timing, often involving fundamental analysis of earnings per share and revenue growth.

- Challenging Feat: Consistently outperforming the financial markets is exceptionally difficult due to market efficiency, management fees, transaction costs, and the difficulty in predicting future performance or the accuracy of analyst ratings.

- Consider Alternatives: For many long-term investors, matching the market through passive management with index funds offers a more reliable path to long-term gains and diversification.

- Align with Goals: Your investment choices should always align with your personal investment goals and financial risk tolerance, regardless of whether you pursue outperformance or market matching.

Remember, true financial success is ultimately defined by achieving your personal investment goals. Whether your investment strategy aims to outperform or steadily participate in the market’s growth, a clear understanding of your objectives and the tools to measure progress is your most valuable asset. Embrace knowledge, choose wisely, and confidently pursue your financial aspirations.