Few individuals have transformed modern markets as profoundly as Elon Musk. From electric vehicles and reusable rockets to artificial intelligence and brain computer interfaces, his ventures have created entire industries and redefined how investors think about innovation and growth.

The group of companies connected to Musk includes Tesla (TSLA), SpaceX, xAI, Neuralink, and The Boring Company. Together they represent one of the most ambitious ecosystems in business today, where technology, risk, and imagination meet to shape the next chapter of the global economy.

Although only Tesla is publicly traded, Musk’s influence reaches far beyond a single stock. His companies touch nearly every frontier of progress, including energy, transportation, data, and automation. For investors, Musk stocks are more than opportunities to profit from innovation. They are a measure of conviction in the technologies that will define the future.

Highlights (as of October 2025)

- Tesla reports record quarterly revenue of 28.1 billion USD in the third quarter of 2025, supported by stable deliveries, strong growth in its energy business, and more than two million active Full Self Driving users worldwide.

- SpaceX reaches a private valuation near 400 billion USD, with Starlink serving over three million subscribers across seventy countries. Launch cadence and government contracts continue to strengthen its position as the dominant global space-transport company.

- xAI completes its merger with X Corp., creating a single platform that combines advanced artificial intelligence models with one of the largest real-time social and content networks. The combined entity is now valued at nearly 200 billion USD following new investment rounds led by major global funds.

- Neuralink advances human-trial research, showing early success in restoring motor control for patients with paralysis. Regulatory progress and investor interest continue to grow as the company moves closer to potential commercial applications.

- The Boring Company expands its urban-transportation projects in Texas and Nevada. While commercial timelines remain long, recent city-level approvals signal growing acceptance of its tunnel-based infrastructure model.

Elon Musk’s Top Stock Holdings

Elon Musk’s wealth and influence are built around a tightly focused set of companies that span electric vehicles, space, artificial intelligence, and infrastructure. His single largest public holding is Tesla, which remains the foundation of his fortune and the centerpiece of his innovation strategy. Beyond Tesla, Musk holds substantial ownership in SpaceX, xAI, Neuralink, and The Boring Company.

1. Tesla (TSLA): From Automaker to Energy Platform

Market Capitalization: 1.49 trillion USD

Elon Musk’s Ownership: 12.8% – 13.0%

2025 Revenue (Est.): 95.1 billion USD

Forward P/E: 272x

Core Businesses: electric vehicles, battery storage and solar energy systems, Full Self-Driving (FSD) software and autonomous-mobility services, and AI-integrated robotics and energy ecosystems.

Tesla remains the anchor of Musk’s public-market empire. Once valued primarily as an electric vehicle maker, it has evolved into a diversified platform spanning energy storage, AI-driven robotics, and autonomous driving technology.

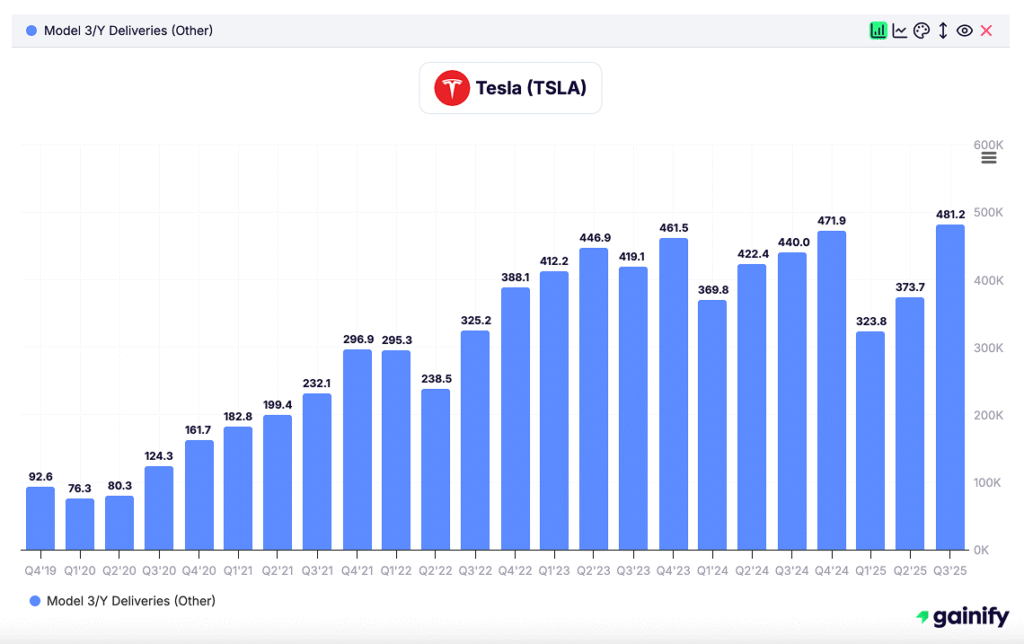

- Vehicle deliveries could reach 1.8 million units in 2025, broadly flat year over year, despite global EV price competition.

- Energy generation and storage revenue rose 5 percent in Q3 2025, now contributing over 10 percent of total sales.

- Full Self-Driving (FSD) adoption continues to expand, with more vehicles now equipped and actively using the software. According to some industry reports, global FSD subscriptions could exceed two million users, although Tesla has not disclosed an official figure.

- Robotaxi platform preparation accelerated, with limited pilot programs beginning in select U.S. cities and early regulatory discussions underway. Tesla aims to launch commercial operations in 2026.

Tesla’s operating margin has compressed to about 5 percent as price cuts & tariffs offset cost gains from new manufacturing efficiencies. Still, the company maintains one of the strongest balance sheets in the sector with over 25 billion USD in cash.

Investment View:

Tesla is transitioning from a hardware-centric company to a software, energy, and AI-driven ecosystem. The stock remains volatile but continues to attract long-term capital focused on decarbonization and automation. Execution on autonomy and AI products could redefine its valuation trajectory into 2026.

2. SpaceX (Private): The Frontier of Commercial Space

Private Valuation (October 2025): approximately 400 billion USD

Elon Musk’s Ownership: ~40%

Core Businesses: launch services, satellite broadband through Starlink, and spacecraft development.

SpaceX continues to expand its position as the world’s dominant space-technology company. Following a recent capital raise and secondary stock sales by insiders, the firm’s valuation climbed from 350 billion USD to about 400 billion USD, according to Bloomberg. The increase adds roughly 20 billion USD to Elon Musk’s personal wealth, as he is estimated to own about 40 percent of SpaceX. His stake is now worth around 160 billion USD, making SpaceX one of his most valuable holdings alongside Tesla.

Starlink, the company’s satellite-based broadband network, remains the largest contributor to this valuation. It now serves roughly six million subscribers worldwide and is reported to be profitable. The launch business continues to account for more than half of all global orbital missions, supported by reusable Falcon rockets and an expanding government-contract pipeline.

SpaceX is also testing Starship, its fully reusable next-generation rocket system designed to cut launch costs further and enable deep-space missions. Although early prototypes have faced technical challenges, progress continues at an accelerated pace.

Investment View:

SpaceX has redefined the economics of space access and remains central to the commercialization of low-Earth orbit. With Starlink generating steady cash flow and Starship development advancing, the company is positioned as a long-term global infrastructure leader in connectivity and space transportation. An eventual Starlink IPO remains one of the most anticipated potential listings of the decade.

3. xAI: Musk’s Bet on Artificial General Intelligence

Estimated Valuation (October 2025): approximately 200 billion USD

Elon Musk’s Ownership: approximately 70% combined stake following the merger.

Core Businesses: artificial intelligence research and deployment, social and content platforms, digital payments, and data infrastructure.

In early 2025, xAI completed its merger with X Corp., uniting one of the world’s largest real-time social networks with an advanced artificial-intelligence research and product platform. The new entity, xAI Holdings, is designed to integrate AI, social interaction, and digital payments within a single ecosystem that serves hundreds of millions of users.

The company’s flagship model, Grok 4, is now embedded across the X platform, powering conversational search, news curation, and creator-driven tools. Integration with Tesla’s AI-training systems provides access to vast real-world data sets, accelerating model refinement and enabling a continuous feedback loop between vehicles, devices, and social interactions.

According to some reports the X platform maintains more than 550 million monthly active users, with subscription and creator monetization now representing over one-quarter of total revenue. Advertising has begun to recover after two challenging years, while digital-payment features are gradually expanding across North America and Europe.

Investment View:

The combined xAI–X Corp. platform positions Musk at the center of AI, communication, and digital commerce. By pairing proprietary language models with a massive global user base, the company is developing a self-reinforcing ecosystem that monetizes intelligence, attention, and data. Musk’s majority ownership ensures strategic control but also concentrates execution risk. If successful, xAI Holdings could evolve into the first truly integrated Western super-app powered by home-grown artificial intelligence.

4. Neuralink: Rewiring the Human Interface

Estimated Valuation (October 2025): approximately 9 billion USD (pre-money), according to multiple reports

Elon Musk’s Ownership: not publicly disclosed; Musk is believed to retain a controlling stake

Core Business: brain–computer interface (BCI) technology and neuroprosthetics

In 2024–2025, Neuralink advanced into human clinical trials for its brain–computer interface, marking a significant step toward commercial viability. The company announced that five patients with severe paralysis are now using its implant to control computers and digital devices through thought. Neuralink raised about 650 million USD in a Series E funding round in early 2025, valuing the company at roughly 9 billion USD.

The company’s long-term ambition extends beyond medical restoration to direct human–machine integration, developing high-bandwidth interfaces that link the brain with digital systems and artificial intelligence. Challenges remain in regulatory approval, safety validation, and surgical scalability, but Neuralink’s progress represents one of the most advanced attempts to merge biology with computing.

Investment View:

Neuralink is a high-risk, high-potential investment in the emerging neurotechnology sector. If the company achieves regulatory approval and demonstrates scalable, safe implantation, it could unlock major markets in neuroprosthetics, assistive devices, and cognitive enhancement. However, timelines remain uncertain and execution risks are significant.

5. The Boring Company: Redefining Urban Mobility

Estimated Valuation (October 2025): approximately 5.7–6 billion USD, based on the most recent publicly reported data

Elon Musk’s Ownership: not publicly disclosed; Musk remains founder and principal shareholder

Core Business: tunneling technology and underground transportation systems

The Boring Company continues its mission to reduce urban congestion through cost-efficient underground transit systems. Its operational Las Vegas Convention Center Loop, spanning approximately 1.7 miles, serves as a demonstration of point-to-point high-speed tunneling technology that cuts travel time from about 45 minutes on foot to less than 2 minutes by vehicle.

As of 2025, the company is expanding its Vegas Loop network and exploring new projects in Texas and Nevada, including potential public-private partnerships. Progress has been slower than early projections, but improvements in tunneling automation and construction efficiency continue to drive cost reductions.

Investment View:

The Boring Company represents a long-horizon infrastructure venture. Success depends on the company’s ability to scale tunneling operations, secure municipal approvals, and prove economic viability. If it achieves significant cost and time advantages over traditional methods, it could reshape the economics of urban transit and infrastructure development.

Investor Takeaways

- Elon Musk’s ecosystem remains an unmatched platform for innovation. Tesla, SpaceX, and xAI operate in industries with trillion-dollar total addressable markets spanning energy, AI, and space.

- Valuations remain high but supported by execution. Tesla trades at a premium because of its integrated ecosystem and AI potential, while SpaceX and xAI command private valuations reflecting dominant positions in their fields.

- Diversification across ventures reduces single-company risk. While Tesla’s public valuation fluctuates, SpaceX’s steady cash flow and xAI’s growth prospects create a multi-asset structure that few other founders can match.

- Catalysts for 2026 include a potential Starlink IPO, Tesla’s rollout of autonomous driving at scale, and wider xAI integration across Musk’s platforms.

Bottom Line

Elon Musk’s portfolio represents a rare intersection of visionary technology and market leadership. For investors, exposure to Musk-linked companies offers access to some of the strongest long-term secular growth themes — from clean energy to AI to space.

Yet with innovation comes volatility. Musk stocks reward conviction and patience but demand tolerance for uncertainty.

As the global economy pivots toward automation, electrification, and intelligence, few ecosystems are as influential — or as unpredictable — as Elon Musk’s.