Cannabis investment remains a long-term opportunity as the sector continues to adjust following the valuation excesses of 2021. Across cultivation, retail, pharmaceuticals, and ancillary services, market capitalizations compressed sharply as capital tightened and early growth assumptions were reset. While cannabis stocks have rallied strongly over the past six months, with many names up more than 70 percent on renewed reform optimism, the industry remains in a transition phase. What remains is a maturing sector where operational discipline, scale, and regulatory navigation matter more than headline growth.

In 2026, federal policy remains the central variable. Cannabis is still classified as a Schedule I substance under the U.S. Controlled Substances Act, which activates Internal Revenue Code Section 280E and materially inflates effective tax rates for plant-touching operators. In late 2025, the White House formally directed agencies to complete the process of rescheduling cannabis to Schedule III. While not yet finalized, this shift would meaningfully improve cash flow, accounting treatment, and research access, even without full federal legalization.

Beyond scheduling, the regulatory environment continues to evolve unevenly. States are expanding medical and adult-use programs, while federal banking access and capital market participation remain constrained in the absence of comprehensive legislation.

This article breaks down the cannabis investment landscape, including business models, sources of underperformance, potential entry points, and the regulatory and operational catalysts shaping the sector.

Understanding the Cannabis Sector

The cannabis sector spans several categories of companies, each offering different exposures and risk profiles. From direct plant-touching operators to pharmaceutical firms and real estate players, understanding this diversity is key to crafting a balanced cannabis investment strategy.

Multi-State Operators (MSOs)

These U.S.-based firms operate across multiple legal states, often managing the entire supply chain: cultivation, processing, and retail. MSOs tend to offer high growth potential but also face elevated legal and tax risks due to federal prohibition.

Examples:

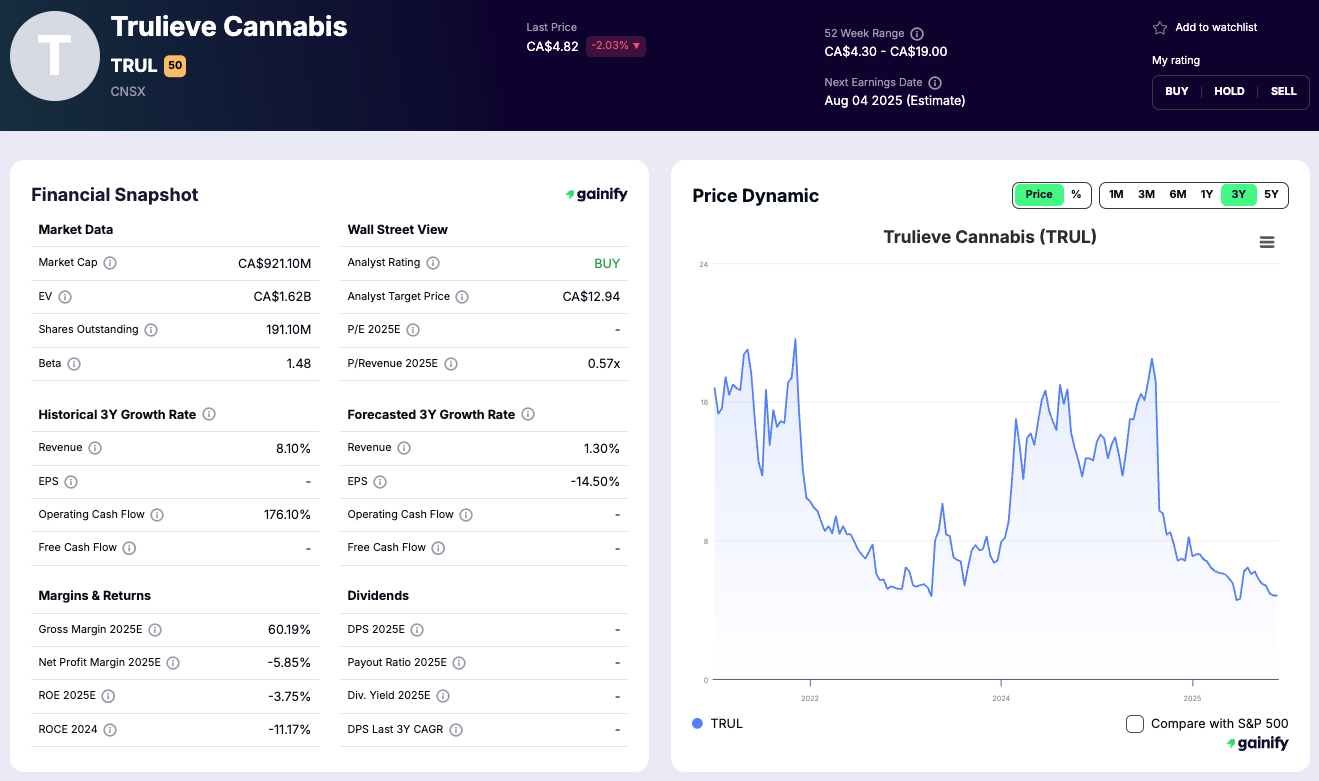

Trulieve Cannabis Corp. (TRUL)

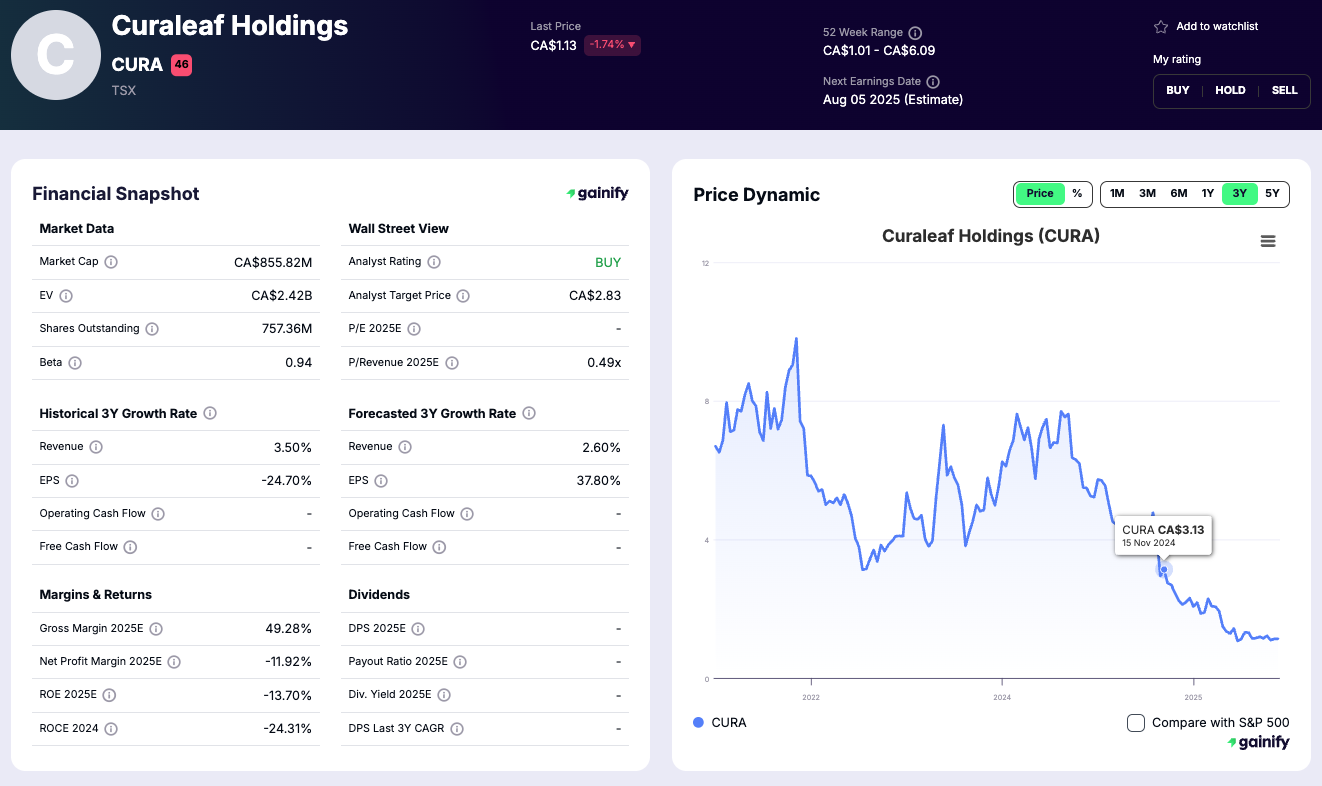

Curaleaf Holdings (CURA)

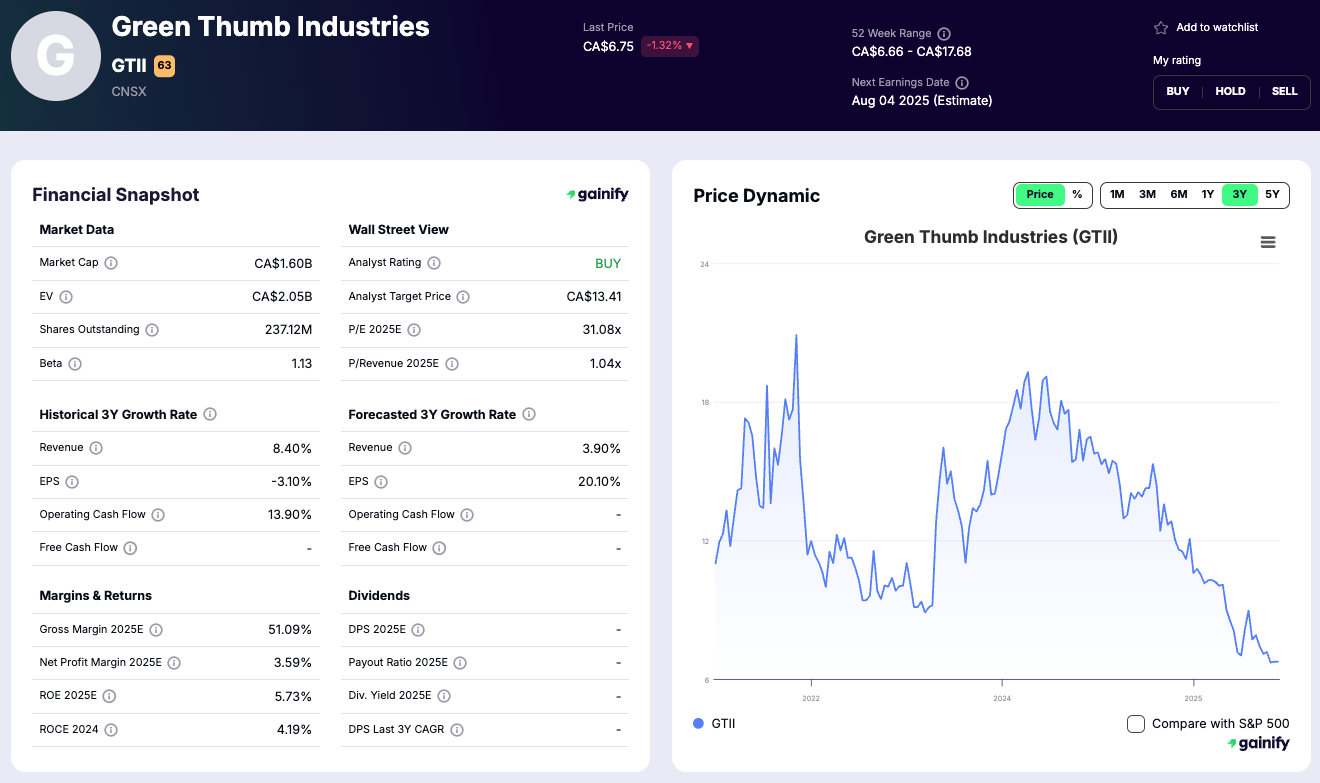

Green Thumb Industries (GTII)

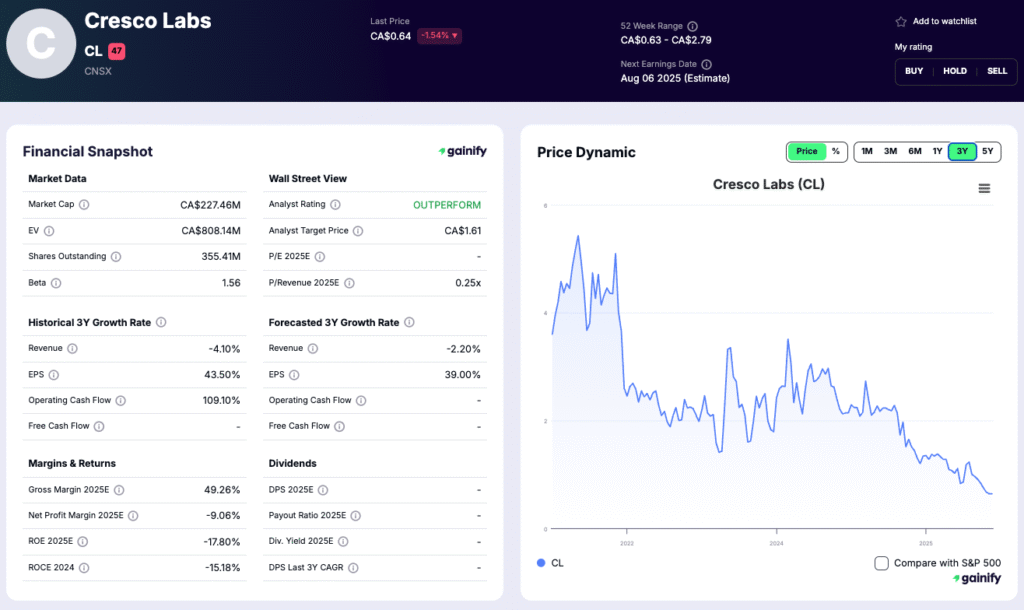

Cresco Labs (CL)

Licensed Producers & Pharma

Primarily based in Canada or the pharmaceutical sector, these firms enjoy clearer legal standing and often focus on export markets or clinical cannabis applications.

Examples:

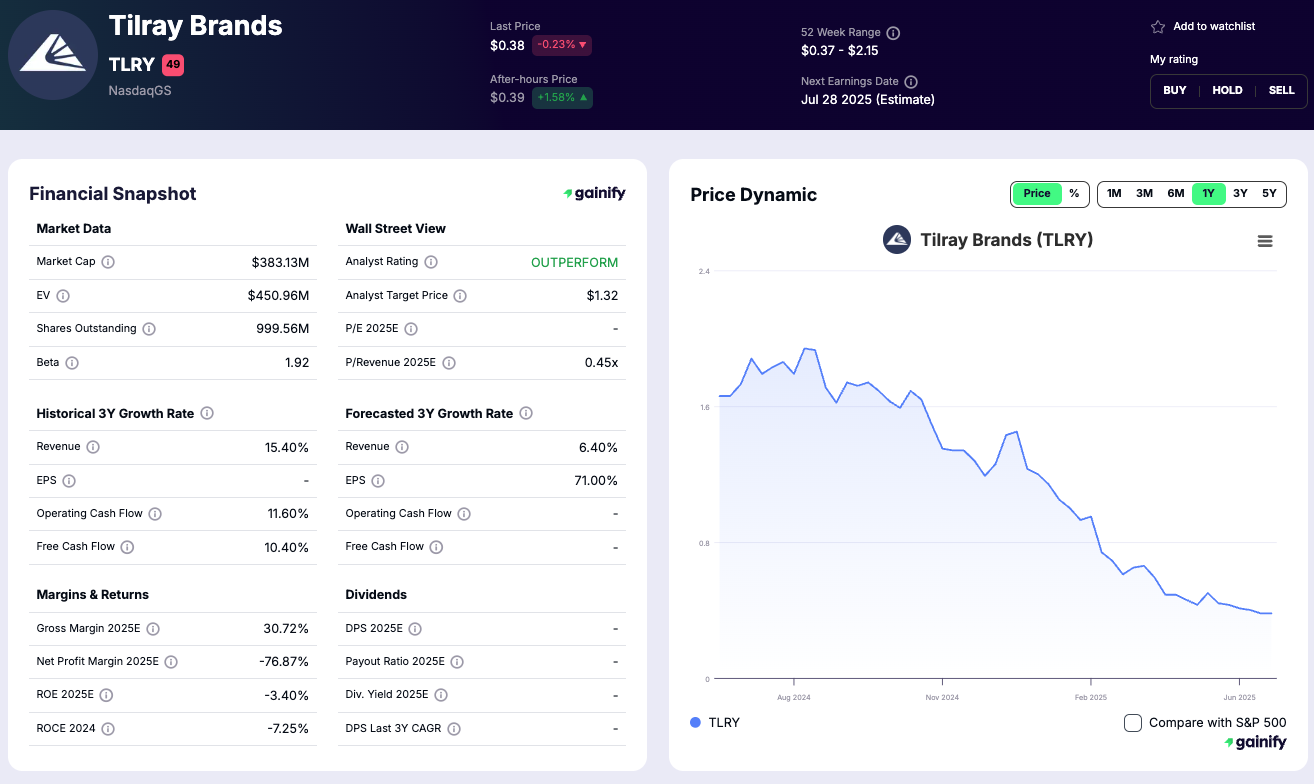

Tilray Brands (TLRY)

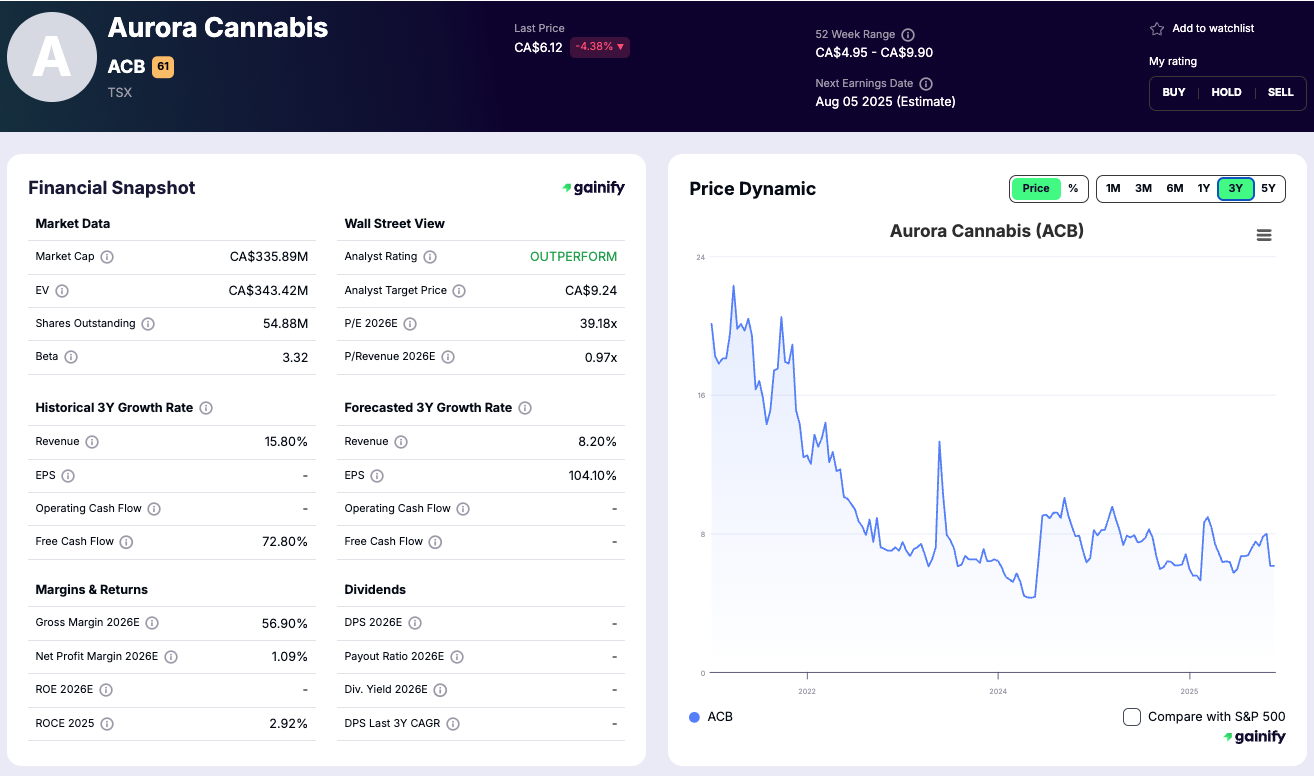

Aurora Cannabis Inc. (ACB)

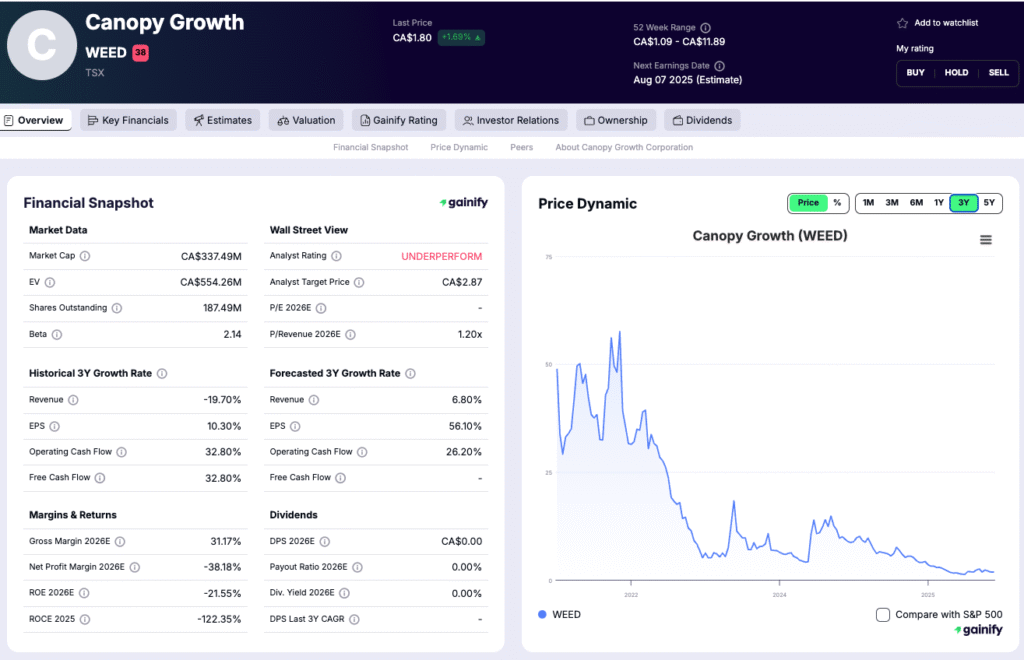

Canopy Growth Corporation (WEED)

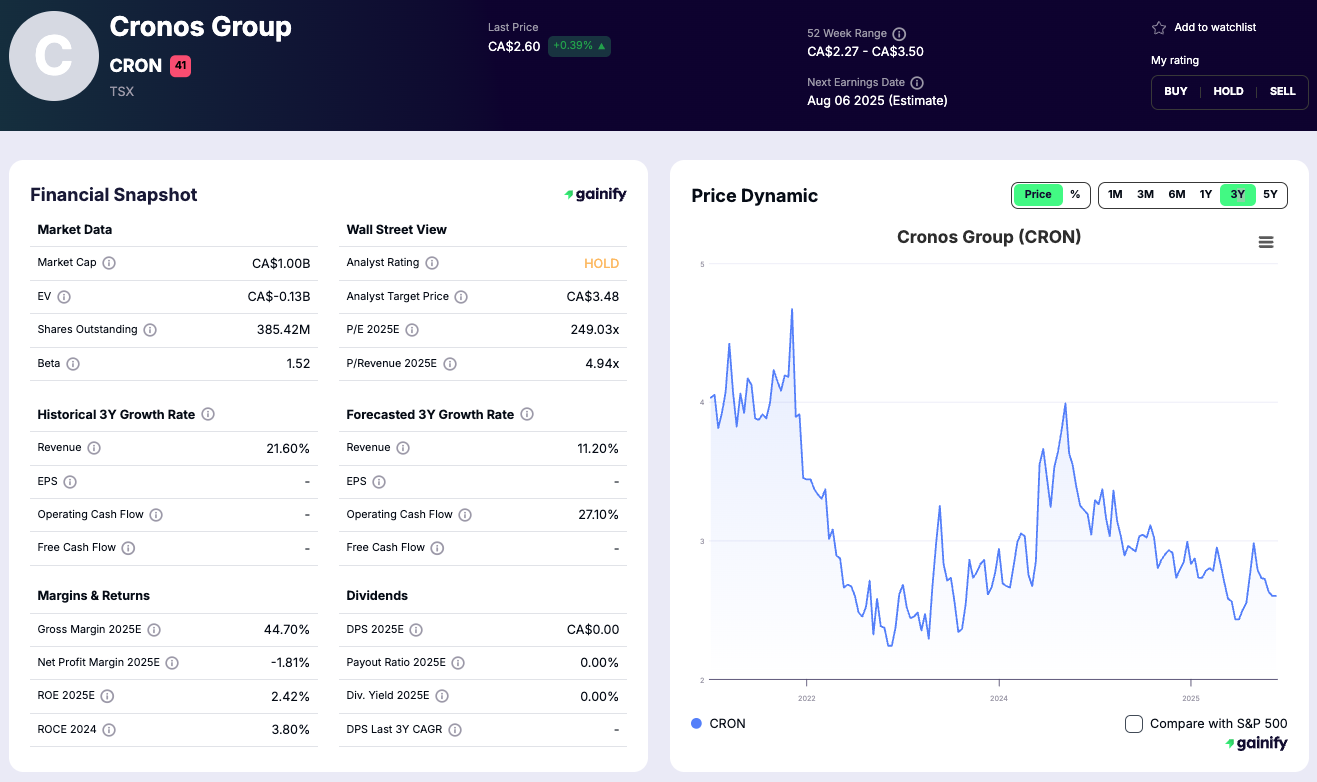

Cronos Group (CRON)

Ancillary & Real Estate Players

These businesses provide services, supplies, or infrastructure for the cannabis industry without directly handling the plant. They tend to be less exposed to regulatory risks and offer more stable revenue streams.

Examples:

- Innovative Industrial Properties (IIPR)

- GrowGeneration Corp. (GRWG)

- WM Technology (MAPS)

- Scotts Miracle-Gro (SMG)

ETFs & Investment Funds

Cannabis-focused ETFs allow investors to gain exposure across many cannabis stocks, offering diversification and convenience.

Notable ETFs:

- MSOS (AdvisorShares Pure US Cannabis ETF): This actively managed fund invests exclusively in U.S.-based multi-state operators (MSOs) and ancillary businesses. It provides focused exposure to the American cannabis market, which is currently the largest in the world by revenue potential. Holdings typically include companies such as Trulieve, Curaleaf, and Green Thumb. Since U.S. cannabis companies cannot be listed on major exchanges due to federal restrictions, MSOS uses total return swaps to gain access to these stocks.

- MJ (ETFMG Alternative Harvest ETF): MJ is one of the oldest and most recognized cannabis ETFs. It provides global exposure, including Canadian licensed producers, U.S. ancillary firms, and international operators. Its portfolio includes companies like Tilray, Aurora Cannabis, and Canopy Growth. The fund also holds tobacco and alcohol firms with ties to the cannabis space, giving it a broader vice-industry perspective.

- VICE (AdvisorShares Vice ETF): Although not purely focused on cannabis, VICE includes cannabis-adjacent businesses within a broader theme of controversial or “sin” industries. This includes alcohol, tobacco, and gaming companies, alongside hemp and CBD-related firms. The ETF is designed for investors looking for exposure to non-traditional, high-margin sectors, including emerging cannabis products and wellness categories.

Why Cannabis Stocks Have Lagged

The sharp underperformance of cannabis stocks since their 2021 highs is not simply a temporary dip. Many equities in the sector have declined more than 90 percent from their peaks, and in some cases, investor capital has been virtually wiped out. This collapse reflects deeper structural issues that go beyond short-term market sentiment:

- Federal prohibition in the U.S. remains the single most significant barrier to sector growth. Cannabis is still classified as a Schedule I drug, putting companies in violation of federal law despite operating legally at the state level. This status prevents access to standard banking services and subjects businesses to Internal Revenue Code Section 280E, which disallows normal business expense deductions. The result is artificially high tax burdens that eat into already thin profit margins.

- Oversupply in mature markets like California and Oregon has made matters worse. A glut of legal cannabis has driven wholesale prices to unsustainable lows, while illegal operators continue to undercut regulated businesses. In California, for example, the majority of cannabis is still sold through the illicit market, undermining licensed operators.

- Capital has dried up. Many companies raised money through aggressive equity offerings during the peak of market hype, but that window has closed. Now, firms are left with high-interest debt, deteriorating balance sheets, and limited options for raising fresh funds. The result has been widespread layoffs, asset sales, and in some cases, bankruptcies.

- To add to these challenges, cannabis companies must navigate unclear accounting rules and inconsistent financial disclosures. Section 280E complicates reporting and obscures the true financial health of many operators. This lack of clarity has reduced analyst coverage and discouraged institutional investment.

That said, sentiment has shifted sharply in recent months, with cannabis stocks up roughly 73 percent over the last six months, reflecting a rapid but fragile rebound driven largely by regulatory expectations rather than fundamentals.

In short, the cannabis sector is not just correcting – it is undergoing a painful, overdue reckoning. Only companies with disciplined financial management, access to capital, and a path to profitability are likely to survive and eventually thrive in the next phase of market development.

U.S. vs. Global Cannabis Markets

The United States remains the largest and most influential cannabis market globally, driven by the size of its consumer base and the depth of domestic demand. At the same time, it remains one of the most complex markets to operate in. Cannabis regulation in the U.S. continues to be determined primarily at the state level, with adult-use cannabis legal in roughly half the country and medical programs in place across nearly all states. This fragmented framework limits national scalability, increases operating costs, and creates uneven competitive conditions.

Federal policy remains the defining constraint. As of January 2026, cannabis is still classified as a Schedule I substance under the Controlled Substances Act, which triggers Internal Revenue Code Section 280E and prevents plant-touching businesses from deducting normal operating expenses. However, the federal rescheduling process to move cannabis to Schedule III formally advanced in late 2025 and is now in the final stages of administrative review. While not yet implemented, rescheduling would materially improve after-tax cash flow, accounting treatment, and capital efficiency for U.S. operators, even without full federal legalization.

Despite these headwinds, the U.S. market remains structurally attractive. Consumer demand continues to grow, product innovation remains robust, and state-level legalization momentum persists. Newer adult-use markets such as New York, New Jersey, Connecticut, and Maryland are still early in their development cycles, offering multi-year growth potential. At the same time, mature markets like California, Colorado, and Oregon are moving through a necessary recalibration, addressing oversupply, pricing pressure, and enforcement gaps as the industry transitions toward more sustainable operating models.

International Cannabis Landscape

Outside the U.S., several countries have adopted more centralized and federally consistent cannabis policies.

- Canada was the first G7 nation to fully legalize adult-use cannabis at the federal level. While the initial boom led to overexpansion and price compression, Canada remains a cornerstone of the global cannabis trade, especially in terms of exports and capital markets access. Canadian licensed producers are active in European medical markets and have been among the first to establish global distribution infrastructure.

- Germany is spearheading the European cannabis transition. With medical cannabis already legal, Germany launched a phased pilot program for adult-use cannabis in 2024. This initiative allows for limited legal cultivation and distribution through cannabis clubs, with broader commercial sales expected in the future. Germany’s leadership is catalyzing regulatory reform across the EU, with countries like the Netherlands, Czech Republic, and Switzerland following closely behind.

- Latin America is emerging as a strategic production hub due to its favorable climate, lower labor costs, and export-friendly policies. Colombia, Uruguay, and Brazil are positioning themselves to supply GMP-compliant medical cannabis to global markets, particularly Europe and Australia. These countries are leaning heavily into the pharmaceutical cannabis model, focusing on research, extraction, and compliance with international standards.

Global markets offer the advantage of regulatory clarity and long-term scalability. However, they also face hurdles, including slow bureaucratic rollouts, physician hesitancy, and limited insurance coverage for medical cannabis. As international demand grows, especially in medical applications, companies with early international positioning and clinical expertise will be well positioned to capitalize on the next wave of global expansion.

Industry Trends & Valuation Outlook

The cannabis sector has undergone a substantial valuation reset since its speculative peak in 2021. While the correction has been painful, it has also brought more realistic pricing and a renewed focus on core business fundamentals. In 2026, investors are approaching the industry with greater scrutiny, demanding operational efficiency, positive cash flow, and regulatory clarity before deploying capital.

Valuations Remain Depressed but More Rational

Many U.S. multi-state operators (MSOs) are trading at deeply discounted multiples. Several are valued well below 2x forward sales, with a handful of firms such as Green Thumb Industries and Trulieve generating positive free cash flow. This divergence between distressed and fundamentally sound companies presents selective opportunity.

Schedule 3 Reclassification: A Potential Game Changer

As of January 2026, the federal effort to reclassify cannabis from Schedule I to Schedule III is actively underway following a December 2025 executive order signed by President Trump directing the Department of Justice to complete the rescheduling process. While cannabis remains classified as Schedule I until final rulemaking is completed, the executive action significantly accelerated the timeline and signaled clear federal intent. If implemented, Schedule III status would remove the application of Internal Revenue Code Section 280E, allowing cannabis companies to deduct normal operating expenses. For profitable multi-state operators, this would materially improve after-tax cash flow, expand EBITDA margins, and strengthen balance sheets, making it one of the most consequential regulatory developments in the sector’s history.

Product Evolution: Beyond THC

Consumer preferences are shifting. Demand for non-psychoactive cannabinoids like CBD and CBG is growing, especially in wellness, skincare, and beverage segments. These products face fewer regulatory hurdles and offer a broader appeal to health-conscious demographics, expanding the industry’s reach beyond traditional cannabis users.

Investment in Manufacturing and Supply Chain

Cannabis product manufacturing is rapidly maturing. Companies are investing in large-scale processing facilities, automated packaging, and CPG-style branding. This signals long-term confidence in regulated cannabis becoming a mainstream consumer category.

Where the Smart Money Is Looking

Not all cannabis investments offer the same risk-reward profile. Institutional and professional investors are focusing on resilient subsectors that demonstrate strong business models, clear regulatory pathways, and less exposure to federal enforcement risk.

1. Pharmaceutical Cannabis

Biotech companies such as Jazz Pharmaceuticals (via GW Pharmaceuticals) and Corbus Pharmaceuticals are advancing cannabis-based therapeutics through FDA approval pipelines. These firms operate under clear federal guidance and can access traditional capital markets.

2. Cannabis Real Estate

Innovative Industrial Properties (IIPR) is a cannabis-focused REIT leasing facilities to licensed producers. It benefits from long-term leases, triple-net agreements, and a lower legal risk profile by avoiding direct plant contact.

3. Ancillary Technology & Equipment

Companies like WM Technology (MAPS), GrowGeneration (GRWG), and Dutchie offer critical infrastructure without handling cannabis directly. These businesses provide data platforms, cultivation supplies, and point-of-sale systems, giving them scalability and legal insulation.

4. Governance and Reporting Quality

The smartest capital is flowing to companies with rigorous financial discipline. Transparent investor presentations, quarterly reporting, GAAP compliance, and clear communication are key factors that set these firms apart in a crowded field.

What to Watch and Consider

The next 12 to 24 months could significantly reshape the cannabis landscape. Retail investors should track the following developments closely:

- Finalization of DEA rescheduling to Schedule III and the resulting impact on taxation, cash flow, and financial reporting

- Passage or advancement of the SAFER Banking Act, which could improve access to capital and banking services

- Upcoming state-level legalization votes, particularly in high-potential markets like Florida and Pennsylvania

- Ongoing industry consolidation, as underperforming operators are acquired or restructured

- Early signs of institutional capital re-entry, including strategic investments or ETF inflows post-regulatory changes

Final Thoughts

The cannabis market in 2026 is no longer defined by hype. It is increasingly shaped by fundamentals, regulatory reform, and operational discipline. The sector still faces meaningful barriers including federal illegality, restricted tax treatment under Section 280E, inconsistent access to capital, and inefficient supply chains. However, those same constraints are helping identify the next generation of winners.

Retail investors should resist the urge to speculate and instead adopt a structured, data-driven approach. A successful investment strategy in cannabis will focus on scalable business models, proven financial performance, and transparent governance.

To build a resilient portfolio, consider exposure across:

- U.S. multi-state operators (MSOs) with sustainable operations and leverage to future federal reform

- International producers with medical licensing, GMP-certified exports, and access to regulated markets

- Cannabis-focused REITs such as IIPR that generate stable cash flow without direct exposure to federal enforcement risk

- Ancillary service providers in technology, logistics, and packaging that enable growth across the supply chain

- Cannabis-based pharmaceutical firms that comply with regulatory frameworks and target clinically approved treatments

Selectivity is essential. Look for strong balance sheets, prudent capital management, experienced leadership teams, and companies that consistently communicate with investors. These attributes matter more than timing the market or chasing speculative names.

In a maturing and consolidating industry, patient capital will be rewarded. Cannabis investments can play a differentiated role in a diversified portfolio, but only when approached with a long-term horizon and a focus on substance over story.

Frequently Asked Questions (FAQ)

What is Section 280E and why does it matter?

Answer: Section 280E of the Internal Revenue Code prevents cannabis companies from deducting normal business expenses while cannabis remains federally illegal. This results in elevated effective tax rates, reduced cash flow, and weaker reported profitability for U.S. plant-touching operators.

What would rescheduling to Schedule 3 change?

Answer: Moving cannabis from Schedule I to Schedule III would remove the application of Section 280E, allowing companies to deduct standard operating expenses. As of January 2026, the rescheduling process has been formally accelerated by executive action but is not yet finalized. If implemented, it would materially improve after-tax cash flow, margins, and balance-sheet strength.

Why are cannabis stocks underperforming despite industry growth?

Answer: Long-term underperformance reflects regulatory uncertainty, constrained access to capital, and pricing pressure from oversupply in mature markets. While cannabis stocks have rebounded sharply in recent months, driven largely by renewed federal reform expectations, many companies are still operating in a capital-scarce environment that prioritizes profitability, balance-sheet strength, and disciplined growth over expansion at any cost.

Is it safer to invest in cannabis ETFs than individual stocks?

Answer: Cannabis-focused ETFs such as MSOS or MJ provide diversified exposure and reduce single-company risk, though they remain sensitive to regulatory developments. They may be appropriate for investors seeking broad exposure rather than concentrated positions in individual operators.

Which companies are best positioned for growth?

Answer: Leading multi-state operators with scale and positive cash flow profiles, such as Green Thumb, Trulieve, and Curaleaf, are relatively well positioned. Ancillary and non-plant-touching businesses may offer greater regulatory insulation, while pharmaceutical-focused companies could benefit from clinical and regulatory progress.

How should I approach investing in cannabis in 2026?

Answer: Adopt a long-term perspective, diversify across sub-sectors, stay informed about regulatory changes, and focus on financially sound businesses with transparent operations.