What truly defines a value stock in 2026? Lessons from Buffett, Lynch, and Marks on identifying lasting opportunity.

In a market fueled by artificial intelligence, tech momentum, and speculative enthusiasm, best value stocks might represent a quieter but more reliable path to wealth creation. While traders chase the next AI winner, long-term investors are asking a different question: Which companies are still worth more than their stock price suggests?

At its core, value investing is about buying strong businesses for less than their intrinsic value. It’s an approach rooted in patience, discipline, and fundamental analysis rather than market noise.

But “value” is not just about low P/E ratios or cheap price tags. True value stocks combine solid balance sheets, durable cash flows, and management teams that consistently create shareholder wealth. To understand how to spot them, it helps to look at how the world’s greatest investors — Warren Buffett, Peter Lynch, and Howard Marks — have refined and practiced the art of value investing over decades.

Highlights

- Value stocks are about quality, not just cheapness. The best ones combine financial strength, durable earnings, and shareholder discipline.

- The world’s top investors use different lenses to find value. Buffett focuses on quality, Lynch on growth at reasonable prices, and and Howard Marks on risk, cycles, and market psychology.

- In 2026, value investing matters again. Slower growth, tariffs, and geopolitical uncertainty are driving investors back to fundamentals.

Three Distinct Approaches to Value Investing

Value investing has evolved far beyond simple bargain hunting. The best investors in history have developed different ways of defining and capturing value, each reflecting their unique perspective, time horizon, and temperament.

At its core, value investing is about buying companies for less than they are worth. But how investors identify that worth can vary dramatically. Some focus on quality and endurance, others on growth at a reasonable price, and some on market psychology and risk control.

In practice, there is no single definition of value. Instead, there are different interpretations of what “quality” truly means. In the sections that follow, we explore three of the most influential approaches to value investing from Warren Buffett, Peter Lynch, and Howard Marks, each offering a distinct perspective on how to identify and capture long-term opportunity.

1. Warren Buffett: The Power of Quality at a Fair Price

Warren Buffett transformed value investing from bargain hunting into a philosophy of buying quality for the long term. While his mentor Benjamin Graham focused on statistical cheapness, Buffett learned that the best investments are “wonderful companies at fair prices”.

What Buffett Looks For:

- Consistent, predictable earnings and cash flow.

- High return on equity (ROE) with low debt.

- Durable competitive advantages that act as moats.

- Honest and disciplined management with strong capital allocation.

Buffett’s approach is not about timing the market but owning businesses that compound capital over decades. His long-term record shows that patience, quality, and consistency can outperform even in volatile conditions.

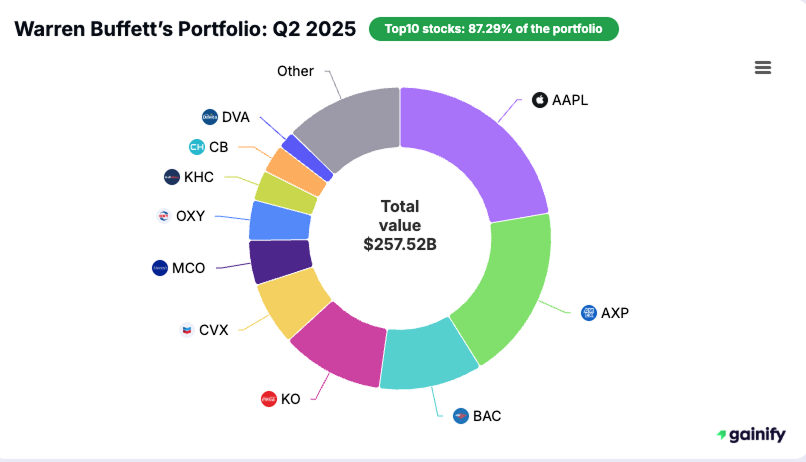

In Buffett’s Q2 2025 portfolio, the pattern of quality and stability is unmistakable. His top holdings include Apple (AAPL), American Express (AXP), Bank of America (BAC), Coca-Cola (KO), and Chevron (CVX). Together, these five companies make up the core of Berkshire Hathaway’s $257.5 billion equity portfolio. They reflect what Buffett values most: enduring brands, reliable cash flow, and the ability to generate strong returns even in uncertain markets.

Key Lesson: True value lies in quality that endures. A great company bought at a reasonable price is more valuable than a cheap company with fading prospects.

2. Peter Lynch: The Hidden Growth Within Value

Peter Lynch, who famously grew Fidelity’s Magellan Fund from $18 million to $14 billion, showed that value doesn’t have to mean slow growth. He coined the concept of “growth at a reasonable price” (GARP), which means investing in companies growing earnings faster than the market, yet still undervalued by investors.

What Lynch Looks For:

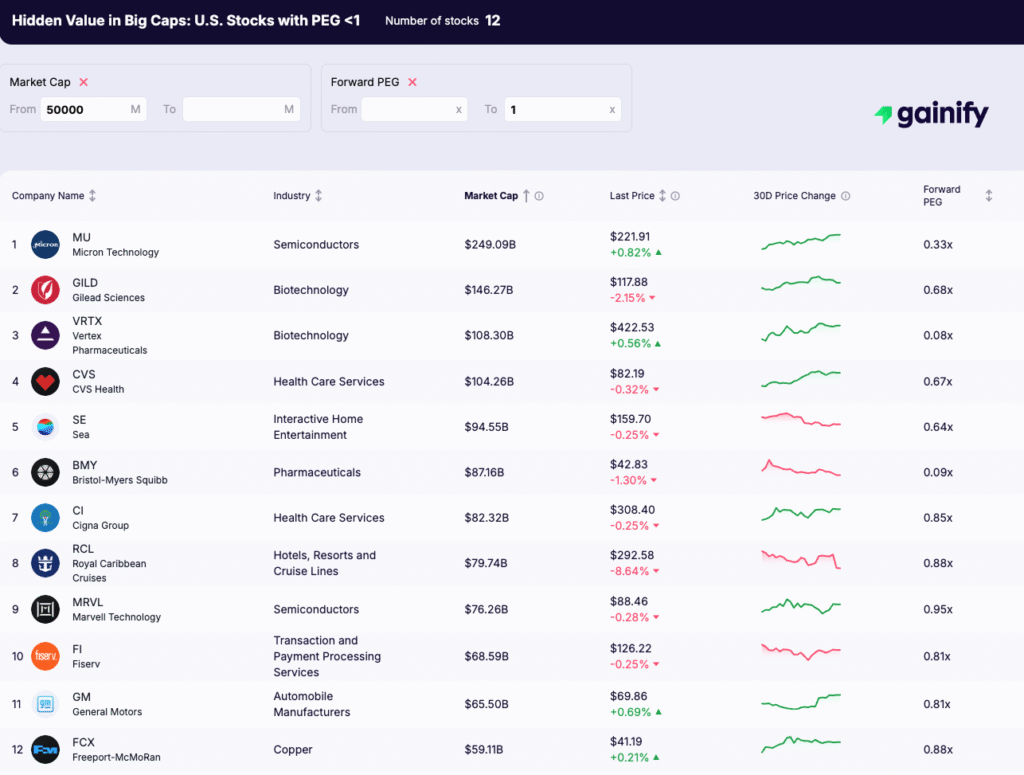

- Strong earnings growth relative to valuation (PEG ratio under 1).

- Businesses with simple, understandable models.

- Insider ownership that aligns management with shareholders.

- Niche industries or companies overlooked by analysts.

Lynch’s genius was his ability to find opportunity in the everyday. He often said, “Invest in what you know,” spotting hidden gems from consumer trends before Wall Street caught on.

For instance, the chart below highlights U.S. large-cap stocks with a forward PEG ratio below 1 – the kind of companies that would have caught Lynch’s eye. Firms like Micron Technology, Vertex Pharmaceuticals, and Sea are examples of businesses combining healthy earnings growth with attractive valuations.

Key Lesson: Value and growth are not opposites. The best investments combine both — companies that can expand earnings while still trading below their long-term potential.

3. Howard Marks: The Discipline of Risk and Reward

Howard Marks, co-founder of Oaktree Capital, has built his investing career on mastering one essential skill: understanding risk. Unlike traditional value investors who focus mainly on cheap valuations, Marks looks for mispriced risk, meaning assets where potential reward significantly outweighs the downside.

What Marks Looks For:

- Companies with strong cash flow and manageable leverage

- Assets that are temporarily out of favor but supported by solid fundamentals

- Cyclical opportunities where market sentiment has swung too far

- A constant focus on downside protection and credit quality

Marks believes that markets move in repeating cycles of fear and greed. The best investors, he argues, stay cautious when optimism is high and act decisively when pessimism dominates. His method combines deep credit analysis with behavioral insight, allowing him to find opportunities where others see only uncertainty.

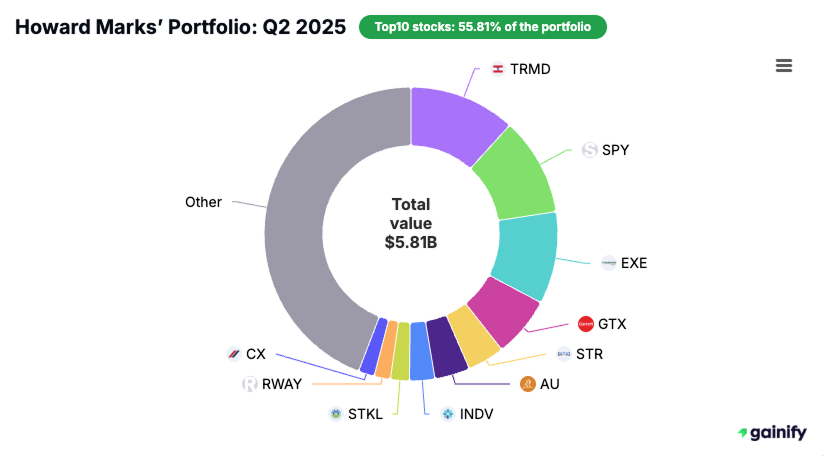

In his Q2 2025 portfolio, Marks holds a mix of industrial, energy, and specialty financial names such as Teekay Tankers (TRMD), Garrett Motion (GTX), and Indivior (INDV). He also maintains exposure to cyclical recovery plays like Cemex (CX) and Royalty Pharma (RWAY), reflecting his belief that real value often hides in complexity or temporary weakness.

Marks often says, “You can’t predict, but you can prepare.” His approach is not about timing the market but about being correctly positioned when the cycle turns.

Key Lesson: The heart of value investing lies in managing risk. Protecting capital and recognizing when the market has mispriced an asset are the true foundations of lasting success.

How to Identify Value Stocks Like a Pro

Value investing is both an art and a discipline. The best investors use a systematic approach that blends financial strength with forward-looking judgment.

1. Start with fundamentals: Focus on companies that generate consistent earnings, maintain manageable debt, and produce steady free cash flow. True value begins with financial resilience.

2. Evaluate quality: Prioritize businesses with high returns on equity, durable brands, and strong pricing power. These qualities protect profitability even during downturns.

3. Look for catalysts: Identify potential triggers that can unlock value, such as share buybacks, restructurings, cost efficiencies, or new product launches.

4. Practice patience: Value investing rewards discipline. Compounding takes time, and the biggest gains often come from holding through volatility rather than trading on headlines.

5. Diversify intelligently: Blend cyclical value sectors like energy, banks, and industrials with defensive areas such as healthcare and consumer staples. This balance provides both stability and upside.

A well-constructed value portfolio offers a powerful mix of income, resilience, and long-term growth potential.

Bottom Line

In 2026, value investing is making a comeback. After years dominated by speculative growth and short-term trading, investors are once again turning to the fundamentals that built generational wealth: strong balance sheets, consistent earnings, and reasonable valuations.

Whether you align with Buffett’s focus on enduring quality, Lynch’s eye for overlooked growth, or Marks’s discipline in managing risk, the lesson remains timeless: Buy great businesses for less than they’re worth, and let time do the compounding.

The best value stocks are not defined by how cheap they look on paper. They stand out for their reliability, their ability to endure market cycles, and their power to quietly build wealth over time.