Howard Marks, co-founder of Oaktree Capital Management, has built his reputation as one of the most influential voices in credit and value investing. Known for his widely read memos and disciplined approach to risk, Marks focuses on capital preservation, patient buying during periods of market distress, and achieving solid long-term returns without overreaching for yield. Oaktree is recognized for its expertise in alternative investments, particularly distressed debt, but its public equity positions also reveal how Marks applies his cautious, opportunistic philosophy to listed markets.

In Q2 2025, Oaktree Capital reported a 13F portfolio value of $5.8 billion spread across 178 stocks, with an average holding period of six quarters. While the portfolio’s one-year performance was down 7.66%, its five-year performance stands at +75.47%, reflecting the long-term resilience of Marks’ strategy. The latest filings show a notable emphasis on derivative hedges, selective emerging market exposure, and measured reductions in cyclical sectors.

The most striking move was the aggressive ramp-up in SPDR S&P 500 ETF (SPY) Puts, signaling heightened caution toward U.S. equities. At the same time, Oaktree trimmed positions in commodities and shipping while adding targeted stakes in healthcare, industrials, and logistics.

In the sections ahead, we will explore Howard Marks’ background, his investment philosophy, and the key Q2 2025 portfolio moves, including detailed commentary on the largest additions, new buys, complete exits, and position cuts. By the end, you will have a clear picture of how one of the world’s most respected investors is positioning for an uncertain macroeconomic landscape.

Who Is Howard Marks

Howard Marks co-founded Oaktree Capital Management in 1995, growing it into one of the largest and most respected investment managers in alternative assets. His expertise in distressed debt, credit markets, and contrarian investing has made him a trusted voice for both institutional and retail investors.

Marks began his career at Citicorp in 1969 where he worked in equity research before transitioning into high-yield bonds and convertible securities. In the 1980s, he moved to TCW Group where he built its distressed debt business. That success laid the groundwork for Oaktree, which now manages more than $150 billion across multiple strategies.

Known for his disciplined temperament, Marks often stresses that the biggest risk is not volatility, but the possibility of permanent loss of capital. His memos, which cover market cycles, investor psychology, and risk management, are read by global finance leaders, including Warren Buffett.

Over the decades, Marks has become one of the biggest names in portfolio management, admired for combining deep market knowledge with patience, prudence, and a willingness to act decisively during moments of market dislocation.

Howard Marks’ Investment Philosophy

At the heart of Marks’ philosophy is the belief that successful investing requires balancing offense and defense. He focuses on knowing when to take advantage of opportunities and when to protect capital. He favors contrarian moves, buying undervalued assets when sentiment is low and scaling back when valuations become stretched.

Risk control is central. Rather than chasing every rally, Marks focuses on positioning portfolios to withstand adverse conditions. This often involves hedging through derivatives, maintaining liquidity, and diversifying across sectors and geographies.

Marks is also known for his emphasis on market cycles. He believes that understanding where we are in the cycle, whether it is credit, equity, or sentiment, is critical for making prudent allocation decisions. In his view, “You can’t predict, but you can prepare,” which often leads Oaktree to keep a defensive tilt during late-cycle markets.

The Q2 2025 13F filing is a clear example of this approach, building macro hedges, trimming cyclical exposure, and selectively adding to companies with favorable valuations or unique market positioning.

Q2 2025 Changes in Detail: Howard Marks’ Equity Portfolio

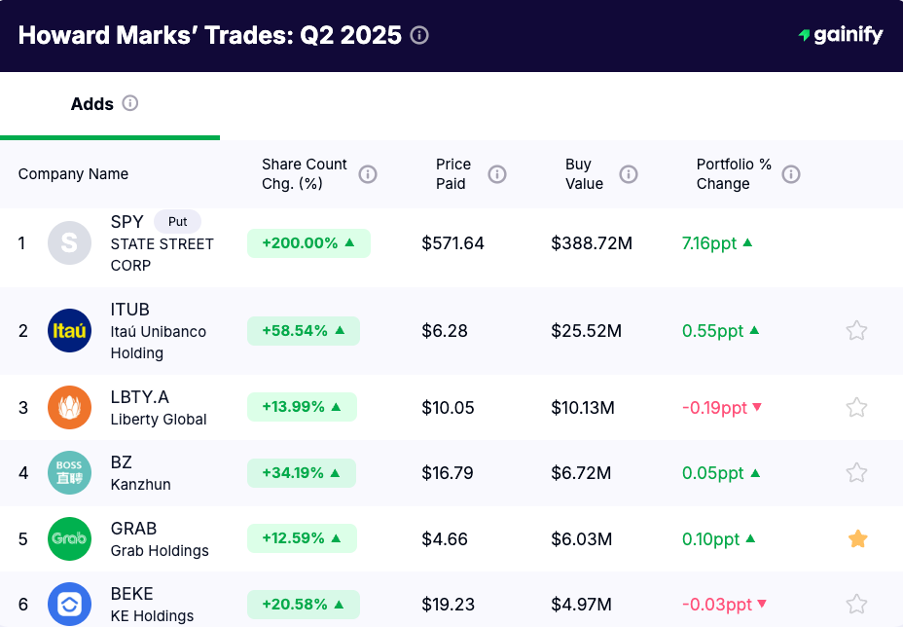

1. Adds: Defensive Hedging and Selective Growth Bets

The headline move in Q2 was the 200 percent increase in SPDR S&P 500 ETF (SPY) Puts worth $388.72 million in new exposure. This boosted SPY Puts to 10.84 percent of the entire portfolio, making it Oaktree’s second-largest position. This is a clear signal that Marks is bracing for potential downside in the broader U.S. equity market while keeping his core positions intact.

Other notable additions include:

- Itaú Unibanco (ITUB) — 58.54 percent more shares, $25.52 million added. Expands exposure to Brazilian banking, offering yield and diversification in emerging markets.

- Kanzhun (BZ) — 34.19 percent more shares, $6.72 million added. An intriguing contrarian bet on China’s labor market recovery despite broader skepticism toward Chinese equities.

- KE Holdings (BEKE) — 20.58 percent more shares, $4.97 million added. Indicates selective confidence in China’s property services sector.

- Liberty Global (LBTY.A) and Grab Holdings (GRAB) saw modest increases, reinforcing exposure to communications and Southeast Asian ride-hailing and logistics.

This mix of moves shows Marks balancing macro protection with targeted, idiosyncratic opportunities.

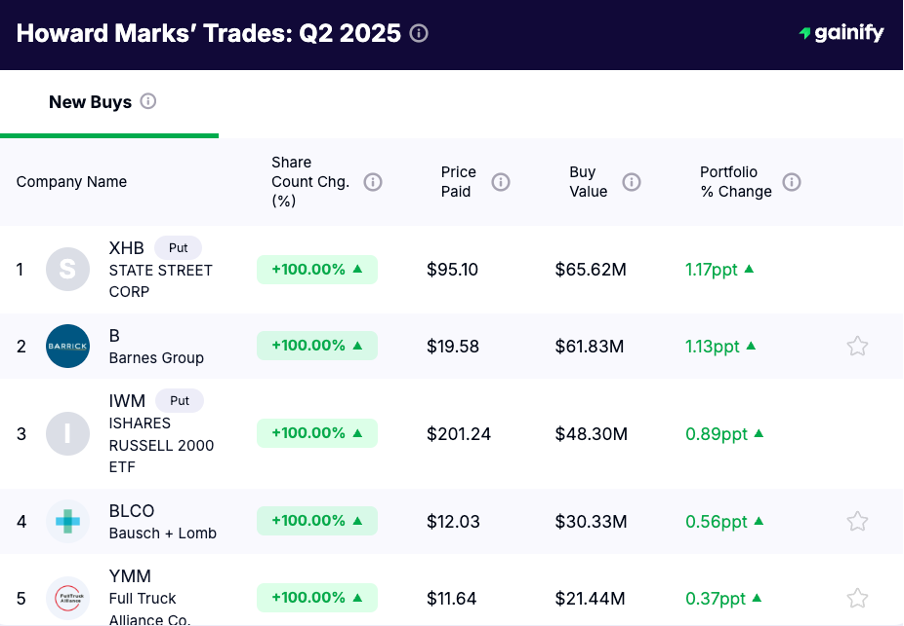

2. New Buys: Industrials, Healthcare, and More Hedging

Marks opened several new positions with a clear barbell approach that combines more macro hedging with selective stock entries.

- XHB Puts (State Street Homebuilders ETF) — $65.62 million, 1.17 percent of portfolio. Positions against U.S. homebuilders, likely reflecting concerns over high mortgage rates and slowing housing demand.

- Barnes Group (B) — $61.83 million, 1.13 percent of portfolio. An industrial and aerospace components maker trading at appealing valuations with potential upside from aviation recovery.

- IWM Puts (iShares Russell 2000 ETF) — $48.30 million, 0.89 percent of portfolio. Targets small-cap U.S. stocks which tend to underperform in economic slowdowns.

- Bausch + Lomb (BLCO) — $30.33 million, expanding healthcare and vision care exposure.

- Full Truck Alliance (YMM) — $21.44 million, adding a Chinese logistics and freight platform to the portfolio.

- Liberty Latin America (LILA.K) — $12.55 million, increasing telecom exposure in emerging markets.

These buys emphasize cautious offense, taking advantage of attractive entry points in select companies while building insurance against broader equity declines.

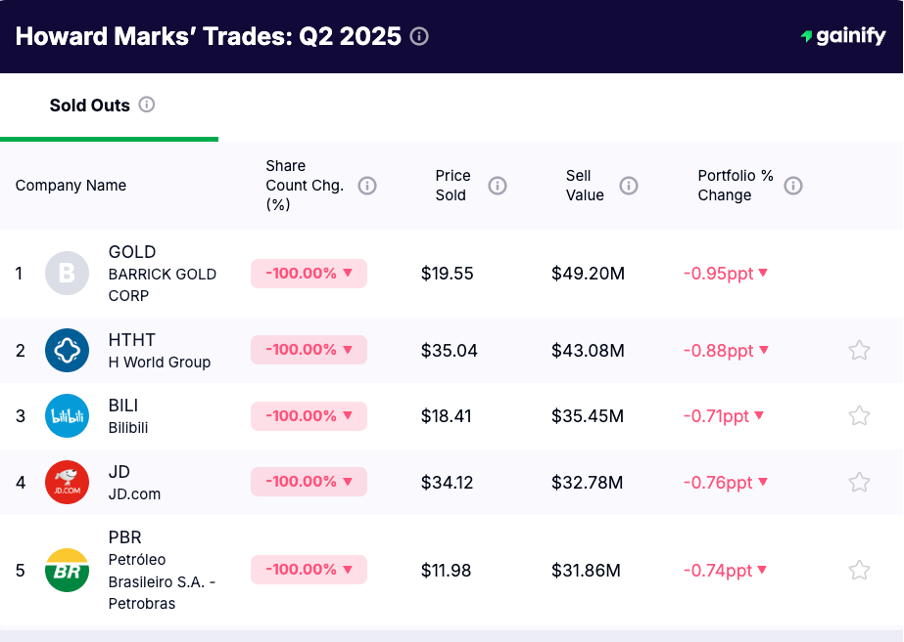

3. Sold Outs: Strategic Exits from Commodities and China Tech

Oaktree fully exited several positions, marking a strategic clean-up of higher-risk or less-aligned holdings:

- Barrick Gold (GOLD) — $49.20 million sold. The complete removal of gold exposure suggests a shift toward derivative-based hedges over commodity-based protection.

- H World Group (HTHT) — $43.08 million, Bilibili (BILI) — $35.45 million, JD.com — $32.78 million, and Baidu (BIDU) — $17.23 million were all liquidated, representing a significant retreat from Chinese consumer and tech names.

- Petrobras (PBR) — $31.86 million sold, reducing emerging market energy risk.

The common theme is to reduce geopolitical complexity and free up liquidity for more flexible strategies.

4. Cuts: Trimming Big Winners and Cyclical Exposure

Several major holdings were reduced:

- Expand Energy (EXE) — 8.99 percent cut, $55.80 million trimmed. Still a top-three holding, but profit-taking after a strong performance.

- Garrett Motion (GTX) — 16.31 percent cut, $72.38 million trimmed. Remains a top-five name, suggesting portfolio rebalancing rather than loss of conviction.

- Vale (VALE) — 66.19 percent cut, $37.50 million reduction. A sharp scale-back in mining exposure likely on weaker commodity demand.

- Talen Energy (TLN) — 59.41 percent cut, $45.08 million sold. Scaling back in the power generation space.

- Star Bulk Carriers (SBLK) — 39.88 percent cut, $33.33 million trimmed. Reducing exposure to volatile freight markets.

- CEMEX (CX) — 23.45 percent cut, $28.81 million reduction though it remains a top-10 position.

These trims point to a deliberate rotation away from cyclicals while locking in gains from outperformers.

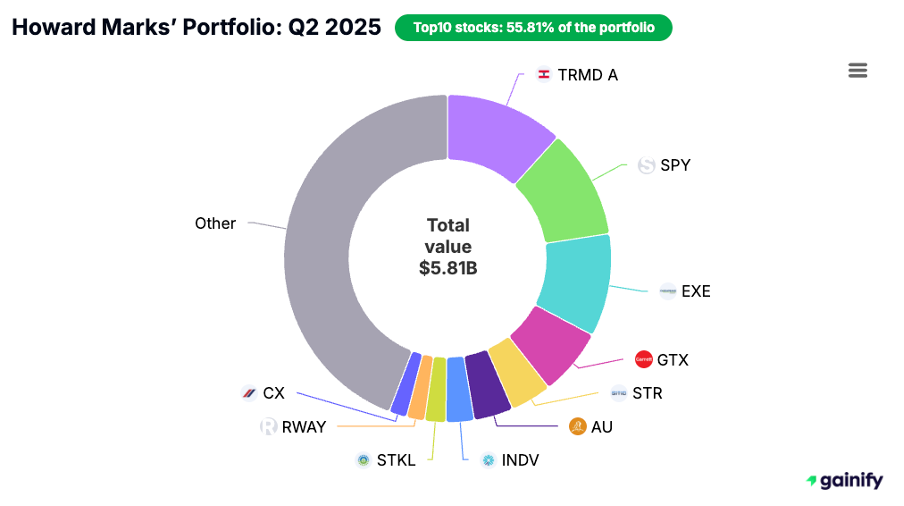

Top 10 Holdings: Q2 2025 Equity Portfolio

As of Q2 2025, Oaktree Capital’s top holdings account for 55.81 percent of the portfolio’s total value:

- TORM (TRMD A) — $681.59M, 11.72 percent

- SPDR S&P 500 ETF Puts (SPY) — $630.21M, 10.84 percent

- Expand Energy (EXE) — $591.99M, 10.18 percent

- Garrett Motion (GTX) — $387.76M, 6.67 percent

- Sitio Royalties (STR) — $237.94M, 4.09 percent

- AngloGold Ashanti (AU) — $225.47M, 3.88 percent

- Indivior (INDV) — $162.27M, 2.79 percent

- SunOpta (STKL) — $120.19M, 2.07 percent

- Runway Growth Finance (RWAY) — $104.94M, 1.80 percent

- CEMEX (CX) — $102.83M, 1.77 percent

This concentration shows a blend of commodity plays, defensive hedges, and niche industry leaders.

Key Takeaways: Howard Marks’ Q2 2025 Equity Portfolio

- $5.81 billion portfolio value with more than half concentrated in the top ten positions.

- Significant additions to SPY and IWM Puts plus new XHB Puts show a clear focus on downside protection.

- Selective emerging market bets in Brazil, China, and Latin America.

- Full exit from Chinese consumer and tech giants, reducing geopolitical exposure.

- Rotation out of cyclicals such as mining, energy, and shipping while keeping core positions.

- A top-heavy portfolio that balances concentrated conviction with diversified hedging.