Chris Hohn is widely recognized as one of the most influential activist investors of the modern era. Through his firm, TCI Fund Management, he has established a reputation for pursuing high-conviction bets and using shareholder influence to push for operational, strategic, and governance improvements. His approach is not built around short-term speculation, but around identifying companies with durable economic advantages and then working to unlock additional value. Few investors combine activism with such a concentrated portfolio structure, which makes every decision both impactful and revealing.

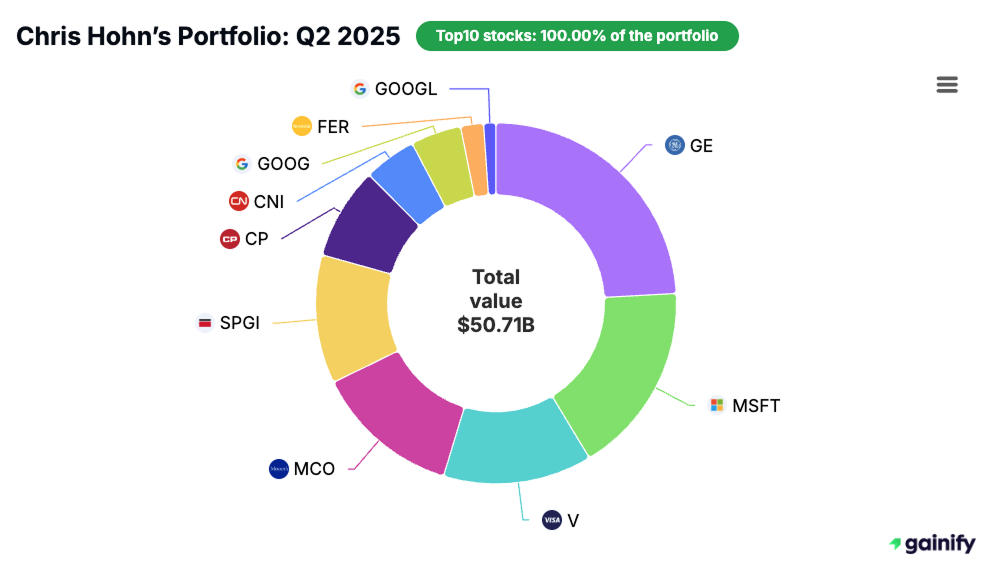

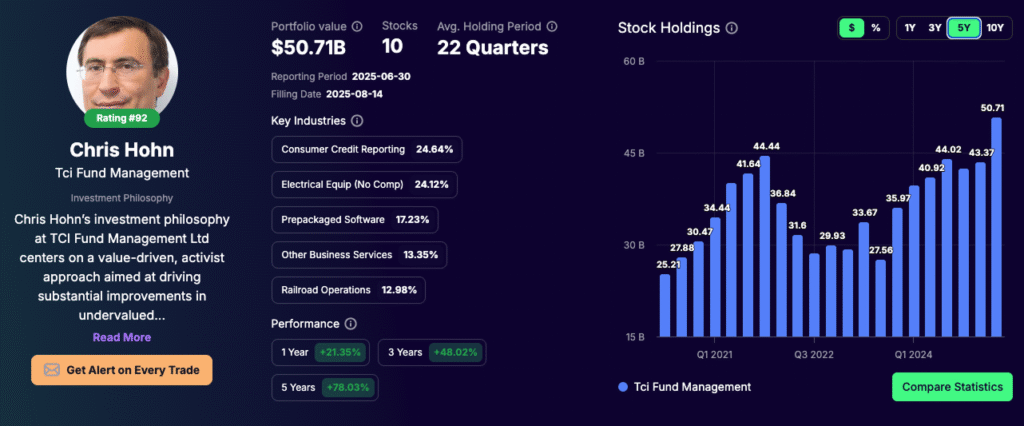

In the second quarter of 2025, TCI reported a 13F portfolio valued at $50.7 billion. This figure represents the fund’s highest equity exposure in more than a decade, underscoring the depth of Hohn’s conviction in his current slate of holdings.

Unlike many hedge funds that spread risk across dozens of names, TCI runs a portfolio of only 10 positions. Each holding is carefully selected and sized with the expectation that it can move the needle on overall performance. The concentration also reflects Hohn’s belief that real value is created not by chasing every market opportunity but by doubling down on the few businesses with the strongest competitive moats and structural growth prospects.

The Q2 filing shows a decisive shift in emphasis. The most notable increases came in Visa, S&P Global, Microsoft, and Moody’s, all businesses tied to the infrastructure of global finance and data. At the same time, TCI trimmed stakes in Canadian railroads and Alphabet, reallocating capital to areas with higher perceived durability and pricing power. General Electric remains by far the largest holding, representing nearly a quarter of the fund, a signal of Hohn’s long-term confidence in the transformation of one of America’s most storied industrial giants. Taken together, these moves illustrate a disciplined portfolio tilt toward companies that combine recurring revenues with global scale and strategic influence.

In the sections ahead, this article will explore Chris Hohn’s background as an activist investor, tracing how he developed a style that blends concentration with advocacy for corporate reform. We will break down TCI’s Q2 2025 portfolio in detail, highlighting the largest additions and reductions, while examining the industries that dominate his holdings. Finally, we will assess what this portfolio reveals about Hohn’s long-term strategy, why he continues to favor financial and industrial leaders, and what lessons individual investors can take from his approach.

Who Is Chris Hohn

Chris Hohn is one of the most powerful activist investors of his generation. He founded The Children’s Investment Fund Management (TCI) in 2003, building it into one of the world’s most concentrated and influential hedge funds. From the start, TCI distinguished itself with a combination of deep value investing and aggressive shareholder activism. The fund became known for demanding accountability from corporate boards, pressing for operational efficiency, and driving capital allocation reforms. Hohn’s reputation as an uncompromising negotiator in boardrooms earned him the label of “the world’s most feared activist investor” from The Telegraph.

Born in 1966 in Surrey, England, Hohn studied accounting and business economics at the University of Southampton, graduating at the top of his class. He later attended Harvard Business School, where he earned his MBA and graduated as a Baker Scholar, the highest academic distinction awarded to the top 5% of the class. His early career included a stint at private equity firm Apax Partners and later at Perry Capital, where he refined the activist investment approach that would define his career.

Since its founding, TCI has delivered long-term compound annual returns in the mid-teens, cementing its place among the most successful hedge funds globally. Unlike funds that hold hundreds of positions, TCI typically runs fewer than 15, with outsized allocations to companies Hohn believes are undervalued but capable of structural improvement. His campaigns have targeted major corporations across industries, including ABN Amro, Deutsche Börse, Canadian National Railway, Alphabet, and General Electric. Many of these campaigns resulted in sweeping changes to corporate governance, capital deployment, and long-term strategy.

Beyond the markets, Hohn has established himself as a leading philanthropist. He founded the Children’s Investment Fund Foundation (CIFF) in 2002, which today is one of the largest charitable foundations in Europe. CIFF focuses on children’s health, nutrition, education, and climate change, with Hohn personally committing at least $5 billion to philanthropic causes over his lifetime. His environmental advocacy has also extended to his role as a financier, where he has pressed companies to adopt stronger climate disclosures and supported shareholder campaigns tied to sustainability.

Chris Hohn’s Investment Philosophy

At the heart of Chris Hohn’s philosophy is a blend of concentration, activism, and patient long-term conviction. TCI does not spread its bets across dozens of industries. Instead, it takes large, carefully selected positions and holds them long enough to influence strategy and capture compounding gains. The fund’s average holding period exceeds five years, underscoring its focus on durable value creation rather than quick trades.

Core characteristics of Hohn’s approach include:

✓ Concentrated positions: TCI typically holds around 10 stocks, each carefully chosen and large enough to materially impact performance. This reflects the belief that too much diversification dilutes returns.

✓ Activist discipline: Hohn is willing to challenge management teams directly, press for governance reforms, push for capital allocation discipline, and drive operational changes that unlock shareholder value.

✓ Focus on durable industries: The portfolio leans on railroads, financial infrastructure, credit agencies, and payments, all of which benefit from high barriers to entry, recurring cash flows, and pricing power.

✓ Selective technology exposure: Instead of broad bets across emerging tech, TCI prefers dominant platforms with proven economics such as Microsoft and Alphabet, where scale and competitive moats are clear.

✓ Patience as a strategy: By holding positions for multiple years, TCI ensures it has both the time and influence needed to push through structural reforms and fully benefit from long-term growth drivers.

Q2 2025 Changes in Detail: Chris Hohn’s Equity Portfolio

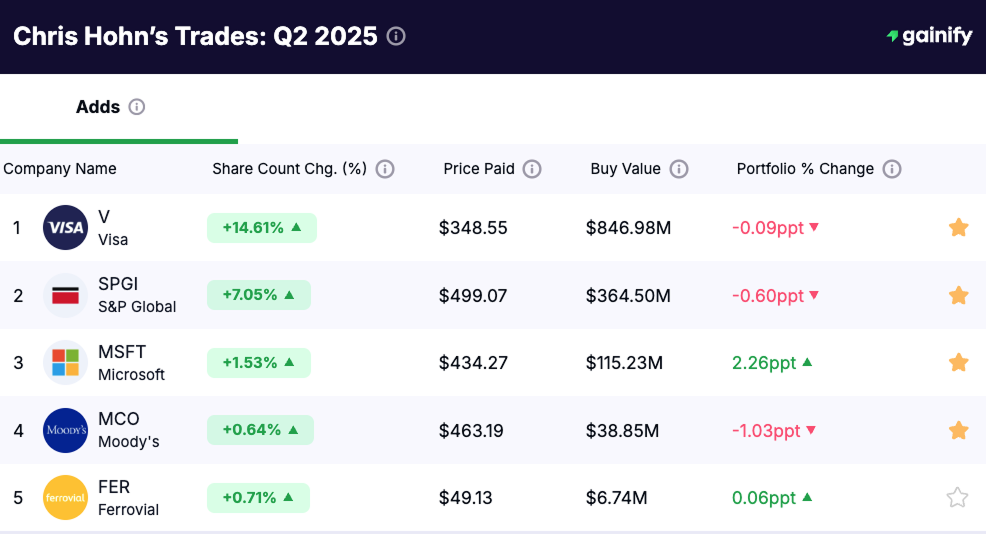

TCI Fund Management made targeted but meaningful adjustments in its Q2 2025 equity portfolio. The filing shows four key areas of activity.

1. Major Additions

Hohn boosted exposure to financial infrastructure and software leaders:

- Visa ($V) +14.61% shares, $846.98M added

- S&P Global ($SPGI) +7.05% shares, $364.50M added

- Microsoft ($MSFT) +1.53% shares, $115.23M added

- Moody’s ($MCO) +0.64% shares, $38.85M added

- Ferrovial ($FER) +0.71% shares, $6.74M added

These moves show a tilt toward financial data, payments, and software, all of which offer scalable, recurring revenue models.

2. Reductions in Current Positions

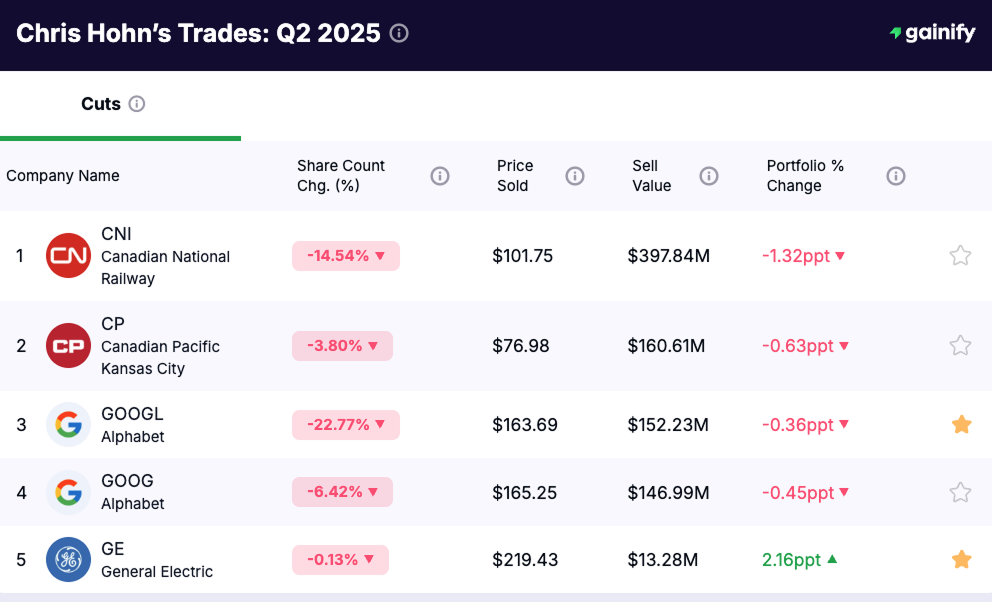

TCI trimmed several railroads and tech holdings:

- Canadian National Railway ($CNI) reduced by -14.54%, $2.39B stake remains

- Alphabet Class A ($GOOGL) reduced by -22.77%, $556M stake remains

- Alphabet Class C ($GOOG) reduced by -6.42%, $2.30B stake remains

- Canadian Pacific Kansas City ($CP) reduced by -3.80%, $4.19B stake remains

- General Electric ($GE) modestly trimmed by -0.13%, though still the largest holding

3. Portfolio Concentration Remains

Despite adjustments, TCI remains highly concentrated. The top 5 holdings account for more than 80% of portfolio value, underscoring its conviction-based strategy.

4. No New Buys

Unlike some quarters, TCI did not open any new positions, choosing instead to rebalance existing holdings.

Top 10 Holdings: Q2 2025 Equity Portfolio

As of the Q2 2025 13F filing, TCI’s equity portfolio was valued at $50.7 billion. The top 10 holdings are:

Rank | Holding | Ticker | Value ($B) | Portfolio Weight |

1 | General Electric | $GE | 12.23 | 24.1% |

2 | Microsoft | $MSFT | 8.74 | 17.2% |

3 | Visa | $V | 6.77 | 13.3% |

4 | Moody’s | $MCO | 6.64 | 13.1% |

5 | S&P Global | $SPGI | 5.85 | 11.5% |

6 | Canadian Pacific Kansas City | $CP | 4.19 | 8.3% |

7 | Canadian National Railway | $CNI | 2.39 | 4.7% |

8 | Alphabet Class C | $GOOG | 2.30 | 4.5% |

9 | Ferrovial | $FER | 1.04 | 2.0% |

10 | Alphabet Class A | $GOOGL | 0.56 | 1.1% |

Key Takeaways — Chris Hohn’s Q2 2025 Equity Portfolio

- Portfolio at record highs: Valued at $50.7B, one of the most concentrated large hedge fund portfolios globally.

- Concentration strategy: Only 10 stocks, with the top 5 making up ~80% of value.

- Big bets on financial infrastructure: Additions to Visa, S&P Global, Moody’s, and Microsoft highlight a focus on recurring-revenue models.

- Railroad trims: Cuts to Canadian Pacific and Canadian National signal a cautious approach to transport exposure.

- Selective tech positioning: Alphabet reduced, but Microsoft increased, showing preference for software over advertising-driven tech.

- GE dominance: General Electric remains the single largest holding at 24% of portfolio value.