George Soros has spent more than half a century redefining what it means to be a macro investor. Unlike managers whose reputations are built on compounding through duration, Soros built his legacy by acting decisively at inflection points, sizing positions aggressively when probability skewed in his favor, and stepping aside just as quickly when reflexive dynamics began to reverse.

His most famous insight — “markets are always wrong” — is not a dismissal of prices, but a framework. Soros believes that prices shape fundamentals just as much as fundamentals shape prices. That feedback loop, which he formalized as reflexivity, remains the intellectual backbone of Soros Fund Management today.

Q3 2025 is a clear example of that philosophy in motion. The portfolio does not read like a directional bet on growth, rates, or geopolitics. Instead, it reflects adaptive positioning: selective exposure to large-cap platforms, tactical use of ETFs and options, decisive exits where reflexive upside has played out, and constant recalibration of risk.

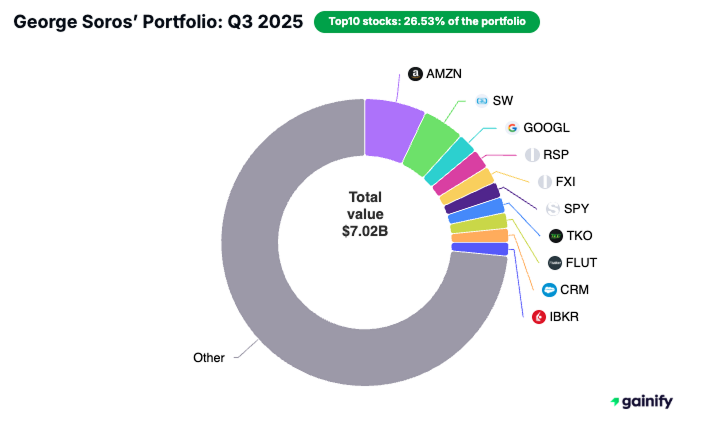

As of Q3 2025, Soros Fund Management reported approximately $7.02 billion in public equity holdings, spread across 184 positions, with an average holding period of just four quarters. That turnover alone tells a story. This is not a portfolio designed to sit still.

Soros’ Investment Style: Conviction Without Attachment

George Soros has never fit the mold of a traditional long-term investor. He is not guided by loyalty to positions, narratives, or even his own past convictions. What defines Soros is detachment. The ability to commit aggressively when the odds tilt in his favor, and to exit just as quickly when they do not.

His most famous trades were never built on certainty. They were built on asymmetry.

Breaking the Bank of England

The moment that cemented Soros’ reputation came in 1992, during the collapse of the British pound. At the time, the United Kingdom was part of the European Exchange Rate Mechanism, a system that forced the pound to trade within a fixed band against other European currencies. The framework looked stable on paper. In reality, it was fragile.

Soros identified the contradiction early. The British economy was weak. Interest rates were painfully high. Defending the currency peg required political will and economic sacrifice that could not last. The longer the Bank of England fought the market, the more pressure built.

Soros did not ask whether the pound was undervalued or overvalued. He asked a more important question.

What happens if this breaks?

The answer was clear. If the peg survived, losses were limited. If it failed, the upside was enormous. That imbalance mattered more than being “right.”

As pressure mounted, Soros increased his short position. When the UK government finally abandoned the peg, the pound collapsed. Soros reportedly made more than one billion dollars in a single day, while the Bank of England was forced to withdraw from the ERM. The trade worked not because Soros predicted the future, but because market pressure itself accelerated the outcome.

It was reflexivity in action.

A Philosophy Built on Risk, Not Certainty

That episode did more than define Soros’ public image. It defined his approach to risk.

As Soros famously said: “It’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when you’re wrong.”

This philosophy explains why Soros portfolios often look complex at first glance. They are not designed for elegance. They are designed for adaptability.

ETFs sit alongside individual stocks. Options coexist with outright equity positions. Long exposures appear next to hedges that seem to contradict them. Positions are layered, resized, reduced, and sometimes eliminated entirely within a single quarter.

Soros believes markets are reflexive rather than efficient. Prices shape behavior. Behavior reshapes fundamentals. Those fundamentals then feed back into prices. Because of this loop, conviction must always remain conditional.

When the feedback loop strengthens, Soros presses. When it weakens, he steps away without hesitation.

George Soros’ Role Today

George Soros is no longer involved in day-to-day trading, but his influence remains central. Soros Fund Management has operated as a family office since 2011, with portfolio execution led by a professional investment team under CEO and CIO Dawn Fitzpatrick.

Soros now plays a strategic and philosophical role. He helps shape how risk is framed, how reflexivity is applied, and how capital is structured, rather than making individual trade decisions. The emphasis on flexibility, use of ETFs and derivatives, and rapid position changes all reflect his enduring framework.

Q3 2025 fits this model well. The portfolio is not driven by a single macro call, but by a system built on Soros’ ideas and executed by a modern investment team.

Portfolio Overview: Q3 2025

At a high level, the portfolio shows moderate concentration with high flexibility:

- Portfolio value: ~$7.02B

- Number of holdings: 184

- Average holding period: ~4 quarters

- Top 10 holdings: ~26.5% of total portfolio value

The surface diversification masks the real signal. Capital above meaningful size thresholds is concentrated in a relatively small group of positions, while the long tail provides optionality, hedging, and tactical exposure.

The Big Picture in Q3 2025

The most important insight from Q3 2025 is not the list of holdings, but the movement of capital through the portfolio. This was not a quarter defined by passive appreciation or by leaning aggressively into a single macro view. It was defined by active repositioning.

Equity exposure was rebalanced rather than expanded. Soros Fund Management did not materially increase net risk. Instead, exposure was reshaped. Capital was shifted toward areas where feedback loops still appeared favorable and trimmed where upside had already been reflected in price. This distinction matters. The firm was not chasing momentum. It was refining exposure.

Large additions did not occur in isolation. They were funded by equally decisive exits and reductions elsewhere in the portfolio. When conviction increased, position sizes moved quickly. When expected returns compressed or narratives became crowded, capital was withdrawn just as decisively. This constant recycling of capital is a hallmark of the Soros framework and a clear signal that flexibility was prioritized over persistence.

ETFs and options played a structural role, not a supplemental one. Broad market ETFs, equal-weight exposures, and regional funds were used to fine-tune market participation, while options were deployed to define risk, express conditional views, and manage tail outcomes. Rather than relying on single stocks to carry macro views, the portfolio used instruments that allow rapid adjustment as conditions evolve.

Technology exposure remained an important component of the portfolio, but it was carefully sized and diversified. Large-cap platforms were favored over speculative expressions, and exposure was balanced through both direct equity positions and sector-level vehicles. This reflects recognition of technology’s structural importance without assuming linear upside.

Taken together, Q3 2025 was not a quarter of accumulation. It was a quarter of calibration. The portfolio was repositioned to remain responsive rather than committed, emphasizing optionality over inertia. Capital was placed where reflexive upside still existed, and withdrawn where the balance of risk and reward had evened out.

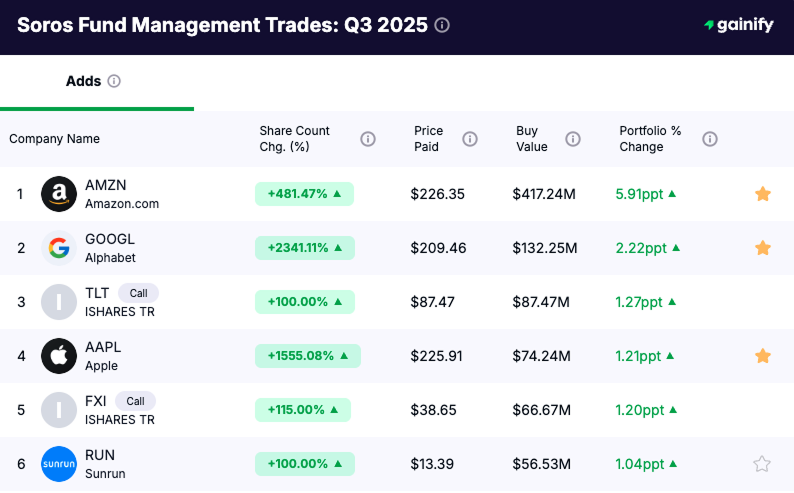

Adds: Leaning Into Select Conviction

The most consequential activity in Q3 2025 came from large, concentrated additions to a small set of positions. These moves reshaped the top of the portfolio and signal where conviction strengthened materially.

Amazon (NASDAQ: AMZN)

- Share count change: +481.5%

- Capital added: ~$417 million

Amazon was the single largest addition of the quarter and moved into the top position in the portfolio. The scale of the increase points to high conviction in Amazon as a structural platform capable of compounding through macro volatility, supported by AWS, logistics scale, and long-term operating leverage.

Alphabet (NASDAQ: GOOGL)

- Share count change: +234.1%

- Capital added: ~$132 million

Alphabet was increased aggressively, reflecting confidence in durable cash flows and data-driven monetization. The add appears focused on long-term platform economics rather than short-term AI enthusiasm, with sizing that meaningfully increases exposure without dominating portfolio risk.

iShares 20+ Year Treasury ETF (TLT) – Call Options

- Share count change: +100%

- Capital added: ~$87 million

The TLT call position introduces convex, rate-sensitive optionality that can hedge equity risk in specific macro scenarios, particularly a decline in long-term yields, without materially increasing downside exposure.

Apple (NASDAQ: AAPL)

- Share count change: +1555.1%

- Capital added: ~$74 million

Apple was expanded sharply from a small base. The move suggests a defensive tilt within technology, emphasizing balance sheet strength, ecosystem durability, and capital return over speculative growth.

iShares China Large-Cap ETF (FXI) – Call Options

- Share count change: +115.0%

- Capital added: ~$66.7 million

FXI was added through call options, signaling a defined-risk re-engagement with China exposure. The structure indicates opportunistic positioning tied to policy or sentiment shifts rather than a long-duration commitment.

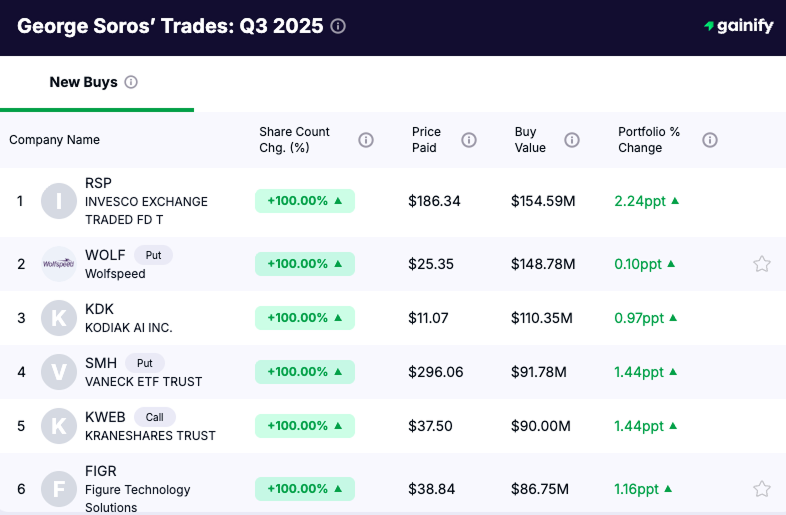

New Buys: Tactical Exposure, Not Exploration

New positions initiated in Q3 2025 were immediately sized to matter, signaling that these were not exploratory trades but deliberate expressions of view. Each position was introduced with clear structure, defined risk, and a specific role within the broader portfolio.

Invesco S&P Equal Weight ETF (RSP)

- Share count change: +100%

- Capital deployed: ~$155 million

RSP entered the portfolio as a meaningful new position, providing exposure to market breadth rather than mega-cap concentration. The equal-weight structure reflects a view that leadership may broaden as index concentration reaches extremes, a common reflexive shift late in narrow market cycles.

Wolfspeed (NYSE: WOLF) – Put Options

- Share count change: +100%

- Capital deployed: ~$149 million

Exposure to Wolfspeed was expressed entirely through put options, signaling skepticism while strictly defining downside. This construction avoids equity ownership risk and allows Soros Fund Management to benefit from adverse outcomes without committing long capital.

Kodiak AI (KDK)

- Share count change: +100%

- Capital deployed: ~$110 million

Kodiak AI was added as a new equity position tied to AI and data infrastructure themes. The sizing places it firmly within the active risk bucket, large enough to influence outcomes but intentionally constrained. The position appears designed to capture upside optionality in AI infrastructure without introducing outsized exposure.

VanEck Semiconductor ETF (SMH)

- Share count change: +100%

- Capital deployed: ~$92 million

SMH was added to gain broad semiconductor exposure without relying on individual stock selection. The ETF complements existing technology holdings by providing diversified access to the compute and memory supply chain while preserving flexibility to adjust exposure quickly as reflexive dynamics evolve.

Cuts: Trimming Where Reflexivity Has Matured

Q3 2025 featured decisive reductions across several positions, signaling that expected upside had narrowed or that portfolio risk needed to be reshaped. These were not minor trims. Each cut exceeded meaningful capital thresholds and materially altered exposure.

First Solar (NASDAQ: FSLR) – Call Options

- Share count change: –93.9%

- Capital reduced: ~$295 million

First Solar was the largest cut of the quarter by capital. The reduction removed most of the exposure after a period where clean energy optimism had become widely priced in. This aligns with a core Soros principle: once a narrative reaches consensus and price reflects it, reflexive upside weakens sharply.

SPDR S&P 500 ETF (SPY) – Put Options

- Share count change: –64.8%

- Capital reduced: ~$223 million

Downside protection through SPY puts was reduced significantly. This move suggests a recalibration of hedge intensity rather than a wholesale shift in market view. Tail risk was trimmed as positioning elsewhere in the portfolio evolved, freeing capital while still retaining flexibility.

Sunrun (NASDAQ: RUN) – Call Options

- Share count change: –76.3%

- Capital reduced: ~$97 million

Sunrun exposure was cut aggressively. The reduction indicates diminished confidence in near-term payoff dynamics, particularly as financing conditions and execution risks weigh on renewable energy plays. The cut materially reduced sensitivity to the theme.

Brown & Brown (NYSE: BRO)

- Share count change: –99.2%

- Capital reduced: ~$97 million

Brown & Brown was effectively exited through a near-total reduction. The move suggests that the original thesis had fully played out, or that relative opportunity elsewhere justified reallocating capital.

GFL Environmental (NYSE: GFL)

- Share count change: –69.3%

- Capital reduced: ~$96 million

GFL Environmental was reduced sharply, lowering exposure to waste management and infrastructure services. The cut reflects tighter risk control rather than a complete abandonment of the theme.

Sold Outs: Clearing the Deck

Q3 2025 saw clean, full exits from several positions, signaling a decisive reset rather than incremental repositioning. These sold outs removed both directional exposure and structural hedges, freeing capital and simplifying portfolio risk.

iShares Russell 2000 ETF (IWM) – Put Options

- Share count change: –100%

- Capital exited: ~$241 million

The complete exit from IWM puts removed downside exposure to small-cap equities. This suggests reduced concern around small-cap underperformance or a shift toward other instruments for managing macro risk.

Invesco QQQ Trust (QQQ) – Call Options

- Share count change: –100%

- Capital exited: ~$229 million

QQQ call exposure was fully eliminated, reducing concentrated upside exposure to mega-cap technology. The exit reflects discipline after a period where large-cap tech performance had already been strongly realized.

Consumer Staples Select Sector SPDR (XLP) – Put Options

- Share count change: –100%

- Capital exited: ~$113 million

The removal of XLP puts signals reduced downside protection on defensive sectors, consistent with a broader reshaping of hedge structures rather than a binary macro call.

Industrial Select Sector SPDR (XLI) – Put Options

- Share count change: –100%

- Capital exited: ~$106 million

XLI puts were fully closed, eliminating downside bets on industrials. This suggests a reassessment of cyclical risk and a desire to simplify sector-level hedging.

Liberty Broadband (NASDAQ: LBRD.K)

- Share count change: –100%

- Capital exited: ~$101 million

Liberty Broadband was exited outright. The move indicates that the original thesis had run its course or that capital was better deployed elsewhere.

AerCap Holdings (NYSE: AER)

- Share count change: –100%

- Capital exited: ~$95 million

The full exit from AerCap removed exposure to aircraft leasing and global travel dynamics, further streamlining the portfolio.

George Soros Top 15 Holdings – Q3 2025

Rank | Company | Ticker / Instrument | Market Value | Portfolio Weight | Share Count Change | Holding Period |

1 | AMZN | $488.80M | 6.96% | +481.47% | 20 Quarters | |

2 | Smurfit Westrock | SW | $329.79M | 4.70% | +3.56% | 5 Quarters |

3 | Alphabet | GOOGL | $160.05M | 2.28% | +2341.11% | 35 Quarters |

4 | Invesco S&P Equal Weight ETF | RSP | $157.38M | 2.24% | +100.00% | 1 Quarter |

5 | iShares China Large-Cap ETF | FXI (Call) | $132.68M | 1.89% | +115.00% | 2 Quarters |

6 | SPDR S&P 500 ETF | SPY (Put) | $125.91M | 1.79% | −64.84% | 21 Quarters |

7 | TKO Group Holdings | TKO | $125.22M | 1.78% | +84.79% | 3 Quarters |

8 | Flutter Entertainment | FLUT | $124.56M | 1.77% | +0.06% | 6 Quarters |

9 | $109.91M | 1.57% | +18.98% | 5 Quarters | ||

10 | Interactive Brokers | IBKR | $109.00M | 1.55% | −29.08% | 15 Quarters |

11 | $102.19M | 1.46% | +1.37% | 3 Quarters | ||

12 | VanEck Semiconductor ETF | SMH (Put) | $101.17M | 1.44% | +100.00% | 1 Quarter |

13 | KraneShares China Internet ETF | KWEB (Call) | $100.82M | 1.44% | +100.00% | 1 Quarter |

14 | iShares 20+ Year Treasury ETF | TLT (Call) | $89.37M | 1.27% | +100.00% | 10 Quarters |

15 | Apple | AAPL | $89.05M | 1.27% | +1555.08% | 2 Quarters |

Conclusion: Reflexivity in Practice

The George Soros portfolio in Q3 2025 is best understood not as a static collection of stocks, but as a living expression of reflexivity and risk control. The quarter was defined by movement, structure, and intent. Capital flowed decisively toward positions where upside remained asymmetric and was withdrawn just as forcefully where narratives had matured or payoff dynamics narrowed.

At the top of the portfolio, Amazon’s rise to the largest position reflects conviction in durable platforms with embedded optionality. At the same time, the heavy use of ETFs and options shows that exposure was not taken blindly. Market breadth was expressed through equal-weight indices, macro views through rate-sensitive and index derivatives, and regional exposure through defined-risk structures rather than permanent commitments.

Technology remains core, but not concentrated. AI exposure is spread across platforms, infrastructure, and sector-level instruments, avoiding dependence on any single outcome. China exposure reappears, but only through options. Downside protection is adjusted, not abandoned. This is positioning designed to evolve, not to sit still.

Most importantly, Q3 2025 reinforces a principle that has defined Soros’ investing for decades: conviction without attachment. Positions are sized to matter, but none are sacred. When reflexive feedback loops strengthen, capital is added. When they weaken, capital is removed. The result is a portfolio built not to predict the future, but to adapt to it.