Ron Baron has built a career around a simple but uncommon idea: some businesses are worth owning for decades. As the founder of Baron Capital, he has consistently focused on companies that combine large addressable markets, founder-led cultures, and the ability to reinvest capital at high rates over long periods of time. Rather than treating volatility as something to manage away, Baron views it as the cost of staying invested in businesses that are still in the process of becoming what they are capable of being.

This philosophy has shaped one of the longest-duration portfolios in public markets. Baron Capital’s holdings are defined less by entry timing and more by endurance. Positions are established early, allowed to scale, and held through multiple market cycles as management teams execute. Over time, a small number of successful investments are allowed to grow into dominant positions, reflecting Baron’s willingness to let outcomes, not position limits, determine portfolio weight.

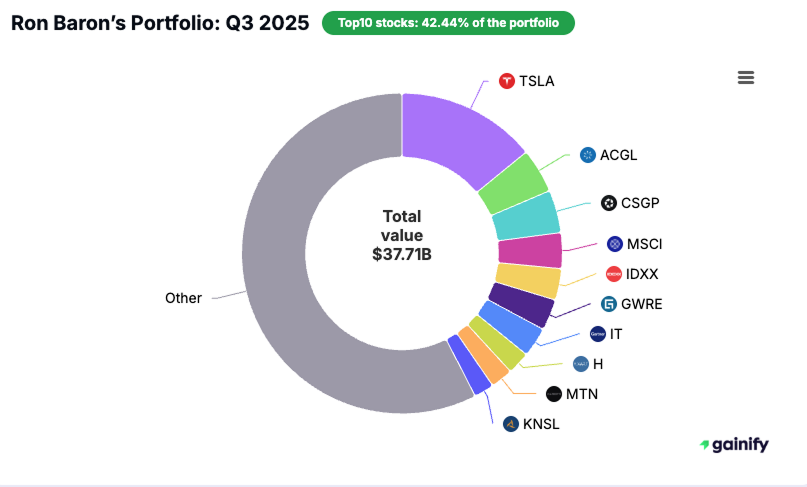

That philosophy is not theoretical. It is visible directly in the structure of his portfolio. As of Q3 2025, Ron Baron’s reported public equity portfolio totaled approximately $37.7 billion, spread across 330 holdings, with an average holding period of 22 quarters, or roughly five and a half years. This is not a portfolio optimized for turnover, event-driven catalysts, or rapid factor rotation. It is a portfolio built on the belief that exceptional businesses create the majority of their value over long periods, not through precise entry and exit points.

Q3 2025 reflects portfolio evolution rather than repositioning. Capital was allocated based on relative opportunity set and expected return contribution, with incremental additions directed toward positions demonstrating improving fundamentals and sustained long-term upside. Position sizes were allowed to expand where conviction remained high, reinforcing concentration in holdings with the greatest potential impact on portfolio outcomes.

Key Highlights from Q3 2025

- $37.7 billion portfolio with deliberate concentration, as the top 10 positions account for 42.44% of total value, reflecting conviction-driven sizing rather than broad diversification.

- Long-duration structure, with an average holding period of 22 quarters, reinforcing a compounding-focused approach over multi-year horizons.

- 330 individual holdings, reflecting broad idea generation but selective capital allocation

- Tesla remains the largest holding at approximately $5.31 billion, representing over 14% of the portfolio

Who Is Ron Baron and Why His Positioning Still Matters

Ron Baron founded Baron Capital in 1982 after beginning his career as a sell-side analyst, and over more than four decades has established himself as one of the most consistent long-duration growth investors in public markets.

His approach centers on identifying founder-led businesses with large addressable markets, strong reinvestment opportunities, and management teams capable of compounding value over extended periods. Baron has often described his process succinctly: “We invest in businesses we think can grow for 10 or 20 years, not in stocks we think will go up over the next year.”

That philosophy is most clearly illustrated by his long-standing investment in Tesla. Baron invested early, maintained conviction through periods of extreme volatility, and allowed the position to grow organically into a defining allocation rather than trimming to manage short-term risk. The outcome reflects his belief that exceptional businesses should be given the time and capital to fully express their potential. As Baron has stated in multiple interviews, “The biggest mistake investors make is selling great companies too soon.”

What continues to distinguish Baron’s positioning is his emphasis on duration over precision. His focus remains on whether management teams are reinvesting capital effectively, expanding competitive advantages, and increasing intrinsic value, rather than meeting or missing quarterly expectations.

This mindset produces portfolios that may appear unconventional over short time frames, but highly coherent over decades. Baron is comfortable maintaining broad exposure across hundreds of companies while allowing a small number of exceptional investments to dominate long-term outcomes. His positioning in Q3 2025 reflects this same discipline, reinforcing why his portfolio remains relevant to investors focused on compounding rather than timing.

The Biggest Moves in Q3 2025

Adds: Increasing Exposure to Core Positions

The most telling activity in Q3 2025 came from additions to existing positions. These were not marginal adjustments. They involved hundreds of millions of dollars deployed into businesses where conviction increased.

- Gartner (NYSE: IT)

Share count increase: +18.32%

Capital added: $195.2 million

Interpretation: A reaffirmation of Gartner’s role as mission-critical infrastructure for enterprise decision-making, with highly recurring revenue and pricing power. - MSCI (NYSE: MSCI)

Share count increase: +10.31%

Capital added: $126.5 million

Interpretation: Continued confidence in index-based investing, analytics, and financial data as foundational market infrastructure. - Birkenstock (NYSE: BIRK)

Share count increase: +41.91%

Capital added: $91.8 million

Interpretation: Indicates belief in brand durability, global expansion, and pricing power in consumer discretionary markets. - Loar Holdings (NYSE: LOAR)

Share count increase: +165.24%

Capital added: $84.75 million

Interpretation: A decisive move into an emerging industrial growth story, suggesting Baron sees a long runway ahead. - Duolingo (NASDAQ: DUOL)

Share count increase: +226.43%

Capital added: $56.5 million

Interpretation: A high-conviction add into scalable education technology with strong engagement and global reach.

New Buys: Adding New Positions

New positions initiated in Q3 2025 reflect an expansion of the opportunity set rather than a shift in strategy. Position sizes were meaningful but measured, consistent with Baron’s approach of scaling exposure over time as conviction develops. These investments align with long-term themes around infrastructure, software, and data-driven services.

- AAON (NASDAQ: AAON)

Initial position size:$59.5 million

Interpretation: Exposure to energy-efficient HVAC manufacturing, benefiting from long-term trends in commercial construction, regulation-driven efficiency upgrades, and replacement demand. - Netskope (NASDAQ: NTSK)

Initial position size: $55.4 million

Interpretation: A bet on cloud security and network modernization, with Netskope positioned at the intersection of enterprise security, remote work, and data protection. - StubHub Holdings (NYSE: STUB)

Initial position size:$54.9 million

Interpretation: Exposure to global live events and secondary ticketing, leveraging platform scale and data advantages as demand for experiences continues to normalize and expand. - Figma (NYSE: FIG)

Initial position size: $51.5 million

Interpretation: Investment in collaborative design software with strong network effects, embedded workflows, and long-term relevance in digital product development. - Badger Meter (NYSE: BMI)

Initial position size: $50.1 million

Interpretation: Long-term infrastructure play focused on smart water metering, data analytics, and municipal efficiency, supported by aging infrastructure and sustainability mandates. - Legence (NASDAQ: LGN)

Initial position size: $43.8 million

Interpretation: Exposure to building systems integration and energy services, aligning with multi-year trends in efficiency retrofits and decarbonization of commercial buildings.

Each of these investments aligns with Baron’s preference for platforms that can scale over time, particularly in software, infrastructure, and data-driven services.

Sold Outs: Exiting Positions

Exits during Q3 2025 were limited and focused, reflecting capital reallocation rather than a broad reduction in exposure. Positions were exited where the opportunity set appeared less compelling relative to new and existing investments.

- Chart Industries (NYSE: GTLS)

Position exited: $168.3 million

Interpretation: The exit suggests a reassessment of the long-term risk-reward profile following a period of strong performance and increased complexity around execution and end-market demand. - ANSYS (ANSS)

Position exited: $72.0 million

Interpretation: The sale indicates capital was redeployed from a mature software franchise toward opportunities offering greater long-term growth or reinvestment

These exits freed capital without signaling a broader defensive shift. The portfolio remains firmly positioned for long-term growth.

Cuts: Reducing Position Size

Position reductions in Q3 2025 were selective and primarily reflected portfolio rebalancing rather than deteriorating conviction. In most cases, cuts were made to large or long-held positions to manage sizing, fund new opportunities, or adjust exposure after periods of strong performance.

- Tesla (NASDAQ: TSLA)

Position reduced: $371.5 million

Interpretation: Despite the reduction, Tesla’s portfolio weight increased, indicating that the cut was driven by position management rather than a change in long-term conviction. Tesla remains the largest holding, and the trim reflects disciplined sizing within a highly concentrated position. - Iridium Communications (NASDAQ: IRDM)

Position reduced: $190.1 million

Interpretation: The substantial reduction suggests a reassessment of return potential relative to other opportunities, likely driven by capital reallocation rather than company-specific deterioration. - FactSet Research Systems (NYSE: FDS)

Position reduced: $157.7 million

Interpretation: The trim points to capital being redeployed from a mature, high-quality data franchise toward investments with greater long-term growth optionality. - Kratos Defense & Security Solutions (NASDAQ: KTOS)

Position reduced: approximately $137.8 million

Interpretation: Indicates moderation of exposure following prior gains, while maintaining residual exposure to defense and security spending trends. - Dayforce (NYSE: DAY)

Position reduced: $118.7 million

Interpretation: The cut reflects portfolio sizing adjustments within enterprise software, potentially to rebalance exposure across overlapping growth themes.

In addition to the primary reductions, a group of meaningful cuts was made across several established positions, including Gaming and Leisure Properties, Guidewire Software, CyberArk Software, IDEXX Laboratories, Arch Capital Group, and Carlyle Group. These adjustments were consistent with ongoing portfolio management rather than changes in underlying business conviction. Most of these positions remain in the portfolio, indicating the reductions were intended to manage exposure and opportunity cost as capital was reallocated toward higher-priority investments.

Top 10 Holdings: Where Conviction Is Expressed

1. Tesla (TSLA)

- Market value: ~$5.31 billion

- Portfolio weight: 14.09%

- Holding period: 47 quarters

Tesla is the defining investment in Ron Baron’s career. The position reflects belief in manufacturing scale, vertical integration, and platform economics rather than short-term EV cycles.

2. Arch Capital Group (ACGL)

- Market value: ~$1.70 billion

- Portfolio weight: 4.51%

- Holding period: 56 quarters

Arch Capital represents a long-term compounder built on underwriting discipline and capital flexibility. The position provides durable returns through insurance cycles and acts as a stabilizing anchor within a growth-oriented portfolio.

3. CoStar Group (CSGP)

- Market value: ~$1.62 billion

- Portfolio weight: 4.31%

- Holding period: 61 quarters

CoStar reflects conviction in proprietary data, network effects, and pricing power. The business occupies a dominant position in commercial real estate information, with recurring revenue and long-term expansion potential.

4. MSCI (MSCI)

- Market value: ~$1.36 billion

- Portfolio weight: 3.60%

- Holding period: 72 quarters

MSCI is held as core financial infrastructure. The position benefits from index-linked assets, analytics adoption, and embedded roles in global capital allocation, supporting predictable growth and high margins.

5. IDEXX Laboratories (IDXX)

- Market value: ~$1.20 billion

- Portfolio weight: 3.19%

- Holding period: 83 quarters

IDEXX represents long-duration exposure to animal health diagnostics. The investment thesis centers on recurring consumables, pricing power, and secular growth in companion animal care.

6. Guidewire Software (GWRE)

- Market value: ~$1.19 billion

- Portfolio weight: 3.15%

- Holding period: 54 quarters

Guidewire reflects confidence in mission-critical enterprise software for insurers. High switching costs and multi-year modernization cycles support durable revenue and long-term relevance.

7. Gartner (IT)

- Market value: ~$1.14 billion

- Portfolio weight: 3.01%

- Holding period: 74 quarters

Gartner is positioned as embedded decision-support infrastructure for global enterprises. Recurring subscriptions and high client retention underpin consistent compounding over time.

8. Hyatt Hotels (H)

- Market value: ~$868 million

- Portfolio weight: 2.30%

- Holding period: 64 quarters

Hyatt provides exposure to global travel through an increasingly asset-light model. The thesis emphasizes brand strength, management execution, and long-term expansion of fee-based revenue.

9. Vail Resorts (MTN)

- Market value: ~$853 million

- Portfolio weight: 2.26%

- Holding period: 50 quarters

Vail Resorts reflects a scarcity-driven leisure model with strong pricing power. The position benefits from destination assets that are difficult to replicate and supported by loyal customer demand.

10. Kinsale Capital Group (KNSL)

- Market value: ~$761 million

- Portfolio weight: 2.02%

- Holding period: 36 quarters

Kinsale represents a high-return specialty insurance franchise. The investment thesis centers on disciplined underwriting, rapid growth in excess and surplus lines, and strong returns on equity.

What the Ron Baron Portfolio Ultimately Says

The Ron Baron portfolio in Q3 2025 reflects a disciplined allocation process anchored in long-term return potential rather than short-term market conditions. Portfolio changes were driven by relative opportunity and capital efficiency, with incremental capital directed toward businesses extending their competitive position and long-term growth runway. Reductions and exits were selective, designed to fund higher-impact opportunities rather than to reduce overall exposure.

Position sizing remains the primary expression of conviction. Capital continues to concentrate in a small group of businesses where execution has validated the original thesis, while a broad research footprint supports selective expansion into new opportunities. This structure allows the portfolio to compound from a limited number of outsized contributors while maintaining flexibility at the margin.

At this stage of the cycle, the portfolio signals confidence in long-duration growth assets with strong reinvestment economics. Rather than repositioning for macro outcomes, the portfolio reflects an emphasis on owning businesses capable of generating value across multiple market environments. The underlying message is clear: durable returns are being pursued through sustained ownership, disciplined sizing, and patience in execution.