Dev Kantesaria’s portfolio is a concentrated, long-only public equity portfolio designed to compound capital by owning a small number of dominant financial infrastructure businesses over long holding periods. Entering 2026, this structure defines how Valley Forge Capital Management allocates risk, time, and capital.

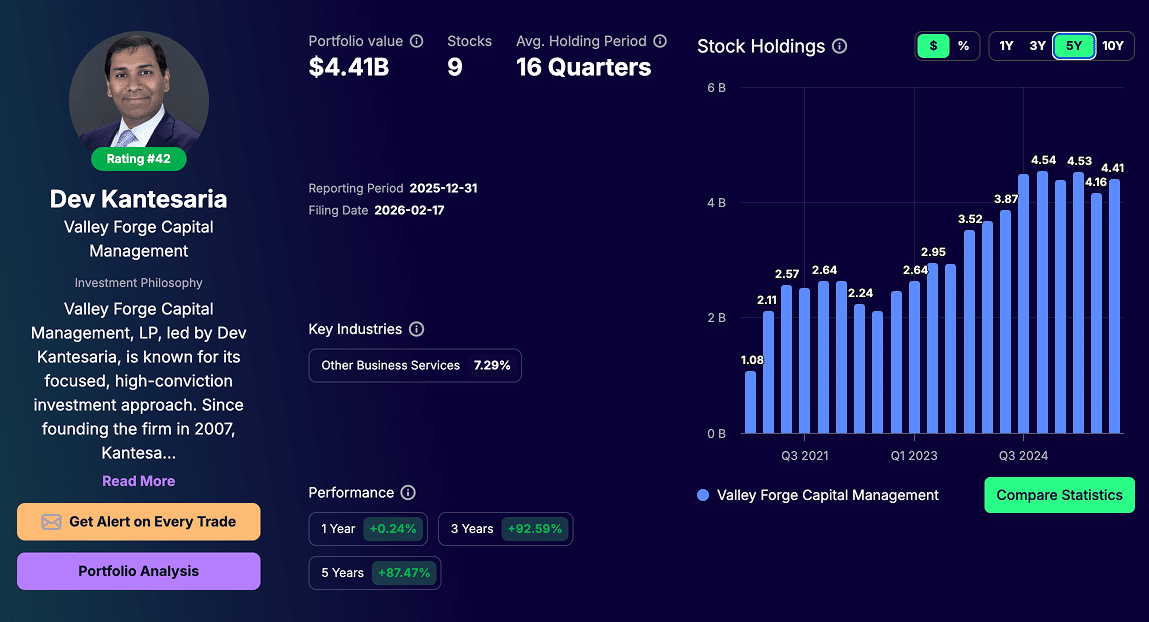

As of the Dec 31, 2025 SEC Form 13F, Valley Forge reported approximately $4.41 billion invested across nine publicly listed companies. The portfolio is intentionally concentrated, with the majority of capital allocated to credit scoring, credit ratings, payment networks, and financial data providers. These businesses generate recurring revenue, strong free cash flow, and operate with high switching costs.

Portfolio activity during Q4 2025 reinforces this design. Valley Forge made no new investments and no full exits, adjusting only one position through a reduction in Intuit. This behavior reflects Kantesaria’s stated approach of allowing business fundamentals, rather than market conditions, to determine holding decisions.

In the sections ahead, we will break down the Q4 2025 13F holdings report, examine the top holdings that dominate the portfolio, and analyze why Kantesaria’s extreme patience and concentration make Valley Forge a standout among modern hedge funds.

Key Takeaways: Dev Kantesaria’s Q4 2025 Portfolio

- Top-heavy concentration – Fair Isaac, S&P Global, and Mastercard remain the three largest holdings and together account for a substantial share of total portfolio value.

- Highly similar business models – the portfolio is dominated by financial infrastructure businesses with recurring, transaction-based or subscription-driven revenue, including credit scoring, credit ratings, payment networks, and financial data platforms.

- Minimal but positive adjustments – share counts increased slightly in most holdings during Q4 2025, reinforcing conviction in the existing portfolio structure.

- Single meaningful reduction – Intuit was the only position reduced in a material way, reflecting rebalancing rather than a change in investment thesis.

- Low turnover by design – no new positions and no full exits, consistent with a long-duration, compounding-focused strategy.

- Conviction-led positioning – capital allocation remains driven by business quality and structural advantages rather than short-term market movements.

Who Is Dev Kantesaria?

Dev Kantesaria is a long-term public equity portfolio manager who allocates capital through a highly concentrated, low-turnover investment strategy focused on predictable, cash-generative businesses.

Kantesaria founded Valley Forge Capital Management in 2007 with a clearly defined mandate: build a small portfolio of exceptional companies and hold them for extended periods while allowing business fundamentals, not market signals, to drive capital allocation decisions. In his public interviews and firm communications, he consistently emphasizes selectivity, patience, and downside protection over diversification or short-term optimization.

Before entering investment management, Kantesaria trained as a physician. He has stated that this background influenced his analytical framework, particularly the emphasis on diagnosis, probability assessment, and long-term outcomes. In portfolio terms, this translates into a preference for businesses with stable demand, structural advantages, and limited exposure to binary risks.

At Valley Forge, Kantesaria operates as the sole decision-maker. The firm does not run multiple strategies, hedge exposures, or pursue tactical trading. Instead, it maintains a long-only, equity-focused portfolio with a small number of positions, each sized to reflect conviction and durability rather than benchmark alignment.

This operating model explains why Valley Forge’s portfolio activity is typically minimal across reporting periods and why holding durations often extend across multiple market cycles. The next section defines how this philosophy is implemented at the portfolio level through Valley Forge Capital’s investment strategy.

Valley Forge Capital’s Investment Philosophy Explained

At the core of Kantesaria’s philosophy is quality over quantity. His stock portfolio is intentionally small, built only around companies that meet his rigorous standards.

A business qualifies only if it meets all of the following functional criteria.

- Durable competitive advantages – companies like Fair Isaac, S&P Global, Moody’s, Visa, and Mastercard that dominate their industries and cannot easily be displaced.

- Free cash flow and share repurchases – firms with strong levered free cash flow, capable of consistently buying back stock.

- Recurring revenues – predictable subscription or transaction-based revenues that withstand downturns.

- Pricing power – the ability to raise prices without eroding demand, protecting margins regardless of the market environment.

- Compounding potential – long-term compounding of double-digit ROIC, fueled by secular tailwinds such as digital payments and consumer credit.

- Global network effect – entrenched ecosystems where the value of the service grows with adoption, such as payment networks and credit ratings agencies.

This philosophy naturally pulls Valley Forge toward financial infrastructure businesses. These companies are the backbone of the global financial system, providing services that are mission-critical and deeply embedded. They are predictable businesses with highly defensible positions.

Q4 2025 Portfolio Overview

The Q4 2025 SEC Form 13F filing shows that Valley Forge Capital Management maintained a highly concentrated portfolio with no structural changes during the quarter. The firm reported $4.41 billion in U.S. equity holdings spread across nine stocks, with an average holding period of approximately 16 quarters, reinforcing its long-term, low-turnover investment model.

Portfolio value has remained relatively stable over recent reporting periods, and multi-year performance continues to reflect compounding rather than short-term positioning. As shown in the Q4 snapshot, Valley Forge delivered modest one-year results while maintaining strong cumulative performance over three- and five-year horizons, consistent with its focus on durable business economics.

From an allocation perspective, capital remains primarily invested in financial infrastructure businesses, including credit scoring, credit ratings, payment networks, and financial data providers. These holdings account for the majority of portfolio value and define the firm’s exposure to recurring, transaction-based revenue models.

Quarterly activity was minimal. Nearly all positions saw small share count increases, indicating continued conviction in existing holdings. The only exception was Intuit, where Valley Forge reduced its position by approximately 15.27%, lowering the portfolio weight without altering the overall structure. There were no new investments and no full exits during the quarter.

Q4 2025 portfolio snapshot:

- 13F value: $4.41B

- Holdings: 9

- Average holding period: 16 quarters

- Quarterly activity: Broadly stable positions; Intuit reduced

Overall, the Q4 2025 filing confirms that Valley Forge’s portfolio remains structurally unchanged, with capital concentrated in a small set of long-duration financial infrastructure businesses as the firm moves into 2026.

Dev Kantesaria Portfolio Q4 2025: Stock Holdings Breakdown

Dev Kantesaria’s Q4 2025 portfolio consists of nine publicly listed companies selected to represent long-duration exposure to financial infrastructure, data, and transaction-based business models. Each holding plays a defined role within the portfolio, either as a core compounding engine or as a complementary position that reinforces exposure to recurring, non-discretionary revenue streams.

1. Fair Isaac Corporation (NYSE: FICO)

Fair Isaac represents the largest position in the portfolio and functions as the core exposure to U.S. consumer credit infrastructure.

- Shares held: 769.42K

- Company market value: $1.30B

- Portfolio weight: 29.49%

- Quarterly share change: +0.13%

- Portfolio % change: +1.82 percentage points

FICO operates the dominant U.S. credit scoring model embedded in mortgage, auto, and credit card underwriting. The business benefits from regulatory entrenchment, switching costs, and recurring usage-based revenue. Valley Forge’s allocation reflects the company’s pricing power and mission-critical role in lending markets.

2. S&P Global (NYSE: SPGI)

S&P Global is Dev Kantesaria’s second-largest portfolio position and operates a global financial information platform spanning credit ratings, benchmark indices, and data analytics services.

- Shares held: 1.76M

- Company market value: ~$918.81M

- Portfolio weight: 20.83%

- Quarterly share change: +0.18%

- Portfolio % change: +0.28 percentage points

The firm operates one of the two dominant global credit rating agencies and owns widely tracked financial indices. Revenue is tied to debt issuance, data subscriptions, and index licensing. Kantesaria’s position reflects preference for recurring revenue and regulatory barriers to entry.

3. Mastercard (NYSE: MA)

Mastercard is Dev Kantesaria’s third-largest holding and operates a global transaction processing network that facilitates electronic payments across consumers, banks, and merchants.

- Shares held: 1.49M

- Company market value: ~$849.13M

- Portfolio weight: 19.25%

- Quarterly share change: +0.18%

- Portfolio % change: –1.07 percentage points

Mastercard operates a global payments network with asset-light economics and high incremental margins. Revenue scales with electronic payment volume rather than credit risk. The long holding period (37 quarters) indicates structural conviction in digital payment penetration.

4. Moody’s Corporation (NYSE: MCO)

Moody’s complements S&P Global within the global credit ratings duopoly, providing issuer ratings, research, and analytics embedded in debt markets worldwide.

- Shares held: 1.32M

- Company market value: ~$672.94M

- Portfolio weight: 15.25%

- Quarterly share change: +0.24%

- Portfolio % change: +0.19 percentage points

Moody’s generates recurring surveillance fees and data analytics revenue in addition to issuance-related ratings. The business benefits from regulatory designation and high switching costs, aligning with Valley Forge’s emphasis on durable financial infrastructure.

5. Visa Inc. (NYSE: V)

Visa represents global electronic payments infrastructure.

- Shares held: 916.41K

- Company market value: ~$321.39M

- Portfolio weight: 7.29%

- Quarterly share change: +0.48%

- Portfolio % change: –0.20 percentage points

Visa operates the largest global card network. Like Mastercard, it benefits from secular migration from cash to electronic payments and high operating leverage.

6. Intuit Inc. (NASDAQ: INTU)

Intuit was the only position reduced during Q4 2025. The company provides tax and small-business financial software, and the reduction reflects portfolio rebalancing rather than a thesis exit, with the position maintained after 37 quarters of ownership.

- Shares held: 221.24K

- Company market value: ~$146.55M

- Portfolio weight: 3.32%

- Quarterly share change: –15.27%

- Portfolio % change: –0.97 percentage points

7. ASML Holding (NASDAQ: ASML)

ASML holds a de facto monopoly in extreme ultraviolet (EUV) lithography systems, which are essential for manufacturing advanced semiconductor chips. This structural dominance creates exceptionally high technological and capital barriers to entry, while the position provides Valley Forge with selective exposure beyond financial infrastructure without compromising on competitive durability.

- Shares held: 126.24K

- Company market value: ~$135.06M

- Portfolio weight: 3.06%

- Quarterly share change: +0.49%

- Portfolio % change: +0.14 percentage points

8. MSCI Inc. (NYSE: MSCI)

MSCI provides index construction, benchmark licensing, and analytics that are deeply embedded in institutional asset management and passive investment products. The business benefits from high switching costs, recurring subscription revenue, and asset-linked fee growth, aligning with Valley Forge’s preference for data-driven financial infrastructure with long-term compounding characteristics.

- Shares held: 60.77K

- Company market value: ~$34.87M

- Portfolio weight: 0.79%

- Quarterly share change: +1.79%

- Portfolio % change: –0.02 percentage points

9. Equifax Inc. (NYSE: EFX)

Equifax complements Fair Isaac exposure by providing consumer credit data and verification services that are embedded across lending, employment, and identity workflows, reinforcing Valley Forge’s concentration in credit infrastructure.

- Shares held: 146.35K

- Company market value: ~$31.76M

- Portfolio weight: 0.72%

- Quarterly share change: +1.63%

- Portfolio % change: –0.17 percentage points

Conclusion: Dev Kantesaria’s Portfolio Built for Compounding

The Dev Kantesaria Portfolio 4Q 2025 is a case study in the power of concentrated portfolios. While many managers diversify widely or mimic venture capital investors, Kantesaria sticks to public equities with recurring revenues, durable cash flows, and ultimately strong compounding potential.

His philosophy mirrors Warren Buffett and Charlie Munger at Berkshire Hathaway and resonates with top investors like Anthony Deden, Guy Spier, and Peter Lynch.

Unlike managers who rotate portfolios or expand into adjacent strategies, Kantesaria maintains a consistent framework centered on financial infrastructure businesses. Credit scoring, credit ratings, payment networks, and financial data platforms dominate the portfolio because these models benefit from structural demand, pricing power, and high barriers to entry. The lack of meaningful trading in Q4 2025, aside from a single reduction in Intuit, reinforces that portfolio outcomes are driven by business performance rather than activity.

Valley Forge’s stock portfolio reflects a deep focus on quality and long-term growth. The lesson for investors is timeless: wealth is built not by trading noise but by owning predictable businesses and letting compounding do the work.