Ray Dalio’s portfolio refers to the U.S. equity holdings managed by Bridgewater Associates, the firm Dalio founded in 1975. While often described under Dalio’s name, the portfolio represents Bridgewater’s institutional equity allocation, built on the investment framework Dalio established and embedded into the firm’s process. These holdings are disclosed quarterly through SEC Form 13F filings, offering a transparent view into how Bridgewater allocates capital across public equities.

Ray Dalio developed Bridgewater’s investment philosophy over nearly five decades, centering it on diversification, disciplined risk management, and systematic asset allocation. Best known for the All Weather Portfolio and the risk parity approach, this framework is designed to balance risk across economic environments and avoid dependence on any single market outcome. These principles continue to shape how Bridgewater structures its equity exposure.

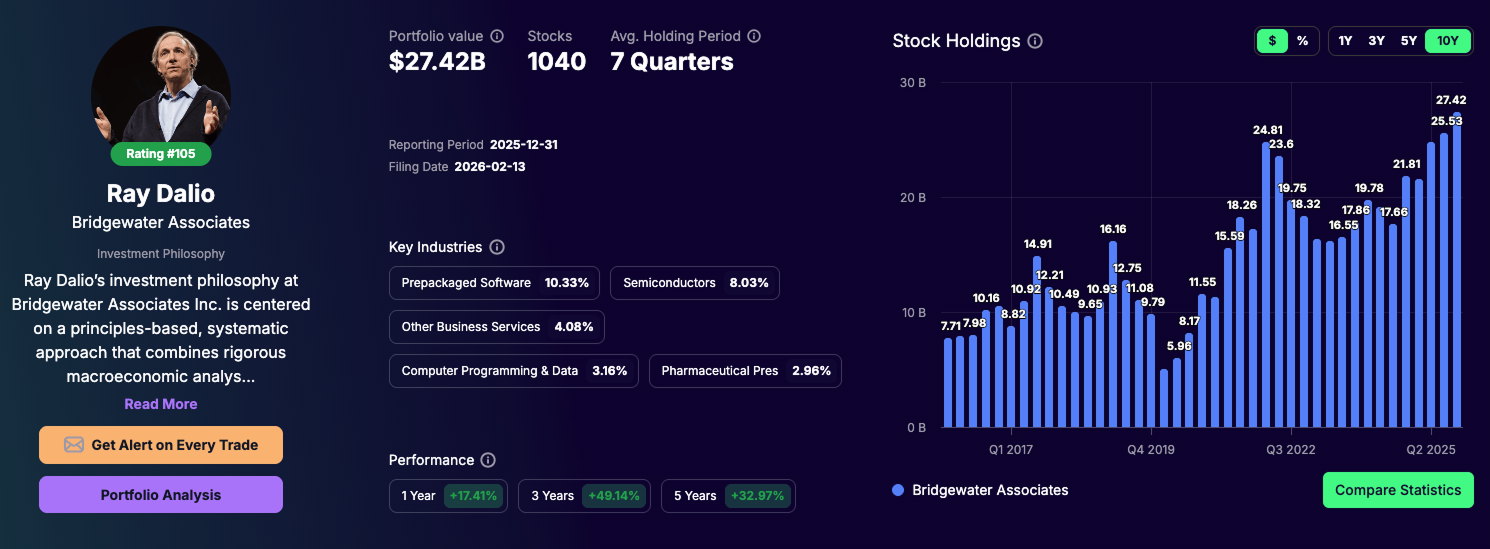

Dalio’s formal role at Bridgewater was reduced in stages over several years. He stepped down as CEO in 2017, exited the Co-CIO role in summer 2020, and relinquished the chairman position at the end of 2021. In October 2022, he transferred all voting rights, handing over control of the firm. His involvement concluded in August 2025, when he sold his remaining ownership stake and left the board. As of Q4 2025, Bridgewater operates fully as an institutional manager, independent of Dalio’s direct involvement.

In Q4 2025, Bridgewater reported an equity portfolio valued at $27.42 billion, the highest equity portfolio value in the firm’s history. The most important development of the quarter was a sharp increase in S&P 500 exposure, driven by a $1.28 billion addition to SPDR S&P 500 ETF Trust, which became the portfolio’s largest holding. This move pushed U.S. equity allocation to an all-time high and reflected a clear shift toward broad market exposure.

During Q4 2025, Bridgewater’s top three stock-level additions were Oracle, NVIDIA, and Micron Technology, increasing exposure to semiconductor infrastructure, data center buildout, and enterprise compute workloads. The two largest cuts were Alphabet and Uber, as the firm reduced exposure to select platform and consumer-facing technology businesses.

In the sections ahead, we will explore Ray Dalio’s background, his core investment philosophy, and how those principles translate into real-world portfolio decisions. You will see a detailed breakdown of Bridgewater’s Q4 2025 13F filing, including its top holdings, the largest additions and reductions, and the reasoning behind these moves. By the end, you will understand not only what Bridgewater owns, but why these positions fit into Dalio’s broader approach to managing risk and navigating market uncertainty.

Who Is Ray Dalio

Ray Dalio founded Bridgewater Associates in 1975 in a small New York apartment. The firm began as a research and advisory service and grew into the largest hedge fund in the world, managing capital for sovereign wealth funds, pension systems, endowments, and major global institutions. Over the decades, Dalio became one of the biggest names in portfolio management, recognized for his ability to combine macroeconomic insight with disciplined investment execution.

His interest in investing started early. At the age of 12, Dalio bought his first stock, Northeast Airlines, using money he earned working as a golf caddie. That experience led to a lifelong interest in understanding how markets operate. He later studied finance at Long Island University and earned his MBA from Harvard Business School. Early successes and failures in his career helped shape the disciplined, research-driven approach he follows today.

Under Dalio’s leadership, Bridgewater became known for its deep macroeconomic research and systematic investment strategies. He introduced a culture of “radical transparency,” which encouraged open debate and direct feedback within the firm. This culture became a cornerstone of Bridgewater’s ability to adapt and remain competitive through different market cycles.

Beyond running Bridgewater, Dalio has become a respected public voice on economic and market issues. He frequently shares insights on market cycles, debt dynamics, and geopolitical developments. His perspectives are followed by investors, policymakers, and business leaders worldwide.

Ray Dalio’s Investment Philosophy

ay Dalio’s investment philosophy is built on the premise that future market outcomes cannot be forecasted with precision, but portfolio risk can be structured so that no single economic environment dominates returns. This principle is laid out most clearly in Principles (Dalio, 2017), where he defines investing as a process of managing cause-and-effect relationships across economic systems rather than predicting short-term price movements. The objective is not to maximize returns in one scenario, but to construct portfolios that remain functional across many.

The most concrete expression of this philosophy is the All Weather Portfolio, which Dalio designed to perform across four primary economic regimes: rising growth, falling growth, rising inflation, and falling inflation. The portfolio is structured using risk parity, meaning asset classes are weighted by their contribution to overall portfolio volatility rather than by capital allocation alone. As described in Bridgewater research and reiterated in Principles, this approach seeks to equalize risk exposure across assets such as equities, nominal bonds, inflation-linked bonds, and commodities, reducing drawdowns caused by regime shifts.

Diversification in Dalio’s framework extends beyond asset classes. He emphasizes diversification across geographies, currencies, sectors, and macro sensitivities, with the goal of lowering portfolio variance and minimizing dependency on correlated outcomes. According to Bridgewater’s internal research summarized in Principles, portfolios diversified across uncorrelated return streams historically achieve higher risk-adjusted returns than those concentrated in a small number of growth drivers.

A central analytical pillar of Dalio’s approach is historical pattern analysis. In Big Debt Crises (Dalio, 2018), he documents recurring economic and market cycles across centuries, focusing on debt accumulation, deleveraging processes, monetary policy responses, and capital flows. Dalio argues that while surface-level conditions change, the underlying mechanics of economies repeat in recognizable ways. Portfolio construction, therefore, should reflect these recurring dynamics rather than rely on novel explanations for each cycle.

Flexibility is embedded in the system, not expressed through discretionary forecasting. Dalio’s framework allows allocations to shift as relative risk and return characteristics change, while maintaining structural balance. This principle remains visible in Bridgewater’s recent equity positioning, where exposure has been reduced to assets and regions with deteriorating risk-adjusted profiles and increased toward areas offering broader diversification benefits and more predictable cash flow dynamics. These shifts reflect application of the framework, not deviation from it.

Taken together, Ray Dalio’s investment philosophy prioritizes systematic risk control, structural diversification, and historical evidence over directional market calls. The consistency of this framework across decades, as documented in his books and Bridgewater’s research, explains why portfolio changes tend to appear gradual, rules-based, and regime-driven rather than reactive to short-term market narratives.

Q4 2025 Changes in Detail: Ray Dalio’s Equity Portfolio

Bridgewater Associates made large-scale adjustments to its U.S. equity portfolio in Q4 2025, as reported in its SEC Form 13F filing for the period ending December 31, 2025. The quarter was defined by a shift toward broad U.S. equity exposure, increased allocation to data-center and semiconductor infrastructure, and sizable reductions in several long-held positions. These moves can be grouped into four clear categories.

1. Major Additions: S&P 500 Becomes the Core Equity Anchor

The defining move of Q4 2025 was a substantial increase in S&P 500 exposure, making it the single most important equity allocation in the portfolio. Alongside SPDR S&P 500 ETF Trust, Bridgewater made several large stock-specific additions concentrated in data centers, semiconductors, and enterprise infrastructure:

- SPDR S&P 500 ETF Trust (SPY) – Bridgewater increased its SPY position by 73.7%, adding approximately $1.28 billion. SPY became the portfolio’s largest holding, accounting for over 11% of total equity value. This move pushed Bridgewater’s overall equity portfolio to an all-time high value, signaling a decisive preference for broad U.S. market exposure over narrower factor or single-stock risk.

- Oracle (NYSE: ORCL) – Bridgewater increased its Oracle position by more than 360%, deploying approximately $349 million. The addition increased exposure to enterprise software closely tied to cloud infrastructure, database workloads, and large-scale data-center demand.

- NVIDIA (NASDAQ: NVDA) – The firm added over 54% to its NVIDIA position, allocating roughly $252 million. This reinforced exposure to semiconductor compute that underpins AI training, inference, and accelerated data-center architectures. Nvidia became the no. 3 position in the portfolio, representing over 2.5% of total equity value.

- Micron Technology (NASDAQ: MU) – Micron saw an aggressive expansion, with approximately $204 million added to the position. The move increased allocation to memory infrastructure critical for AI workloads, hyperscale data centers, and high-performance computing systems.

- Amazon (NASDAQ: AMZN) – Bridgewater increased its Amazon stake by more than 73%, committing around $188 million. The addition strengthened exposure to cloud infrastructure through AWS and to large-scale logistics and fulfillment networks.

Together, these additions show a concentrated tilt toward U.S. equity beta and physical compute infrastructure, rather than speculative or region-specific growth.

2. New Buys: Small, Non-Core Initiations

New positions opened during Q4 were limited in size and impact and did not materially change portfolio structure.

Bridgewater initiated small positions in names such as Caterpillar, Ford Motor, Dell Technologies, First Horizon, and Diageo. Each represented well under 0.2% of portfolio value.

These trades appear tactical and incremental rather than strategic, consistent with portfolio fine-tuning rather than directional conviction.

3. Sold Outs: Financials Lead the Exits

Full position closures in Q4 were numerous but concentrated in smaller holdings, with one exit standing out.

- Fiserv (FI) – Bridgewater fully exited its Fiserv position, selling approximately $133 million. This was the largest complete divestment of the quarter and marked a continued reduction in exposure to payment processors and transaction-based financial services.

Other full exits included DraftKings, CoreWeave, Cameco, Elevance Health, and Palo Alto Networks, though each represented a relatively small portion of the overall portfolio. These exits freed capital for redeployment into core index and infrastructure exposure.

4. Top Cuts: Major Reductions Across Mega-Cap and Cyclical Exposure

The most consequential rebalancing in Q4 occurred through large dollar-value reductions in several core equity positions, materially lowering concentration in select mega-cap and cyclical names that previously ranked among the portfolio’s larger individual holdings.

The five largest cuts were as follows:

- Alphabet (GOOGL) – Bridgewater reduced its Alphabet position by over 40%, selling approximately $304 million of stock. Alphabet had been one of the firm’s larger single-name technology exposures, and the cut significantly reduced allocation to digital advertising and platform-driven revenue.

- Uber Technologies (UBER)– The position was cut by more than 64%, with roughly $208 million sold. Uber had ranked as a mid-sized holding, and the reduction lowered exposure to consumer-facing mobility and delivery demand.

- Meta Platforms (META) – Bridgewater reduced its Meta stake by over 46%, selling about $129 million. This continued a multi-quarter de-risking of social media platform exposure that had previously been a meaningful contributor to portfolio concentration.

- Wells Fargo (WFC) – The firm cut its Wells Fargo position by approximately 55%, monetizing around $121 million. The reduction lowered exposure to traditional banking and credit-cycle sensitivity within the equity book.

- Regeneron Pharmaceuticals (REGN) – The Regeneron position was reduced by nearly 70%, with roughly $110 million sold. The cut meaningfully decreased reliance on single-name pharmaceutical earnings risk.

In aggregate, these five reductions released over $870 million in capital. The scale of the cuts underscores a deliberate move away from company-specific execution risk and cyclical exposure, reinforcing Bridgewater’s broader shift toward diversified U.S. equity exposure and infrastructure-oriented allocations with more stable, system-level return drivers.

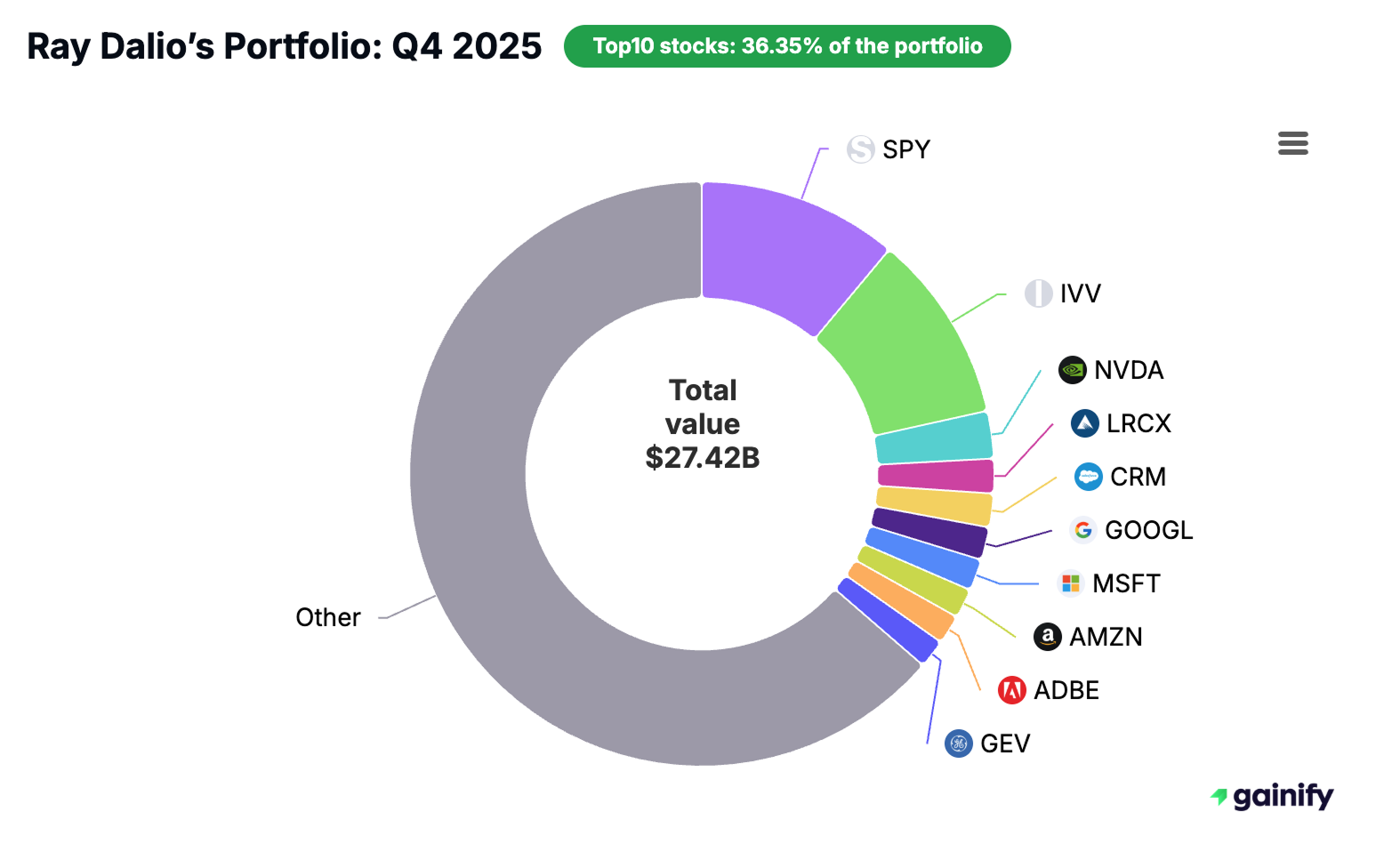

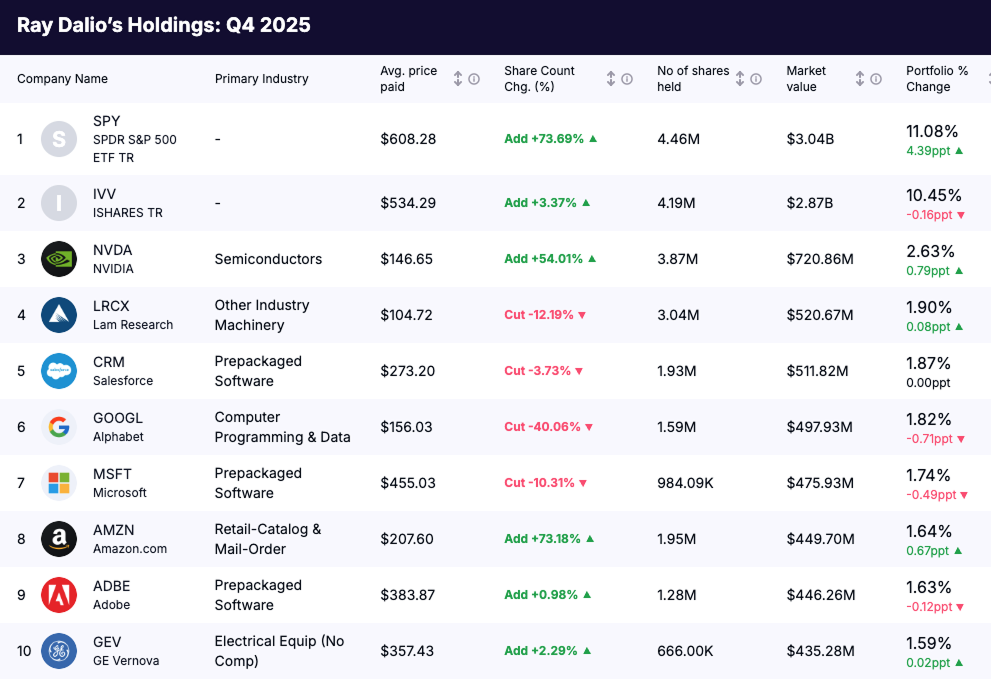

Top 10 Holdings: Q4 2025 Equity Portfolio

As of the Q4 2025 SEC 13F filing, Bridgewater Associates reported a U.S. equity portfolio valued at $27.42 billion, the highest equity value disclosed by the firm to date. The portfolio is structured around broad U.S. market exposure, with selective allocations to semiconductor infrastructure, enterprise software, and large-scale platforms.

The top ten holdings represent approximately 36% of total equity capital, confirming that diversification remains a core design feature rather than concentrated stock selection.

Top Holdings by Market Value and Portfolio Weight

- SPDR S&P 500 ETF Trust (SPY) — $3.04B | 11.08% of portfolio

- iShares Core S&P 500 ETF (IVV) — $2.87B | 10.45% of portfolio

- NVIDIA (NVDA) — $720.86M | 2.63% of portfolio

- Lam Research (LRCX) — $520.67M | 1.90% of portfolio

- Salesforce (CRM) — $511.82M | 1.87% of portfolio

- Alphabet (GOOGL) — $497.93M | 1.82% of portfolio

- Microsoft (MSFT) — $475.93M | 1.74% of portfolio

- Amazon (AMZN) — $449.70M | 1.64% of portfolio

- Adobe (ADBE) — $446.26M | 1.63% of portfolio

- GE Vernova (GEV) — $435.28M | 1.59% of portfolio

Portfolio Structure and Allocation Signals

Broad-market ETFs dominate the allocation. SPY and IVV together account for roughly 21.5% of total equity exposure, making index-based U.S. market participation the single largest risk driver in the portfolio. This reflects a deliberate choice to anchor returns to the overall U.S. equity market rather than rely on concentrated security selection.

Single-stock exposure is distributed across AI compute, semiconductor manufacturing, and enterprise software, with no individual company exceeding 3% of portfolio value. NVIDIA remains the largest thematic position at 2.63%, supported by Lam Research and a cluster of software platforms including Salesforce, Microsoft, and Adobe.

Mega-cap technology exposure remains present but moderated. Alphabet, Microsoft, Amazon, and Adobe are all held between 1.6% and 1.8%, indicating valuation-aware sizing rather than momentum-driven concentration. The inclusion of GE Vernova at 1.59% adds industrial and energy-transition exposure, broadening the portfolio’s economic sensitivity.

Overall, the Q4 2025 holdings show a portfolio built around broad U.S. equity exposure first, with disciplined, size-controlled allocations to infrastructure and platform businesses positioned to benefit from long-duration technological and industrial trends.

Q3 2025 Changes in Detail: Ray Dalio’s Equity Portfolio

Ray Dalio’s Bridgewater Associates made significant strategic shifts in its Q3 2025 equity portfolio, reflecting changes in global economic outlook, sector trends, and macro positioning. The firm’s SEC Form 13F filing reveals four major areas of activity.

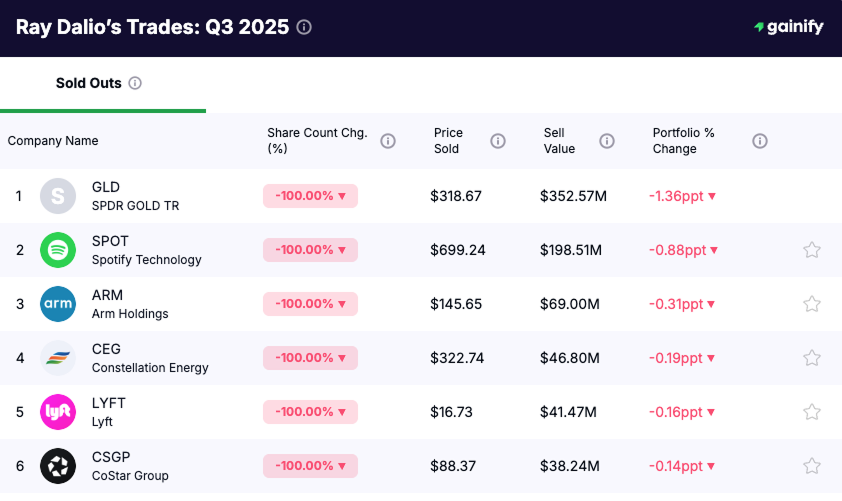

1. Full Closures: Gold and Spotify Lead a Sweep of Legacy Positions

Bridgewater opened Q3 by closing several positions outright, but two exits stood out as the most meaningful:

- SPDR Gold Trust (GLD). The fund fully unwound its gold exposure, removing one of its last macro hedges. This signals a clear shift away from defensive stores of value and toward higher-conviction equity deployment. Gold has historically been a cornerstone in Bridgewater’s risk-balanced framework, so eliminating GLD marks a deliberate move toward a more return-seeking posture.

- Spotify (NYSE: SPOT). Spotify was fully closed after a strong run that pushed valuations well ahead of forward earnings power. The exit reflects Bridgewater’s move away from high-multiple consumer internet names where momentum has outpaced fundamentals. Closing SPOT frees capital for areas with better risk-adjusted upside and clearer long-term cash flow trajectories.

Bridgewater also closed positions in Arm Holdings (NASDAQ: ARM), Constellation Energy, Lyft, and several smaller holdings. These exits reflect a broader effort to step out of areas where valuations no longer offered compelling risk-reward. By trimming names that had rerated aggressively, the firm freed capital for segments of the market trading at more reasonable multiples and offering cleaner long-term fundamentals.

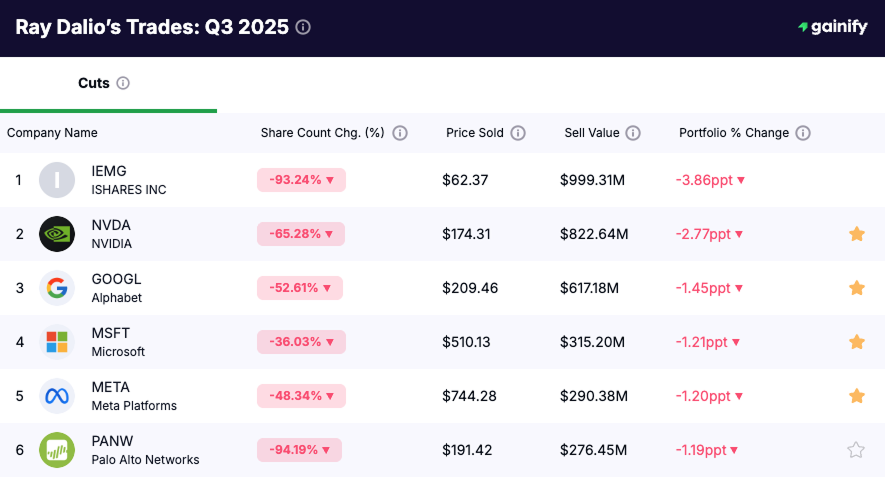

2. Deep Cuts: Emerging Markets and the Magnificent Seven

SBridgewater’s largest reductions in Q3 were concentrated in Emerging Markets and the Magnificent Seven. The cuts released billions in capital and reshaped the portfolio’s risk profile.

- Emerging Markets. The position in the iShares Emerging Markets ETF (IEMG) was reduced by 93.2%, eliminating almost all remaining EM exposure. The sale generated approximately $1.0 billion, completing the firm’s multi-quarter withdrawal from Emerging Markets after exiting China in Q2. This was one of the largest single monetizations in the entire filing.

- Magnificent Seven. Bridgewater also took down several mega-cap tech holdings where valuations had expanded sharply. NVIDIA was reduced by $822.64 million, Alphabet by $617.18 million, Microsoft by $315.20 million, and Meta by $290.38 million. These cuts lowered concentration in names that had dominated the portfolio and freed capital for more attractively valued opportunities elsewhere in the U.S. market.

Together, these reductions pulled significant capital out of crowded trades and lowered exposure to the highest-multiple segments of global equities.

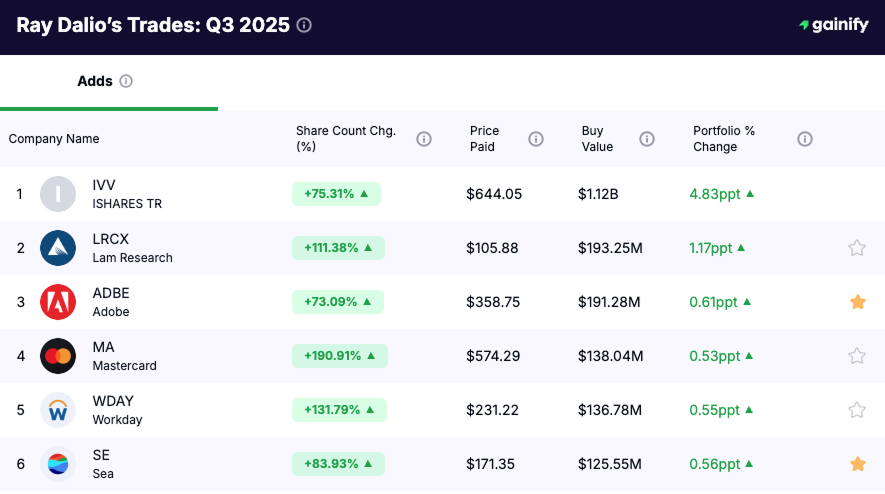

3. Major Additions: S&P 500 Exposure and High-Quality U.S. Growth

Bridgewater’s additions in Q3 centered on rebuilding broad U.S. exposure and allocating into companies where valuations had reset to more compelling levels.

- S&P 500 Exposure (IVV). The most significant single addition was the iShares Core S&P 500 ETF (IVV). Bridgewater increased its position by 75.3%, adding roughly $1.12 billion to the fund. This move strengthens the portfolio’s core U.S. equity base and reflects a shift toward broad-market exposure at a time when select mega-cap valuations had become stretched.

- Attractively Valued U.S. Growth Names. The firm also added to a group of high-quality companies tied to software, payments, and semiconductor supply chains. Lam Research saw $193.25 million in additions, Adobe $191.28 million, Mastercard $138.04 million, Workday $136.78 million, and Sea $125.55 million. These additions target businesses with durable earnings power, cleaner balance sheets, and valuations that had compressed to more appealing entry points.

The pattern is clear. Bridgewater rotated capital out of crowded mega-cap tech trades and Emerging Markets and redeployed it into broad U.S. exposure and select growth names with stronger long-term fundamentals and more reasonable multiples.

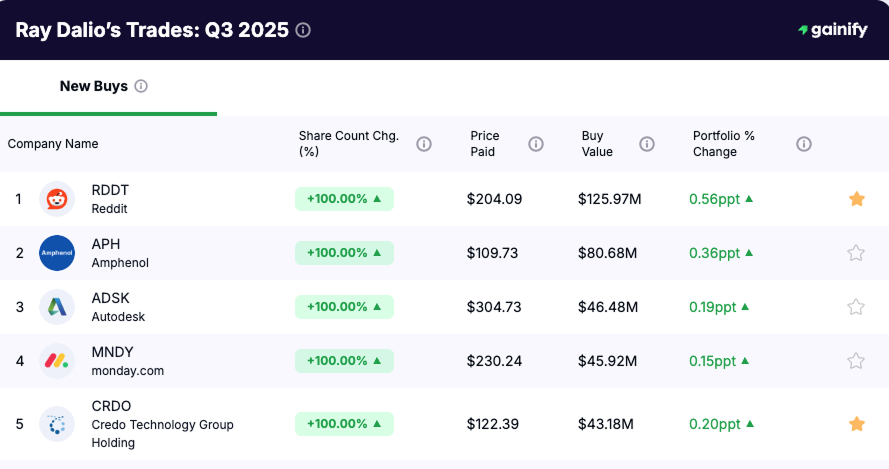

4. New Positions Opened

Bridgewater also initiated several new positions in Q3, expanding into software, components, and digital platforms aligned with long-term technology adoption. The largest new stakes were:

- Reddit ($RDDT) +$125.97M

- Amphenol ($APH) +$80.68M

- Autodesk ($ADSK) +$46.48M

- monday.com ($MNDY) +$45.92M

- Credo Technology Group ($CRDO) +$43.18M

In total, these new positions accounted for over $750 million in fresh capital deployment. The selections highlight Bridgewater’s focus on companies with strong recurring revenue, mission-critical products, and exposure to digital infrastructure. The moves broaden the portfolio into areas where growth visibility remains high and valuations offer cleaner long-term risk-reward.

Key Takeaways from Ray Dalio’s Q4 2025 Portfolio

Bridgewater Associates closed Q4 2025 with its highest reported U.S. equity allocation on record, according to its SEC Form 13F filing. The quarter was defined by a decisive expansion in broad market exposure, selective reinforcement of semiconductor and data-center infrastructure, and meaningful reductions in several large legacy holdings. Rather than introducing new themes, the portfolio reflects a structural reweighting designed to increase diversification while positioning for 2026.

Equity Allocation Reached an All-Time High

Bridgewater’s disclosed U.S. equity portfolio rose to $27.42 billion, marking the highest level in the firm’s 13F reporting history. This increase signals a clear expansion of equity exposure heading into 2026.

S&P 500 Exposure Became the Core Driver

The largest additions were to SPDR S&P 500 ETF Trust (SPY) and iShares Core S&P 500 ETF (IVV). Together, these two positions now represent more than 21% of total portfolio value, making broad U.S. market exposure the dominant allocation within the equity book.

Infrastructure-Focused Stock Additions

Major stock-level additions were concentrated in Oracle, NVIDIA, and Micron Technology, reinforcing exposure to semiconductor compute, memory infrastructure, and enterprise data-center demand.

Deep Cuts Reduced Single-Stock Concentration

The largest reductions occurred in Alphabet, Uber, Meta Platforms, Wells Fargo, and Regeneron Pharmaceuticals, lowering exposure to mega-cap platform, financial, and single-product pharmaceutical risk.

Reallocation Over Expansion

New positions were limited and small relative to total assets. Most activity reflected capital reallocation within existing exposures rather than broad thematic expansion.