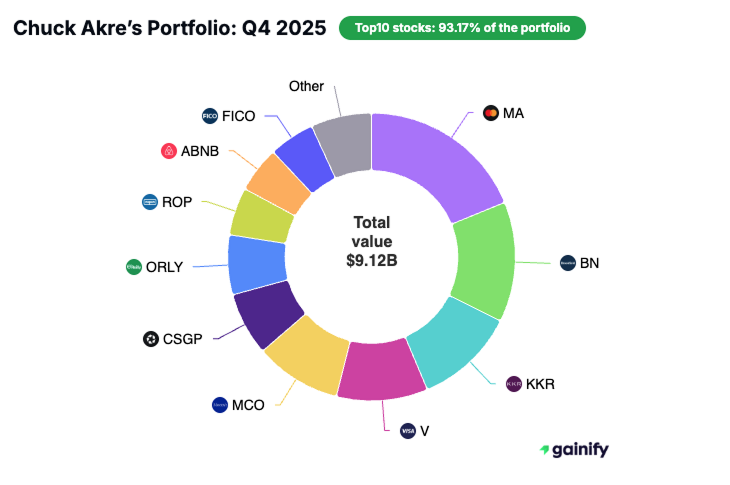

Chuck Akre’s portfolio entering 2026 reflects a highly concentrated, long-term equity strategy built around business quality and capital compounding. As of December 31, 2025, and reported on February 13, 2026, Akre Capital Management oversees an equity portfolio valued at $9.12 billion, invested across 18 publicly listed companies, with an average holding period of 35 quarters, or nearly nine years.

Chuck Akre is one of the most respected long-term investors on Wall Street, yet he operates far from the spotlight. Known for his philosophy of compounding wealth through high-quality businesses, Akre has quietly built an extraordinary track record with Akre Capital Management, the firm he founded in 1989. While investors often look to names like Warren Buffett, Seth Klarman, or Bill Ackman, Akre’s disciplined and patient approach has consistently placed him in the upper echelon of professional money managers.

Chuck Akre is best known for his investment framework referred to as the “three-legged stool” strategy. In practical investment terms, this approach focuses on owning businesses that combine durable economic advantages, management teams with disciplined capital allocation records, and the ability to reinvest free cash flow at high incremental returns. The objective is sustained internal compounding rather than short-term valuation arbitrage or macro-driven positioning.

The portfolio structure reflects this philosophy clearly. The top 10 holdings account for 93.17% of total portfolio value, indicating a conviction-driven allocation model rather than diversification for volatility management. Academic research on active portfolio concentration, including studies published by the Yale School of Management on long-term fund performance, shows that concentrated portfolios outperform when driven by repeatable security selection skill rather than tactical rotation.

This article provides a structured analysis of Chuck Akre’s Q4 2025 portfolio entering 2026. It explains how his investment philosophy translates into portfolio construction, examines the largest holdings and sector exposures, reviews the most important trades from the latest quarter, and identifies the strategic signals implied by his capital allocation decisions as markets transition into 2026.

Key Insights from Chuck Akre’s Q4 2025 Portfolio Update

- Concentration at the Core: Public equity holdings stood at $9.12 billion as of December 31, 2025, spread across 18 positions, with the top 10 representing 93.17% of total assets.

- Long Holding Periods, Minimal Turnover: The 35-quarter average holding period confirms a business-owner mindset. Portfolio changes were infrequent and reflected capital discipline.

- No New Buys, Internal Reallocation: No new equity positions were initiated during the quarter. Capital was redeployed within existing holdings.

- Financial Infrastructure Dominance: Holdings such as Mastercard, Visa, Brookfield, KKR, and Moody’s continue to anchor the portfolio due to durable cash flows and high returns on capital.

- Targeted Adjustments, Stable Framework: Significant additions to Brookfield, Copart, and CCC Intelligent Solutions were offset by selective trims in mature positions.

- Compounding First: Position sizing, concentration, and holding duration remain aligned with Akre’s primary objective: long-term capital compounding through businesses with durable economics and reinvestment capacity.

Who Is Chuck Akre?

Chuck Akre’s story is one of consistency, patience, and a lifelong commitment to the principles of compounding. He began his career in the financial industry in the 1970s, a time when Wall Street was still dominated by traditional brokers and fast-talking traders. Rather than following the herd, Akre gravitated toward the quieter, more disciplined side of investing. He studied companies in depth, learned from some of the greats of the era, and gradually built a framework that would become the foundation of his life’s work.

In 1989, after years of sharpening his skills and refining his ideas, he founded Akre Capital Management. From the very beginning, the firm stood apart. Instead of trying to run a giant mutual fund with hundreds of positions, Akre focused on a small, concentrated portfolio of high-quality companies. His view was simple but radical: true investment opportunities are rare, and when you find them, you should own them in size. That mindset has shaped every decision since.

Over the decades, Akre built his reputation as a patient value investor with an uncanny ability to spot businesses capable of sustained internal compounding. Unlike hedge funds that chase quarterly trends, short-term catalysts, or macro trades, Akre thinks and acts like a business owner. He prefers to buy exceptional companies, trust their leadership teams, and let time and compounding do the heavy lifting. This approach not only created significant wealth for his clients but also allowed Akre to avoid the distractions and emotional swings that come with short-term speculation.

Another key element of Akre’s story is geography. While most investors of his caliber gravitate to New York, Boston, or San Francisco, Akre chose to base himself in Middleburg, Virginia. That decision, far from Wall Street’s noise and hype, has become symbolic of his philosophy: independence of thought, humility, and focus. By staying grounded, Akre has been able to ignore market fads and concentrate on what really matters – the businesses themselves.

Over time, this low-profile, disciplined approach earned him the respect of both peers and individual investors. Many now see him not just as a successful fund manager, but as a practitioner of timeless investing principles. His track record, built over decades, is a testament to the power of staying patient, staying selective, and staying the course.

Chuck Akre’s Investment Philosophy Explained

At the heart of Chuck Akre’s success lies a philosophy that is elegant in its simplicity yet incredibly powerful in practice. He often describes it as the “three-legged stool” approach. Like a stool, it is only stable if all three legs are strong. For Akre, those legs are: exceptional business models, talented and aligned management, and reinvestment of free cash flow.

1. Exceptional Business Models

Akre begins with the business itself. He looks for companies with durable competitive advantages – what Warren Buffett famously called “economic moats.” These moats may come from brand strength, market share dominance, switching costs, or regulatory barriers that keep rivals at bay.

Examples from his own portfolio highlight this thinking. Visa and Mastercard, for instance, operate global payment networks that are nearly impossible to replicate. Every transaction strengthens their ecosystem, and as digital payments expand worldwide, their dominance only deepens. Similarly, Moody’s and S&P Global hold near-duopolies in the credit ratings industry. Their brand reputation and regulatory integration make them indispensable, allowing them to maintain pricing power decade after decade.

For Akre, these are not just businesses; they are compounding machines, capable of generating high returns on capital with relatively low incremental costs.

2. Talented and Aligned Management

The second leg of Akre’s stool focuses on leadership. A great business can be derailed by poor decision-making, so Akre places enormous weight on management quality. He studies how executives allocate capital, how they treat shareholders, and whether their incentives are tied to long-term performance rather than short-term bonuses.

He has often remarked that he wants to invest alongside managers who think like owners, not caretakers. Leaders at firms like Mark Leonard of Constellation Software exemplify this alignment. They consistently reinvest earnings wisely, pursue thoughtful acquisitions, and avoid empire-building for its own sake.

Akre believes that when management is both talented and aligned, shareholders can trust the business to thrive even through inevitable periods of market volatility.

3. Reinvestment of Free Cash Flow

The final leg, and perhaps the most important, is what Akre calls reinvestment opportunity. It is not enough for a company to earn high returns today; the real magic happens when those earnings can be reinvested at similarly high rates of return.

Take Moody’s again as an example. The company generates significant free cash flow, and instead of hoarding it or paying out all of it as dividends, it reinvests into new services, data products, and acquisitions that expand its moat. Over time, this compounding effect snowballs into exponential growth in both earnings and shareholder value.

Akre has explained that even a great business can stagnate if it lacks reinvestment opportunities. He deliberately avoids firms that return cash to shareholders because they cannot find productive uses for it. In his view, the most attractive companies are those where management can recycle every dollar of profit into creating even more profit.

Chuck Akre’s Portfolio Structure and Key Metrics (Q4 2025)

Chuck Akre’s portfolio structure entering 2026 is defined by extreme concentration, long holding periods, and sector exposure aligned with capital-light compounding businesses. These characteristics are not Core Portfolio Metrics

As of December 31, 2025, reported on February 13, 2026, the portfolio metrics are:

Metric | Value |

|---|---|

Total Portfolio Value | $9.12 billion |

Number of Holdings | 18 stocks |

Average Holding Period | 35 quarters |

Top 10 Holdings Weight | 93.17% |

Portfolio Turnover | Very low |

Performance Profile

Portfolio returns reflect both long-term compounding and short-term valuation cycles:

Period | Total Return |

|---|---|

1 Year | -10.24% |

3 Years | +33.67% |

5 Years | +31.62% |

Position Sizing Discipline

Position sizing in Akre’s portfolio is not equal-weighted. Capital allocation increases as conviction and business durability are validated over time.

Key characteristics:

- Positions are initiated at modest weights

- Successful holdings are allowed to grow into large allocations

- Winners are not trimmed mechanically to rebalance risk

- Reductions typically follow changes in fundamentals, reinvestment runway, or capital allocation quality

This sizing approach aligns with research on asymmetric return distributions in equity portfolios, where a small number of holdings often generate the majority of long-term gains.

What the Structure Signals Entering 2026

The portfolio structure indicates:

- Confidence in a small number of durable compounders

- Willingness to tolerate short-term volatility in exchange for long-term compounding

- Limited reliance on macro timing or sector rotation

- A preference for businesses that can internally fund growth across cycles

This structural context is critical before analyzing individual holdings, as it explains why certain positions dominate the portfolio and why changes are infrequent but meaningful.

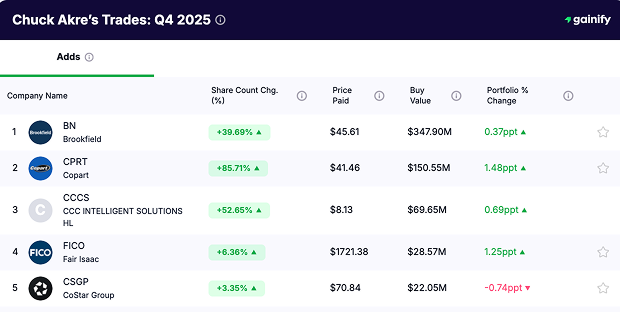

Chuck Akre’s Key Trades in Q4 2025

Chuck Akre is known for his low turnover and long holding periods, so when he makes significant changes, they carry weight. In Q4 2025, the portfolio saw a handful of important moves: some were dramatic reallocations, while others were fine-tuning adjustments. The most notable activity involved a huge additions to Brookfield and Copart , selective reductions in positions that remain consistent with his long-term framework, and measured trims in several larger holdings. These changes reflect capital reallocation within the portfolio rather than a shift in overall investment philosophy.

Major Additions to Existing Positions in Q4 2025

Chuck Akre increased exposure to a small number of high-conviction holdings in Q4 2025. The additions were concentrated in businesses with durable cash flows, strong reinvestment capacity, and long operating histories, consistent with his three-legged stool framework.

- Brookfield (BN)

✔️ Share count increased by +39.69%, representing approximately $347.9 million in additional capital deployed.

✔️ Brookfield remains one of the portfolio’s largest positions at 13.51% of total assets.

✔️ The increase reinforces Akre’s conviction in asset-heavy, fee-generating platforms with long-duration capital and inflation-linked cash flows across infrastructure, real assets, and private markets. - Copart (CPRT)

✔️ Position increased by +85.71%, adding roughly $150.6 million.

✔️ Copart’s portfolio weight rose by +1.48 percentage points, making it a meaningful mid-sized holding.

✔️ The business operates a dominant global vehicle auction platform with high operating margins, recurring transaction volume, and strong returns on incremental capital. - CCC Intelligent Solutions (CCCS)

✔️ Share count increased by +52.65%, with approximately $69.7 million invested.

✔️ CCCS provides mission-critical software to the insurance and automotive repair ecosystem.

✔️ The addition reflects confidence in recurring subscription revenue, high switching costs, and expanding data-driven workflows across claims management. - Fair Isaac (FICO)

✔️ Stake increased by +6.36%, representing about $28.6 million in added exposure.

✔️ FICO’s portfolio weight increased by +1.25 percentage points.

✔️ The company’s credit scoring models remain deeply embedded in consumer lending, giving it pricing power, predictable cash flows, and limited competitive threat.

New Buys in Q4 2025

There were no new equity positions initiated in Q4 2025. This lack of new buys is consistent with Chuck Akre’s long-standing approach of capital concentration over idea proliferation, where incremental capital is allocated to existing businesses that continue to meet return on capital, management quality, and reinvestment criteria.

Sold Out in Q4 2025

In Q4 2025, Chuck Akre fully exited Verisk Analytics (VRSK), selling the entire position at an average price of $225.67 for a total value of $1.87 million. The exit reduced the portfolio weight by 0.02 percentage points, indicating that the position had already been non-core. A full sell-out, even at a small weight, is consistent with Akre’s discipline of removing holdings that no longer meet his return on capital or reinvestment criteria, rather than maintaining legacy positions for diversification purposes.

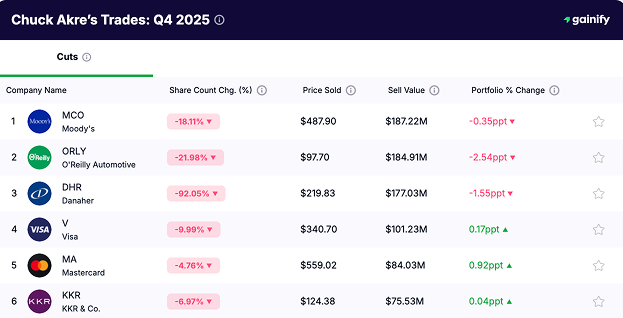

Major Cuts in Q4 2025

In Q4 2025, Chuck Akre reduced exposure across several long-held core positions. These moves reflect portfolio rebalancing and capital reallocation rather than a shift away from his long-term investment philosophy.

- Moody’s (MCO)

✔️ Share count reduced by 18.11%, with approximately $187 million sold.

✔️ Despite the cut, Moody’s remains a core holding, indicating position sizing discipline rather than a loss of conviction in the credit ratings business. - O’Reilly Automotive (ORLY)

✔️ Position reduced by 21.98%, representing roughly $185 million in sales.

✔️ The trim followed a period of strong performance and reduced portfolio concentration after ORLY became a larger weight earlier in the year. - Danaher (DHR)

✔️ Share count reduced by 92.05%, effectively de-risking the position.

✔️ This represents one of the most significant reductions in the quarter and reflects a reassessment of capital allocation within industrial and life sciences exposure. - Visa (V)

✔️ Position reduced by 9.99%, with approximately $101 million sold.

✔️ Despite the cut, Visa’s portfolio weight increased slightly, driven by relative performance versus other holdings. - Mastercard (MA)

✔️ Share count reduced by 4.76%, equivalent to about $84 million in sales.

✔️ Mastercard remains the largest holding, showing that trims were incremental and focused on exposure management. - KKR & Co. (KKR)

✔️ Position reduced by 6.97%, with around $76 million sold.

✔️ The modest reduction suggests fine-tuning within alternative asset managers rather than a strategic exit.

Chuck Akre’s Portfolio Holdings – Q4 2025

As of December 31, 2025, Chuck Akre’s equity portfolio remains highly concentrated, with capital allocated to a small number of businesses that meet his return on capital and reinvestment criteria. The table below outlines the full portfolio composition, ranked by portfolio weight, and highlights how a limited set of core holdings continues to drive overall performance and risk exposure.

Rank | Company | Ticker | Primary Industry | Shares Held (M) | Market Value ($M) | Portfolio Weight |

|---|---|---|---|---|---|---|

1 | Mastercard | MA | Other Business Services | 3.01 | 1,720 | 18.81% |

2 | Brookfield | BN | Nonresidential Buildings | 26.84 | 1,230 | 13.51% |

3 | KKR & Co. | KKR | Investment Advice | 8.11 | 1,030 | 11.33% |

4 | Visa | V | Other Business Services | 2.68 | 939 | 10.29% |

5 | Moody’s | MCO | Consumer Credit Reporting | 1.74 | 886 | 9.72% |

6 | CoStar Group | CSGP | Other Business Services | 9.62 | 647 | 7.09% |

7 | O’Reilly Automotive | ORLY | Retail Auto & Home Supply | 6.72 | 613 | 6.72% |

8 | Roper Technologies | ROP | Industrial Instruments | 1.11 | 492 | 5.39% |

9 | Airbnb | ABNB | Dwelling & Building Services | 3.47 | 471 | 5.17% |

10 | Fair Isaac | FICO | Other Business Services | 0.277 | 469 | 5.14% |

11 | Copart | CPRT | Retail Auto Dealers & Gas | 7.87 | 308 | 3.38% |

12 | CCC Intelligent Solutions | CCCS | Prepackaged Software | 24.84 | 197 | 2.16% |

13 | American Tower | AMT | Real Estate Investment Trusts | 0.26 | 45 | 0.49% |

14 | Goosehead Insurance | GSHD | Insurance Agents & Brokers | 0.37 | 27 | 0.30% |

15 | Sophia Genetics | SOPH | Biological Products | 3.72 | 17 | 0.19% |

16 | Danaher | DHR | Industrial Instruments | 0.07 | 16 | 0.17% |

17 | Berkshire Hathaway (B) | BRK.B | Casualty Insurance | 0.012 | 6 | 0.07% |

18 | CarMax | KM |

Key Takeaways from Akre’s Q2 2025 Portfolio

Concentration Remains High

Akre Capital continues to run one of the most concentrated portfolios among major investment managers. With just 18 positions and the top 10 holdings making up 93% of total assets, Akre demonstrates a conviction-driven approach that prioritizes quality over quantity. This reflects his philosophy that true investment opportunities are rare and should be held in size when conviction is highest. Such concentration allows his winners to compound meaningfully, but it also requires rigorous discipline and patience to withstand market volatility.

Concentration Remains Extremely High

As of December 31, 2025, Akre Capital holds 18 positions, with the top 10 accounting for 93.17% of the portfolio. This confirms that concentration remains a defining characteristic of Akre’s strategy.

Portfolio concentration, in practical terms, means allocating a large share of capital to a limited number of high-conviction businesses rather than diversifying broadly. Academic evidence supports this approach when applied with skill. Research titled “Best Ideas” by Antti Petajisto (Yale School of Management, 2013) found that the highest-conviction holdings of active managers generated statistically significant alpha relative to their broader portfolios.

Akre’s structure reflects this principle. Capital is intentionally focused in businesses that meet strict criteria for return on capital, reinvestment capacity, and management quality.

Equity Allocation at 5-Year Lows

Equity allocation within Akre Capital’s reported portfolio is now at a five-year low, based on total disclosed market value trends.

Lower equity exposure typically signals one of two things.

- Higher internal liquidity levels

- Selective capital deployment discipline

Academic research such as “Market Timing Ability of Mutual Fund Managers” by Henriksson (University of California, 1984) shows that consistent timing success is rare. However, reducing exposure during periods of valuation compression or limited reinvestment opportunity can reflect process discipline rather than macro timing.

In Akre’s case, the reduction in overall equity exposure appears consistent with selective capital allocation rather than a shift in philosophy.

Financial Infrastructure Remains the Core

Financial services and payments companies continue to anchor the portfolio. The largest positions remain Mastercard, Brookfield, KKR, Visa, and Moody’s, underscoring Akre’s preference for businesses that sit at the center of global financial infrastructure.

These companies share several economically important traits. They generate consistently high returns on invested capital, operate with relatively asset-light models, and benefit from recurring, contract-driven or transaction-based revenue. Most importantly, their competitive positioning is reinforced by scale, regulation, or network effects, which limits effective competition over long periods.

Structural growth further supports this allocation. As reported in the McKinsey Global Payments Report 2023, global electronic payment volumes continue to expand at high-single-digit annual rates, reinforcing long-term earnings visibility for payment networks such as Visa and Mastercard. In parallel, credit rating agencies like Moody’s benefit from regulatory entrenchment. The U.S. Securities and Exchange Commission’s designation of Nationally Recognized Statistical Rating Organizations creates formal barriers to entry, preserving pricing power and market share.

Capital allocation within the portfolio reflects these fundamentals. Akre continues to concentrate exposure in financially entrenched businesses where cash flow durability and reinvestment capacity remain intact across economic cycles.

Conclusion

Chuck Akre’s Q4 2025 portfolio is a clear example of long-term, conviction-driven investing. Unlike investors who spread themselves thin across dozens or even hundreds of stocks, Akre proves that depth often matters more than breadth. His $9.12 billion portfolio is structured around a small number of world-class businesses, carefully chosen for their ability to generate consistent returns over time.

The results highlight the enduring power of his “three-legged stool” philosophy: focus on companies with durable business models, partner with strong management teams, and ensure those companies can reinvest capital at high rates of return. This framework allows him to identify firms capable of compounding value for decades rather than chasing short-lived trends.

With top holdings in Mastercard, Visa, Brookfield, and Moody’s, Akre emphasizes the stability of financial infrastructure and payment networks, while selective bets like O’Reilly, Airbnb, and Copart show he is not afraid to evolve and capture emerging opportunities. At the same time, decisive trims to names like American Tower demonstrate the importance of active risk management in maintaining a resilient portfolio.

For investors, Akre’s approach offers a timeless lesson: wealth is built not by chasing what is popular in the stock market today, but by owning exceptional businesses through full cycles and letting compound interest do its work.

Akre’s strategy serves as a blueprint for serious investors: stay focused on quality, ignore short-term noise, and let compounding create lasting wealth.