Michael Burry, the legendary American investor and founder of Scion Asset Management, remains one of the most closely watched figures in global finance. Best known for his billion-dollar bet against the subprime mortgage market during the 2008 financial crisis (immortalized in The Big Short movie) Burry has spent his career making unconventional calls that often run counter to the crowd. His contrarian philosophy, deeply rooted in value investing and forensic balance sheet analysis, has repeatedly enabled him to spot hidden risks and opportunities before they become mainstream headlines.

In the third quarter of 2025, Burry once again reshaped his portfolio with the decisiveness that has defined his career. After spending Q2 in a rare risk-on stance, building long equity exposure and call options across healthcare, consumer, and technology sectors, he has now reversed course entirely. His latest 13F filing, dated September 30, 2025, shows that Scion Asset Management liquidated all Q2 positions and initiated a new portfolio built from the ground up.

At the center of this repositioning are large put option holdings in Palantir Technologies (PLTR) and NVIDIA (NVDA), together representing the majority of Scion Asset Management’s reported market value. These trades indicate a renewed skepticism toward the artificial intelligence and semiconductor momentum that has dominated investor enthusiasm throughout 2025. In characteristic fashion, Burry is positioning against two of the market’s most popular names at a time when sentiment remains overwhelmingly bullish.

Where the second quarter reflected a dramatic shift from bearish hedging to selective optimism, the third quarter represents another strategic recalibration. Scion Asset Management has once again demonstrated its flexibility, shifting focus from broad market participation to concentrated positioning based on valuation, sentiment, and risk management.

Who is Michael Burry?

Michael J. Burry rose to global fame following the 2008 financial crisis, immortalized by Christian Bale’s portrayal in the Hollywood blockbuster The Big Short. But long before the cameras rolled, Burry was already a financial legend in the making.

A trained physician turned self-taught investing genius, Burry left his medical career to launch Scion Capital, where he pioneered a data-driven, deep-value investment approach. He famously predicted the collapse of the housing market by analyzing the toxic structure of mortgage bond markets and purchased credit default swaps to profit from the coming implosion. That trade earned his fund – and himself – hundreds of millions of dollars.

Today, he operates Scion Asset Management, applying the same rigorous analysis and sharp skepticism toward market overreactions, speculative bubbles, and irrational valuations. A man who prefers spreadsheets over CNBC appearances, Burry is known for his laser focus on fundamentals and a fearless attitude when it comes to going against the crowd.

Scion Asset Management’s Current Portfolio Snapshot – Q2 2025

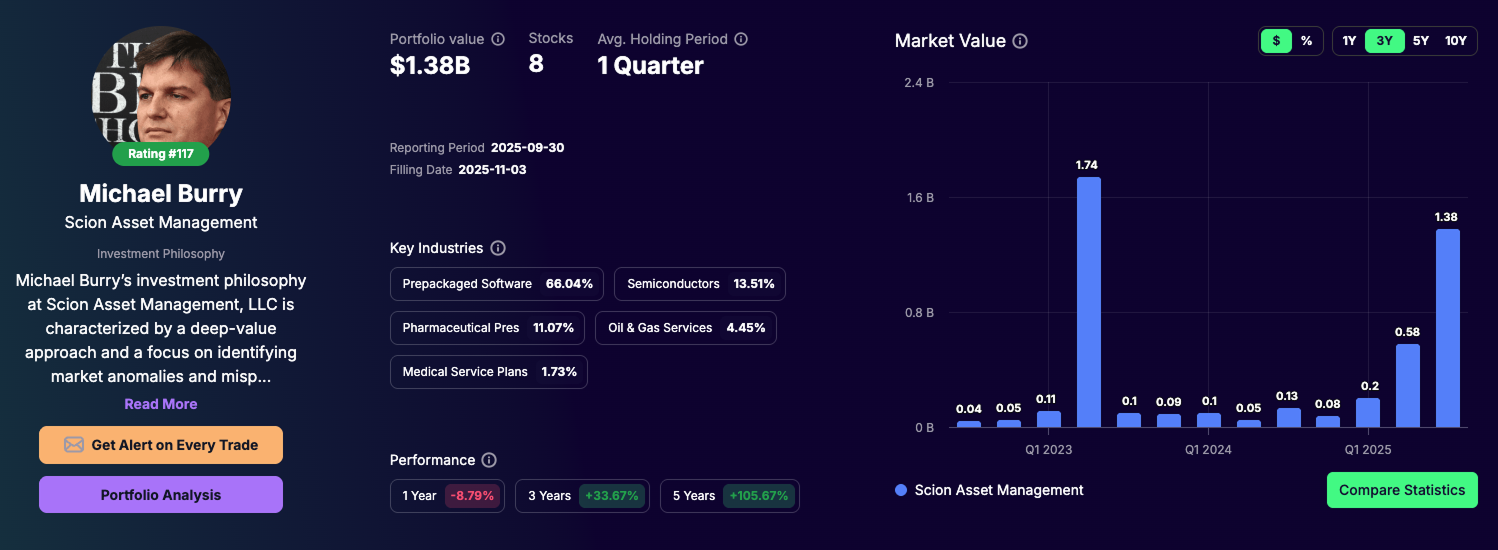

- Notional Value: $1.38 Billion

- Number of Stocks: 8

- Average Holding Period: 1 Quarter

Scion Asset Management’s latest 13F filing for the quarter ended September 30, 2025, reveals another large-scale repositioning under Michael Burry’s direction. The reported portfolio value increased sharply from $578 million in Q2 to $1.38 billion in Q3, more than doubling the prior quarter’s figure. This expansion, however, reflects notional exposure through options rather than pure equity holdings, underscoring Burry’s preference for tactical leverage to express conviction at scale.

Check out Michael Burry’s stock portfolio.

The new composition is dominated by large put option positions on Palantir Technologies (PLTR) and NVIDIA (NVDA), which together represent more than 79 percent of Scion Asset Management’s reported holdings. These trades mark a decisive return to a bearish macro posture, focused on two of the year’s most momentum-driven names in artificial intelligence and semiconductors.

Outside these core bets, the portfolio includes a smaller but purposeful mix of healthcare, energy, and consumer positions, maintaining exposure to defensives while expressing caution toward overextended technology valuations.

Major Q2 Exits Ahead of the Q3 Rebuild

Scion Asset Management closed every position held in Q2 2025, marking a complete liquidation of the prior quarter’s bullish portfolio. The exits included both direct equity stakes and leveraged call option exposures across healthcare, technology, and consumer sectors.

Closed Positions:

- UnitedHealth Group (UNH) – $109.19M, 18.88% of portfolio [Call Options]

A healthcare giant with unmatched scale in managed care. Burry established this position through calls, giving leveraged exposure to long-term healthcare demand and defensive cash flows. - Regeneron Pharmaceuticals (REGN) – $105M, 18.16% of portfolio [Call Options]

A biotech leader in immunology and ophthalmology treatments. Burry used calls to capture upside from Regeneron’s pipeline strength and recurring revenues from blockbuster drugs like Eylea. - Lululemon Athletica (LULU) – $95.03M, 16.43% of portfolio [Call Options]

A premium consumer discretionary name. Despite macro uncertainty, Lululemon’s pricing power and expanding international footprint made it a high-conviction call option bet. - Meta Platforms (META) – $73.81M, 12.76% of portfolio [Call Options]

Burry took leveraged exposure via calls. Meta’s pivot toward AI monetization and its continued dominance in digital advertising underpin this thesis. - Estée Lauder (EL) – $40.40M, 6.99% of portfolio [Call Options]

A luxury beauty leader. Burry had already initiated a direct equity buy in Q1, but in Q2 he doubled down by layering on call options. This provides additional leverage to the brand’s recovery story, especially in Asia. - JD.com (JD) – $32.64M, 5.64% of portfolio [Call Options]

Burry re-entered Chinese e-commerce, but this time through calls rather than puts, signaling a reversal in his outlook. He sees valuation support despite regulatory and competitive pressures. - Alibaba (BABA) – $28.35M, 4.90% of portfolio [Call Options]

Similar to JD.com, this is a call option bet on a depressed valuation story with enduring scale in Chinese e-commerce. - ASML (ASML) – $20.03M, 3.46% of portfolio [Call Options]

A strategic call option bet on the semiconductor supply chain. Instead of targeting chipmakers directly, Burry chose ASML, the critical lithography supplier powering advanced chip production. - V.F. Corporation (VFC) – $17.63M, 3.05% of portfolio [Call Options]

Exposure to global apparel via calls. With brands like Vans and The North Face, Burry appears to be betting on a turnaround at depressed valuations. - MercadoLibre (MELI) – $7.84M, 1.36% of portfolio [Call Options]

Latin America’s leading e-commerce and fintech platform. Burry expressed this view through calls, targeting growth beyond the crowded U.S. and Chinese markets. - Bruker (BRKR) – $10.3M, 1.78% of portfolio [Direct Equity Buy]

A life sciences instruments company. Unlike the above positions, Bruker was purchased outright as common stock, giving Burry direct exposure to healthcare innovation.

The total capital redeployed from these exits exceeded $550 million in notional exposure, freeing Scion Asset Management to construct a completely new portfolio for Q3 2025 centered on tactical option trades.

Massive New Additions: Contrarian Reset

After closing every long and call-heavy position from Q2, Michael Burry rebuilt Scion Asset Management’s portfolio entirely in Q3 2025. The new structure, consisting of eight total positions, is concentrated, tactical, and unmistakably contrarian. Instead of broad bullish exposure, Scion Asset Management now holds a selective mix of large bearish option positions and smaller long or call holdings across defensive and value-oriented sectors.

Top New Buys in Q3 2025

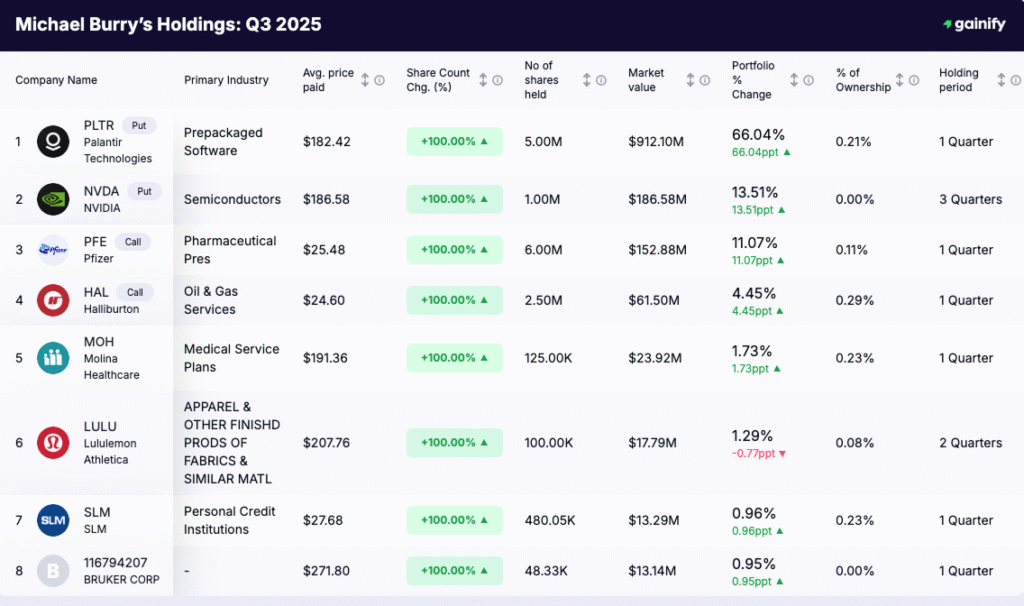

- Palantir Technologies (PLTR) – $912.10M, 66.04% of portfolio [Put Options]

Scion’s largest new position is a significant put option bet against Palantir Technologies. Burry appears to be challenging one of 2025’s most popular AI-driven stories, signaling concern that enthusiasm may have outpaced fundamentals. The position’s size underscores both conviction and asymmetry in his outlook. - NVIDIA (NVDA) – $186.58M, 13.51% of portfolio [Put Options]

Another large-scale put position, this time in NVIDIA, mirrors Burry’s skepticism toward overheated valuations in semiconductors. After years of exceptional performance, the company remains central to the AI supply chain, but Burry’s stance suggests expectations have reached extremes. - Pfizer (PFE) – $152.88M, 11.07% of portfolio [Call Options]

In contrast to the heavy bearish positions, Burry added a sizable bullish call stake in Pfizer. The trade reflects a view that the market is underestimating the company’s pipeline strength and cash flow stability following a difficult post-pandemic adjustment period. - Halliburton (HAL) – $61.50M, 4.45% of portfolio [Call Options]

Halliburton offers leveraged upside to energy and infrastructure spending. Through calls, Burry maintains exposure to oilfield recovery without committing excess capital, aligning with his preference for controlled optionality. - Molina Healthcare (MOH) – $23.92M, 1.73% of portfolio [Equity]

A smaller but deliberate equity holding, Molina provides exposure to the managed care and Medicaid segments. The position aligns with Burry’s consistent interest in healthcare businesses that combine policy resilience with predictable margins. - Lululemon Athletica (LULU) – $17.79M, 1.29% of portfolio [Equity]

Burry reintroduced exposure to Lululemon through a modest equity position. The company’s strong brand equity and expanding global footprint make it a durable play on consumer resilience. - SLM Corporation (SLM) – $13.29M, 0.96% of portfolio [Equity]

A measured position in SLM adds exposure to consumer finance and the student lending market, offering indirect sensitivity to interest rate shifts and credit trends. - Bruker (BRKR) – $13.14M, 0.95% of portfolio [Equity]

Bruker continues to appear in Scion’s holdings, reflecting long-term confidence in life sciences instrumentation and analytical technology as steady sources of value creation.

What This Shift Reveals

Michael Burry’s Q3 2025 portfolio reflects a continued commitment to contrarian thinking, now expressed through a more defensive and tactical structure. After building a long and call-heavy portfolio in Q2 that favored recovery and selective growth, Scion Asset Management has shifted toward bearish option exposure and concentrated risk control.

The firm’s largest positions in Palantir Technologies and NVIDIA represent significant put option stakes, showing skepticism toward extended valuations in artificial intelligence and semiconductor sectors that have led market enthusiasm throughout 2025. Alongside these, smaller holdings in Pfizer, Halliburton, Molina Healthcare, and Bruker signal an ongoing focus on companies with stable earnings, tangible assets, and reliable cash generation.

This setup reflects a valuation-driven portfolio rather than an outright bearish one. It shows Burry’s readiness to position early when optimism dominates and his preference for structures that can benefit from volatility or valuation normalization in overheated parts of the market.

Overall, the Q3 2025 portfolio represents a tactical adjustment from broad market exposure to precise, conviction-based trades. It emphasizes flexibility, asymmetric opportunity, and disciplined capital preservation, consistent with Scion Asset Management’s long-term approach.

Recap of Michael Burry’s Q3 2025 Investment Moves

✅ Closed All Q2 Positions: Fully exited every long and call option holding from Q2, including UnitedHealth, Regeneron, Meta, and Lululemon.

✅ New Bearish Core: Established large put option stakes in Palantir Technologies and NVIDIA, together representing over 79% of Scion Asset Management’s reported portfolio value.

✅ Selective Long Exposure: Added smaller long or call positions in Pfizer, Halliburton, Molina Healthcare, Lululemon, SLM Corporation, and Bruker.

✅ Sector Focus: Portfolio concentrated in software, semiconductors, pharmaceuticals, and energy, balancing defensive cash flow with tactical downside exposure.

✅ Active Turnover: For the second consecutive quarter, Scion Asset Management completely rebuilt its portfolio, underscoring Burry’s flexible, conviction-driven approach to capital deployment.

Final Thoughts: A Different Kind of Contrarian Bet

Michael Burry’s portfolio reset in Q3 2025 shows that his contrarian instincts remain intact but continue to evolve with the market cycle. After turning bullish in Q2 through a series of call-heavy positions, he has once again shifted direction, this time toward a selective defensive stance built around large put option exposure and a focused group of long holdings.

This pattern reflects more than tactical repositioning. It shows a disciplined investor who moves entirely with data and conviction, not narrative. When valuations stretch and sentiment reaches extremes, Burry adjusts, regardless of market consensus or past success.

For investors, the lesson remains consistent. Contrarian investing is not about being permanently bearish or isolated from the crowd. It is about timing conviction with precision, protecting capital when enthusiasm runs high, and being ready to act when opportunity reappears.

Across more than two decades, Burry’s 13F filings have told a single story: conviction and flexibility can coexist. His Q3 2025 moves reinforce that message, reminding markets that independent thinking, when backed by discipline and analysis, remains a lasting competitive edge.