The financial world lost a titan with the passing of Charlie Munger in late 2023. While he was widely known as the esteemed Vice Chairman of Berkshire Hathaway, Munger also served as Chairman of the Daily Journal Corporation, where he personally managed the company’s investment portfolio for decades. His legacy is an intellectual framework of value investing principles: a “latticework of mental models” that prioritized rationality over emotion and focused relentlessly on a few great ideas. For discerning investors and students of his wisdom, the Daily Journal’s Q4 2025 portfolio report is a final, tangible blueprint of his strategic genius.

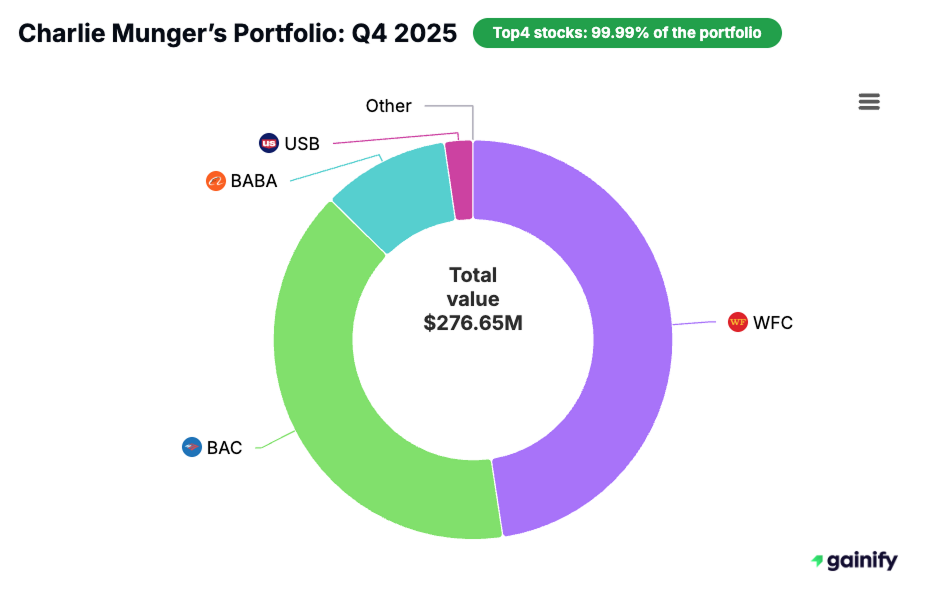

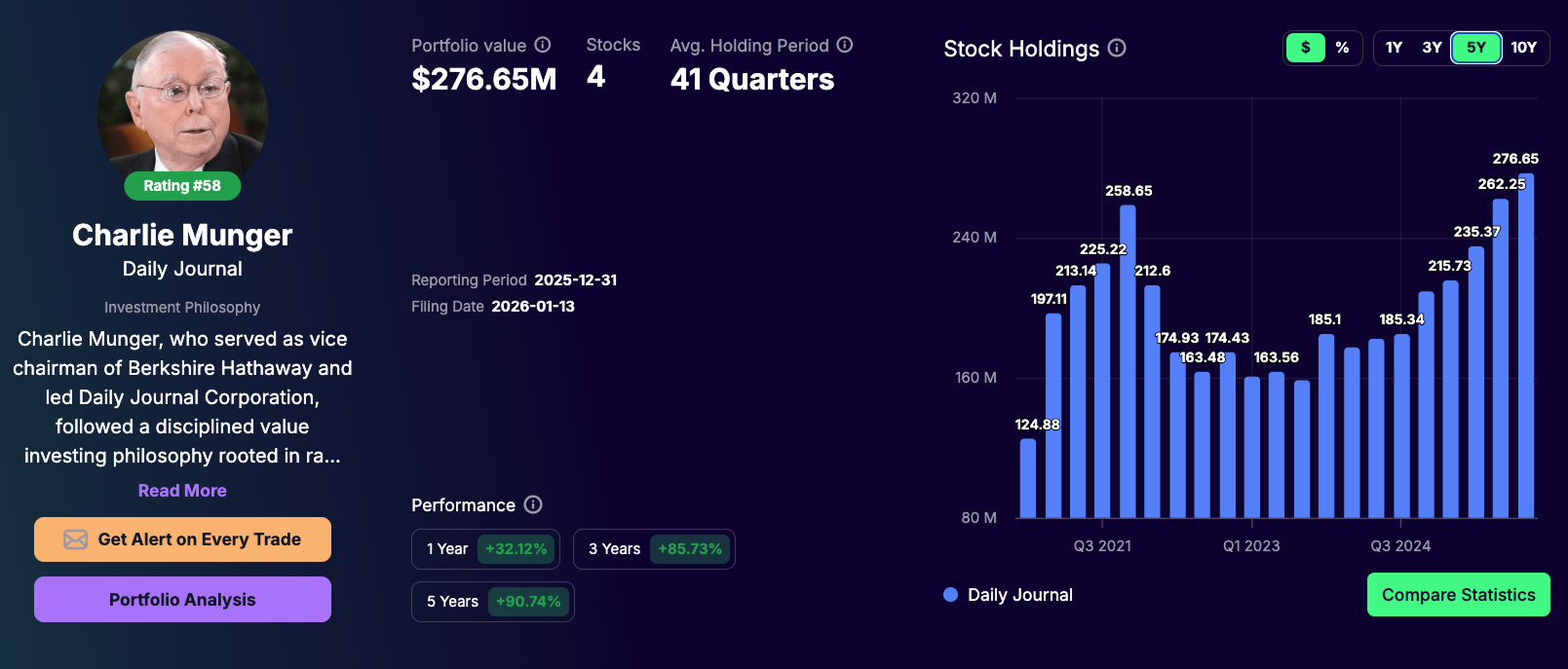

This quarterly filing is not just a routine disclosure; it is an unaltered snapshot of the strategy Munger applied with quiet conviction. The fact that the portfolio has remained completely untouched since his death speaks volumes, transforming the report into a poignant testament to his unwavering discipline. It reveals a portfolio valued at $279.65 million, but the true lesson lies in its composition: just four companies. All positions remained unchanged during the quarter, providing a powerful final lesson in patience, inaction, and the conviction that the best investment move is often to do nothing at all.

The portfolio consists of exactly four companies. These are Wells Fargo & Company, Bank of America Corp, Alibaba Group Holding Ltd, and U.S. Bancorp. This highly concentrated list, with its heavy weighting towards established financial institutions and the single, calculated bet on an international e-commerce giant, represents the culmination of Munger’s lifelong investment thought.

In the remainder of this article, we will deconstruct this portfolio section by section. We will examine the philosophy that guided these specific choices, analyze the performance that proves the power of his buy-and-hold strategy, and ultimately, show how this final, static portfolio serves as a silent, enduring lecture on the principles of rational investing.

A Philosophy Built on Clarity, Not Complexity

Charlie Munger had little patience for the noise and restlessness that dominate much of modern finance. He rejected the idea that investors should spread their money thinly across dozens of companies or trade frequently to chase short-term gains. To him, that was not strategy, it was distraction. His approach, shaped by decades of experience and sharpened by his legal training at Harvard Law School and earlier studies at the University of Michigan, was simple to explain yet rooted in deep intellectual discipline.

Munger often spoke about how human behavior and psychology lead investors astray. He believed that biases, overconfidence, and the constant search for action cause many people to complicate something that works best when kept simple. Instead of trying to outguess the market every day, he argued for a method built on careful selection, thoughtful analysis, and the willingness to do nothing when nothing needs to be done.

At the center of his strategy were a few enduring principles:

- Concentration: Munger preferred to own a small group of outstanding businesses instead of a long list of average ones. He saw no advantage in spreading capital across companies he did not fully understand. This willingness to make large, focused investments was a hallmark of his success and stood in sharp contrast to the highly diversified approach used by many modern hedge funds.

- Patience: Time, not trading, was the most powerful force in investing. Munger’s long holding periods were deliberate choices to let compounding work without interference. The Q4 2025 Daily Journal portfolio, with no changes to its positions, is a recent and clear example of this principle in action.

- Rationality: Every decision was anchored in logic and supported by a careful study of a company’s fundamentals. Emotion had no place in the process. Munger often said that this kind of rational thinking is rare, but it can be learned with discipline and practice.

His well-known saying, “The big money is not in the buying or the selling, but in the waiting,” captures the essence of this philosophy. The Daily Journal portfolio today stands as a real-world monument to that belief. It is built on conviction, not constant activity, and on understanding, not speculation. It serves as a reminder that sometimes the most effective move an investor can make is to stay still and let time do the work.

Q4 2025 Portfolio: The Holdings and Their Significance

The portfolio’s composition speaks volumes about Munger’s enduring beliefs. It is heavily weighted toward the financial services sector, specifically U.S. banking, an industry he believed could provide steady returns when managed prudently. His inclusion of Wells Fargo & Company and Bank of America Corp for over a decade reflects a deep-seated conviction that was not shaken even by the turmoil of the financial crisis. These holdings also provided consistent dividend income, which aligned with Munger’s preference for owning businesses that could generate both steady cash flow and long-term growth for shareholders.

Stock Company Name | Value | Allocation | Duration |

Wells Fargo & Co. | $131.69M | 47.60% | 49 quarters |

Bank of America Corp. | $110.00M | 39.76% | 49 quarters |

Alibaba Group Holding Ltd – ADR | $28.58M | 10.33% | 20 quarters |

U.S. Bancorp | $6.38M | 2.30% | 49 quarters |

The inclusion of Alibaba Group Holding Ltd is a fascinating layer of nuance. While Munger favored domestic, well-established financial sectors, he was not averse to making a calculated bet on a powerful international business with a strong competitive moat, such as e-commerce platforms. This position demonstrates that his philosophy was not rigid, but flexible enough to adapt to a compelling opportunity, even in technology-driven sectors.

The Performance: Visualizing the Power of Compounding

The portfolio’s performance over the years tells the story Munger often spoke of – a story of steady, compounding returns driven by time and unwavering conviction. As the chart illustrates, the portfolio’s value has more than doubled over the last decade, from $114.22M in Q3 2014 to its current value.

Despite significant market volatility, the portfolio has demonstrated impressive resilience and growth:

- 1-Year Return: +32.12%

- 3-Year Return: +85.73%

- 5-Year Return: +90.74%

These results are not the product of sophisticated algorithms or frequent trading; they are the direct outcome of Munger’s philosophy in action. The graph is a visual representation of how patience, when combined with a sound thesis, can overcome market noise and unlock the magic of compounding.

Beyond the Numbers: The Broader Context of an Investment Mind

To fully appreciate the Q2 2025 report, one must understand the evolution of Munger’s investment journey. The 13F form, which publicly discloses security holdings for large institutional investors, provides a valuable but incomplete picture. We see the final positions, but not the average buy price or the specific timing of trades. This portfolio, therefore, is not a list of his best trades, but a final statement of his highest-conviction holdings.

Earlier in his career, Munger led Wesco Financial Corporation, which later merged into Berkshire Hathaway. Wesco became a proving ground for many of his ideas about investing and capital allocation. Over the years, his portfolios held a range of notable companies, from POSCO Holdings Inc, a major steel producer, to Costco Wholesale, where he served as a director for decades. He also famously backed See’s Candies through Berkshire’s Blue Chip Stamps subsidiary. Each of these investments shared a common thread: they were strong businesses with durable competitive advantages and capable leadership.

Munger’s commitment to these principles was never about following a rigid set of rules. It was the product of careful thinking and an ability to recognize what he called the “Lollapalooza effect,” where several favorable forces work together to create exceptional results. In his case, those forces included disciplined selection, rational analysis, patience, and the power of compounding over decades. The Q4 2025 Daily Journal portfolio stands as a clear and final representation of this process, distilled to its essence.

The Enduring Wisdom

Some observers might point to the portfolio’s concentrated nature and argue it carries undue risk. Munger would likely have offered a simple rebuttal: risk comes from not knowing what you own, not from owning a lot of it. His confidence was the result of a deep, multi-disciplinary understanding of each business and its competitive moat.

The Q4 2025 13F portfolio is more than a list of numbers. It reflects the core lesson Charlie Munger spent a lifetime teaching:choose a small number of strong companies, buy them at a fair price, and hold them with patience. The absence of any changes since his passing shows how firmly those principles remain in place. It is a simple approach, yet one that has proven its strength over decades.