If you’re trying to find winning stocks among 33,000+ global opportunities, it can feel like searching for a needle in a haystack.

But if you only invest based on what you read about in financial newsletters or on Bloomberg, you’ll miss a lot of great investing opportunities.

Stock screeners are the best way to filter through thousands of global stocks to find companies that meet your specific investing criteria.

But using stock scanners can be complex. To get the most out of them you really need to know which specific metrics and criteria you are looking for – and there are hundreds of them to choose from, like EBITDA, forward growth projections, price multiples, and more.

A free stock screener is a great way to get started so you can learn the ins and outs of stock screening.

However, many free stock screening platforms lock their best features behind paywalls. You’ll get limited results or lack access to key search & filter criteria – which can leave you frustrated.

But not all of them heavily gate their features.

Other free stock screening like Gainify provide pre-built and customizable stock screening across 33,000+ global stocks – plus an AI stock analysis assistant to help you screen stocks using simple queries.

Choosing the right platform will make a huge difference in your stock screening experience.

In this guide, we’ll analyze the 6+ best free stock screeners available in 2026. You’ll see their exact limitations.

Quick Decision Framework: Choosing Your Free Stock Screener

Need immediate results? Below is your quick decision framework based on what you’re looking for.

Best Free Stock Screeners by Use Case

What You Need | Best Platform | Why It Works | Key Limitation |

AI-Powered Research | Pre-built, customizable, and AI-powered screening across 33,000+ stocks | Slight limitations on the free account (just $7.99/month for unlimited access) | |

Complete Beginners | No registration required, simple interface | Only 5 basic filters available | |

Visual Learners | Best data visualization and heat maps | 15-minute delayed data, 20-row limit | |

Technical Traders | Strong charting integration | Only 2 indicators per chart free | |

Stock Analysis | Clean interface, export capabilities | US markets only (5,496 stocks) |

Why Free Stock Screeners Matter in 2026

Finding undervalued stocks can be tough. You simply cannot analyze all the stocks you need to find the top opportunities.

You have a few choices to combat this:

1) Machine learning models (out of reach to most)

2) Investing newsletters and subscriptions who find top picks for you (expensive and limited stock coverage)

3) Stock screeners (best coverage and most accessible)

Stock screeners give you the same filtering capabilities institutional investors use – and are available free (or at very accessible pricing. Use them to discover opportunities across global markets on your own terms – from value plays to thematic investment strategies in emerging sectors.

The Free Screener Challenge

The truth is most platforms offer free stock screener access as marketing. It’s a way to get you into their platform. In most cases you will need to sign up for a paid subscription for full functionality.

But not all stock screeners have the same limitations. Some may offer delayed data with full results availability. Others may offer real-time data but only let you view 20 results.

Understanding exact limitations is important when finding the best free stock screener for you.

Three factors determine whether a screener serves your goals: data quality, screening depth, and result accessibility.

1. Gainify: Custom and AI-Powered Screening

Best for you if you want pre-built and highly customizable stock screening – or if you’re tired of juggling multiple limited platforms.

Gainify is not only the premier free stock screening tool available to you today as a retail investor. It is the best full-suite stock research & analysis platform you can get your hands on.

You get institutional-grade data across 33,000+ global stocks without overly restrictive or frustrating feature walls.

It’s hard to overstate how much Gainify stands out head and shoulders above the rest.

Not only do you get pre-built and customizable stock screening (filter by 1000+ key metrics and industries) – you can also ask AI to find stocks meeting your specific criteria.

But that’s not all. Once you’ve found stocks via the stock screener, you can deep dive into researching the company using:

- Gainify’s proprietary 5-point rating system (Health, Performance, Valuation, Outlook, Momentum)

- 10+ years of forward valuation trends (track forward P/E, FCF Yield, P/S evolution)

- World’s largest analyst estimates database for retail investors

- AI-powered earnings call summaries with sentiment analysis

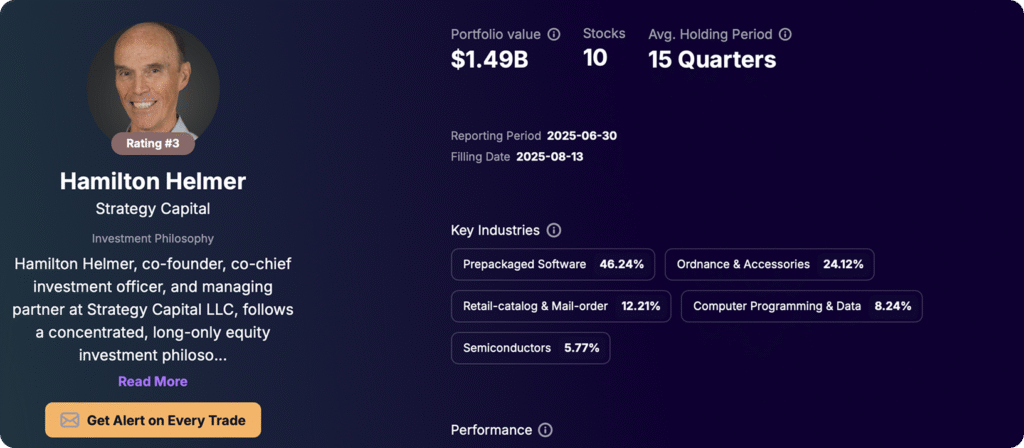

- Top investor & Congress member trading activity with portfolio comparison tools

- Ideas tab for thematic investing (AI stocks, quantum computing, dividend champions)

- Advanced earnings calendar with beat/miss history and estimate revisions

Customizable Stock Screeners

Gainify’s custom screener gives you institutional-grade filtering across 33,000+ global stocks and 30+ exchanges.

Use customizable filters when you have a specific investment thesis and need to define it precisely.

With customizable stock screeners you can search using 1000+ screening metrics, including:

- Fundamentals: P/E, P/B, P/S, PEG, EV/EBITDA, debt ratios, ROE, ROA, profit margins

- Forward Estimates: Projected earnings, revenue growth, forward P/E, analyst consensus

- Dividend Metrics: Yield, payout ratio, growth rate, consistency, ex-dividend dates

- Technical Indicators: 52-week highs/lows, moving averages, RSI, volume patterns

- Growth Metrics: Revenue CAGR, earnings growth, sales acceleration

- Valuation Multiples: Both current and historical forward multiples over 10 years

- Quality Factors: Free cash flow yield, ROIC, gross margins, operating leverage

You will find that having the ability to screen on forward-looking metrics is a huge advantage – one not offered by many other stock screening platforms.

Name and save as many screeners as you need. Gainify provides one of the most generous free tier offerings available to retail investors today.

Platform Strengths

With Gainify you gain access to capabilities that most free platforms lock behind premium walls:

- 33,000+ global stocks across 30+ exchanges give you market coverage (beats many US-only platforms)

- Real-time S&P Global Market Intelligence data provides the same information institutional investors use

- Integrated workflow combines screening, analysis, watchlists, and charting in one platform

- Gainify AI lets you ask questions like “Find undervalued dividend stocks” or “Analyze Tesla’s latest earnings call” and get instant, structured answers

- Portfolio forking lets you copy top investor strategies to your watchlist with one click

If you’re seeking an advanced but easy to use all-in-one stock research platform – Gainify is for you.

Pricing That Makes Sense

Gainify’s FREE tier gives you access to features that most other platforms lock behind a paywall.

If you need increased AI, Gainify paid plans start at just $7.99/month.

Compare this to TradingView ($19.95/month), Finviz Elite ($39.50/month), or Seeking Alpha ($239/year). Gainify delivers more value for less.

Why Investors Choose Gainify

Whether you’re screening for value plays, tracking what Congress members are buying, or analyzing earnings transcripts for strategic shifts, Gainify connects in a unified workflow.

You finally get screening that actually works – which means:

- No more clicking through 50 dropdown menus to build basic filters.

- No more discovering your perfect screen returns “showing 1-10 of 500+ results” behind a paywall.

- No more rebuilding the same screens every session because free tiers don’t let you save.

2. TradingView: Best for Chart Integration (With Restrictions)

Best for you if you prioritize technical analysis – or if you need international market coverage beyond US stocks.

TradingView connects screening results directly to professional charting for technical analysis. But free tier restrictions limit serious analysis.

Free Strengths You Can Access

TradingView provides strong value through its technical analysis chart integration:

- No registration required for basic screening access

- International markets include global stocks beyond US-only platforms

- 100+ fundamental and technical filters cover market cap, sectors, P/E ratios, and volume indicators

You will also find crypto, futures, and ETF screening.

Restrictions and Limitations

TradingView’s limitations are designed to get you hooked into the platform, and then get you to pay up.

But the stock screener feature is one aspect of the platform that gives solid free-tier access. You can access pretty much everything except for auto-refresh screeners.

However, you will hit frustrating limitations when it comes to actually analyzing the stocks you uncover during screening.

Limitations include:

- 5 price alerts

- 1 chart per tab

- 1 saved chart layout

- 2 indicators per chart

Data on the free tier is delayed by approximately 15 minutes, but this shouldn’t impact you if you’re pursuing value or growth investing strategies.

Another of your main frustrations will likely be in-platform advertising. You’ll need to upgrade to a paid plan to remove it.

TradingView Pricing

Some TradingView features are available free. But serious analysis requires paid upgrades starting at $16.95/month and going all the way up to $239.95/month.

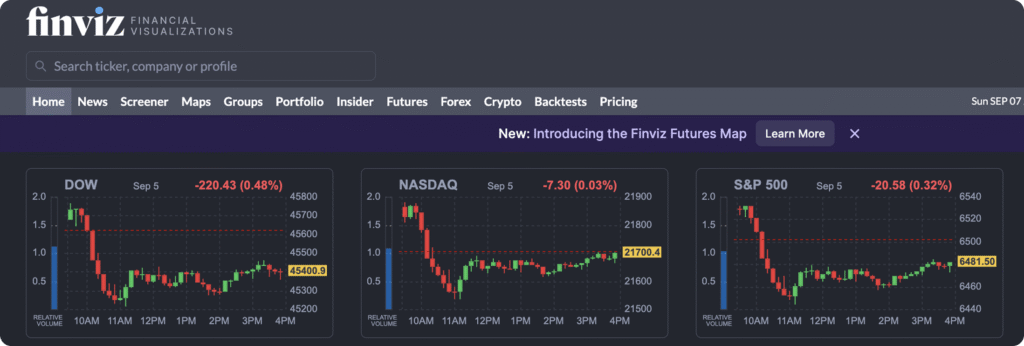

3. Finviz: Best Visual Interface (20-Row Limit)

Best for you if you’re a visual learner who needs heat maps – or if you want powerful free screening with reasonable limits.

Finviz delivers a visually appealing screening experience. Heat maps show market trends clearly. But the 20-row limit constrains your research.

Visual Strengths You’ll Appreciate

Finviz excels at making data visual and intuitive:

- No registration gives you immediate insights

- Clean interface with logical filter organization

- 60+ filters cover valuation, growth, and financial ratios

- Market visualization shows momentum in intuitive graphics

- Heat maps reveal sector performance and market trends at a glance

Not all platforms offer the heat maps, which can be a really nice way to quickly compare and contrast the stocks your screener uncovers.

Restrictions and Limitations

Finviz’s restrictions will likely have you reaching for the paid subscription. To motivate you to upgrade, Finviz holds you back with:

- No custom alerts for criteria changes

- 3-year historical data vs 10+ years in Elite

- 15-minute data delays limit your real-time trading decisions

- 20-row result limit forces multiple screening sessions for detailed analysis

The 20-row limit particularly hurts your sector analysis. You can’t see complete opportunity sets – meaning you’re likely to miss top opportunities. This goes against the entire motivation for using a screener, which is to uncover even the best hidden companies to invest in.

Finviz Pricing

Finviz works for quick visual market orientation. But the 20-row limit and high cost of the Elite subscription ($39.50/month billed monthly) make alternatives like Gainify more cost-effective for unlimited research.

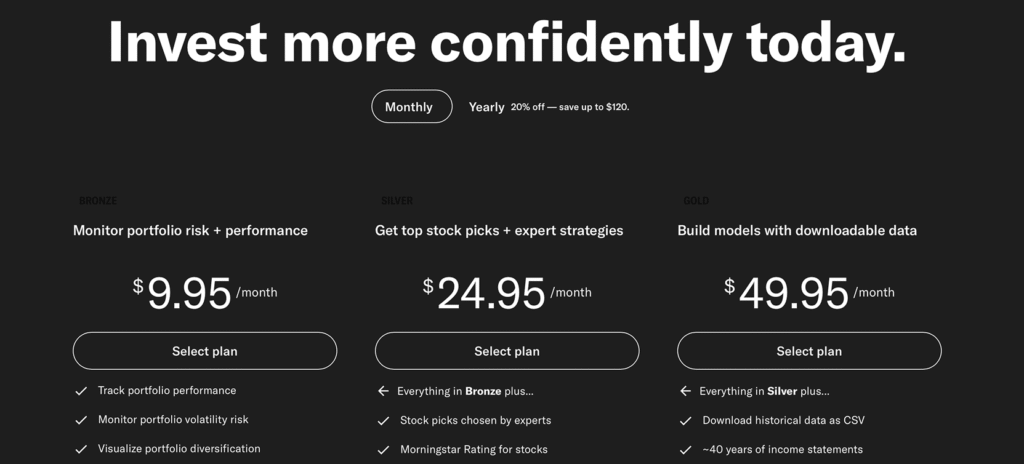

4. Yahoo Finance: Most Accessible Entry Point

Best for you if you’re completely new to screening – or if you need quick market insights without any registration barriers.

Yahoo Finance offers free screening. But limited criteria (only 5 basic filters – market cap, sector, P/E ratio, dividend yield, and beta) restrict what you can uncover from your stock research.

Features You’ll Value

Like with Gainify, you will have access to both pre-built and customizable screeners.

20+ pre-built screens (Most Active, Day Gainers, Day Losers, 52-Week Highs/Lows, etc.) make finding top stocks easy. But customizable screeners leave little to be desired.

While Yahoo Finance gives you comprehensive filtering criteria – even including ESG and ownership data – the overall custom screening experience feels clunky.

With that being said, it does still give you some strong advantages:

- Real-time data without delays

- Market movers show immediate opportunities

- Zero barriers mean you start screening right away

Restrictions and Limitations

On the face of it Yahoo gives you much of what you need for stock screening. But when you start actually using the platform, you will experience some frustrations:

- User interface can be hard to use

- No saved screens prevent building reusable strategies

- US market focus limits your international research (only around 10,000 stocks are covered)

To access premium screener filters like Morningstar ratings, technical pattern screening, and more – you will need a Gold plan subscription ($49.95/month.)

These limitations make Yahoo a starting point for testing out stock screening, rather than a complete solution.

Yahoo Finance Pricing

The Bronze tier ($9.95/month) and Silver tier ($24.95/month) add zero screening improvements beyond the free version’s capabilities. Only at the Gold tier ($49.95/month or $480/year) do you finally unlock premium screening features like the Smart Money Screener, Analyst Ratings Screener, Technical Events Screener, and CSV export capability.

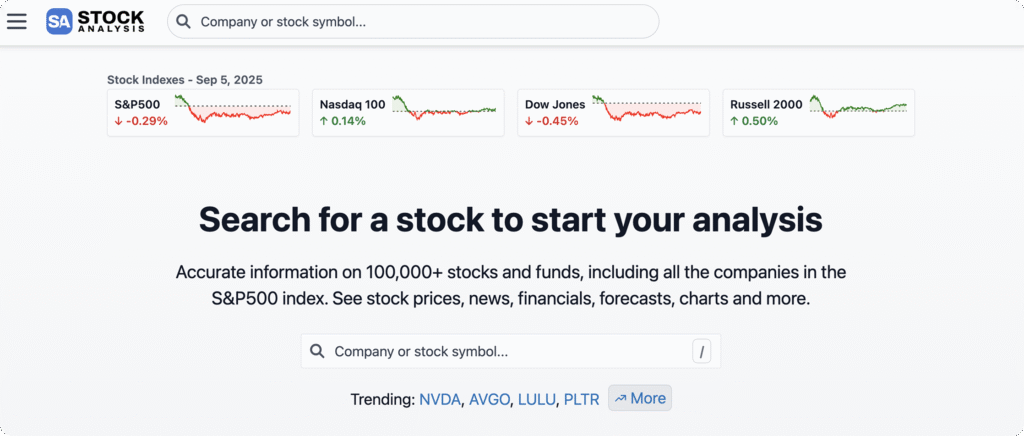

5. Stock Analysis: Clean Professional Interface

Best for you if you focus on US fundamental analysis metrics – or if you want genuinely free professional screening.

Stock Analysis provides unrestricted access to 5,496+ US stocks with no artificial limitations or premium walls – just honest free access.

But that’s a very limited selection of stocks compared to many competitors. Its filtering criteria, while far from modest (270 filters) is far less than the 1000+ offered by Gainify.

Genuine Free Access You Get

Stock Analysis stands out by not restricting functionality:

- Real-time data without delays

- No registration for immediate access

- Related tools connect to comparisons and ETF screening

You get refreshingly honest free access without limited search results.

Restrictions and Limitations

Stock Analysis focuses narrowly on US fundamentals:

- Unable to save your screeners without a paid subscription

- Limited financial history when it comes to analyzing stocks

- Limited watchlists on the free plan

- In-platform ads

Such limitations don’t severely impact your stock screening, compared to those imposed by other platforms.

Stock Analysis Pricing

The Pro tier ($9.99 monthly) finally unlocks the ability to save your custom screeners and choose from 200+ indicators. The Unlimited tier ($29/month) removes download restrictions but adds little else for screening specifically.

6. Koyfin: Limited Free Screening

Koyfin’s free screening is quite limited (only 2 free screens, then you need to upgrade) – but the platform itself is a top player in stock research & analysis.

Unfortunately you will only have access to US stock data unless you sign up for a paid plan.

Limited Screener Access

Koyfin’s free plan requires registration and includes a 7-day trial of all features before automatically downgrading to restricted access.

Free plans enable you to screen stocks – paid plans add in ETF and mutual fund screening.

With a free plan you receive:

- 2 watchlists

- 2 screeners

- 2 chart templates

- 2 custom dashboards

It’s quite limited compared to the generous free tier of Gainify, but enough to test out stock screeners and how they fit into your stock research process.

Historical financial data is limited to 2 years of actuals and 12 quarters – compared to 10 years and 40 quarters on paid plans.

Restrictions and Limitations

Korfin’s platform overall is very strong in the stock research & analysis space. However its free screening capabilities are lacking compared to what competitors like Gainfy can offer you.

Limitations include:

- No ability to export screening results without a paid subscription

- Stock-only screening – ETFs and mutual funds require paid plans

- No screening templates or pre-built screens on free tier

- Only 2 saved screeners allowed on the free plan

Koyfin Pricing

Koyfin’s Plus tier at $39 monthly removes virtually all quantity restrictions (unlimited watchlists, screeners, dashboards, and chart templates.) It also adds in ETF screening. The Premium tier at $79 monthly adds in mutual fund screening.

Beyond Free Screeners: Gainify’s Complete Investment Research Platform

Gainify powers your stock research with institutional-grade coverage:

- 33,000+ stocks across 50+ global markets

- 10+ years of historical data for trend spotting

- S&P Global Intelligence data (the same data used by Wall Street)

Complete Stock Analysis Capabilities

Gainify delivers everything you need for professional investment research through integrated tools that work seamlessly together.

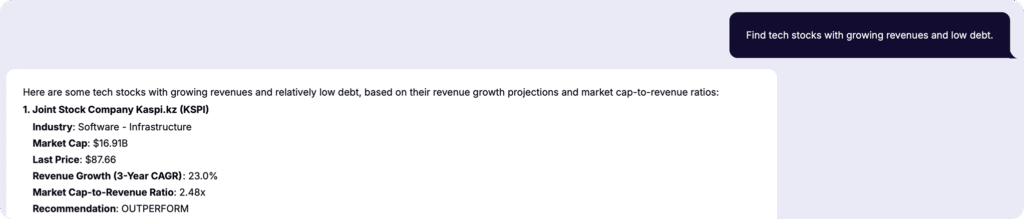

AI-Powered Discovery

Ask questions in plain English like “Find tech stocks with growing revenues and low debt.” You get answers without learning complex programming or rules-based screening formulas.

Gainify AI suggests opportunities you might miss with traditional screening.

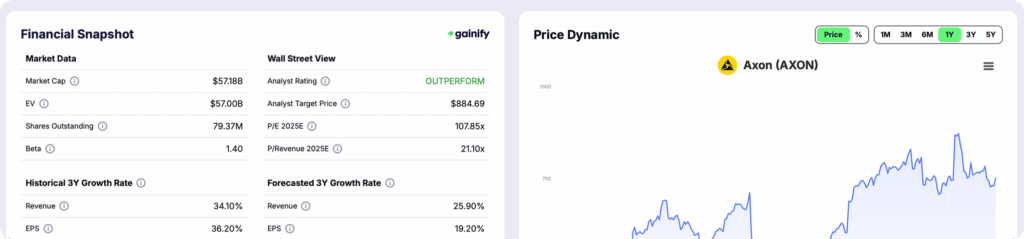

Fundamental Analysis Tools

Access hundreds of institutional metrics that reveal company health and growth potential.

You analyze cash flow quality alongside balance sheet strength indicators. Profitability margins and efficiency ratios reveal operational performance. Revenue growth trends show future potential while peer comparisons put every metric in context.

Every metric comes with context. You understand whether a company outperforms its sector.

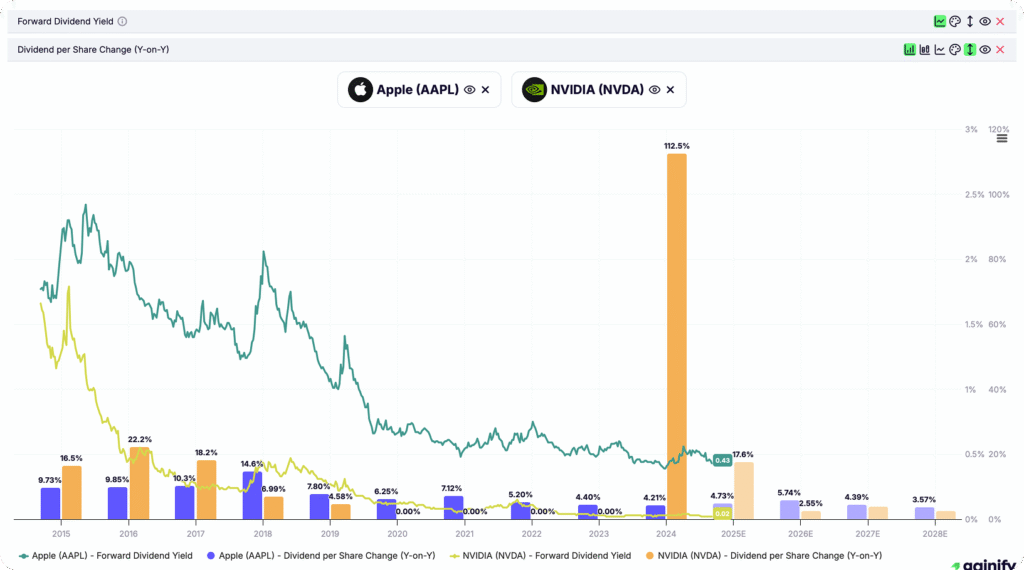

Strong Custom Charting

Pick any ticker, choose from hundreds of financial metrics powered by S&P Global data, and watch your custom stock chart appear.

Want to compare Tesla’s revenue growth against Rivian’s? Overlay multiple companies on the same chart and spot important trends.

Add multiple metrics to analyze complex interactions.

Top Investor Tracking

Mirror the strategies of investing legends with portfolio data updated from fresh 13-F filings. Know what top investors are buying or selling, how much, and when.

Use this information to inform your own investing strategy.

Looking to what Wall Street’s best investors are doing can be another great way to “screen” for companies worth investing in.

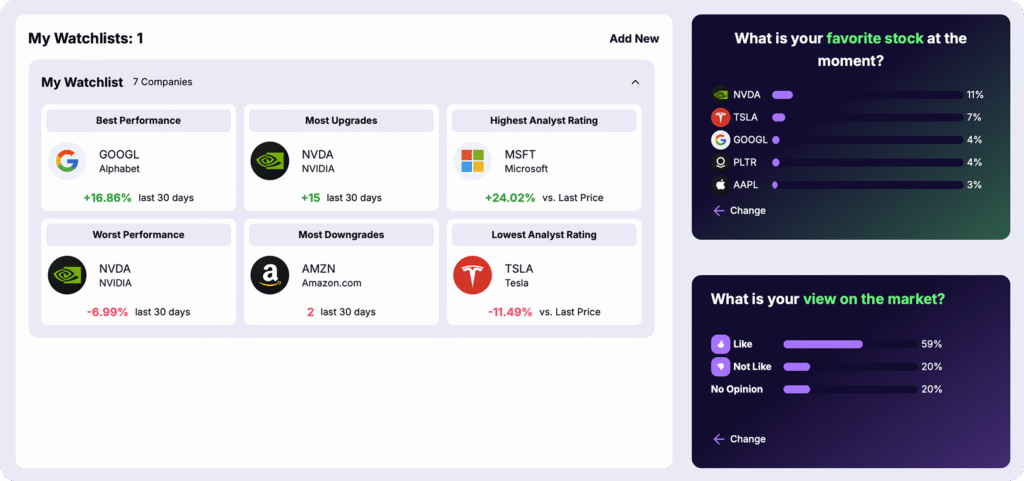

Watchlists

Gainify watchlists are simple to create. Build groups of stocks based on investing approach (value investing, growth investing, etc.), industry focus, and more.

Daily snapshot shows analyst upgrades and downgrades for every stock you’re tracking.

Rate stocks as Buy, Hold, or Sell to track your sentiment for each stock.

You can even fork top investors’ portfolios to your watchlist(s) with a single click.

Making Your Screening Decision

When Free Screeners Make Sense

Free screeners serve specific investor profiles well. They work if you research stocks occasionally (checking a few ideas monthly rather than daily screening.)

If you focus only on US large-cap stocks, most free platforms in this analysis provide adequate coverage.

But if you research stocks several times per week, or just want the best coverage – the only free tier that covers your needs exceptionally well is Gainify.

When You Need More

The first case when you’ll need to upgrade to a paid tier is if you need international stock coverage. Many free tier tools focus solely on US stocks.

However, if you use Gainify, you will have access to international data even on the free tier.

If you regularly research stocks you need a stock screener with unlimited access. That means you can create and search as many screens as needed, and receive unlimited results (not just the top 20 stocks returned by that screener.)

The most cost effective unlimited subscription is Gainify. However, Koyfin provides a compelling suite of tools including mutual fund and ETF screening (features not found in Gainify.)

Conclusion: Your Path to Better Investment Research

With the right stock screener, instead of relying on tips from financial media, you have the tools to systematically find stocks that match your exact criteria.

The free stock screeners we’ve analyzed each serve different investor needs.

Yahoo Finance offers the simplest entry point for beginners who need quick insights without registration.

Finviz excels at visual market analysis with its heat maps, though the 20-row limit prevents you from doing deep research.

TradingView integrates screening with charting for technical traders, while Stock Analysis provides clean fundamental screening for US markets.

However, if you’re serious about finding winning investments across global markets, Gainify is your best bet. With 33,000+ stocks, 1000+ screening metrics, and AI-powered discovery – all available on a genuinely useful free tier – it delivers capabilities that others lock behind expensive paywalls.

Pre-built screeners save you time, while customizable filters let you execute complex investment strategies. Add in the integrated analysis tools, top investor tracking, and institutional-grade data – and you have everything you need for professional investment research.

Whether you’re hunting for undervalued dividend stocks, high-growth tech companies, or the next market leaders, the right screener unlocks a world of investing opportunity.

Frequently Asked Questions

What is a stock screener?

A stock screener is a tool that filters thousands of stocks based on specific criteria like P/E ratio, market cap, or dividend yield to help you find investment opportunities matching your strategy. For a full explanation, see what is a stock screener.

Do I really need a stock screener for investing?

While not mandatory, stock screeners help you discover opportunities beyond popular stocks covered in financial media. They’re especially valuable for finding undervalued stocks or companies matching specific criteria across global markets.

Can free stock screeners compete with paid versions?

Yes, some free screeners like Gainify offer institutional-grade data and features. However, most free versions have limitations like delayed data, result caps, or restricted filtering options designed to encourage upgrades.

What’s the main limitation of most free stock screeners?

The most common restrictions are: limited search results (showing only 20-50 stocks), delayed data (15-20 minutes), inability to save screens, and restricted access to advanced filters or international markets.

Which free screener is best for beginners?

Yahoo Finance requires no registration and offers simple filters, making it ideal for beginners. However, Gainify’s pre-built screeners and AI assistance make complex screening accessible even for newcomers.

Can I screen international stocks for free?

Yes, Gainify covers 33,000+ global stocks across 30+ exchanges on its free tier. TradingView also offers international coverage. Most others like Stock Analysis focus only on US markets.

How accurate is the data in free stock screeners?

Data accuracy varies by platform. Gainify uses S&P Global Market Intelligence (institutional-grade data), while others may have 15-20 minute delays. Always verify critical information before making investment decisions.

Should I use multiple free screeners?

Many investors combine 2-3 platforms to overcome individual limitations. However, comprehensive platforms like Gainify may eliminate this need by offering complete functionality in one place.

When should I upgrade to a paid screener?

Consider upgrading if you screen stocks daily, need real-time data for trading, require international coverage, want to save unlimited custom screens, or hit frustrating limitations that slow your research.

What screening criteria should I start with?

Begin with basic filters like market cap, P/E ratio, and sector. As you gain experience, add criteria like revenue growth, debt-to-equity, ROE, and forward earnings estimates to refine your searches.