Thematic investing works by starting with a long-term global trend and then identifying the companies positioned to benefit from that trend over time. Instead of relying on traditional sector classifications, this approach looks across industries to capture the full economic impact of a theme.

The process typically begins with identifying a structural change, such as artificial intelligence adoption, demographic aging, or the transition to cleaner energy systems. Once the theme is defined, investors map the entire ecosystem surrounding it. This can include technology providers, infrastructure builders, service platforms, and end-market beneficiaries.

After mapping the ecosystem, investors select how they want to gain exposure. This can be done through thematic ETFs, actively managed funds, or curated lists of individual stocks. Each approach offers different levels of diversification, control, and risk.

What differentiates thematic investing from traditional strategies is that company relevance is determined by exposure to the theme, not by sector labels or index membership. As a result, a single theme can span multiple industries and geographies, reflecting how real-world trends actually develop.

Understanding what is thematic investing also means recognizing that it is not a set-and-forget strategy. Themes evolve, adoption curves shift, and companies can gain or lose relevance over time. Investors who use this approach effectively revisit their assumptions, monitor whether holdings remain aligned with the theme, and ensure that fundamentals and valuations continue to support the long-term thesis.

Thematic Investing Highlights

- Long-term trends: Thematic investing targets structural global shifts shaping the future of the economy, technology, and society.

- Cross-sector exposure: Themes span multiple industries and geographies, capturing full ecosystems rather than single sectors.

- Flexible access: Investors can gain exposure through ETFs, mutual funds, or individual stocks aligned with a specific theme.

- Active oversight required: Themes evolve over time, making ongoing research, risk management, and portfolio review essential.

How Is Thematic Investing Defined?

Thematic investing is an investment strategy that focuses on long-term trends shaping the future of the economy, society, and technology. These trends can include innovations in artificial intelligence, increased demand for clean energy, global shifts in demographics, or changes in how people shop, communicate, or receive healthcare.

Instead of building a portfolio around traditional sectors like banking or utilities, thematic investing starts with a specific idea or trend. That idea becomes the foundation for selecting investments. For example, a theme based on electric vehicles might include companies that produce lithium batteries, manufacture charging stations, or develop advanced driving software. A theme around sustainable water use could involve firms working on water purification, smart irrigation, or infrastructure repair.

Popular themes today include generative AI, climate transition and renewable energy, digital health, cybersecurity, and automation and robotics. These are not short-term fads. Each one reflects ongoing developments backed by clear data and broad adoption across industries.

Investors can access these themes through exchange-traded funds, mutual funds, or by selecting individual stocks that align with the trend. Thematic investing can be used to complement a traditional portfolio or, when diversified across several well-researched themes, serve as the foundation of a long-term investment strategy.

This approach is especially appealing for people who want to invest in the future they believe is coming, using a method that connects real-world change with financial opportunity.

Types of Investment Themes: Structural vs Values-Based

Not all investment themes are the same. To use thematic investing effectively, it helps to understand the difference between structural themes and values-based themes, as they behave differently over time and carry different risk profiles.

Structural Themes

Structural themes are driven by long-term forces that have the potential to reshape industries and economies over many years. These themes are typically supported by measurable adoption trends, capital investment, and technological or demographic change.

Examples of structural themes include:

- Artificial intelligence and automation

- Aging populations and healthcare demand

- Electrification and energy transition

- Cloud computing and digital infrastructure

Structural themes tend to evolve gradually and persist through economic cycles. Because of their long duration, they are often well suited for long-term investors who are willing to tolerate short-term volatility in exchange for exposure to transformational change.

What matters most with structural themes is durability. Investors should look for clear evidence that the theme is supported by long-term demand, regulatory backing, or sustained corporate investment rather than short-term hype.

Values-Based and Lifestyle Themes

Values-based themes are shaped by consumer preferences, social priorities, or lifestyle shifts. These themes often reflect what people care about, how they choose to spend money, or which causes they want to support through their investments.

Examples include:

- Sustainable and ethical investing

- Healthy living and wellness

- Financial inclusion

- Diversity and workplace equity

These themes can still deliver strong returns, but they may be more sensitive to changing consumer behavior, sentiment, or economic conditions. Adoption can accelerate quickly, but it can also slow if preferences shift or if supporting fundamentals weaken.

For investors, values-based themes require careful evaluation to ensure that companies included in the theme have meaningful exposure rather than a superficial connection.

Why the Distinction Matters

Understanding whether a theme is structural or values-based helps investors set realistic expectations. Structural themes often require patience and long time horizons, while values-based themes may need closer monitoring and more frequent reassessment.

In practice, many successful thematic portfolios combine both types. Structural themes provide long-term growth potential, while values-based themes allow investors to align capital with personal beliefs and evolving consumer trends.

Recognizing this distinction is an important step in applying what is thematic investing thoughtfully and building a portfolio that balances conviction with discipline.

How Themes Are Identified and Evaluated

Identifying a strong investment theme requires more than spotting a popular idea. Effective thematic investing starts with disciplined research and continues with ongoing evaluation to ensure the theme remains relevant over time.

Identifying Investable Themes

Themes typically emerge from structural changes in the global economy rather than short-term market narratives. These changes are often driven by technology, demographics, regulation, or shifts in consumer behavior.

Common sources for identifying themes include:

- Long-term economic and demographic data

- Technological adoption trends

- Regulatory and policy developments

- Corporate investment patterns and capital spending

- Repeated references to emerging topics in earnings calls and industry research

A credible theme should be broad enough to support multiple companies, yet specific enough to represent a clear economic opportunity. If a theme relies on only one or two stocks to work, it is often too narrow to be durable.

Evaluating Theme Durability

Once a theme is identified, the next step is evaluating whether it has staying power.

Key questions investors should ask:

- Is the theme supported by long-term demand rather than short-term hype?

- Does adoption depend on discretionary spending, or is it becoming embedded in core infrastructure?

- Are governments, enterprises, or institutions allocating capital toward it?

- Is the theme resilient across economic cycles?

Themes tied to infrastructure, productivity, healthcare needs, or regulatory mandates often show greater durability than those driven purely by sentiment.

Assessing Company Relevance Within a Theme

Not every company associated with a theme has equal exposure. A critical part of thematic investing is determining how directly a company benefits from the trend.

Investors should consider:

- Whether the theme is a core revenue driver or a small side business

- The company’s competitive advantage within the theme

- How dependent future growth is on the theme’s success

- The proportion of capital and R&D allocated to theme-related activities

This step helps avoid theme dilution, where portfolios include companies with only superficial links to the underlying trend.

Ongoing Evaluation and Review

Themes are not static. New companies emerge, business models change, and adoption curves evolve.

Investors applying what is thematic investing in practice regularly reassess:

- Whether the theme is progressing as expected

- If valuations still reflect realistic long-term outcomes

- Whether portfolio holdings remain aligned with the original thesis

Regular review helps prevent style drift and ensures that the portfolio continues to represent the intended theme rather than outdated assumptions.

Three Thematic Investing Examples

Understanding what is thematic investing becomes clearer when applied to real-world examples. Each theme represents a long-term trend that is already reshaping industries, capital allocation, and corporate strategy. Rather than existing in isolation, these themes cut across multiple sectors and business models, creating investable ecosystems of companies positioned to benefit as adoption grows.

The following three themes highlight how thematic investing works in practice. Each one is driven by structural change, supported by measurable demand, and connected to a broad range of companies operating at different points in the value chain.

Theme No. 1: Artificial Intelligence and Infrastructure

Artificial intelligence (AI) is one of the most transformative forces in today’s economy. It affects how companies operate, how people communicate, and how entire industries innovate. This theme spans a wide range of sectors and technologies, from data infrastructure to automation.

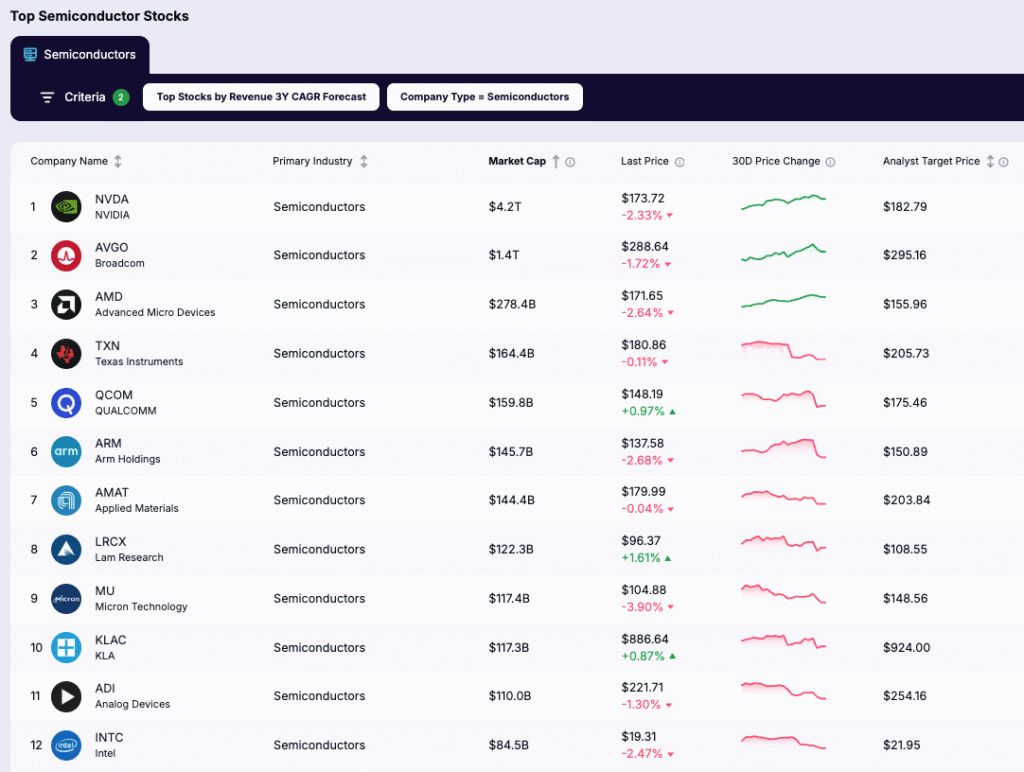

Semiconductors

Semiconductors are the core processing units that make AI possible. They allow machines to handle massive datasets and perform real-time learning and inference.

Why it matters: Every stage of AI (training, inference, and deployment) relies on computing power made possible by advanced chip technology.

Examples:

- NVIDIA (NVDA): Industry leader in GPUs used for AI training and generative models

- Advanced Micro Devices (AMD): Supplies high-performance CPUs and GPUs for AI computing

- Taiwan Semiconductor Manufacturing Company (TSM): Manufactures advanced chips for AI hardware providers

Cloud Computing and Data Centers

Cloud infrastructure and global data centers host AI models and manage the enormous data requirements involved in machine learning and deployment.

Why it matters: AI cannot scale without cloud-based environments and storage. These systems allow AI applications to be accessed and deployed worldwide.

Examples:

- Amazon – AWS (AMZN): Offers AI services and infrastructure through Amazon Web Services

- Microsoft – Azure (MSFT): Hosts AI platforms used by enterprise and government clients

- Alphabet – Google Cloud (GOOGL): Provides scalable infrastructure and AI development tools used by enterprises to build, train, and deploy machine learning models

Generative AI and Large Language Models

Generative AI systems create original content, including text, images, video, and code. Large language models are the most recognized type, powering tools like chatbots and writing assistants.

Why it matters: Generative AI is creating new markets in content creation, automation, and enterprise productivity.

Examples:

- OpenAI (Private): Creator of ChatGPT, with strategic investment from Microsoft

- Anthropic (Private): Developer of the Claude AI platform focused on safe generative systems

- Alphabet – Gemini (GOOGL): Develops large-scale generative AI models for tasks like search, content creation, and productivity across Google’s ecosystem

- Meta Platforms – LLaMA (META): Builds open-source large language models designed for research, enterprise use, and AI development across Meta’s platforms

Natural Language Processing (NLP)

NLP enables machines to understand, process, and respond to human language. It is used in voice search, customer service bots, and text analysis tools.

Why it matters: NLP makes AI more useful in day-to-day interactions, enabling companies to deliver better customer support and automation.

Examples:

- Amazon – Alexa (AMZN): Powers one of the world’s most widely used voice assistants, using NLP for speech recognition and conversation

- Zoom Video Communications – Zoom IQ (ZM): Uses NLP to generate meeting summaries, highlight key moments, and enhance communication productivity

- ServiceNow (NOW): Applies NLP to automate enterprise workflows and customer support through intelligent virtual agents

Autonomous Vehicles

AI plays a central role in enabling vehicles to perceive surroundings, make decisions, and navigate complex environments without human intervention.

Why it matters: Autonomous driving represents one of the most high-profile applications of AI, combining data analytics, computer vision, and robotics.

Examples:

- Tesla (TSLA): Develops Full Self-Driving (FSD) software using proprietary AI models

- Alphabet – Waymo (GOOGL): Operates autonomous ride-hailing services using AI-based navigation

- Aurora Innovation (AUR): Develops autonomous driving systems for freight and passenger transport, partnering with major logistics and automotive companies to commercialize self-driving technology

Robotics and Automation

AI-powered robots improve productivity and precision in industries such as manufacturing, healthcare, logistics, and agriculture.

Why it matters: Robotics brings AI into the physical world, creating systems that adapt, learn, and perform tasks in real-time environments.

Examples:

- Tesla – Optimus (TSLA): Designing humanoid robots intended to automate repetitive factory tasks, combining real-world AI, vision systems, and in-house robotics engineering

- ABB (ABB): Provides industrial automation systems and AI-enhanced robotics

- Intuitive Surgical (ISRG): Develops robotic-assisted surgical systems using machine vision and analytics

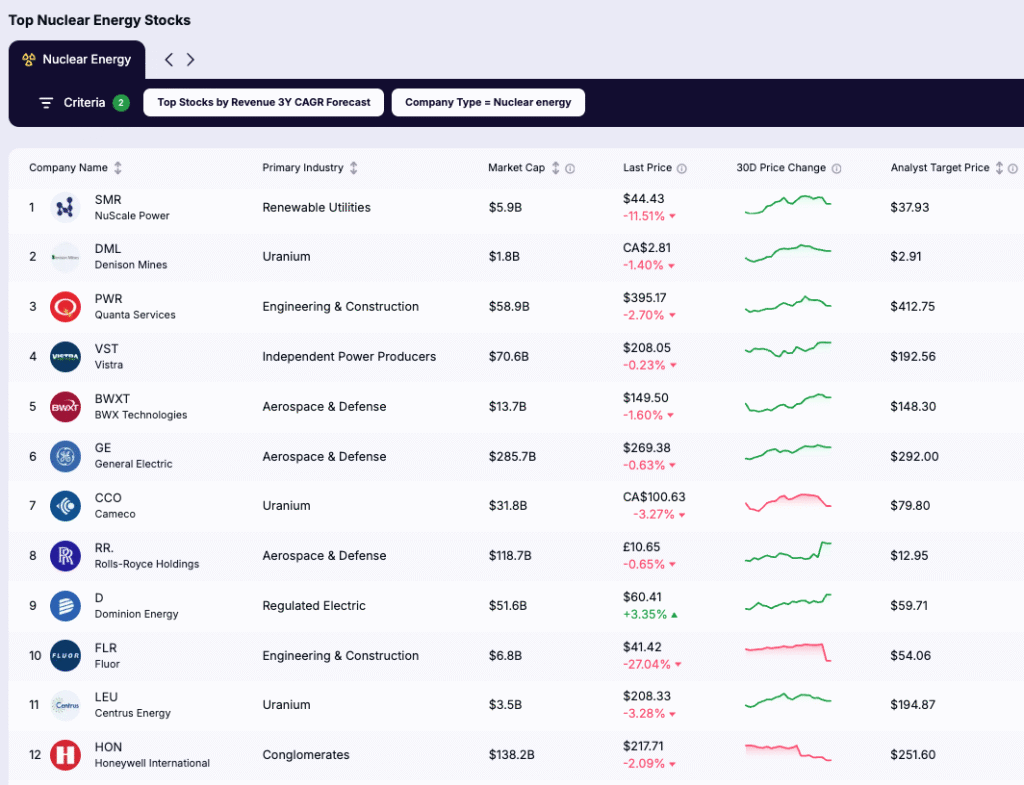

Smart Energy Systems and Nuclear Power

AI requires enormous computational power, which in turn demands a stable, scalable, and increasingly sustainable energy supply. As AI models grow in size and complexity, the energy systems that power data centers, chip factories, and cloud infrastructure must evolve in efficiency, reliability, and intelligence.

Why it matters: The future of AI is deeply tied to the future of energy. Smarter grids and advanced nuclear technologies are becoming essential to support the rising energy consumption of AI infrastructure, from high-density servers to 24/7 cloud operations.

Examples:

- Siemens AG (SIEGY): Offers AI-enabled solutions that help utilities manage peak demand, improve grid stability, and optimize energy distribution across regions that support tech and data infrastructure

- General Electric – GE Vernova (GE): Applies AI to increase power plant efficiency and support renewable integration, helping energy systems keep pace with the computing needs of cloud platforms and AI services

- Rolls-Royce (RYCEY): Develops nuclear power systems with AI-enhanced monitoring and safety tools, aimed at powering everything from national grids to micro-reactors for critical infrastructure

- Oklo (OKLO): Builds compact nuclear reactors designed to deliver clean, consistent power for high-demand users such as data centers, with AI embedded for autonomous operation and energy optimization

Theme No. 2: Sustainable and Environmental Innovation

Sustainability is becoming a central investment focus – not only for environmental reasons, but also because it’s increasingly linked to economic efficiency, energy independence, and long-term corporate performance. This theme highlights U.S.-relevant companies building the infrastructure and systems that support a cleaner, more resilient economy.

These businesses are helping to reduce emissions, conserve resources, promote social inclusion, and reinforce the systems that support innovation, including the energy grid and capital access. As AI, urbanization, and population growth drive demand, these companies will likely play a foundational role in supporting future growth.

Net Zero Transition

This subtheme includes companies helping reduce carbon emissions through clean energy production, energy storage, and grid modernization.

Why it matters: To support rising electricity demand from sectors like AI and electric vehicles, the U.S. grid must become cleaner and more efficient.

Examples:

- NextEra Energy (NEE): The largest generator of wind and solar energy in the U.S., investing heavily in grid modernization

- AES (AES): Provides utility-scale battery storage and low-carbon energy solutions to major tech clients

- Clearway Energy (CWEN): Owns and operates renewable energy projects across wind, solar, and storage

Solar Panels and Clean Energy Infrastructure

This area includes companies producing solar panels, providing installation services, and supporting residential and commercial solar growth.

Why it matters: Solar is the fastest-growing renewable energy source in the U.S., critical to decentralizing the grid and reducing emissions.

Examples:

- First Solar (FSLR): Manufactures high-efficiency solar panels with U.S.-based production and low carbon intensity

- SunPower (SPWR): Offers solar panels and installation services tailored to residential customers

- Array Technologies (ARRY): Develops solar tracking systems that boost solar output for utility-scale projects

Water Resource Management

This subtheme includes solutions for water conservation, treatment, and smart infrastructure used in agriculture, urban areas, and industry.

Why it matters: Clean, accessible water is essential for food production, manufacturing, and data center cooling, especially in drought-prone regions of the U.S.

Examples:

- Xylem (XYL): Develops smart water infrastructure, including leak detection and real-time monitoring systems

- Essential Utilities (WTRG): Operates water and wastewater services across several U.S. states

- Ecolab (ECL): Provides water treatment solutions for hotels, factories, and healthcare facilities

Sustainable Forestry

This subtheme includes forest management companies practicing responsible harvesting, carbon capture, and land conservation.

Why it matters: Forests are both a renewable resource and a natural carbon sink. Sustainable forestry supports housing, packaging, and carbon markets.

Examples:

- Weyerhaeuser (WY): Manages over 11 million acres of timberland in the U.S. and integrates replanting and conservation into its model

- PotlatchDeltic (PCH): Focuses on sustainable forest management and rural land development in the Pacific Northwest and South

Waste Management and Resource Circulation

This includes recycling, composting, landfill gas capture, and circular economy platforms that turn waste into usable products.

Why it matters: Managing waste efficiently supports sustainability goals and can reduce operating costs in industries ranging from retail to manufacturing.

Examples:

- Waste Management (WM): The largest provider of waste collection and recycling services in the U.S., investing in landfill gas-to-energy technologies

- Republic Services (RSG): Operates recycling and composting programs across U.S. municipalities and businesses

- Casella Waste Systems (CWST): Focuses on waste recovery and environmental solutions in the Northeast U.S.

Inclusive Finance

This subtheme covers companies improving access to credit, digital banking, and insurance for historically underserved individuals and businesses.

Why it matters: Financial inclusion strengthens economic resilience, expands consumer markets, and enables small business growth across U.S. communities.

Examples:

- SoFi Technologies (SOFI): A digital-first personal finance company offering banking, lending, and investing tools to underserved Millennials and Gen Z

- Upstart Holdings (UPST): Uses AI-driven credit modeling to offer loans to borrowers without traditional credit histories

- Lemonade (LMND): A tech-driven insurance company using behavioral data and automation to serve renters, homeowners, and small businesses

Theme No. 3: Health, Wealth, and Demographics

Demographic change is one of the most powerful forces shaping the future of the economy. As populations age, healthcare needs grow. As wealth transfers across generations, consumption habits shift. And as social expectations evolve, so do the companies that lead.

This theme captures the intersection of longevity, innovation, inclusion, and consumer evolution. It is especially relevant to U.S. investors navigating a market environment influenced by healthcare transformation, generational wealth transfer, and rising demand for personalization and equity.

Aging Populations

This subtheme includes companies that provide healthcare services, diagnostics, senior living, and age-focused products to meet the needs of older adults.

Why it matters: By 2030, one in five Americans will be over 65. Meeting the needs of this group presents long-term opportunities across health, housing, and care delivery.

Examples:

- UnitedHealth Group (UNH): Through its Optum division, UnitedHealth provides home health, Medicare Advantage plans, and chronic care services specifically designed for seniors

- Humana (HUM): Specializes in Medicare Advantage and value-based care programs, with a strong focus on preventative health and aging in place

- ResMed (RMD): Offers digital health solutions and medical devices for respiratory conditions, including sleep apnea, which is increasingly common in older adults

Health Outcomes and Innovation

This includes biotech firms, medical device companies, and diagnostics providers focused on improving life expectancy and quality of care.

Why it matters: Demand for personalized, proactive, and affordable healthcare is increasing. Innovation is enabling earlier detection, targeted treatment, and better long-term outcomes.

Examples:

- Exact Sciences (EXAS): Offers non-invasive cancer screening tests like Cologuard

- Teladoc Health (TDOC): Delivers telemedicine and chronic care management services

- Edwards Lifesciences (EW): Develops minimally invasive heart valve therapies for aging patients

- Hims & Hers Health (HIMS): Provides personalized, subscription-based telehealth services for mental health, sexual health, dermatology, and chronic care

Pharmaceutical Companies and Biotech

This segment focuses on R&D-heavy companies developing therapies for chronic diseases, cancer, rare conditions, and next-gen drug delivery.

Why it matters: As chronic illnesses rise, demand for innovative treatments continues to grow. Many of these companies benefit from regulatory support and strong intellectual property.

Examples:

- Amgen (AMGN): Develops biologic therapies for cardiovascular disease and cancer

- Regeneron Pharmaceuticals (REGN): Focused on gene therapies, eye disease, and inflammatory disorders

- Moderna (MRNA): Known for its mRNA platform, now expanding beyond COVID-19 into flu, RSV, and rare diseases

Consumer Behavior Shifts

This includes wellness-oriented brands, digital health platforms, and lifestyle companies responding to younger consumers’ values and spending habits.

Why it matters: Millennials and Gen Z are driving changes in what people buy and how they buy it, prioritizing wellness, experience, ethical sourcing, and technology integration.

Examples:

- Lululemon Athletica (LULU): Combines wellness branding with premium activewear and community-focused marketing

- Chewy (CHWY): Benefits from increased pet spending and personalized, subscription-based e-commerce

- Hims & Hers Health (HIMS): Offers telehealth-driven personal care, prescription, and wellness products, primarily targeting younger consumers

How to Build a Thematic Portfolio

Building a thematic portfolio begins with clarity of purpose and continues with structured execution. Below is a proven process:

1. Define the Trend

Start with a long-term trend supported by data. Use sources like industry reports, regulatory forecasts, and adoption statistics to validate relevance.

2. Map the Ecosystem

Identify the full value chain, including enablers, service providers, and final applications. This ensures proper diversification within the theme.

3. Select the Vehicle

Choose among ETFs, mutual funds, or individual equities based on your research capacity and risk preference. Check for holdings overlap.

4. Set Position Sizes

Limit any single theme to a proportion of your total portfolio. Most disciplined investors keep thematic exposure under 25 percent of total assets.

5. Review and Rebalance

Use a calendar-based or performance-triggered review process. Monitor earnings, adoption metrics, and valuation levels.

Risks and Considerations

Thematic investing can be exciting, but it’s important to look beyond the trend and understand what you’re really investing in. Here are some key things to watch out for before committing your money.

- Valuation Risk

When a new theme gains attention (like AI or clean energy) some stocks can rise too fast, too soon. Prices may reflect hype instead of actual earnings or business strength.

Why it matters: Buying at inflated prices increases the risk of poor returns later. Always look at company fundamentals, not just headlines.

- Theme Dilution

Not all funds that claim to follow a theme stick closely to it. Some include companies that only have a small connection to the trend.

Example: A fund labeled “digital health” might include a telecom company that simply offers video conferencing.

Why it matters: This weakens the theme and may leave you holding stocks unrelated to your original idea. Always check what the fund actually owns.

- Overlap and Concentration

Many themes include the same popular companies. You might think you’re diversifying, but end up investing in the same few stocks again and again.

Why it matters: This can make your portfolio more risky than it looks. Use tools or platforms that help you spot overlap before investing in multiple themed funds.

- Timing and Patience

Themes play out over years, not months. There can be long periods where nothing seems to happen or the stocks underperform the broader market.

Why it matters: Thematic investing isn’t for short-term gains. You need a long-term view and the patience to let the trend develop.

- Complexity and Understanding

Some themes (like nuclear innovation or biotech) are technical and fast-moving. It’s easy to invest in ideas you don’t fully understand.

Why it matters: If you can’t explain how the theme works or why a company fits into it, it’s harder to manage risk or stay confident during market swings.

How to Manage These Risks

- Know what you own: Always look at the actual holdings in a fund, not just the theme in the name.

- Understand the story: If a theme sounds exciting, learn the basics. What are the key drivers? Who are the main players?

- Check for overlap: Use free portfolio tools to avoid doubling up on the same stocks.

- Be patient: Allocate money you won’t need right away. Some themes take years to show strong returns.

- Stick with data: Use trusted sources like Morningstar or fund reports to understand performance, exposure, and risk.

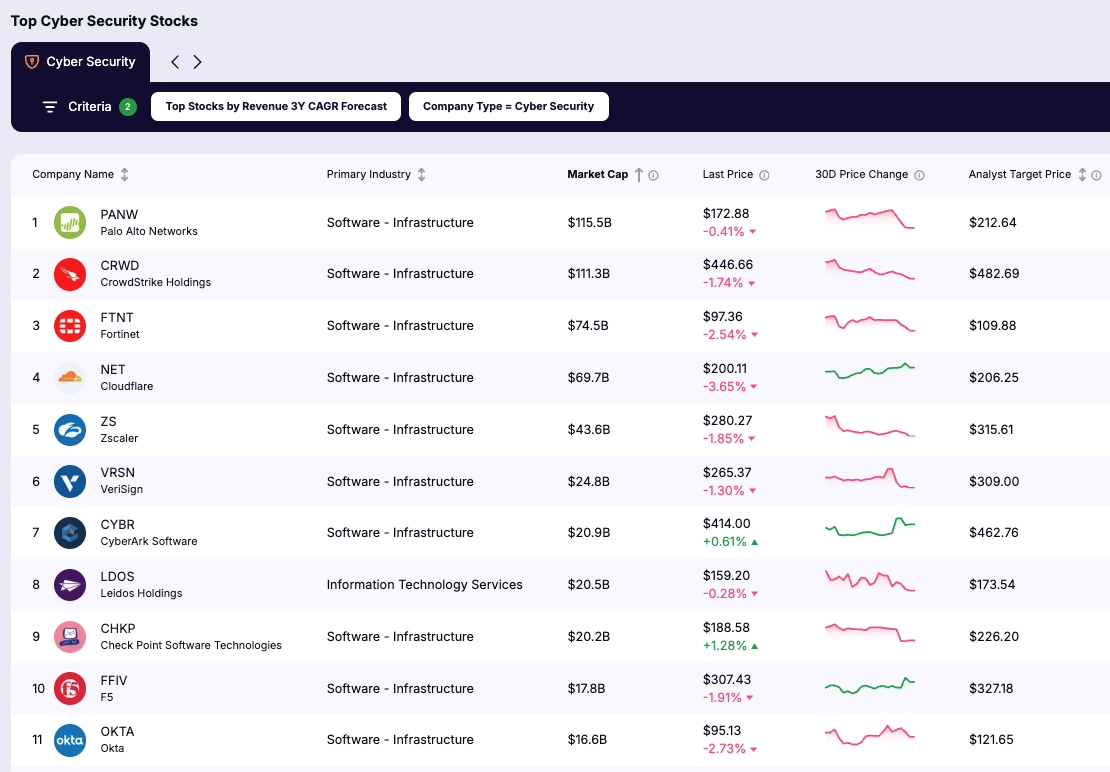

Example Strategy: Focused Cybersecurity Exposure

Theme: Protecting digital systems across industries

Goal: Build a long-term portfolio around the growing need for cybersecurity as digital threats increase and businesses modernize.

Approach:

- Begin with a core position in a well-diversified cybersecurity ETF, offering exposure to multiple companies across cloud security, firewalls, endpoint protection, and identity verification.

- Add satellite positions in individual companies with strong revenue growth, large enterprise contracts, or recurring subscription models.

- Track performance indicators like contract wins, customer growth, operating margins, and R&D investment.

- Rebalance semi-annually to manage risk, trim overperformers, and reallocate toward high-conviction names or underweighted areas.

Why it works: Cybersecurity is foundational to digital business, government, and infrastructure. This strategy blends stability from broad exposure with the potential for outperformance through targeted company selection.

Frequently Asked Questions (FAQ)

What is thematic investing?

It is a strategy that organizes portfolios around long-term global trends, such as AI, sustainable energy, or healthcare innovation.

Is it different from sector investing?

Yes. Sector investing is tied to static industry classifications, while thematic investing follows cross-sector trends that evolve over time.

Can I invest thematically through mutual funds?

Yes. Many mutual funds focus on single themes or blended megatrends, offering professional management and research-backed selection.

What is the ideal holding period?

Three to ten years is typical, depending on the maturity and adoption speed of the theme.

Is this strategy suitable for all investors?

Yes, when matched with your goals and risk tolerance. Thematic investing should be part of a broader, well-balanced portfolio.

Final Thoughts: Transforming Change Into Opportunity

Thematic investing turns structural shifts into portfolio strategy. Whether you focus on artificial intelligence, resource sustainability, or healthcare evolution, this approach offers a way to align your capital with long-term global developments.

Key Points to Remember:

- Select themes backed by measurable data and long-term drivers

- Diversify across the full value chain within a theme

- Manage risk through sizing, overlap checks, and regular review

- Keep your investment aligned with your personal goals and time horizon

When built thoughtfully, thematic investing transforms complexity into clarity and future-focused growth.