A stock screener is a research tool that helps investors create a short list of stocks based on specific rules or parameters. Instead of looking at every company in the stock market, you choose what matters to you, such as company size, profitability, valuation, dividends, or expected growth, and the screener does the filtering for you.

This makes stock research much easier and much faster, especially for beginners. Rather than manually reviewing thousands of publicly traded companies, a stock screener quickly narrows the market to a manageable group of stocks that fit your investing goals. From there, you can spend your time learning more about a few companies instead of feeling overwhelmed by the entire market.

Key takeaways:

- Shortens the market into a manageable list of stocks

- Filters companies using clear rules like size, profitability, valuation, or dividends

- Saves time and keeps your research focused and organized

- Supports better decisions by highlighting which stocks deserve deeper analysis

How Stock Screeners Work

A stock screener works by applying your chosen rules to a large database of publicly traded companies and showing only the stocks that meet those rules.

Instead of manually reviewing thousands of companies, you tell the screener what you are looking for. The tool then does the filtering for you and returns a short, relevant list.

The process usually follows these steps:

- Choose your parameters

You decide what matters to you as an investor. This can include country, sector, exchange, company size, profitability, valuation, or dividends.

- The screener scans the market

The screener checks every stock in its database against your selected parameters. - Non-matching stocks are filtered out

Any company that does not meet your criteria is automatically removed. - You receive a focused list

The result is a short list of stocks that fit your requirements and are worth further research.

A stock screener does not replace analysis. It helps you organize information and focus your time on the stocks that match your investing goals.

Example: Using a Stock Screener Step by Step

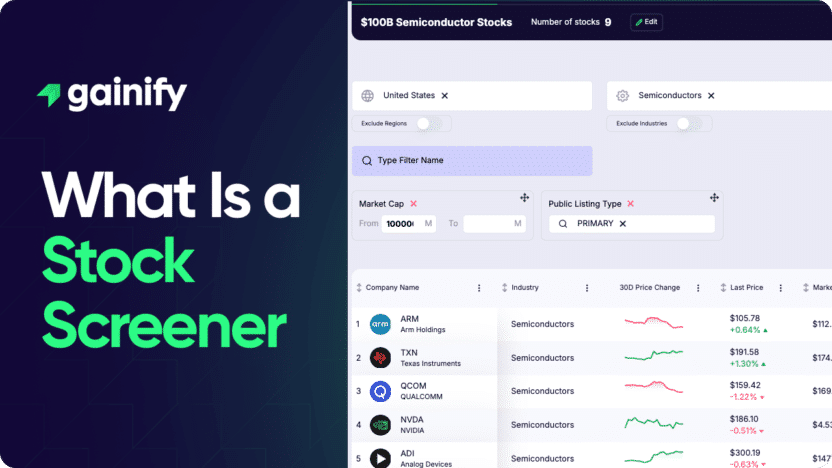

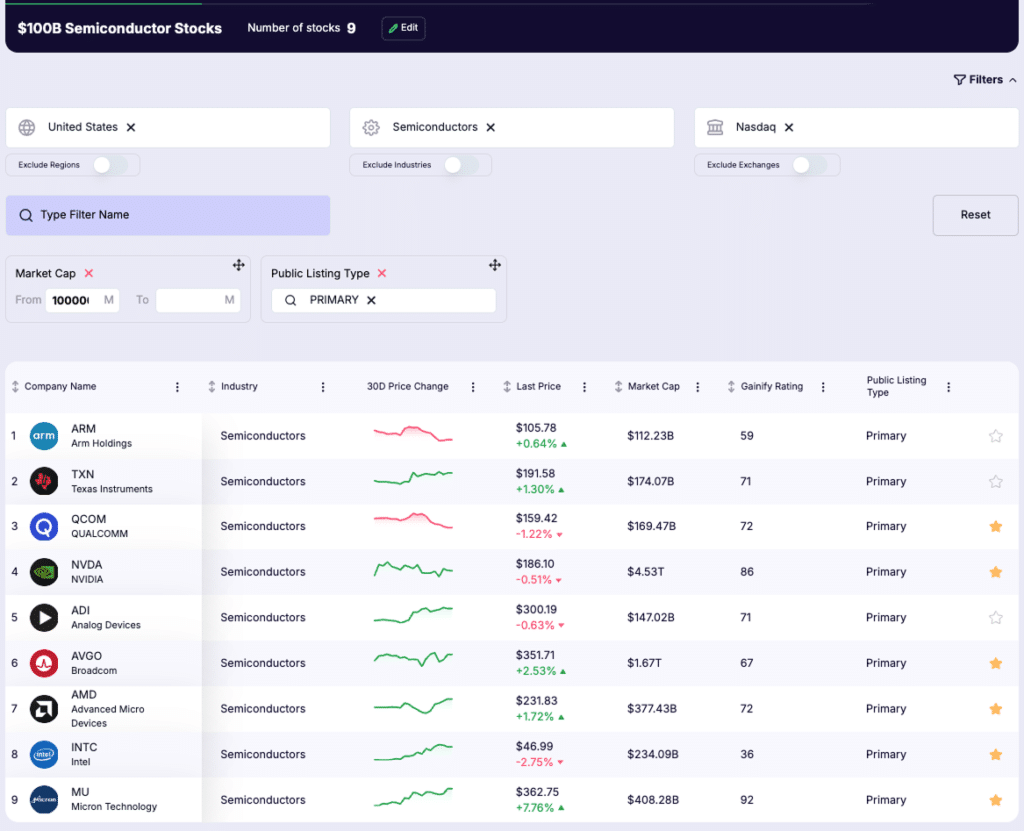

To see how this works in practice, consider the following example using Gainify’s Stock Screener on gainify.io.

An investor wants to find large US semiconductor companies listed on a major exchange.

They would set up their stock screener like this:

- Country: United States

- Sector: Semiconductors

- Exchange: NASDAQ

- Market capitalization: Greater than $100 billion

Once all these parameters are applied, Gainify filters out every company that does not match. The result is a short list of large-cap US semiconductor stocks trading on NASDAQ, which is exactly the kind of shortlist you want before doing deeper research.

From there, the investor can review each company in more detail by checking financial statements, valuation metrics, cash flow trends, and business fundamentals directly inside the platform.

This example shows how a stock screener helps move from a broad market view to a focused, research-ready list of stocks in just a few steps.

Types of Stock Screener Filters

Best stock screeners organize filters into logical groups to make research easier. On platforms like Gainify, filters are grouped by the type of information they describe, from basic market data to detailed financial metrics.

Below is an overview of the main filter categories and how investors typically use them.

Income Statement Filters

Income statement filters focus on a company’s revenue and profitability.

Examples:

- Revenue and revenue growth

- Earnings from continuing operations

- Earnings per share (EPS) development

- Operating income vs. Non-operating income

These filters help investors identify companies that are growing or consistently profitable.

Balance Sheet Filters

Balance sheet filters measure a company’s financial strength and stability.

Examples:

- Total debt

- Cash and equivalents

- Debt-to-equity ratio

- Asset and liability levels

Investors use these filters to avoid overly leveraged companies or focus on strong balance sheets.

Cash Flow Statement Filters

Cash flow filters focus on how much cash a business generates.

Examples:

- Operating cash flow

- Free cash flow

- Cash flow growth

- Cash conversion metrics

These filters are especially useful for identifying companies with sustainable business models.

Dividend Filters

Dividend filters are used by income-focused investors.

Examples:

- Dividend yield

- Dividend growth

- Payout ratio

- Dividend history

These filters help identify companies that return cash to shareholders consistently.

Stock Info and Technical Filters

This category includes general stock-related information and can also support technical analysis parameters.

Examples:

- Exchange and country

- Industry and sector

- Relative strength index (RSI)

- Trading volume

These filters are often used early in the screening process to define the investment universe.

Valuation Filters

Valuation filters compare a stock’s price to its financial performance.

Examples:

- Price-to-earnings (P/E)

- EV/EBIT

- Forward valuation metrics

- Valuation relative to historical averages

These filters help investors understand what they are paying for a business.

Estimates Filters

Estimates filters focus on forward-looking data.

Examples:

- Forward earnings

- Expected revenue growth

- Analyst Target Prices

- Forward cash flow metrics

These filters are useful for investors who care about future performance, not just past results.

Ratio Filters

Ratio filters combine financial metrics into standardized comparisons.

Examples:

- Profit margins

- Return on equity (ROE)

- Return on invested capital (ROIC)

- Leverage ratios

Ratios help compare companies across industries and sizes.

Best Stock Screener Filters for Beginners

When you are new to stock screening, the goal is not to find the perfect stock. The goal is to reduce the market to a manageable list of solid companies that are easier to understand and research.

Using too many filters too early often leads to confusion or missed opportunities. A simple setup works best.

1. Start With Market and Location Filters

Begin by defining where you want to invest.

Recommended beginner filters:

- Country: United States

- Exchange: NASDAQ or NYSE

- Public listing type: Primary listings

This immediately removes foreign listings, secondary shares, and less liquid stocks.

2. Focus on Company Size

Company size helps manage risk, especially for beginners.

Recommended filter:

- Market capitalization: Greater than $10 billion

Larger companies tend to have:

- More established businesses

- More stable financials

- Better data availability

This makes them easier to analyze and follow.

3. Add Basic Financial Quality Filters

Once the universe is defined, add one or two simple financial filters.

Good beginner options:

- Positive Revenue and Earnings growth

- Positive operating cash flow growth

- Positive free cash flow

These filters help avoid unprofitable or unstable businesses without being overly restrictive.

4. Use Valuation Filters Carefully

Valuation matters, but beginners should keep this simple.

Suggested approach:

- Use broad valuation ranges, not strict cutoffs

- Focus on forward metrics when available

- Avoid stacking multiple valuation filters at once

Valuation is most useful after you already understand the business.

5. Avoid Advanced or Technical Filters at First

Filters like technical indicators, complex ratios, or narrow growth thresholds can wait.

As a beginner, your focus should be on:

- Understanding the business

- Learning how financial statements connect

- Comparing companies within the same sector

You can always add more complexity later.

Limitations of Stock Screeners

Stock screeners are powerful tools, but they are not perfect. Understanding their limitations is important so you use them correctly and avoid common mistakes.

Quantitative Data Only

Stock screeners work with numbers. They rely on financial statements, market data, and estimates.

What they cannot assess:

- Management quality

- Company culture

- Competitive advantages

- Brand strength

These qualitative factors still require manual research.

No Context Behind the Numbers

A screener shows what the numbers are, not why they look that way.

For example:

- A stock may look cheap due to temporary issues

- High growth may be driven by one-time events

- Strong cash flow may not be sustainable

Screeners highlight signals, but context matters.

Risk of Over-Filtering

Using too many filters can remove good companies.

Common beginner mistake:

- Adding strict valuation, growth, and margin filters at the same time

This often results in:

- Very few results

- Missing strong long-term businesses

Simple screens are usually more effective.

Data Timing and Estimates

Some data is:

- Reported quarterly

- Based on analyst estimates

- Subject to revisions

This means screen results can change as new information becomes available.

Not a Buy or Sell Signal

A stock appearing in a screener result is not a recommendation.

A screener:

- Helps narrow choices

- Does not predict future stock performance

- Does not manage risk for you

Final decisions should always involve deeper analysis.

Best Way to Think About Screeners

A stock screener is a starting point, not a finish line. The difference between research and real-time timing is explained in stock scanner vs screener.

Used correctly, it helps you:

- Save time

- Stay organized

- Focus on the most relevant opportunities

Used incorrectly, it can create false confidence.

Effective Strategies for Using Stock Screeners

A stock screener is most powerful when used with a clear strategy. Some common approaches include:

- Screening for large, profitable companies for long-term investing

- Finding stocks trading near 52-week lows with strong fundamentals

- Identifying companies with accelerating cash flow growth

- Tracking sector or industry trends

Avoid overloading your screener with too many filters. Start simple and refine as you learn more.

Top Stock Screeners for Investors

There are several well-known stock screeners available today, including some of the best free stock screeners, each designed for a different type of investor. Some focus on technical analysis and short-term signals, while others prioritize fundamentals, valuation, and long-term research.

Choosing the right screener depends on how deeply you want to analyze companies and what kind of decisions you are trying to make.

Gainify

Gainify offers one of the most comprehensive stock screener databases available to investors today. The platform includes over 1,000 screening parameters, covering market data, financial statements, cash flow, valuation, ratios, and forward-looking estimates.

One of Gainify’s key strengths is its depth of forward-looking metrics, including next-twelve-month (NTM) data, analyst estimates, and multi-year projections. This allows investors to screen not only based on historical performance, but also on how businesses are expected to perform in the future.

Gainify is especially well suited for:

- Investors who want deep, institutional-level data

- Fundamental and cash-flow-focused analysis

- Screening based on valuation and forward estimates

- Building precise, research-ready shortlists

For investors who value data depth, flexibility, and long-term insight, Gainify provides an unmatched screening experience.

Finviz

Finviz is widely known for its visual layout and strong technical screening tools. It is often used by traders who focus on price action, momentum, and short-term market patterns.

Finviz is best suited for:

- Technical analysis

- Short-term trading ideas

- Visual market scanning

While powerful for technical users, it offers more limited depth when it comes to cash flow and forward-looking fundamentals.

Yahoo Finance

Yahoo Finance provides a basic stock screener integrated with company news, charts, and profiles. It is easy to use and widely accessible, making it a common starting point for new investors.

Yahoo Finance is best suited for:

- Beginners

- Simple screening needs

- General market research

Its screener is functional but limited compared to more advanced platforms.

StockFetcher

StockFetcher focuses heavily on technical and rule-based screening. Users can create highly specific conditions using technical indicators and custom logic.

StockFetcher is best suited for:

- Experienced traders

- Users with technical strategies

- Investors who prefer precise, rule-driven screens

It is less commonly used for long-term, fundamentals-based investing.

Final Thoughts

A stock screener is one of the most practical tools an investor can use. It helps reduce complexity, bring structure to research, and turn a large market into a focused set of opportunities.

Modern platforms like Gainify show how powerful a stock screener can be when depth and usability are combined. With access to comprehensive data, forward-looking metrics, and flexible filtering, investors can build repeatable processes that scale with experience.

Used thoughtfully, a stock screener does more than surface ideas. It strengthens decision-making, improves discipline, and helps investors better understand businesses, valuations, and risk over time.