A stock scanner vs screener comes down to one simple difference: screeners help you find what to buy, scanners help you decide when to act.

Both tools are used to discover stocks, but they serve very different purposes. Screeners filter the market using static data like fundamentals or end-of-day indicators. Scanners track live price and volume movements to surface opportunities as they happen.

Confusing the two leads to common mistakes, such as using a screener to time trades or relying on a scanner for long-term investment research. Using the right tool, or combining both correctly, improves stock selection, timing, and overall decision-making.

This guide explains stock scanner vs screener in clear, practical terms, showing how each works, when to use them, and which one fits your trading or investing style.

Key Takeaways

Short on time? Here’s the quick takeaway:

- Stock screeners filter stocks using static data like fundamentals or end-of-day technicals

- Stock scanners track the market in real time to surface actionable trading opportunities

- Screeners answer “what stocks should I watch?”

- Scanners answer “what’s moving right now?”

What Is a Stock Screener?

A stock screener is a tool that filters stocks using predefined fundamental or technical criteria based on static or end-of-day data. For a deeper breakdown, see our guide on what a stock screener is. Instead of tracking live market moves, it helps narrow thousands of stocks into a focused list that matches a specific research or investment objective.

Think of a stock screener as a market snapshot. It applies your filters to the most recent available data and returns stocks that currently meet those conditions, making it easier to compare companies side by side.

Common stock screener filters include

- Market capitalization

- Valuation metrics such as P/E ratio or EV/EBITDA

- Revenue or earnings growth

- Dividend yield

- Balance sheet strength such as debt-to-equity

- Technical indicators like RSI or drawdown from 52-week highs or lows

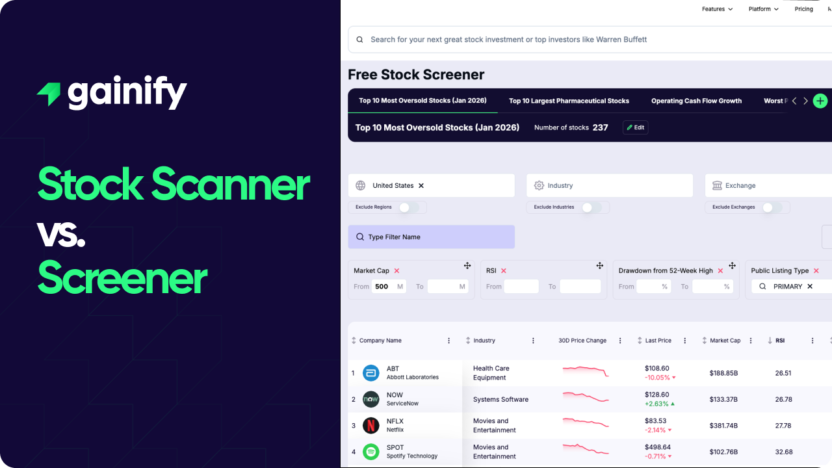

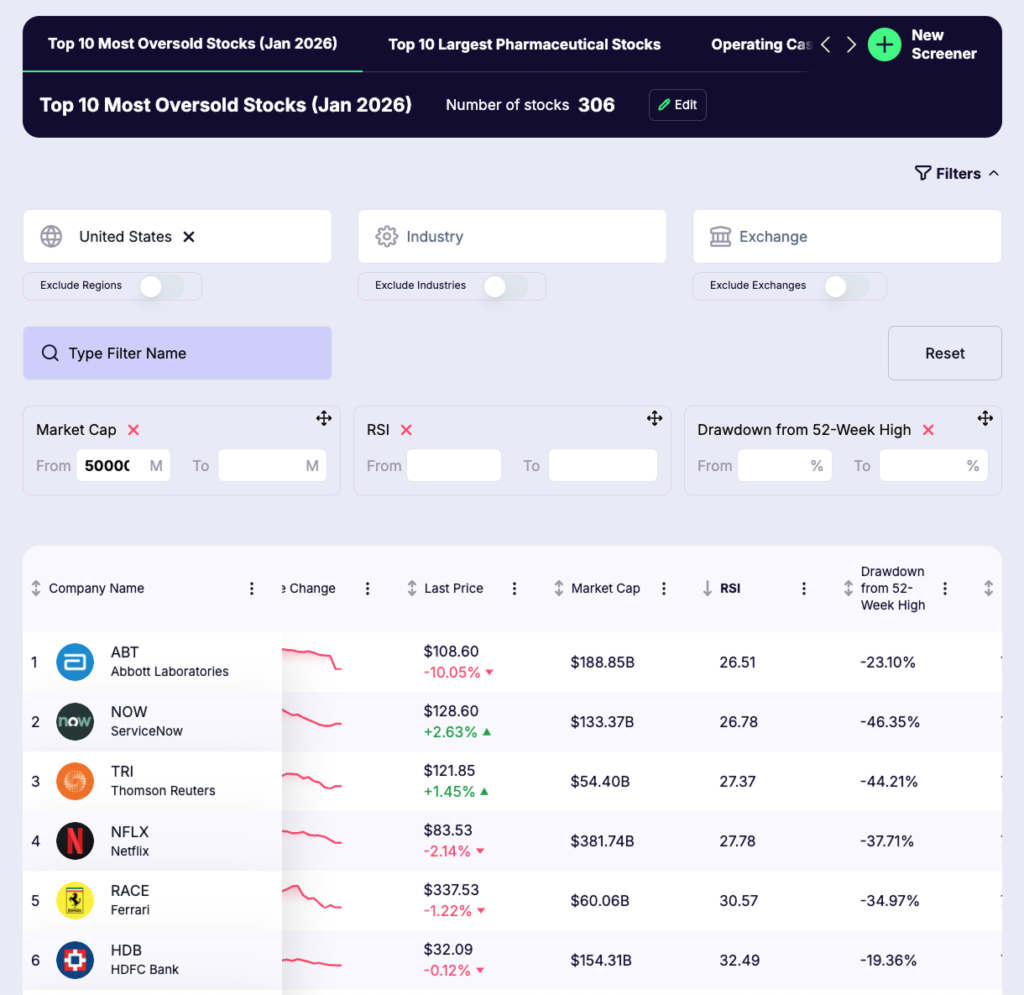

Example of a stock screener in action

Using a screener like the one shown above, you can filter for U.S. large-cap stocks with low RSI readings and meaningful drawdowns from their 52-week highs to surface oversold candidates. This approach produces a ranked list of large-cap stocks experiencing elevated downside pressure, helping investors quickly identify potential rebound or value opportunities based on the latest available data.

Stock screeners are most effective for longer-term workflows such as idea generation, fundamental analysis, portfolio construction, and periodic market reviews. As a result, they are widely used by investors, analysts, and portfolio managers to narrow the market before deeper analysis.

What Is a Stock Scanner?

A stock scanner monitors the market in real time and identifies stocks that meet specific intraday price, volume, or volatility conditions. Rather than filtering based on static data, scanners continuously update as market activity changes, making them tools for timing and execution.

Think of a stock scanner as a live market radar. It watches thousands of stocks simultaneously and surfaces opportunities the moment predefined conditions are met, allowing traders to react as setups develop.

Common stock scanner triggers include

- Price breaking above or below key levels

- Unusual or accelerating volume

- Momentum strength or rapid price movement

- New intraday or multi-day highs and lows

- Gap ups or gap downs at the open

- Volatility expansions

Example of a stock scanner in action

A scanner may alert you when a stock gains 5 percent within ten minutes while trading at three times its average volume. Because the alert is generated in real time, traders can evaluate the setup immediately and decide whether to enter, manage, or avoid the trade.

Stock scanners are best suited for short-term strategies such as day trading, swing trading, momentum-based setups, and news-driven trades. For this reason, they are essential tools for active traders who rely on speed, timing, and real-time market awareness.

Stock Scanner vs Screener: Key Differences

Feature | Stock Screener | Stock Scanner |

Data Type | Static (end-of-day or delayed) | Real-time, live |

Purpose | Filtering stocks | Detecting opportunities |

Time Horizon | Medium to long term | Short term / intraday |

Updates | Manual refresh | Continuous |

Best For | Investors | Traders |

Alerts | No (usually) | Yes |

Which Is Better: Stock Scanner or Screener?

The better tool depends entirely on how you participate in the market and what decisions you are trying to make. Stock screeners and stock scanners solve different problems, and using the wrong one often leads to frustration or poor results.

Use a Stock Screener If You Are:

- A long-term investor

- Focused on fundamentals

- Building or rebalancing a portfolio

- Researching companies outside market hours

Use a Stock Scanner If You Are:

- A day trader or swing trader

- Trading momentum or breakouts

- Reacting to news and volatility

- Needing real-time alerts

Best Practice: Use Both Together

Experienced traders and investors rarely rely on just one tool. Instead, they combine screeners and scanners to align stock quality with timing.

A common workflow looks like this:

- Use a stock screener to identify high-quality or high-potential stocks

- Monitor those stocks with a stock scanner for real-time trade signals

This approach ensures you are focusing on the right stocks first, then acting when conditions are favorable. It is one of the most effective ways to balance research with execution.

Stock Scanner vs Screener: How to Choose in 10 Seconds

The fastest way to choose between a stock scanner and a stock screener is to ask one question: are you trying to decide what to buy, or when to act?

A stock screener is built for selection. It helps you narrow a large universe of stocks into a short list based on fundamentals, valuation, or end-of-day technicals. This makes it ideal for investors and anyone focused on research and portfolio construction.

A stock scanner is built for timing. It monitors the market in real time and highlights stocks as price, volume, or volatility conditions change. This makes it essential for traders who rely on speed, momentum, and execution.

If your process requires both high-quality stocks and precise entry timing, the strongest approach is not choosing one tool over the other, but combining them.

The Most Common Mistakes Traders Make With Scanners and Screeners

Most underperformance comes from misusing tools, not from bad market ideas. Stock scanners and screeners are often blamed when the real issue is how they are applied.

One common mistake is using a stock screener to time trades. Screeners work on static data, which makes them poorly suited for intraday decision-making. Another is relying on scanners for long-term investment research, where short-term price movement adds noise rather than insight.

Traders also hurt results by over-filtering. Adding too many conditions can eliminate valid opportunities and create a false sense of precision. Others treat scanner alerts as trade signals without context, ignoring liquidity, broader market conditions, or risk management.

The key is understanding the role each tool plays. Screeners narrow the field. Scanners identify moments. Confusing those roles leads to frustration and inconsistent outcomes.

Final Thoughts

When comparing a stock scanner vs screener, the real edge comes from knowing when and how to use each.

Screeners help you find what to buy.

Scanners help you decide when to buy or sell.

Master both, and you dramatically increase your chances of success in the market.