If you’re searching for a stock research platform and GuruFocus is on your radar, there are several alternatives you need to consider before making your decision.

In this guide, we’ll compare GuruFocus against top stock analysis platforms like Gainify, Simply Wall St, Stock Rover, WallStreetZen, Seeking Alpha, and Morningstar.

Read on to find the best stock research app for your specific needs.

GuruFocus is built around value investing principles. It tracks the portfolios or methods of legendary investors like Warren Buffett, Bill Gates, Carl Icahn, and more.

The platform gives you access to over 100,000 stocks across 100+ global markets with up to 30 years of historical financial data. That’s very comprehensive, and something many other stock research platforms fail to beat.

But it does come with a cost…

GuruFocus is very expensive compared to competing apps. Especially when you consider that for true global data, you need to purchase multiple subscriptions.

It could cost you a whopping $4,410 each year. That’s steep when platforms like Gainify offer coverage of the world’s most popular stocks for free.

As the name suggests, the platform particularly excels at tracking “guru portfolios”. You can monitor holdings and investment strategies of prominent hedge fund managers.

It also makes tracking “insider” trades easy. You can see trades from politicians, CEOs, CFOs, and other company insiders.

While GuruFocus has some unique features like an Excel add-in for custom analysis/dashboards; the platform can feel overwhelming for newer investors. Additionally, the most valuable features are locked behind higher subscription tiers.

If you’re looking for GuruFocus alternatives with more comprehensive features for less, continue reading as we explore the top alternatives available in 2026.

Quick Guide: GuruFocus Alternatives at a Glance

Platform | Best For | Standout Features | Pricing | Key Limitations |

Gainify | Customized screening & charting, and top investor tracking | • Custom stock screening • Custom charting • S&P Global data • 33,000+ stocks • 30 exchanges • Top investor tracking | Free – $26.99/month ($7.99/month billed annually for Investor plan) | Limited to 10 years of historical data |

Stock Rover | Advanced screening & analysis | • Complex custom screeners • Fair value calculations • Portfolio managemet • Quality/value scoring | $7.99-$27.99/month ($79.99-$279.99/year) | Steep learning curve for beginners |

WallStreetZen | Value investors on a budget | • Zen Score automated analysis • Top analysts tracking • User-friendly interface • $1 trial option | $59/month (~$708/year) | Less comprehensive than premium platforms |

Visual learners | • Infographic financial analysis • Intuitive charts • Global market coverage • Visual company health reports | Free + Premium ($119.88-$258/year) | Limited depth for advanced analysis | |

Seeking Alpha | Community-driven research | • Crowdsourced analyst articles • Quant ratings system • Community discussions • Diverse investment perspectives | Free + Premium ($299-$2,400/year) | Quality varies across contributors |

Morningstar Premium | Fund analysis & traditional research | • Professional analyst reports • Morningstar fund ratings • Fundamental analysis focus • Established research quality | $249/year ($34.95/month) | Lacks modern AI features |

Koyfin | Professional-grade analysis | • Institutional-level tools • Capital IQ data • Advanced visualization• Macro analysis capabilities | $468-$948/year ($39-$79/month) | Targets advanced users only |

Quick Recommendations

- Best overall value: Gainify for custom screening, charting, and top investor tracking

- Most affordable premium: Stock Rover ($79.99/year) or Gainify Investor ($95.88/year billed annually)

- Easiest for beginners: Gainify with built-in learning features or Simply Wall St

- Most advanced screening: Gainify (1000+ criteria) or Stock Rover

- Best free option: Gainify’s starter plan with screening, charting, and watchlist tools

Alternative 1: Gainify.io – Best for Custom Screening and Top Investor Tracking

Gainify stands out as the most accessible alternative to GuruFocus, providing institutional-grade research tools at a fraction of the cost. Built on S&P Global Market Intelligence data, Gainify offers professional-level analysis without the complexity or high price point that makes GuruFocus challenging for many investors.

With coverage of 33,000+ global stocks across 29+ exchanges, Gainify provides everything individual investors need to make smarter investment decisions.

Customized Screening

Start with pre-built “Ideas” screeners covering trending themes like semiconductors, quantum computing, AI stocks, and space exploration.

There are 20+ pre-built screeners covering the market’s most interesting industries and themes.

Then just to Gainify’s custom stock screener to find stocks meeting your own precise criteria. Gainify’s stock screener allows you to filter across 1000+ data points.

Filters available include:

- Valuations: Price-based and enterprise-value metrics.

- Drawdowns: Identify stocks based on historical performance declines and recovery potential.

- Gainify Rating: A proprietary score combining growth, quality, and valuation signals.

- Fundamentals: Key financial ratios and performance indicators.

- Valuation Multiples: Compare P/E, PEG, EV/EBITDA, P/B, and other ratios.

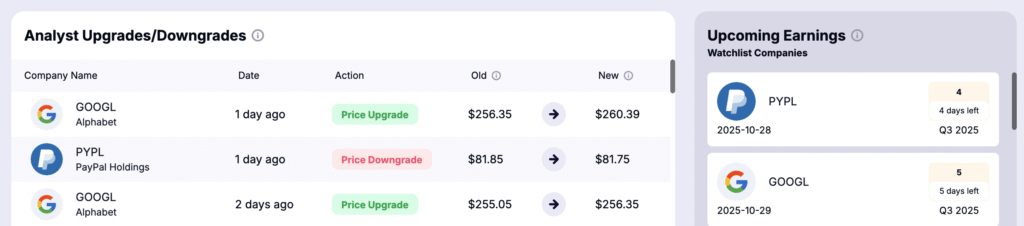

- Analyst Forecasts: Consensus estimates for revenue, earnings, and profit growth over the next three years.

- Relative Valuations: Compare current multiples against historical averages to spot under- or over-valued stocks.

Use negative filters to narrow down to exactly what you need, excluding any industries, countries, or exchanges that are not relevant to your search.

Few stock research platforms come close to Gainify’s comprehensive stock screening.

You can also build your own custom screener by combining filters across fundamentals, valuations, analyst estimates, and growth metrics spanning 150+ industries.

You’ll instantly get lightning-fast results backed by S&P Global data – the same trusted source used by finance pros worldwide.

One advantage of Gainify is that you can create unlimited custom stock screeners. Build based on investing thesis, strategy, or industry.

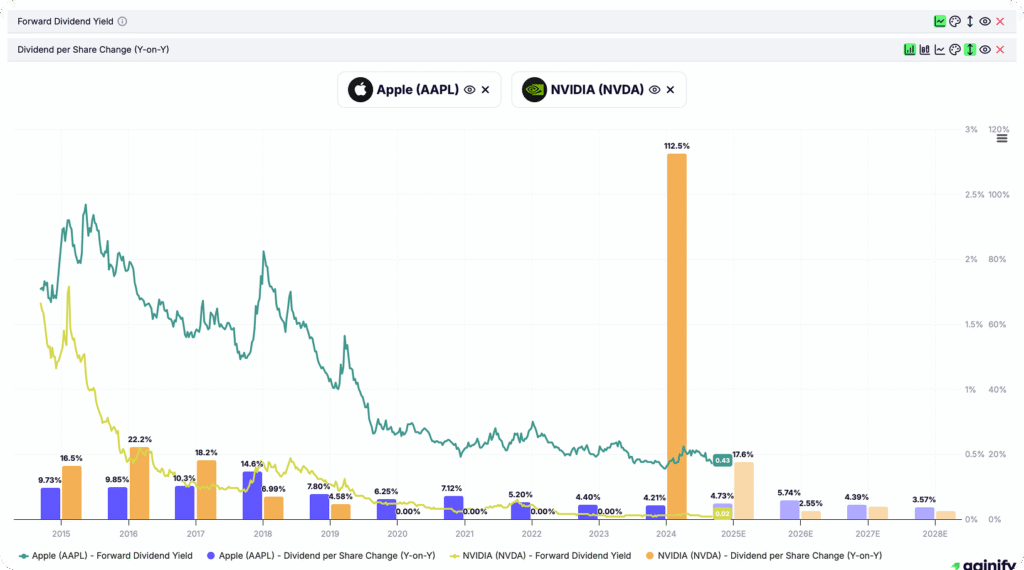

Custom Charting

Many stock research platforms struggle to provide a comprehensive and modern easy to use stock charting solution.

Some may provide comprehensive charting, but you may find them messy and difficult to use. Others look nice but lack features.

Gainify is different because it provides a user-friendly interface with the most comprehensive and customizable fundamentals charting in the industry.

Compare companies side-by-side to see who’s scaling faster, improving margins, or turning profitable. With multi-axis support, you can plot metrics with different units on separate axes for accurate apples-to-apples comparisons.

Smart timeline controls let you zoom into quarters for granular analysis or expand to decades for long-term trend identification.

You can create unlimited custom dashboards organized by strategy, theme, or metric.

Another nice feature is being able to export any chart as PNG to share insights on social media, include in reports, or save for your records.

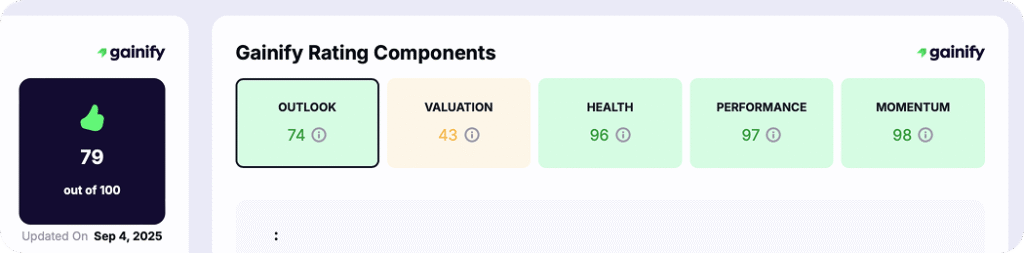

Gainify Rating System

Gainify’s proprietary rating system helps you quickly evaluate stock quality without spending hours analyzing financial statements.

The Gainify Rating evaluates stocks across five critical dimensions, each telling a different part of the investment story:

- Outlook evaluates growth potential using four key financial forecasts, analyzing projected revenue and EPS growth compared to both industry peers and the broader market.

- Performance provides a data-driven view of management’s track record over the past five years.

- Momentum analyzes recent price trends using three different price-movement indicators.

- Valuation assesses whether a stock is undervalued, fairly priced, or overvalued.

- Health examines the company’s ability to withstand economic storms.

If you’re familiar with other rating systems like GuruFocus’s GF Score, you’ll notice Gainify takes a distinctly modern approach to stock evaluation.

Other stock rating tools overemphasize past performance. Gainify dedicates an entire dimension to Outlook – highlighting future earnings expectations, not just past performance.

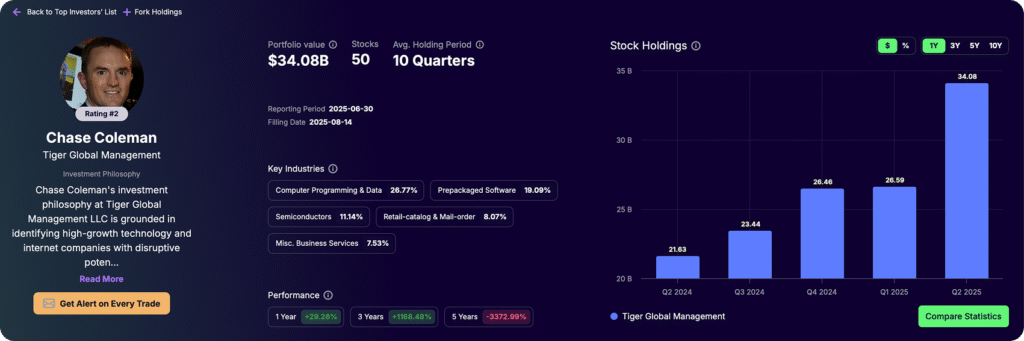

Top Investor Tracking

Monitor the portfolios and trades of successful institutional investors and hedge fund managers. See how top investors like Bill Gates manage their portfolios for long-term wealth building.

Unlike GuruFocus’s guru portfolios that focus primarily on value investors, Gainify enables you to track diverse investment styles including:

- Dividend-focused institutional investors

- ESG-focused portfolio managers

- Growth-focused fund managers

- Technology sector specialists

- Emerging market strategists

Get real-time alerts when top investors make significant position changes. Copy investors’ portfolios to your watchlist with one click.

Built-in Learning Features

GuruFocus’s user interface is complex and some may find it difficult to use. It’s also better suited to experienced investors who are already familiar with investing terms.

Gainify has put a great deal of effort into democratizing investing, making powerful tools and institutional-grade data available to retail investors.

Another step Gainify took to help newer investors research stocks confidently, is including built-in learning at every step.

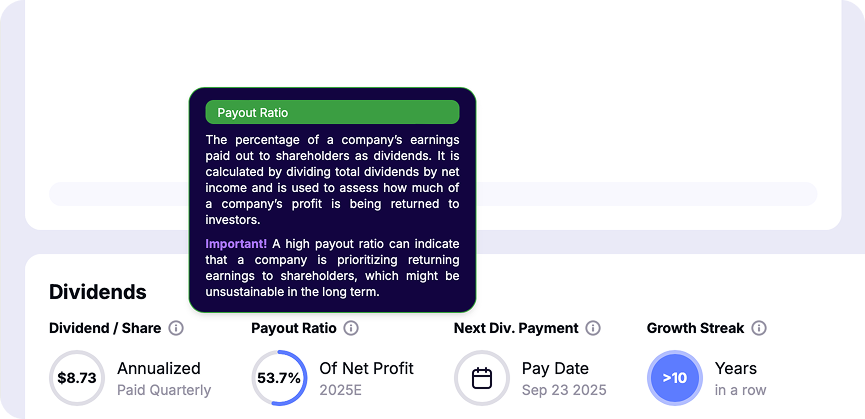

When viewing charts and metrics, the platform provides context and explanations to help you understand what the data means for investment decisions.

Smart Watchlist Management

Create unlimited watchlists with advanced organization and alert features. Unlike basic watchlist tools, Gainify’s system includes advanced features for portfolio building and stock analysis:

- Custom alert triggers for price, volume, or fundamental changes

- Automated screening updates showing which watchlist stocks meet new criteria

- Performance tracking across different watchlists

- Integration with Gainify AI for watchlist-specific analysis

Pricing

Unlike GuruFocus’s $499 annual fee, Gainify offers transparent, affordable pricing:

- Starter (FREE): Basic screener, limited charting, unlimited watchlists, and 10 AI queries monthly

- Investor ($7.99/month): Full platform access, 50 AI queries monthly, top investor alerts, and priority support

- Gainer Pro ($26.99/month): Premium features, 500 AI queries monthly, advanced analytics, and 6-hour priority support

This pricing structure provides institutional-grade tools at accessible price points, making professional research available to investors regardless of portfolio size.

Alternative 2: Stock Rover – Best for Advanced Screening and Analysis

Stock Rover excels at complex stock screening and ranking systems.

Advanced Screening Features

Stock Rover’s screening capabilities are extensive and customizable. You’ll be able to create complex filters using hundreds of metrics, making it easier to identify stocks that meet your specific investment criteria.

One of Stock Rover’s standout features is its automatic calculation of Fair Value and Margin of Safety using discounted cash flow analysis. You’ll be able to see which of your watchlist or portfolio holdings are undervalued.

You’ll also get detailed analytics on portfolio composition, sector allocation, and risk-adjusted returns.

Pricing

You can start with Stock Rover’s free basic plan or upgrade to three paid tiers: Essentials at $7.99/month or $79.99/year, Premium at $17.99/month or $179.99/year, and Premium Plus at $27.99/month or $279.99/year. You’ll get a 14-day Premium Plus trial as a new user, and you’ll save significantly by choosing annual billing.

Alternative 3: WallStreetZen – Best Value for Value Investors

WallStreetZen is a strong alternative to GuruFocus if you’re planning to take a value investing approach to your portfolio.

Premium plans start at approximately $234 annually, making it significantly more affordable than GuruFocus’s $424 entry price – but still much more expensive than Gainify.

Analysis Features

WallStreetZen’s signature feature is the Zen Score, which gives you multi-factor stock analysis. Much like the Gainify Rating or GuruFocus score.

One interesting feature is Wall Street Zen’s Top Analysts tracking. It monitors only those Wall Street analysts with proven track records. So not only do you get analyst ratings, you can filter for those with the best performance.

Pricing

You can get started with WallStreetZen for a lot less than GuruFocus. The platform offers a $1 trial option allowing you to test features before committing. There is also a free tier available, although it is highly limited.

Unfortunately, paid plans are quite expensive when you consider the limited features. It will set you back $59/month (over $20 more than Gainify’s top tier but offering a fraction of the features.)

Alternative 4: Simply Wall St – Best for Visual Analysis

Simply Wall St transforms complex financial metrics into easy-to-understand infographics and charts. It’s perfect if you’re tired of Bloomberg style text-heavy terminals.

Visual Financial Analysis

If you’re tired of text heavy platforms and want to quickly grasp a stock’s balance sheet, you’ll find helpful Sankey diagrams and the 5-point snowflake analysis invaluable.

You will find the platform easier to use than text heavy GuruFocus or Bloomberg style terminals.

Portfolio Sync

Simply Wall St is one of the few platforms in this comparison that enables you to connect your broker and trade directly.

You can also bulk import your historical trades so you don’t lose any valuable information.

It’s great if you have several portfolios across multiple brokers – giving you a unified view of everything in one dashboard.

Syncable brokers include Robinhood, Fidelity, Charles Schwab, Interactive Brokers, and more.

Pricing

You can access Simply Wall St’s free plan with 5 company views monthly, or upgrade to Premium ($131/year) for 30 views. The Unlimited plan offers unrestricted company reports for $258/year.

Alternative 5: Seeking Alpha – Best for Community Insights

In addition to stock data, Seeking Alpha provides you with crowd sourced stock research (from the company’s own editorial team, and community investors). If you’re looking for more than just data, and want to read and compare the opinions of other investors, you’ll value this approach.

Crowdsourced Research

The main advantage you get from Seeking Alpha – compared to other platforms – is its large library of investment articles.

You’ll find content written by both independent analysts and community investors, and the Seeking Alpha team.

It’s one of the best places to go for diverse perspectives on stocks and market trends.

However, you may find it difficult to parse the vast depths of contradicting opinions. If you prefer to hear the final word on a topic from one top investor, Seeking Alpha may not be for you.

Quant Ratings System

The platform’s proprietary Quant Ratings gives you simple to understand algorithmic stock analysis. If you just want to make some fast investing decisions without reading hours of community articles, then these ratings are helpful.

Community Interaction

Some data heavy stock research platforms can feel lonely. Lots of data but little interaction. Seeking Alpha helps you discuss trending topics and strategies with investors through its forum. This kind of interaction is helpful if you’re seeking authentic input from other traders rather than carefully curated articles.

Pricing

You have three options with Seeking Alpha – a very basic free plan, Premium at $299/year with full content access and Quant ratings, and Pro at $2,400/year with advanced features.

It’s much more expensive than top platforms like Gainify, but you can often find first-month trials at steep discounts, sometimes as low as $4.95 for Premium.

Alternative 6: Morningstar Premium – Best for Fund Analysis

Morningstar Premium focuses heavily on fundamental analysis. You will find it particularly suitable for your investment research if your focus is on mutual funds, ETFs, stocks.

Fundamental Analysis Focus

Unlike platforms that emphasize technical analysis or AI-powered insights, Morningstar Premium gives you strong fundamental company analysis.

You will benefit from detailed stock analysis based on traditional value investing principles. The same strategy followed by top investors such as Warren Buffet, Seth Klarman, Joel Greenblatt, and more.

Fund Research Excellence

Morningstar’s signature strength is fund analysis. The platform provides detailed research on mutual funds and ETFs, including Morningstar Ratings that help investors identify quality funds.

Research Quality

Morningstar employs professional analysts who provide you with in-depth research reports on individual stocks and funds. The institutional-grade research quality sets it apart from crowd-sourced platforms like Seeking Alpha.

Pricing

You’ll pay $249/year ($34.95/month) for Morningstar Investor. You can typically get a $50 first-year discount plus a 7-day free trial as a new subscriber.

Alternative 7: Koyfin – Best for Professional-Grade Analysis

Koyfin stands out from other platforms due its deep asset type coverage. If you want to research across stocks, ETFs, Mutual Funds, indices, currencies, commodities and more. You’ll be hard pressed to find a better range elsewhere.

Advanced Visualization

If you often find yourself repeating the same analyses, you’ll appreciate Koyfin’s custom reports and dashboards. Build them once and check in once a week or month to stay up to date with the latest.

Pricing

You can start with Koyfin’s free plan with basic features, upgrade to Plus at $468/year ($39/month) for 10 years of data, or choose Pro at $948/year ($79/month) for mutual fund data and unlimited formulas.

If you’re a financial advisor, you’ll find Advisor tiers ranging from $2,508-$3,588 annually.

How to Choose the Right GuruFocus Alternative

There is no one size fits all solution for any investor. Your choice depends on budget, investing style, how often you intend to invest, and more.

Consider Your Investment Style

When creating portfolios, you will likely be building based on fundamental, technical, growth, or value investing principles. Or you may need to research alternative assets outside of stocks.

For value investors: WallStreetZen or Morningstar Premium provide strong fundamental analysis tools. Gainify’s stock screener offers 1,000+ criteria allowing you to build value screens using both historical data (last quarter, last year) and forward estimates.

For growth investors: Gainify’s top investor tracking lets you follow legendary growth investors’ portfolios and see which stocks they’re accumulating in real-time.Trending stock features help identify growth opportunities across emerging sectors like AI data center stocks, cybersecurity, and quantum computing through thematic investing approaches.

For visual learners: Simply Wall St’s infographic approach makes complex financial data more digestible than GuruFocus’s traditional data tables. Gainify has custom charting with clear easy-to-understand visualizations. Koyfin offers customized dashboards and reports.

For community-driven research: Seeking Alpha provides diverse perspectives from independent analysts. Combine community insights with reliable stock news apps for comprehensive market coverage beyond the data tables & charts.

For asset coverage: Koyfin provides the best asset coverage. You will have access to data for stocks, ETFs, Mutual Funds, Options, and more.

Evaluate Your Budget

Budget will obviously play a big role in your decision making. Some platforms will simply be out of reach. Thankfully, many do offer free or affordable options with limited features.

Free Options: Gainify, Simply Wall St, and Seeking Alpha all offer solid free tiers. Try each to find which delivers the most value, or combine multiple tools to meet your unique stock research needs.

Budget-Conscious: WallStreetZen at $234 annually provides significant savings over GuruFocus’s $499 entry price. Gainify’s free and Investor ($7.99/mo paid annually) tiers offer supreme value for money.

Premium Features: Gainify’s top tier ($26.99 monthly) offers AI-powered analysis at a much lower cost than GuruFocus Premium. Simply Wall Street is also strong on features, including broker sync.

Choosing the Best GuruFocus Alternative: Final Recommendations

While GuruFocus provides extensive value investing tools. But you’ll find several alternatives that offer better value.

Gainify is the most compelling overall alternative, giving you institutional-grade S&P Global data with 1,000+ screening criteria (updated 4 times daily), custom fundamental charting, and comprehensive top investor tracking

With Gainify, you can:

- Screen across 33,000+ global stocks using historical data (last quarter, last year) and forward estimates (1-year, 2-year, 3-year forward.)

- Visualize 10-15 years of fundamental trends through custom charts with peer comparisons.

- Follow the exact portfolios of legendary investors like Warren Buffett, Ray Dalio, and other top fund managers.

If you’re a professional investor managing client portfolios, you may prefer Koyfin for its client management, brokerage sync, and custom reporting tools.

The key is matching platform capabilities with your investment style, budget, and technical requirements. Many stock research platforms offer freemium models, so you can test multiple platforms to find the best fit.

See our complete stock analysis and thematic investing guides to get the most out of whichever platform you choose.

Ready to experience institutional-grade stock research? Start using Gainify for free today. No credit card required.

Access 1,000+ screening criteria, S&P Global data, top investor tracking, custom charting tools, and more.

Frequently Asked Questions

What are the most affordable GuruFocus alternatives?

You can find several alternatives offering similar features for $200-300 annually versus GuruFocus’s $424+ entry price. Gainify gives you institutional-grade S&P Global data starting free (premium just $95.88/year). WallStreetZen costs approximately $234/year with value investing features. Stock Rover offers screening tools at $179.99/year. Simply Wall St provides visual analysis at $131/year. You’ll get fundamental analysis, screening capabilities, and portfolio tracking at 50-80% lower cost than GuruFocus.

Are there free alternatives to GuruFocus?

Yes, you can access several platforms with solid free tiers. Gainify gives you strong screening capabilities across 1000+ data points, unlimited watchlists, custom charting, and 10 AI queries monthly at no cost! Simply Wall St offers you 5 company analysis reports per month free. Seeking Alpha has a free tier with limited article access and basic stock data. Koyfin provides free access to basic charting and screening features. These free options work well if you’re starting out or have a small portfolio.

Which GuruFocus alternative is best for beginners?

Gainify and Simply Wall St are your best beginner-friendly options. Gainify includes built-in explanations for every metric, conversational AI to answer your questions, and an intuitive interface. Simply Wall St transforms financial data into easy-to-understand infographics and visual charts. It’s perfect if you’re new to reading balance sheets and income statements. Both platforms avoid the terminal-style complexity that makes GuruFocus challenging for newer investors. For comprehensive beginner guidance, see our complete stock analysis guide.

Which platforms have the most powerful stock screening tools?

Gainify and Stock Rover lead in screening capabilities. Gainify gives you 1000+ screening criteria across fundamentals, valuations, analyst estimates, and growth metrics – all using S&P Global Intelligence data. You can create unlimited custom screens and access 16+ pre-built thematic screeners. Stock Rover offers 700+ metrics with complex custom filtering and automatic fair value calculations using discounted cash flow analysis.

What is the cheapest alternative to GuruFocus?

Gainify offers the most affordable professional-grade alternative with a completely free starter plan that includes AI stock analysis, basic screening, and charting. For full features, Gainify’s Investor plan costs just $7.99/month, significantly less than GuruFocus’s $499 annual premium membership.

Which GuruFocus alternative offers the best value for money?

Gainify provides the best overall value with institutional-grade S&P Global data, AI analysis, and advanced features starting free and scaling to $26.99/month for premium features. This compares favorably to GuruFocus’s $499 annual entry price (which can be as high as several thousand dollars for global data feeds).

Can I get global stock coverage with GuruFocus alternatives?

Yes, several alternatives provide global coverage:

- Gainify: 33,000+ stocks across 29+ global exchanges

- Simply Wall St: Major international stock exchanges

- Koyfin: Comprehensive global market coverage

- Morningstar: International stocks and funds

Which platform is best for tracking investor portfolios?

Gainify excels at investor tracking with features to follow top investors, Congress insider trades, and trending stock movements. See how successful investors like Bill Gates structure their portfolios for insights.