Whether insider trading is legal for Congress has become one of the most pressing and troubling questions in American politics. While U.S. law prohibits trading on material, nonpublic information, enforcement is inconsistent when it comes to lawmakers.

Members of the House of Representatives and the Senate frequently execute stock trades, often in sectors directly impacted by legislation they craft or influence through powerful congressional committees. And although they are technically bound by the same securities laws and insider trading prohibitions as the rest of the public, few face scrutiny or consequences.

This disconnect between the law and its application has caused growing public frustration. The American people are watching elected officials build personal wealth while serving in public office, raising serious concerns about conflicts of interest, ethical standards, and the lack of meaningful accountability.

What Is Insider Trading?

Insider trading refers to the buying or selling of securities such as stocks, bonds, or options while in possession of material, nonpublic information (MNPI). This conduct is illegal under U.S. securities laws because it provides an unfair advantage and undermines the integrity of financial markets.

Put simply, if a person acts on confidential information that is not yet available to the public and that information would likely affect a stock’s price, that individual is breaking the law.

The goal of insider trading laws is to ensure that all investors operate on a level playing field. Using MNPI for personal gain not only violates legal standards, it also breaks the relationship of trust between the individual and their institution, whether in the private sector or while performing official duties in public office.

This includes corporate executives, federal judges, financial professionals, and public officials, such as members of the House of Representatives, the Senate, or other reporting individuals in government service.

There are several types of insider trading that regulators and courts recognize. Each involves the misuse of MNPI in different ways:

1. Classic Insider Trading

This is the most well-known form. It involves a company insider, such as an executive or employee, trading on confidential company information. For example, an executive selling shares before a poor earnings report becomes public.

2. Tipping

Tipping occurs when someone with MNPI shares it with another person who then trades on that information. Even if the original insider does not trade, both the tipper and the tippee can be held liable under securities laws.

3. Misappropriation

This type involves someone outside a company (such as a lawyer, consultant, or auditor) who gains access to MNPI through a relationship of trust and uses it for personal benefit. It violates their duty not to exploit confidential information for unauthorized purposes.

4. Third-Party Trading

Insiders may pass information to family members, friends, or advisors who then trade on their behalf. Even without direct financial compensation, courts have ruled that any benefit to the original insider may be enough to trigger liability.

Understanding these types helps clarify why insider trading is such a high-stakes issue, especially when applied to individuals in public office, where the line between governance and self-interest must be strictly guarded.

Are Members of Congress Covered?

Yes.

Members of the House of Representatives, the Senate, and their staff are explicitly subject to U.S. insider trading prohibitions under both securities laws and federal ethics regulations. These rules apply not only to elected officials but also to a broader group of government personnel who may have access to material, nonpublic information. That includes:

- Congressional employees

- Special government employees

- Civilian employees

- Employees in the competitive service

- Members of the uniformed service

- Anyone holding a covered public office

They are all considered reporting individuals under federal ethics law and must comply with transaction reporting requirements through financial disclosure forms.

The STOCK Act: Congress Tries to Regulate Itself

The 2012 Stop Trading on Congressional Knowledge (STOCK) Act was passed after media reports revealed members of the House of Representatives and Senate had traded stocks following confidential briefings.

What the STOCK Act Requires:

- Mandatory reporting of financial transactions over $1,000 within 45 days

- Submission of financial disclosure reports available for public disclosure

- Compliance oversight by the House of Representatives Ethics Office, Senate Ethics Committee, and Office of Government Ethics

The STOCK Act reaffirmed that trading stocks based on information acquired during official duties – even in Congress – violates insider trading prohibitions.

However, it did not ban the ownership or trading of individual stocks.

A Loophole-Ridden System

Although the STOCK Act was designed to increase transparency and accountability, its real-world enforcement, especially within the House of Representatives and the Senate, remains alarmingly weak. The law may look solid on paper, but its limitations in practice allow potentially unethical behavior to continue with minimal consequence.

Key Weaknesses:

- Minimal Penalties – Missing a disclosure deadline usually leads to a $200 fine. For lawmakers with vast stock holdings, this is negligible.

- Delayed Oversight – Financial disclosure forms are reactive, not preventative. They inform the public weeks or months after a financial transaction occurs.

- Difficult Prosecution – Agencies like the SEC and DOJ must prove that a lawmaker knowingly used material, nonpublic information – a tall order when protected by the Speech or Debate Clause or vague ethics rules.

- Inadequate Ethical Enforcement – The Ethics Office in the House of Representatives and the Senate lacks investigative power. Meanwhile, each agency ethics official in the executive branch has limited jurisdiction.

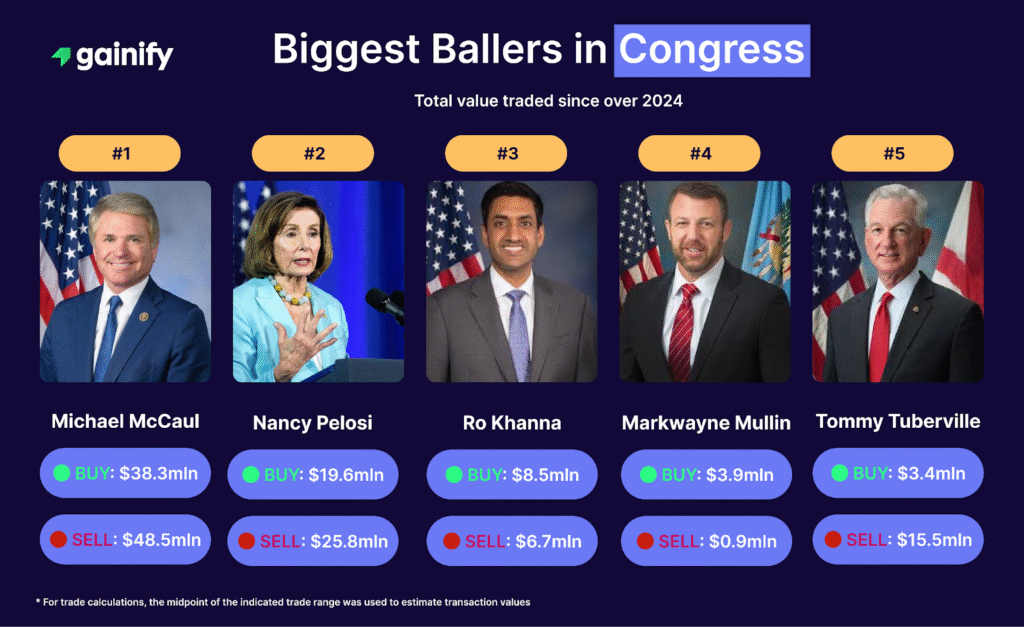

Case Study: Nancy Pelosi’s Trades

Perhaps no lawmaker has had their stock trades tracked as closely as Nancy Pelosi, former Speaker of the House of Representatives.

In 2021, her husband purchased large call options on NVIDIA, a semiconductor stock, just weeks before a vote on the CHIPS Act – a bill that offered subsidies to chip manufacturers.

While she denied direct involvement, the trade raised questions because she served in one of the most powerful roles in the House of Representatives, where such legislation was being actively debated.

Platforms like Unusual Whales, Gainify, and Senate Stock Watcher began tracking her disclosures and today, there are traders who mirror the Pelosi portfolio.

Congress and Financial Power: A Structural Conflict

Members of the House of Representatives wield immense power – not just through legislation, but through their roles on specialized congressional committees that shape the future of major industries. Whether overseeing national defense, healthcare policy, financial markets, or emerging technology, these lawmakers have regular access to material, nonpublic information that can move markets long before the public is informed.

Despite this privileged position, many lawmakers continue trading individual stocks in the very sectors they influence. A representative on the House Financial Services Committee may trade banking or fintech stocks, while another on the House Energy and Commerce Committee may buy or sell shares of energy companies, pharmaceutical firms, or defense contractors.

This is not simply a matter of poor optics. It is a structural conflict of interest embedded within the system itself.

Reform Is Coming, But Slowly

In response to mounting public pressure and ongoing media scrutiny, lawmakers have introduced several high-profile bills aimed at restricting or banning individual stock trading by members of Congress. These proposals seek to address the inherent conflicts of interest that arise when elected officials regulate industries in which they also invest. These are leading reform proposals:

1. Ban Congressional Stock Trading Act

This bill would prohibit members of the House of Representatives, the Senate, and their immediate family members from buying, selling, or holding individual stocks while in office. Lawmakers would still be allowed to invest in diversified vehicles such as mutual funds, ETFs, or Treasury securities. The aim is to eliminate direct financial entanglement with the industries they oversee.

2. TRUST in Congress Act

Short for “Transparent Representation Upholding Service and Trust,” this bill requires all members of Congress to place their investable assets in a qualified blind trust. By removing lawmakers from day-to-day control of their portfolios, the act would reduce the risk of trades being influenced by nonpublic knowledge gained through official duties.

3. Bipartisan Ban on Congressional Stock Ownership Act

This broader proposal not only targets elected officials but also includes congressional employees, a group often overlooked despite their regular access to confidential policy discussions. The bill aims to close a major loophole by ensuring that staffers cannot serve as proxies for trades legislators themselves would be barred from making.

Should Lawmakers Own Stocks at All?

The question of whether lawmakers should be allowed to own and trade individual stocks is no longer a fringe debate. It has become central to the national conversation about ethics, trust, and the proper role of elected officials in a modern democracy.

Many government ethics experts, former regulators, and bipartisan advocacy groups argue that members of the House of Representatives, the Senate, and senior public officials should not hold direct investments in companies they have the power to regulate or influence. Even if trades are properly disclosed and technically legal, the conflict—real or perceived—is damaging to the credibility of public office.

To avoid sector-specific conflicts of interest, most reform advocates recommend that lawmakers limit their investments to:

- Mutual funds that offer broad diversification

- Index-tracking ETFs, which reduce individual company exposure

- U.S. Treasury securities, considered conflict-free and low-risk

- Qualified blind trusts, which remove lawmakers from active investment decisions

These investment vehicles allow elected officials to build long-term wealth without raising questions about whether their official duties are influenced by personal financial gain.

By removing the ability to trade individual stocks while in office, Congress could take a meaningful step toward rebuilding public trust and demonstrating that lawmakers are focused on serving the American people, not their portfolios.

What Investors Should Do

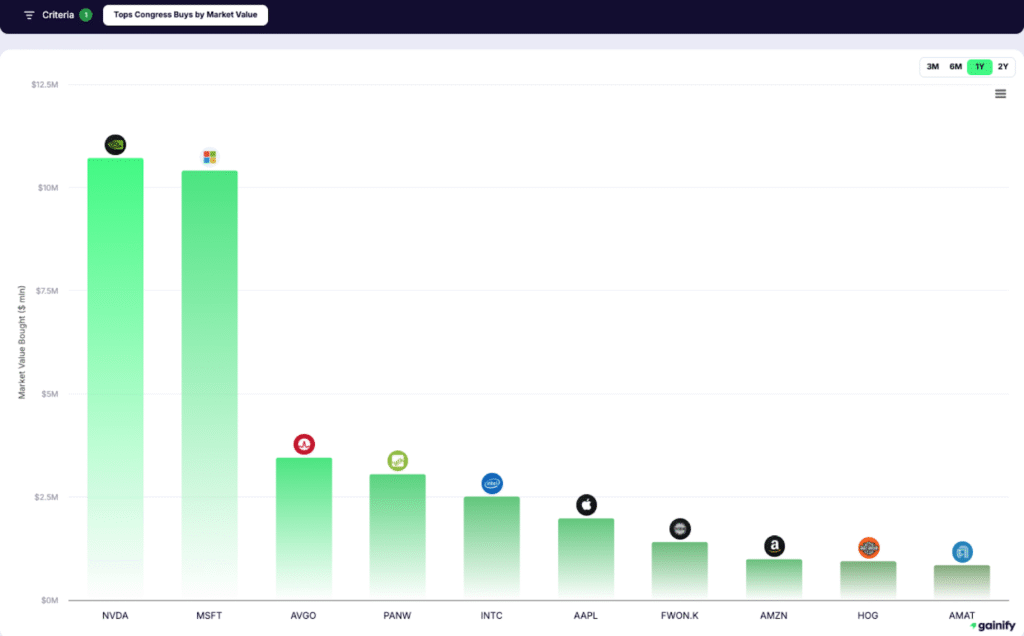

Retail investors don’t get access to closed-door briefings, classified intelligence, or early policy drafts. But they can still gain an edge by following how public officials, especially members of the House of Representatives or the Senate, are allocating their portfolios.

Understanding what lawmakers are buying or selling and when can offer valuable insight into where legislation, regulation, or market sentiment might be heading next.

How to Monitor Congressional Trading Activity

✅ Gainify.io

Unlike most platforms, Gainify doesn’t just track individual trades. It allows users to:

- View the most bought and most sold stocks by Congress, ranked by volume and activity

- Analyze how congressional interest in specific tickers has changed over time

- Instantly see whether a stock has been recently traded by any member of Congress

Whether you’re evaluating a semiconductor stock or a bank, Gainify helps you answer a critical question: Has Congress shown interest in this name recently or repeatedly?

✅ Other Tools

Quiver Quant and Unusual Whales also provide trade-level data, disclosures, and performance comparisons of lawmaker portfolios

By integrating this information into your decision-making process, you gain visibility into one of the market’s most opaque forces: legislative capital flows.

Following trades made by those with official duties may not guarantee alpha, but in a world where information equals advantage, it’s one of the smartest edges a retail investor can pursue.

Final Verdict: Is Insider Trading Legal for Congress?

❌ No — Members of Congress are not exempt from U.S. securities laws or insider trading prohibitions. Just like corporate executives or federal employees, they are legally barred from trading on material, nonpublic information.

⚠️ But in practice — Members of the House of Representatives, the Senate, and even their staff face minimal penalties, operate under vague ethics rules, and rarely face legal consequences unless intent can be clearly proven. Enforcement is weak, and loopholes remain deeply embedded in the system.

Until there is a clear, enforceable ban on trading individual stocks while in office and meaningful consequences for violations public trust in Congress will continue to erode. Transparency alone is not enough. The system must be restructured to prevent conflicts before they happen, not just reveal them after the fact.