If you’re trying to manage multiple investment accounts across different brokerages, it can feel like juggling blindfolded.

You log into five different platforms, manually track performance in spreadsheets, put in a lot of effort into managing your portfolio, and you know you’re still missing crucial data.

Plenty of investment portfolio management solutions have sprung onto the market to help you solve this problem.

In fact, the investment portfolio management software market has exploded with solutions. It’s understandable if you find it difficult to research and compare them all.

After analyzing 8 leading portfolio management platforms, we’ve identified clear winners for every investor type and budget. Whether you need basic tracking, tax optimization, or institutional-grade analytics, this guide helps you find a suitable portfolio management tool.

But portfolio tracking is only half the equation. The real challenge is finding the right stocks to invest in. While these platforms excel at tracking what you own, Gainify specializes in helping you discover what you should own next. With custom stock screeners, AI-powered analysis, and access to the world’s largest database of analyst estimates available to retail investors, Gainify transforms how you research and select winning investments.

Quick Comparison: Top Investment Portfolio Management Software

Software | Best For | Price | Key Features |

Empower | Free comprehensive tracking | Free | Net worth tracking, retirement planning, fee analyzer |

Quicken | Desktop power users | $47.88-$131.88/yr | Tax reporting, historical tracking, TurboTax integration |

Morningstar Investor | Research-focused investors | $249/yr | Portfolio X-Ray, analyst reports, fair value estimates |

Betterment | Automated investing | 0.25% AUM | Tax-loss harvesting, goal-based planning, robo-advisor |

Wealthfront | Direct indexing | 0.25% AUM | Direct indexing at $100k+, tax harvesting, Path planner |

SigFig | Free tracking + advisory | Free/$10k min | Portfolio diagnostics, fee analysis, advisor access |

Sharesight | DIY investors | $9.33-$31/mo | Global coverage, XIRR tracking, tax reports |

M1 Finance | Automated rebalancing | $3/mo under $10k | Visual “pie” portfolios, automatic rebalancing |

What Is Investment Portfolio Management Software?

Investment portfolio management software consolidates your holdings across multiple accounts into a single dashboard.

Instead of collecting everything from your many accounts into a spreadsheet, you’ll be able to access real-time tracking, performance analytics, and investment insights.

These platforms connect to your brokerages, banks, and retirement accounts to:

- Automatically sync transactions

- Track asset allocation

- Generate tax reports

- Calculate returns

Core Features Every Platform Should Offer

Modern portfolio management software has access to some of your most sensitive and important data.

The main things you want to ensure are that your data is secure and accurate.

Portfolio management software must deliver these essential capabilities:

- Security features including bank-level encryption and read-only access

- Automatic account aggregation from multiple brokerages and banks

- Asset allocation visualization showing diversification across sectors

- Real-time performance tracking with accurate return calculations

- Tax reporting tools for capital gains and dividend income

- Mobile access for portfolio monitoring on-the-go

Portfolio Management vs Investment Tracking

You’ve probably come across the terms ‘portfolio management’ and ‘investment tracking’ before. If you’re just hearing of them now, then like many of us you’re likely wondering “what is the difference?”

On the face of it, both types of software seem similar and it sounds as if they do the same thing.

But there are a few small (though important) differences you should be aware of.

While the terms are sometimes used interchangeably, portfolio management software offers deeper functionality than basic investment trackers.

Simple trackers show current values and basic gains/losses.

Portfolio management platforms provide:

- Rebalancing recommendations

- Forward-looking projections

- Tax optimization strategies

- Performance attribution

- Risk analysis

Investment Portfolio Management Software Platform Reviews

Let’s dive into detailed reviews of each platform to help you understand their strengths and limitations.

1. Empower (Personal Capital): Best Free Comprehensive Portfolio Tracker

Empower gives you free institutional-grade portfolio analytics. You’ll gain access to aggregated financial data across all your accounts – from checking to 401(k)s.

It’s a great platform if you want a complete picture of your wealth in one place.

While competitors charge $20-50 monthly for similar features, Empower provides sophisticated portfolio analytics, real-time net worth tracking, and retirement planning simulations for free.

The trade-off? Empower monetizes through its optional advisory services (starting at $100,000), which means you’ll receive sales calls from their advisors.

Advantages

Empower’s standout features make it particularly powerful if you want professional-grade analytics without the professional price.

- The Investment Checkup tool analyzes portfolios across 12 dimensions including risk, diversification, and tax efficiency.

- The Retirement Planner uses Monte Carlo simulations to test thousands of scenarios.

- Connects with over 20 account types including all major brokerages, banks, credit cards, mortgages, and even some pension systems.

- Net worth tracking with historical trends, cash flow analysis with spending categorization, and asset allocation visualization

Drawbacks

Despite its impressive free features, Empower has some notable limitations you should consider.

- Persistent sales calls from financial advisors trying to upsell you – some users report multiple calls weekly.

- No automated crypto support – crypto holdings require manual entry.

- Can be overwhelming if you’re a new investor due to the depth of features and analytics.

Pricing

Empower’s core platform is completely free. Here’s the breakdown of costs for their various services.

- Core Platform: Completely free with no account minimums or hidden fees

- Cash Account: 3.75% APY (variable) with no minimum balance, no fees

- Advisory Services: 0.89% AUM for accounts $100,000-$999,999; 0.79% for $1M-$4.99M; 0.69% for $5M+

- No charges for: Account aggregation, portfolio analysis, retirement planning, fee analyzer.

Who Empower is Best For

Empower is ideal if you’re a comprehensive wealth tracker who wants to see your entire financial picture – from checking accounts to 401(k)s – in one place.

2. Quicken: Best for Desktop Power Users with Complex Taxes

If managing taxes among your different accounts and portfolios is a pain point for you, then Quicken is worth trying.

Tax support includes capital gains tracking, tax-loss harvesting identification, and Schedule D report generation. You can even export directly to TurboTax for seamless tax filing.

Quicken syncs with over 14,500 financial institutions for comprehensive account integration.

Advantages

Quicken’s approach is good if you want an all in one investing and budgeting tool.

- Connect all your investment accounts from major brokerages including Fidelity, Schwab, Vanguard, and E*TRADE for real-time portfolio updates.

- Personal finance management including bill pay, budgeting, and spending analysis.

- Institutional-quality portfolio insights via Morningstar Portfolio X-Ray analysis.

- Taxable account tracking across 401(k)s, IRAs, and RSUs.

- Cryptocurrency holding support.

Drawbacks

Quicken has some significant drawbacks that may frustrate you. It’s important to understand these limitations before committing to a subscription.

- Steep learning curve. The comprehensive feature set creates complexity that overwhelms new investors.

- Some users feel “locked in” due to proprietary data formats.

- No free tier. All features require a paid subscription.

Pricing

Quicken offers multiple subscription tiers to fit your budget and needs.

Quicken requires annual payment upfront, though they market with monthly price equivalents. Here’s the actual cost structure:

- Simplifi: $47.88/year (marketed as $3.99/month) – Basic investment tracking, mobile/web only

- Classic Deluxe: $71.88/year (marketed as $5.99/month) – Full investment management, desktop software

- Classic Premier: $95.88/year (marketed as $7.99/month) – Morningstar X-Ray, advanced tax tools, capital gains optimization

- Business & Personal: $131.88/year (marketed as $10.99/month) – All Premier features plus business investment tracking

There is a 30-day money-back guarantee on all plans

Who Quicken is Best For

Quicken is particularly valuable if you have complex tax situations involving multiple brokerages, retirement accounts, and taxable investments that require careful capital gains management.

However, if you’re new to investing or prefer modern, cloud-based interfaces, the learning curve and desktop-centric approach may feel outdated.

3. Morningstar Investor: Best for Fundamental Research Integration

Morningstar Investor – one of the most recognized names in investment research – gives you institutional-quality research into over 620K global stocks and investments.

You’ll benefit from the analysis of Morningstar’s own internal team of analysts – and the same research relied on by major funds.

Morningstar is known for its proprietary rating systems like the Economic Moat rating and Fair Value Estimates.

If you’re a serious investor seeking something more than basic portfolio tracking – Morningstar Investor may be a good fit for you.

Advantages

Morningstar’s features give you access to the same insights used by professional fund managers.

- Comprehensive reports include fair value estimates, economic moat ratings, uncertainty assessments, and 5-year financial forecasts.

- Morningstar Investing Classroom gives you access to 170+ courses from beginner to advanced.

- Broad international asset coverage. Research spans stocks, bonds, ETFs, mutual funds, and CEFs across every major market.

- Portfolio X-Ray excellence analyzes holdings across 12 dimensions including geographic allocation, sector exposure, style box positioning, and fee analysis.

- Holdings-based analysis reveals what funds actually own, not just what they claim to invest in.

Drawbacks

Morningstar issues range from user experience problems to value concerns.

- Very low rating (1.6/5) on Trustpilot from over 100 reviews.

- Less integration with external services than similar platforms.

- Costs more than many competitors offering similar features.

- Interface can feel dated compared to modern fintech applications.

- Steep learning curve. Extensive capabilities come with overwhelming complexity

Pricing

Here’s what you’ll pay for access to Morningstar’s comprehensive analytical tools.

- Basic (Free): Limited access to articles, basic quotes, and portfolio tool

- Annual subscription: $249 per year ($20.75/month effective rate)

- Monthly subscription: $34.95 per month ($419.40 annually)

- Institutional plans: Custom pricing for advisors and firms

You can explore the platform through a 7-day free trial – credit card required – providing full access to evaluate whether the tools justify the investment.

Morningstar offers substantial discounts if you’re a student, teacher, or military member

Who Morningstar is Best For

If you think you will actively use Morningstar’s advanced features like comprehensive fund analysis for selection decisions, fair value estimates for stock picking, portfolio X-Ray for risk management, and educational resources for skill development – then Morningstar may be a good fit for you.

However, if you’re a passive index investor, technical trader, or seeking simple portfolio tracking – you will find better value elsewhere.

4. Betterment: Best for Automated Tax-Optimized Investing

If you’re seeking robo-advisor features then Betterment is a solid option. It also has a strong focus on tax efficiency, helping you with Tax Loss Harvesting.

You can set multiple investing goals with individual timelines – such as retirement planning, emergency funds, and major purchases – and Betterment’s robo-advisor will build an investing strategy to help you achieve them.

You’ll have access to 10 different portfolio strategies to further customize your investing, including:

- Core Portfolio

- The Innovative Technology portfolio focusing on AI and clean energy

- Three socially responsible investing options (Broad Impact, Climate Impact, Social Impact)

Advantages

Betterment combines automated investing with sophisticated tax optimization to maximize your after-tax returns.

- Tax optimization with Tax Loss Harvesting. Betterment says most customers offset fees through tax savings.

- Hands-off investing. Betterment’s robo-advisor automatically rebalances your portfolio, and reinvests dividends.

- Set your goals and risk tolerance so that Betterment’s robo-advisor can trade your way.

- Manage your cash and earn 4.00% APY (variable).

Drawbacks

Betterment does come with notable restrictions that limit your control.

- Cannot buy specific stocks, only ETF portfolios. No options, commodities, or alternative investments.

- 1.6/5 Trustpilot rating with complaints about account freezes, slow support responses, and difficulty withdrawing funds.

Pricing

Betterment’s fee structure is designed to be simple and transparent. Here’s how pricing works across various account balances.

- $4/month for accounts under $20,000

- 0.25% annual fee once accounts exceed $20,000 or maintain regular deposits

- Can result in expensive 0.48% effective fee on a $10,000 balance

- No trading commissions or transfer fees

Who Betterment is Best For

Betterment is best for you if you’re a beginner just getting started in your investing journey. Its clear guided onboarding and robo-advisor features make investing easy. But you do lose some control in exchange for simplicity.

It’s fine to start out with a platform like Betterment, but to truly master investing you need to build your own stock research and analysis skills.

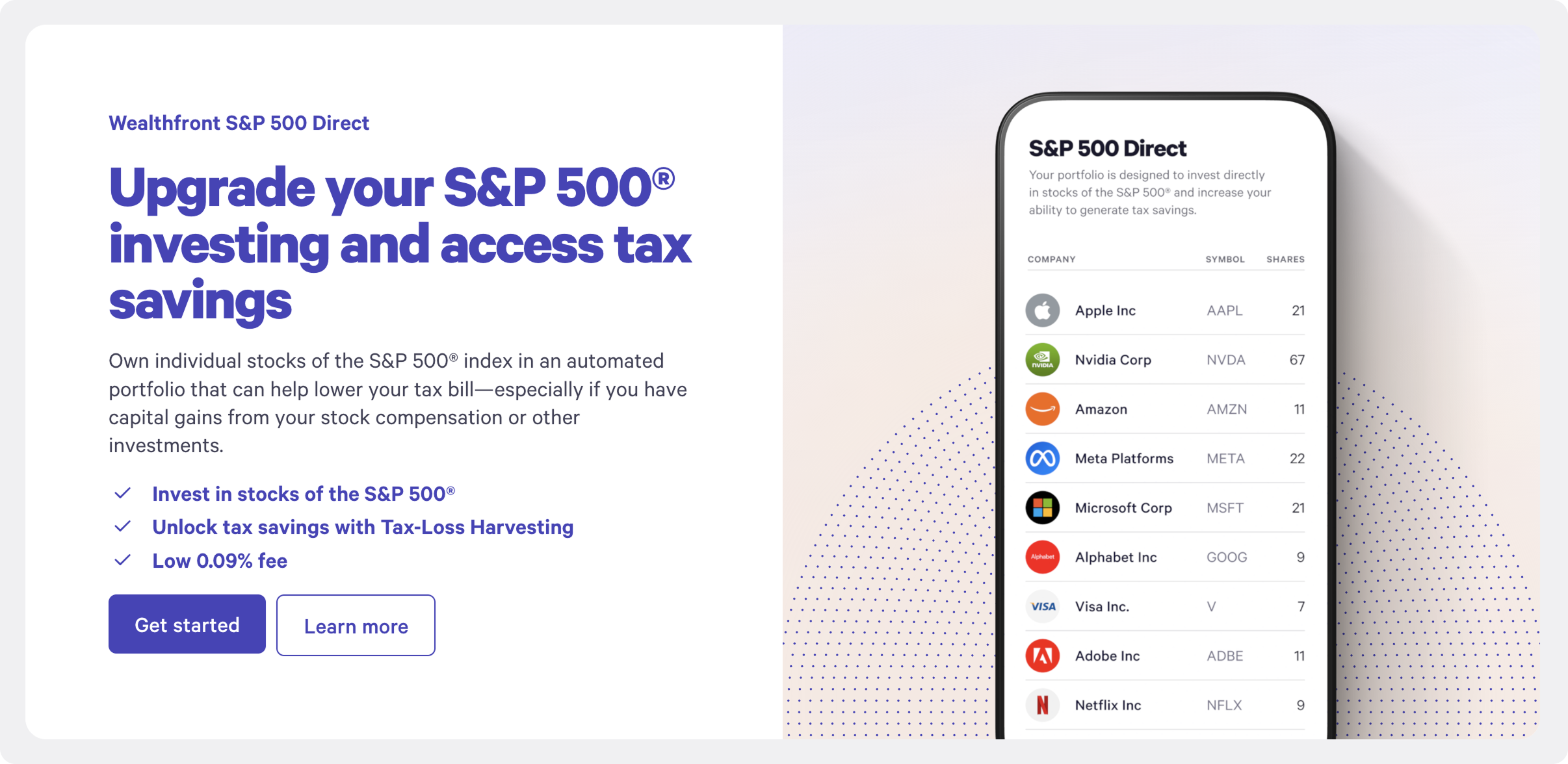

5. Wealthfront: Best for Direct Indexing and Advanced Automation

Wealthfront, like Betterment, lets you automate your investing. You’ll be able to invest in up to 17 global asset classes through low-cost ETFs.

Wealthfront’s research team is led by Dr. Burton Malkiel, author of “A Random Walk Down Wall Street.”

Its Core portfolios are founded upon Modern Portfolio Theory – using it to find the portfolio with the maximum return based on your selected risk tolerance.

Like Betterment, Wealthfront is also very strong in tax loss harvesting. Wealthfront estimates 96% of their customers covered their fees thanks to its tax loss harvesting feature.

If you’re a tech-savvy investor with substantial taxable assets who wants hands-off wealth management – Wealthfront may be a good fit for you.

Advantages

Wealthfront gives you access to sophisticated features typically reserved for ultra-high-net-worth investors.

- Commission-free stock trading for self-directed investing.

- Direct indexing at $100,000+ allows the platform to buy individual stocks instead of ETFs.

- Sophisticated automation includes automatic rebalancing, dividend reinvestment, and portfolio drift monitoring.

- High-yield cash account currently offering 4.00% APY (variable) on uninvested cash.

- Borrowing available with a Portfolio Line of Credit for qualifying accounts.

Drawbacks

Consider Wealthfront’s drawbacks before committing to the platform.

- No human financial advisors. Unlike competitors like Betterment Premium.

- $500 minimum locks out true beginners.

Pricing

Wealthfront keeps its pricing simple with a flat advisory fee across most services.

- Standard portfolios: 0.25% annual advisory fee with $500 minimum.

- Automated Bond Ladder: 0.15% annual fee with $500 minimum.

- S&P 500 Direct: 0.09% annual fee with $5,000 minimum.

- Portfolio Line of Credit: 5.41% interest rate (variable).

Who Wealthfront is Best For

If you’re comfortable with algorithm-driven investment management and have taxable investment accounts, as well as a long-term investment horizon – then Wealthfront may be suitable for you.

But if you prefer doing your own stock research and building your own portfolios, then a dedicated research platform may be more suitable.

6. SigFig: Best For Free Service on Small Portfolios

SigFig is another robo-advisor – but it also provides access to human financial advisors.

You’ll receive free service on your first $10,000 – helping you get started if you’re new to investing and starting to build your portfolio.

If you’re seeking robo-advisor features without high fees with human advice to support your investing – SigFig may be a good fit for you.

Advantages

SigFig gives you free portfolio tracking with optional robo-advisory services at competitive prices.

- Free management on the first $10,000 means your $40,000 portfolio only pays fees on $30,000.

- Unlimited human advisor access included at no extra cost (competitors charge you 0.40-0.65% or more for similar).

- Tax-loss harvesting included (but only activates at $10,000).

- Free portfolio tracker with no account minimum. Includes account aggregation and fee analysis.

Drawbacks

Unfortunately, SigFig has a history of poor reviews. It also has high account minimums compared to other platforms in the space.

- Very poor user rating (-30 recommendation score on SuperMoney, 2.4/5 stars)

- No support for 401(k)s, 529 plans, trust accounts, or business accounts.

- $2,000 minimum for managed accounts is WAY higher than Betterment ($0) or Wealthfront ($500).

Pricing

Sigfig actually charges you less money if you’re just getting started. Unlike other platforms with flat-rate fixed fees for small portfolios (which really eat into your returns.)

- First $10,000: Free management (no fees)

- Above $10,000: 0.25% annual fee (approximately $2.08/month per $10,000)

- ETF expense ratios: 0.07% to 0.15% annually

Who SigFig is Best For

SigFig is best if your portfolio is already over $2000, and you want to track your portfolio across multiple brokerages.

7. Sharesight: Best for Global DIY Investors

Sharesight provides you with detailed analytics for 750,000+ stocks, ETFs, Funds and Cryptocurrencies across 60+ international exchanges.

If you’re located (or have tax obligations) in Australia, New Zealand, Canada, the UK, or the US you’ll benefit from automated tax reporting.

Along with its global presence, Sharesight provides integrations with 240+ brokers worldwide.

Sharesight is worth checking out if you’re managing multi-currency global portfolios and need tax features to handle global reporting requirements.

Advantages

If you’re an international investor you’ll appreciate Sharesight’s comprehensive global market coverage and multi-currency support.

- Tax reporting with FIFO/LIFO methods, franking credit tracking for Australian investors, and FIF reports for New Zealand users.

- 240+ broker integrations with Interactive Brokers, Charles Schwab, CommSec, Hargreaves Lansdown etc.

- ETF X-ray analysis reveals underlying holdings within funds, showing your true portfolio exposure.

- Strong user ratings with 4.0/5 star average on Trustpilot.

Drawbacks

Sharesight comes with a steep price tag that may not justify the cost if your portfolio is on the smaller side.

- Expensive for small portfolios – at $372+ annually for useful features, costs can exceed $4 per trade if you are an occasional investor.

Pricing

Sharesight’s tiered pricing can become expensive quickly. Consider opting for cheaper plans if your portfolio is small, so that costs do not eat into your returns.

- Free: 1 portfolio, up to 10 holdings, basic features

- Starter: $7/month annually ($9.33 monthly) – 30 holdings, cash accounts

- Standard: $18/month annually ($24 monthly) – Unlimited holdings, 4 portfolios, tax reports

- Premium: $23.25/month annually ($31 monthly) – 10 portfolios, priority support

Who Sharesight is Best For

If you actively manage international investments across multiple markets and need professional tax reporting for Australia/NZ/Canada/UK – then Sharesight may be a good fit for you.

8. M1 Finance: Best for Disciplined Automated Investing

M1 Finance aims to be your one stop finance app – combining robo-advisor automation with full portfolio customization control at zero management fees.

Its signature “pie investing” visualization system transforms your complex asset allocation data into intuitive visual portfolios.

If you want to trade without the 0.25% annual fees common among competitors like Betterment or Wealthfront – then M1 Finance is worth a try.

Advantages

M1 Finance delivers you automation features without the management fees charged by traditional robo-advisors.

- Dynamic rebalancing without selling automatically allocates new deposits and dividends to underweight positions.

- Pie-based visual portfolio management transforms asset allocation into intuitive circular charts with up to 100 “slices.

- Fractional share support across 6,000+ stocks and ETFs enables precise allocation maintenance even if you have a portfolio.

Drawbacks

M1 Finance has significant limitations and concerning regulatory issues. Consider carefully before opening an account.

- No automatic tax-loss harvesting puts you at a significant disadvantage versus modern robo-advisors that include this feature.

- $100 ACATS transfer fee plus $100 IRA termination fee create expensive exit barriers.

- $850,000 FINRA fine in 2024. M1 was fined due to misleading influencer marketing practices. Raises questions about ethics and authenticity.

Pricing

M1 Finance has zero management fees but includes some other charges. Here’s the complete breakdown of costs so you know what to look for.

- Basic investing: $3/month for accounts under $10,000 (automatically waived at $10,000+)

- Management fees: $0 regardless of account size

- Trading commissions: $0 for stocks and ETFs

- Account minimums: $100 for brokerage, $500 for retirement accounts

- Transfer out fee: $100 ACATS fee plus $100 for IRA termination

- Cryptocurrency trading: 1% fee through Bakkt partnership

Who M1 Finance is Best For

M1 Finance is suitable if you follow a long-term buy-and-hold investment strategy, want portfolio automation, and don’t want to pay management fees.

How to Choose the Right Investment Portfolio Management Software

Selecting the right portfolio management software depends on your investing style, portfolio complexity, and specific goals. The key is to find the platform that best fits your needs without overpaying for features you won’t use.

Start with Free or Cheap Options

Before you commit to any paid subscription, test the waters with free platforms to understand what features actually matter for your investing style.

Empower offers institutional-grade analytics at zero cost, so it’s a good starting point.

You’ll get comprehensive net worth tracking, retirement planning with Monte Carlo simulations, and a powerful fee analyzer.

Empower’s free tier gives you comprehensive portfolio tracking, retirement planning, and fee analysis – enough to understand your complete financial picture.

After using Empower’s portfolio tracking for a few weeks, you’ll know whether you need automated investing(consider Betterment) or advanced research tools for stock selection.

Check Broker Compatibility First

You’ll want to find a portfolio management tool that connects to your existing accounts (brokers, banks, etc.)

Empower connects with over 20 account types including all major brokerages, while Sharesight offers 240+ broker integrations globally (which should have just about anyone covered!)

If you’re planning for retirement, be sure to pay attention to retirement account support. Some platforms like SigFig can’t sync 401(k)s or 529 plans.

Consider Your Investment Style

If you’re an active investor (trading regularly), you’ll need different tools than buy and hold investors. Tax-loss harvesting features from Betterment or Wealthfront won’t help if you’re entering and closing positions multiple times per month.

If you’re a passive investor, you will benefit most from automated rebalancing alerts and long-term performance tracking.

M1 Finance’s pie investing system is excellent if you want a set-it-and-forget-it portfolio.

Forward-looking research tools become truly valuable when you want to identify undervalued opportunities to hold long term.

What Premium Features Actually Matter

Focus on features that directly improve returns through tax savings (Betterment/Wealthfront’s harvesting) or significant time savings (automated rebalancing).

Tax-loss harvesting from Wealthfront or Betterment can save 0.5-2% annually – which easily covers your subscription costs.

Advanced analytics platforms can unlock institutional-grade data that was previously accessible only to Wall Street professionals, including forward valuations, comprehensive scoring systems, and access to detailed financial data.

Stock screeners help you discover opportunities across the market by filtering stocks based on financial metrics, growth prospects, and valuation criteria.

The right premium features pay for themselves many times over through improved portfolio performance.

Tax Optimization

The right portfolio management software can help you keep more of what you earn through strategic tax features.

Tax-loss harvesting involves selling securities at a loss to offset capital gains taxes. The best platforms automate this process, potentially saving you 0.5-2% annually on taxable accounts.

Automated tax-loss harvesting:

- Wealthfront: Industry leader with daily harvesting across all accounts over $500. Their direct indexing feature (accounts $100k+) enables stock-level harvesting for even greater tax efficiency. Estimated savings: 1.8% annually for typical investors.

- Betterment: Harvests losses daily with no minimum balance. Claims most customers offset their 0.25% fee through tax savings alone. Coordinates harvesting across household accounts to avoid wash sales.

- M1 Finance: No automatic harvesting – a significant disadvantage for taxable accounts.

Platform Integrations & Connections

The best portfolio management software connects seamlessly with your entire financial life.

Empower has a strong connections network through its partnership with Yodlee. Connections include major US brokerages: Fidelity, Schwab, Vanguard, E*TRADE, TD Ameritrade, Robinhood, and Interactive Brokers. It also boasts comprehensive retirement account support.

Quicken gives you broad financial institution coverage with thousands of connections globally. If you’re in Canada you’ll benefit from Canadian bank and brokerage support through Quicken Canada. You can also export to TurboTax and Quickbooks.

Morningstar covers major US brokerages with automatic sync, including Charles Schwab, Chase, Fidelity, E Trade, Principal, Wells Fargo, and more.

Betterment integrates with Plaid, giving you instant connections with your external bank accounts. Plaid offers connection to thousands of financial institutions for seamless account setup on Betterment.

Wealthfront provides major brokerage tracking for a comprehensive financial picture. The platform includes Coinbase integration for cryptocurrency visibility.

SigFig connects with partner brokerages including Fidelity, Charles Schwab, and TD Ameritrade. The platform explicitly supports trust accounts along with individual, joint, and all IRA types.

M1 Finance offers basic account aggregation through Plaid for external account tracking. Integrations with both TurboTax and H&R Block are both available to help you with tax reporting.

Sharesight leads in global integration with 150+ verified broker connections worldwide. Australian investors get CommSec with bulk import and automatic syncing, while Canadian users can connect with Questrade, TD Direct, and RBC Direct.

Start Building Your Smarter Portfolio Today

Managing your investments doesn’t have to mean juggling multiple platforms or drowning in spreadsheets. The right portfolio management software transforms chaos into clarity, helping you make data-driven decisions that actually move the needle on your returns.

While free trackers like Empower give you the big picture and robo-advisors like Betterment automate the basics, serious investors need deeper intelligence to outperform the market. That’s where forward-looking analysis becomes your edge.

Start with Empower’s free tier for comprehensive portfolio tracking, then consider upgrading to paid features or adding specialized research tools as your investment needs grow more sophisticated.

How Gainify Helps You Find Better Investment Opportunities

While the portfolio management platforms above are great for tracking your existing investments – finding the right stocks to invest in is often the bigger challenge. This is where Gainify comes in – as your investment research tool.

Custom & Pre-Built Stock Screeners

Gainify’s powerful screening tools help you discover investment opportunities across 25,000+ stocks. Both custom screeners with high customizability and pre-built screeners are available.

When you sign up for Gainify you’ll have access to:

- Custom screeners: Filter by forward P/E ratios, FCF yield, growth metrics, and dozens of other criteria.

- Pre-built screens: Ready-made filters for dividend stocks, growth companies, value opportunities, and trending sectors.

- Thematic investing: Screen for AI stocks, clean energy companies, dividend aristocrats, and other investment themes.

Thematic Watchlists & Organization

With Gainify you can create unlimited themed watchlists to organize potential investments by strategy:

- Growth portfolio watchlist for high-growth companies

- Dividend income watchlist for steady income generators

- Value opportunities watchlist for undervalued stocks

- Sector-specific watchlists (tech, healthcare, financials, etc.)

- Custom themes based on your investment thesis

You can even fork entire portfolios from top Wall Street investors to your own watchlist.

Gainify Rating System

The proprietary Gainify Rating analyzes stocks across five key dimensions to help you identify the strongest opportunities. This comprehensive score from 1 to 100 distills over 100 data points and considers:

- Financial Health – Examines debt and liquidity metrics like Debt-to-EBITDA to assess the company’s ability to manage its financial obligations

- Outlook – Evaluates growth potential using projected revenue and EPS growth, comparing the stock’s potential to peers and the market

- Valuation – Assesses metrics like P/E Ratio, FCF Yield, and Dividend Yield to show how the stock’s price aligns with earnings and revenue

- Performance – Reviews 5-year historical growth in revenue and stock price to indicate the company’s track record and consistency

- Momentum – Analyzes recent trends and investor interest through metrics like 90-day price change and Relative Strength Index (RSI)

World’s Largest Database of Analyst Estimates

Gainify is one of the best ways to access institutional-grade data that was previously only available to Wall Street professionals.

You’ll have access to S&P Global Intelligence data – the same source used by professional investors – covering:

- Valuations data (up to 10 years history)

- Analyst estimates covering 3+ years of projections

- Consensus targets compiled from leading research firms

Gainify AI & Earnings Intelligence

AI-powered analysis from Gainify helps you research and compare stocks to understand which companies are worth a place in your portfolio:

- 50+ monthly AI queries on paid plans to ask about earnings trends, competitive positioning, and growth prospects

- AI earnings call summaries that capture management sentiment and guidance changes

- Comprehensive earnings calendar so you never miss important company updates

- Daily snapshots showing analyst upgrades and downgrades for stocks you’re tracking

Top Investor Tracking

One feature you won’t find in many portfolio management tools is the ability to see what Wall Street investors are buying & selling.

With Gainify’s top investor tracking you can:

- Track hedge funds and institutional investors

- Monitor portfolio changes of top-performing fund managers

- Get alerts when your followed investors make new moves

- Learn from the pros by analyzing their investment strategies

Ready to upgrade your investment research? Start with Gainify’s free tier to experience AI-powered stock analysis and unlimited watchlists. Discover tomorrow’s opportunities today with the same data and tools used by Wall Street professionals.

Frequently Asked Questions

Are there good free portfolio management options?

Yes, several excellent free options exist, with Empower leading the pack for portfolio tracking. Empower provides the most comprehensive free portfolio tracking with institutional-quality analytics including retirement planning with Monte Carlo simulations, and investment checkup across 12 dimensions. For stock research and selection, there are separate specialized platforms that complement portfolio trackers with features like AI-powered stock analysis, unlimited watchlists, earnings intelligence, and access to institutional-grade financial data.

Which portfolio software connects to my brokerage?

Empower connects to virtually every major U.S. brokerage including Fidelity, Schwab, Vanguard, E*TRADE, TD Ameritrade, Interactive Brokers, Robinhood, and dozens more through Yodlee’s aggregation service. Quicken syncs with over 14,500 financial institutions, offering the broadest compatibility. Sharesight provides 240+ broker integrations globally, excelling for international investors.

Note that research-focused platforms take a different approach – instead of automatic broker syncing, you manually create watchlists of your holdings. While this requires initial setup, it allows you to organize portfolios by strategy (growth, dividends, tech stocks) and access deeper analytical insights than platforms focused purely on transaction tracking.

Can I track crypto alongside stocks?

Most traditional portfolio managers struggle with cryptocurrency, requiring workarounds or manual entry.Empower allows manual crypto entry but doesn’t automatically sync with exchanges. Quicken supports crypto holdings with manual updates. M1 Finance recently added crypto trading with 1% fees through Bakkt partnership.

For serious crypto portfolios, consider dedicated platforms like Kubera ($150 annually) which excels at DeFi and crypto tracking, or CoinTracker for tax reporting.

What’s the best portfolio tracker for beginners?

For beginners, start with Empower for comprehensive portfolio tracking. Empower’s interface remains intuitive despite professional features, with guided setup walking you through account connections.

As you gain experience, consider adding specialized research tools to help learn fundamental analysis through AI-powered insights and educational features that build investing knowledge while researching actual stocks.

What makes Gainify different from competitors?

Gainify uniquely combines AI-powered analysis with forward-looking metrics typically reserved for institutional investors. While competitors focus on historical data, Gainify’s AI analyzes earnings calls, tracks top investors, and provides forward valuations to predict future performance.

How much should I expect to pay for portfolio management software?

Quality portfolio management software ranges from free (Empower, Yahoo Finance) to $50 monthly for premium features. Most investors find optimal value between $10-30 monthly. Research platforms typically range from $7.99-$10.99 monthly for professional-grade features.

Can I use multiple portfolio management platforms simultaneously?

Absolutely. Many investors combine platforms for different purposes: Empower for free comprehensive tracking, specialized research platforms for AI insights and stock analysis, and Betterment or Wealthfront for automated investing. Using multiple platforms maximizes capabilities while managing costs.