Prem Watsa has long been called the “Canadian Warren Buffett,” a nickname that reflects his disciplined, value-oriented investment philosophy. To reduce Watsa to merely a Buffett clone, however, would be to miss the nuances of his unique approach. As the founder, chairman, and CEO of Fairfax Financial Holdings, Watsa has built a global reputation as an investor who blends insurance-driven conservatism with value-investing opportunism. Where many investors chase growth at any price, Watsa emphasizes patience, long time horizons, and careful risk management.

Unlike many fund managers who chase quarterly earnings or fashionable sectors, Watsa builds portfolios designed to withstand shocks and deliver steady long-term results. He is known for combining conservative insurance underwriting with opportunistic equity investments, a model that allows Fairfax to weather downturns while taking advantage of undervalued opportunities. His investment philosophy emphasizes not just return generation but also the preservation of capital, making him a role model for investors who prioritize resilience over hype.

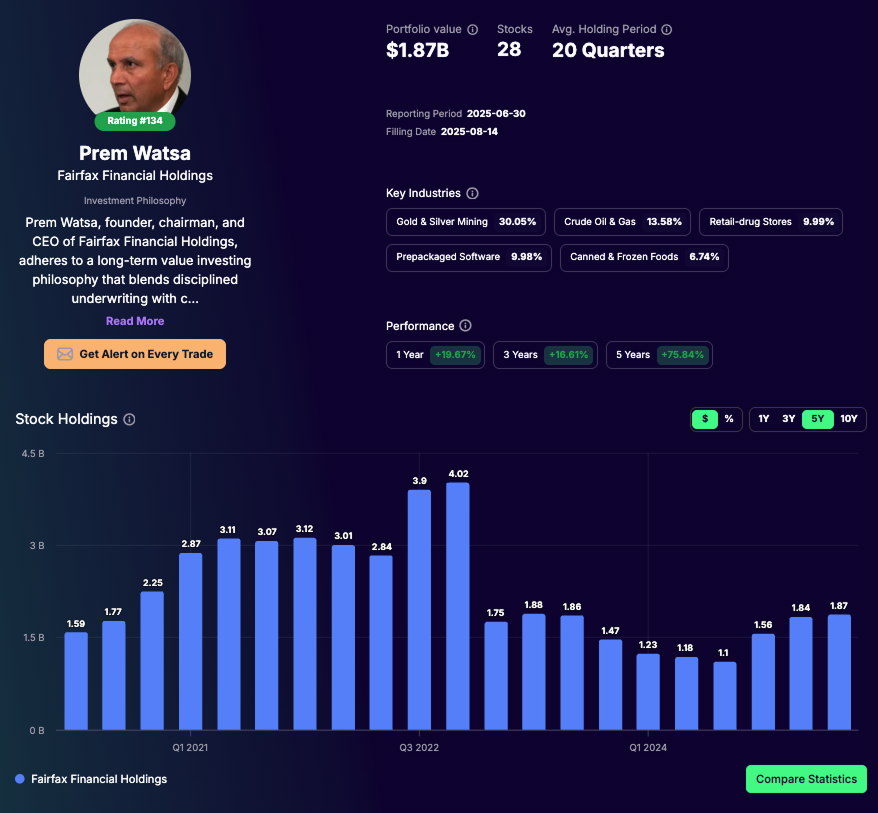

At the end of Q2 2025, Watsa’s publicly disclosed U.S. equity portfolio stood at $1.87 billion, spanning 28 individual holdings. What sets him apart is not just his stock selection but also the extraordinary average holding period of 20 quarters (5 years). In a market dominated by high-frequency trading, quarterly rotations, and hedge funds chasing momentum, Watsa’s patience stands out. He invests in businesses he understands, in industries where he sees enduring value, and then holds them through both upturns and downturns.

In this article, we take a deep and detailed dive into Prem Watsa’s Q2 2025 portfolio. We will explore his philosophy, industry allocations, top holdings, recent trades, and what his positioning reveals about how one of the most disciplined minds in investing views the world right now.

Prem Watsa’s Investment Philosophy: Value with Insurance DNA

Prem Watsa built his career on a foundation of both entrepreneurship and insurance expertise. Born in India and later moving to Canada, he founded Fairfax Financial in 1985, growing it from a small insurer into a global powerhouse. His background in insurance underwriting shaped his entire approach to investing: every decision begins with careful risk assessment and a determination to protect capital.

Like Buffett and Munger, Watsa is a value investor, but his approach goes further by weaving in lessons from decades of managing insurance float and preparing for worst-case scenarios. He prefers resilient, cash-generating businesses, holds them patiently, and often allocates heavily to themes that protect against systemic risk.

Here are the central principles that define his philosophy:

1. Long-Term Value Orientation

Watsa seeks companies trading below intrinsic value, often during times of temporary distress. He favors firms with durable business models and strong cash flow potential, such as consumer staples and healthcare companies. His goal is to allow compounding to work over decades rather than months.

2. Patience Over Activity

His average holding period is five years, and some positions, such as BlackBerry (48 quarters) and Kennedy-Wilson (57 quarters), have lasted for more than a decade. This patience reflects confidence built on deep research and trust in management teams.

3. Concentration in Themes

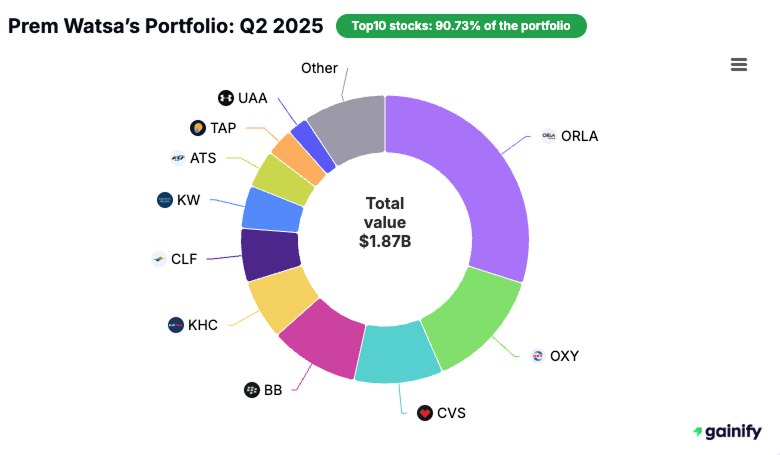

Although Fairfax holds 28 stocks, more than 90% of its value is tied up in the top 10. Gold miners account for 30% of the portfolio, energy another 13%, and defensive plays like CVS anchor healthcare. Watsa prefers conviction over excessive diversification.

4. Macro-Aware Value Investing

Unlike purely bottom-up investors, Watsa always accounts for macro risks such as inflation, interest rates, and currency shifts. His oversized bet on gold miners is as much a hedge against financial instability as it is a value play.

5. Downside Protection First

Reflecting his insurance mindset, Watsa structures his portfolio to survive extreme events. This explains his preference for real assets and defensive sectors that hold value during recessions or market shocks.

6. Contrarian Streak

Watsa is not afraid to take unpopular positions if his analysis shows long-term promise. His persistence with BlackBerry and his early support for Indian markets through Fairfax India Holdings reflect this willingness to go against the crowd.

✅ In short, Watsa’s philosophy blends Buffett-style value investing, insurance discipline, and macro awareness. He is not chasing fads but building a portfolio that can compound steadily while remaining resilient in times of crisis.

Sector Allocation: Defensive Yet Opportunistic

Watsa’s portfolio construction reflects both caution and selective aggression:

- Gold & Silver Mining – 30.05%

His single largest allocation. In an era of inflationary pressures, central bank gold buying, and geopolitical instability, Watsa sees precious metals as both a hedge and an opportunity. His Orla Mining (ORLA) position alone is nearly a third of his portfolio. - Crude Oil & Gas – 13.58%

A sector where cash flow and geopolitical significance align. Occidental Petroleum (OXY) anchors his energy bet, mirroring Warren Buffett’s heavy exposure to OXY through Berkshire. - Retail-Drug Stores – 9.99%

CVS Health provides defensive exposure to healthcare and retail. These are sectors that remain steady in both economic booms and recessions. - Prepackaged Software – 9.98%

BlackBerry, once a mobile giant, has pivoted to cybersecurity and enterprise software. Watsa has held this stock for 12 years, reflecting deep conviction despite trimming in Q2. - Consumer Staples – 6.74%

Kraft Heinz (KHC) represents his belief in the durability of brands that stock grocery shelves. His Q2 2025 addition (+45.4%) demonstrates rising confidence in staples.

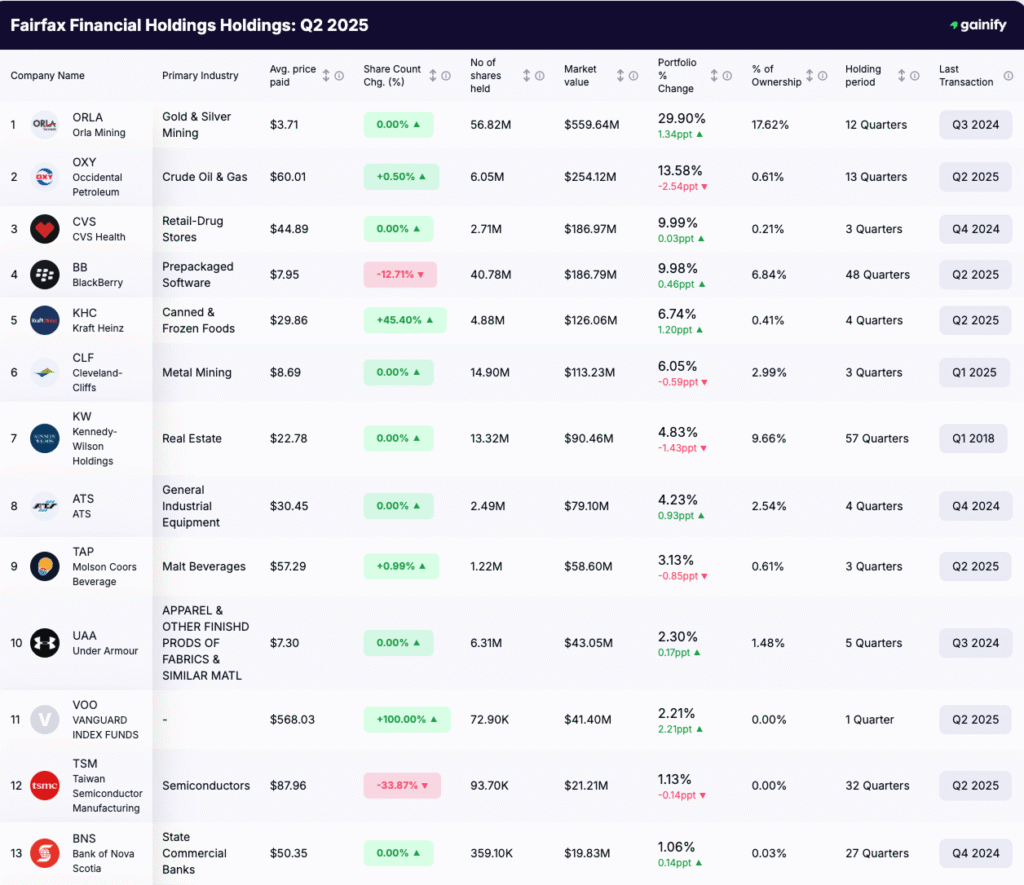

Top Holdings (Q2 2025)

Orla Mining (ORLA) – $559.64M (29.90%)

Watsa’s largest holding and the anchor of his inflation hedge. With 56.8M shares held at an average price of $3.71, this represents a long-term conviction bet. He sees ORLA as both a defensive play and an asymmetric upside opportunity if gold rallies further.

Occidental Petroleum (OXY) – $254.12M (13.58%)

Energy remains central. Watsa slightly added to OXY this quarter (+0.50%), reinforcing his view that fossil fuels remain cash generators even in an era of transition to renewables.

CVS Health (CVS) – $186.97M (9.99%)

CVS provides healthcare stability, retail presence, and recurring cash flows. It has been a steady anchor since Q4 2024.

BlackBerry (BB) – $186.79M (9.98%)

Despite cutting -12.71%, Watsa continues to hold BB as a top position. Once a smartphone pioneer, BlackBerry has reinvented itself as a cybersecurity firm. Watsa’s ultra-long holding (48 quarters) reflects conviction that BB can deliver in enterprise software.

Kraft Heinz (KHC) – $126.06M (6.74%)

Consumer staples are back in focus. Watsa increased KHC holdings by +45.40% in Q2, buying 4.88M shares at $27.76. With inflation squeezing consumers, food giants such as KHC retain pricing power.

Other top holdings include Cleveland-Cliffs (CLF), Kennedy-Wilson (KW), ATS, Molson Coors (TAP), Under Armour (UAA), and Taiwan Semiconductor (TSMC).

Q2 2025 Trades

📈 Largest Additions

- Kraft Heinz (KHC) → +45.40% ($42.33M added)

- Helmerich & Payne (HP) → +25.84% ($3.67M added)

- Occidental Petroleum (OXY) → +0.50% ($1.25M added)

- Molson Coors (TAP) → +0.99% ($661K added)

- Lifeway Foods (LWAY) → +82.06% ($338K added)

🆕 New Buys

- Vanguard S&P 500 ETF (VOO) → $38.31M new position (2.21% of portfolio)

- PENN Entertainment (PENN) → $861K position

Watsa’s buy of VOO is fascinating. For a value purist, this signals respect for broad U.S. market exposure. It is an unusual but pragmatic allocation that balances his more concentrated bets.

📉 Trims / Cuts

- BlackBerry (BB) → -12.71% ($22.45M sold)

- Taiwan Semiconductor (TSMC) → -33.87% ($8.89M sold)

❌ Sold Outs

- Micron Technology (MU) → Entire $7.47M stake liquidated

- Gentex (GNTX) → $1.86M position sold

- MGM Resorts (MGM) → $935K position sold

These sales reflect a reallocation from semiconductors and consumer discretionary into staples and energy.

Analyst’s Take

Prem Watsa’s Q2 2025 portfolio reveals an investor who:

- Trusts real assets in uncertain times with heavy allocations to gold miners and energy.

- Balances defense with staples through positions in Kraft Heinz, CVS, and Molson Coors.

- Prunes where conviction wanes by exiting Micron, Gentex, and MGM and reducing exposure to BlackBerry and TSMC.

- Experiments with diversification by adding VOO, signaling an unusual but pragmatic tilt toward broad market exposure.

Unlike Duan Yongping, who leans into concentrated technology bets such as Apple and Alphabet, Watsa remains defensive and inflation-conscious. His focus is not on chasing AI-driven growth, but on owning businesses that endure regardless of market cycles.

Conclusion

Prem Watsa’s Q2 2025 portfolio (worth $1.87B across 28 positions) is a powerful reminder of the value of discipline, patience, and defensive positioning. His conviction in Orla Mining (30%) and Occidental Petroleum (14%) shows where he sees the safest value today: hard assets with cash flow durability.

Yet he is not inflexible. His new positions in VOO and PENN demonstrate a willingness to broaden exposure when the timing is right. Meanwhile, his continued bets on consumer staples such as Kraft Heinz reflect confidence in pricing power and brand resilience.

For investors studying super-investors, Watsa teaches a timeless lesson: wealth is preserved and built not by chasing fads but by marrying discipline with selective conviction.