If you’re serious about building a winning portfolio, the quality of stock research you have access to is the difference between losing big or building a sizable source of income.

Seeking Alpha and Motley Fool are two long-established stock research and news platforms available to you as an investor. But both have very distinct approaches to bringing you top stock picks.

Seeking Alpha is a provider of what you could call “crowdsourced” stock analysis. It brings together diverse perspectives from thousands of contributors.

The Motley Fool provides select stock picks, around 2 per month on base plans (more expensive plans give you more stock picks). These picks come after extensive analysis from the Motley Fool’s internal analysts – all qualified finance professionals.

In this blog we’ll examine how each platform stacks up, and which might suit your investment style and stock research needs best.

Content Philosophy and Analysis Approach

Each stock research platform has a different approach to stock analysis (the analysis style, what is included in reports, who creates the analyses & how trustworthy their insights are, etc.).

Understanding this will help you find the right platform for your analysis needs. Perhaps you have most stock research bases covered, but you struggle with specific aspects of technical analysis or macroeconomics. Finding a platform that fills those gaps will be your first priority.

Importantly, you need to be able to trust the information. So you need to know the credentials of the source. You’ll find Seeking Alpha to be less consistent in providing credentialed expertise. While Motley Fool relies on analysis constructed by verified finance professionals.

Seeking Alpha

Seeking Alpha’s key feature is its ability to produce up to 400 unique articles daily covering all aspects of the stock market, broader economy, and a huge range of individual stocks. This is possible thanks to its large editorial team based in India, along with over 18,000 individual analysts who contribute content to the platform.

This “wisdom of crowds” approach has some advantages. Mainly that you can find a range of opinions – bull cases, bear cases, and more.

But the disadvantage is that you can’t possibly keep up with the huge flow of information. Not if you have a job, hobbies, studies, or family.

Additionally, and most importantly, you need to evaluate the author’s credentials with each new article. A content team lacking specialized credentials or experience in finance may not give you the confidence you need. Articles from community analysts – even if they have some background in finance – can vary in quality and “alpha.”

Motley Fool

The Motley Fool was founded by brothers Tom and David Gardner in 1993. David being the lead advisor for the Rule Breaker service, and serving as co-lead with brother Tom for the flagship The Motley Fool Stock Advisor subscription service.

The brothers are backed by a team of internal investment analysts – however the oversight and stability provided by the founders continued involvement provides consistency in quality and structure. This makes it easier for you to compare different stock picks across multiple recommendations and articles.

Seeking Alpha on the other hand, due to its huge number of authors (numbering in the thousands) is less consistent in its insights, analysis, and presentations.

The Motley Fool approach is to provide you a few select stock picks each month. Stocks that have passed their analyst’s reviews, and that their internal team believe are sound investments.

It is worth noting however that the Motley Fool team selects stocks based on the assumption that you will buy and hold for 5 years. They also expect that you will have a portfolio size of at least $25,000 (for their cheapest $199/year plan providing 2 stock picks each month), and up to $500,000 (for their premium $13,999/year plan providing 30+ monthly stock picks).

For many of you reading this, the Motley Fool strategy (and minimum portfolio size) may not be suitable for your investment style.

Gainify Advantage

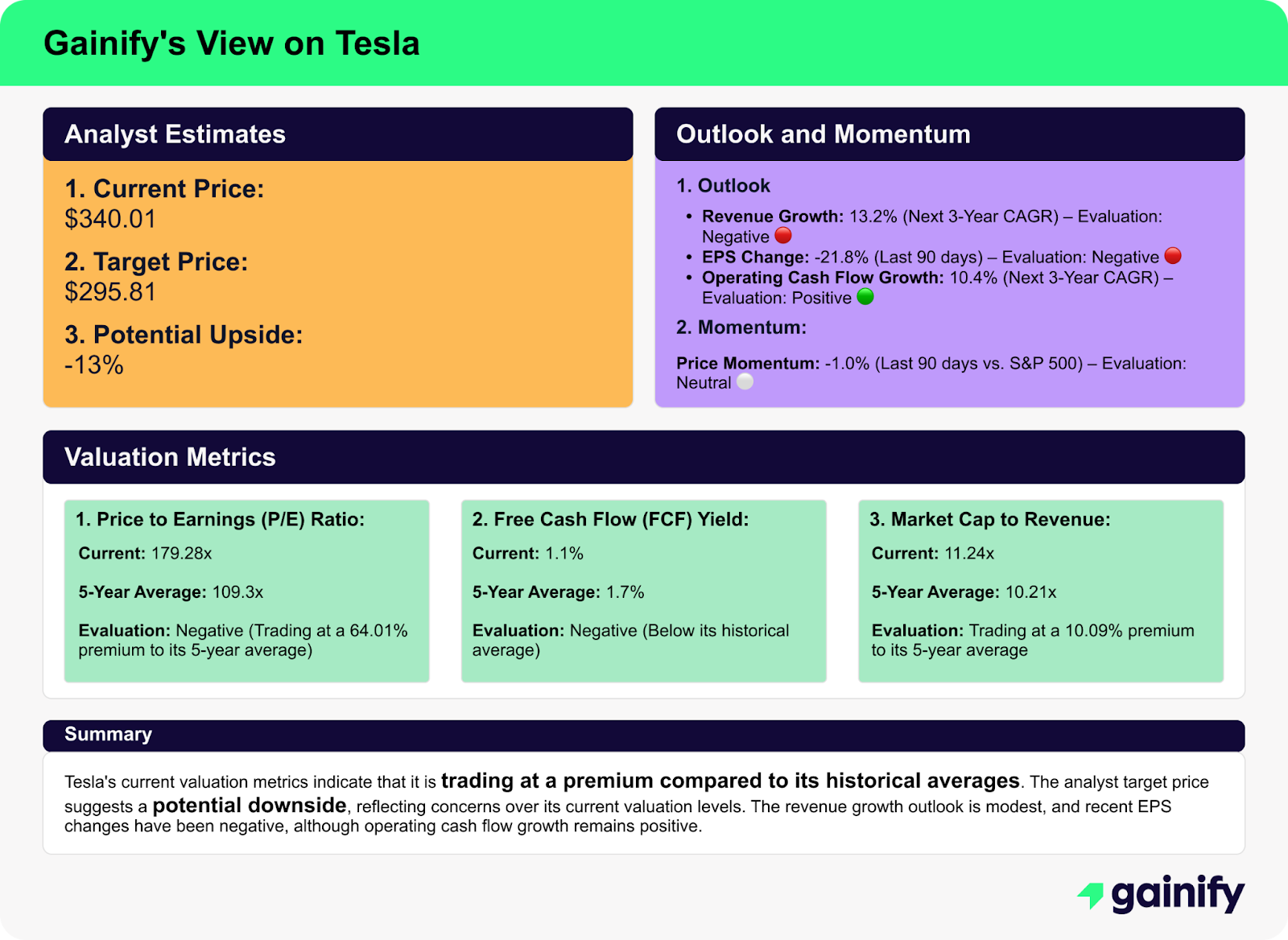

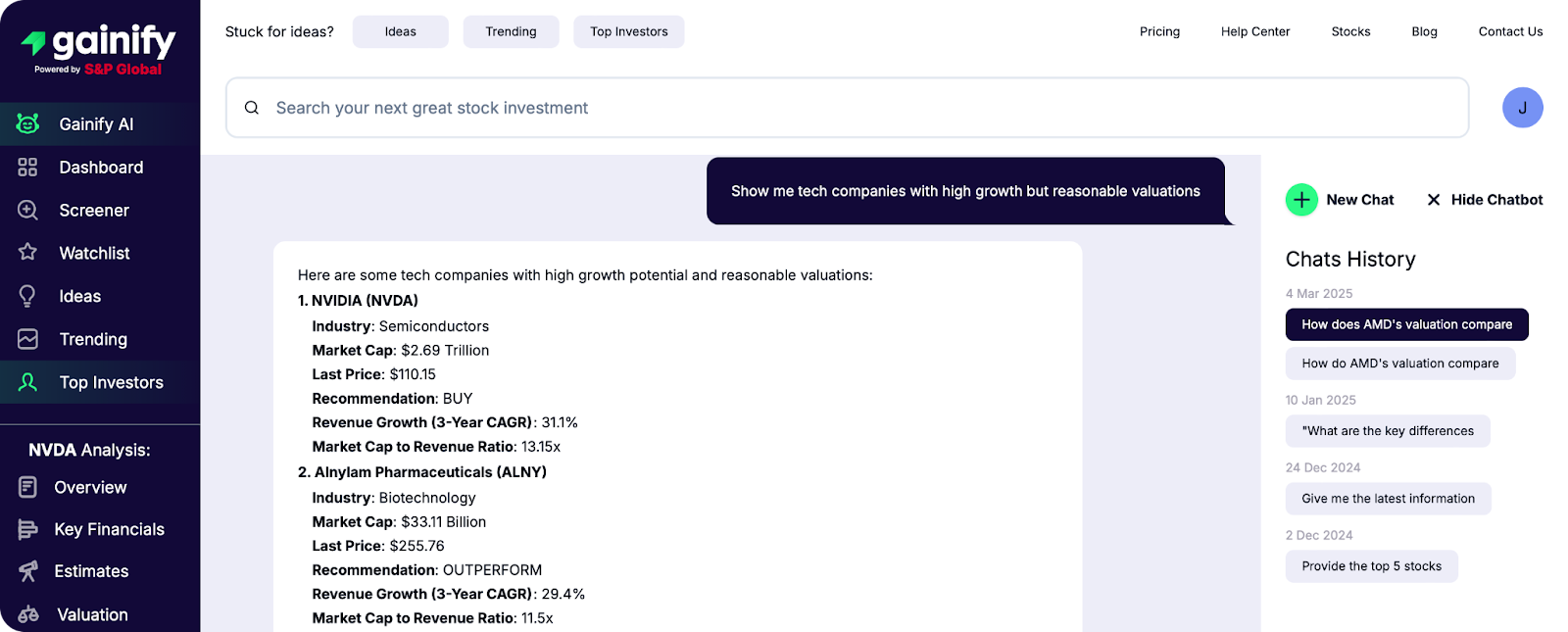

Unlike Motley Fool and Seeking Alpha which rely on analyst prepared reports – Gainify’s AI stock analysis assistant connects directly to real-time Wall Street data from S&P Global Intelligence. This allows you to ask specific questions about the stocks you’re interested in and receive data-driven answers instantly.

This approach combines the best of both worlds – providing you with diverse data points, without the information overload of Seeking Alpha or the limited perspective of Motley Fool’s analyst team.

Time to Insight

The speed at which you can uncover quality companies and actionable investment insights is vital. In this section we analyze how long it will take you to research companies with each platform.

Seeking Alpha

Seeking Alpha gives you more freedom than Motley Fool. Rather than relying on research the company decides to provide you, you’ll be able to explore a wide range of companies and industries based on your investing strategy and interests.

However, less structure means a much more time intensive research process. When researching a company like Tesla, you’ll likely need to:

- Sift through dozens of articles with contradicting viewpoints (some bullish, some bearish)

- Read multiple earnings analyses from different contributors with varying expertise

- Compare conflicting interpretations of the same financial data

- Manually extract key points from lengthy articles

For example, if you wanted to understand Tesla’s latest earnings call implications, you might need to read 5-10 different articles. After all this, you may still be left wondering which analysis to trust.

Motley Fool

Motley Fool will cut down your research time because its internal analysts do all that heavy lifting for you. At least in bringing you deep insights into what they believe are the top stocks to invest in right now.

But you still need to read the analysis reports, cross check information to validate it, and decide for yourself whether the stock is really worth investing in.

This all takes time, requiring you invest at least 1-2 hours per stock (if not more).

Gainify Advantage

Gainify dramatically accelerates the research process through its AI-powered approach:

- Instant AI responses to specific questions about any of the 25,000+ stocks in its database

- Real-time analysis of earnings calls, financial metrics, and valuation models

- Focused answers that cut through noise to deliver exactly what you need

For instance, asking Gainify AI “What are the Key Highlights, Key Debates, and Guidance and Future Outlook from the Tesla Earnings Call Summary for FY2025 Q1 2025?” will instantly generate a comprehensive summary.

Follow up with “What is the current Gainify view and analyst estimate outlook for Tesla?” for comprehensive up to date metrics to guide your decision making.

Key Financial and Operational Highlights

- Production and Deliveries: Tesla successfully updated all its factories for the Model Y, the world’s best-selling car, within a single quarter. Despite challenges, Tesla managed to sell out the legacy Model Y in major markets like the US and China.

- Energy Storage Business: Achieved record gross profit despite a sequential decline in deployments. The Megapack continues to be a significant contributor, with utility companies increasingly adopting it for energy buffering.

- Autonomy and Robotics: Tesla is focused on launching fully autonomous rides in Austin by June. The Optimus robot program is progressing, with expectations to have thousands of units in Tesla factories by the end of the year.

Key Debates of the Call

- Tariffs and Supply Chain: There was significant discussion around the impact of tariffs on Tesla’s operations, particularly concerning the energy business and the sourcing of LFP battery cells from China. Tesla is working on localizing supply chains to mitigate these risks.

- Autonomy Challenges: Analysts questioned the readiness of Tesla’s FSD (Full Self-Driving) software, particularly regarding its ability to operate without supervision. Tesla is addressing these challenges by focusing on specific launch cities like Austin to refine the technology.

- Market Penetration: Questions were raised about why Tesla’s market share in the luxury segment isn’t higher, given the superiority of the Model 3 and Model Y. Tesla’s strategy to address this includes focusing on affordability and expanding its product lineup.

This same level of insight might take hours to compile from Seeking Alpha articles or may not be available at all through Motley Fool if Tesla isn’t one of their current recommendations.

Gainify’s AI stock analysis advantage gives you an 80-90% reduction in research time, on-demand insights for any stock, and the ability to ask follow-up questions to drill deeper into specific areas of interest. All things you will miss out on with Seeking Alpha and Motley Fool.

Data Coverage and Depth

When it comes to different types of investors, you can group them into two broad psychological profiles.

The first are the net fishers – they like to “cast a wide net,” analyze a lot of information, compare many alternatives, and then take the pick of the catch.

Then you have the spearfishers – they’re content with a few solid stock recommendations and ready to pull the trigger on an investment that meets their criteria. Even if they haven’t analyze all alternatives yet.

The Motley Fool is more suited to spearfishers, while Seeking Alpha is a better fit for the net fishers of the investing world.

Seeking Alpha

With Seeking Alpha you’ll have access to strong coverage of US stocks. You’ll also find coverage beyond the large caps that capture a lot of analyst’s attention, and uncover insights into small & mid cap stocks.

Seeking Alpha provides you hundreds of articles and analyst estimates daily on almost any topic you could ever think to research.

But this data breadth comes with a lack of data depth. Some analysts may provide extremely detailed analyses – others may provide surface level insights.

Motley Fool

Because Motley Fool’s model centers around providing you with just a few stock picks each month, its data coverage is limited.

But you will be heavily reliant on what Motley Fool chooses to analyze for you – which can be as little as two stocks per month.

The analyses you do receive are deep, well thought out, and provide a lot of information for you to chew on. The format, quality, and style are very consistent across publications.

Gainify Advantage

Gainify tracks data for over 25,000 public companies across 29+ exchanges, with extensive historical analyst estimate data and 3-year forward projections.

While Seeking Alpha exceeds in data breadth – much of what you read on the platform will be a mix of opinion, anthropological style insights, and analysis.

Gainify on the other hand provides what can be called “analytical data breadth.” You’ll have access to a broad range of analytics, charts, proprietary metrics, and forecasts for every stock available on Gainify.

Neither Motley Fool or Seeking Alpha can match this level of comprehensive stock analytics.

Gainify also exceeds in data depth – each stock comes with up to a decade of history for key metrics, earnings call transcripts, and more. Not to mention proprietary metrics not found elsewhere – designed to dive deep into 5 crucial aspects of a company: Outlook, health, valuation, performance, and momentum.

User Experience and Information Processing

You’ll have trouble unlocking actionable insights if information is not presented in a way you can easily process. Text heavy articles and reports are among the most time consuming stock research mediums out there. Seeking Alpha and Motley Fool mostly provide this kind of stock analysis – articles and reports.

To uncover quality companies and actionable insights fast – you really need a platform boasting a range of visualizations, graphs, and charts. Something Motley Fool and Seeking Alpha struggle to deliver on as well as available alternatives do.

Seeking Alpha

You’ll probably feel overwhelmed by Seeking Alpha’s interface – there’s a lot of information to process and its hard to know where to get started or how to find what will really be useful for you.

When you have so much information about so many stocks, and no definitive voice or authoritative analysis, you may experience analysis paralysis (the inability to make a decision due to having too many options and too many factors to compare.)

The platform lacks a comprehensive range of visualizations to help you quickly understand and compare stocks.

Motley Fool

Motley Fool only provides a few stock picks per month. So you won’t have dozens or even hundreds of articles to analyze.

However, these articles can be a mix of text-heavy information, with some charts and graphs included. You will need to spend a lot of time reading research and opinions.

Additionally, stock research reports are only one type of information you’ll be exposed to as a Motley Fool subscriber. The other type is marketing materials disguised as stock insights. Users complain of being bombarded with constant marketing messages and upsells.

Gainify Advantage

Gainify’s clean, intuitive interface and extensive use of data visualizations dramatically reduce your research time.

Its AI earnings call summaries transform hour-long transcripts into actionable investing insights in seconds.

It would take you many hours to get the same insights from Seeking Alpha or Motley Fool.

Price vs. Value

The investment research platforms you’ll find on the market today vary widely in cost.

Platforms that rely on analyst-prepared reports, like Motley Fool, tend to be among the most expensive. Those such as Seeking Alpha, which are still very much “analyst report” focused but use a mix of crowd-sourced analyst insights and internal content creation, tend to be a little cheaper.

But the best value for money is typically found in more modern stock research solutions. Those like Gainify which provide access to real-time Wall Street data in a clean app interface, with useful visualizations and AI stock analysis features built in.

Seeking Alpha

Seeking Alpha’s premium tier at $299/year offers reasonable value if you’re an avid reader. But the Pro tier at $2,400 annually may be tough to justify for the average retail investor.

Motley Fool

Motley Fool’s Stock Advisor at $199/year is competitively priced. But their premium tiers reach $13,999/year (Fool One) – truly out of reach for most retail investors.

The biggest problem you will face, however, is not the cost of subscriptions. It is that even the lowest-priced tier requires a portfolio of at least $25,000. This is Motley Fool’s own recommendation, so you can actively invest in and hold all recommendations (2 per month) for 5 years.

Gainify Advantage

Gainify offers institutional-grade data and AI tools starting with a generous free tier and maxing out at just $26.99/month for the top tier Gainer Pro plan.

This gives you far more comprehensive tools and data access, unlimited stock reports, and 500 AI queries per month.

You’ll get much more value for your money from a setup like this.

Key Takeaways: Choosing Your Stock Research Platform

There are four main factors you should consider when selecting an investment research platform:

- Research style: Do you prefer reading diverse opinions (Seeking Alpha), following expert recommendations (Motley Fool), or leveraging data-driven AI insights (Gainify)?

- Time investment: Consider how much time you can dedicate to research. Seeking Alpha requires significant time to process information. Motley Fool requires less time but also gives you less flexibility. Gainify’s AI tools dramatically reduce research time.

- Budget sensitivity: Assess value relative to your portfolio size. Premium services that cost between $299 and $13,999 per year must generate significant additional return to justify their cost.

- Decision making: Do you prefer making independent decisions with information support or following specific recommendations from professionals?

For an increasing number of investors in 2025, the ideal solution combines the best elements of fundamental research with the efficiency and depth of AI-powered analysis – the best solution is Gainify.

Gainify: The Complete Stock Research Platform for Modern Investors

Both Seeking Alpha and Motley Fool are well-established stock research platforms.

Gainify presents a fundamentally different approach to stock analysis. Less text-heavy analyst reports and more high-powered stock analysis tools to help you uncover quality companies yourself.

You’ll benefit from real-time Wall Street data, top investor tracking, AI stock analysis, earnings calendar and earnings call summaries, customizable stock screeners, and more.

AI-Powered Research

Gainfy’s AI is connected to real-time Wall Street data from S&P Global Intelligence – making it the premier AI stock analysis assistant available to investors today.

With Gainify AI you can:

- Analyze companies: “What is Gainify’s view on Apple stock right now?”

- Compare competitors: “Compare Visa and Mastercard on growth, margins, and valuation”

- Analyze industries: “Which healthcare sub-sectors have the highest profit margins?”

- Find dividend stocks: “Which banking stocks pay the best dividends right now?”

You’ll also be able to make use of Gainify’s earnings call analysis. It turns hour-long earnings call transcripts into concise, actionable summaries. You’ll gain a quick overview of the key strategic points, management sentiment, forward guidance, and critical metrics mentioned in an earnings call.

Find What’s Hot In the Markets

Today’s markets move fast. It can feel like you’re always missing out on the top opportunities. This can be especially frustrating when it comes out later that a few insiders seemed to know well before you ever could have.

With Gainify, that has changed. You gain access to multiple powerful approaches to help you spot which stocks are hot right now.

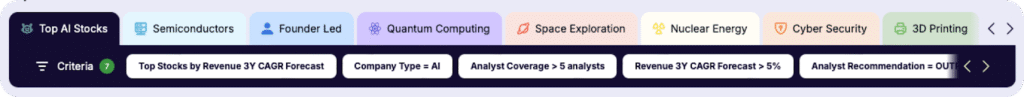

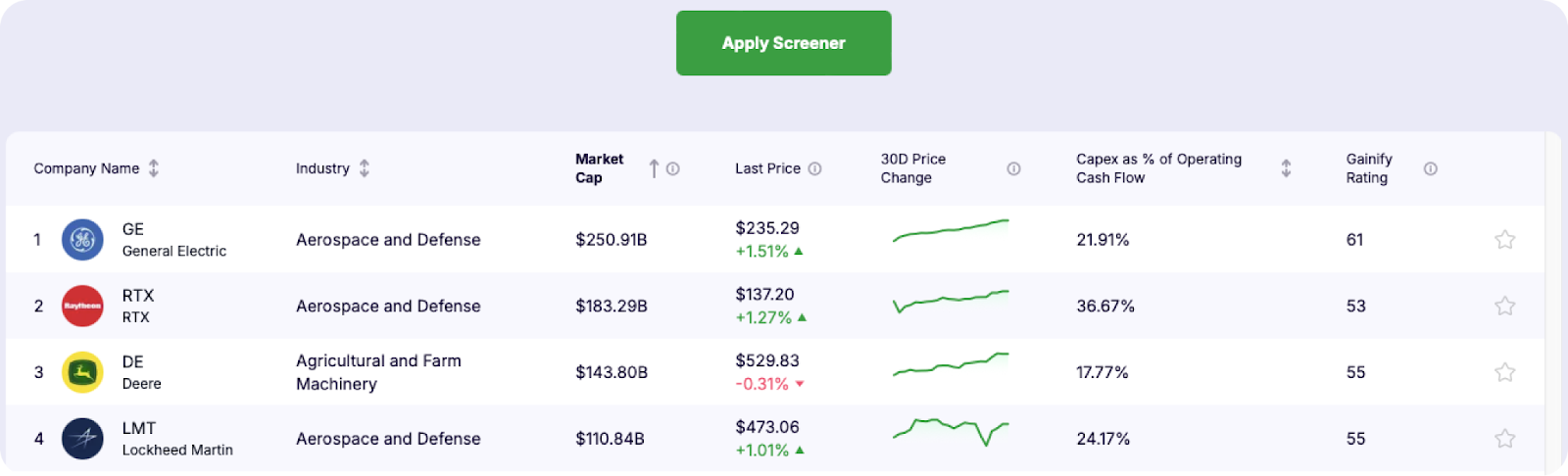

Pre-built thematic screeners

Thematic screeners cover AI stocks, growth stocks, dividend champions, the semiconductor industry, and more. These help you uncover quality companies aligned with your investment philosophy in minutes.

Customizable screeners

Make use of over 370 metric-based filters covering fundamental analysis and forward-looking estimates. Discover quality companies that match your precise investment criteria, on autopilot with customized screeners.

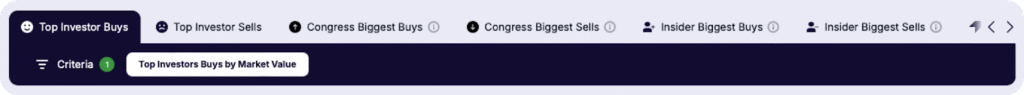

Top investor tracking

Want to see what top investors are buying and selling, and then dive into deeper stock research from there? Gainify’s top investor tracking is a great place to start if you want to replicate the success of Wall Street’s best.

You’ll be able to:

- Compare top investor’s portfolios head to head

- Copy winning portfolios to your own watchlist and attempt to replicate top funds’ success

- Get alerts as soon as top investors’ trades are registered so you can have your finger on the pulse at all times

Insider & Congress tracking

Gainify’s Congress and insider tracking tool reveals how corporate executives and Congress members are trading.

If you feel like you’re often too late to a stock, and tired of hearing about corporate insiders & Congress members who seemed to know something important before you ever possibly could, insider tracking is for you.

Frequently Asked Questions

Does Seeking Alpha or Motley Fool offer better returns?

Motley Fool’s Stock Advisor has documented market-beating returns over a 20+ year period, while Seeking Alpha’s performance varies widely based on which contributors you follow. However, neither platform guarantees future returns, and actual results depend on your implementation of their insights.

Are the premium subscriptions worth the cost?

The value depends on your portfolio size and how you use the platforms. Motley Fool’s Stock Advisor ($199/year) can be worthwhile for investors with at least $10,000 to invest, while Seeking Alpha Premium ($239/year) delivers value for active researchers. However, the highest tiers of both services are difficult to justify for most retail investors.

Can I get good results using just the free versions?

Seeking Alpha’s free tier provides limited but useful content, though with significant limitations. Motley Fool offers minimal value without a paid subscription. For investors seeking free resources, Gainify’s free tier provides exceptionally strong value with access to core AI capabilities, analyst estimates, and investor tracking features with usage limits.

How much time do I need to spend on research with each platform?

Seeking Alpha requires significant time investment to read and analyze multiple perspectives. Motley Fool requires less time but offers less flexibility. Gainify’s AI tools can reduce research time by 80-90% while maintaining or improving analysis depth, making it the most efficient option for time-constrained investors.

What if I want to follow specific investment styles?

Seeking Alpha covers diverse strategies but requires filtering. Motley Fool focuses primarily on growth investing with limited options for value or dividend strategies. Gainify’s AI assistant and comprehensive data enable tailored research across any investment style, with the added benefit of top investor tracking for those who want to follow proven strategies from investors like Warren Buffett or Cathie Wood.