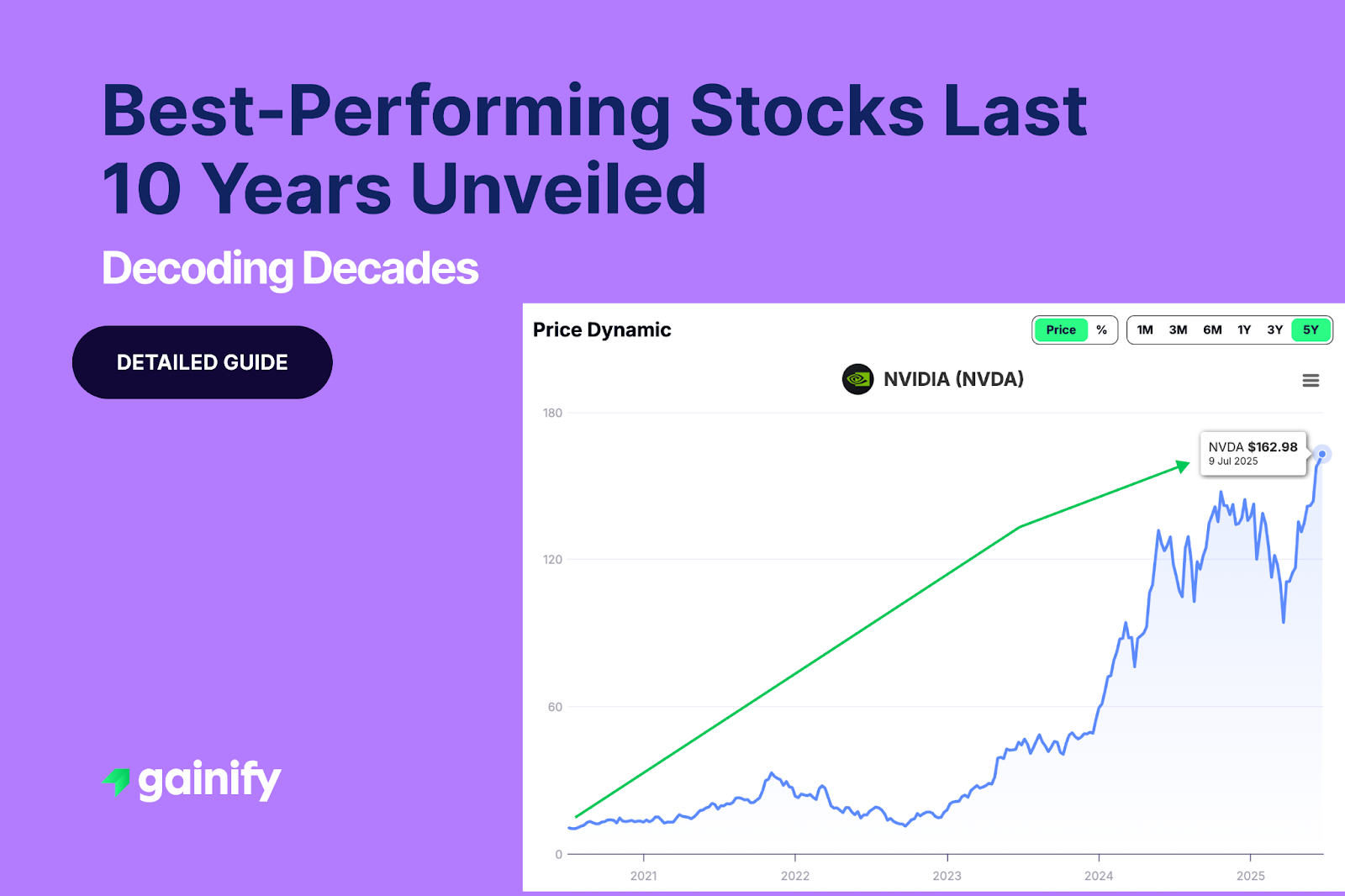

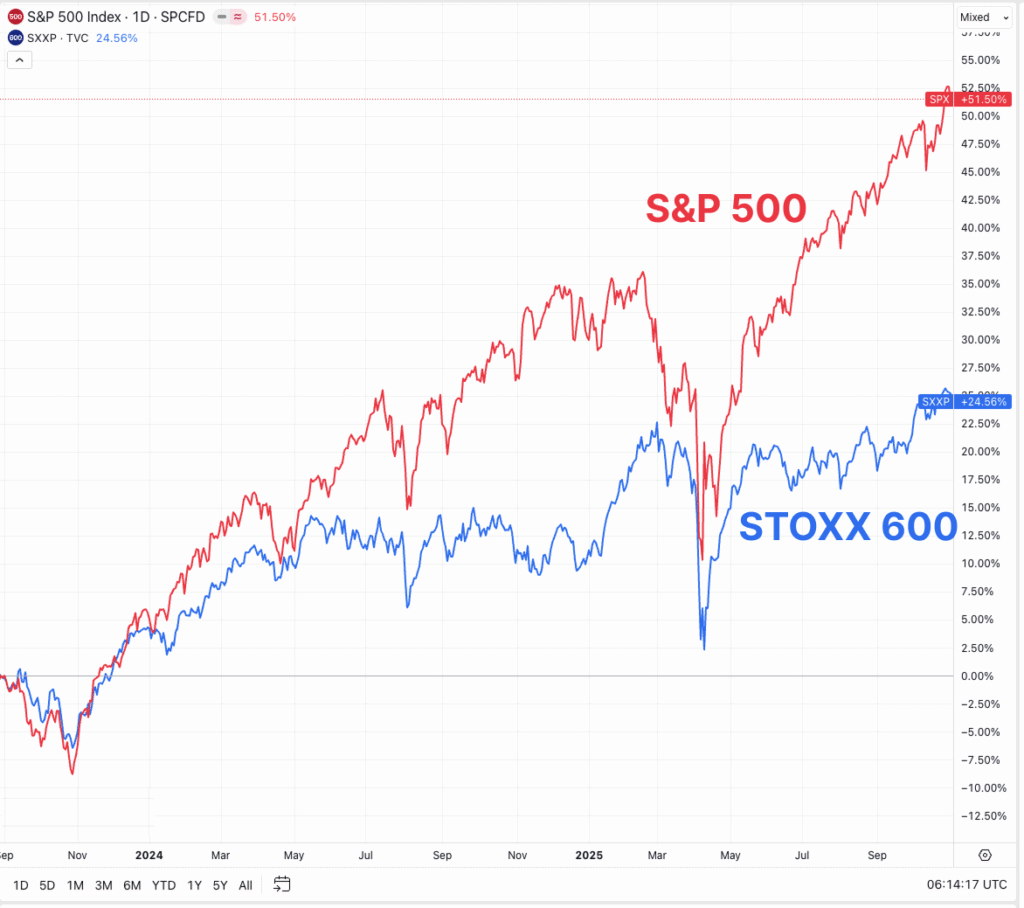

For over a decade, Europe has been overshadowed by the United States in nearly every market metric. The S&P 500 has soared ahead, powered by America’s tech revolution, while the STOXX Europe 600 has grown at half that pace in the last 3 years. Innovation, scale, and capital flow have all tilted westward.

Yet Europe’s story is far from over. Behind the headlines of slower GDP growth and political tension lies a collection of world-class global companies. From semiconductor leaders to luxury powerhouses, these firms quietly dominate their industries. Many trade at valuations well below U.S. peers, offering investors exposure to profitability, stability, global pricing power and dividends.

This article highlights the Top 10 largest European stocks, examining their industries, strategies, valuation metrics, and analyst outlooks for 2026.

Top 3 Key Takeaways from This Article

- European blue chips trade at meaningful valuation discounts to U.S. peers, despite global leadership in sectors such as luxury and healthcare.

- Analysts expect steady mid-single-digit earnings growth in 2025, supported by pricing power and disciplined cost control.

- While structural growth remains slower, European stocks offer a compelling blend of income, stability, and international exposure.

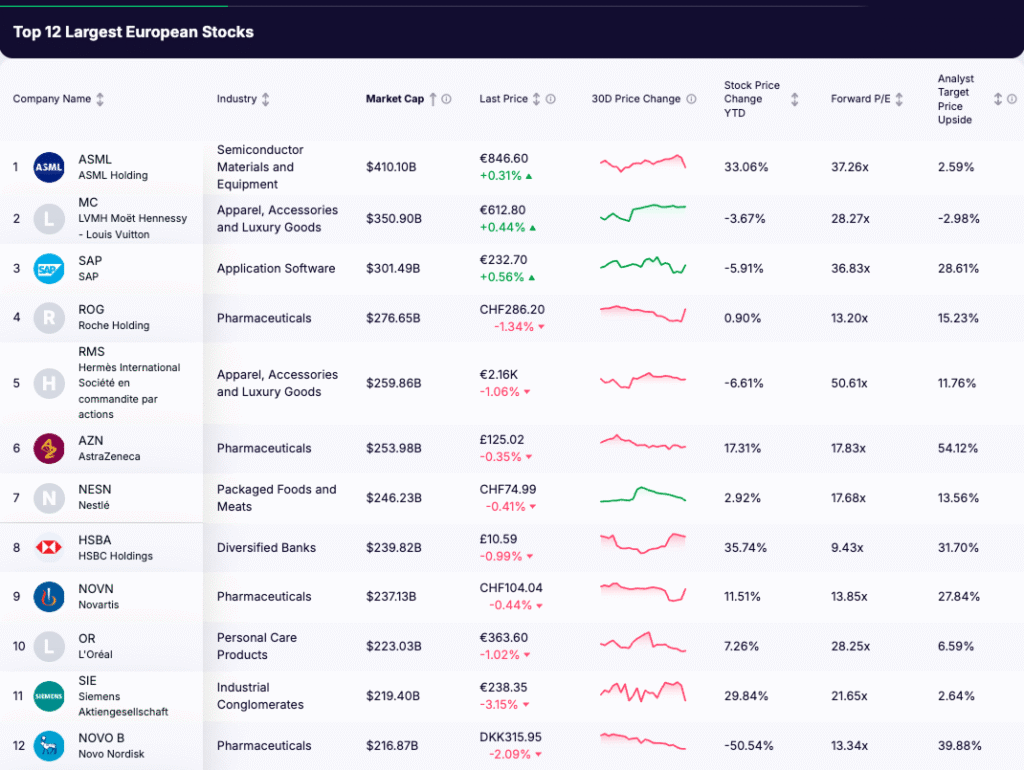

The 10 Largest European Stocks in 2025

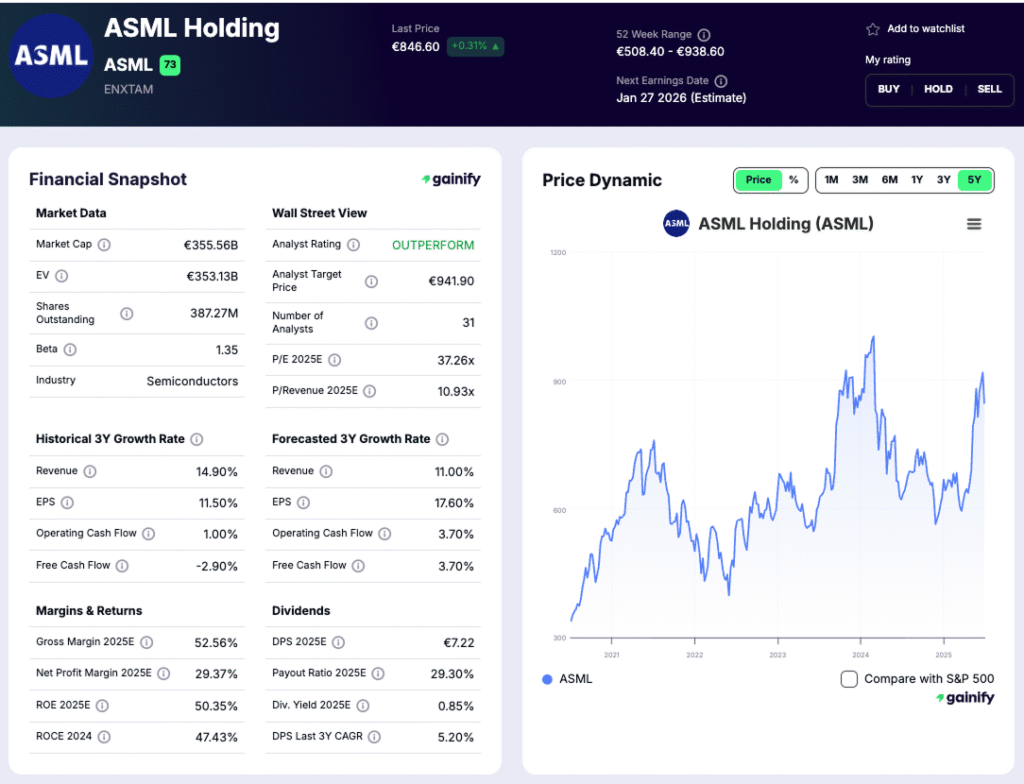

1. ASML Holding

Country: Netherlands

Market Cap: $410.1B

Forward P/E: 37.3x

YTD Performance: +33.1%

Analyst Target Upside: +2.6%

Profile: ASML (ENXTAM: ASML) is the crown jewel of European technology and arguably the most critical company in the global semiconductor supply chain. It is the sole producer of EUV lithography systems, essential for manufacturing advanced chips used in AI, data centers, and smartphones.

Investment Case:

The company’s long-term growth remains tied to the global chip cycle. Even with near-term softness in equipment orders, ASML’s backlog exceeds €35 billion, giving exceptional revenue visibility. Analysts call it a “must-own strategic asset” in technology manufacturing.

Latest Reported Key Numbers:

In the latest quarter, ASML reported revenue of €7.5 billion and a net profit margin of 28%. New bookings totaled €5.4 billion, reflecting steady demand from major foundry and logic customers. The company maintains a forward P/E ratio of approximately 37x, underscoring investor confidence in its long-term growth potential and technological leadership.

Risk Factors:

Potential risks include export restrictions to China, which may limit unit shipments, and cyclicality in semiconductor capital expenditure. ASML’s premium valuation also makes it sensitive to any slowdown in the chip market.

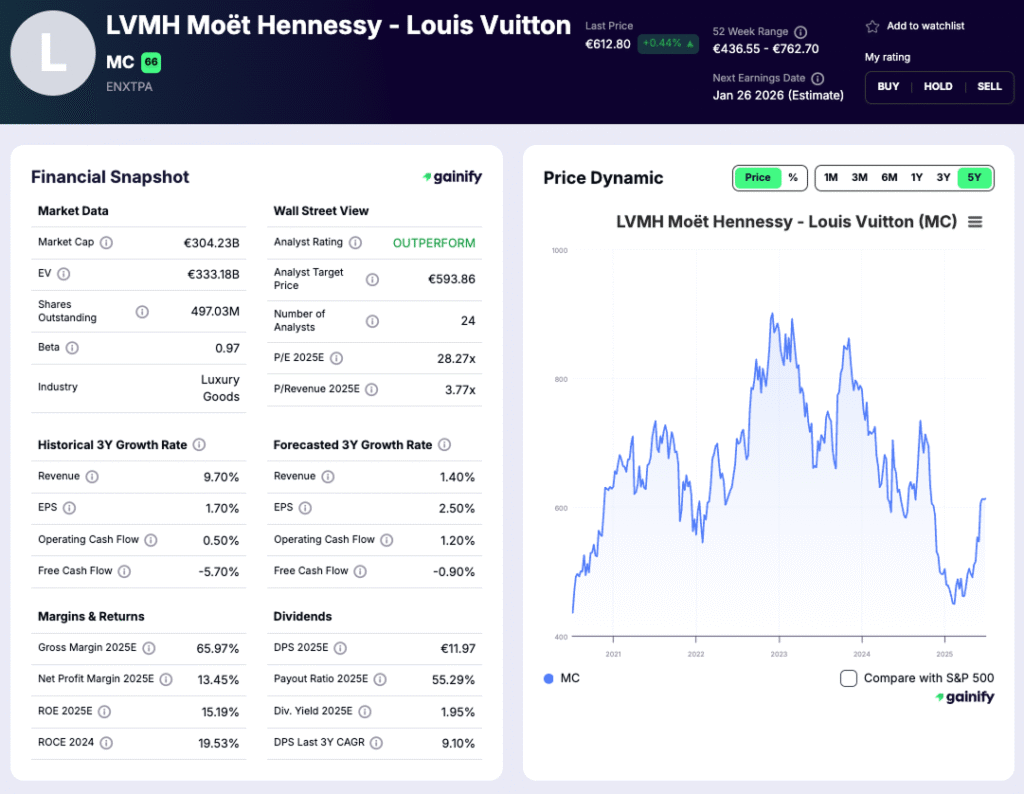

2. LVMH Moët Hennessy Louis Vuitton

Country: France

Market Cap: $350.9B

Forward P/E: 28.3x

YTD Performance: -3.7%

Analyst Target Upside: -3.0%

Profile:

LVMH (ENXTPA: MC) is the world’s largest luxury conglomerate, owning more than 70 prestigious brands across fashion, jewelry, cosmetics, wines, and spirits. Its flagship houses include Louis Vuitton, Christian Dior, Tiffany & Co., Hennessy, and Sephora. The company operates globally, with a strong presence in Europe, Asia, and North America. Its vertically integrated model allows it to control product quality, distribution, and pricing, ensuring exclusivity and brand consistency.

Investment Thesis:

LVMH’s investment appeal lies in its combination of brand power, diversification, and operational excellence. The group’s scale enables superior marketing, premium positioning, and resilience through economic cycles. Although luxury demand has softened in China and Europe, LVMH’s core labels remain highly profitable and continue to outperform peers in pricing power and margins. Long term, the company’s exposure to wealth creation in emerging markets and its ability to sustain double-digit returns on capital make it a cornerstone of the global consumer luxury sector.

Latest Reported Key Numbers:

In Q3 2025, LVMH reported revenue of €19.1 billion, reflecting steady performance across its key divisions despite regional softness. The Fashion and Leather Goods segment remained the primary profit driver, while Selective Retail and Wines & Spirits experienced slower growth. Analysts currently forecast a low single-digit revenue increase for 2025 as demand gradually normalizes.

Key Risks:

LVMH faces potential headwinds from a prolonged slowdown in discretionary spending, particularly in China and Europe. Currency volatility could also affect earnings given its global exposure. Additional risks include luxury market saturation, potential brand dilution from overexpansion, and geopolitical tensions that may disrupt international tourism.

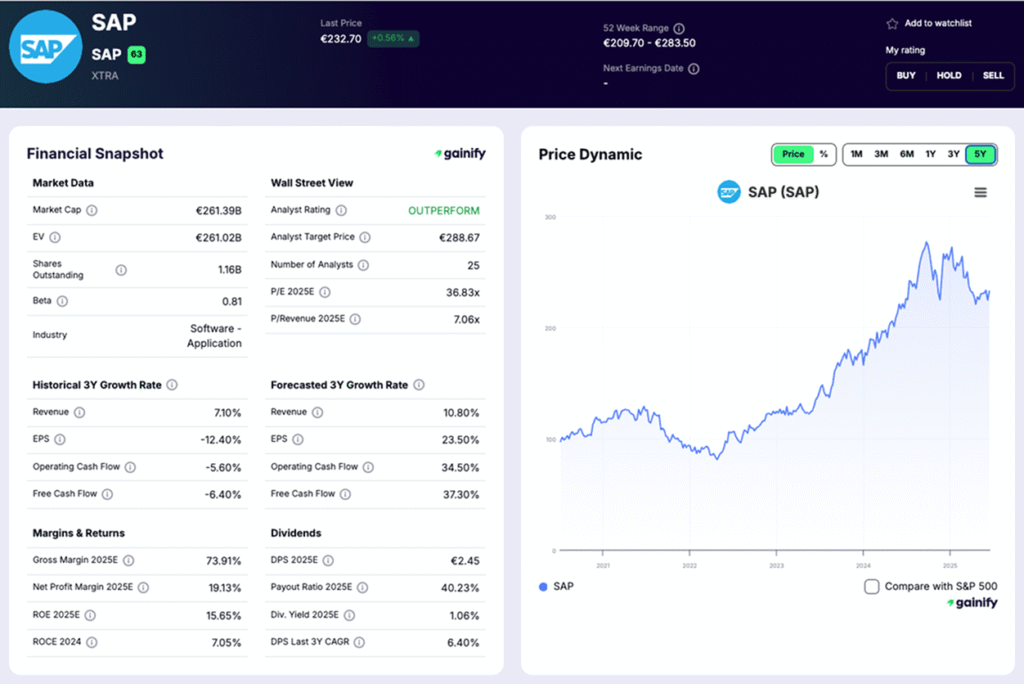

3. SAP SE

Country: Germany

Market Cap: $301.5B

Industry: Enterprise Software

YTD Performance: -5.9%

Analyst Upside Potential: +28.6%

Forward P/E: 36.83x

Profile:

SAP (XTRA: SAP) is Europe’s largest software company and a global leader in enterprise applications. Its platforms, including SAP S/4HANA and a broad suite of cloud-based solutions, help companies manage finance, supply chains, and operations. With more than 400,000 customers in over 180 countries, SAP has become a core component of global business infrastructure.

Investment Thesis:

SAP is transitioning from traditional licenses to a cloud-first model, driving recurring revenue and improving margins. Strong demand for digital transformation, AI-enabled analytics, and automation underpins steady growth. Analysts see SAP as a high-quality value opportunity, trading at a discount to U.S. peers despite comparable profitability and market reach.

Latest Reported Key Numbers:

In the latest quarter, SAP SE reported revenue of €9.08 billion, up 7 % year-over-year. Cloud revenue increased by 22 %, while adjusted operating profit rose 12 % to €2.49 billion. The company reiterated full-year guidance and trades at a forward P/E of approximately 37×, reflecting investor confidence in its cloud-transition trajectory.

Key Risks:

Execution challenges in customer cloud migration, competition from Oracle and Microsoft, and potential slowdowns in enterprise IT budgets could weigh on growth. Currency volatility and sustained investment needs in AI and infrastructure may also pressure margins.

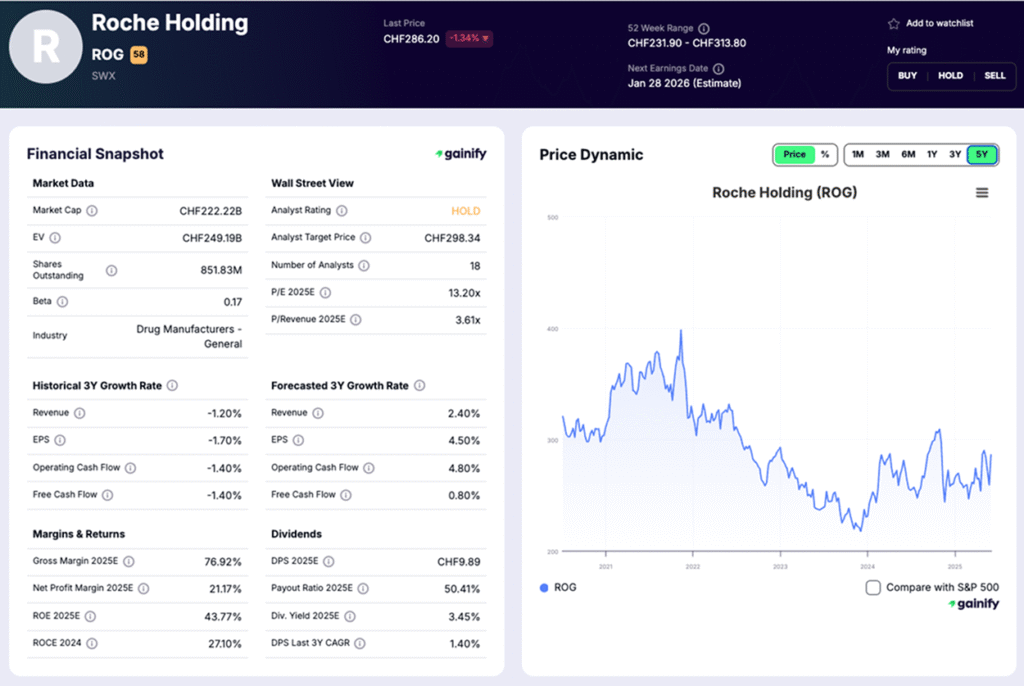

4. Roche Holding

Country: Switzerland

Market Cap: $276.7B

Industry: Pharmaceuticals and Diagnostics

YTD Performance: +0.9%

Analyst Upside Potential: +15.2%

Forward P/E: 13.20x

Profile:

Roche (SWX: ROG) is one of the world’s largest healthcare companies, operating through two primary divisions: Pharmaceuticals and Diagnostics. It is a global leader in oncology, immunology, and molecular testing, with blockbuster drugs such as Tecentriq, Ocrevus, and Hemlibra. The company’s diagnostics division plays a crucial role in disease detection and monitoring worldwide.

Investment Thesis:

Roche provides investors with defensive earnings stability, strong free cash flow, and consistent dividend growth. Its deep R&D pipeline and established market share in oncology and diagnostics make it one of Europe’s most resilient large-cap healthcare holdings. Continued growth in new medicines and diagnostic testing should offset biosimilar headwinds in older cancer treatments.

Latest Reported Key Numbers:

For the first nine months of 2025, Roche reported group sales of CHF 45.9 billion, up 7% year-over-year at constant exchange rates (CER). The Pharmaceuticals division grew 9%, driven by strong demand for new oncology and neuroscience drugs, while the Diagnostics division remained broadly flat due to pricing reforms in China.

Key Risks:

Roche faces challenges from patent expirations on legacy oncology drugs and competition from biosimilars, which could pressure pricing. Slower recovery in the Chinese diagnostics market and foreign exchange volatility may affect reported earnings. Ongoing R&D execution and successful commercialization of new drugs will be critical to maintaining momentum in 2026 and beyond.

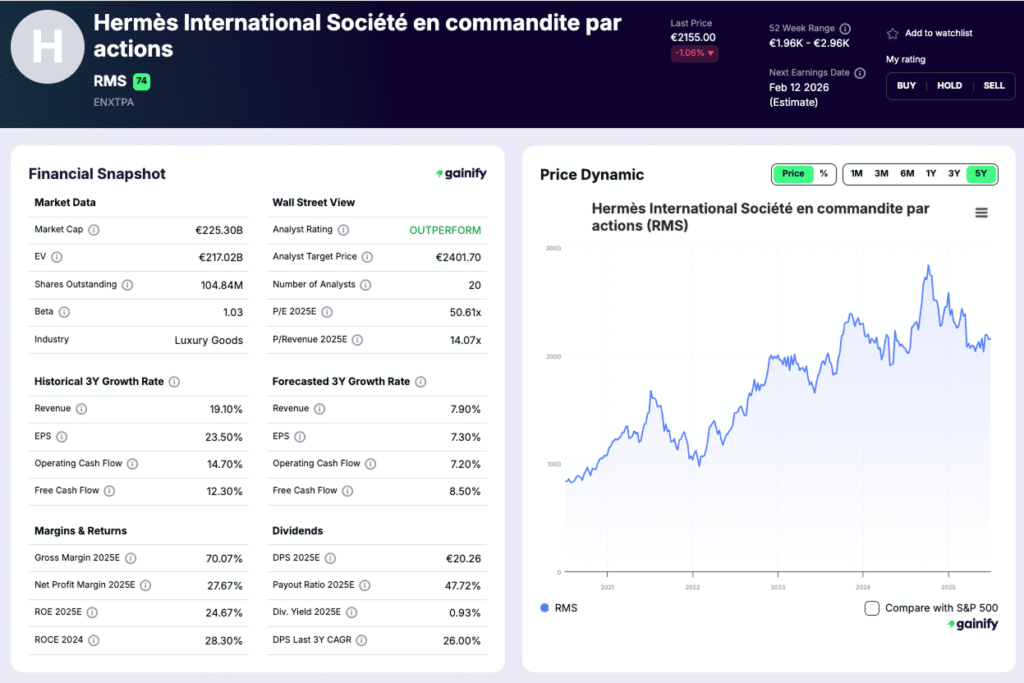

5. Hermès International

Country: France

Market Cap: $259.9B

Industry: Luxury Goods

YTD Performance: -6.6%

Analyst Upside Potential: +11.8%

Forward P/E: 50.6x

Profile:

Hermès International (ENXTPA: RMS) is one of the world’s most prestigious luxury houses, renowned for its craftsmanship, heritage, and exclusivity. The brand’s product range includes high-end leather goods, silk accessories, fashion, home décor, and jewelry. Its most iconic products, the Birkin and Kelly bags, have become global symbols of status and artistry. Unlike many peers, Hermès maintains tight control of its production and distribution, which helps preserve brand scarcity and premium pricing power across more than 300 boutiques worldwide.

Investment Thesis:

Hermès represents best-in-class quality and long-term brand durability in the luxury sector. Its limited production model and loyal high-net-worth clientele allow it to maintain exceptional margins, even during weaker macroeconomic periods. The company’s strategy focuses on timeless design, selective growth, and operational independence, which supports steady, compounding returns.

Latest Reported Key Numbers:

In the third quarter of 2025, Hermès reported revenue of €3.88 billion, up 9.6% year-over-year at constant exchange rates, supported by robust performance across most regions. The Leather Goods and Saddlery division grew 12.6%, driven by continued demand for iconic handbags and leather accessories. The Ready-to-Wear and Accessories segment rose 5.8%, while Watches and Perfumes remained softer, each declining 3–5%. Operating profitability remained among the highest in the luxury industry, with recurring operating income margin above 40%. Management reaffirmed its full-year outlook for revenue growth at constant exchange rates, reflecting continued confidence in global brand demand.

Key Risks:

Hermès remains heavily reliant on high-net-worth consumers, making it sensitive to shifts in luxury sentiment and global wealth dynamics. Softening demand in China and slower tourism recovery could impact sales growth. Additionally, its strict production limits, while vital for exclusivity, could constrain capacity if global demand accelerates. Currency fluctuations and luxury tax policies may also influence profitability in key markets.

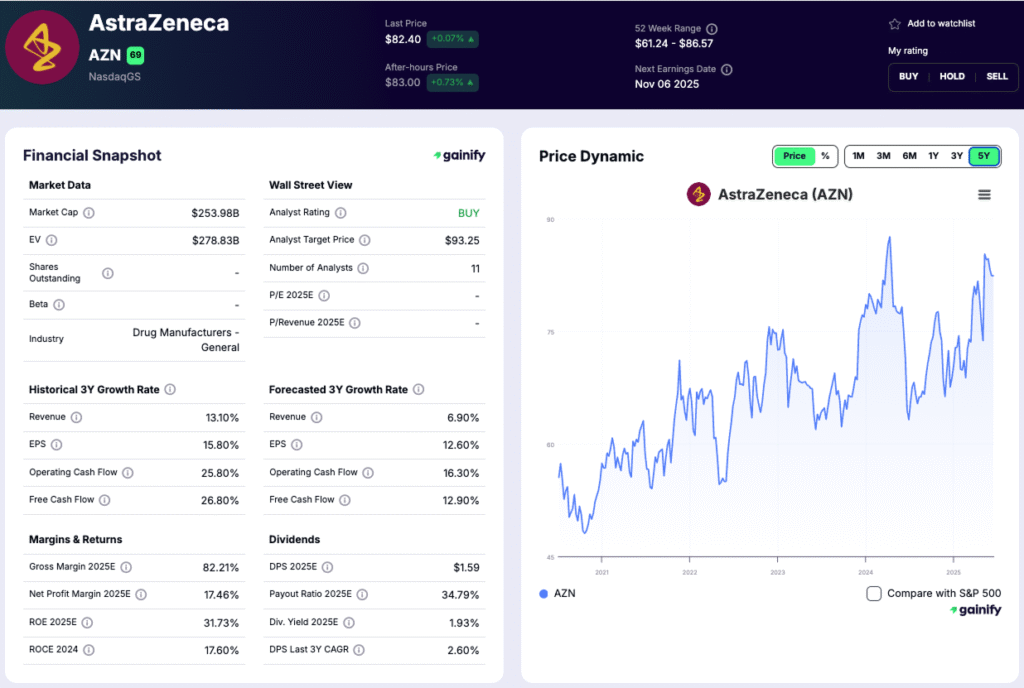

6. AstraZeneca

Country: United Kingdom / Sweden

Market Cap: $254.0B

Industry: Pharmaceuticals

YTD Performance: +17.3%

Analyst Upside Potential: +54.1%

Forward P/E: ~17.8×

Profile:

AstraZeneca (LSE: AZN) has evolved into a top-tier pharmaceutical and biotechnology company, specializing in oncology, cardiovascular/renal/metabolism (CVRM), respiratory & immunology, and rare diseases. It has expanded rapidly through strategic acquisitions and in-house development, strengthening its position in next-generation therapeutics and broad global reach.

Investment Thesis:

The company’s portfolio includes several market-leading medicines, and its strong pipeline with high-value new launches supports multi-year earnings growth. Emerging markets now account for over 35 % of its sales, giving diversification from mature market pressures. Analysts are overwhelmingly bullish, with some naming AstraZeneca a global leader in transformational therapeutics; the consensus anticipates significant upside from both earnings growth and multiple expansion.

Latest Reported Key Numbers (Q2 2025):

For the quarter ending 30 June 2025, AstraZeneca reported revenue of $14.46 billion, up 16.1% year-over-year, beating consensus expectations. Core EPS was approximately $2.17, up from $1.98 in the prior year. Key segments: oncology revenue rose ~18% to ~$6.31 billion, biopharmaceuticals up ~8% to ~$5.6 billion. The Company reaffirmed its 2025 guidance of high single-digit revenue growth and low double-digit core EPS growth.

Key Risks:

Patent expirations and biosimilar competition in critical drug franchises remain a significant threat to growth. Regulatory and pricing pressures in major markets could erode margins. Execution risk is elevated as the company launches multiple new products and invests heavily in R&D and manufacturing capacity.

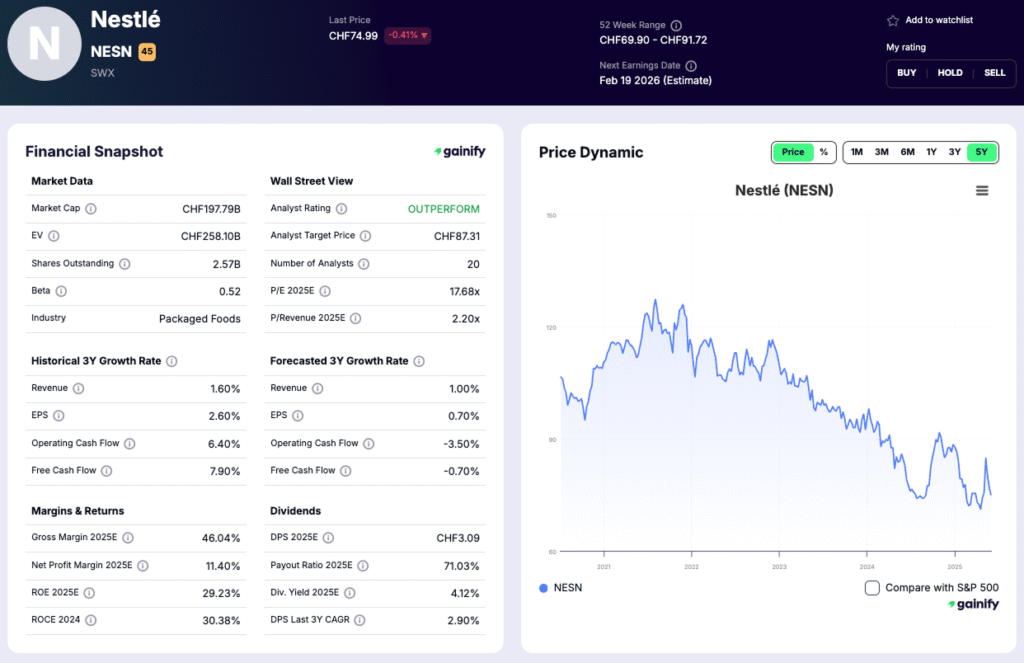

7. Nestlé

Country: Switzerland

Market Cap: $246.2B

Industry: Food, Beverage, and Nutrition

YTD Performance: +2.9%

Analyst Upside Potential: +13.6%

Forward P/E: 17.7x

Profile:

Nestlé (SWX: NESN) is the world’s largest food and beverage company, operating more than 2,000 brands in categories such as coffee, bottled water, nutrition, dairy, and pet care. Its global portfolio includes household names like Nescafé, KitKat, Purina, Gerber, and Perrier. The company operates in 180 countries, serving billions of consumers daily. Nestlé’s scale, diversified business mix, and trusted brands make it one of the most resilient consumer staples companies in the world.

Investment Thesis:

Nestlé is regarded as a defensive, high-quality compounder offering steady earnings and dependable dividends. The company has been strategically shifting toward higher-margin categories, such as pet care, coffee, and health science, while exiting lower-growth segments. Its pricing discipline and strong brand equity help offset cost inflation and currency headwinds. Analysts view Nestlé as well-positioned to deliver moderate organic growth and consistent shareholder returns, underpinned by buybacks and dividend increases.

Latest Reported Key Numbers (Q2 2025):

For the first half of 2025, Nestlé reported organic sales growth of 5.2%, supported by 4.1% pricing growth and 1.1% volume growth. Total revenue reached CHF 48.5 billion, with strong performance in Purina PetCare and Nestlé Health Science, which offset weaker demand in confectionery and bottled water. Operating profit margin was 17.3%, up slightly from 17.0% a year earlier, reflecting effective cost control. Earnings per share increased 6% on a constant-currency basis. The company reaffirmed its 2025 guidance for organic growth between 4% and 6% and a modest improvement in underlying margins.

Key Risks:

Nestlé faces slower volume growth in developed markets as consumer demand normalizes post-inflation. Persistent input cost pressures and currency volatility could constrain margin expansion. In addition, rising competition from private-label and local brands may limit pricing power in certain regions. Continued execution in portfolio optimization and innovation will be key to sustaining growth momentum.

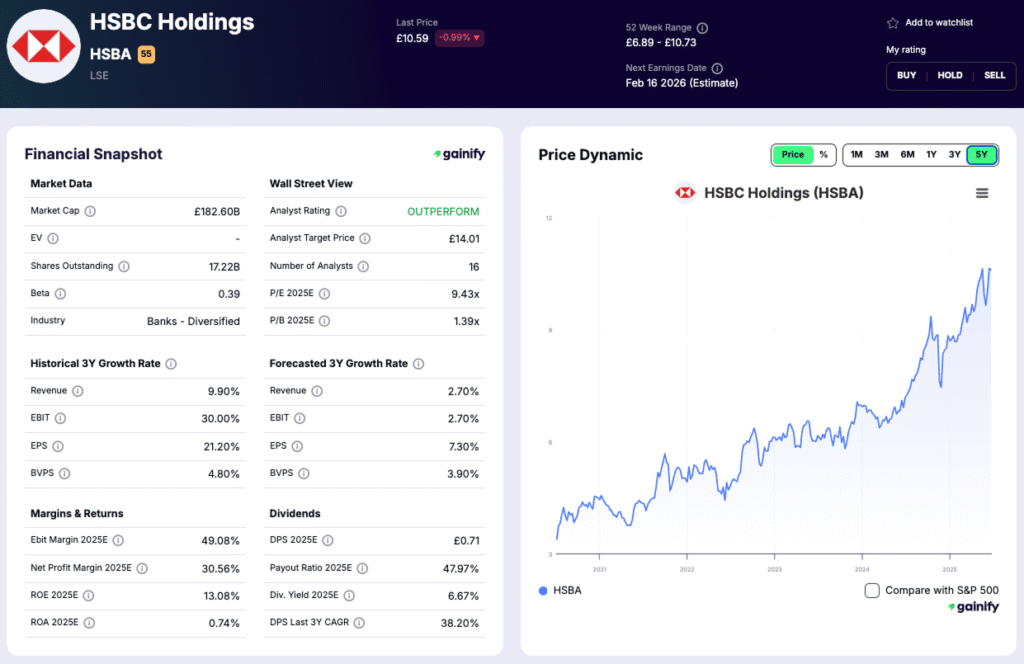

8. HSBC Holdings

Country: United Kingdom

Market Cap: $239.8B

Industry: Banking & Financial Services

YTD Performance: +35.7%

Analyst Upside Potential: +31.7%

Forward P/E: 9.4x

Profile:

HSBC (LSE: HSBC) is one of the world’s largest and most geographically diversified banks, serving over 40 million customers in more than 60 countries. The bank operates across retail banking, wealth management, commercial banking, and global markets. Its strategic focus on Asia, particularly Hong Kong and mainland China, positions it at the center of global trade and capital flows.

Investment Thesis:

HSBC remains a value-driven income opportunity within the global banking sector. The bank’s profitability has improved meaningfully from rising interest rates and tight cost control. Its strategic refocus on Asia has boosted returns, while divestments in less profitable regions have streamlined operations. With a dividend yield above 5%, share buybacks, and an improving return on tangible equity, HSBC continues to deliver attractive shareholder returns.

Latest Reported Key Numbers (Q2 2025):

For the quarter ended 30 September 2025, HSBC Holdings plc reported revenue of $17.9 billion, up approximately 3% year-over-year. The bank’s annualised return on average tangible equity (RoTE) for the first nine months reached 17.6%, excluding notable items. Growth in net interest income and wealth management fees supported the results. The Group also reiterated its guidance, expecting a mid-teens RoTE for the full year, excluding notable items.

Key Risks:

HSBC’s performance remains vulnerable to China’s slowing economy and weakness in Hong Kong’s property market. Rising regulatory scrutiny and potential geopolitical tensions across Asia could further pressure earnings. Execution challenges in ongoing restructuring and exposure to credit quality deterioration are additional watch points for investors.

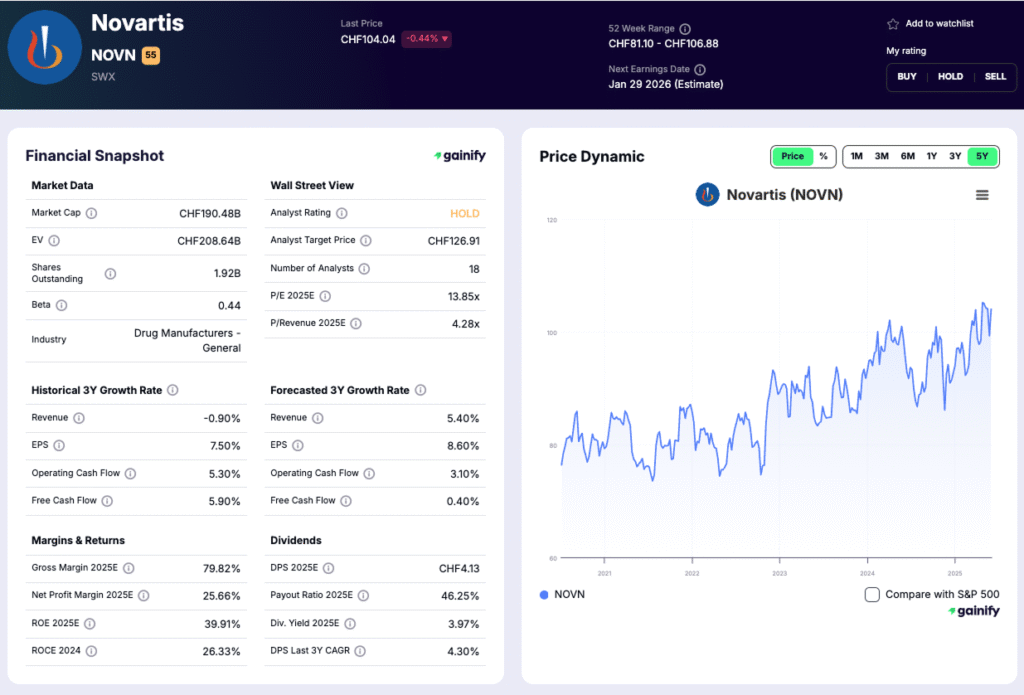

9. Novartis (Switzerland)

Country: Switzerland

Market Cap: $237.1B

Industry: Pharmaceuticals

YTD Performance: +11.5%

Analyst Upside Potential: +27.8%

Forward P/E: ~13.9x

Profile:

Novartis (SWX: NOVN) is a global, Swiss-based pharmaceutical company focused on high-value patented medicines in oncology, immunology, and cardiovascular/renal/metabolism diseases. After spinning off its generics division, the company now concentrates on innovation, with a strong global footprint and a growing pipeline of next-generation therapies.

Investment Thesis:

Novartis is positioned as a growth-and-income pharmaceutical standard. Its streamlined business model following the generics spin-off improves capital efficiency and margin potential. Analysts highlight the company’s favorable valuation relative to peers, strong free cash flow, and robust pipeline as key drivers of upside. With major launches underway and cost optimization advancing, Novartis may deliver above-industry growth over the medium term.

Latest Reported Key Numbers:

For the quarter ended 30 September 2025, Novartis reported net sales of USD 13.91 billion, up 8% year-over-year and 7% in constant currency (cc). Core operating income was USD 5.46 billion, up 6% in USD and 7% cc. Free cash flow reached USD 6.2 billion, up roughly 4%. The company reaffirmed its 2025 guidance of high single-digit sales growth and low-teens growth in core operating income.

Key Risks:

Potential risks include clinical trial setbacks, regulatory or pricing pressure in major markets, and generic or biosimilar competition for older drugs. Additionally, being in a heavy R&D period increases investment requirements, which could temporarily pressure margins if launches or approvals are delayed.

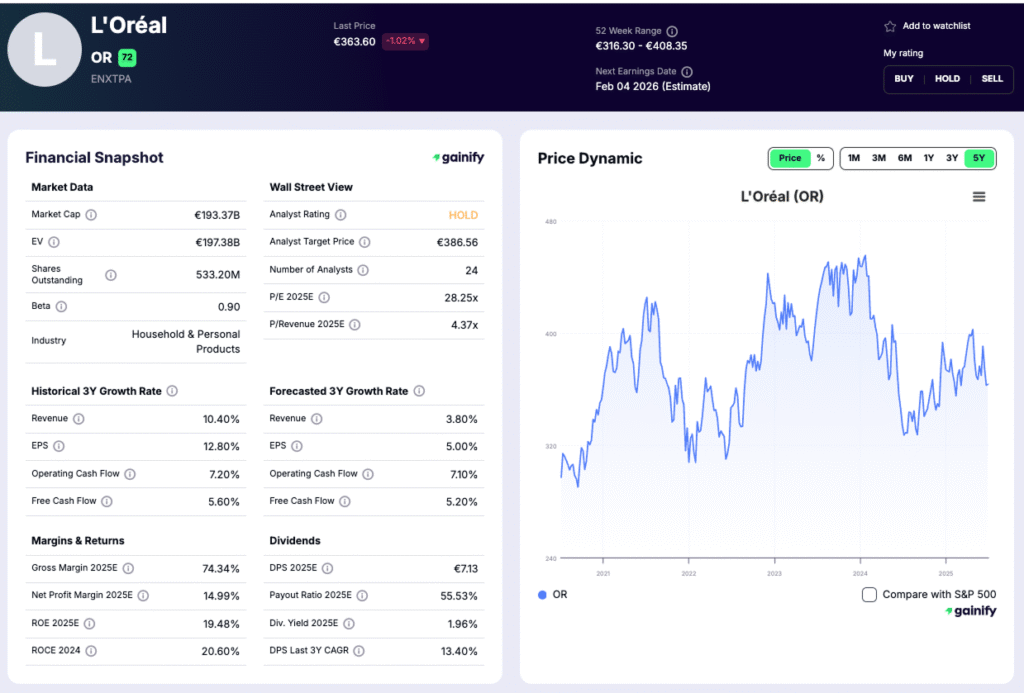

10. L’Oréal (France)

Country: France

Market Cap: $223.0B

Industry: Beauty & Personal Care

YTD Performance: +7.3%

Analyst Upside Potential: +6.6%

Forward P/E: 28.3x

Profile:

L’Oréal (ENXTPA: OR) is the world’s largest beauty and cosmetics company, with operations spanning more than 150 countries. The company’s portfolio includes leading global brands such as Lancôme, Garnier, Maybelline, and L’Oréal Paris, alongside professional and luxury divisions like Kiehl’s, Yves Saint Laurent Beauté, and Giorgio Armani Beauty. Its products cover skincare, makeup, haircare, and fragrance, serving a broad range of consumers from mass-market to ultra-premium segments.

Investment Thesis:

L’Oréal’s growth continues to be driven by innovation in skincare, digital marketing leadership, and its expanding footprint in emerging markets. The company benefits from a strong omnichannel strategy, leveraging both online and in-store retail. While mature markets like Western Europe show slower growth, demand from Asia-Pacific and Latin America remains robust. Analysts see L’Oréal as a consistent compounder—offering earnings predictability, brand resilience, and moderate upside supported by steady margin improvement through 2026.

Latest Reported Key Numbers:

For the third quarter of 2025, L’Oréal reported sales of €10.33 billion, up 4.2% year-over-year on a like-for-like basis, supported by strong momentum in Professional Products (+6.5%) and Dermatological Beauty (+7.1%). The Luxury Division delivered moderate growth of around 3%, while Consumer Products remained stable as price increases offset slower volumes. Sales in North Asia recovered modestly after a weaker first half, while Europe and the Americas continued steady single-digit growth. The company maintained an operating margin above 20% and reaffirmed its full-year 2025 outlook for mid-single-digit organic growth and continued profitability expansion.

Key Risks:

L’Oréal faces exposure to currency volatility, particularly in emerging markets, and potential slowdowns in consumer spending on discretionary beauty products. Growth in China and Southeast Asia remains sensitive to shifting economic conditions and regulatory trends. Additionally, raw material cost inflation or disruptions in global supply chains could pressure margins in the short term.

Europe vs. the U.S.: ETFs, Growth, and Valuation Gap

Over the past three years, the divide between U.S. and European equities has widened dramatically. The S&P 500 has climbed more than 50%, powered by tech mega-caps and resilient corporate earnings, while the STOXX 600 has gained around 25%, held back by slower growth and limited exposure to high-margin technology sectors.

For diversified exposure, investors can look to European ETFs such as the Vanguard FTSE Europe (VGK) and iShares Europe (IEV), both of which trade at a notable discount to U.S. benchmarks like the SPDR S&P 500 (SPY) and Invesco QQQ (QQQ). European equities currently trade at 16–18× forward earnings, versus 25–30× for U.S. peers — a gap that highlights how optimism remains concentrated across American markets.

Europe, however, still delivers a compelling income advantage, with dividend yields averaging 3–4%, roughly double those in the U.S. For investors seeking value, diversification, and steady cash returns, Europe offers an attractive counterbalance to America’s growth-heavy narrative.

Final Thoughts

Europe’s largest corporations continue to demonstrate stability, global reach, and strong financial discipline, delivering consistent earnings even in a lower-growth environment. While they may not rival Silicon Valley in innovation speed, they provide what many investors value most: reasonable valuations, steady dividends, and proven resilience.

In an increasingly uncertain global market, Europe’s blue-chip leaders represent enduring quality and diversification potential. For long-term investors, they remain a cornerstone of balanced, globally diversified portfolios.

Disclaimer: This article is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any securities. Investors should conduct their own research or consult a qualified financial advisor before making investment decisions.