An earnings calendar is one of the most important tools investors use to stay informed about upcoming company earnings reports. Earnings announcements often act as catalysts for stock price movement, making it essential to know when companies report, what to expect, and how estimates are changing.

This article explains what an earnings calendar is, how investors use it, and why modern tools like the Gainify earnings calendar make earnings season easier to navigate.

What Is an Earnings Calendar?

An earnings calendar is a tool that shows the scheduled dates and times when publicly traded companies are expected to release their quarterly or annual financial results. These announcements typically occur four times a year and often act as major catalysts for stock price movement.

An earnings calendar helps investors understand when new financial information will become available, allowing them to plan ahead rather than react after the fact.

A typical earnings calendar includes:

- The reporting date, showing when results are expected to be released

- The release timing, such as before market open or after market close

- The fiscal period, indicating which quarter or year is being reported

- Key companies reporting each day, often grouped by sector or market size

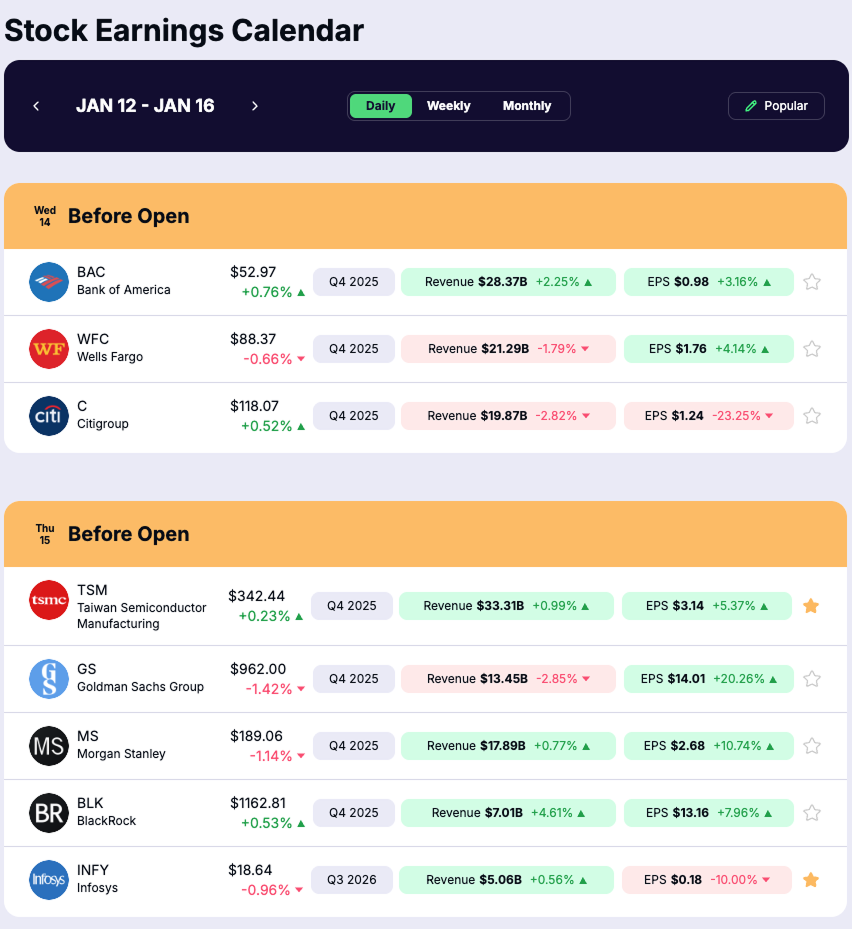

In addition to scheduling information, many modern earnings calendars also display consensus estimates for key financial metrics, which represent the market’s expectations going into the report.

Common consensus estimates include:

- Revenue, showing expected top-line performance

- Earnings per share (EPS), reflecting expected profitability

- Operating Profit and Cash Flow, in some cases

- Forward guidance expectations, when available

These consensus estimates are compiled from analyst forecasts and provide critical context for interpreting earnings results. Stocks often move based on how reported numbers compare to expectations, not just on whether results are strong or weak in absolute terms.

Because earnings reports can significantly influence stock prices, tracking both earnings dates and consensus estimates helps investors prepare for volatility, understand market expectations, and avoid surprises during earnings season.

Why the Earnings Calendar Matters

Earnings reports provide some of the most important information investors receive about a company throughout the year. Each report offers insight into both current performance and future direction, and often acts as a key catalyst for stock price movement.

An earnings calendar helps investors stay prepared by highlighting when this information will be released and what the market is expecting. Specifically, earnings reports allow investors to evaluate:

- Revenue and earnings performance, showing how the business is executing

- Changes in business momentum, including shifts in growth, margins, or costs

- Forward guidance, outlining management’s expectations for upcoming periods

- Management commentary, providing context around strategy, demand, and risks

- How results compare with consensus estimates, which often drives market reactions

By tracking earnings dates and expectations in advance, investors can manage risk more effectively, avoid surprises during volatile periods, and make more deliberate decisions rather than reacting emotionally to short-term price movements.

How Investors Use an Earnings Calendar

Investors use earnings calendars differently depending on their goals, time horizon, and risk tolerance. While the tool itself is the same, how it is applied can vary significantly.

Long-Term Investors

Long-term investors use an earnings calendar primarily as a monitoring and planning tool rather than a trading signal.

They focus on:

- Understanding how the business is performing over time

- Listening to management commentary and guidance

- Tracking margins, cash flow, and long-term strategy

- Avoiding unnecessary portfolio moves driven by short-term volatility

For long-term investors, knowing the earnings date helps set expectations and prevents surprise reactions to price swings.

Active Investors

Active investors rely more heavily on earnings calendars to manage timing and volatility.

They use the calendar to:

- Adjust position sizes ahead of earnings

- Decide whether to hold, hedge, or exit positions

- Monitor estimate revisions leading into reports

- Identify clusters of earnings within specific sectors

In both approaches, timing matters.

Key Features of a Modern Earnings Calendar

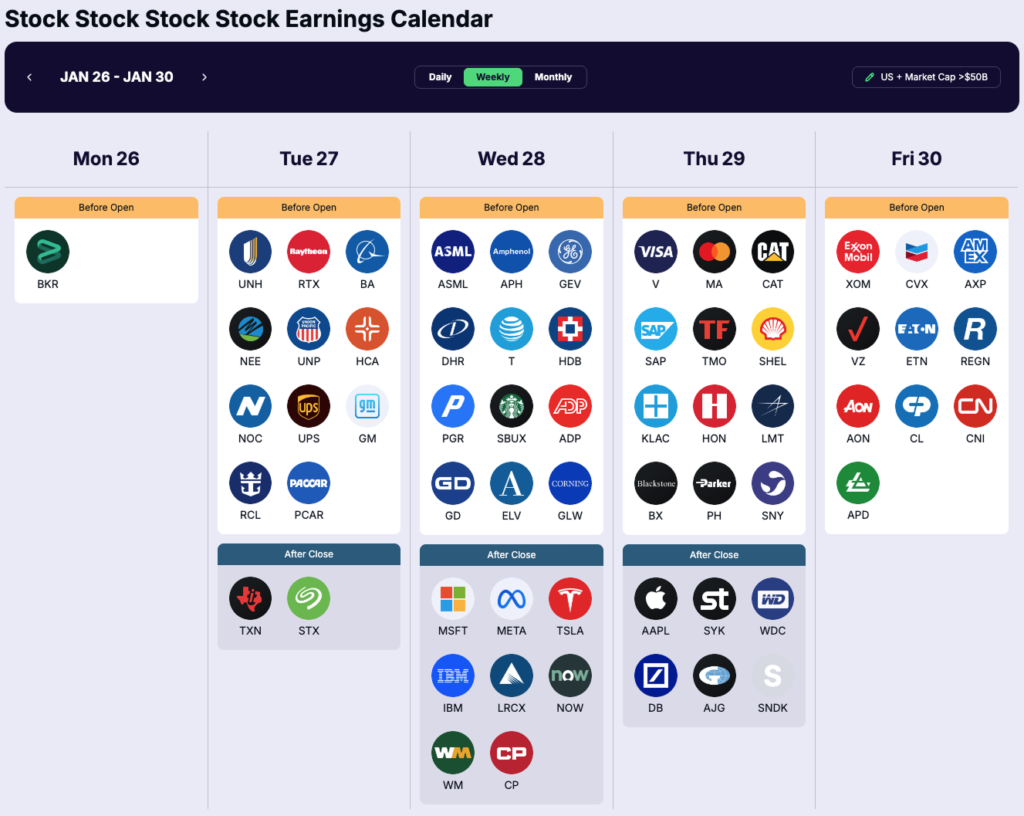

A modern earnings calendar does more than list reporting dates. Investors increasingly rely on tools that provide context, flexibility, and forward-looking data around each earnings event.

Key features typically include:

- Daily, weekly, and monthly views, allowing investors to plan around busy earnings periods

- Filtering options, such as market capitalization, country, sector, or popularity, to focus on relevant companies

- Company-specific earnings pages, offering historical results and reporting context

- Analyst consensus estimates and revisions, helping investors track changing expectations ahead of reports

Together, these features help investors prioritize the earnings events that matter most to their portfolio, understand market expectations in advance, and navigate earnings season with greater clarity and confidence.

Using the Gainify Earnings Calendar

The Gainify earnings calendar is designed to help investors track earnings efficiently while adding useful context.

With Gainify, investors can:

- View earnings by day, week, or month

- Filter earnings by market cap, country, or popular stocks

- See whether earnings are reported before open or after close

- Click into individual companies for deeper analysis

Each company’s earnings page typically includes historical revenue and earnings trends, analyst estimate revisions, earnings call summaries, and key highlights from recent reports. This structure allows investors to move seamlessly from a high-level earnings calendar view to detailed, company-specific insight in just a few clicks.

Why Estimate Revisions Matter

One of the most overlooked aspects of earnings season is estimate revisions.

Analysts often adjust revenue and earnings expectations leading up to an earnings report. Rising estimates can signal improving fundamentals, while declining estimates may indicate emerging challenges.

Tracking estimate revisions alongside the earnings calendar helps investors:

- Understand market expectations

- Identify positive or negative momentum

- Avoid reacting only to headline numbers

Final Thoughts

An earnings calendar is a foundational tool for investors who want to stay informed and prepared throughout earnings season. By highlighting when companies report and what the market expects, it helps bring structure and clarity to periods that are often marked by heightened volatility.

Modern earnings calendars go beyond simple scheduling by incorporating analyst estimates, revisions, and company-level context. Platforms like Gainify show how combining these elements can help investors better understand expectations, manage risk, and focus on the earnings events that matter most to their portfolio.

Used thoughtfully, an earnings calendar does more than track dates. It supports disciplined decision-making, reduces surprises, and helps investors stay focused on fundamentals rather than short-term market noise.