The best construction stocks to watch in 2026 are companies whose revenue is tied to projects that are already moving through the construction process. Current spending is concentrated in infrastructure repair, power and grid upgrades, data centers, and large industrial facilities. These projects require steady delivery of equipment, materials, transportation, and skilled labor as construction progresses.

For investors, this means construction stocks are best understood by looking at where work is actively happening and how companies participate in it. Businesses that supply heavy machinery, aggregates, engines, trucks, and mechanical systems tend to generate revenue as projects advance, with backlog providing added visibility into future demand.

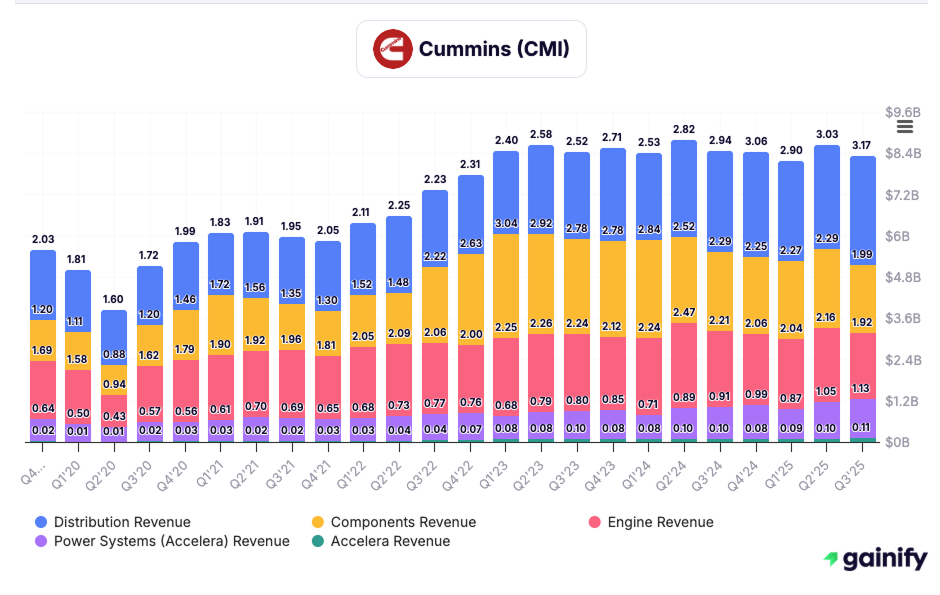

In this article, the seven largest construction-related companies with significant exposure to ongoing construction activity in 2026 are covered:

- Caterpillar

- CRH

- Vulcan Materials

- Cummins

- Quanta Services

- PACCAR

- Comfort Systems USA

Each company serves a different function, from building roads and power systems to moving materials and installing critical infrastructure inside buildings. Together, they provide a practical view of where construction activity is concentrated in 2026.

Below, each stock is explained in plain terms, including what the company does, why investors are paying attention in 2026, and the main risks to keep in mind.

Key Takeaways

- Construction activity in 2026 is centered on infrastructure repair, power and grid upgrades, data centers, and large industrial projects

- Revenue generation for construction-related companies follows project execution as equipment, materials, and services are delivered

- Operational scale and execution capability are increasingly important as projects grow in size and complexity

- Backlog visibility helps investors understand how current construction activity may extend into future periods

- Stock selection in this article focuses on Caterpillar, CRH, Vulcan Materials, Cummins, Quanta Services, PACCAR, and Comfort Systems USA

1. Caterpillar (NYSE: CAT)

What it does

Caterpillar designs and manufactures heavy construction and mining equipment, engines, and power systems used across infrastructure, energy, mining, and industrial construction. In addition to equipment sales, Caterpillar generates recurring revenue through parts, maintenance, digital monitoring, and services delivered via its global dealer network. These services support machines throughout their operating life and deepen customer relationships.

Investment thesis

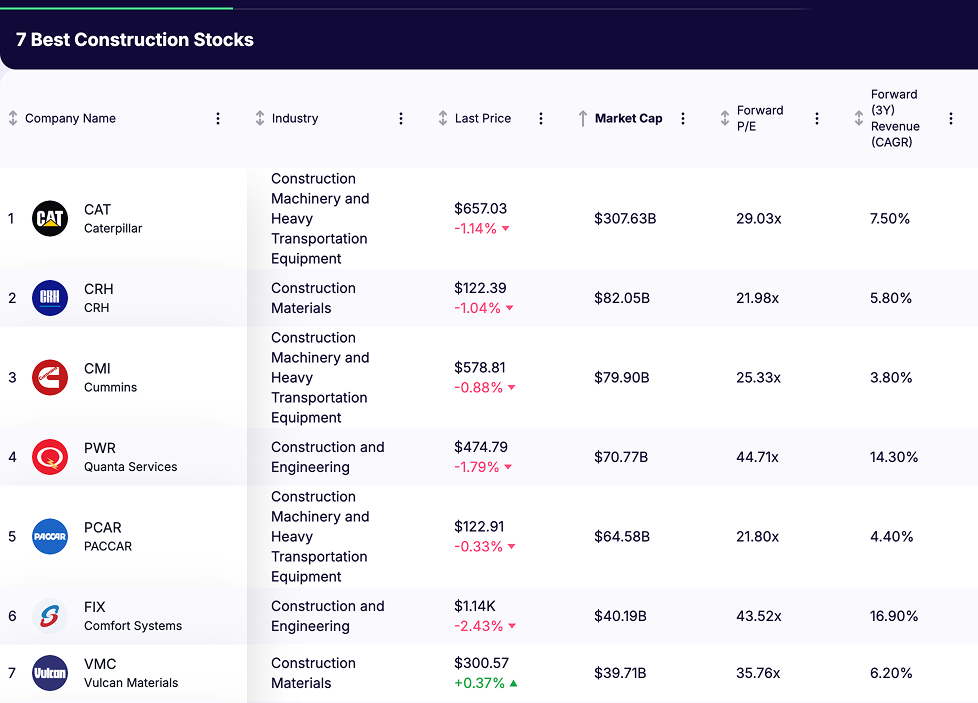

Caterpillar’s investment case in 2026 is built around strong demand visibility, a favorable business mix, and disciplined capital management.. The company enters the year with a record order backlog, reflecting sustained demand tied to energy, power generation, including nuclear energy, and large infrastructure projects. Management is prioritizing sales to end users, services growth, and operational efficiency rather than pushing volume.

A growing contributor is the Power and Energy segment, which benefits from grid expansion, power generation, and industrial energy needs. At the same time, services revenue continues to expand as a share of the business, helping stabilize earnings when equipment demand varies by market or region.

Caterpillar also emphasizes free cash flow generation and consistent capital returns, reinforcing its position as a mature, cash-generative leader within construction and industrial equipment.

Key risks

Caterpillar is sensitive to global economic conditions, particularly in mining and resource-related markets. Higher tariffs and manufacturing costs can pressure margins if not fully offset by pricing. Dealer inventory changes may also introduce short-term volatility in reported results even when underlying demand remains steady.

2. CRH (NYSE: CRH)

What it does

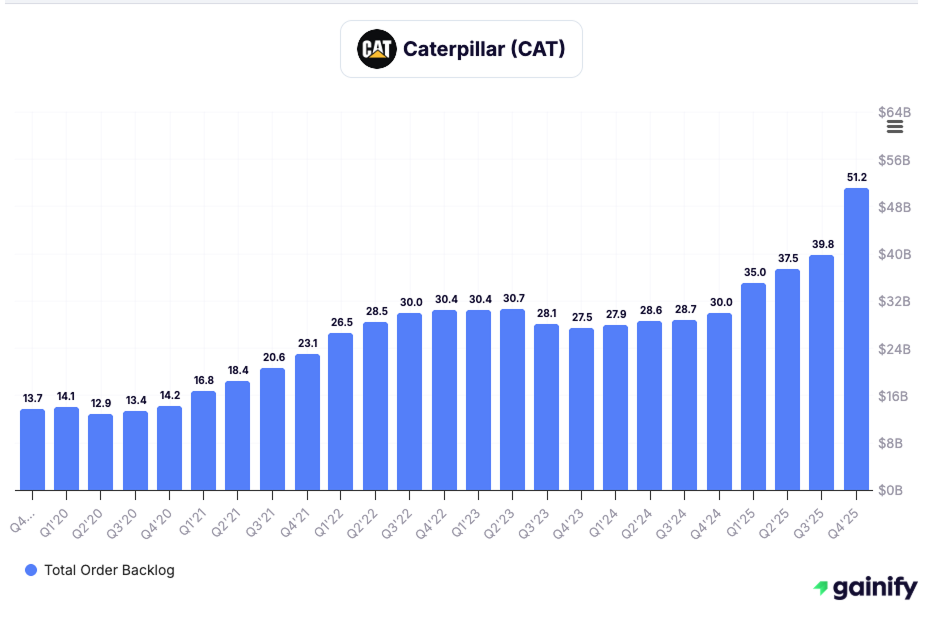

CRH produces aggregates, cementitious materials, asphalt, and road solutions used in transportation infrastructure, water systems, data centers, and industrial construction. Its operations are concentrated near end markets, which limits transportation risk and supports local pricing power.

Investment thesis

CRH’s investment case in 2026 centers on its role at the execution stage of construction. Aggregates and cement are required once projects move from planning to building, making CRH directly exposed to real construction activity rather than project approvals.

The company has intentionally narrowed its focus to infrastructure-led markets where funding and demand are more predictable. Transportation upgrades, water infrastructure, and reindustrialization projects remain core drivers. CRH’s disciplined pricing approach and selective capital deployment have improved earnings stability and reduced sensitivity to short-term volume swings.

CRH’s scale, regional density, and portfolio focus position it as a steady compounder within construction materials rather than a cyclical trade.

Key risks

CRH is sensitive to fuel, energy, and transportation costs, which can compress margins if pricing lags. Construction activity can slow in specific regions depending on funding timing. Weather disruptions may affect short-term production and shipment volumes.

3. Cummins (NYSE: CMI)

What it does

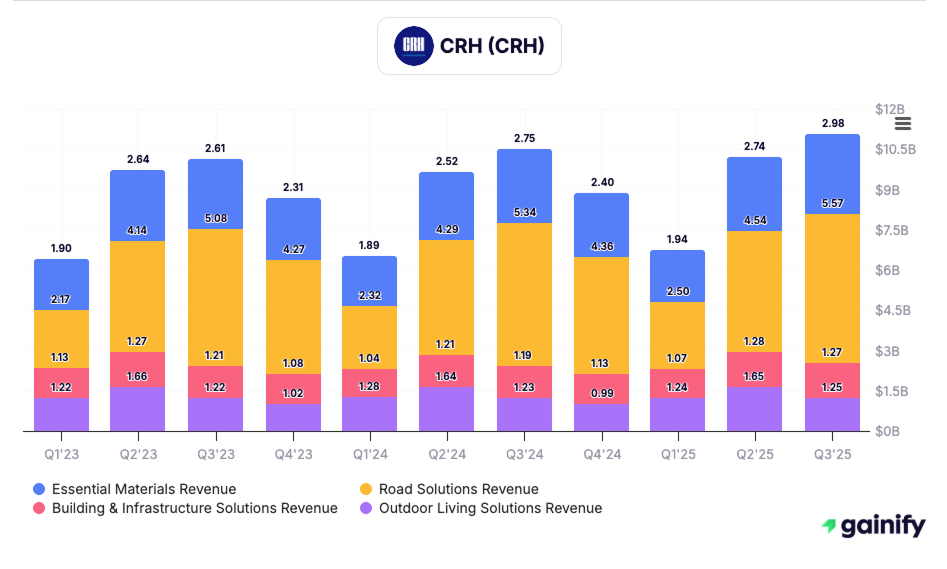

Cummins supplies engines, components, and power systems that are built into construction equipment, trucks, and industrial machinery. Its core Cummins-branded engines are widely used across construction and industrial fleets. The company also operates a global distribution and service network that supports these products with parts, maintenance, and technical support over long operating lifecycles.

In addition, Cummins has expanded into alternative power systems through brands such as Accelera, which focuses on batteries, fuel cells, and electric powertrain components.

Investment thesis

Cummins’ role in construction is embedded rather than visible. Its engines and power systems sit inside the equipment and vehicles that keep construction sites operating day to day. Once installed, these systems generate ongoing demand for parts and service, making the aftermarket a meaningful and stabilizing part of the business.

In 2026, Cummins is positioned to support emissions and efficiency transitions in a way that fits how construction fleets actually operate. Operators tend to adopt new technologies gradually, prioritizing uptime and reliability. Cummins’ ability to offer traditional engines alongside newer platforms such as Accelera allows customers to extend the life of existing fleets while planning longer-term upgrades.

Key risks

Cummins remains sensitive to slowdowns in heavy-duty truck and equipment demand, particularly in North America. Regulatory changes can raise development and compliance costs, and competition in alternative power systems continues to evolve. Execution risk exists as the company balances investment in newer technologies while maintaining profitability in its core engine business.

4. Quanta Services (NYSE: PWR)

What it does

Quanta Services builds and maintains power and utility infrastructure, including transmission lines, substations, and related systems that support electricity delivery, renewable generation, and large power users such as data centers and industrial facilities.

Investment thesis

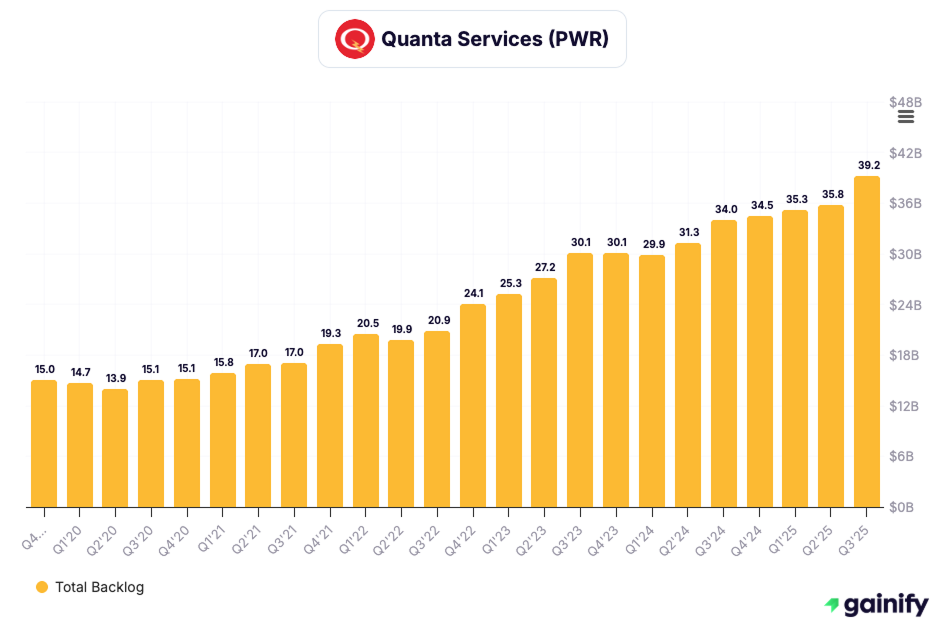

Quanta’s business is closely tied to ongoing grid expansion and reliability work. Utilities continue to invest in network upgrades to handle higher power demand, system aging, and new generation sources. These projects typically run over multiple years and require specialized labor and technical expertise.

The company’s self-perform model is central to its economics. By relying on its own skilled workforce, Quanta maintains control over execution and safety while reducing dependence on subcontractors. This matters in an environment where qualified labor is limited and project complexity is increasing.

Quanta’s positioning links it directly to power infrastructure needs that extend beyond short-term construction cycles.

Key risks

Project execution risk remains the primary concern. Unexpected cost increases, labor availability issues, or scheduling delays can affect profitability. Regulatory and permitting processes may also influence the timing of project awards and construction activity.

5. PACCAR (NASDAQ: PCAR)

What it does

PACCAR manufactures heavy-duty and medium-duty trucks under brands such as Kenworth, Peterbilt, and DAF. Its vehicles are widely used in construction logistics, materials transport, and industrial supply chains.

Investment thesis

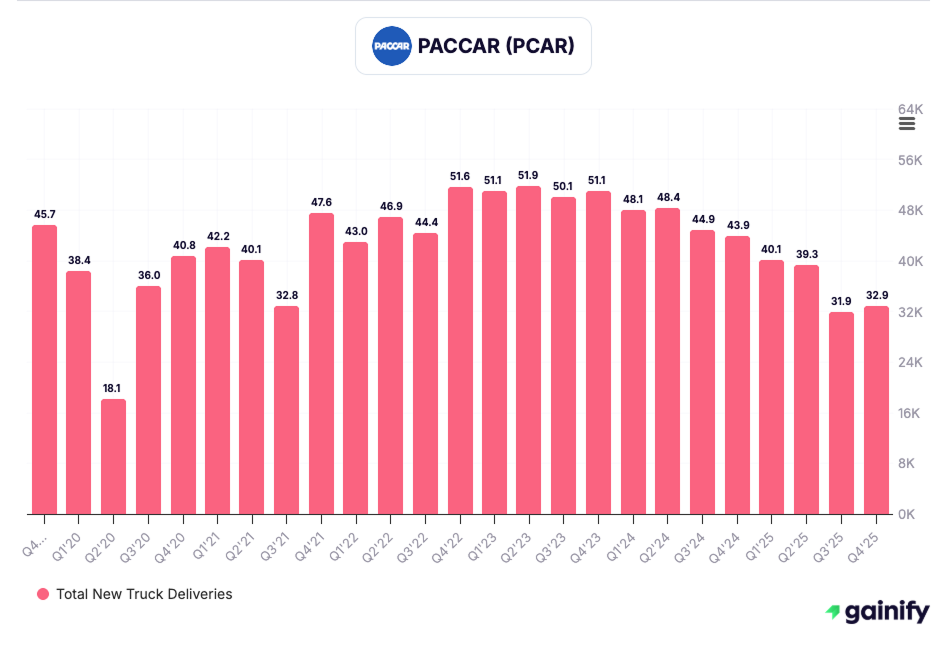

PACCAR offers indirect exposure to construction activity through fleet utilization and replacement cycles. Construction projects drive demand for hauling materials, equipment, and prefabricated components. Even when new construction slows, older fleets still require replacement.

PACCAR’s conservative balance sheet, strong parts business, and long history of profitability make it a stable way to participate in construction-related demand without taking on project-level risk.

Key risks

Truck demand can be cyclical and sensitive to freight conditions beyond construction. Regulatory changes around emissions can raise development costs. International exposure introduces currency and regional demand risks.

6. Comfort Systems USA (NYSE: FIX)

What it does

Comfort Systems USA installs and services mechanical, electrical, and plumbing systems in commercial and industrial buildings. Its work includes HVAC, electrical distribution, and modular systems used in data centers, healthcare facilities, manufacturing plants, and other complex projects.

Investment thesis

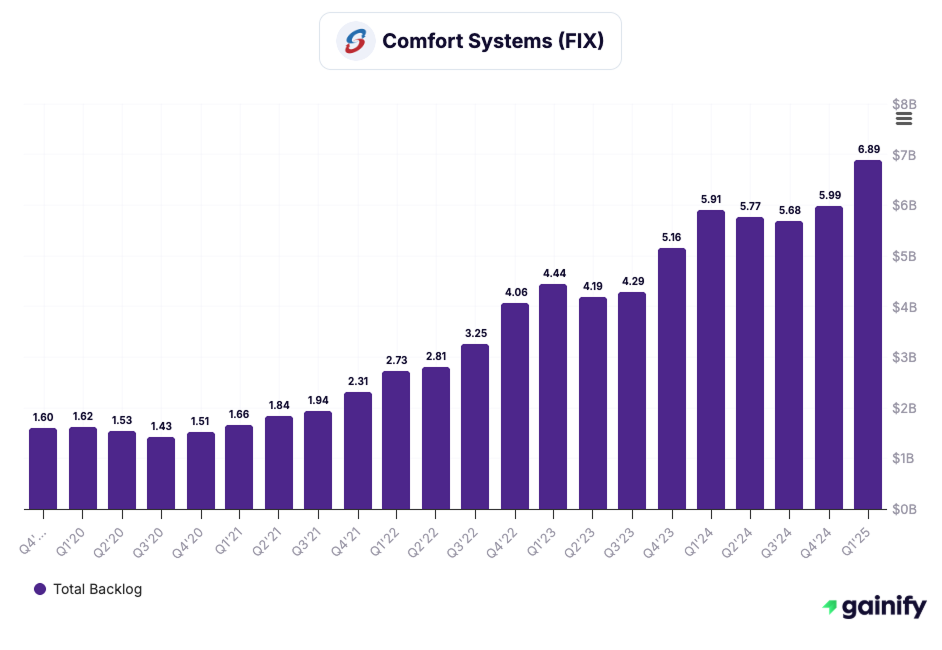

Comfort Systems operates late in the construction process, which provides visibility into which projects are actually being built. Demand in 2026 is supported by data centers, industrial facilities, and infrastructure-related construction that requires specialized mechanical and electrical systems. The company’s decentralized model and skilled labor base support consistent execution in a labor-constrained environment.

Key risks

The business is labor intensive, and workforce availability remains a constraint. Project mix can affect margins, particularly on fixed-price contracts. A slowdown in non-residential construction could reduce project flow.

7. Vulcan Materials (NYSE: VMC)

What it does

Vulcan Materials produces construction aggregates used in roads, highways, and commercial projects. Aggregates are heavy, location-specific materials that are difficult to substitute or transport long distances.

Investment thesis

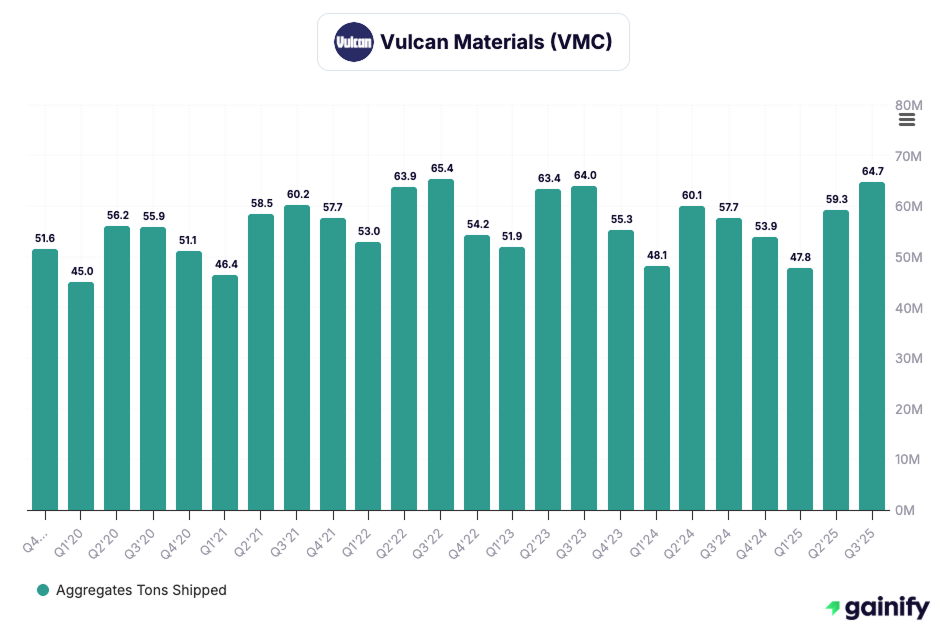

Vulcan’s advantage comes from reserve location and pricing power. Infrastructure repair and road maintenance create steady demand that is less sensitive to housing cycles. In many regions, limited permitting restricts new supply, supporting long-term pricing.

In 2026, Vulcan benefits from public infrastructure funding and improving non-residential construction activity, particularly in high-growth regions.

Key risks

Aggregates demand can slow during economic downturns. Regulatory and permitting challenges can affect expansion plans. Transportation costs and fuel prices influence profitability.

What These Construction Stocks Tell Us About 2026

Looking across Caterpillar, CRH, Vulcan Materials, Cummins, Quanta Services, PACCAR, and Comfort Systems USA, a clear pattern emerges about construction in 2026. Activity is concentrated in areas where projects are funded, underway, and operationally necessary, including infrastructure repair, power and grid expansion, industrial facilities, and materials supply.

Each of these companies sits at a different but essential point in that process. Equipment and engines enable work to start, aggregates and materials make construction possible, trucks and logistics keep projects moving, and specialized services complete complex builds. Together, they reflect how construction spending is actually being deployed in 2026, offering investors a practical way to gain exposure to the sector through businesses tied to execution rather than speculation.