Nancy Pelosi’s stock portfolio has become one of the most widely discussed financial disclosures in American politics. As a senior Democratic representative from California and the first woman to serve as Speaker of the House, Pelosi has shaped national legislation for decades. Her political decisions influence industries ranging from healthcare and technology to energy and finance. This dual role as a policymaker and an investor has turned her family’s financial filings into must-read documents for traders, watchdogs, and analysts alike.

Pelosi’s net worth is estimated at more than $267 million, and her stock trading activity between 2014 and 2026 amounts to 183 transactions worth $164.21 million in reported volume. These trades, filed under the STOCK Act, are not just routine disclosures. They have become market-moving events, often leading to increased trading activity in the same companies once her positions are revealed.

For critics, the combination of Pelosi’s political power and her family’s financial activity raises ethical concerns about insider access and fairness. For investors, however, her portfolio has become a sort of compass for where money and influence converge — especially in the technology sector.

Nancy Pelosi’s Latest Trades

No trades have been reported in 2026 to date. 2025 revealed a series of high-profile trades, underscoring Pelosi’s focus on technology, artificial intelligence, and energy. Below is a breakdown of her reported 2025 transactions:

Apple (AAPL) – October 22, 2025

- Purchase: $100,001 – $250,000

- Action: CONTRIBUTION OF 382 SHARES HELD PERSONALLY TO TRINITY UNIVERSITY IN WASHINGTON, DC.

- Context: Apple is a dominant force in consumer technology, with massive recurring revenue from iPhone, services, and wearables. Its expanding ecosystem, growing services margins, and long-term AI/edge-computing roadmap position it as a stable compounder.

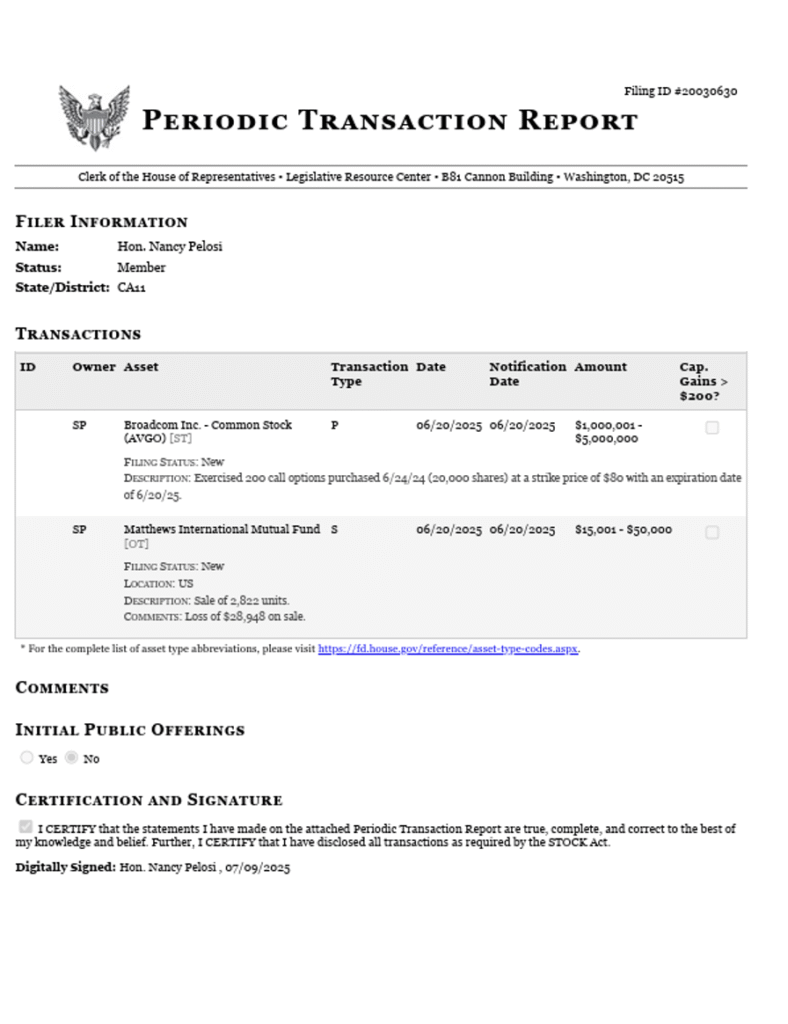

Broadcom (AVGO) – June 20, 2025

- Purchase: $1,000,001 – $5,000,000

- Action: Exercised 200 call options (20,000 shares).

- Strike price: $80, expiration 6/20/25.

- Context: Broadcom is a leader in semiconductors, essential for AI chips, networking hardware, and data centers. Pelosi’s large position aligns with the semiconductor boom and growing demand for AI infrastructure.

Amazon (AMZN) – January 14, 2025

- Purchase: $250,001 – $500,000

- Action: Purchased 50 call options.

- Strike price: $150, expiration 4/16/26.

- Context: Amazon Web Services (AWS) dominates cloud computing. The trade coincided with optimism about AI integration across Amazon’s retail, logistics, and cloud divisions.

Alphabet (GOOGL) – January 14, 2025

- Purchase: $250,001 – $500,000

- Action: Purchased 50 call options.

- Strike price: $150, expiration 4/16/26.

- Context: Alphabet’s AI arms (Google DeepMind and Gemini) and Google Cloud are driving growth. Pelosi’s position reflects confidence in Alphabet’s AI-first strategy.

NVIDIA (NVDA) – December 20, 2024 & January 14, 2025

- Dec 20, 2024: Exercised 500 call options (50,000 shares) at a strike price of $52, expiring 12/20/24. Amount: $500,001 – $1,000,000.

- Jan 14, 2025: Purchased 50 call options. Strike price $150, expiration 4/16/26. Amount: $250,001 – $500,000.

- Context: NVIDIA is the backbone of AI computing with its GPUs powering everything from data centers to autonomous vehicles. Pelosi has a track record of profitable trades in NVIDIA, capitalizing on its meteoric rise during the AI boom.

Tempus AI (TEM) – January 14, 2025

- Purchase: $50,001 – $100,000

- Action: Purchased 50 call options.

- Strike price: $100, expiration 4/16/26.

- Context: Tempus applies AI to healthcare, analyzing clinical and molecular data for better treatment insights. Pelosi’s move into this smaller player signals interest in healthcare-focused AI innovation.

Vistra Corp (VST) – January 14, 2025

- Purchase: $500,001 – $1,000,000

- Action: Purchased 50 call options.

- Strike price: $90, expiration 4/16/26.

- Context: Vistra is a U.S. utilities and energy company transitioning toward renewable power. Pelosi’s investment coincided with federal incentives for clean energy expansion.

Palo Alto Networks (PANW) – December 20, 2024

- Purchase: $1,000,001 – $5,000,000

- Action: Exercised 140 call options (14,000 shares).

- Strike price: $100, expiration 12/20/24.

- Context: A global cybersecurity leader. Pelosi’s trade reflects growing demand for digital security in an AI-driven world.

Pelosi’s Investment Style: Deep in the Money Calls

One of the most striking features of Nancy Pelosi’s reported trading activity is her repeated use of deep in-the-money (DITM) call options. Unlike speculative, “lottery-ticket” style trades often associated with options, these are sophisticated contracts that allow her to replicate the performance of a stock with less upfront cash and enhanced flexibility.

What Are Deep in the Money Calls?

An option is a financial contract that gives the holder the right but not the obligation to buy a stock at a preset “strike price.”

A deep in-the-money call means the strike price is set far below the stock’s current market value. Because of this, the option already has substantial intrinsic value and behaves much like the underlying stock.

Example:

- NVIDIA trades at $500.

- Pelosi buys a call option with a strike price of $150.

- Since the stock is already well above $150, the option is “deep in the money.” It will rise and fall almost in lockstep with NVIDIA stock.

Key Traits of DITM Calls

- High Delta (Close to 1.0):

The option’s price changes almost dollar-for-dollar with the stock. In practice, owning a DITM call feels nearly identical to holding the stock itself. - Capital Efficiency:

Buying 1,000 shares of a $500 stock would cost $500,000. A DITM call controlling the same 1,000 shares might cost a fraction of that, freeing up cash to invest elsewhere. - Leverage and Amplified Gains:

Because less money is tied up, percentage returns are magnified. A 10% rise in the stock could deliver a much larger return on the option. - Reduced Risk Compared to Out-of-the-Money Calls:

Out-of-the-money options are cheap but risky, since they only pay off if the stock makes a big move. DITM calls already carry intrinsic value, making them far less likely to expire worthless.

Why Pelosi Uses Them

Pelosi’s filings show a deliberate preference for DITM calls in companies like NVIDIA, Broadcom, and Palo Alto Networks. This isn’t random. It’s a strategy with several advantages:

- Amplifying Exposure to Tech Leaders:

By using DITM calls, Pelosi captures nearly the same upside as owning shares of high-growth firms without committing the full cash cost. - Diversification Through Capital Efficiency:

The lower upfront cost lets her spread investments across multiple companies. Instead of putting tens of millions into one stock, she can allocate across AI, semiconductors, cloud, cybersecurity, and energy simultaneously. - Aggressive but Risk-Adjusted:

Options always carry leverage, but DITM calls are a more conservative way to use them. Pelosi gets amplified returns while avoiding the “all-or-nothing” nature of speculative trades. - Flexibility:

Options allow easier scaling in and out of positions. She can exercise the calls to acquire stock, roll them into new contracts, or sell them if market conditions change — without the same cash lock-in as direct stock ownership.

A Real Example: NVIDIA, January 2025

In January 2025, Pelosi reported purchasing NVIDIA call options with a strike price of $150, when the stock traded far higher. This gave her nearly full exposure to NVIDIA’s performance but at a fraction of the cost of buying shares outright.

- Owning the stock directly: Buying 20,000 shares at $500 would cost $10 million.

- Using DITM calls: The options might cost only a few million, while controlling the same number of shares.

If NVIDIA climbs another 20%, her options will deliver returns almost identical to the stock, but with far greater capital efficiency.

Why It Matters

Pelosi’s preference for DITM calls highlights a sophisticated investment style. It blends:

- High-conviction bets on dominant tech and AI firms.

- Smart use of leverage to boost returns.

- Capital efficiency that allows wide exposure across sectors.

This approach explains how her reported trades consistently position her to benefit from technology megatrends while maintaining flexibility and managing risk more effectively than speculative traders.

👉 In short, DITM calls let Pelosi “think like a billionaire investor”: she can act as if she owns tens of millions in stock while only committing a fraction of that capital, giving her both leverage and optionality in some of the world’s most powerful companies.

Who Manages Pelosi’s Portfolio?

Although trades are filed under Nancy Pelosi’s name, much of the investment activity is widely believed to be managed by Paul Pelosi, her husband.

Paul Pelosi’s Background: A San Francisco businessman with decades of experience in real estate, private equity, and finance. He has built connections across California’s investment community and is regarded as the more active investor in the family.

Disclosure Rules: Under the STOCK Act, all trades by members of the House of Representatives must be reported in the elected official’s name. This is why Nancy Pelosi’s filings bear her name, regardless of who executes the trade.

Her Office’s Position: Pelosi’s spokesperson has long maintained that she does not personally execute trades and does not manage the portfolio directly. Instead, her husband oversees the strategy and activity.

The Ethical Debate: Critics argue that, regardless of who presses “buy” or “sell,” the family benefits from proximity to sensitive policy debates. As House Speaker, Pelosi has historically been privy to information capable of influencing entire industries. This raises the appearance of insider access, even if no laws are technically violated.

The Controversy: Insider Trading or Smart Strategy?

Pelosi’s stock activity has become a lightning rod in U.S. politics. Watchdog groups and retail traders often accuse her family of operating dangerously close to insider trading, citing her access to classified briefings, regulatory negotiations, and legislative deals.

The Tempus AI example is a case in point: Pelosi disclosed her purchase of options on January 17, 2025. Within a month, Tempus stock skyrocketed from $35.15 to $89.44. To critics, this was not mere coincidence. Even if the trade was managed by Paul Pelosi, the optics reinforced suspicions that lawmakers can profit from knowledge unavailable to the public.

This ongoing controversy has fueled bipartisan calls to ban members of Congress from trading individual stocks. Several reform bills have gained momentum, reflecting widespread frustration with the blurred lines between governance and personal wealth-building.

The Market Impact: The “Pelosi Effect”

Regardless of the debate, Pelosi’s filings undeniably move markets. The so-called “Pelosi Effect” describes how her disclosures spark waves of retail interest and trading activity.

- Broadcom (2025): After Pelosi disclosed her $1–5 million call exercise in June 2025, retail traders flagged AVGO as a Pelosi-backed stock. Trade volume surged in the days following.

- NVIDIA (2023–2025): Each disclosure of NVIDIA trades coincided with bullish momentum, making the company a central figure in Pelosi tracking portfolios.

- Apple (2024): Pelosi sold more than $5 million in Apple shares late in 2024. Weeks later, Apple stock weakened on reports of slowing demand. Traders saw this as another example of her “perfect timing.”

- Tempus AI (2025): Perhaps the clearest recent case: after Pelosi’s disclosure in January 2025, retail interest flooded into the stock, sending it up more than 150% in 30 days. The trade transformed Tempus from an obscure healthcare AI firm into a retail sensation.

Her impact is now so prominent that financial platforms have launched “Pelosi Tracker” portfolios and ETFs, which automatically mirror her trades. Some of these products have even outperformed the S&P 500, further cementing her reputation as one of the most market-moving politicians in U.S. history.

Conclusion: Pelosi’s Portfolio as a Political and Financial Symbol

Nancy Pelosi’s stock portfolio has become a political and financial symbol. To some, it demonstrates financial acumen and confidence in America’s most innovative sectors. To others, it represents a conflict of interest and raises profound ethical concerns.

Her latest trades highlight a deliberate strategy: heavy exposure to AI, semiconductors, cloud products, cybersecurity, renewable energy, and healthcare AI, executed primarily through deep in-the-money call options. Managed largely by Paul Pelosi, the portfolio consistently beats market benchmarks and attracts outsized attention.

Whether seen as shrewd investing or skating close to insider trading, the reality is undeniable: Pelosi’s portfolio moves markets. For as long as her STOCK Act disclosures remain public, they will continue to fuel debate, shape investor behavior, and blur the line between Wall Street and Washington.