Discover the best paper trading apps and platforms for 2026.

Compare top simulators like thinkorswim, Interactive Brokers, Webull, and more. Practice trading stocks, options, and futures risk-free with our comprehensive guide.

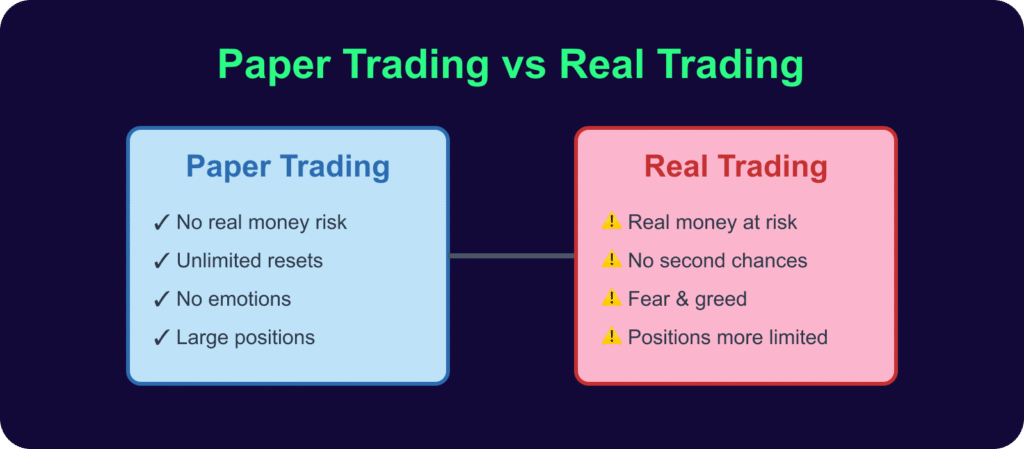

Paper trading – also known as virtual trading, practice trading, or simulated trading – allows you to practice buying and selling stocks using “fake money.”

However, while the money might be fake, the market conditions are real. Prices, market movements, and trading mechanisms match live market conditions – but your profits and losses exist only “on paper.”

Advanced platforms like Interactive Brokers simulate realistic order routing and potential slippage. Other simpler platforms might fill orders instantly at the displayed price.

Order types available in paper trading typically include market orders, limit orders, and stop-loss orders. Less commonly, trailing stops or one-cancels-other (OCO) orders are available.

You will get real valuable practice on what it’s like to invest in the actual market without having to risk your hard earned cash.

Think of it like a fully decked out flight simulator for investors.

It’s a great way to learn valuable investing lessons without sending your real portfolio into the red. Better to learn the hard way in a simulated trading environment with fake cash, than to lose your shirt in the “real world.”

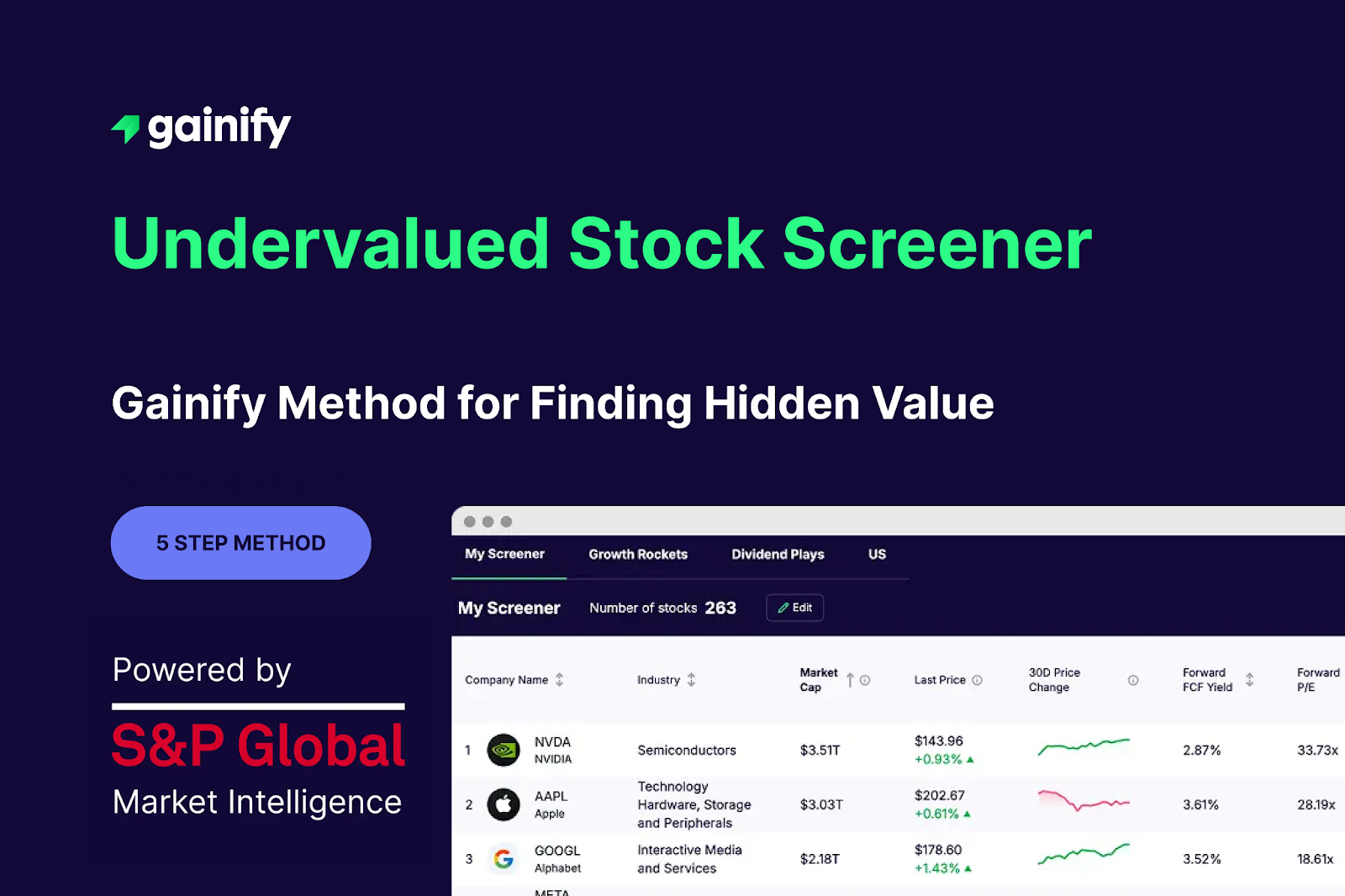

But paper trading isn’t all you need to learn the ropes. You need to understand what makes stocks valuable and how to find quality companies worth investing in. That’s where stock research platforms like Gainify come in.

With Gainify you unlock access to:

- Custom stock screener: Filter 30,000+ stocks using 500+ metrics to find exactly what fits your strategy. Search based on dividend yields, P/E ratios and more.

- AI stock analysis: Get instant insights on 25,000+ stocks with advanced AI that analyzes earnings calls and trends.

- Institutional-grade data: Access the same S&P Global Market Intelligence data used by Wall Street.

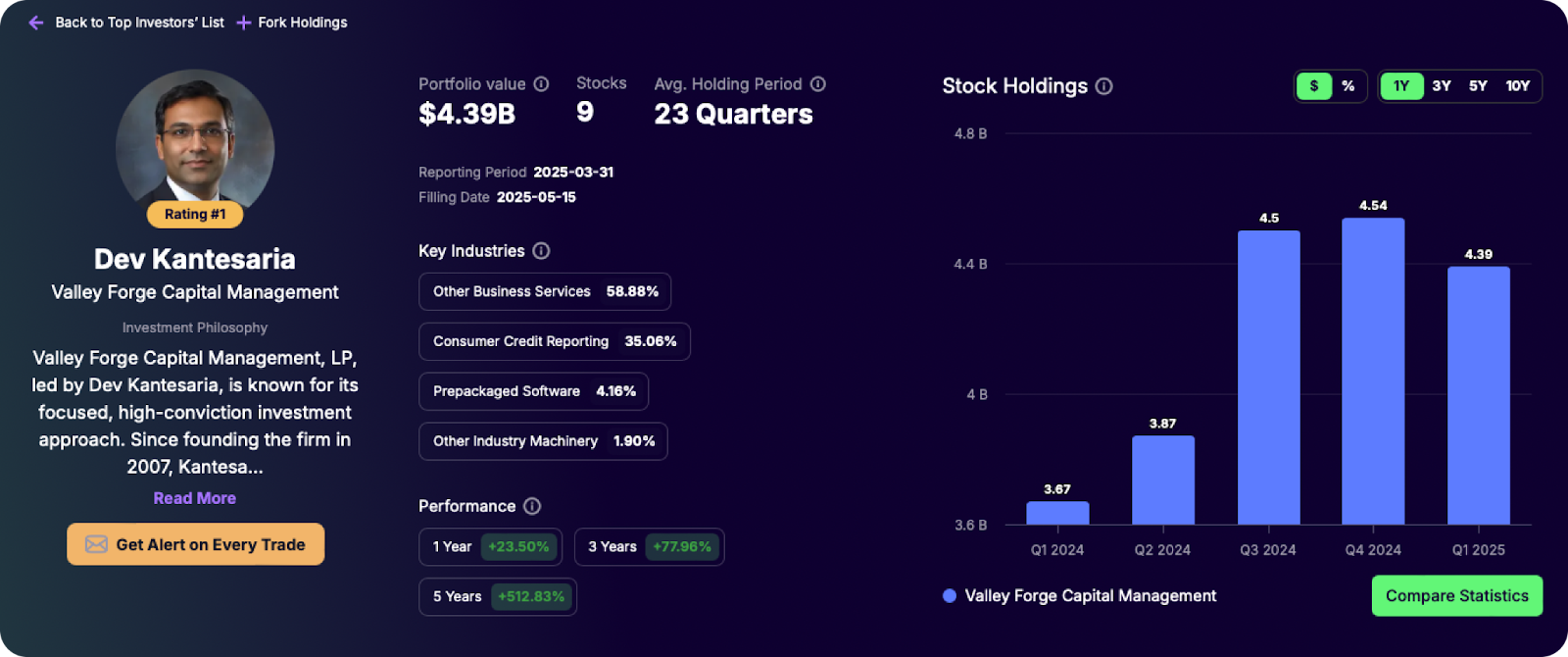

- Top investor tracking: See what legendary investors are buying and selling in real-time.

- Forward estimates: The largest database of analyst estimates available to retail investors for key value and growth metrics.

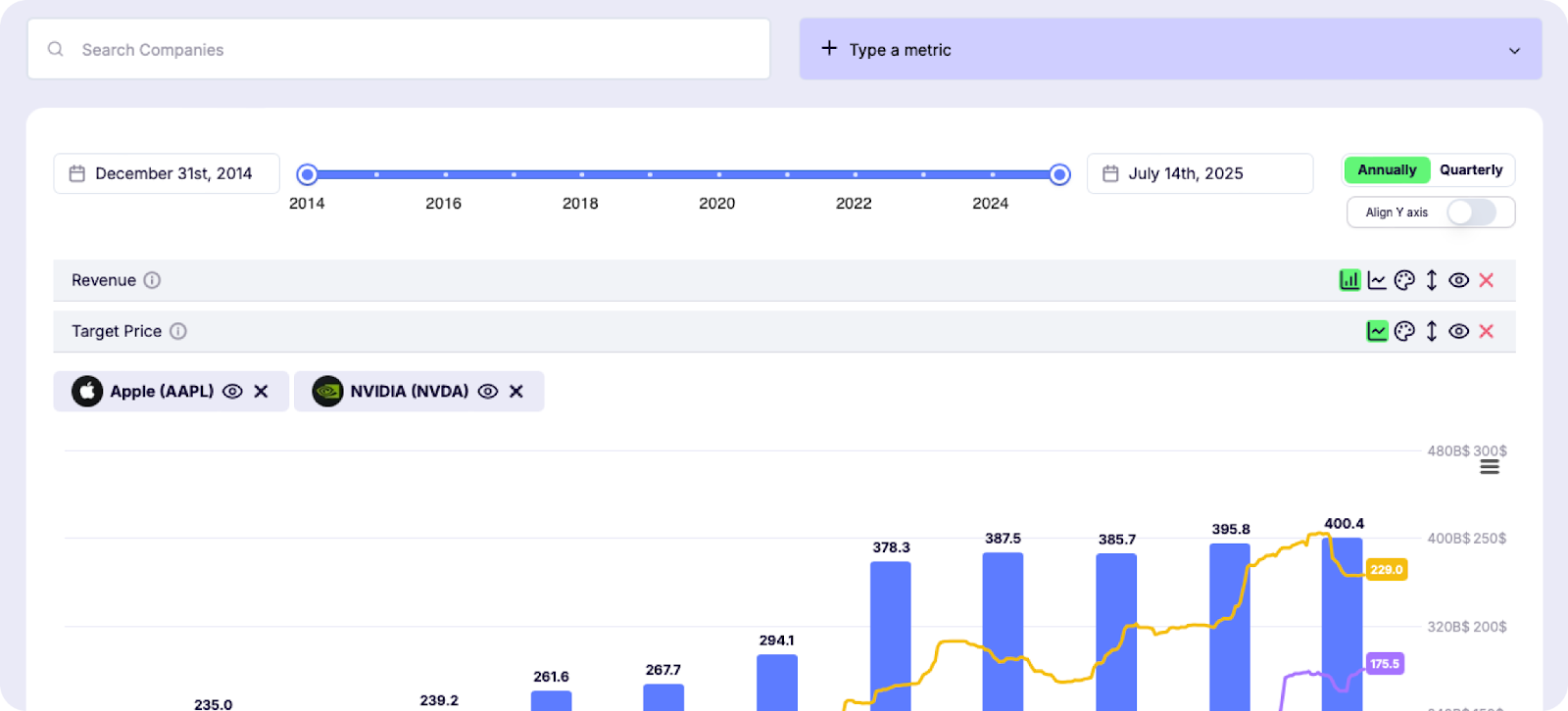

You’ll also have access to custom charting – enabling you to:

- Track sectors by comparing several companies side-by-side

- Chart based on 500+ financial metrics

- Create unlimited chart boards organized by theme, sector, or strategy

- Plot different scales together (like revenue vs. margins) with multi-axis support

- Zoom from quarterly earnings to decade-long trends instantly with smart timeline controls.

Try Gainify FREE today.

This comprehensive guide reviews 11 major trading platforms. We cover everything from professional-grade platforms like Charles Schwab’s thinkorswim to mobile-first apps like Webull, examining features, limitations, and costs.

We’ll show you exactly what to expect and help you choose the platform that matches your learning style and investing goals.

Read on to identify which paper trading apps offer the best paper trading experiences in 2026.

Paper Trading vs. Stock Simulators vs. Demo Accounts

You might be unsure about the difference between demo accounts, stock simulators, and paper trading.

While they all enable you to do essentially the same thing (practice trading) there are important differences between them. Depending on your investing goals, these differences will strongly impact your decision making when it comes to choosing a platform.

- Paper trading: Practicing trades on actual brokerage platforms using virtual money, with the intention of eventually transitioning to real trading on the same platform.

- Stock simulators: Typically educational tools that may simplify market mechanics for learning purposes. Examples include Investopedia Simulator and MarketWatch Virtual Stock Exchange.

- Demo accounts: Offer a limited trial period with full platform features before requiring real funding. Most commonly found in forex and CFD trading.

Risk-Free Learning Environment

Beginners and experienced traders alike can benefit from paper trading. Whether you’re just learning the ropes or testing new advances strategies – a risk-free learning environment is a huge help.

Paper trading is great for:

- Technical analysis practice

- Fundamental analysis for companies

- Order execution simulated market conditions

- Risk management development for trading skills

- Emotional control training with paper trading simulators

- Strategy refinement practice for building reliable processes

It becomes even more valuable when exploring new markets & asset types, or testing algorithmic trading systems.

Cost Savings and ROI

The benefit of paper trading isn’t just in ‘practice’ or ‘experience.’ It’s in becoming a materially more professional investor, and avoiding common pitfalls or deep losses.

Beginners benefit from a risk-free learning environment with fake cash, intermediate investors are able to conduct deep strategy testing and refinement without financial risk, and advanced traders can execute complex or expensive investment strategies (such as backtesting a quantitative strategy, then forward-testing it in paper trading.)

Key benefits come from:

- Learning from mistakes freely with fake cash

- Testing expensive trading strategies risk-free

- Getting familiar with a platform before live trading

- Avoiding beginner losses while building trading skills

11 Top Paper Trading Platforms for 2026 (In-Depth Reviews)

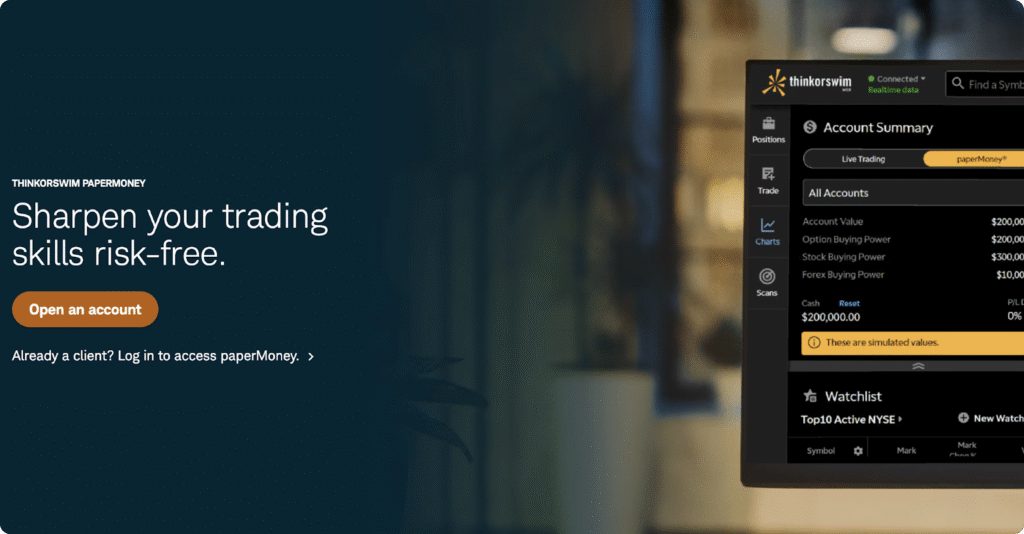

1. Charles Schwab thinkorswim paperMoney – Best Overall

As the former TD Ameritrade platform (now owned by Charles Schwab) thinkorswim sets the standard for paper trading.

You also gain access to 400+ technical studies covering:

- Support and resistance indicators

- Trend indicators

- Momentum indicators

These help you identify potential entry and exit points, visualize market trends & price levels, and develop & test customized trading strategies.

One unique feature you won’t find elsewhere is the proprietary thinkScript programming language. With it you can create your own studies, strategies, watchlist columns, scan queries, and alerts. You can also add conditional orders that execute when a specific ‘study’-based criteria is met.

If you’re an options trader you’ll appreciate advanced options analysis tools including probability cones and profit/loss diagrams.

Asset types supported

Charles Schwab thinkorswim supports:

- Stocks

- Options

- Futures

- Forex trading

Advantages

In addition to integrated CNBC streaming and news feeds to keep you up to date with all market happenings, thinkorswim offers:

- Backtesting capabilities

- $100,000 virtual money to start

- Real-time quotes and market data access

- Advanced charting tools and technical analysis features

- Seamless transition to live trading with the same interface

- Complex options strategies support with options chain analysis

Another bonus is 24/7 customer support with dedicated paper trading assistance.

Pricing

Free demo account with Charles Schwab account.

Best for

Thinkorswim is best if you’re a serious trader who doesn’t want to settle for anything less than institutional-quality tools. It’s also very suitable if you are pursuing options or futures trading strategies.

2. Interactive Brokers – Best for Foreign Investments

One huge advantage of Interactive Brokers is that you can practice across 150+ exchanges worldwide.

IBKR’s Trader Workstation (TWS) delivers realistic order routing and market impact, preparing you for the complexities of live trading.

You’ll also benefit from extensive educational resources. Although having moderate trading and paper trading experience is recommended before using International Brokers.

If you’re code-savvy you’ll be able to use the API to build custom analysis and trading solutions.

To get started paper trading you will need to have a live brokerage account.

Just keep in mind that while there are a lot of advantages to using International Brokers, the platform interface can have a steep learning curve and be overwhelming for beginners.

Asset types supported

Interactive brokers support a huge range of asset types:

- International stocks

- Cryptocurrency

- Options

- Futures

- Bonds

- Forex

- CFDs

Advantages

- Access to 150+ global markets with market access tools

- Realistic order execution with smart money routing

- Educational resources through IBKR Campus

- API access for automated trading systems

- Professional-grade stock trading platforms

Pricing

You’ll need to have an active account to access paper trading, but there are zero annual or inactivity fees and no account minimums. You can paper trade for free.

Best for

Interactive Brokers is best for you if you’re a retail investor investing globally and in multiple asset classes.

3. Webull – Best Free Paper Trading App

Many platforms provide you with a set amount of ‘fake cash’ when you set up a paper trading account. If you want unlimited virtual funds that you can reset anytime, then Webull is a good option.

But we recommend matching your paper trading portfolio to the amount you actually have available to invest – to make your trading more realistic based on your investible capital.

When you sign up for Webull you’ll gain access to:

- Extended trading hours (4AM to 8PM ET)

- Technical indicators and customizable charts

Another major advantage is Webull’s level 2 quotes.

Level 1 quotes only display the highest bid price and lowest ask price with their quantities. Level 2 quotes on the other hand show you multiple price levels on both sides of the order book.

Level 2 quotes include:

- Time and sales data showing recent transactions

- Market maker identifications (who is providing each quote)

- Multiple ask prices (not just the lowest) with corresponding quantities

- Multiple bid prices (not just the highest) with corresponding quantities

- Order book depth showing supply and demand at various price levels

This means your orders execute based on realistic bid-ask spreads. Not just on the stock’s last price. Other platforms that use instant fills at last price can create an unrealistic trading experience.

Webull also has strong mobile app capabilities, so you’ll be able to learn about trading from your mobile or tablet as well. Convenient if you’re trying to fit your paper trading into a lunch break or commute.

But there are some cons to be aware of, because Webull:

- Can fill orders of any size without price impact, unlike real markets where large orders move prices.

- Doesn’t simulate option assignments, missing critical risks like early assignment, dividend risk, and pin risk.

- Only offers limit and market orders, missing other real-world order types.

- Uses 15-minute delayed data unless you’re subscribed to real-time feeds.

Asset types supported

With Webull you can trade:

- Futures

- Options

- Stocks

- ETFs

Advantages

- User-friendly mobile interface

- Extended hours trading simulation

- Real-time data and Level 2 quotes

- Active community features and discussions

- No account funding required for paper trading

- Switch seamlessly between paper and real accounts

Pricing

You can paper trade on Webull completely free. You don’t need to have a funded trading account either.

Best for

Webull is best for you if you need extended hours trading and a strong mobile app experience.

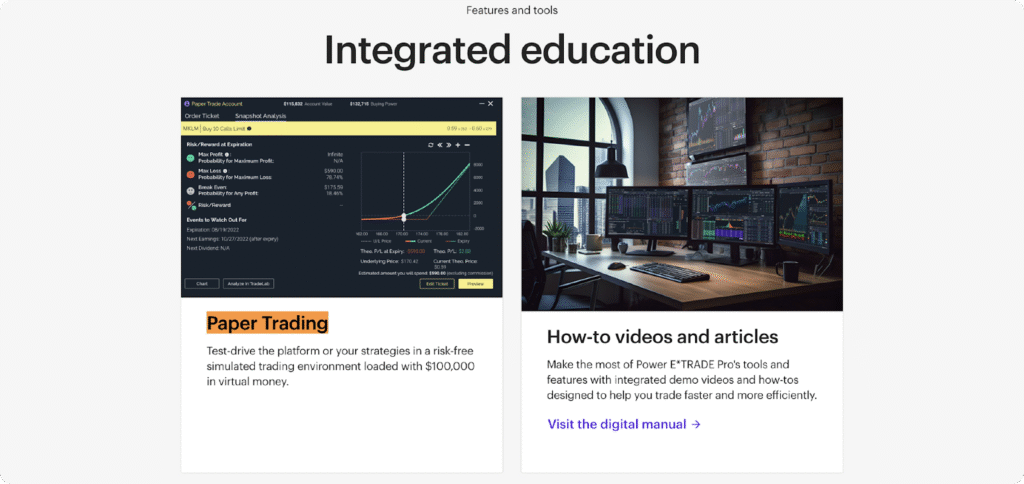

4. E*TRADE – Best for Options Paper Trading

If it’s sophisticated options trading you’re after then E*TRADE should be on your list of platforms to explore. While it requires using a specific Power E*TRADE platform (not the regular E*TRADE app) this additional step unlocks powerful options-focused paper trading features.

You’ll be able to practice complex multi-leg strategies up to 4 legs and test various options trading approaches.

Other key benefits include:

- Options Analyzer: Enables you to visualize strategies before execution, providing “what if” scenarios for risk assessment.

- Strategy Optimizer: Helps you identify the best options strategies based on your market outlook.

Asset types supported

With E*TRADE you’ll be able to pursue strategies covering:

- Options

- Stocks

- ETFs

Advantages

- Options backtesting for validating approaches on historical data

- Snapshot Analysis tool for strategy visualization

- Options education integrated into the platform

- Options screeners and strategy builders

Pricing

Paper trading is free with an E*TRADE account.

Best for

Best for you if you’re an options beginner or intermediate trader and want to master options strategies. The strong educational support is a big advantage if you fall into either of these groups.

5. TradeStation – Best for Automated Trading

TradeStation is a solid option if your strategy centers around automated trading.

The platform has 40+ years of historical data for backtesting which you can “trade on” automatically using EasyLanguage programming – which does not require complex coding.

Additional key features include:

- RadarScreen market scanning

- Matrix tool visualizing market depth

One small disadvantage is that unlike some platforms that offer paper trading without a funded account – TradeStation requires you fund your brokerage account before you can access paper trading.

Asset types supported

- Forex

- Stocks

- Options

- Futures

Advantages

- EasyLanguage programming for trading strategies

- Strategy backtesting with historical market data

- Advanced order types and trader workstation

Pricing

Paper trading is free but to access it you will need to fund your TradeStation brokerage account.

Best for

TradeStation will suit your trading style if your focus is on systematic algorithmic trading.

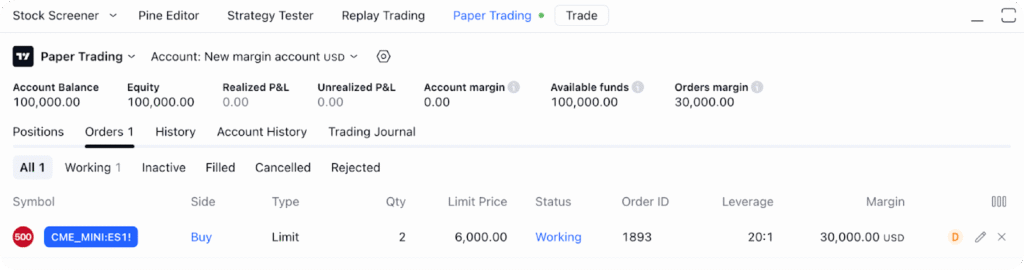

6. TradingView – Best for Chart Analysis

You can’t go past TradingView and its native Pine Script for technical analysis and trading. Paper trading on TradingView gives you access to most major asset classes, including crypto.

If you’re seeking a platform with strong and intuitive charting and TA capabilities then it’s hard to go past TradingView, known for its world class tools.

Use Pine Script to build custom indicators and automated trading strategies, then back test your strategies on historical data.

You can place several different order types via TradingView paper trading:

- Market

- Limit

- Take profit

- Stop loss

Every now and then TradingView holds paper trading competitions called “The Leap” which offer real cash prizes for paper trading with virtual money! Getting the hang of paper trading on TradingView could bring you real cash prizes of several thousand dollars.

Asset types supported

TradingView supports a wide range of asset classes, including:

- ETFs

- Forex

- Crypto

- Stocks

- Futures

Advantages

- Large, active community for learning and idea sharing

- Best-in-class charting and technical analysis tools

- Pine Script for custom indicators and strategies

Pricing

TradingView offers a range of free and paid accounts. Paper trading is accessible on all plans, including the free plan.

Best for

TradingView is best for you if you prefer technical analysis and trading based on chart patterns rather than fundamental analysis or long term value investing.

It’s also one of the few platforms offering paper trading for crypto.

7. eToro – Best Social Trading Simulator

eToro’s paper trading capabilities are pretty similar to those offered by other platforms. Although it does offer crypto trading, which is not found on all platforms.

The main reason you may wish to try paper trading on eToro is not for its specific paper trading prowess, but for the experience you will gain on eToro itself.

One thing that sets eToro apart from other brokers and trading platforms is that it gives you the ability to copy top traders’ portfolios.

With the CopyTrader feature simply find a top trader whose performance you would like to replicate, have at least $200 available to copy their portfolio, and watch as your trades are synced with theirs.

Like TradingView, eToro sometimes hosts paper trading competitions, giving you the chance to earn real cash prizes through virtual trading.

Asset types supported

- Commodities

- Stocks

- Crypto

- Forex

- ETFs

Advantages

- Unique copy trading feature for learning from experts

- Strong social community

Pricing

It’s free to sign up for eToro and use paper trading.

Best for

eToro is best if you prefer learning through a community of traders, and may even wish to simply copy top investors’ portfolios and trades.

8. ProRealTime – Best for European Traders

If you’re in Europe or are trading the European market, ProRealTime is worth exploring.

You’ll gain sophisticated technical analysis tools (over 100 technical indicators) and the ability to create automated trading systems.

Like TradingView and other platforms, ProRealTime boasts its own programming language (ProBuilder.)

With ProRealTime you’ll be able to paper trade based on real-time data from major European exchanges.

Practice with different order types, including market orders, limit orders, stop-loss orders, and trailing stop orders.

Asset types supported

- Forex

- Stocks

Advantages

- Technical analysis tools rival TradingView

- Broad European market coverage

- Automated trading

- Real-time data

Pricing

ProRealTime Web is completely free, including paper trading.

Best for

ProRealTime is best for you if your strategy revolves around investing in European markets.

9. Moomoo – Best for International Markets

Try Moomoo for paper trading if you want to practice in US, Hong Kong, Singapore, and China A-shares markets.

When paper trading on MooMoo you gain access to buy/sell orders, limit orders and odd lot orders. You will even be able to short sell options and futures (but not stocks).

Moomoo has a huge amount of learning material available. You’ll benefit from over 900 courses designed to guide you through all aspects of stock research & trading.

Paper trading is available on Moomoo’s web app, mobile app, and desktop app – making it a good option if you want to practice from your office, at home, or on the go.

Your orders will be filled based on the bid/ask price – similar to real trading (unlike some platforms that fill orders based on last price).

Moomoo sometimes holds paper trading competitions where you can win cash prizes and Apple tech!

Asset types supported

- Options

- Stocks

- ETFs

Advantages

- $1 million virtual funds for stocks/options, $10 million for futures

- Multi-market access (US, Hong Kong, China A-shares, Singapore)

Pricing

Access Moomoo paper trading free. You don’t need to sign up for a brokerage account to start.

Best for

Moomoo is best for you if you’re focused on Asian markets.

10. Investopedia Simulator – Best Educational Integration

The Investopedia Simulator – unlike broker sponsored platforms which want to funnel you into actual trading – is designed purely for learning.

If you prefer to learn about stock trading without being nudged into actual live trading, you may prefer this approach.

Investopedia has a large library of investing articles and tutorials to help you learn about all the aspects of investing.

If you need a little bit of competition to keep you motivated, you can join a game with other investors and compete for the number 1 spot on the leader board.

One disadvantage however is that data is not real time. You’ll have to settle for 15-minute delayed data when paper trading with the Investopedia Simulator.

Asset types supported

Be aware that Investopedia is heavily US market focused. It covers 6000+ stocks on Nasdaq and NYSE.

- Options

- Stocks

- ETFs

Advantages

- Learning focused

- Beginner-friendly interface

- Regular competitions and games

- Completely free with no registration barriers

Pricing

Use Investiopedia’s market simulator for free.

Best for

Investopedia Simulator is best if you’re seeking a beginner friendly platform with integrated learning content. It’s also great if you’re seeking fun paper trading competitions.

11. MarketWatch Virtual Stock Exchange – Best for Competitions

MarketWatch, like Investopedia, also offers competitions and games where you can compete to earn the top spot on the leaderboard.

You’ll be able to:

- Talk strategies with others in your “game”

- Create public games that others can join and play

- Select a custom list of symbols to trade in your game

Features and trade types not found on all paper trading platforms that you’ll have access to via MarketWatch include margin trading, short selling, and stop loss trades.

However, you will not be able to paper trade any stocks or funds outside the US.

Asset types supported

- Stocks

- ETFs

Advantages

- Public and private game creation

- Social competition features

- Simple trading interface

- Free access

Pricing

MarketWatch’s Virtual Stock Exchange is free to use.

Best for

MarketWatch is best for you if you’re seeking to teach groups of students how to trade or want to create games with friends & coworkers.

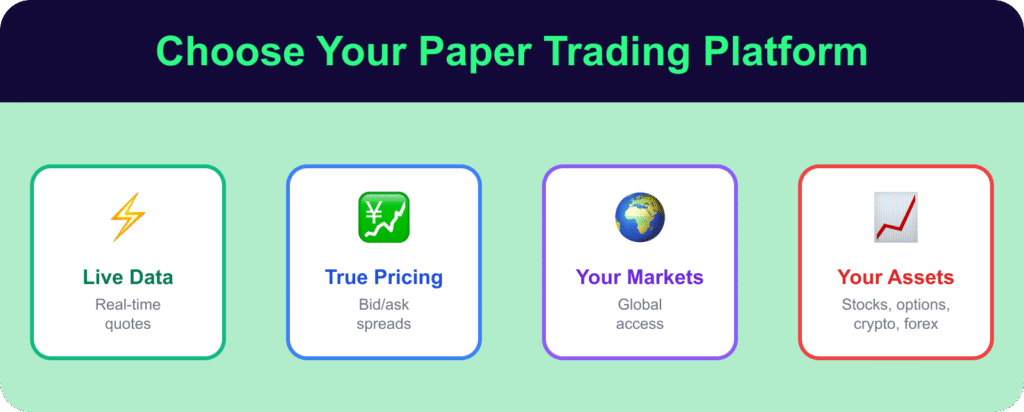

How to Choose the Right Paper Trading Platform

When choosing a paper trading platform your main goal should be to make your experience as realistic as possible. This means data that mirrors real-world trading, and also having access to the specific stocks and strategies you wish to trade.

- Look for real time quotes rather than delayed data

- Seek a platform that fills orders based on buy/ask prices not last price

- Ensure the markets you intend to trade are available (some platforms focus heavily on US markets which makes little sense for you if you wish to trade Asian markets)

- Trade the specific asset classes and trade types you plan to in real trading, be that options, crypto, or short selling)

If you’re more technically inclined then you will also require the presence of programmatic/automated trading capabilities and backtesting vital to your experience.

Platform Selection by Trading Style

The platform you choose also depends heavily on your specific trading style.

- Long-term investing: Seek strong fundamental analysis, portfolio tracking, and research integration. Charles Schwab’s thinkorswim combines strong research tools with paper trading, making it suitable for investors testing value-based strategies.

- Day trading: You’ll need fast execution, Level 2 quotes, advanced charting, and real-time data. Check out platforms like Interactive Brokers and TradeStation.

- Options trading: You’ll require specialized tools like options chains, Greeks analysis, and strategy builders. ETRADE’s Power ETRADE platform is worth evaluating if this is you.

- Forex and futures: You’ll need global market access. Interactive Brokers and TradeStation offer futures markets, while eToro provides accessible forex trading.

Getting Started with Paper Trading: Step-by-Step Guide

Setting Up Your First Paper Trading Account

Free platforms like TradingView and Webull allow immediate access with just an email, while broker-affiliated platforms may require more detailed information.

Some platforms even require you fund a brokerage account before you can access paper trading.

If you really just want to learn and don’t necessarily intend to switch to real trading on that specific platform – get started with any app that meets your investing criteria and offers fast & free setup.

Once you’re set up you’ll have a lot of options available for building charts and conducting analysis.

Start simple and gradually personalize charts, watchlists, and tools as you understand your preferences.

Best Practices for Paper Trading Success

Paper trading can be a lot of fun. It can also lead you to establish poor trading habits. While you’re using fake cash in simulated markets, treat it just like you would your own money.

- Set realistic position sizes based on your actual planned trading capital, not the inflated virtual balance.

- Set realistic goals aligned with market conditions. Aim for consistent small gains rather than home runs.

- Track metrics like win rate, average gain/loss, and maximum drawdown to measure improvement objectively.

- Maintain a trading journal. Record entry/exit points, rationale, emotions, and lessons learned.

- Test multiple strategies to identify those matching your experience level, trading style, and investing goals.

- Test more advanced trade types like stop-loss and take profit trades before you try them in real-life trading.

- Practice during different market conditions. Backtest if you can to cover a broad range of up down and sideways markets.

Transitioning from Paper Trading to Real Trading

When you’re ready to switch from paper trading to real trading, understand that the psychological differences between paper and real trading can be unnerving to begin with.

Real trading triggers all the emotions under the sun, including fear and greed.

Your first real trades will likely feel very different. Where you traded $10K positions in paper trading, you may get extreme anxiety about $1K trades in real life.

Start with small amounts and work your way up.

You’ll also need strict risk controls. Losing your portfolio in paper trading means little when you’re just a “reset” away from having $100,000 to $1,000,000 in fake cash to trade with.

In real life, losing your portfolio is devastating. Something you may never recover from. You’ll need to implement strict risk controls. Try the 1-2% rule: never risk more than 1-2% of your account on a single trade.

Gradual transition strategies:

- Start with 10% of your planned position sizes

- Trade only your most successful paper trading setups

- Limit yourself to 1-2 trades daily in the beginning

- Increase position sizes only after consistent real-money profits

- Continue paper trading alongside real trading to test new strategies

You also need to ensure you have the right research tools. Trading stocks is one thing, finding the right ones to invest in is another.

Gainify: The Perfect Research Companion for Paper Traders

While paper trading platforms let you practice your execution skills risk-free, they often lack the deep research capabilities needed to make informed trading decisions. That’s where Gainify comes in as an ideal companion app if you want to level up your paper trading and real-life investing.

Why Paper Traders Need More Than Just a Trading Simulator

Paper trading is invaluable for learning market mechanics. You can test strategies, and build confidence without the pressure of risking your real money. But investing is about much more than order execution and portfolio tracking. Investing without thorough research and analysis can leave you in some stressful trading pinches.

To invest with confidence and get the best results for your portfolio, pair your paper trading app with Gainify.

1. Institutional-Grade Data at Your Fingertips

Gainify gives you access to S&P Global Intelligence data – the same trusted source used by finance professionals worldwide.

This is enhanced with data from Financial Modeling Prep, and Gainify’s own proprietary data collection processes & metrics.

Gainify’s proprietary metrics provide a comprehensive 360-degree view of a stock’s investment potential. These metrics evaluate stocks across five key dimensions:

- Outlook (expected financial trajectory)

- Valuation (whether stocks are undervalued or overpriced)

- Health (financial stability based on debt and liquidity)

- Performance (management’s historical ability to deliver growth)

- Momentum (current market strength)

2. Custom Screening & Charting for Rapid Learning

With Gainify, you can instantly analyze any stock with precise filtering and easy visualization.

Gainify’s stock screener helps you discover opportunities that match your investing criteria.

Use custom screening to filter 30,000+ stocks using 500+ metrics like debt ratios, P/E ratios, and revenue growth.

Custom screeners are ideal for:

- Identifying dividend champions: Screen for stocks with 3%+ yields and 5+ years of consecutive increases

- Spotting value plays: Filter by P/B ratio, free cash flow, and other value metrics to find undervalued companies

- Conducting risk assessment: Screen using volatility, beta, and debt metrics to match your risk tolerance.

You can filter by specific industries and indices of interest – enabling you to narrow in on stocks that fit YOUR specific investing goals.

Custom charting, another strong feature if you like to compare stocks visually, enables you to:

- Overlay several companies to track who’s scaling faster, improving margins, or turning profitable.

- Use multi-axis support to plot different scales accurately (revenue vs. margins on the same chart).

- Analyze different time frames by zooming seamlessly from quarterly data to decade-long trends with smart timeline controls.

Stock analysis & comparisons have never been more convenient. Dive deeper into any metric in an instant – hover any data point for insights into exact values, YoY%, and rolling CAGR.

The opportunities are endless with custom charting because you’ll be able to create unlimited chart boards organized by sector, strategy, or watchlist.

Once you’re finished analyzing, export Gainify’s professional-grade charts as PNG images for reports, presentations, or to share your insights on social media.

3. Top Investor Tracking for Strategy Inspiration

Through Gainify’s Top Investor Tracking feature, you can mirror the strategies of stock market legends.

Gain proven strategies to test in your simulated portfolios, see real investor portfolios updated from 13-F filings, track recent buy/sell activity, and more.

Conclusion

Paper trading is a great way to help you bridge the gap between a desire to start trading or testing new strategies, and actually putting real money on the line to trade them.

Whether you’re a beginner investor or a seasoned trader seeking to test advanced strategies, we definitely recommend paper trading as a way to hone your skills.

If you plan to take your paper trading strategies into the real world, ensure your strategy and process develops the required discipline, risk management, and emotional control.

And remember, while paper trading teaches you the mechanics of trading, platforms like Gainify provide the fundamental analysis and valuation insights you need to identify quality investments.

AI-powered stock analysis, forward-looking estimates from S&P Global Market Intelligence, and tracking of top investors’ portfolios can help you make informed investment decisions backed by institutional-grade data.

Frequently Asked Questions

Is Paper Trading Free?

Yes, paper trading is completely free on most platforms. While some require opening a brokerage account first, the account opening itself costs nothing. A few platforms may require funding your account to access paper trading features, but you’re never charged for the virtual trading itself. Premium features like real-time data or advanced tools might have associated costs.

Can You Make Money Paper Trading?

No, paper trading uses virtual money, so all profits exist only within the simulation. However, some platforms host competitions with real cash prizes, and the skills developed through paper trading can lead to profitable real trading later.

Is Paper Trading Legal?

Yes, paper trading is completely legal worldwide. It’s educational software simulating market conditions without actual securities transactions. No regulations apply since no real trading occurs. Anyone can paper trade regardless of age, location, or financial status.

How Long Should You Paper Trade Before Going Live?

Most experts recommend 3-6 months of consistent profitable paper trading. Focus on achieving at least 100-200 trades for day traders or 2-3 consecutive profitable months for swing traders. Practice through different market conditions (bull, bear, sideways) and ensure emotional readiness beyond just profitability.

Do Paper Trading Results Translate to Real Trading?

Paper trading provides valuable insights but expect 20-30% performance degradation initially in real trading. Key differences include psychological factors (fear and greed with real money), execution differences (slippage and partial fills), and market impact from larger orders. The correlation exists but isn’t perfect.

Can You Paper Trade Cryptocurrency?

Yes, several platforms offer cryptocurrency paper trading with major coins like Bitcoin and Ethereum. Some platforms even allow practicing with crypto derivatives and leverage. Note that crypto markets trade 24/7, providing unique practice opportunities.

What’s the Best Paper Trading App for Beginners?

The best beginner app balances user-friendly design with educational resources. Look for platforms offering unlimited virtual money with reset capabilities, integrated educational content, and simplified interfaces that don’t overwhelm new traders.

Can You Paper Trade Options?

Yes, many platforms offer robust options paper trading with features like strategy builders, Greeks analysis, and profit/loss diagrams. Practice everything from basic calls and puts to complex multi-leg strategies. Pay special attention to time decay and volatility impacts.

Can You Paper Trade During Extended Hours?

Extended hours paper trading varies by platform. Some offer pre-market (4:00 AM ET) and after-hours (8:00 PM ET) trading, while educational simulators typically support only regular market hours. Extended hours practice helps understand lower liquidity and wider spreads.

How Realistic is Paper Trading?

Realism varies significantly. Professional platforms simulate slippage, partial fills, and realistic order routing with real-time data. Educational simulators may use delayed data and simplified execution. The biggest gap however is psychological – no platform can simulate the emotional impact of risking real money.