Creating a stock watchlist is one of the most important habits successful investors develop. A well-built watchlist helps you track opportunities, compare stocks using consistent metrics, and act decisively when market conditions change.

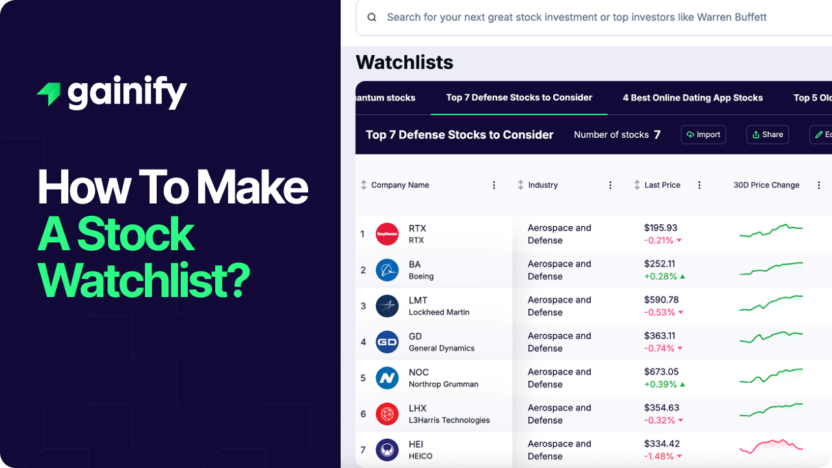

Modern investing platforms like Gainify have taken stock watchlists far beyond simple ticker lists. Investors can now create unlimited watchlists, track global stocks across multiple markets, and customize hundreds of financial and market metrics. This flexibility allows each watchlist to be tailored precisely to a specific investment strategy, whether focused on income, growth, valuation, or regional opportunities.

This guide explains how to make a stock watchlist, what metrics to include, and provides three real-world watchlist examples for dividend stocks, tech stocks, and oversold stocks.

What Is a Stock Watchlist?

A stock watchlist is a structured list of stocks you track for a specific investment purpose, such as income, growth, value, or tactical opportunities. Rather than reacting to market headlines or short-term price moves, a watchlist helps investors evaluate stocks using consistent, data-driven criteria.

A well-built stock watchlist allows you to:

- Compare companies side by side using the same financial and market metrics

- Monitor valuation, growth, income, and momentum in one place

- Filter large universes of stocks into actionable candidates

- Reduce emotional decision-making by relying on predefined signals

With modern platforms like Gainify, stock watchlists are no longer static lists of tickers. They become dynamic analysis tools, where metrics can be added, removed, sorted, and refined as investment strategies evolve.

Why Watchlists Matter More in 2026

Markets are more data-driven than ever. Investors today can track 40,000+ global stocks and access thousands of financial, valuation, and technical metrics. Without structure, that volume of data quickly turns into noise.

Platforms like Gainify help investors manage this complexity by enabling:

- Unlimited watchlists for different investment strategies across global stocks

- 40,000+ stocks from U.S. and international markets available in one place

- 1,000+ metrics that can be added as customizable columns

- Full control to add, remove, reorder, or delete columns at any time

- Bulk imports and fast sorting to manage large stock universes efficiently

This flexibility allows investors to think in frameworks and systems, rather than isolated stock picks, which is increasingly essential in global equity markets.

How to Make a Stock Watchlist (Step by Step)

Step 1: Define the strategy

Every watchlist should have a single purpose. Common examples include:

- Dividend income

- Growth investing

- Value or contrarian setups

- Technical or momentum strategies

Avoid mixing strategies in one watchlist.

Step 2: Create a new watchlist by adding stocks

In Gainify, you can create a new watchlist instantly by:

- Naming the watchlist based on the strategy

- Adding stocks manually or importing tickers in bulk

Because there is no limit to the number of watchlists, it’s better to separate ideas clearly.

Step 3: Customize columns with the right metrics

This is where most investors gain an edge.

Instead of tracking only price and market cap, Gainify allows you to select from hundreds of financial, valuation, growth, and technical metrics.

Columns can be:

- Added or removed at any time

- Sorted ascending or descending

- Rearranged based on importance

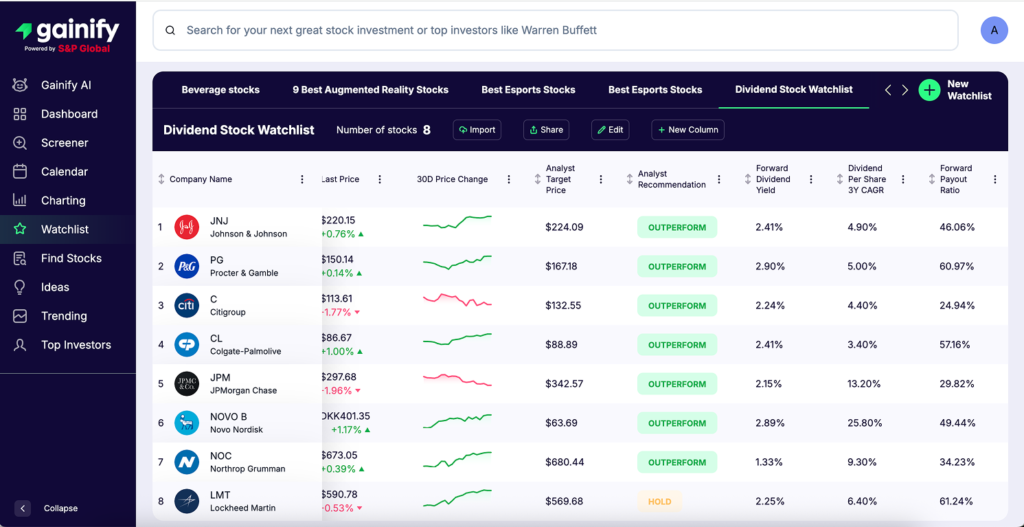

Example 1: Dividend Stock Watchlist

Goal: Identify high-quality dividend stocks with sustainable payouts.

Recommended columns

- Dividend yield

- Payout ratio

- Dividend per share growth

- Expected dividend growth (next 3 years)

- Free cash flow coverage

Why this works

High dividend yield alone is not enough. Combining yield with payout ratio and growth metrics helps avoid dividend traps and focus on long-term income reliability.

This watchlist is ideal for income-focused and conservative investors.

Example 2: Tech Stock Watchlist

Goal: Track growth-oriented technology stocks while managing valuation risk.

Recommended columns

- Price-to-sales ratio

- PEG ratio

- Revenue growth (next 3 years CAGR)

- Gross margin

- Free cash flow growth

Why this works

Tech stocks often trade at premium valuations. Using sales-based multiples and forward growth expectations provides better context than traditional P/E ratios alone.

This watchlist helps investors compare tech companies on growth-adjusted fundamentals.

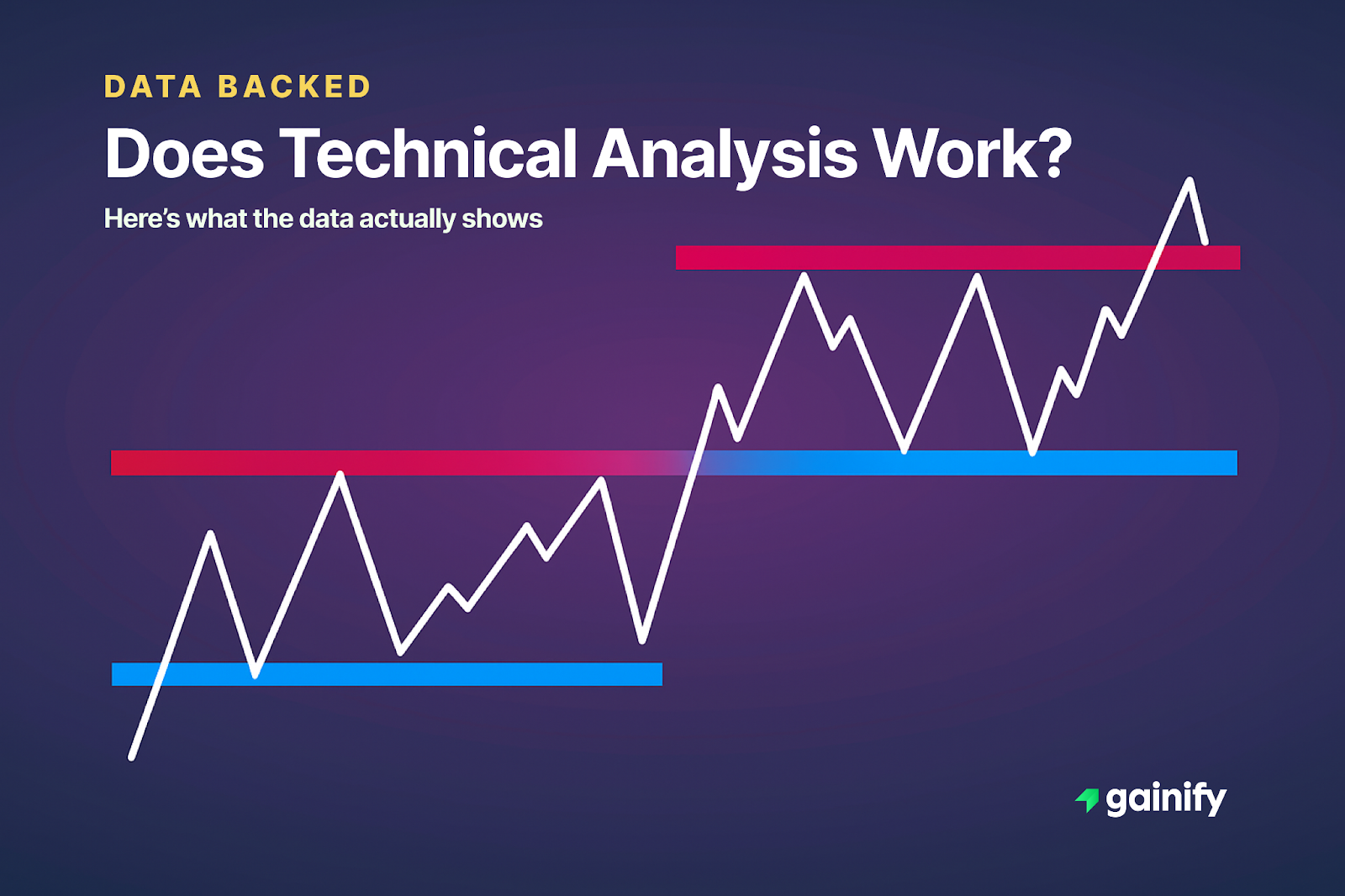

Example 3: Most Oversold Stock Watchlist

Goal: Identify stocks that may be temporarily oversold.

Recommended columns

- Relative Strength Index (RSI)

- 3-month price performance

- 6-month price performance

- P/E relative to 5-year average

- Analyst target price upside

Why this works

Combining technical indicators with valuation context helps distinguish between:

- Stocks experiencing short-term pressure

- Stocks facing long-term structural decline

This watchlist is useful for tactical and contrarian investors.

Best Practices for Managing Watchlists

- Review weekly, not daily: Watchlists are most effective when reviewed on a regular schedule rather than constantly. Weekly reviews help you stay informed without reacting to short-term price noise or headlines.

- Remove misaligned stocks: If a stock no longer fits the original strategy of the watchlist, remove it. A focused watchlist is far more useful than a long list of unrelated names.

- Reduce column noise: Over time, watchlists can become cluttered with unused metrics. Deleting unnecessary columns keeps the focus on the data points that actually drive decisions.

- Separate strategies clearly: Create multiple watchlists for different approaches such as dividends, growth, value, or tactical setups. Avoid overcrowding a single watchlist with conflicting strategies.

- Refine continuously: A good watchlist evolves. As market conditions change, metrics and rankings should be adjusted to reflect what matters most at that moment.

Gainify’s column-based design makes this process easy by allowing investors to adjust metrics, sorting, and structure on the fly, turning watchlists into living tools rather than static tracking lists.

Common Watchlist Mistakes to Avoid While Creating Watchlists

Even well-designed watchlists can lose their effectiveness if they are not managed correctly. Most watchlist mistakes come from lack of structure, inconsistent metrics, or treating watchlists as static lists rather than active tools. Being aware of these common pitfalls helps keep watchlists focused, useful, and aligned with your investment process.

- Tracking too many stocks. Overcrowded watchlists quickly lose their usefulness. When too many names are grouped together, it becomes difficult to spot meaningful signals or prioritize opportunities. Smaller, focused watchlists tend to produce better insights.

- Using generic metrics across all strategies. Different investment approaches require different data. Applying the same metrics to dividend stocks, growth stocks, and tactical setups often hides what actually matters and leads to poor comparisons.

- Never updating columns as conditions change. Markets evolve, and watchlists should evolve with them. Metrics that were useful in one environment may lose relevance in another. Regularly revisiting and adjusting columns keeps watchlists aligned with current conditions.

- Confusing a watchlist with a portfolio. A watchlist is a place to observe and evaluate ideas, not a list of positions you must own. Treating a watchlist like a portfolio can encourage premature or emotionally driven decisions.

- Letting watchlists become static. Watchlists are most effective when they are actively maintained. Removing outdated stocks, adding new candidates, and refining metrics keeps them useful over time.

A watchlist should function as a decision-support tool, not a commitment to buy.

Final Thoughts

Knowing how to make a stock watchlist is a foundational investing skill. The most effective watchlists are strategy-driven, metric-focused, and continuously refined.

Platforms like Gainify make this process powerful by offering unlimited watchlists, deep metric customization, and full control over how data is displayed.

When used correctly, a watchlist becomes more than a list of stocks. It becomes the framework behind better investment decisions.