The most oversold stocks often emerge during market pullbacks, but not every sharp decline represents an opportunity. When stocks fall rapidly, investors need a way to separate short-term dislocations driven by sentiment from deeper structural issues tied to fundamentals. One of the most widely used tools for this purpose is the Relative Strength Index (RSI), which helps identify when selling pressure may be extreme.

As of January 2026, several large-cap and widely followed companies are trading with RSI levels below 35, a range commonly associated with oversold conditions. Many of these stocks have also suffered significant drawdowns from their 52-week highs, increasing the potential for short-term rebounds or longer-term reassessments of value, depending on business fundamentals and broader market conditions.

This article examines the top 10 most oversold stocks based on RSI readings, recent price action, and drawdowns, and explains how investors can evaluate oversold signals responsibly within a broader risk-management framework.

Key Takeaways on Oversold Stocks

- Oversold stocks have experienced sharp recent declines, often reflected by RSI readings below 30.

- RSI does not predict direction, but it signals when selling pressure may be extreme.

- Large drawdowns can create opportunity, especially in fundamentally strong companies.

- Oversold conditions can persist, making risk management essential.

What Does “Oversold” Mean in the Stock Market?

A stock is considered oversold when its price has declined sharply over a short period, often due to heavy selling pressure rather than a sudden deterioration in the company’s underlying fundamentals. Oversold conditions are frequently driven by negative sentiment, market-wide stress, or short-term panic rather than long-term business performance.

The most common way investors identify oversold stocks is through the Relative Strength Index (RSI), a momentum indicator that measures the speed and magnitude of recent price movements:

- RSI below 30: Traditionally considered oversold, signaling extreme selling pressure

- RSI between 30 and 35: Indicates weak momentum and proximity to oversold territory

Importantly, oversold does not mean undervalued. An oversold reading suggests that selling momentum may be stretched, increasing the likelihood of a pause, bounce, or short-term reversal. However, prices can remain oversold for extended periods, particularly during broader market downturns or company-specific challenges.

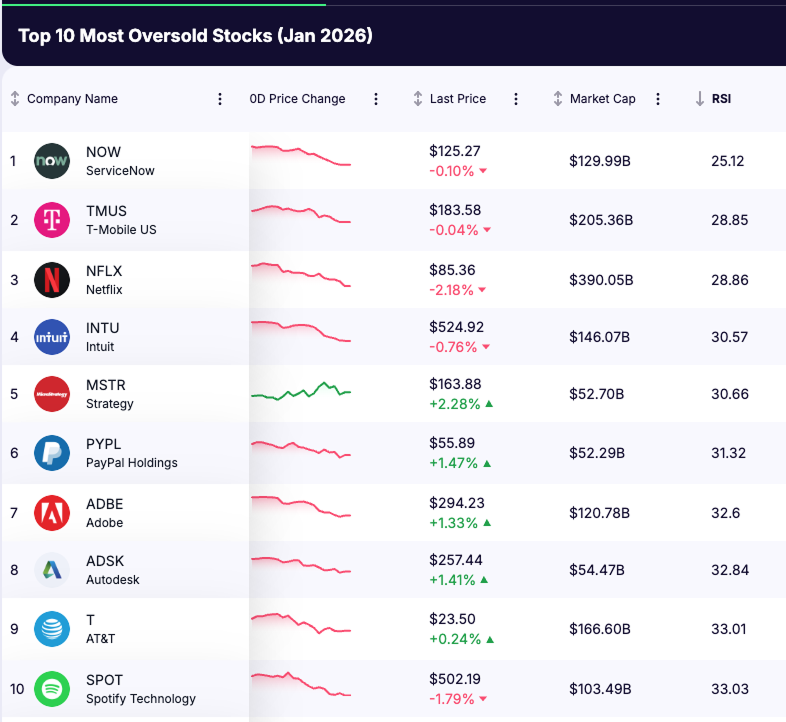

Top 10 Most Oversold Stocks (January 2026)

Based on RSI readings, market capitalization, and drawdowns from 52-week highs, the following stocks with +$50B Market Capitalization stand out as some of the most oversold in the current market environment.

1. ServiceNow (NYSE: NOW)

- RSI: 25.12

- Market Cap: $130B

- Drawdown from 52-Week High: ~47.7%

ServiceNow shows the lowest RSI on the list, indicating intense and sustained selling pressure relative to recent price history. The stock’s sharp decline reflects not only broader weakness across high-valuation software names, but also investor concerns about how rapidly evolving artificial intelligence tools may disrupt traditional enterprise software pricing and workflows. Despite this pressure, ServiceNow remains a core enterprise software provider with a business model built on long-term contracts and highly recurring subscription revenue. Its platform continues to be deeply embedded within large enterprise operations, offering a degree of fundamental resilience as the market reassesses growth expectations, competitive dynamics, and valuation across the software sector.

2. T-Mobile US (NASDAQ: TMUS)

- RSI: 28.85

- Market Cap: $205B

- Drawdown: -33.6%

T-Mobile’s oversold condition reflects investor concerns around slowing growth normalization and intensifying competition within the U.S. wireless market, rather than any immediate balance sheet stress. As subscriber gains moderate following years of outsized expansion, market focus has shifted toward pricing discipline, capital expenditures, and long-term margin sustainability. Despite the recent sell-off, the company continues to generate strong cash flow and maintains a leading position in 5G coverage, suggesting the current weakness is driven more by sentiment and expectations than by structural financial risk.

3. Netflix (NASDAQ: NFLX)

- RSI: 28.86

- Market Cap: $390B

- Drawdown: -36.4%

Netflix has experienced renewed pressure amid volatility in subscriber growth expectations and ongoing concerns around content spending cycles. Sentiment has also been affected by developments in the broader media landscape, including the approval of an all-cash acquisition involving Warner Bros., which has intensified discussion around industry consolidation. The deal has raised questions about competitive positioning, content pricing power, and whether large-scale mergers could alter bargaining dynamics across streaming platforms. While the transaction does not directly involve Netflix, it has contributed to uncertainty around long-term margins and strategic flexibility in an increasingly consolidated market.

4. Intuit (NASDAQ: INTU)

- RSI: 30.57

- Market Cap: $146B

- Drawdown: -35.5%

Intuit’s decline has pushed the stock into oversold territory despite its strong position in financial software and tax services. The sell-off reflects broader pressure across software and fintech names as investors reassess growth durability, valuation multiples, and the impact of artificial intelligence on pricing power and product differentiation. While Intuit continues to benefit from deeply embedded platforms such as TurboTax and QuickBooks, near-term sentiment has been weighed down by concerns that AI-driven tools could increase competition and compress margins across financial software. As with other high-quality software companies, the recent weakness appears driven more by shifting expectations than by a deterioration in the company’s core business fundamentals.

5. Strategy (NASDAQ: MSTR)

- RSI: 30.66

- Market Cap: $52.7B

- Drawdown: -64.2%

Strategy’s oversold status is closely tied to the recent contraction in Bitcoin prices, which has driven heightened volatility and amplified downside pressure on the stock. Given the company’s significant Bitcoin holdings, its share price has increasingly traded as a leveraged proxy for cryptocurrency sentiment rather than its underlying software operations. As Bitcoin has pulled back, investor risk appetite has deteriorated, leading to one of the largest drawdowns on this list. While this dynamic creates potential upside if Bitcoin stabilizes or rebounds, it also underscores the stock’s elevated sensitivity to crypto market cycles rather than traditional operating fundamentals.

6. PayPal Holdings (NASDAQ: PYPL)

- RSI: 31.32

- Market Cap: $52B

- Drawdown: -38.5%

PayPal remains under pressure as investors reassess growth prospects and competitive dynamics in digital payments. Despite its scale and global reach, the stock has delivered little net progress over the past five years, reflecting slowing user growth, margin compression, and intensifying competition from banks, card networks, and newer fintech platforms. This prolonged period of underperformance has weighed on sentiment, pushing the stock into oversold territory as the market questions PayPal’s ability to reaccelerate growth and defend its long-term relevance within an increasingly crowded payments ecosystem

7. Adobe (NASDAQ: ADBE)

- RSI: 32.6

- Market Cap: $121B

- Drawdown: -36.8%

Adobe’s oversold reading reflects valuation compression across the software sector rather than a deterioration in operating fundamentals. The stock has faced pressure as investors reassess long-duration growth assets amid concerns around pricing power, competitive threats, and the pace at which artificial intelligence could reshape creative software workflows. Despite these concerns, Adobe continues to benefit from strong recurring subscription revenue and deep customer integration, suggesting the recent weakness is driven more by sentiment and multiple contraction than by a breakdown in the underlying business.

8. Autodesk (NASDAQ: ADSK)

- RSI: 32.84

- Market Cap: $54B

- Drawdown: -21.8%

Autodesk’s drawdown has been more moderate relative to other names on the list, but momentum indicators continue to signal weak near-term sentiment as investors weigh slowing demand visibility and broader pressure across enterprise and construction-related software stocks. The stock’s oversold condition reflects caution around growth expectations rather than a material change in the company’s long-term positioning.

9. AT&T (NYSE: T)

- RSI: 33.01

- Market Cap: $167B

- Drawdown: -21.1%

AT&T’s oversold condition reflects persistent pressure on income-oriented stocks, combined with competitive challenges and elevated leverage that have weighed on investor confidence. The stock has a history of sharp corrections during periods of market stress, and even in more stable environments it has shown vulnerability to sudden sentiment shifts. While AT&T continues to generate steady cash flow from its core wireless and broadband businesses, ongoing concerns around debt levels, subscriber competition, and the gradual decline of legacy wireline operations have kept near-term sentiment weak rather than signaling a sudden breakdown in fundamentals.

10. Spotify Technology (NYSE: SPOT)

- RSI: 33.03

- Market Cap: $103B

- Drawdown: -36.0%

Spotify’s oversold condition reflects moderating growth expectations and valuation reassessment following a sharp pullback from recent highs. The stock has declined meaningfully as management guidance pointed to near-term revenue growth in the single digits, prompting investors to recalibrate expectations after a strong prior run. While sentiment has softened, the company continues to benefit from pricing actions and the potential for reacceleration as higher subscription rates and advertising initiatives work through results. Ongoing developments around artificial intelligence, including Spotify’s efforts to manage AI-generated content and explore its own AI-driven features, add both uncertainty and longer-term opportunity, contributing to near-term volatility rather than a fundamental breakdown in the business.

How to Use Oversold Signals Correctly

Oversold indicators are not buy signals on their own. Instead, they should be used as part of a broader framework:

- Confirm with fundamentals: Strong balance sheets and cash flow matter

- Watch for stabilization: Momentum often needs time to shift

- Use position sizing: Oversold stocks can fall further

- Consider broader market trends: Macro pressure can override technical signals

Many stocks remain oversold longer than expected during bear markets or sector-wide corrections.

Oversold vs. Undervalued: A Critical Distinction

The terms oversold and undervalued are often used interchangeably, but they describe very different conditions and serve different purposes in investment analysis.

- Oversold refers to short-term price momentum. A stock becomes oversold when it has declined rapidly, often due to heightened selling pressure, negative sentiment, or broader market stress. Technical indicators such as the Relative Strength Index (RSI) are commonly used to identify oversold conditions. These signals highlight when selling may be excessive, but they do not explain why a stock has fallen or whether the decline is justified.

- Undervalued relates to long-term intrinsic value. A stock is considered undervalued when its market price is below what fundamentals suggest it should be worth over time. This assessment depends on factors such as earnings potential, cash flow generation, competitive position, balance sheet strength, and long-term growth prospects.

Because these concepts measure different things, they do not always overlap. A stock can be oversold yet still expensive if its fundamentals deteriorate or if its prior valuation was unsustainably high. Conversely, a stock may be undervalued for extended periods without becoming technically oversold if sentiment remains stable.

The strongest opportunities often occur when a stock is both oversold and fundamentally sound, indicating that short-term market pessimism may have pushed prices below reasonable long-term expectations. However, identifying this overlap requires patience and careful analysis, as oversold conditions can persist and valuation gaps can take time to close.

How to Use Oversold Signals Responsibly

Oversold indicators can be useful tools, but they are most effective when used as alerts rather than conclusions. An oversold reading highlights elevated selling pressure, not a guaranteed price reversal.

- Use oversold signals as a starting point, not a decision point. An RSI reading below 30 or near oversold territory suggests momentum may be stretched, but prices can remain oversold for extended periods, particularly during broader market corrections or sector-wide downturns.

- Look for confirmation beyond technicals. Oversold conditions carry more weight when paired with stabilizing fundamentals, improving guidance, or signs that negative expectations are already reflected in the price. Without confirmation, oversold stocks can continue to decline.

- Pay attention to market context. Oversold signals behave differently depending on the environment. In strong bull markets, oversold readings often lead to short-term rebounds. In volatile or bearish markets, they may simply indicate continued weakness.

- Manage position size and timing. Rather than committing capital all at once, investors often use staggered entries or smaller position sizes when dealing with oversold stocks. This approach helps manage risk if prices move lower before stabilizing.

- Separate short-term trades from long-term investments. Oversold conditions may attract traders looking for tactical rebounds, while long-term investors should focus more heavily on valuation, cash flow, and business quality. Confusing these objectives can lead to poor outcomes.

Oversold signals are most valuable when combined with discipline, patience, and a broader analytical framework rather than used in isolation.

The Bottom Line on Oversold Stocks

Oversold stocks highlight areas of the market where selling pressure has been extreme. In January 2026, several large-cap and widely followed companies are trading at RSI levels that suggest heightened pessimism.

While oversold conditions can create opportunities, they also carry elevated risk. Investors should combine technical indicators like RSI with fundamental analysis, risk management, and patience.

Oversold signals are best viewed as alerts, not guarantees, in navigating volatile market environments.