Managing a successful portfolio can be tough. Markets seem to move faster than ever, and it can feel impossible to keep track of everything worth watching.

Watchlists help add some order to the chaos of stock markets, enabling you to build the thematic and industry based groups of stocks to keep track of over time.

They are especially helpful if you don’t have a lot of capital to deploy and want to monitor a group of stocks over time to see which seem to be realizing analyst expectations and which may be diverging from underlying fundamentals or investor expectations.

You can do all this without investing a single dollar in the actual stock. Just add it to your watchlist and monitor it over time, staying up to date with earnings insights and changing analyst sentiment.

Once you think you’re getting a feel for that group of stocks, investment, strategy or industry – and are seeing some specific stocks that stand out to you – you can then pull the trigger and invest.

While watchlists may seem like a simple and almost inconsequential feature for your portfolio building – when used correctly, they can be very powerful and bring you a lot of confidence and understanding to your next investing steps.

After testing 11 leading platforms, we’ve identified clear winners for every investor type and trading style.

Whether you need real-time alerts, AI-powered insights, or advanced technical analysis, this guide shows you exactly which app fits your needs.

Quick Comparison: Top Stock Watchlist Apps

App | Best For | Price | Watchlist Limits | Key Features |

Fundamental analysis | Free–$7.99/mo | Unlimited watchlists, no stock limits | Top investor tracking, customized screeners and charting | |

TradingView | Technical analysis | Free–$239.95/mo | 1 free watchlist, 1,000 stocks per list | Advanced charting, 400+ indicators, social trading |

Free basic tracking | Free–$39.95/mo | Unspecified limits | News integration, portfolio sync, simple interface | |

WallStreetZen | Analyst tracking | Free–$59/mo | Multiple watchlists, unlimited stocks | Top analyst ratings, price catalysts, fundamental data |

Benzinga Pro | Real-time news | $37–$197/mo | Unlimited watchlists and stocks | Breaking news alerts, unusual options activity |

Stock Rover | $7.99–$47.99/mo | 10-60 watchlists, 100-600 stocks (plan-dependent) | Fundamental screening, dividend tracking | |

Empower | Comprehensive tracking | Free | Unspecified limits | Portfolio management strategies, retirement planning |

Seeking Alpha | Community insights | Free–$200/mo (annual billing) | Multiple portfolios, 500 stocks each | Expert analysis, earnings transcripts, discussions |

Koyfin | Customizable dashboards | Free–$349/mo | 2 free watchlists, unlimited paid | Institutional data, macroeconomic analysis |

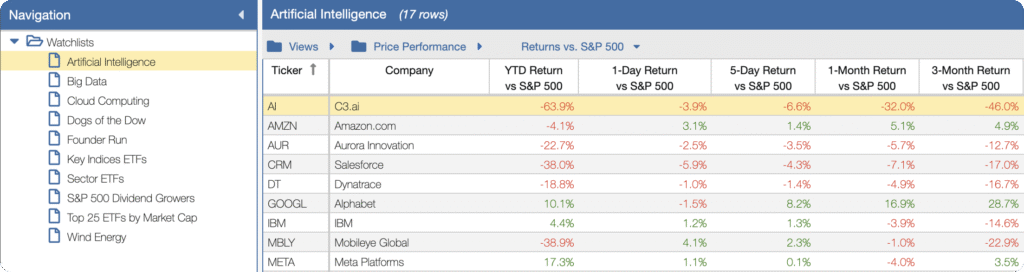

Professional watchlists | Free | Unlimited watchlists, 300 stocks each | Up to 300 stocks per watchlist, unlimited custom lists, advanced views | |

Fidelity | Trading-focused watchlists | Free | 15 watchlists, 50 stocks each | Real-time quotes, analyst ratings, integrated trading dashboard |

What Is a Stock Watchlist App?

A stock watchlist app helps you monitor investment opportunities and track portfolio performance.

Instead of jumping between different broker apps and websites, you get:

- Instant price alerts

- Centralized tracking

- Actionable market intelligence

All in one place.

Unlike charting software that focuses on technical patterns, watchlist apps combine price monitoring with news, fundamentals, and alerts for complete market awareness.

Stock Watchlist vs Portfolio Tracker

Watchlist apps focus on monitoring potential opportunities and current market movements that affect stock prices.

The main difference between a watchlist and portfolio tracker is performance tracking with gain/loss calculations. Watchlists don’t necessarily have it. Portfolio trackers do.

Portfolio trackers provide deep analysis of your actual holdings including:

- Tax-loss harvesting recommendations

- Dividend income projections

- Asset allocation analysis

- Performance attribution

- Cost basis tracking

Watchlists on the other hand might contain stocks you do own, and stocks you’re just keeping an eye on. So “portfolio tracking” isn’t always relevant.

The best platforms combine both capabilities.

Stock Watchlist App Platform Reviews

Let’s examine each platform so you can understand their strengths, limitations, and ideal use cases.

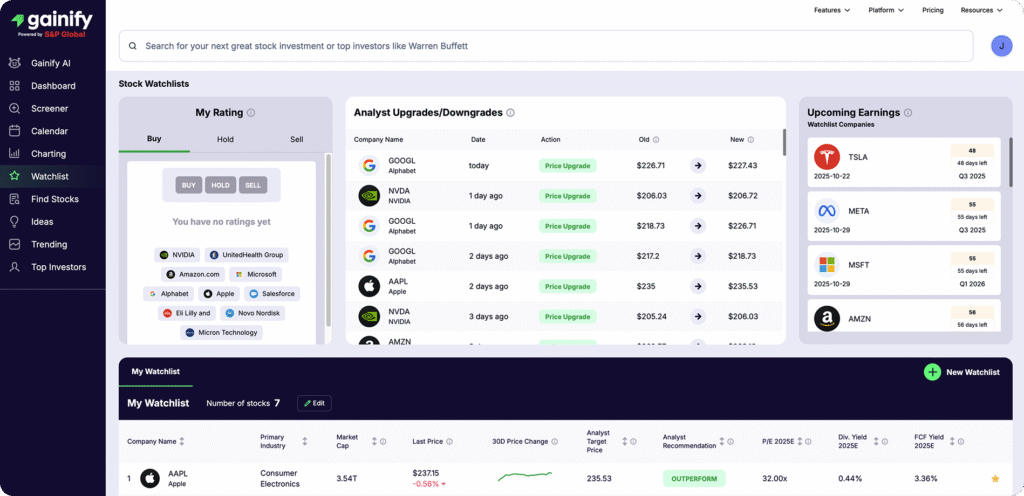

1. Gainify: Best for AI-Powered Investment Intelligence

Gainify changes how you research and track stocks. You get access to a powerful combo of:

- Stock screener

- Custom charting

- Top investor tracking

- AI-powered research

- Institutional-grade data

Best for you if you want to track portfolios of top investors, build unlimited thematic watchlists, and get analyst insights into the stocks you’re interested in.

While it doesn’t sync with brokerage accounts like traditional trackers, Gainify does help you make smarter investment decisions.

Through its powerful custom charting, proprietary Gainify Rating insights, and earnings call summaries you’ll develop strong analytical capabilities.

Advantages

Gainify brings institutional-level intelligence to retail investors. You get features that help identify quality companies worth investing in.

- Create thematic watchlists

- Mark holdings as Buy, Hold, or Sell

- Create unlimited themed watchlists

- Upcoming earnings calendar integration

- Analyst upgrade and downgrades tracking

- Copy top investor’s portfolios to your watchlist

- Comprehensive watchlist table displays 30+ data points

Drawbacks

Gainify is great for analysis and intelligence. It has some limitations that may affect your workflow.

The main limitation is that it has no brokerage sync. You’ll manually add stocks to watchlists instead of automatic position import

If you’re after technical analysis tools, you might find the platform lacking. Its focus is on fundamental analysis.

Pricing

Gainify offers generous free access. Premium features (more AI use and extended historical data & forecasts) are available for as little as $7.99/month.

Who Gainify is Best For

Gainify works well if you enjoy analyzing individual companies rather than just buying index funds.

It’s valuable if you want to learn while you invest, too. You’ll have access to unprecedented analytical capabilities – the same used by pro investors.

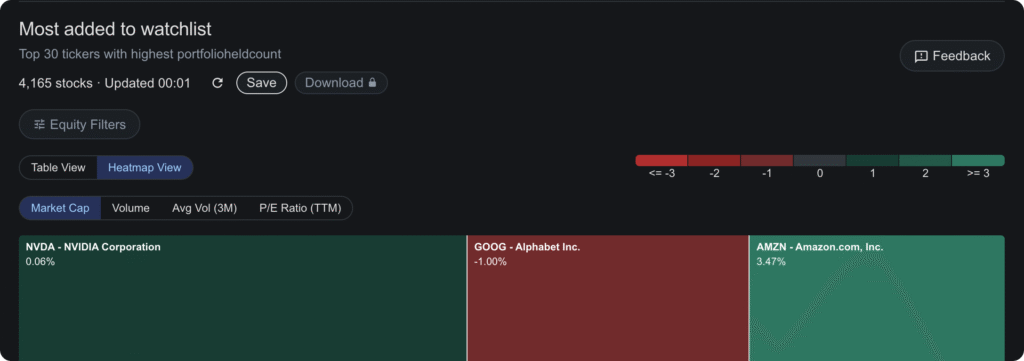

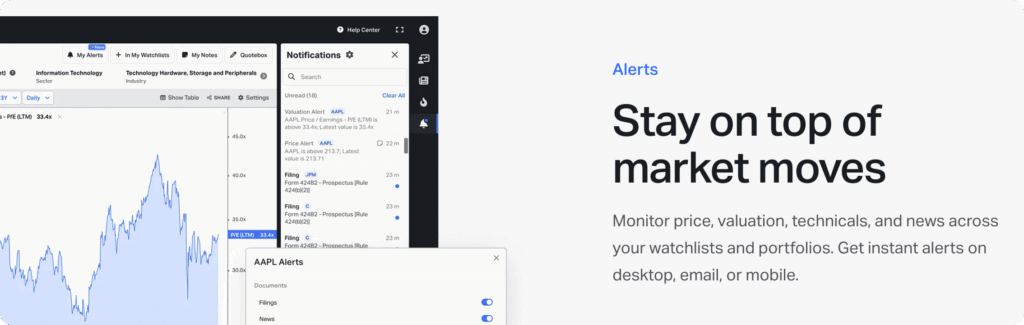

2. TradingView: Best for Technical Analysis and Social Trading

TradingView is the leading platform for technical traders. Its advanced charting systems are almost unmatched in the industry – certainly some of the best available to retail investors.

Best for you if you make decisions based on chart patterns and technical indicators – or if you want to learn from other traders’ analysis. TradingView has over 100 million users and community members.

You’ll access advanced drawing tools, 400+ technical indicators, and multi-timeframe analysis.

You’ll find TradingView a compelling choice if your investing extends beyond stocks. You’ll have access to:

- Forex

- Stocks

- Crypto

- Commodities

However, the free plan is severely limited to just 1 watchlist. Alert limits vary by plan (2-15 alerts.)

Advantages

TradingView’s technical analysis capabilities match professional trading terminals. Top advantages include.

- 400+ technical indicators available

- Drawing tools for technical analysis

- Real-time alerts for price movements

- Custom Pine Script strategies for automated trading

- Track stocks, crypto, forex, commodities, and bonds

- Coverage includes 150+ exchanges from 50+ countries

Drawbacks

TradingView’s powerful features can be complex – especially for new traders. It’s also best suited for technical trading, and not a great choice if you follow value or growth investing principles.

- Free plan includes ads and delayed data for some markets

- Limited fundamental analysis compared to research platforms

- Steep learning curve for advanced features and custom scripting

Pricing

TradingView has a strong free tier. But premium plans can be very expensive compared to other platforms on the market.

- Basic (Free): Real-time data for select exchanges, basic charting, community access

- Essential ($16.95/month): No ads, 2 charts per tab, 20 price alerts, 5 indicators per chart

- Plus ($33.95/month): 4 charts per tab, 100 alerts, 10 indicators per chart, volume profile

- Premium ($67.95/month): 8 charts per tab, 400 alerts, 25 indicators per chart, custom time intervals

- Expert ($119.95/month): 10 charts per tab, 600 alerts, 30 indicators per chart, priority support

- Ultimate ($239.95/month): 16 charts per tab, 1,000 alerts, 50 indicators per chart, institutional features

Who TradingView is Best For

TradingView is best if you’re a technical trader, and actively trade based on chart patterns, technical indicators, and market momentum.

It’s a strong choice if you trade multiple asset classes and want custom scripting.

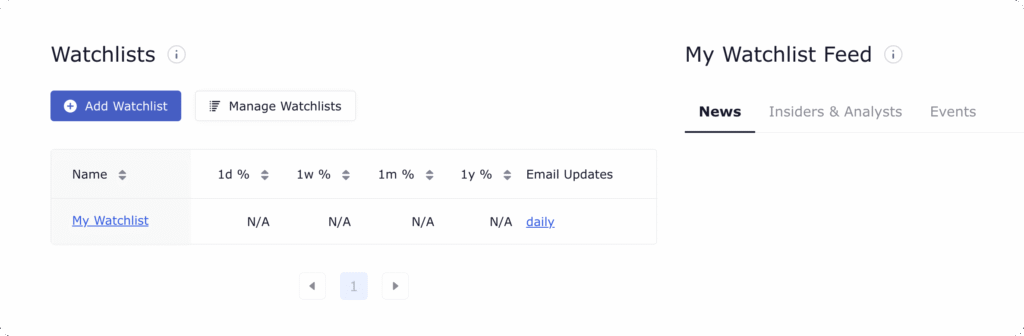

3. Yahoo Finance: Best for Free Basic Watchlists

Yahoo Finance is one of the best sources of free market data and news.

As one of the largest financial news aggregators, Yahoo Finance keeps you informed about market-moving events affecting your watchlist stocks.

Best for you if you want reliable market data and news without subscription fees.

You’ll get real-time quotes for major exchanges, customizable watchlists, and basic charting tools – all for free.

But if you want access to premium articles (from Financial Times & MT Newswires), Morningstar ratings, and advanced screeners – you will need to pay up to $39.95/month.

Advantages

Yahoo Finance is one of the few platforms to give you free unrestricted watchlist access. Many other platforms limit how many watchlists you can create, or the number of stocks each watchlist can hold.

- No subscription required for core features

- Stock screener tools for finding opportunities

- Complete news aggregation for tracked stocks

- Unlimited free watchlists with real-time updates

- Basic portfolio tracking with gain/loss calculations

Drawbacks

Yahoo Finance is a comprehensive platform with many useful features. But the free tier is littered with ads, and most stock screening features are limited to the most expensive $39.95/mo tier.

Pricing

Yahoo Finance gives you access to most features at no cost.

- Basic (Free): Unlimited watchlists, real-time quotes, news, basic portfolio tracking, screeners

- Bronze ($7.95/month): Portfolio monitoring and tracking only.

- Silver ($19.95/month): Adds expert stock picks, research reports, and premium content.

- Gold ($39.95/month): Adds downloadable historical data and advanced screening tools.

Who Yahoo Finance is Best For

Yahoo Finance works perfectly for casual investors and beginners. Choose it if you want stock market data without subscription costs or complex features.

4. WallStreetZen: Best for Following Top Analysts

WallStreetZen focuses on enabling your fundamental research. Its Zen Rating analyzes 115 factors to help you find stocks poised to beat the market.

You will also be able to see forecasts & ratings from proven top performing analysts. Those analysts who underperform are filtered out, giving you more signal & less noise.

Best for you if you want to follow the stock recommendations of proven analysts – or if you make investment decisions based on ratings and price targets.

For each stock within your watchlist, you will be supplied with:

- Insider activity (like buys/sells)

- Upcoming events (such as earnings calls)

- News (from publications like Motley Fool, Seeking Alpha, and GlobalNewsWire)

When you create your watchlist on WallStreetZev you can also choose between receiving daily or weekly email updates – helpful if you need an easy way to stay up to date.

Advantages

WallStreetZen’s analyst tracking capabilities help you identify which recommendations deserve your attention. Focus on ratings and predictions from top performing investors.

- Top analyst identification with performance tracking

- Watchlist feeds showing news and insider activity

- “Why Price Moved” one-sentence explanations

- Daily/weekly email alerts for watchlist updates

- Free access to core watchlist features

Drawbacks

WallStreetZen’s focus on fundamental analysis means it lacks some features found in more comprehensive platforms.

- No brokerage integration requires manual entry

- Limited technical analysis tools for chart traders

- Premium tier quite expensive at $59/month

Pricing

WallStreetZen provides fairly comprehensive free access. But premium is quite expensive – especially for the limited feature set it provides. for better analyst intelligence.

- Basic (Free): Unlimited watchlists, daily email updates, basic analyst tracking, screening tools

- Premium ($59/month billed annually): “Why Price Moved” explanations, advanced analyst metrics, enhanced screening

Who WallStreetZen is Best For

WallStreetZen suits fundamental investors who make decisions based on analyst research, earnings projections, and company financial performance rather than technical chart analysis.

You’ll find it valuable if you want to distinguish between accurate and inaccurate analysts before following their stock recommendations.

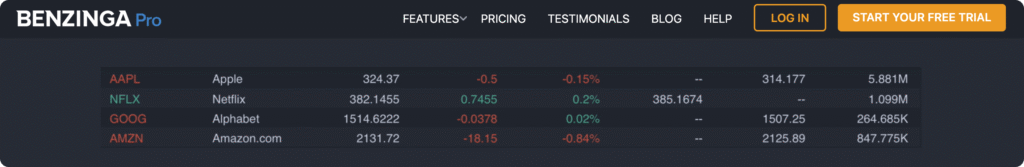

5. Benzinga Pro: Best for Real-Time News and Active Trading

Benzinga Pro is mostly for market news but it also provides actionable trading intelligence. It is built for active traders who need to react quickly to market-moving events.

Best for you if you make trading decisions based on breaking news and market catalysts – or if you need real-time alerts.

You’ll get customizable news feeds, audio squawk alerts, and advanced scanner tools that identify trading opportunities.

Watchlist functionality is quite typical of tools in the industry, you will be able to:

- Create a watchlist

- Get news and updates for stocks in your watchlist

- See earnings reports and income statements for your watched stocks

Advantages

Benzinga Pro is invaluable if you trade based on short-term market movements and news catalysts.

- Community chat rooms for sharing ideas with other active traders

- Real-time breaking news delivered faster than mainstream media

- Customizable watchlist alerts for news and price moves

- Unusual options activity scanner for trade signals

- Audio Squawk live market commentary

- Earnings calendar with surprise alerts

Drawbacks

Benzinga Pro focus may not suit you if you’re a long-term investor seeking fundamental analysis tools.

- Expensive if you’re a casual investor and don’t actively trade

- Constant information overload can overwhelm

- Limited fundamental analysis

Pricing

Benzinga Pro offers multiple subscription tiers. Most center around news and screening.

There are not a lot of additional unique features outside of these categories in paid tiers – you basically just get better filtering.

Compared to other platforms Benzinga Pro is very expensive, and you may struggle to justify the investment for its limited features.

- Essential ($37/month): Real-time newsfeed, basic alerts, premium articles, movers list

- Streamlined ($147/month): Advanced newsfeed filtering, Audio Squawk, enhanced alerts

- Professional ($197/month): Full scanner access, signals, calendar alerts

Who Benzinga Pro is Best For

Benzinga Pro is great for day traders, swing traders, and options traders. If you make decisions based on breaking news, market catalysts, and short-term price momentum – try Benzinga Pro.

6. Stock Rover: Best for Long-Term Fundamental Investors

Stock Rover specializes in fundamental analysis and long-term portfolio management. In addition you get complete screening tools and detailed financial metrics.

Best for you if you invest based on company fundamentals and financial statements – or if you need in-depth research tools for dividend strategies.

While the user interface is outdated – the feature set is strong. You’ll have access to a huge range (10+ years) of historical data, helping you evaluate companies’ long-term track record.

Stock Rover’s tiered plans do limit your watchlist creation, though. Basic plans offer as few as 10 watchlists, with 100 stocks per list.

Advantages

Stock Rover’s research capabilities approach those of professional stock research platforms, but at acceptable prices for retail investors.

- Customizable watchlist metrics in table format

- Research report generation for detailed analysis

- Complete fundamental screening with 10+ years data

- Dividend income projections and sustainability tracking

- Stock comparison tools for 20 companies simultaneously

- Advanced portfolio analytics with rebalancing suggestions

Drawbacks

Stock Rover will serve you well if your investing hinges on fundamental analysis. But you will find it lacking if you day trade based on technical analysis.

- Complex interface

- Limited real-time data

- North American focus

Pricing

Stock Rover offers tiered pricing. If you want unlimited watchlists it will cost you $27.99/month – quite expensive when other platforms offer unlimited watchlists for free.

- Essentials ($7.99/month): Basic screening, 5-year data, limited watchlists

- Premium ($27.99/month): Full screening, 15-year data, unlimited watchlists, portfolio optimization tools

- Premium Plus ($47.99/month): Advanced analytics, backtesting, factor analysis, priority support

Who Stock Rover is Best For

Stock Rover is best for you if you are a value investor, dividend investor, or long-term strategic investor. It enables you to make decisions based on complete fundamental analysis rather than short-term price movements.

7. Empower (Personal Capital): Best for Comprehensive Wealth Tracking

Empower provides free institutional-grade portfolio analytics that consolidate your entire financial picture – from checking accounts to 401(k)s – in one complete dashboard.

Best for you if you want to see your complete wealth across all accounts and investments – or if you need retirement planning tools alongside portfolio tracking.

While other platforms of the basic watchlist creation to help you discover stocks worth investing in, Empower gives you full portfolio tracking.

Empower’s sophisticated portfolio analytics, net worth tracking, and retirement planning simulations can be incredibly helpful for building long-term wealth .

The trade-off? Empower monetizes through optional advisory services. You will be on the receiving end of occasional sales calls from their wealth management team.

Advantages

Empower’s complete approach helps you understand how your stocks are performing within your broader financial goals and investment strategy.

- Investment Checkup analyzes portfolios across 12 dimensions

- Connects 20+ account types including brokerages and banks

- Retirement Planner with Monte Carlo simulations

- Asset allocation visualization across all accounts

- Fee analyzer identifies hidden investment costs

- Net worth tracking with historical trends

Drawbacks

Despite impressive free features, Empower has limitations that may affect your experience.

- No automatic crypto support – requires manual entry

- Sales calls from advisors promoting wealth management

- Complex for basic tracking due to wealth management focus

Pricing

Empower operates on a freemium model. Its wealth management services generate revenue, not subscription fees.

- Core Platform (Free): Complete portfolio analytics, retirement planning, fee analysis, net worth tracking

- Advisory Services: 0.89% AUM for $100K-$999K; 0.79% for $1M-$4.99M; 0.69% for $5M+

Who Empower is Best For

Empower works best if you need not just a watchlist, but a complete wealth tracker. It’s less for monitoring stocks you might like to invest in, and more for monitoring your entire financial picture (for stocks you’ve already purchased.)

8. Seeking Alpha: Best for Community-Driven Investment Research

Seeking Alpha combines expert analysis with community discussions to provide diverse perspectives on investment opportunities.

The articles available on seeking Alpha are a mix of community written articles and editorial pieces from the internal Seeking Alpha content team.

Best for you if you want to read detailed analysis from investment professionals and experienced investors – or if you enjoy discussing investment ideas with an engaged community.

There really is a lot of content to read on Seeking Alpha. We’re talking about thousands of articles. This has both advantages and disadvantages

The advantage is that you get a wide range of perspectives you might not find elsewhere. You’ll also find stocks and industries covered that are not covered on other platforms.

The disadvantage is that it’s a lot of information to process. You’ll find bull cases and bear cases across different articles. It’s your job to compare and analyse these and then come up with your own position.

When it comes to watchlist features, not only can you create a watchlist (called a “portfolio” on Seeking Alpha,) you can also upload one via CSV or link your brokerage account.

If you choose, you can also receive daily emails with the news updates about your portfolio stocks.

The watchlist dashboard shows you the latest news articles, press releases, earning call transcripts, and even warnings for your portfolio.

Advantages

Seeking Alpha’s community-driven approach provides diverse investment perspectives and detailed analysis that helps inform your watchlist decisions.

- Expert contributor network of professional analysts

- Earnings call transcripts with full Q&A sessions

- Quant Rating system for objective stock scoring

- Portfolio tracking with performance analysis

- Community discussions for investment ideas

- News aggregation curated for each stock

Drawbacks

Seeking Alpha’s focus on written analysis and community engagement may not suit your needs or research style.

- Variable contributor quality between professionals and amateurs

- Information overload from thousands of articles

- Limited technical analysis tools

Pricing

Seeking Alpha gives you free access to basic features. But premium features can be very expensive and you need to pay for a full year upfront. There are no monthly plans.

- Free: Limited article access, basic portfolio tracking, community discussions.

- Premium ($299/year): Adds unlimited expert content, Quant Ratings, stock screeners, and Top Analyst access. But no VIP service or short ideas.

- Pro ($2400/year): Adds PRO Quant Portfolio, exclusive coverage on uncovered stocks, Top Analyst Ideas with filters, and short ideas.

Who Seeking Alpha is Best For

Seeking Alpha is good if you’re a research-oriented investor who wants a broad range of perspectives.

9. Koyfin: Best for Customizable Institutional-Grade Dashboards

Koyfin is an institutional-quality stock data platform available to retail investors.

It has highly customizable dashboards that match professional trading terminals at a fraction of the cost.

Best for you if you need Bloomberg-style data and analyticsor if you need advanced customization.

Koyfin lets you create personalized screens combining watchlists, charts, news feeds, and calendars in one dashboard.

However, the Free plan severely limits you – allowing only 2 watchlists.

Advantages

Koyfin’s approach provides you with professional-grade tools and data. It’s for serious investors who need full scope stock analysis capabilities.

- Highly customizable dashboards with multiple widgets

- Global market coverage including emerging markets

- Advanced charting tools with technical indicators

- Macroeconomic analysis tools for market trends

- Multiple watchlist creation with custom columns

- Institutional data quality for global markets

Drawbacks

Koyfin’s institutional focus means it may overwhelm you if you’re a casual investor. Additional customization brings complexity and a steeper learning curve.

- Limited free access restricts customization

- Complex interface requires learning investment

- Steeper learning curve for non-professional investors

Pricing

Koyfin offers limited free access. But most likely you will need to upgrade so you can create more than two watchlists.

- Free: 2 watchlists, 2 custom screens, basic market data access

- Professional ($49/month): Unlimited watchlists and screens, real-time US data, advanced analytics

- Advisor Pro ($349/month): Global real-time data, advanced screening (mutual funds), short & leveraged model portfolios

Who Koyfin is Best For

Koyfin stands out if you’re an experienced investor or financial professional.

You’ll benefit most if you analyze global markets and want Bloomberg-style capabilities at reasonable pricing.

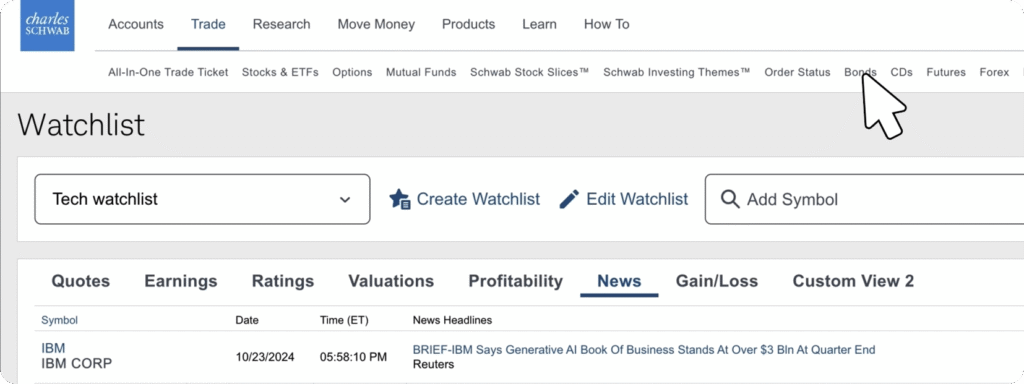

10. Charles Schwab: Best for Professional-Grade Watchlists

Charles Schwab is known for its institutional-quality functionality with strong customization options.

Best for you if you want professional-grade features without paying premium fees – or if you need to track large numbers of stocks with advanced analytics.

The platform’s watchlist system supports up to 300 stocks per watchlist with unlimited custom watchlists. It is perfect if you monitor diverse investment opportunities across multiple sectors and strategies.

You’ll access advanced views, real-time data, and strong integration with Schwab’s ecosystem (trading, banking, etc.)

However, the user interface leaves a little to be desired. It’s clunky and closer to the old school terminal look and feel.

Advantages

Charles Schwab’s stock research tools are available completely free for account holders.

- My Positions Watchlists auto-track holdings

- Up to 300 securities per watchlist

Drawbacks

While Charles Schwab offers excellent watchlist functionality, it requires you open a brokerage account to access full features.

- Account required for full feature access

- Advanced features come with a steep learning curve

- Interface complexity may overwhelm casual investors

Pricing

Charles Schwab provides comprehensive watchlist functionality at no additional cost for account holders.

- Free: Complete watchlist features with up to 300 stocks per list, unlimited custom watchlists, advanced analytical views

- Account required: You must maintain Schwab brokerage account for full feature access

Who Charles Schwab is Best For

Charles Schwab is best if you want integrated brokerage and trading, within a banking ecosystem.

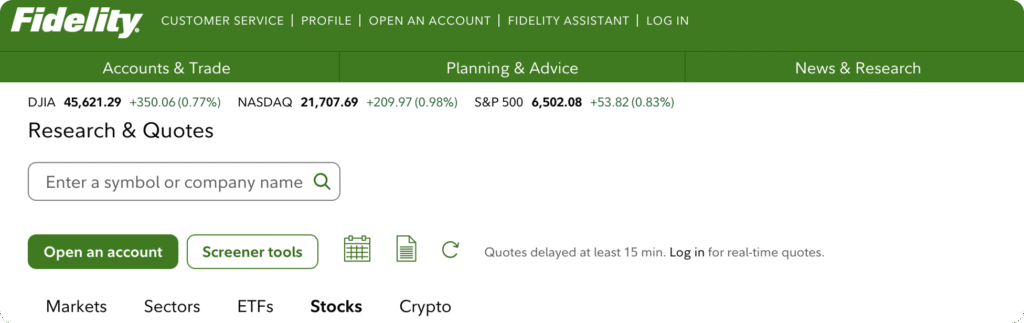

11. Fidelity: Best for Trading-Integrated Watchlists

Fidelity combines typical watchlist functionality alongside integrated trading capabilities through its Trading Dashboard.

Best for you if you prefer one platform that handles both research and execution without switching between apps.

The platform’s Trading Dashboard integrates watchlists with real-time quotes, third-party analyst ratings, and direct trading functionality. It’s one of the few platforms in this article that enables you to easily track potential investments and execute trades.

However, watchlist creation is limited. You can only create 15 watchlists, with each restricted to 50 stocks.

Advantages

Fidelity’s integration with trading tools allows you to move quickly from research to execution.

- Real-time quotes within watchlist views

- Third-party analyst ratings integrated directly

- Direct trading execution from watchlist interface

Drawbacks

To use Fidelity you must open an account with them to get full functionality.

Strong customization and a traditional terminal-like interface also mean it comes with a steeper learning curve. New investors may find it overwhelming.

Pricing

Fidelity provides limited watchlist and trading integration at no cost for account holders.

- Free: Full Trading Dashboard access, limited watchlists, real-time data, analyst ratings, integrated trading.

- Account required: Must open Fidelity brokerage account for complete feature access.

Who Fidelity is Best For

Fidelity is great if you’re going to be actively moving in and out of positions, and want to trade right from your watchlists.

Choosing the Best Stock Watchlist App

The best stock watchlists for investors vary depending on your investing style, research needs, and budget.

To identify the ideal platform for you, start with these steps:

- Identify your investing style – Are you a day trader, value investor, or long-term portfolio builder?

- Prioritize your must-have features – Do you need technical indicators, analyst ratings, or news alerts?

- Test the free versions – Most platforms offer free trials or free tiers to explore functionality

For most investors, Gainify is the best all-round stock research platform and watchlist. It will serve you well if you’re a growth investor, value investor, or dividend investor.

Its institutional grade data, customizable stock screening, top investor tracking, and the ability to copy top investors’ portfolios to your watchlist are all incredibly helpful.

Within the watchlist you get important analyst estimate updates, earnings call calendar updates, and more.

The watchlist feature – unlike many other platforms – is not limited. You can create as many thematic watchlists as you like based on investing strategy, industry, and more.

But other platforms do have their strengths, and are worth checking out if you fit their ideal investor profile.

For technical analysis: TradingView offers professional charting tools and social trading features that appeal to chart-focused investors.

For analyst tracking: WallStreetZen helps you follow proven analysts and understand price movement catalysts.

For active trading: Benzinga Pro provides real-time news and actionable alerts for traders who need speed advantages.

For trading integration: Fidelity and Charles Schwab combine watchlist functionality with trading execution.

Take Control of Your Investment Strategy

In this article we analyzed 11 of the top stock research platforms – each of them offering some form of watchlist capabilities. Some offer a pure watchlist experience. Others veer into portfolio tracking territory, enabling you to actually trade directly from the platform.

There’s no right or wrong answer as to which watchlist tool is best for you. It is highly dependent on whether you’re an active trader or a long-term value investor.

It will also depend on whether you are looking for a platform that offers trading & stock purchases – or if you already have one that you like using and are not looking to switch away from.

Whichever watchlist tool you opt for, there’s no doubt that when used well a watchlist can be really powerful for your investing strategy.

Watchlists give you a sense of control and clarity in chaotic market environments. They also help you build coherent investment theses over time.

For most investors seeking a balance of customized stock screening and charting, unlimited watchlist creation, and top investor tracking – Gainify provides the most comprehensive solution.

Gainify is also available to you completely free with no credit card required – there are no hurdles to getting started and you can try it out for yourself today.

Frequently Asked Questions

What is a stock watchlist app and why do I need one?

A stock watchlist app helps you monitor investment opportunities and track portfolio performance in one centralized location. Instead of manually checking prices across multiple websites, you get real-time updates, customizable alerts, and market intelligence. This saves time and helps you catch important movements you might otherwise miss.

Which is the best free stock watchlist app?

Yahoo Finance offers comprehensive free features with unlimited watchlists and real-time quotes. Gainify provides exceptional free value with unlimited watchlists, AI insights, and institutional-grade data. For technical analysis, TradingView’s free tier is strong but limits you to one watchlist.

What’s the difference between a watchlist and a portfolio tracker?

A watchlist monitors stocks you’re interested in without tracking investment performance. Portfolio trackers analyze your actual holdings with gain/loss calculations, cost basis tracking, and dividend projections. The best platforms combine both capabilities.

Which watchlist app is best for beginners?

Gainify and Yahoo Finance are both excellent choices. Yahoo Finance offers simplicity with no learning curve. Gainify provides more educational value with AI explanations, analyst insights, and the ability to copy top investor portfolios. Avoid complex platforms like Koyfin until you’re comfortable with investing basics.

Are paid watchlist apps worth it?

It depends on your needs. Active traders using real-time news (Benzinga Pro) or advanced charting (TradingView Premium) often benefit from paid tiers. Long-term investors may not need expensive tools. Gainify’s affordable premium ($7.99-$26.99/month) offers strong value compared to pricier alternatives like Benzinga Pro ($197/month).

Do watchlist apps connect to my brokerage account?

Empower, Seeking Alpha, Fidelity, and Charles Schwab offer automatic brokerage syncing. Gainify, TradingView, and Yahoo Finance require manual entry but work with any broker and offer more privacy.