If you’re trying to expand beyond owning stocks directly, you might be interested in CFD trading. It gives you leverage and global market access from a single account.

Contract for Difference (CFD) trading lets you speculate on stock price movements without owning shares. You enter contracts that pay the difference between opening and closing prices. This means you can profit from both rising and falling markets.

However, it doesn’t come without risks.

Leverage amplifies gains, sure. But it also magnifies losses when trades turn against you. Between 62-82% of retail CFD traders lose money, according to official broker statistics.

You want to be prepared for this kind of trading. It’s not something you should just jump into and hope you will learn as you go.

If you’re certain that CFD trading is something you wish to try, you may have already noticed that the industry is characterized by dozens of brokers promising low costs and advanced features.

Having options is good. But the many different platforms and terms available can overwhelm.

In this guide you will learn about the top CFD platforms for 2026. We break down costs, features, and safety measures.

You’ll discover which platforms align with your trading style and why fundamental research is non-negotiable.

Before you risk money on CFD price movements, you need to understand the companies you’re trading.

Tools like Gainify’s AI-powered stock analysis help you identify which stocks deserve your attention by providing real-time financial insights, analyst estimates, and proprietary ratings on over 25,000 global stocks.

When you combine Gainify’s fundamental analysis with the right CFD platform, you’re building a complete trading system.

Due to the leveraged aspect of CFD trading, it’s vital you know both what to trade (company quality and value) and how to trade (timing and position management).

Can US Citizens Trade CFDs?

If you’re reading from the United States, know that CFD trading is not available to US traders – because it is against US securities law. The Commodity Futures Trading Commission (CFTC) and The Securities and Exchange Commission (SEC) prohibit US residents and citizens from opening CFD accounts – on both domestic and foreign platforms.

Which Leveraged Products Can US Residents Trade?

While CFDs are banned, US traders have several alternatives that offer similar leverage and trading opportunities. These include futures trading, options trading, leveraged ETFs, binary options, forex trading.

In most cases, these are offered at a more conservative leverage – lower than what’s available with CFDs internationally.

These alternatives provide similar market exposure while offering greater investor protections.

Understanding CFDs vs Direct Stock Trading

CFDs are certainly not for every trader. You need a certain appetite for risk, and a portfolio large enough to handle significant drawdowns if you happen to suffer a leveraged loss.

Risk management and understanding the impact of magnified losses is crucial. Being risk-tolerant is not enough. You must also possess strong trading discipline. Not to mention the knowledge required to trade CFDs strategically.

If you’re wondering whether CFDs fit your trading style, it will help if you understand how they differ from regular stock trading you’re likely familiar with.

When you buy actual stocks, you:

- Own shares in the company

- Are rewarded with voting rights

- Benefit from long-term company growth

- Receive dividends (if the company pays them)

If you’re new to stock trading and focused on building wealth over years or decades, direct stock ownership with proven strategies like dollar-cost averaging may be a better starting point for you.

CFDs are derivatives that mirror stock price movements without giving you ownership.

When trading CFDs, you’re speculating on price direction using leverage. CFDs are ideal for short-term trades and hedging your existing positions.

As an example, while with DCA investing you may build positions for years or decades, most CFD positions close within days or weeks – similar to options trading strategies.

Your choice depends on what you’re trying to achieve and how much risk you can stomach. But we must reiterate – feeling as if you can handle the risk is the LEAST important aspect of CFD trading. Knowledge, discipline, and a clear strategy are MUCH more relevant.

Finding Your Ideal Platform: Quick Guide

Before you spend hours researching each platform, here’s a quick reference to help you narrow down your options based on what matters most to you.

Best for | Platform |

Overall CFD Trading | XTB |

Low Costs & MetaTrader | IC Markets |

Market Leadership & Research | IG |

Advanced Trading Tools | Saxo Bank |

Forex-Focused CFDs | FxPro |

Professional Trading | Interactive Brokers |

Beginner-Friendly Interface | Capital.com |

If you’re new to trading, consider starting with paper trading apps to practice CFD strategies first. You’ll gain valuable experience without risking real money.

Which platform is right for you depends on your trading style and experience level. Many serious traders use multiple platforms. We recommend you combine CFD trading with fundamental analysis tools like Gainify for comprehensive market research – that way you will identify the best stocks to trade before you decide how to trade them.

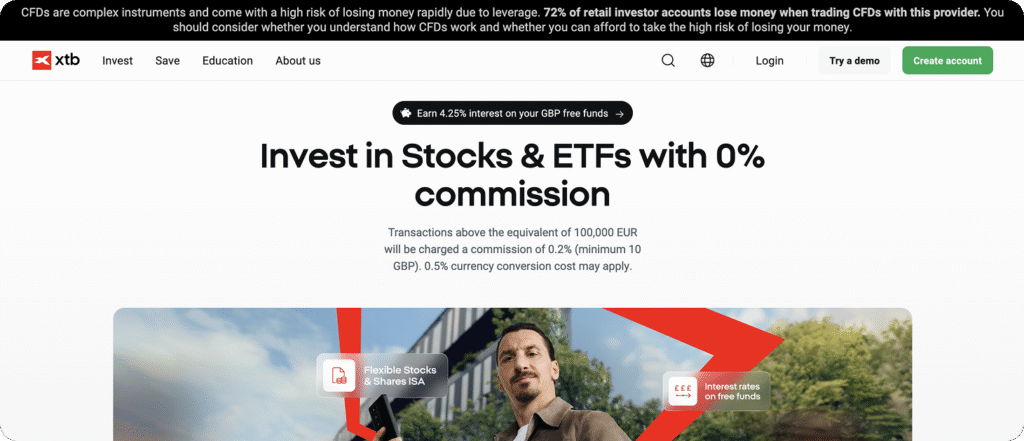

1. XTB: Best Overall CFD Trading Platform

Best for you if you want a single platform that balances low costs with market access – or if you’re seeking commission-free trading.

XTB delivers the strongest combination of features across all key areas. You get access to:

- 25 stock indices and 27 commodity CFDs

- Over 2,200 stock CFDs across global markets

- Competitive pricing through commission-free structure

Key Features

- Multiple regulatory licenses across EU jurisdictions

- Over 2,200 individual stock CFDs from 16 global markets

- Comprehensive educational resources and market analysis

- Advanced xStation 5 platform with professional charting tools

- Commission-free stock and ETF CFDs up to €100,000 monthly volume

Regulation and Safety

You need to be able to trust your CFD trading platform. XTB has strong regulatory credentials – which may provide peace of mind. You’re protected under FCA regulation in the UK and multiple EU licenses.

This doesn’t mean you’re any better protected from losing money on your trades, though. All it means is that your funds stay segregated from company money. Protection extends up to €20,000 under EU investor compensation schemes.

Costs and Pricing

Stock and ETF CFDs trade commission-free for the first €100,000 each month. After this threshold, you will need to pay a competitive 0.2% (minimum €10) commission.

Beyond that:

- Forex CFDs start from 0.9 pips on EURUSD.

- Index CFDs feature competitive spreads with the US100 at 0.9 points.

- Overnight financing costs (typically 2.5% to 6.5% annually) apply to leveraged positions.

As you can see – pricing structures for CFD trading are quite complex in comparison to simple buy and hold stock trading strategies.

But at least the fee structure is transparent so you can calculate precisely what you’ll be in for.

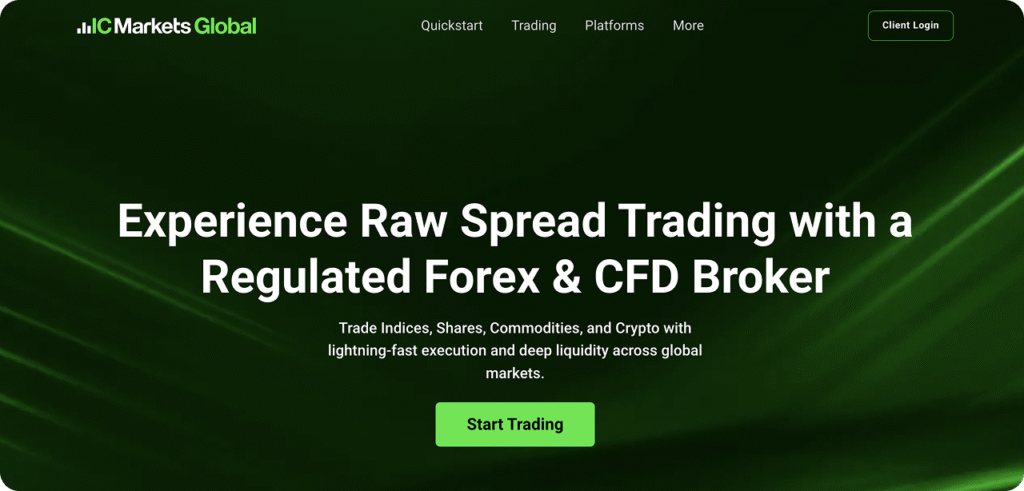

2. IC Markets: Lowest Cost MetaTrader Platform

Best for you if you’re cost-conscious and want MetaTrader functionality – or if you’re looking for tight spreads.

IC Markets delivers professional-grade features rivaling institutional platforms.

You’ll benefit from ultra-tight spreads from 0.0 pips on major pairs (if you recall, XTB pips begin at 0.9. Fees are also lower than those offered by most competitors.

You will have access to 2,100+ stock CFDs – similar to XTB.

Key Features

- Tight spreads from 0.0 pips on forex CFDs

- True ECN execution with institutional liquidity

- Over 2,100 stock CFDs across global markets

- MetaTrader 4, MetaTrader 5, and cTrader platforms

Trading Conditions

IC Markets Raw Spread accounts give you institutional spreads plus a transparent commission structure.

EURUSD spreads average 0.1 pips with $7 round-turn commissions (the cost to both open and close the lot.)

Your Stock CFDs will benefit from the same tight pricing. For example, some CFD fees average just $1.5 for $2,000 positions held for one week. Other platforms, in comparison, would charge you $4-8 for identical trades.

Platform Technology

IC Markets supports three professional trading platforms: MetaTrader 4, MetaTrader 5, TradingView, and cTrader.

MetaTrader will appeal to you if you:

- Are an experienced stock trader familiar with technical analysis tools

- Understand algorithmic trading or wish to explore it

- Want to build custom indicators

3. IG: Market Leader with Premium Research

Best for you if you want market-leading research and analysis – or if you need the broadest selection of CFD markets available.

IG pioneered CFD trading and maintains its market leadership today. With over 17,000 CFD markets, you will be hard pressed to find a broader selection elsewhere.

The platform is as strong in educational resources as it is market analysis. The platform still has a steep learning curve – but if you’re willing to learn you will have all the support needed.

Key Features

- Advanced ProRealTime charting integration

- Guaranteed stop losses for risk management

- Industry-leading research and market analysis

- Over 17,000 CFD markets including niche sectors

With 50 years of market experience and innovation, IG is hard to beat.

Research and Analysis

IG’s research team provides you with daily market commentary. These analyses cover:

- Major stock movements

- Earnings results

- Sector trends

Your research capabilities are boosted by Reuters news feeds and Morningstar fundamental data – each piped directly into trading interfaces.

ProRealTime (a top stock charting software) is integrated into the platform, providing you with institutional-grade charting (over 100 technical indicators.)

Market Coverage

IG offers CFDs on individual stocks from 16 countries, including major markets like US, UK, Germany, and Japan.

If you’re more of a thematic investor, sector-specific CFDs allow you to take positions based on themes like renewable energy or biotechnology. You don’t need to select individual stocks – just trade the theme in general.

As you know by now, CFDs are a risky trading strategy – guaranteed stop losses provide you with additional risk protection during volatile market conditions.

However, you may notice wider spreads than on other platforms. The wider the spread, the more expensive it is to execute a round-turn (buy then sell) trade.

4. Capital.com: AI-Powered Platform for Beginners

Best for you if you’re new to CFD trading and want AI-powered guidance – or if you need a beginner-friendly interface.

Capital.com uses artificial intelligence to help new CFD traders avoid common mistakes. You’ll benefit from AI-powered risk management that identifies dangerous trading patterns – great if you’re just getting started and concerned about high loss rates common in CFD trading.

Key Features

- AI-powered trading insights and risk warnings

- TradingView integration for advanced charting

- Commission-free stock CFDs with competitive spreads

AI Trading Technology

Capital.com’s proprietary AI system analyzes individual trading patterns to identify risks.

If it looks as if you will be taking on too much risk due to overtrading or excessive leverage – the platform’s AI acts as a guardrail and warn you.

If you’re unfamiliar with leveraged product risks and CFD dynamics but still want to give it a try – Capital.com may be a good place to start.

Educational Resources

You will have access to a huge range of educational articles covering:

- CFD trading basics

- Technical analysis

- Risk management

Interactive trading courses are available to guide you through both platform features and market concepts.

5. Saxo Bank: Premium Platform for Professional Traders

Best for you if you’re a professional trader with sophisticated requirements – or if you manage larger account sizes with complex multi-asset strategies.

If you’re a high net worth individual with several hundred thousand, (or million) to invest, Saxo Bank is well catered to your needs.

The platform provides:

- Institutional-grade research

- Advanced order types

- Multi-asset portfolio management tools

Saxo Bank’s offering will appeal to you if you intend to manage complex strategies across larger accounts.

Key Features

- Premium client services and support

- Multi-asset portfolio optimization tools

- Institutional-grade research and analysis

- Over 7,800 stock CFDs across global markets

- Advanced SaxoTraderGO and SaxoTraderPRO platforms

Research Capabilities

One of the biggest advantages you’ll find within the Saxo platform is research covering over 6,000 global stocks. Reports dive deep into:

- Fundamental analysis

- Earnings forecasts

- Price targets

You’ll find reports from 15+ research providers including Morningstar, Trading Central, and Recognia.

Professional Trading Tools

SaxoTraderPRO gives you access to advanced order types such as algorithmic orders, conditional orders, and multi-leg strategies.

Not only can you take on simple long/short positions, you will also be able to take advantage of options CFDs – providing you with additional hedging and income generation opportunities.

Portfolio analysis tools calculate risk metrics across multi-asset position – helping you understand correlation exposures and optimize your position sizing.

6. FxPro: Forex-Focused CFD Specialist

Best for you if you focus on forex and currency-related CFDs – or if you need expertise in currency hedging.

FxPro specializes in forex and currency-related CFDs. You will find competitive forex spreads alongside stock CFDs from major global markets If you want to hedge international positions or trade currency-sensitive sectors, FxPro’s currency expertise is invaluable.

Key Features

- Negative balance protection

- Advanced algorithmic trading support

- 1,800+ stock CFDs across global markets

- Competitive forex CFD spreads from 0.6 pips

- MetaTrader 4, MetaTrader 5, and cTrader platforms

Currency Market Expertise

If currency trading is your thing, then it’s difficult to go past FxPro. The platform offers over 70 currency pairs with institutional-grade execution and pricing.

You can also capitalize on currency trends affecting international stock valuations.

Algorithmic Trading Support

The platform provides free VPS hosting for your algorithmic strategies. If you’re not up for building your own algo, head to the strategy marketplace where you will find pre-built trading systems.

7. Interactive Brokers: Professional Multi-Asset Platform

Best for you if you’re a professional trader and need institutional-quality tools – or if you want low margin rates and multi-asset access.

With Interactive Brokers you will have access to approximately 8,500 stock CFDs across global markets.

A Direct Market Access (DMA) model means your orders appear directly on exchange order books (preventing dealer intervention.)

Additionally, unlike typical CFD brokers, IB enables pairs trading where you can trade one stock CFD against another in a single order.

If CFDs are only one part of your investing strategy, you will be happy to know you can trade options, futures, and bonds from a single account.

Key Features

- Industry-lowest margin rates from 1.83% for USD balances over $100,000

- Direct Market Access with orders on real exchange order books

- 8,500+ stock CFDs plus index, commodity, and forex CFDs

- Overnight trading from 8pm-3:50am ET for US stock CFDs

- Access to 150+ global markets and exchanges

- API access for algo trading strategies

Cost Advantages

If you want the lowest total trading costs through minimal spreads and unbeatable financing rates – the Interactive Brokers might be for you.

Stock CFD commissions start from $0.005 per US share.

However the real difference is in the overnight financing rate. Overnight financing comes in at approximately benchmark +/-1.5%. In comparison, competitors charge 5-7% annually for financing.

Complementing CFD Trading with Fundamental Analysis

Success in CFD is driven by capturing price movements and technical patterns. But successful stock traders understand that technical analysis is not everything. They understand the fundamental truth that price follows value over time.

Fundamental analysis platforms like Gainify.io provide the company insights that CFD platforms lack.

Fundamental research helps identify which companies deserve your trading attention, including finding undervalued stocks with strong potential. CFDs help you profit from short-term price movements.

The combination of CFD trading and fundamental analysis rounds out your approach to stock trading – making you a more versatile investor.

Use CFDs for timing and position management. Rely on fundamental research to guide your overall market view and stock selection.

Risk Management: Essential for CFD Success

CFD trading amplifies both profits and losses. This means risk management is critical for your long-term success.

We’ve covered a lot of solid CFD trading platforms in this article. But position sizing will impact your success much more than the platform you choose. Even the best CFD platform cannot protect you from overleveraging or poor risk management decisions.

Key risk management principles if you’re trading CFDs:

- Maintain cash reserves for unexpected margin calls

- Monitor correlation risk across multiple CFD positions

- Never risk more than 1-2% of account capital on a single trade

- Understand overnight financing costs for positions held multiple days

- Use stop losses on every position to limit downside exposure

The platforms in this guide provide tools for effective risk management. But discipline and education remain your responsibility as a trader.

Regulatory Considerations for 2026

CFD regulation continues evolving. Consumer protections and stricter capital requirements for brokers are two trends making CFD trading a little bit safer for investors.

European ESMA regulations limit retail trader leverage to 30:1 for major stocks and 20:1 for non-major stocks. Negative balance protection prevents account losses exceeding deposited capital.

UK FCA regulations mirror European standards while adding enhanced disclosure requirements for CFD marketing and client onboarding.

US residents cannot trade CFDs due to CFTC regulations. However, US brokers offer similar leveraged products like Options and ETFs.

The Bottom Line for Stock Traders

CFD trading offers useful tools for short-term speculation and portfolio hedging. It requires different skills than long-term stock investing.

XTB provides the best overall combination of low costs, market access, and regulatory protection. IC Markets delivers the lowest spreads for cost-conscious traders using MetaTrader platforms. IG offers market leadership with premium research capabilities.

Success in CFD trading requires disciplined risk management, proper education, and realistic expectations about profitability. Most retail CFD traders lose money. That’s a fact.

When trading CFDs you should:

- Consider CFDs as tactical tools rather than core investment strategies.

- Combine CFD trading capabilities with fundamental research platforms like Gainify.

- Educate yourself in risk management, position sizing, and CFD trading best practices.

Ready to Start CFD Trading? Here’s Your Next Step

Before you risk money on any CFD trade, you need to understand which stocks deserve your attention. That’s where Gainify becomes invaluable. You get real-time insights on over 25,000 global stocks, Wall Street analyst estimates, and proprietary ratings that help you identify quality companies before you decide how to trade them.

With custom and pre-built screeners, you can filter through over 25,000 global stocks using the exact criteria that matter to your investment strategy – whether that’s revenue growth, profit margins, or debt ratios.

Gainify’s top investor tracking lets you follow the moves of successful fund managers and institutional investors, giving you insights into where smart money is flowing. Compare top investors head-to-head or copy their portfolios to your watchlist.

Custom charting helps you visualize company performance metrics and financial health. a stock’s valuation metrics like P/E, P/S, and EV/EBITDA visually against competitors.

Charting features include:

- Time period selections (various historical ranges)

- Multiple visualization types (bar charts, line graphs, etc.)

- Separate y-axis support for comparing different metrics on the same chart

- Ability to chart different metric categories (income statement, balance sheet, cash flow metrics)

The proprietary Gainify Rating system evaluates stocks based on multiple fundamental factors. You get a clear picture of which companies have the strongest investment potential by analyzing:

- Outlook – Assesses a company’s growth potential

- Performance – Analyzes historical track record

- Momentum – Tracks recent price strength

- Health – Evaluates financial stability

- Valuation – Examines current value

Try Gainify’s stock analysis for free and discover which stocks align with your trading strategy.

Frequently Asked Questions

What percentage of CFD traders lose money?

Between 62% and 82% of retail CFD traders lose money, according to official broker statistics. Interactive Brokers has the best success rate at 62% losing traders, while some platforms report up to 82% losses. You’re facing challenging odds that require disciplined risk management and proper education to overcome.

Are CFDs legal in the US?

No, CFDs are not legal for US residents. The CFTC prohibits CFD trading by US citizens, even on offshore platforms. US traders can access leveraged products through different structures like margin trading and options, but traditional CFDs remain unavailable.

What’s the difference between CFDs and buying stocks directly?

When you buy stocks directly, you own shares in the company and receive dividends and voting rights. CFDs are contracts that mirror stock price movements without ownership. CFDs offer leverage and easier short selling, while direct ownership provides long-term wealth building through dividends and compound growth.

How much money do I need to start CFD trading?

Most CFD platforms require minimum deposits between $50-$200, but you should start with money you can afford to lose completely. Due to leverage, you can control larger positions with smaller capital, but this also amplifies your potential losses. Never trade with money needed for essential expenses.

Which CFD platform has the lowest fees?

IC Markets offers the lowest overall fees with spreads from 0.0 pips plus transparent commissions. XTB provides commission-free trading up to €100,000 monthly volume. Your total costs depend on trading frequency, position sizes, and overnight financing charges for held positions.

Can I lose more money than I deposit?

European regulations require negative balance protection, preventing losses exceeding your deposited capital. However, this protection varies by jurisdiction and may not apply during extreme market events. Always understand your platform’s negative balance policy before trading.

What’s the best CFD platform for beginners?

Capital.com offers the most beginner-friendly experience with AI-powered risk warnings and educational resources. XTB provides excellent educational materials and competitive pricing. Both platforms help new traders avoid common mistakes while learning CFD mechanics.

How do I choose between different CFD platforms?

Focus on regulation (FCA, ASIC, or CySEC), transparent pricing, available markets, and educational resources. Consider your trading volume, preferred platforms (MetaTrader vs proprietary), and whether you need advanced features or simple execution.

Do I pay tax on CFD profits?

CFD profits are typically subject to capital gains tax, but tax treatment varies by country and your total income. In some jurisdictions, CFDs may be considered gambling rather than investing. Consult a tax professional familiar with derivative trading in your location.

Can I use CFDs to hedge my stock portfolio?

Yes, CFDs excel at portfolio hedging because you can easily short markets or specific stocks. If you’re worried about a market downturn affecting your long-term holdings, you can open short CFD positions to offset potential losses. This strategy requires careful position sizing and monitoring.