To use AI for investing effectively, you need two key elements: specialized AI tools built specifically for stock research (not generic chatbots), and access to real-time financial data from trusted sources like S&P Global. The best approach is to use AI-powered platforms like Gainify for in-depth stock analysis, earnings insights, and portfolio research.

The most exciting shifts in investing have always come from statistics, machine learning, and artificial intelligence.

From statistics-based methods in the early 20th century to machine learning hyper-quant funds like Renaissance Technologies, and finally to full-blown AI algorithmic trading using deep learning to predict market movements.

AI excels for investing-related tasks because it can process vast amounts of data instantly, recognize patterns that humans miss, and remove emotions and bias from stock analysis and trading.

But much of the top AI tech is locked up in the world’s largest hedge funds. Before large language models for investing (inspired by ChatGPT and other early language models) became available, to use AI for investing you needed to be a statistician, mathematician, or data science.

Today, however, retail investors have access to swathes of AI-powered tools for investing research, stock analysis, and more.

With the rise of large language models, AI for investing is democratizing at breakneck speed. Already, almost two in five US adults are using AI for finances – and around 1 in 5 using it to identify new investment strategies. This number will only rise.

In this comprehensive guide, we’ll explore how to leverage AI for smarter, more confident investment decisions – and reveal why specialized AI platforms like Gainify are transforming how reinvestors approach the market.

Benefits of AI for Investing

AI gives you key advantages previously unavailable to retail investors, including enhanced accuracy, speed, predictive analytics, sentiment analysis, and elimination of emotional bias.

Enhanced Accuracy and Speed

AI can process huge amounts of financial data in seconds. Analyzing earnings reports and hundreds of market indicators is no longer a burden with super fast AI analysis.

And because AI can easily analyze hundreds of data points to identify patterns, it can make your stock analysis more accurate, uncovering insights that even experienced analysts might miss.

It will help you find undervalued stocks, quality dividends, and companies poised for growth. But it will also help you avoid poor investments – like companies with a shaky track record or concerning health metrics.

However, while AI is a huge power-up for your stock research process – you should still double check its assumptions, analysis, and insights yourself – just to be sure.

Predictive Analytics for Market Trends

AI can use sophisticated pattern recognition to analyze historical stock data, company performance, and economic indicators to forecast potential market movements.

However such predictive models aren’t foolproof. Use them for valuable insights to inform your investing and uncover quality companies. But don’t follow them blindly.

Eliminating Emotional Bias

If you’ve been investing for a while, you know that one of the hardest things to learn is managing the emotional side of investing.

AI can be helpful to give you a second opinion, contradict your beliefs, or help you build bull and bear cases. Use it to avoid common mistakes, errors, and cognitive biases.

Access to Professional-Grade Analysis

When using AI built specifically for investing and stock research, you gain access to deep insights and information. This information covers much more than just stock prices.

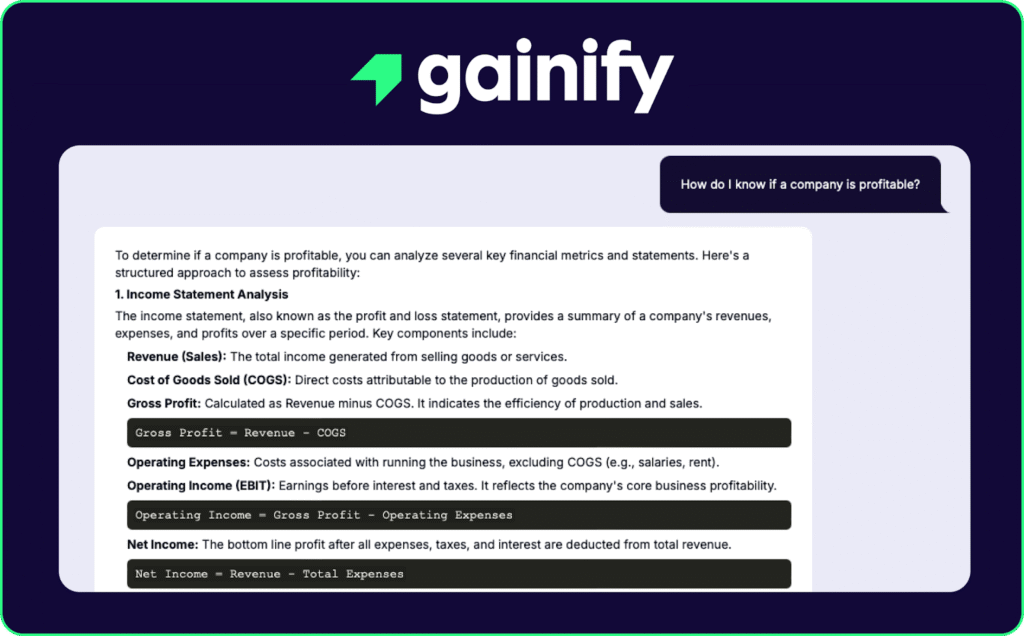

One of the best use cases for AI is to get pro-level explanations of investing principles and strategies.

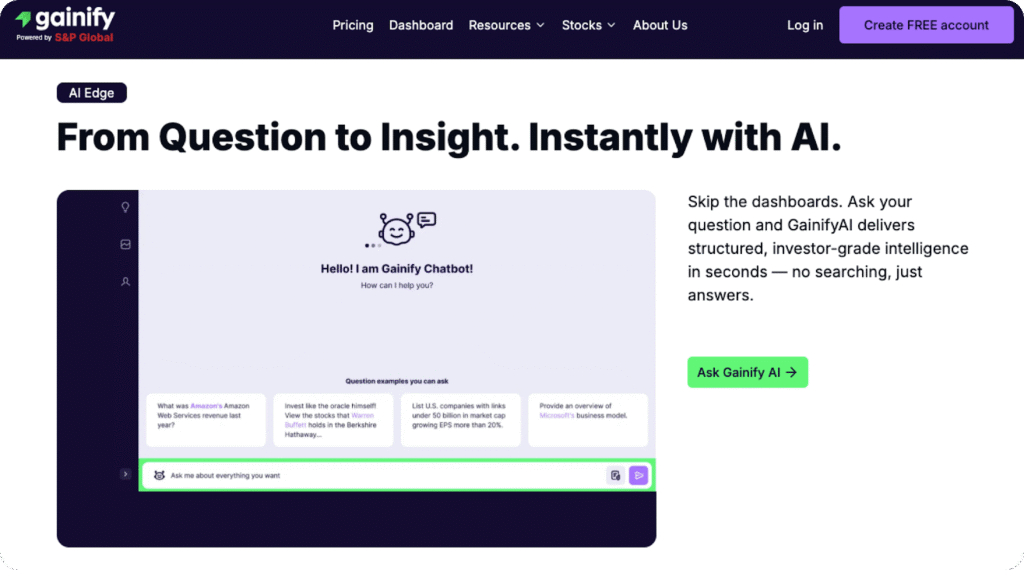

An AI chatbot like that of Gainify can help answer your important investing questions, acting as your own professional stock analyst available 24/7.

AI-Powered Investment Tools for Retail Investors

Institutional investors can use AI and high-frequency trading to execute thousands of trades per second. But if you’re a retail investor, these types of AI trading bots are unlikely to be the best fit for your investing needs. You’ll likely benefit most from AI-powered research and analysis tools designed for long-term wealth building.

As a retail investor, you have three main categories of AI investment tools to choose from:

- Robo-advisors like Betterment and Wealthfront use AI for automated portfolio management, rebalancing your investments based on risk tolerance and goals. These are ideal for passive investors wanting hands-off portfolio management.

- Specialized AI stock research platforms like Gainify focus on empowering investors with AI-driven analysis, earnings insights, and stock research capabilities. These tools help active investors make more informed individual stock decisions.

While robo advisors can be helpful for a few stock picks a month, if you want to understand your investments deeply and make informed stock picks, specialized AI research platforms (not robo-advisors) offer the most value.

Choosing the Right AI Tools for Investing

The critical flaw in many AI tools available to the general public and retail investors is that they are generic – not catered to the needs of investors. They lack access to real time stock market data, earnings call data, 13F filings, and more.

Nor are they built for your stock research and analysis workflows. Instead, they are built to cater to a range of tasks, from writing emails to analyzing images – lacking the required specialization to truly perform in investing related tasks.

When faced with a choice between generic training vs. specialized knowledge – always choose specialized knowledge.

If you’re serious about your stock portfolio, you need a specialized AI investing assistant that is:

- Built by investors for investors

- Trained specifically on stock data to complete investing related tasks

- Connected to a real-time institutional grade data source

Without these three key elements, you will likely be left disappointed with the results. This will be reflected not only in your stock research, but also in your portfolio returns.

ChatGPT, Gemini, Grok and other generic AI tools are not built for investing. Without access to current market data, these tools are essentially flying blind. Their insights are not something you want to stake your hard earned savings on.

Gainify AI: Built By Investors for Investors

Unlike generic AI tools, Gainify was built by investors, for investors, with a clear mission: to democratize access to Wall Street-level insights and analysis.

Gainify gives you AI tools and insights that were previously available only to institutional traders.

Gainify’s Data Advantage

Unlike chatGPT, Grok, Gemini, and other large language models – Gainify does not rely on outdated data, or data simply scraped from random web sources. Gainify AI is connected to premium Wall Street data from S&P Global Intelligence, the same trusted data provider used by professional investors globally.

But S&P Global Intelligence isn’t Gainify’s only data advantage. You’ll also be benefitting from direct access to Financial Modeling Prep, and proprietary data.

Instead of scraping blogs and articles on the web (like other AI tools), Gainify uses the world’s most comprehensive and trusted financial data sources.

You gain access to accurate historical data, providing your analyses much needed context. You’ll be able to understand how current valuations compare to historical averages, track the evolution of past analyst estimates versus actual results, and identify long-term trends.

Gainify AI also has access to a range of forecasts & analyst estimates for revenue, earnings, EBITDA, cash flow, dividends, and more – extending up to 3 years into the future.

Purpose Built for Stock Research

When you sign up for Gainify you gain access to a suite of features designed specifically for investment research.

All of these are based on institutional-grade data and connected to Gainify AI – enabling you to request direct analysis and comparison of key stock information.

You can ask Gainify AI for:

- In-depth earnings call analysis that captures management sentiment, key takeaways, and guidance changes – going beyond basic summaries

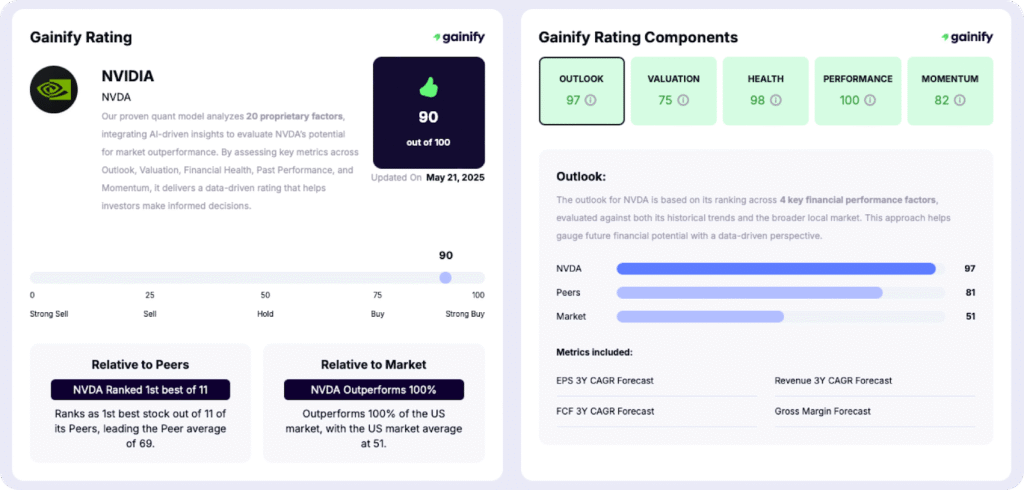

- Analysis of Gainify’s proprietary metrics focused on future value, including Performance, Momentum, Valuation, Outlook, and Health scores.

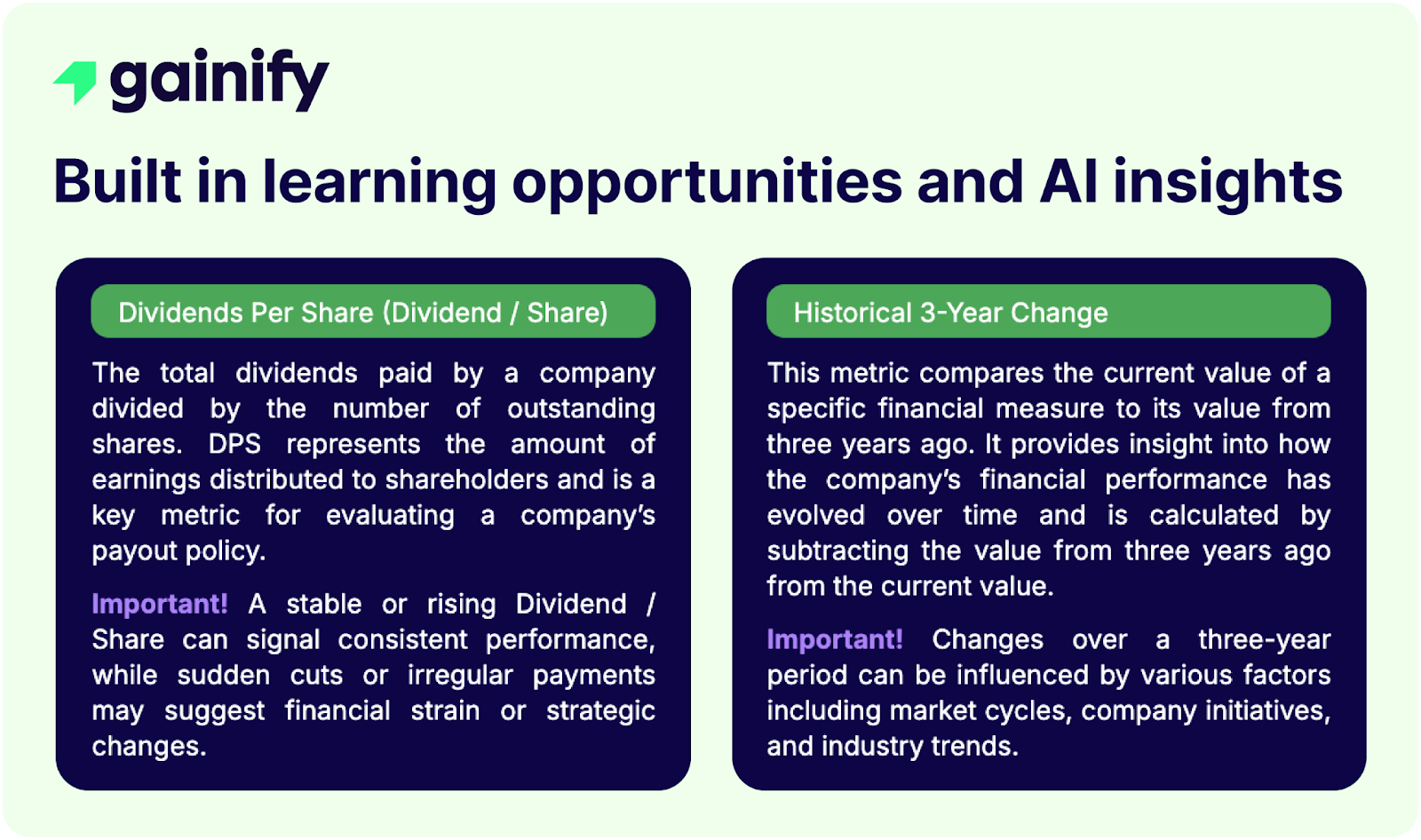

AI for Every Stage of Your Investing Journey

From just getting started to managing an impressive portfolio of diversified global stocks, Gainify AI is there to help you every step of the way.

Learn as you invest – Ask questions like “What makes a stock undervalued?” or “How do I read an earnings report?” and receive clear, educational responses that build your knowledge base

Gainify AI explains metrics in plain English, helping you understand why metrics like FCF Yield or ROIC matter for your investment decisions.

When it comes to researching top stocks to uncover quality companies, Gainify AI gives you unprecedented access to:

- Company deep dives: Leverage Gainify’s proprietary metrics with queries like “What is Gainify’s view on NVIDIA?” to receive comprehensive analysis covering valuation, momentum, health, and future outlook based on Wall Street data

- Head-to-head comparisons: Execute sophisticated competitor analysis such as “Compare Apple and Microsoft’s forward P/E ratios, revenue growth, and dividend yields” to identify relative value opportunities

- Industry intelligence: Uncover sector leaders with requests like “Who are the top players in renewable energy by market cap and profitability?” or “Which semiconductor stocks have the strongest earnings growth forecasts?

- Dividend analysis: Find income opportunities with targeted queries such as “Show me S&P 500 companies with dividend yields above 4% and consistent payout growth over 5 years”

- Earnings intelligence: Go beyond surface-level summaries with requests like “Analyze Microsoft’s last earnings calls for changes in cloud revenue guidance and competitive positioning”

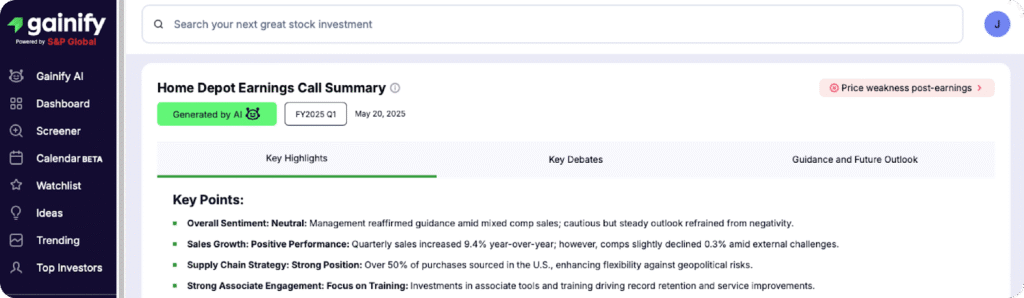

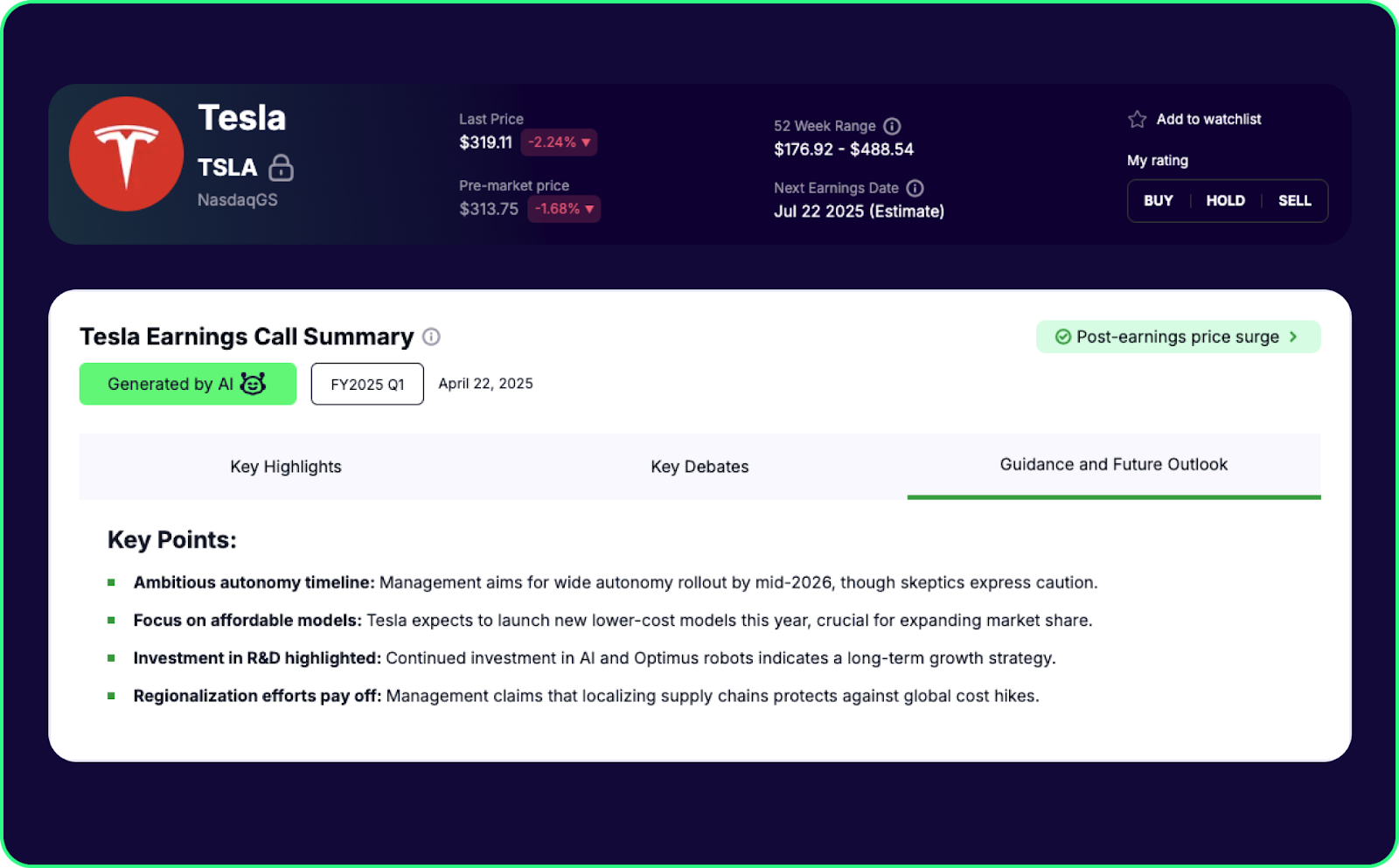

Earnings Call Summaries with AI

Earnings reports show what happened, earnings calls reveal why it happened and what’s coming next.

But earnings call transcripts can run 15-20 pages of dense text. Multiply that by four quarters and several companies in your portfolio, and that’s hundreds of pages of critical information you need to analyze. Impossible to do alone, especially as a retail investor.

Enter Gainify’s AI earnings call summaries and earnings call calendar.

First, Gainify’s earnings call calendar keeps you organized and prepared. You’ll be notified about upcoming earnings dates and analyst consensus estimates and revision trends.

Gainify’s AI earnings call analysis then transforms earning calls into actionable insights within hours of release. With instant summaries of key points, you’ll be able to quickly identify:

- Strategic shifts that could impact long-term value

- Changes in competitive dynamics

- Management confidence levels and areas of concern

- Guidance revisions and their implications

Affordable AI for investing

Many stock research platforms charge thousands of dollars annually – all while giving access to less advanced features. Gainify breaks the mold by making institutional-grade stock data and analysis available to retail investors at an affordable price.

- Free plan (no CC required): 10 AI queries monthly, 1 year of analyst estimates, and access to core features – no credit card required.

- Investor plan: As little as $7.99/month for 50 AI queries, 3 years of estimates, and the proprietary Gainify Rating.

- Gainer pro: As little as $26.99/month for 500 AI queries and 15 years of historical valuation data.

Even on Gainify’s free account, you’re getting AI trained specifically for investment analysis, the same S&P Global Market Intelligence data used by Wall Street, and proprietary metrics and ratings not available anywhere else. Gainify is truly the best value for money stock research platform with AI tools for investing.

Maximizing Your AI Investment Assistant

AI is a powerful tool for investing, especially Gainify’s AI stock research assistant. But to get the most out of it, you must follow some best practices.

Best Practices for AI Queries

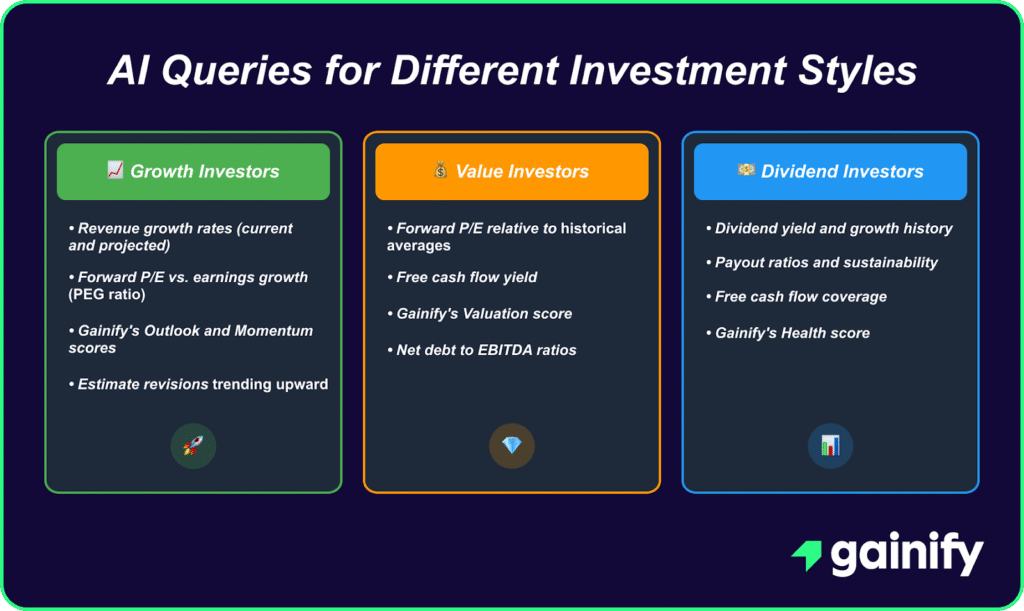

Instead of asking generic questions like “Is Apple a good stock”, be specific in your queries. Ask about a targeted aspect of the stock’s performance like its valuation, earnings growth, or revenue growth. Ask for competitor comparisons to gain added context based on how similar companies are performing.

- What is Gainify’s view on Apple’s valuation compared to Microsoft and Google?

- “How has Tesla’s revenue growth compared to Ford and GM over the past 3 years?”

- “Which semiconductor stocks have the strongest earnings growth forecasts for 2025?”

Act like a seasoned investor or stock analyst –attempting to truly get to the bottom of a company’s fundamentals, key value investing metrics, and outlook.

You can also chain queries for deeper analysis.

- Start broad: “Who are the top players in renewable energy?”

- Narrow down: “Compare the financial health scores of NextEra Energy and Brookfield Renewable

- Get specific: “What risks does Gainify identify for NextEra Energy based on recent earnings calls?”

- Validate: “How do these companies’ dividend yields compare to the utility sector average?

And be sure to ask follow-up questions when you don’t understand a metric: “What does a high ROIC mean for long-term investors?

Utilizing the Full Range of AI Capabilities

Gainify AI can do a lot more than simply tell you a stock’s current trading price. To get the most out of AI for investing, explore its full range of capabilities.

- Sector analysis: “Compare all cloud computing stocks by revenue growth and profitability”

- Trend identification: “Which stocks show improving analyst sentiment over the past quarter?”

- Risk assessment: “What are the main financial health concerns for companies in the retail sector?”

- Opportunity discovery: “Find undervalued dividend stocks with consistent payout growth”

Other Gainify Tools for Stock Research

Gainify’s flagship feature is its AI connected to real time Wall Street data. But that’s not all it has to offer you. Other Gainify features you simply must add to your stock research process include pre-built and customized stock screeners, and top investor tracking. Not to mention Gainify’s proprietary 5 point matrix of key company health, performance, valuation, outlook and momentum metrics.

Proprietary Gainify Metrics

Gainify’s proprietary metrics are one feature you won’t find anywhere else. Using composites of 15+ key criteria across 5 areas, these metrics give you a deep understanding of a stock.

Each metric helps you answer a key question about the company – vital for informing your investing decisions:

- Valuation: Is the stock priced attractively relative to its fundamentals?

- Outlook: What’s the company’s growth potential?

- Health: Can the business weather economic storms?

- Performance: How well has management performed historically?

- Momentum: What’s the current market sentiment?

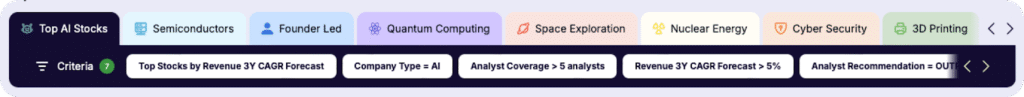

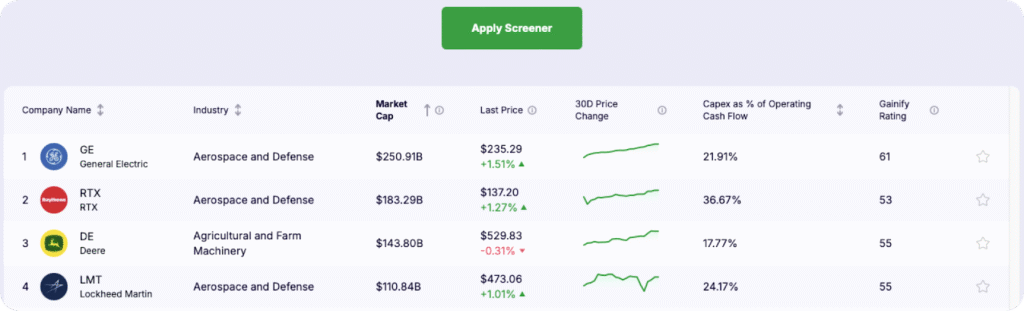

Pre-built Intelligent Stock Screeners

Save serious time in your stock research process with automated pre-built stock screeners. Covering key industries, investment styles, and growth indicators – in just minutes you’ll be able to find quality companies that fit your investment thesis.

Below are just a few examples of top screener groups you’ll have access to the minute you sign up:

- AI Stocks – Companies leading the artificial intelligence revolution

- Cash Cows – Businesses generating substantial free cash flow

- Dividend Champions – Consistent dividend payers and growers

- Valuation Opportunities – Stocks trading below intrinsic value

- Pivot Year Companies – Businesses at inflection points

Custom Stock Screeners

If you have very specific investing criteria not covered by Gainify’s automated screeners, you can build your own! With access to over 500+ customizable filters across market data, fundamentals, forward estimates, and valuation multiples, you can create highly targeted searches based on:

- Geographic regions and specific exchanges

- Industry sectors and sub-industries

- Financial metrics like revenue growth, profit margins, and debt levels

- Valuation ratios including P/E, EV/EBITDA, and forward multiples

- Growth rates for revenue, earnings, and cash flow

- Quality indicators such as ROE, ROIC, and dividend consistency

You can implement any investment strategy, from growth to value hunting or a dividend income approach.

Top Investor Tracking

If you want to follow what top company execs, Congress insiders, and the world’s best investors are doing – then Gainify’s top investor tracking and trending stock insights are for you.

As soon as a top investor’s trade is registered, you’ll know about it. Gainify’s comprehensive tracking system covers:

- Legendary investors like Warren Buffett and Ray Dalio

- Congress members and their trading activity

- Hedge fund managers and institutional investors

- Company insiders including executives and board members

You can even compare top investors’ portfolios head-to-head and copy winning portfolios to your watchlist with one click.

Other Ways to Use AI in Investing

While Gainify is one of the top AI tools purpose built for investing and stock research, it’s not the only solution out there. You can also explore robo-advisors for portfolio management, trading apps with AI features, or AI that analyzes social media sentiment about companies and brands.

Robo-Advisors and Trading Apps with AI Features

Platforms like Betterment, Wealthfront, and Schwab Intelligent Portfolios use AI algorithms to automatically manage diversified portfolios.

Robo-advisors utilize algorithms to construct and manage investment portfolios for you. Some robo-advisor & trading platforms even provide tax-loss harvesting. Such tools offer you an accessible entry point into investing – taking care of the portfolio management and tax details for you.

Other honorable mentions include M1 Finance, and Public.

AI Pattern Recognition for Technical Analysis

If you’re more focused on chart patterns and technical indicators than fundamental analysis and value/growth investing, there are specialized AI tools that help you automatically identify trading opportunities.

TrendSpider, for example, detects over 150 candlestick patterns, trendlines, and support/resistance levels. It’s able to do this not only for stocks, but also for forex, crypto, and ETFs. You can even use their AI to find entry points and automate orders.

Addressing AI Investment Concerns

While AI offers powerful capabilities for investors, it’s important to understand its limitations.

AI investing tools can identify patterns and risks, but they cannot guarantee profits or predict stock market movements. Be wary of any AI tools offering 100% certainty.

The Importance of Human Oversight

Combine AI insights with your own research and judgment. Always cross-reference insights with fundamental analysis and multiple sources before making investment decisions.

Avoid Unrealistic Expectations

Be cautious of any AI tools that promise guaranteed, outsized, or “risk-free” returns. You should be skeptical of high-pressure sales tactics (via direct messages, text, email, phone, etc.) or urgencies to make quick decisions.

Opt for established companies with a strong track record. Companies that don’t rely on pressure tactics or big promises to get you to use their AI trading bots or tools.

Start Small and Learn

If you’re just getting started with a new stock research app or trading tool – start with small amounts and build up your investment portfolio slowly. Evaluate that you can truly trust a platform’s insights before investing more than you’re comfortable losing.

Stay Educated

AI tools for investing are most effective when you understand the underlying fundamentals. Continue learning about stocks, investing principles, market dynamics, and financial analysis to make the most of any AI-powered investment tool.

The Future: AI for Investing

Strategic use of AI enables you to build streamlined stock research processes, analyze more stocks in less time, and keep up with increasingly complex & fast moving stock markets.

Due to huge advances in AI the gap between those who use AI for investing and those who rely on more traditional manual stock research methods will only widen. By embracing AI tools for investing today you are building a significant advantage.

The divide between retail and institutional investor capabilities is disappearing. Gainify proves that individual investors can now access the same quality of data and analysis that was once exclusive to Wall Street firms.

The best time to start using AI for investing was yesterday. The second-best time is now.

Start today with your free Gainify account.

Getting Started with AI Investing Today

Ready to transform your investment approach? Here’s your action plan:

- Sign up for Gainify’s free account – No credit card required

- Ask Gainify AI – Try “What are the top growth stocks right now?”

- Explore stock ideas – Browse curated investment themes

- Set up your watchlist – Track stocks that interest you

- Follow top investors – See what the pros are buying

Frequently Asked Questions

How is AI for investing different from regular ChatGPT?

AI investing platforms like Gainify are specifically trained on financial data and connected to real-time market information from trusted sources like S&P Global Market Intelligence. Unlike ChatGPT’s outdated training data, specialized AI investing tools provide current market insights, analyst estimates, and forward-looking projections essential for investment decisions.

What are the main benefits of using AI for stock research?

AI investing tools offer enhanced accuracy and speed in analyzing financial data, predictive analytics for market trends, elimination of emotional bias from investment decisions, and access to professional-grade analysis previously only available to institutional investors. These benefits help retail investors make more informed, data-driven investment choices.

Can AI predict stock market movements accurately?

No AI tool can predict stock movements with 100% certainty. However, AI excels at identifying patterns, analyzing fundamentals, and processing vast amounts of historical data to provide insights that often outperform traditional analysis methods. AI’s predictive analytics help investors understand potential trends, but markets remain unpredictable due to unforeseen events.

What’s the difference between robo-advisors and AI stock research platforms?

Robo-advisors use AI for automated portfolio management and rebalancing, while AI stock research platforms like Gainify focus on providing investment analysis and insights. Robo-advisors handle the actual buying and selling (trading), whereas AI research tools empower you to make informed decisions about individual stocks.

How does AI analyze earnings calls and company data?

AI investing platforms use natural language processing to scan earnings call transcripts, capturing management sentiment, strategic shifts, and guidance changes. Platforms like Gainify can identify subtle changes in management tone and competitive positioning that signal investment opportunities or risks ahead of the market.

Is AI investing suitable for beginners?

Yes! Modern AI investing platforms are designed with user-friendly interfaces that make sophisticated analysis accessible to everyone. You can ask questions in plain English (or any language!) about investing concepts and receive educational responses. AI tools help beginners learn while providing professional-grade analysis as experience grows.

How much does AI investing typically cost?

AI investing tools range from free tiers to premium subscriptions. Gainify offers a free plan with 10 AI queries monthly, while paid plans start at $7.99/month. This is significantly cheaper than traditional financial advisors or enterprise platforms that can cost thousands annually.

What should I look for in an AI investing platform?

Choose AI investing tools that are built specifically for investors (not generic AI), connected to real-time financial data from trusted sources, and offer transparency about their data sources. Avoid platforms promising guaranteed returns or using high-pressure sales tactics.

How does AI sentiment analysis work for investing?

AI sentiment analysis uses natural language processing to scan news articles, social media, earnings calls, and financial reports to gauge market sentiment about specific stocks or sectors. This helps investors understand market psychology and identify potential opportunities or risks based on changing sentiment.

Can I use multiple AI investing tools together?

Absolutely! Many successful investors combine different AI tools – using robo-advisors for basic portfolio management, AI research platforms like Gainify for stock analysis, and AI pattern recognition tools for technical analysis. The key is understanding each tool’s strengths and using them together.

What are the risks of relying too heavily on AI for investing?

The main risks include over-reliance without verification, ignoring AI insights that challenge your assumptions, and not understanding the limitations of AI predictions. Always cross-reference AI analysis with additional research and remember that no tool guarantees investment success.