The robotics revolution is no longer science fiction.

Intelligent machines powered by advanced robotics technology are reshaping everything from factory assembly lines to robotic-assisted surgeries. With global labor gaps, rising labor costs, and exponential growth in artificial intelligence and machine vision, the demand for automation has entered a phase of rapid growth.

The robotics industry has become a transformative market, touching sectors from electric vehicles to healthcare logistics.

With a growing number of public companies now offering robotic solutions, investors are turning to robotics stocks to align their investment objective with the future of innovation. This article presents a complete list of top robotics companies, spanning commercial drones, humanoid robots, and industrial automation systems. It draws on tools and insights from Gainify.io, combining live stock price data, earnings projections, and growth indicators to evaluate future performance and revenue growth potential.

Why Invest in Robotics Stocks?

Investing in robotics stocks is more than a bet on automation. It’s participation in a long-term industrial shift across virtually every global sector. Here are deeper reasons why robotics is increasingly viewed as a strategic allocation:

- Addressing structural labor challenges: With aging populations in developed markets and persistent labor shortages across manufacturing and logistics, robotic systems are filling structural workforce gaps. These systems don’t just replicate human effort. They enhance efficiency in environments unsuitable for humans due to danger, precision, or 24/7 operational needs.

- A convergence of exponential technologies: Robotics is no longer isolated; it intersects with machine learning, AI-driven mobility, sensor fusion, and IoT. These intelligent machines are not only capable of completing complex tasks, but can continuously learn and adapt. This makes them vital in industries like electric vehicles, aerospace, and healthcare.

- Surging enterprise and government demand: From government contracts for defense and infrastructure to hospital systems adopting healthcare robotic-assisted surgeries, demand is being driven by institutional adoption, not just consumer or hype cycles. Robotics through subsidies, public-private partnerships, and national AI strategies are accelerating the industrial rollout.

- Multiple paths to exposure: Investors can gain exposure through individual equities, ETFs like the VanEck Robotics ETF Holdings, or diversified funds tracking the broader industrial robot market. These vehicles often include companies involved in semiconductor manufacturing systems, AI infrastructure, and commercial drone networks.

- Fundamental and thematic tailwinds: Many robotics companies display solid fundamentals: robust earnings growth rates, expanding revenue growth potential, and competitive market share. With supply chain optimization and efficient inventory management becoming boardroom priorities, automation stocks are increasingly seen as essential infrastructure plays.

That said, robotics investing comes with substantial risk. The sector is capital-intensive and sensitive to economic growth dynamics, supply chain constraints, and regulation. There are special risk considerations including valuation uncertainty, and binary outcomes for newer entrants.

Investors should match exposure to their investment objective, consider the liquidity of fund shares, and assess their financial situation before diving in. As with any transformative market, the upside can be immense, but so too can the volatility.

9 Best Robotics Stocks by Market Cap to Watch

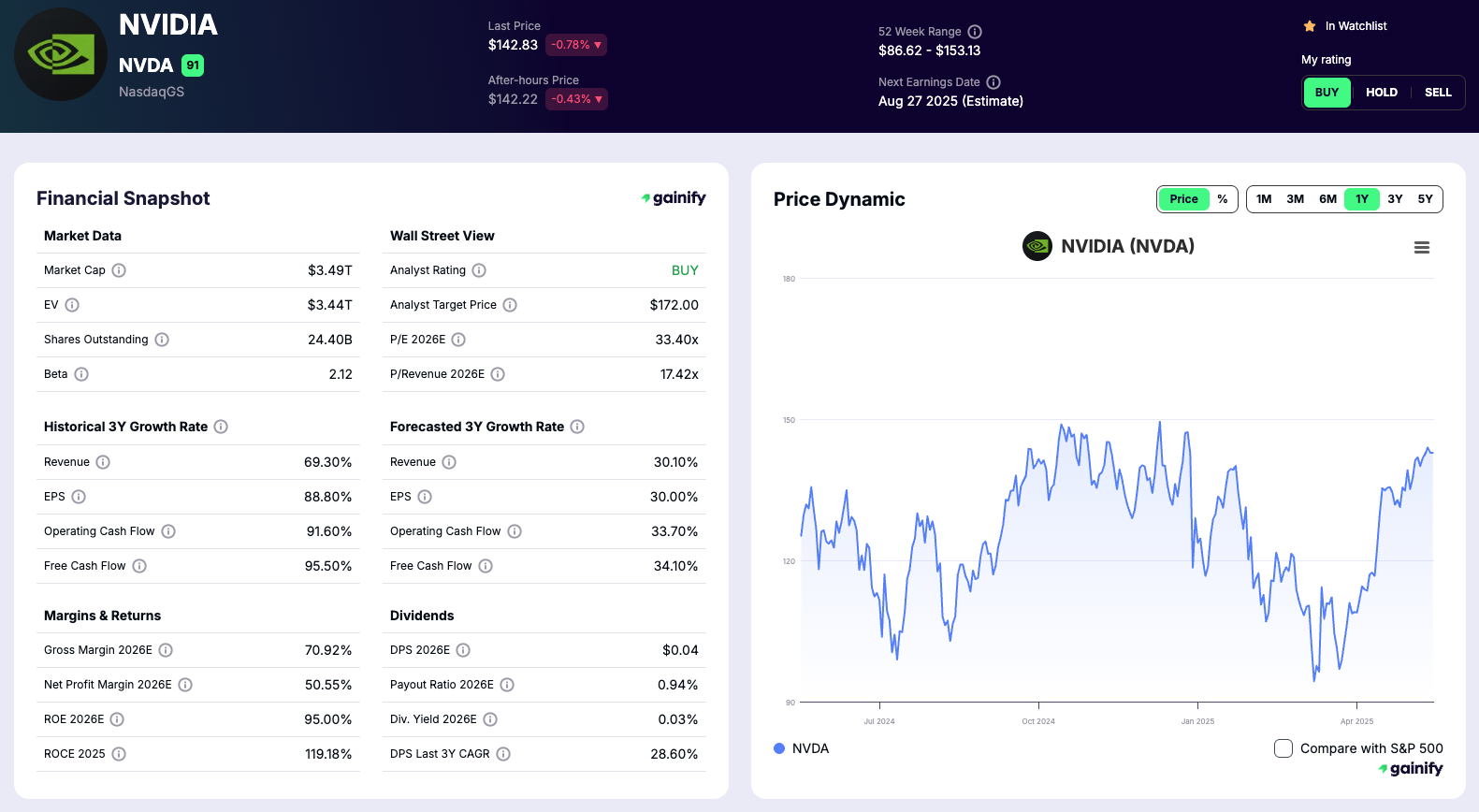

- NVIDIA Corporation (NVDA)

- Market Cap: $3.5 trillion

- Why: NVIDIA supplies the basic building blocks for AI and robotics technology from chips used in autonomous vehicles to machine learning platforms for humanoid robots. It plays a critical role in powering robotic systems in smart factories and 3D printing ecosystems.

- Expert View: NVIDIA is the undisputed leader in powering robotics through its advanced chipsets and software stacks. Its role in enabling robotic vision, real-time processing, and simulation environments makes it central to the robotics technology stack.

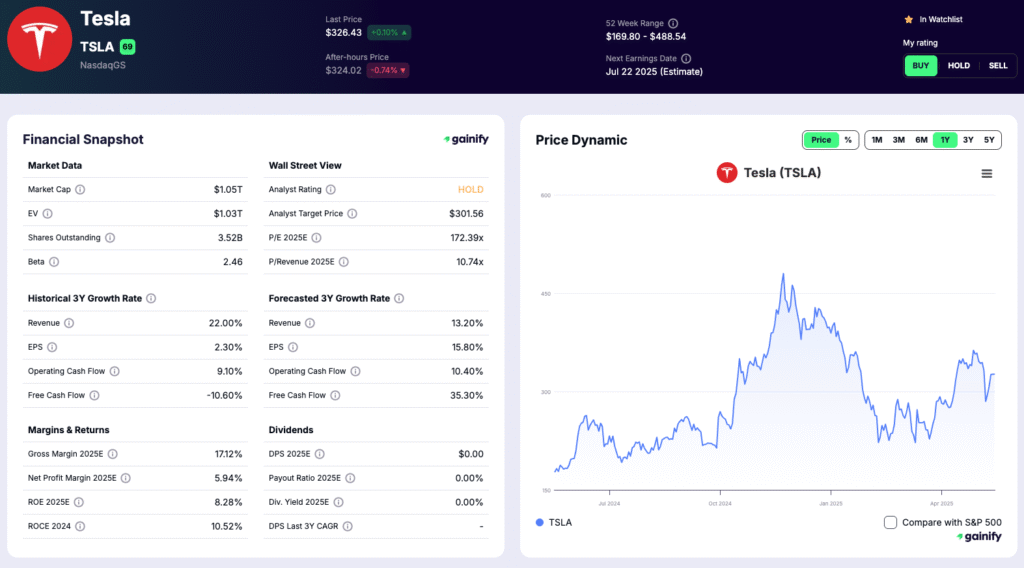

- Tesla Inc. (TSLA)

- Market Cap: $1.0 trillion

- Why: Tesla is integrating robotics into both its manufacturing processes and consumer-facing platforms. Its humanoid robot, Optimus, and its heavy use of factory automation show a clear commitment to driving innovation in robotic systems and intelligent mobility.

- Expert View: Tesla represents the convergence of robotics, AI, and electric vehicles. Its internal development of robotic platforms gives it unique control over both hardware and software, pushing the boundaries of humanoid robotics and autonomous manufacturing.

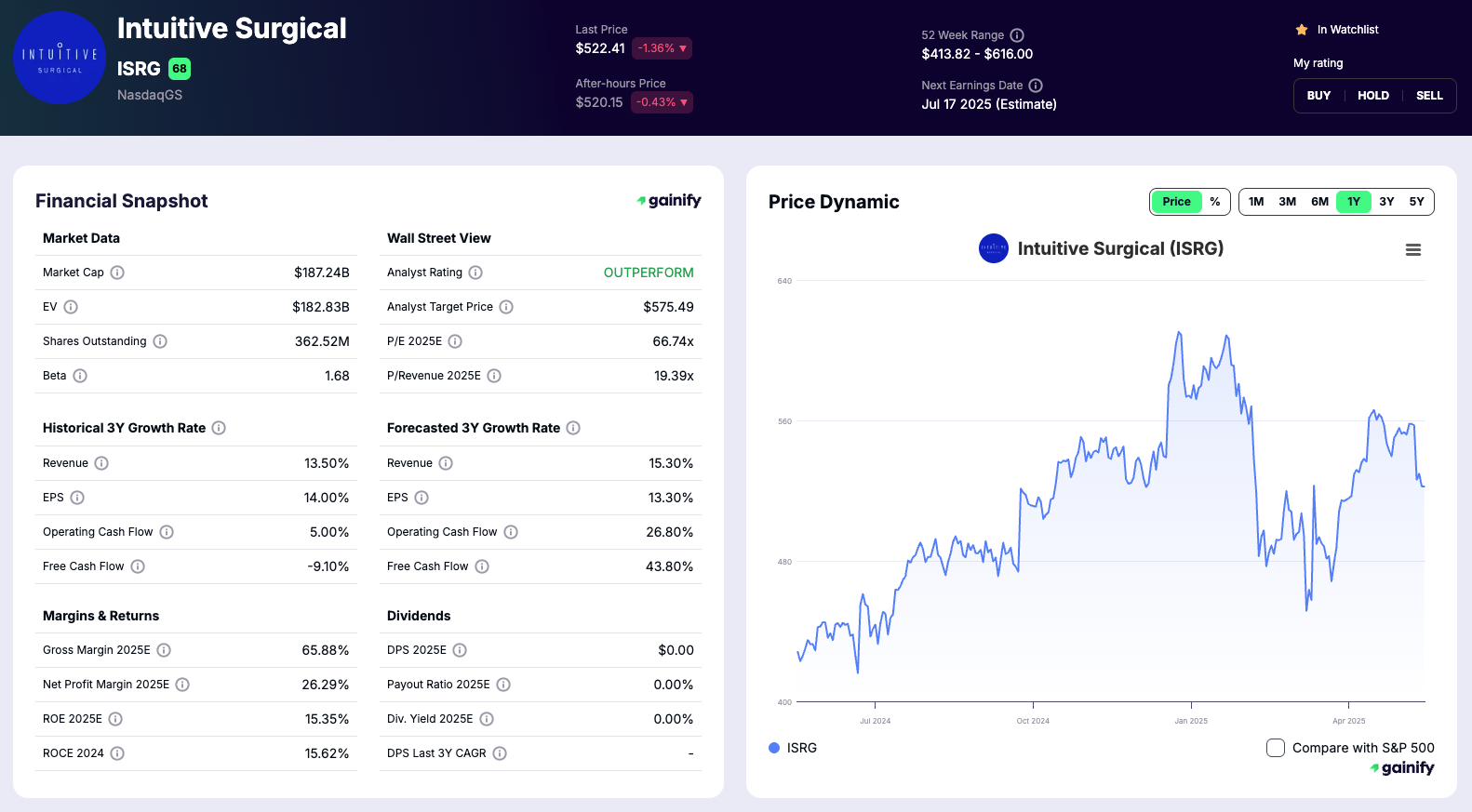

- Intuitive Surgical (ISRG)

- Market Cap: $187 billion

- Why: ISRG revolutionized surgical robotics with its da Vinci platform, enabling minimally invasive procedures with precision and control. It continues to lead in robotic-assisted surgeries across global healthcare systems.

- Expert View: Intuitive’s robotics technology enables a seamless human-machine interface, combining tactile feedback, 3D visualization, and advanced motion control. It is the gold standard in surgical robotics innovation.

- ABB Ltd (ABB)

- Market Cap: $107 billion

- Why: ABB is a pioneer in industrial robotics, providing advanced automation systems for industries ranging from automotive to packaging. Its solutions integrate robotics, motion control, and digital services.

- Expert View: ABB’s modular and scalable robotic systems are a benchmark in factory automation. Its strength lies in delivering reliable, flexible solutions tailored for both large-scale and niche industrial environments.

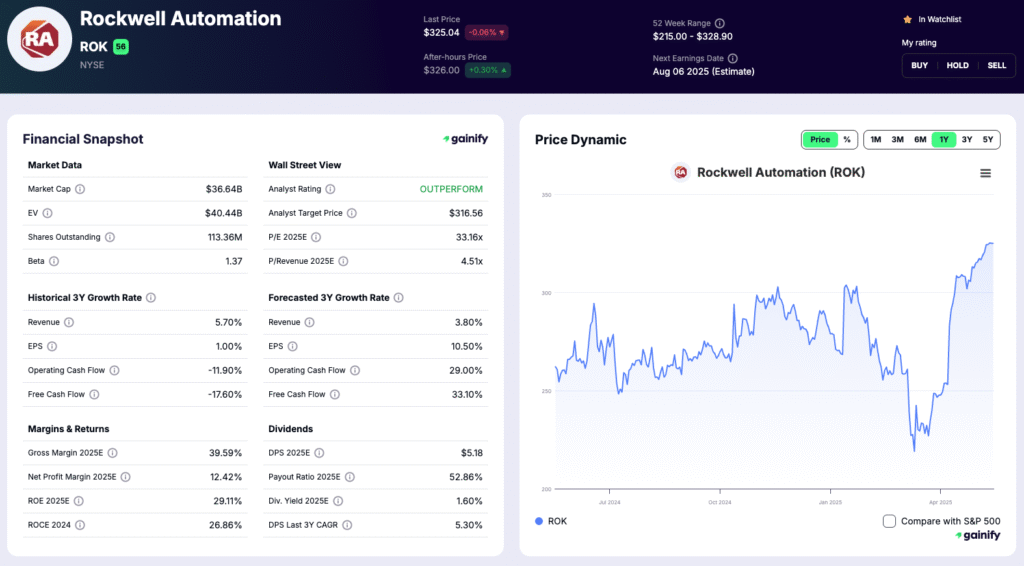

- Rockwell Automation (ROK)

- Market Cap: $37 billion

- Why: Rockwell’s technology forms the backbone of digital factories, offering smart automation, control systems, and data integration for robotics in industrial environments.

- Expert View: Rockwell is key to the transition from traditional to smart manufacturing. Its robotics integration platforms help connect robots, sensors, and data analytics across production lines, enhancing agility and uptime.

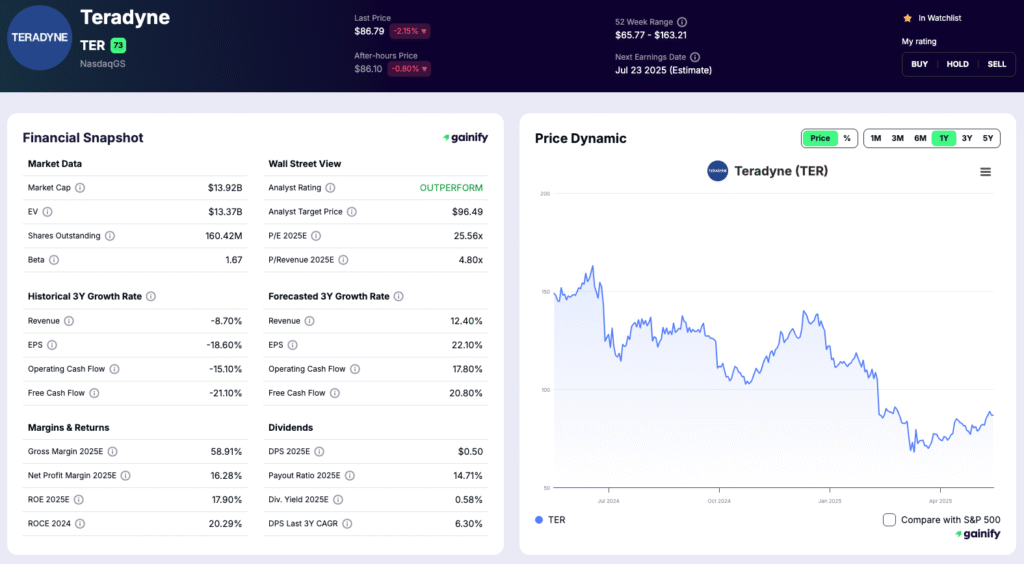

- Teradyne (TER)

- Market Cap: $14 billion

- Why: Through Universal Robots, Teradyne delivers collaborative robots (cobots) designed to work safely alongside humans in flexible production environments.

- Expert View: Teradyne’s cobots redefine human-machine collaboration. Their lightweight design, intuitive programming, and modularity make them ideal for small and medium-sized enterprises looking to scale robotics adoption.

- AeroVironment (AVAV)

- Market Cap: $8.6 billion

- Why: AeroVironment specializes in autonomous aerial vehicles used in defense, surveillance, and logistics. Its drone platforms are engineered for real-time mission adaptability.

- Expert View: AVAV leads in rugged, lightweight robotics for airborne environments. Its edge lies in high-performance autonomous navigation, payload management, and AI-enhanced aerial intelligence.

- UiPath (PATH)

- Market Cap: $7 billion

- Why: UiPath is a leader in robotic process automation (RPA), automating repetitive digital workflows in industries like finance, healthcare, and insurance.

- Expert View: UiPath brings robotics to the back office. Its software robots execute structured digital tasks at scale, expanding the definition of robotics beyond hardware to cloud-based, cognitive systems.

- Rekor Systems (REKR)

- Market Cap: $160 million

- Why: Rekor specializes in AI-powered traffic analytics and automated infrastructure solutions for smart cities, focusing on vehicle recognition, traffic flow monitoring, and real-time data integration for public safety and transportation systems.

- Expert View: While not a robotics company in the traditional sense, Rekor contributes to the broader automation ecosystem through its advanced computer vision and AI platforms. Its technologies support intelligent infrastructure, which can be foundational for future autonomous mobility and smart city planning.

Contrarian View: What Could Go Wrong?

While the robotics sector appears promising, skeptics point out that many companies have unclear paths to profitability, especially those relying on subsidies or lacking diverse revenue streams. Active trading markets can drive prices above intrinsic value, making robotics a risky space for those without a clear investment objective. The presence of penny stocks and high-flying small caps increases the chance of capital loss.

Investors must also consider whether robotics stocks align with their broader financial situation and long-term portfolio goals. A lack of standardization in robotic systems and uncertain regulatory environment could delay deployment, especially in sectors like healthcare or autonomous driving.

Conclusion

The robotics sector presents a compelling investment thesis for those seeking exposure to intelligent machines that are reshaping global industries. With applications ranging from factory automation and AI mobility to healthcare robotics and commercial drone deployments, the performance of companies involved depends on innovation, scale, and adaptability.

Investors should approach the robotics category with a long-term mindset, recognizing both the growth ratio potential and the substantial risk. Whether through individual equities, ETFs like the VanEck Robotics ETF, or diversified funds, robotics remains one of the most transformative opportunities in the broader market.

Frequently Asked Questions (FAQs)

Q: What is considered a robotics stock?

A: It refers to any company that directly supports the design, deployment, or operation of robotic systems, including commercial drones, factory robots, or AI software platforms.

Q: What are the most popular robotics ETFs?

A: The VanEck Robotics ETF is among the most well-known, offering a broad list of holdings in automation, AI, and robotics stocks across developed and emerging markets.

Q: What risks should I consider?

A: Potential risks include sector volatility, reliance on a few contracts, valuation multiples, and company-specific performance. Always consider elevated risks and consult a financial advisor before investing.

Q: Is this sector suitable for long-term investment?

A: Robotics stocks may offer long-term growth, especially in emerging areas like AI mobility, Healthcare robotic-assisted surgeries, and consumer drones. But due diligence is crucial.

Q: Can robotics stocks improve accessibility in healthcare?

A: Yes. Robotic systems are already reducing wait times, improving accuracy in surgeries, and expanding access to care in underserved areas.

Disclaimer: This article is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any financial instrument. Always consult with a licensed professional to assess your financial situation and investment objective before making decisions.