Tobacco is still one of the most profitable consumer industries. Despite decades of pressure, it continues to generate steady cash flow for investors.

Cigarette sales are falling across developed markets. Growth now comes from heated tobacco, vaping, and nicotine pouches.

The sector is in transition. Global giants are investing heavily in smoke-free products, while smaller players focus on niches and regional strength.

For investors, tobacco stocks remain unusual. They combine defensive income with exposure to changing consumer habits.

Here we review NINE MAJOR PUBLICLY LISTED TOBACCO STOCKS ranked by market value. Each profile highlights their brands, strategies, and role in a shifting industry.

Global Smoking Trends

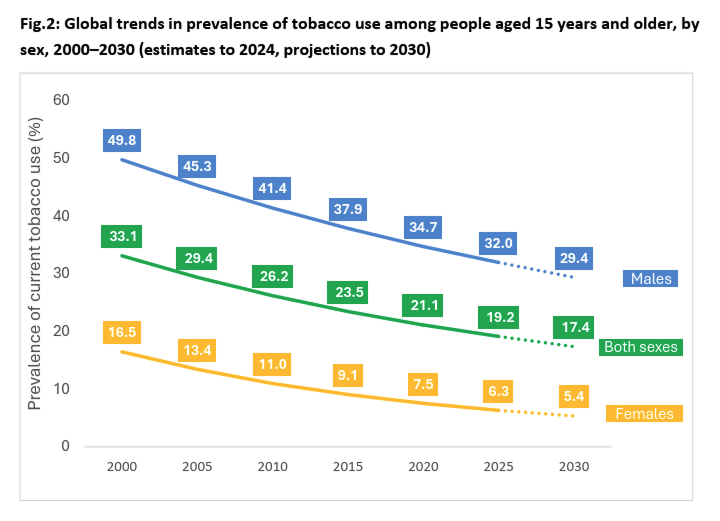

Tobacco use is shrinking worldwide. The numbers tell a clear story.

According to the World Health Organization (WHO), in 2000 about 33.1% of adults used tobacco. By 2020, that share had dropped to 21.1%, and projections show it falling further to 17.4% by 2030.

The decline is consistent across all groups:

- Men: nearly 50% in 2000, down to a projected 29.4% in 2030.

- Women: 16.5% in 2000, projected to just 5.4% in 2030.

WHO attributes this shift to stronger regulation, higher taxes, and growing health awareness. At the same time, millions of smokers are moving toward alternatives like heated tobacco, vaping, and nicotine pouches.

For tobacco companies, the trend is double-edged. Declining cigarette volumes pressure legacy revenues, but reduced-risk products offer fast-growing new markets.

Growth in E-Cigarettes / Vaping: Key Trends & Statistics

E-cigarettes and vaping are reshaping the tobacco industry. The global market was valued at about USD 28 billion in 2023 and is projected to grow more than sixfold by 2030. It is now one of the fastest-growing areas in consumer nicotine.

The drivers are clear. Younger consumers are moving away from cigarettes. Regulators in some markets are more open to reduced-risk products. Innovation in devices, flavors, and nicotine delivery continues to attract demand, especially in the U.S. and Europe.

For tobacco companies, vaping is no longer optional. It has become a core growth engine, helping offset declines in traditional cigarette volumes.

For investors, this means exposure to both defensive cash flow from legacy brands and high-growth potential from new categories.

9 Major Tobacco Stocks

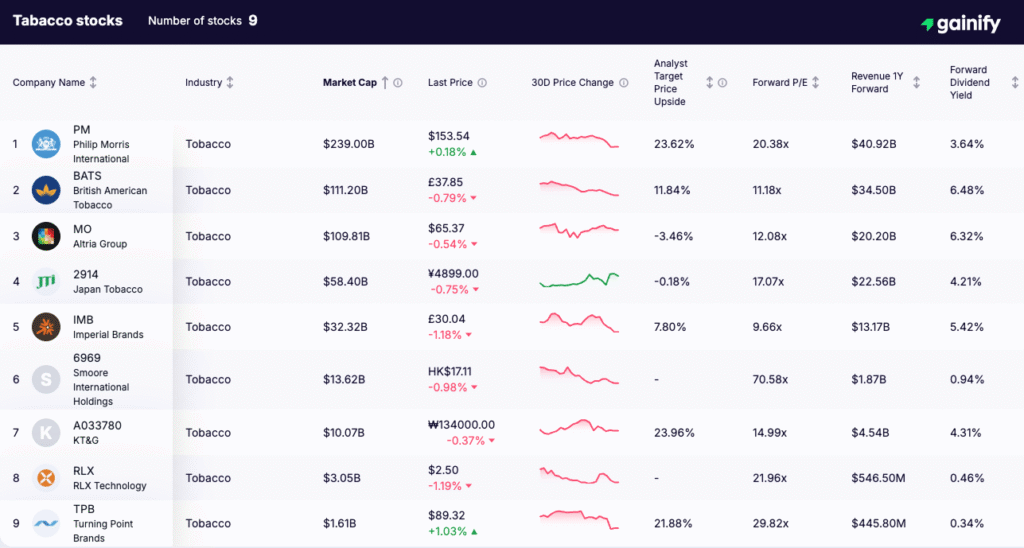

# | Company | Price | Analyst Upside | Forward P/E | Revenue 1Y Forward | |

1 | $239.0B | $153.54 | +23.62% | 20.38x | $40.92B | |

2 | $111.2B | £37.85 | +11.84% | 11.18x | $34.50B | |

3 | $109.8B | $65.37 | -3.46% | 12.08x | $20.20B | |

4 | $58.4B | ¥4897 | -0.18% | 17.07x | $22.56B | |

5 | $32.3B | £30.04 | +7.80% | 9.66x | $13.17B | |

6 | $13.6B | HK$17.11 | +70.58% | 70.58x | $1.87B | |

7 | $10.1B | ₩134,000 | +23.96% | 14.99x | $4.54B | |

8 | $3.05B | $2.50 | – | 21.96x | $546.50M | |

9 | $1.61B | $89.32 | +21.88% | 29.82x | $445.80M |

Below is a closer look at nine publicly traded tobacco stocks, ranked by market value, with insights into their brands, strategies, and position in today’s evolving industry.

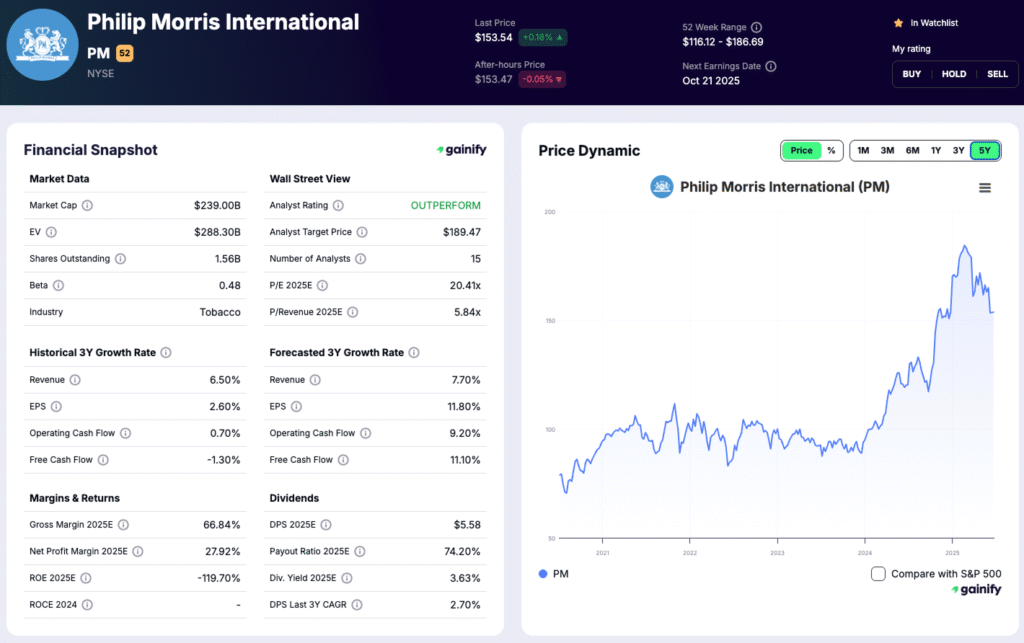

1. Philip Morris International (PM)

Market Cap: $239.0B

Price: $153.54

Forward P/E: 20.38x

Revenue Forward: $40.92B

Brands: Marlboro (international), IQOS, L&M, Chesterfield

Philip Morris International is the largest publicly listed tobacco company. It operates in more than 180 markets and generates strong global cash flows.

Marlboro remains its flagship brand. But PMI has made an aggressive pivot into heated tobacco with IQOS. This shift positions the company as a leader in reduced-risk products.

For investors, PMI offers stability, global reach, and a clear transformation strategy. Its focus on IQOS provides exposure to the industry’s fastest-growing segment.

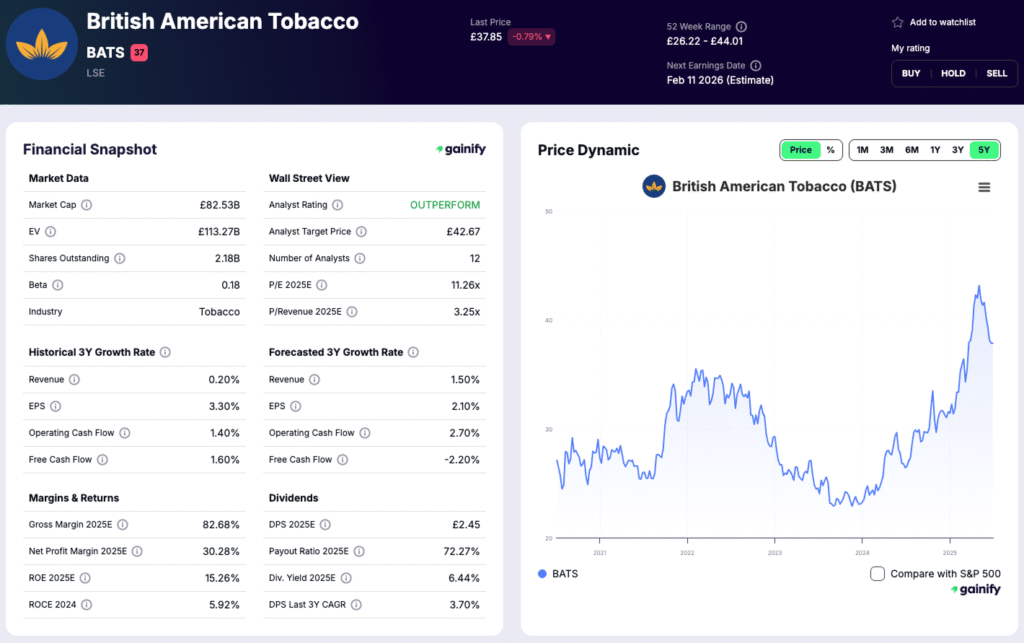

2. British American Tobacco (BATS)

Market Cap: $111.2B

Price: £37.85

Forward P/E: 11.18x

Revenue Forward: $34.50B

Brands: Dunhill, Lucky Strike, Pall Mall, Vuse, glo

British American Tobacco is the world’s second-largest tobacco company. It has strong geographic diversification across Europe, Asia, Africa, and the Americas.

Its traditional brands like Dunhill and Lucky Strike continue to generate reliable sales. But BAT is also pushing hard into new categories. Vuse vaping and glo heated tobacco are central to its growth strategy.

For investors, BAT provides high dividends and exposure to next-generation products. Its balanced portfolio combines legacy stability with new market opportunities.

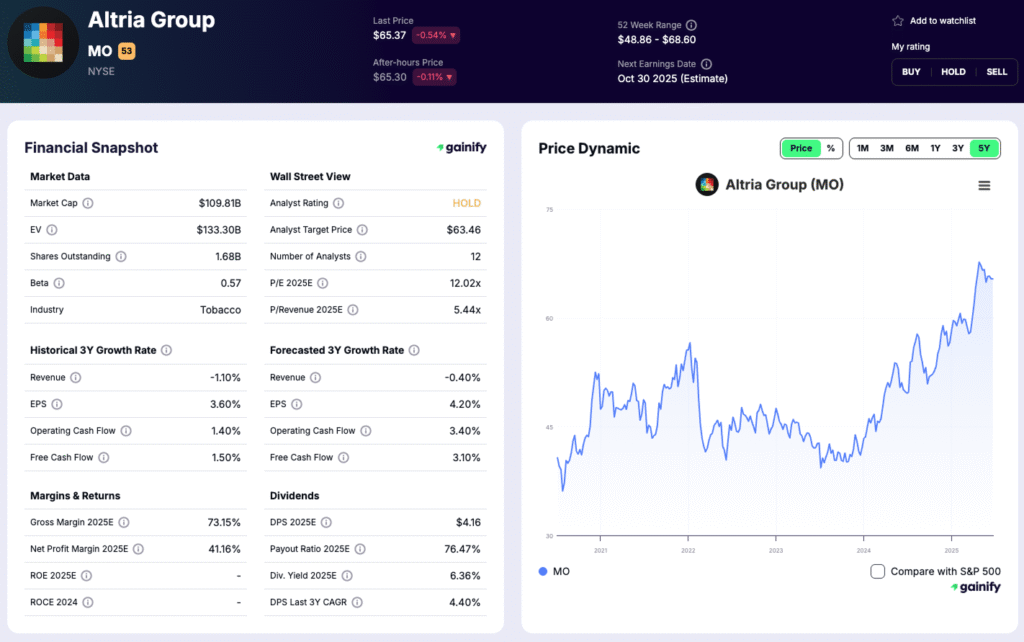

3. Altria Group (MO)

Market Cap: $109.8B

Price: $65.37

Forward P/E: 12.08x

Revenue Forward: $20.20B

Brands: Marlboro (U.S.), Copenhagen, Skoal, on!

Altria dominates the U.S. tobacco market. It holds exclusive rights to Marlboro in the United States, making it one of the most profitable franchises in the industry.

Beyond cigarettes, Altria owns Copenhagen and Skoal smokeless tobacco brands. It also markets on! nicotine pouches and has investments in cannabis and vaping.

For investors, Altria represents a defensive U.S.-focused play. It provides steady cash returns while cautiously expanding into new categories.

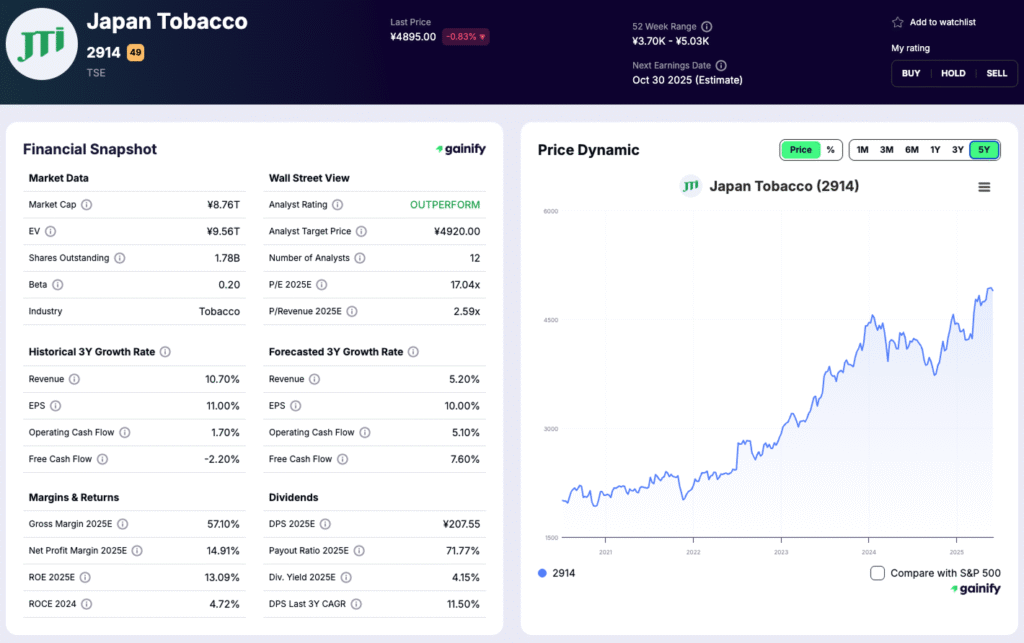

4. Japan Tobacco (JT – 2914)

Market Cap: $58.4B

Price: ¥4897

Forward P/E: 17.07x

Revenue Forward: $22.56B

Brands: Winston, Camel (outside U.S.), Mevius, LD

Japan Tobacco is a global group with strong operations across Asia and Europe. It also runs smaller pharmaceutical and food businesses, though tobacco remains its core.

Its brand portfolio includes Winston and Camel (outside the U.S.), plus Mevius, Japan’s top cigarette brand. JT is gradually expanding into reduced-risk products to stay competitive.

For investors, JT is known for stable earnings and generous dividends. It offers a reliable defensive option with regional growth exposure.

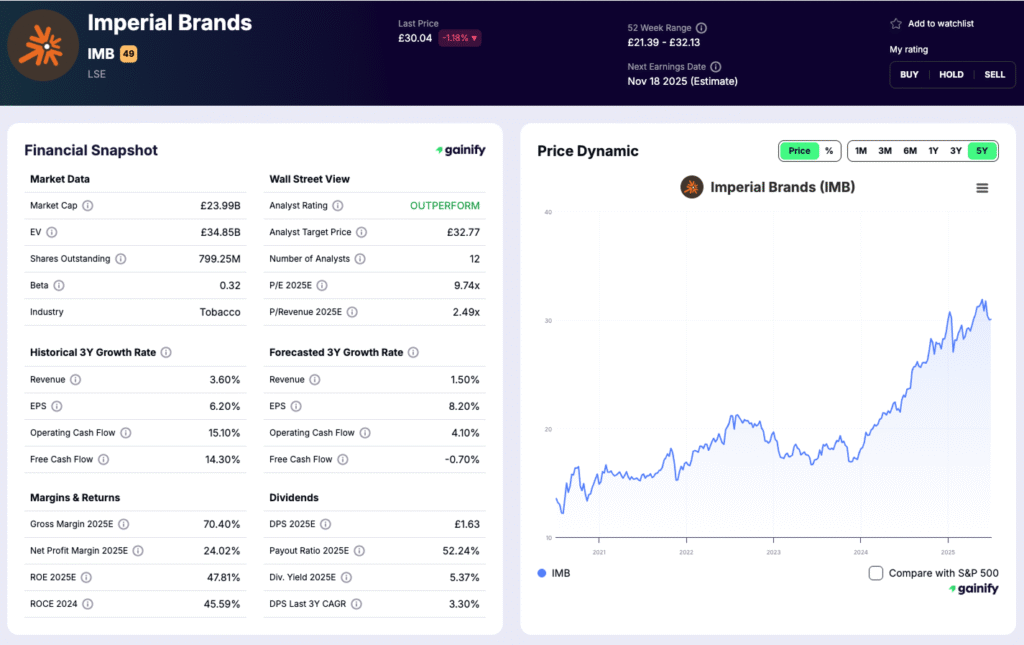

5. Imperial Brands (IMB)

Market Cap: $32.3B

Price: £30.04

Forward P/E: 9.66x

Revenue Forward: $13.17B

Brands: Davidoff, Gauloises, Winston (in select regions), blu e-cigarettes

Imperial Brands is a UK-based member of the global “Big Four.” It has deep roots in Europe and a wide mix of cigarette brands.

Its key labels include Davidoff and Gauloises, alongside its vaping brand blu. Imperial has refocused on its strongest markets and exited less profitable regions.

For investors, Imperial stands out with one of the lowest valuations in the sector. It appeals to value-oriented buyers seeking stable returns.

6. Smoore International Holdings (6969)

Market Cap: $13.6B

Price: HK$17.11

Forward P/E: 70.58x

Revenue Forward: $1.87B

Brands: Vaporesso, FEELM

Smoore is the world’s largest vaping technology manufacturer. Based in China, it supplies hardware and components to leading global vaping brands.

Through FEELM technology, it powers many popular devices worldwide. It also sells its own Vaporesso products directly to consumers.

For investors, Smoore represents a high-growth bet on vaping adoption. Its elevated valuation reflects strong expectations but also higher risk.

7. KT&G (A033780)

Market Cap: $10.1B

Price: ₩134,000

Forward P/E: 14.99x

Revenue Forward: $4.54B

Brands: Esse, Lil, Red Devil

KT&G is South Korea’s dominant tobacco company. It has built a strong export business across Asia and the Middle East.

Its cigarette brand Esse is popular among slim-smoker demographics. The Lil heated tobacco platform anchors its reduced-risk strategy.

For investors, KT&G offers steady cash flows and measured international growth. It also provides diversification through its ginseng and pharmaceutical divisions.

8. RLX Technology (RLX)

Market Cap: $3.05B

Price: $2.50

Forward P/E: 21.96x

Revenue Forward: $546.50M

Brands: RELX

RLX Technology is China’s largest e-cigarette company. It markets its products under the RELX brand, giving it strong name recognition.

The company faces strict regulation in China, which limits short-term visibility. However, it still holds significant market share and consumer loyalty.

For investors, RLX is a high-risk, high-reward play. Success depends on the regulatory environment in the world’s biggest nicotine market.

9. Turning Point Brands (TPB)

Market Cap: $1.61B

Price: $89.32

Forward P/E: 29.82x

Revenue Forward: $445.80M

Brands: Zig-Zag, Stoker’s, Solace

Turning Point Brands is a U.S.-based tobacco and alternatives company. It has built its business on a distinctive niche strategy.

Its iconic Zig-Zag rolling papers connect it directly to the cannabis industry. Stoker’s smokeless tobacco appeals to traditional users, while Solace provides a next-generation vaping option.

Unlike global majors, TPB thrives in alternative and specialty markets. This positioning creates unique growth potential but also higher volatility. Its premium valuation reflects investor appetite for differentiated exposure.

Key Takeaways for Investors

- Largest Players: Philip Morris and British American Tobacco dominate globally.

- Value Opportunities: Imperial Brands trades at the lowest P/E among the majors.

- Growth Leaders: Smoore and RLX focus on vaping, offering higher upside with higher risk.

- Regional Specialists: KT&G and Altria provide strong positions in their home markets.

- Niche Exposure: Turning Point Brands gives investors a differentiated play tied to cannabis and alternatives.