For more than four decades, Seth Klarman has been one of the most respected names in global finance. Known as the “Oracle of Boston,” he has built his reputation through discipline, patience, and an ability to see value where others only see risk. Unlike many high-profile hedge fund managers, Klarman has rarely courted the spotlight. Instead, his reputation has been earned through his work at Baupost Group, a firm he co-founded in 1982 with just 27 million dollars in seed capital. From that modest start, Baupost grew into a powerhouse, managing nearly 30 billion dollars at its peak and becoming a model for risk-averse value investing.

The latest portfolio disclosure for Q3 2025 offers a revealing look at how Baupost is navigating today’s uncertain markets. The firm reported stock holdings worth 4.79 billion dollars spread across 22 equities. On the surface this looks like a sharp retreat from public markets, especially when compared to the 12.56 billion dollar equity portfolio Baupost managed in 2021. Yet this reduction is not a sign of disengagement. Instead, it reflects Klarman’s long-held philosophy of patience, discipline, and the refusal to invest capital unless the odds are clearly in his favor.

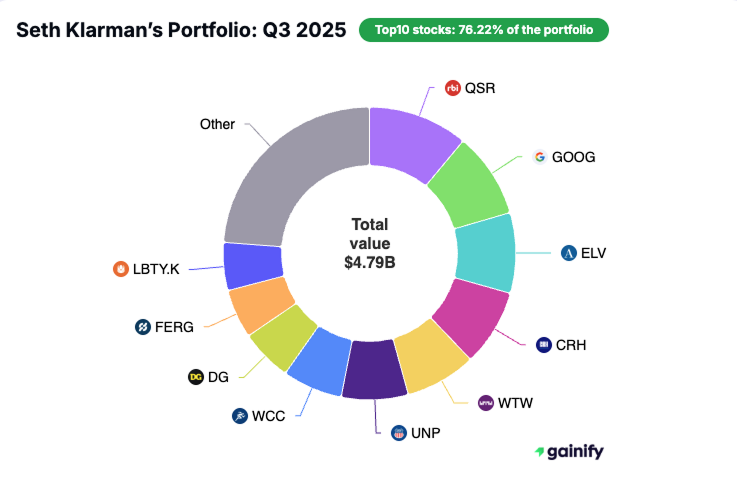

What is especially striking is the precision of Baupost’s current holdings. The portfolio is relatively concentrated, with thetop 10 stocks accounting for almost 76 percent of the total value. This shows Klarman’s conviction-based style, where capital is allocated heavily to a handful of opportunities rather than spread thin across dozens of positions. The current lineup blends technology, healthcare, infrastructure, and consumer defensives, which together create a portfolio designed to endure a wide range of market outcomes.

The context is critical. Over the past three years, Baupost has faced significant client withdrawals. According to Bloomberg, investors pulled out around 7 billion dollars from the fund since 2021 after years of underwhelming performance. Average annual gains since 2014 have been just 4 percent, far below both the firm’s historic record and the returns of the broader market. While Baupost delivered a 10 percent gain in 2024, its first double-digit return in three years, this was still modest compared to competitors.

The disappointment reflects both market conditions and Baupost’s style. A long bull market, driven by ultra-low interest rates and speculative excess, created few opportunities for distressed investing, which has always been Klarman’s specialty. Without a steady pipeline of distressed assets to buy at deep discounts, Baupost was forced to hold larger cash positions and accept lower returns. In response, the firm undertook the largest restructuring in its 42-year history in June 2024, cutting almost 20 percent of its investment staff and refocusing on core strategies such as distressed debt, special situations, and event-driven equities.

This pivot is visible in the numbers. Credit investments now account for roughly 25 percent of Baupost’s assets, compared to only 5 percent two years ago. Cash holdings have been reduced to around 10 percent as the firm deploys more capital into distressed opportunities. Public equities, by contrast, have been scaled back. Yet this does not mean Klarman is inactive in stocks. On the contrary, the Q3 2025 filings show meaningful changes, including large increases in certain positions and complete exits from others. For investors who want to understand how to manage capital with discipline in today’s markets, there are few better case studies than Seth Klarman and Baupost Group.

Who is Seth Klarman and What is His Investment Philosophy?

Seth Klarman was born in 1957 in New York and raised in Baltimore. He studied economics at Cornell University before earning his MBA at Harvard Business School. In 1982, at just 25 years old, he co-founded Baupost Group. Over the following decades, he transformed Baupost into one of the most admired hedge funds in the world, with a reputation for protecting capital and exploiting complex, unconventional opportunities.

Klarman is perhaps best known for his 1991 book Margin of Safety. Though long out of print, it has achieved cult status among investors, with secondhand copies sometimes selling for thousands of dollars. The book distills his philosophy into a simple but profound idea: always demand a margin of safety when investing. In practice, this means buying securities well below their intrinsic value to create a cushion against mistakes, uncertainty, and unforeseen events.

For Klarman, risk is not volatility, as many academics define it, but the possibility of permanent capital loss. He has never been afraid to hold large amounts of cash if opportunities are scarce, a stance that frustrates some clients during bull markets but ensures he is prepared when markets turn. He once explained that patience is not passivity but preparation. When panic sets in and prices collapse, Baupost is able to act decisively because it has the liquidity and conviction to buy.

Another distinguishing feature of his philosophy is flexibility. Baupost is not confined to equities. The firm invests across distressed debt, real estate, private equity, litigation claims, and special situations. Many of its greatest successes have come from areas that other investors avoided because they were considered too complicated or too risky.

Even within equities, Klarman’s approach is different from many peers. He tends to concentrate his holdings in a small number of companies where he has the highest conviction. He is quick to cut or sell out entirely if the investment case deteriorates. This results in a portfolio that is constantly evolving, not through frantic trading but through deliberate reassessment of risk and reward.

In essence, Klarman’s philosophy can be summarized in three principles:

First, always buy with a margin of safety.

Second, focus on capital preservation above all else.

Third, be patient and opportunistic, acting aggressively only when the conditions are right.

These principles explain both Baupost’s long-term success and the current shape of its 2025 portfolio.

Why Has Baupost’s Stock Portfolio Declined So Sharply?

Between 2021 and 2025, Baupost’s stock portfolio declined from 12.56 billion dollars to 4.79 billion dollars. This reduction has several key explanations.

Client withdrawals. Over the past three years, investors pulled out about 7 billion dollars, reducing Baupost’s assets under management from 28.8 billion at the end of 2021 to 23 billion today. These redemptions were triggered by underwhelming returns. Since 2014, Baupost has averaged only 4 percent annual gains, well below both its earlier record and the market indices.

Strategic pivot. Public equities have struggled to deliver results for Baupost in recent years. In response, the firm restructured in 2024, cutting 20 percent of its team and refocusing on its traditional strengths. Distressed debt, event-driven strategies, and special situations now play a larger role. Credit investments rose from 5 percent of assets two years ago to 25 percent in 2025. This naturally reduced the share of capital allocated to equities.

Market conditions. A prolonged bull market, combined with historically low interest rates, limited the supply of distressed opportunities. This environment was unfavorable for Klarman’s style. Equities were often fully priced or overvalued, which left little margin of safety. Rather than compromise, Baupost chose to scale back its exposure.

Active reduction of positions. Finally, the Q3 2025 filings show that Klarman has deliberately exited certain investments and trimmed others. He sold out of Amcor, Viasat, and ICON, while reducing positions in Google, Wesco Interantional, and Willis Towers Watson. These moves reflect a manager who is unwilling to hold on to positions once they no longer meet his standards.

Taken together, these factors show that the decline in Baupost’s equity portfolio is not a retreat from investing but a deliberate reallocation of capital in line with Klarman’s philosophy.

Baupost Portfolio Structure: Q3 2025

Although Baupost’s public equity portfolio has contracted significantly compared to previous years, the latest 13F filings for Q3 2025 show a structure that is both concentrated and deliberate. Seth Klarman is not spreading capital thinly across dozens of ideas. Instead, he is focusing on a select group of businesses that together reflect Baupost’s strategy in a more uncertain, less forgiving market.

Key figures at a glance:

- Total holdings: 22 stocks with a market value of 4.79 billion USD

- Average holding period: 8 quarters (about 2 years)

- Top 10 holdings: 76.22% of total equity portfolio value

This level of concentration is typical of Baupost. By allocating nearly 80 percent of assets to the top 10 positions, Klarman is signaling strong conviction in a handful of companies while using smaller allocations for optionality or special situations.

Sector Allocation

The portfolio is distributed across industries that combine resilience, pricing power, and exposure to long-term themes:

- Computer Programming and Data: 21.52%

- Wholesale Hardware and Plumbing: 10.83%

- Hydraulic Cement: 13.04%

- Eating Places: 11.05%

- Medical Service Plans: 8.90%

At first glance, this mix may appear unusual, but it reflects Baupost’s style. Technology, represented primarily by Alphabet, is balanced with tangible, hard-asset businesses in cement, industrial supplies, and wholesale plumbing. Eating Places and healthcare add further diversification. In effect, the portfolio combines growth engines with defensive anchors.

Top 10 Holdings

- Restaurant Brands International (QSR): $529.3 million USD (11.05%)

Parent company of Burger King, Tim Hortons, and Popeyes. Provides steady cash flow from global franchising in consumer staples. - Alphabet (GOOG): $452.6 million USD (9.45%)

Baupost’s largest position. Alphabet is one of the few technology companies that Klarman has consistently held, given its dominant market share, strong cash flows, and balance sheet strength. - Elevance Health (ELV): $426.2 million USD (8.90%)

A major health insurer. After a 150 percent increase in Q2, Elevance solidified its role as one of Baupost’s top 10 positions. - CRH: $405.7 million USD (8.47%)

A multinational building materials and cement company. CRH represents a bet on infrastructure demand and real assets that hold value in inflationary conditions. - Willis Towers Watson (WTW): $376.2 million USD (7.85%)

A global advisory and insurance brokerage firm. Even after a reduction this quarter, it remains one of Baupost’s largest holdings. - Union Pacific (UNP): $353.7 million USD (7.38%)

One of North America’s largest railroad operators. This newly built position provides exposure to U.S. industrial activity and logistics, benefiting from high barriers to entry and durable, long-term cash flows. - WESCO International (WCC): $317.9 million USD (6.64%)

A leading distributor of electrical and industrial products, WESCO provides exposure to infrastructure and industrial demand. - Dollar General (DG): $275.6 million USD (5.75%)

A discount retailer. Dollar General performs well during economic slowdowns, when consumers seek value, making it a defensive holding - Ferguson Enterprises (FERG): $259.5 million USD (5.42%)

A distributor of plumbing and heating products. Like WESCO, Ferguson ties Baupost’s portfolio to real-economy infrastructure and construction. - Liberty Global (LBTY.K): $254.5 million USD (5.31%)

A telecommunications and media group. Despite headwinds in the industry, it adds diversification and exposure to subscriber-driven cash flows.

Trade Activity in Q3 2025

Q3 2025 shows Baupost Group, led by Seth Klarman, staying active in public equities. The 13F disclosures point to a clear pattern: large position building in a few names, full exits from several holdings, and trims in select core positions. Together, these moves highlight where Baupost is committing capital and where it is reducing exposure.

Adds: Increasing Conviction in Existing Holdings

- Restaurant Brands International (QSR): Increased by +103.80%, with $276.54M added, lifting portfolio weight by +4.55ppt.

- Elevance Health (ELV): Increased by +114.12%, adding $218.65M, raising portfolio weight by +3.09ppt.

- Eagle Materials (EXP): Increased by +38.95%, adding $59.71M, increasing portfolio weight by +1.26ppt.

- Ferguson (FERG): Increased by +2.08%, adding $5.32M, with portfolio weight down -0.55ppt.

Summary: Baupost added roughly $560.2M across four existing holdings, led by the largest increases in QSR and ELV.

New Buys: Initiating Fresh Positions

- Union Pacific (UNP): New position worth $337.21M, added +7.38ppt to portfolio weight.

- Genuine Parts (GPC): New stake valued at $187.13M, adding +4.04ppt.

- Americold Realty Trust (COLD): New position worth $53.64M, adding +0.92ppt.

Summary: Baupost initiated $577.98M across three new positions, with the largest allocation going to Union Pacific.

Sold Outs: Exiting Entire Positions

- Amcor (AMCR): Entire position sold, $246.57M, portfolio change -1.22ppt.

- Viasat (VSAT): Fully exited, $219.84M, portfolio change -3.25ppt.

- ICON plc (ICLR): Entire holding sold, $67.78M, portfolio change -1.43ppt.

- Liberty Broadband (LBRD.K): Entire position sold, $52.11M, portfolio change -1.78ppt.

- Liberty Broadband (LBRD.A): Entire position sold, $0.53M, portfolio change -0.02ppt.

Summary: Baupost fully exited positions totaling about $586.8M in market value.

Cuts: Reducing Existing Stakes

- Alphabet (GOOG): Reduced by -29.46%, trimming $163.08M, portfolio change -1.87ppt.

- WESCO International (WCC): Reduced by -31.91%, trimming $147.93M, portfolio change -3.26ppt.

- Willis Towers Watson (WTW): Reduced by -17.13%, trimming $72.91M, portfolio change -1.90ppt.

- CRH: Reduced by -11.55%, trimming $46.68M, portfolio change -0.04ppt.

- Liberty Global (LBTY.K): Reduced by -12.17%, trimming $33.60M, portfolio change -0.84ppt.

Summary: Baupost trimmed roughly $464.2M across five holdings, with the largest reductions in WCC and GOOG.

Trade Activity in Q2 2025

The second quarter of 2025 shows that Baupost Group, under Seth Klarman, was highly active in public equities. The 13F filings confirm a series of major adds, new buys, complete exits, and trims. Together, these moves highlight where Baupost is committing capital and where it is pulling back.

Adds: Increasing Conviction in Core Holdings

- Elevance Health (ELV): Increased by +150.41%, an additional 148.8 million USD, bringing the position to 239.6 million USD. This move elevated Elevance into the firm’s top 10 holdings.

- CRH: Increased by +41.98%, adding 103.1 million USD, taking the total stake to 351.2 million USD.

- Alphabet (GOOG): Increased by +26.76%, adding 91.9 million USD, raising the position to 467.2 million USD. Alphabet is now Baupost’s single largest holding.

- Dollar General (DG): Increased by +26.70%, adding 55.8 million USD, for a total of 305.0 million USD.

- Liberty Broadband (LBRD.K): Increased by +337.03%, adding 51.6 million USD, bringing the total to 66.9 million USD.

- WESCO International (WCC): Increased by +10.07%, an additional 33.3 million USD, taking the position to 408.9 million USD.

Summary: Baupost added over 480 million USD across six existing holdings, with the largest increases going into healthcare (Elevance), infrastructure (CRH), and technology (Alphabet).

New Buys: Initiating Fresh Positions

- Fiserv (FI): A new position worth 162.3 million USD, representing 3.74% of the portfolio.

- Amcor (AMCR): New stake valued at 50.8 million USD, or 1.22% of the portfolio.

- PagSeguro Digital (PAGS): New holding worth 22.5 million USD, or 0.58% of the portfolio.

Summary: Baupost committed 235.6 million USD into three new companies.

Sold Outs: Exiting Entire Positions

- Solventum (SOLV): Entire position of 74.6 million USD sold.

- Somnigroup International (SGI): Full stake of 44.2 million USD exited.

- Clarivate (CLVT): Entire holding of 43.4 million USD liquidated.

Summary: Baupost fully exited positions worth 162.2 million USD in combined market value.

Cuts: Reducing Existing Stakes

- Willis Towers Watson (WTW): Reduced by –13.86%, trimming 65.6 million USD, leaving a position worth 402.8 million USD.

- Eagle Materials (EXP): Cut by –25.66%, or 50.3 million USD, leaving a stake of 145.9 million USD.

- GDS Holdings (GDS): Reduced by –23.53%, or 25.4 million USD, leaving a position worth 82.4 million USD.

- Viasat (VSAT): Cut by –9.81%, or 10.1 million USD, leaving 92.9 million USD invested.

Summary: Baupost trimmed about 151.4 million USD across four existing holdings.

Is Seth Klarman Still Active?

Yes. Although Baupost’s public equity portfolio is smaller, Klarman remains deeply active. His Q3 2025 trades show a manager rotating aggressively into high-conviction names while exiting others. The restructuring in 2024, which cut 20 percent of the staff, was designed to sharpen focus, not to wind down. The increase in credit investments, the reduction of cash, and the meaningful moves within equities all confirm that Klarman is still very much engaged.

Conclusion: Lessons from Klarman’s Strategy

Seth Klarman’s Q2 2025 portfolio tells a story of discipline, adaptation, and survival. The equity portfolio has shrunk, clients have withdrawn money, and performance has been weaker than in earlier decades. Yet Klarman has not abandoned his philosophy. Instead, he has doubled down on his core strengths: distressed debt, special situations, and selective equity investing.

For investors, the lessons are clear. First, stick to your edge, even if it means looking different from the crowd. Second, protect capital first and worry about chasing returns later. Third, be willing to adapt when the environment changes. And fourth, always demand a margin of safety.

At 67 years old, Klarman continues to practice the principles that made him one of the most respected investors in history. His current portfolio may be smaller, but the strategy behind it remains as relevant as ever.