Among today’s professional investors, Thomas Russo occupies a rare place. While many managers chase quarterly catalysts or rotate portfolios to follow trends, Russo has spent nearly four decades practicing a slower, more deliberate form of value investing. His philosophy is rooted in the tradition of Benjamin Graham and the Graham & Dodd Investing framework taught at Columbia Business School, but adapted to the realities of global markets.

As the long-time portfolio manager of Gardner Russo & Quinn and leader of his flagship Semper Vic Partners funds, Russo has earned a reputation as one of the most disciplined long-term investors in the world. His approach blends the wisdom of Warren Buffett and Charlie Munger with his own global reach, concentrating on companies with enduring brands, resilient balance sheets, and the ability to reinvest free cash flow for decades.

Russo’s style is the opposite of flashy. He does not trade in and out of hot themes or attempt to time markets. Instead, his investment management philosophy centers on owning the world’s strongest businesses, often family-controlled public companies such as Nestlé, Heineken, Compagnie Financiere Richemont, and Pernod Ricard, alongside global franchises like Philip Morris, Mastercard, and Alphabet. These firms share common traits: durable moats, organic revenue growth, and pricing power that remains intact across market cycles.

With almost 40 years of experience in equity investments, Russo has become a leading figure in portfolio management and investment strategy. Beyond the investing world, he has taught at Columbia’s Heilbrunn Center for Graham & Dodd Investing, mentored young analysts in the discipline of value investing principles, and served on the board of institutions like the Storm King Art Center. For Russo, investing is not just about making the right stock picks. It is about preserving and compounding capital in a way that aligns with history, culture, and stewardship.

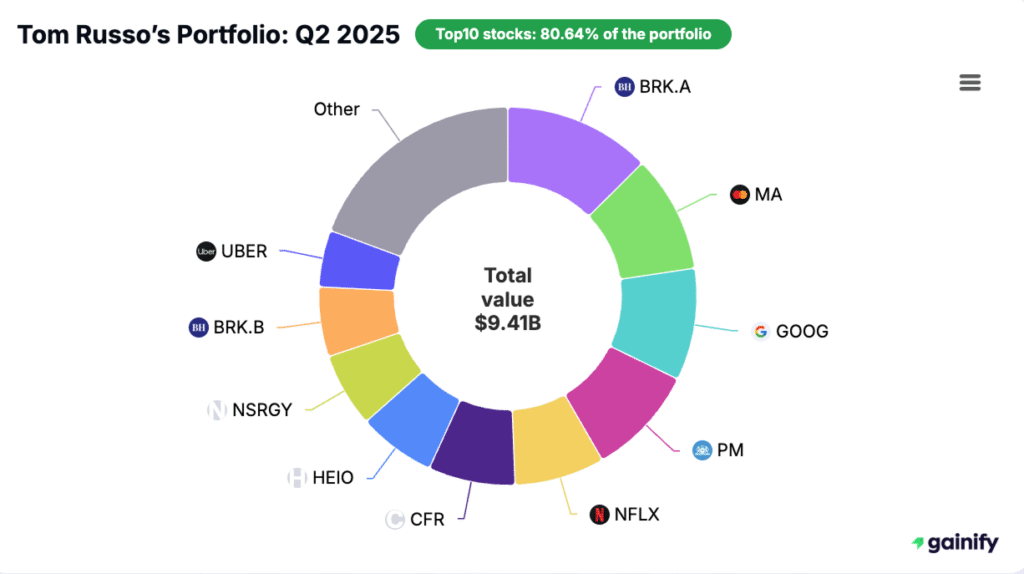

The most recent SEC 13F filings for Q2 2025 provide another window into the Tom Russo Portfolio. The report, showing $9.41 billion in security holdings, underscores his trademark mix of patience and selectivity. Yet unlike some quarters where very little changes, this update highlights a clear theme: cuts and trims across multiple sectors, reflecting Russo’s willingness to refine exposure while keeping his long-term-oriented investments firmly intact.

Who Is Thomas Russo?

Thomas Russo graduated from Dartmouth before pursuing both a JD and MBA at Stanford, a background that shaped his understanding of corporate law, governance, and finance. Unlike many modern equity hedge fund managers, Russo views himself as a steward of capital, an investment advisor who takes seriously the responsibility of safeguarding families’ wealth.

After joining Gardner Investments in the 1980s, he went on to establish Gardner Russo & Quinn Inc., and later launched his famous Semper Vic partnerships. The Latin phrase Semper Vic translates to “always victorious,” reflecting his faith in the power of long-term investing through ownership of great companies.

Russo’s guiding philosophy has always been about what he calls the “capacity to suffer”: a willingness to endure short-term underperformance and inflation issues in order to achieve long-term gains. He favors businesses with wide moats, global reach, and a total addressable market that allows reinvestment of profits at high returns.

Russo is also closely associated with value investing principles in the mold of Buffett and Munger. He regularly emphasizes margin of safety, intrinsic value, and long holding periods. His portfolio style is not unlike that of Berkshire Hathaway itself: focused, disciplined, and committed to long-term-oriented investments.

Investment Philosophy

At the core of Russo’s investment strategy is the belief that equity investments should be made in businesses capable of compounding capital through decades of reinvestment. His approach can be summarized as follows:

- Predictable businesses — Russo seeks stock picks with recurring revenues, strong pricing power, and proven ability to weather cycles. Examples include Netflix, Uber, and Mastercard.

- Reinvestment of free cash flow — The hallmark of his stock selection is management’s ability to reinvest profits into expanding brands, improving market shares, or funding share repurchases.

- Family-controlled public companies — Russo values the stability and long-term orientation of businesses like Compagnie Financiere Richemont, which controls luxury brands.

- Long-term investing horizon — With an average holding period of 40 quarters (10 years), Russo resists the temptation of short-term bets and embraces the compounding of long-term-oriented investments.

- Sector diversification — While concentrated in global brands and consumer franchises, Russo ensures exposure across industries including luxury goods, digital payment solutions, cloud computing, and consumer staples.

This bottom-up fundamental approach is reinforced by historical data and decades of experience analyzing portfolio holdings. Russo views companies not just as tickers or market cap sizes but as living businesses with moats, cultures, and long-term trajectories.

Q2 2025 Portfolio Overview

The Tom Russo Portfolio 2025 reported the following metrics in the Q2 SEC 13F filing:

- Portfolio value (reported): $9.41 billion

- Holdings: 85

- Average holding period: 40 quarters (10 years)

- Top industry positions:

- Computer Programming & Data: 19.2%

- Casualty Insurance: 18.7%

- Other Business Services: 17.9%

- Cigarettes: 9.6%

- Luxury Goods (e.g., Richemont, Pernod Ricard): ~8%

Performance has been volatile: –31.7% in 1 year, but +84.1% over 3 years and +28.7% over 5 years. This illustrates Russo’s philosophy: long-term gains outweigh short-term volatility, and his ability to hold through cycles remains central to his style.

Activity in Q2 2025: A Quarter of Cuts

The Q2 filing shows Russo’s portfolio activity was defined by cuts and trims, even while a handful of small new positions were added.

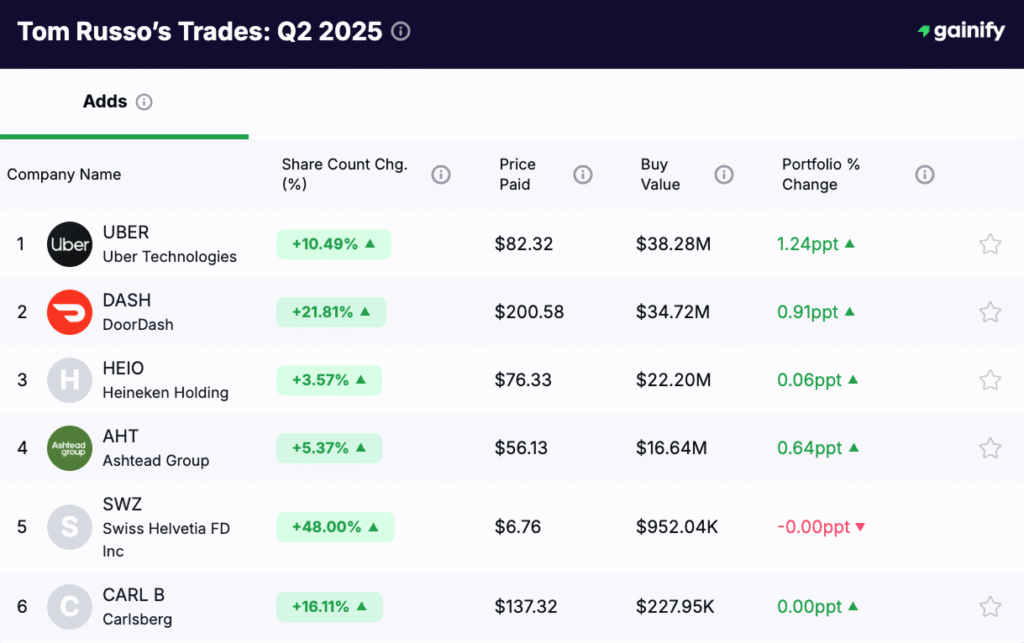

Adds

In Q2 2025, Tom Russo made several incremental increases across consumer platforms and beverage companies, collectively adding about $120 million in reported value.

- Uber Technologies (UBER) +10.5%, raising the position to roughly $176 million. Russo continues to lean into Uber’s platform economics and long-term total addressable market, making it one of his top 10 holdings.

- DoorDash (DASH) +21.8%, now valued at approximately $64 million. Reflects a conviction in consumer delivery infrastructure as a scalable, long-term service.

- Heineken Holding (HEIO) +3.6%, bringing the stake to about $242 million. A long-time Russo favorite, reinforcing his belief in family-controlled public companies with global beverage brands.

- Ashtead Group (AHT) +5.4%, worth around $37 million after the increase. A niche but resilient rental business with recurring demand.

- Swiss Helvetia Fund (SWZ) +48%, expanding this relatively small allocation to about $15 million. While minor in size, the sharp increase signals interest in Swiss market exposure.

- Carlsberg (CARL B) +16.1%, raising the holding to roughly $72 million. Complements Russo’s positions in Heineken and Pernod Ricard, reinforcing his overweight stance in global beverages.

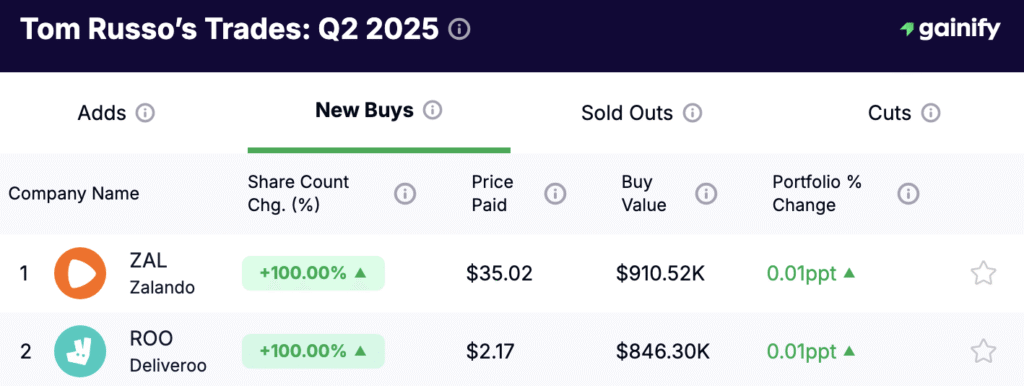

New Buys

Russo initiated two small new positions in European consumer platforms, together amounting to about $25 million in reported value. These positions are minor relative to his core holdings but signal selective interest in digital platforms with long runways for organic revenue growth.

- Zalando (ZAL) – Opened a new stake worth roughly $14 million. Zalando is Europe’s largest fashion e-commerce platform, with significant market shares across Germany, the U.K., and other European markets. Russo’s entry suggests a long-term bet on the continued growth of digital apparel retail in international markets.

- Deliveroo (ROO) – New position valued at about $11 million. While relatively speculative, Deliveroo represents optionality in food delivery, a sector where scale and cash-flow characteristics could eventually yield durable advantages.

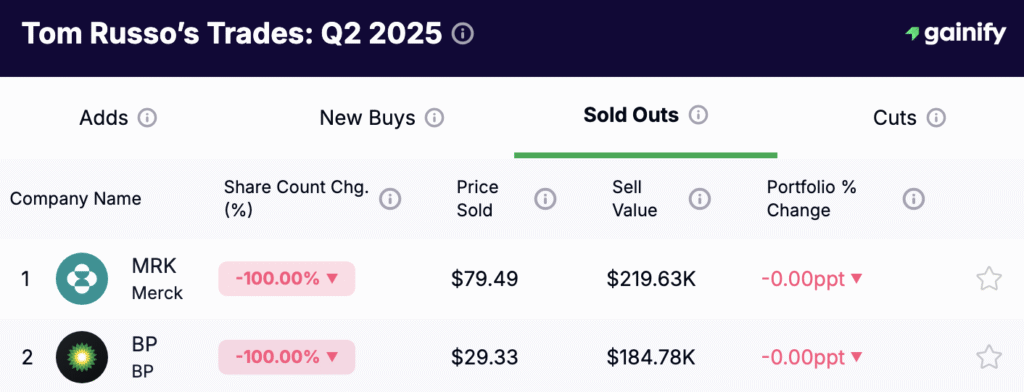

Sold Outs

In Q2 2025, Russo fully exited two positions, both relatively small in the context of his $9.41 billion portfolio. Combined, these sales freed up just under $0.5 million in reported value, reinforcing his preference for predictable businesses over sectors with volatile fundamentals.

- Merck (MRK) – Position worth about $220,000 was sold completely. Pharma has never been a central part of Russo’s stock selection, as drug pipelines and regulatory risk make it difficult to model intrinsic value with long-term certainty.

- BP (BP) – Holding worth approximately $185,000 was exited. This move is consistent with Russo’s broader philosophy of avoiding commodity-driven companies, where earnings are tied more to oil price cycles than to durable cash-flow characteristics.

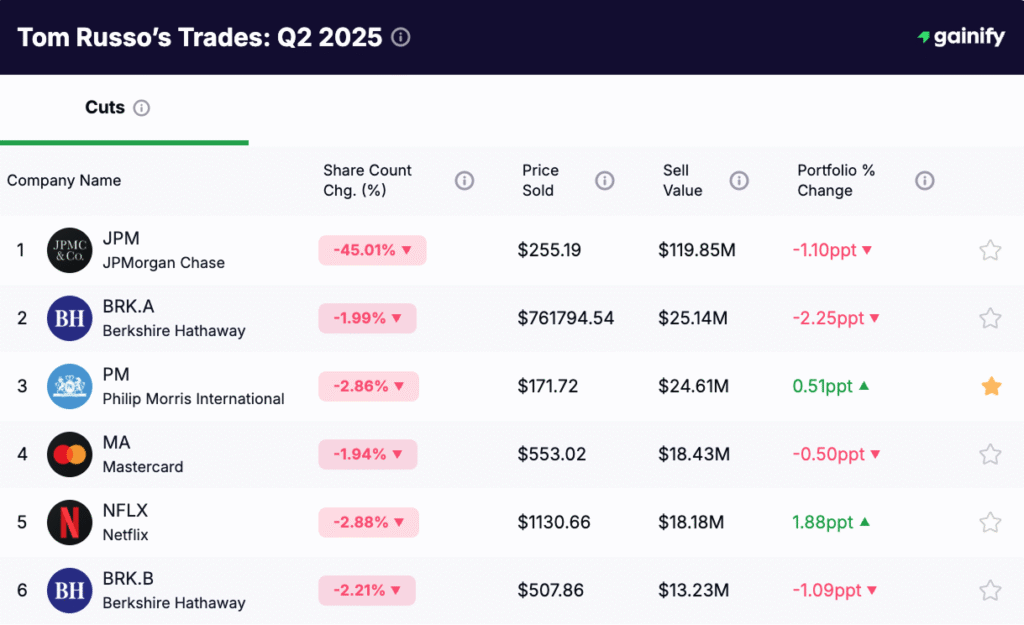

Cuts

The defining theme of Q2 2025 was Russo’s sweeping cuts across multiple sectors, trimming more than $500 million in reported value. These reductions highlight his willingness to rebalance, manage risk, and sharpen his portfolio, while keeping his long-term conviction names intact.

Financials:

- JPMorgan Chase & Co. (JPM): cut by -45.0%, a reduction of roughly $68 million. Reflects caution around U.S. banks facing tighter balance sheets and interest rate sensitivity.

- Wells Fargo (WFC): reduced by -63.7%, trimming more than $52 million. This was one of the largest single percentage cuts of the quarter.

Core Holdings:

- Berkshire Hathaway (BRK.A, BRK.B): small trims of about -2% each, freeing up ~$40 million combined, though the company remains Russo’s single largest position.

- Philip Morris (PM): reduced by -2.9%, about $18 million, still a core tobacco and consumer staple holding.

- Mastercard (MA): trimmed by -1.9%, or $16 million, reflecting valuation discipline rather than a shift in conviction.

- Netflix (NFLX): lowered by -2.9%, worth about $12 million, while retaining a strong belief in streaming’s long-term total addressable market.

Tobacco and Staples:

- Altria (MO): cut by -22.4%, removing about $25 million. This deep trim signals Russo’s preference for the global reach of Philip Morris over U.S.-focused Altria.

- Anheuser-Busch InBev (ABI): down -12.5%, about $30 million, a reflection of weak U.S. beer demand and ongoing consumer headwinds.

Luxury Goods & Beverages:

- Compagnie Financiere Richemont SA (CFR): modest -1.6% cut, about $8 million, but the position remains one of his top holdings in luxury.

- Pernod Ricard (RI): down -2.0%, about $6 million, a small trim in an otherwise durable spirits franchise.

Consumer & Cyclical Names:

- Levi Strauss (LEVI): cut by -29.5%, a reduction of roughly $14 million, signaling concern over discretionary apparel demand amid inflation.

- Hyatt Hotels (H): reduced by -25.7%, about $11 million.

- Vulcan Materials (VMC): slashed -45.8%, worth nearly $10 million, one of Russo’s sharpest cuts among cyclicals.

Top Holdings in Detail

Company Name | Reported Value (Q2 2025) | Portfolio % | Overview & Russo’s Thesis |

Berkshire Hathaway (BRK.A, BRK.B) | ~$2.35B combined | ~25% | Russo’s anchor position, reflecting admiration for Buffett’s reinvestment model. Serves as a diversified vehicle across insurance, energy, rail, and public equities. |

Mastercard (MA) | ~$834M | ~8.9% | Long-term bet on digital payment solutions. Mastercard benefits from secular growth in cashless transactions and global commerce. |

Alphabet (GOOG) | ~$755M | ~8.0% | One of the world’s most dominant tech firms, with leadership in search, advertising, cloud computing, and AI technology. Generates robust free cash flow. |

Nestlé (NSRGY) | ~$612M | ~6.5% | The quintessential family-controlled public company with 150+ years of history. Russo values its predictable cash-flow characteristics and vast market shares in food and beverages. |

Philip Morris (PM) | ~$540M | ~5.7% | A global tobacco leader transitioning to reduced-risk products. Despite inflation issues and regulation, it delivers durable long-term gains via dividends and reinvestment. |

Netflix (NFLX) | ~$402M | ~4.3% | Exposure to global streaming, a massive total addressable market. Russo remains confident in Netflix’s ability to scale revenues and expand internationally. |

Heineken (HEIO) | ~$242M | ~2.6% | A cornerstone beverage holding. As a family-controlled brewer with stable governance, it aligns with Russo’s preference for long-term-oriented investments. |

Compagnie Financiere Richemont SA (CFR) | ~$210M | ~2.2% | Owner of Cartier and Van Cleef & Arpels. Russo sees Richemont as a defensive play in luxury goods, with high margins and generational brand equity. |

Pernod Ricard (RI) | ~$184M | ~2.0% | Another family-controlled public company, Pernod offers global spirits exposure with predictable sales and steady organic revenue growth. |

Uber Technologies (UBER) | ~$176M | ~1.9% | Russo’s newer allocation, reflecting confidence in Uber’s platform economics, global network effects, and growing equity investments in mobility and delivery. |

Key Takeaways from Q2 2025

- Active quarter of cuts – Russo reduced across banks, cyclicals, and weaker consumer names while maintaining his durable core.

- Selective international additions – New small bets in Zalando and Deliveroo show ongoing interest in global platforms.

- Luxury goods exposure – Ongoing allocations to Compagnie Financiere Richemont and Pernod Ricard highlight his interest in family-controlled public companies.

- Durable franchises remain – Berkshire Hathaway, Nestlé, Philip Morris, Alphabet, Mastercard, and Netflix continue to anchor the portfolio.

- Long-term focus – Despite near-term volatility, Russo’s style remains rooted in long-term investing, compounding, and margin of safety discipline.

Conclusion

The Tom Russo Portfolio 2025 demonstrates the unique balance between activity and patience that defines Russo’s career. While Q2 was marked by widespread cuts and even a few sold outs, his core equity investment partnerships remain focused on enduring, cash-rich businesses.

Russo’s philosophy is clear: use trims and reallocations to refine exposure, but never abandon the central mission of owning predictable businesses with cash-flow characteristics that compound for decades. His selective new stock picks (Zalando, Deliveroo) show openness to new consumer trends, but they represent small allocations compared to the weight given to his long-term-oriented investments in giants like Berkshire Hathaway, Philip Morris, Alphabet, and Mastercard.

For students of portfolio management, Russo’s latest filing is a reminder that a successful investment strategy is not about guessing quarterly moves. It is about identifying companies with strong balance sheets, intrinsic value, and the ability to thrive in any market environment. By keeping faith in these businesses and refining around the edges, Russo continues to uphold the tradition of Graham & Dodd Investing and the enduring principles of value investing.