Keeping up with Wall Street is hard when you’re limited to manually clicking buy and sell, while hedge funds run thousands of trades a second. Your process is manual and slow, theirs is automated and hyper intelligent. Teams of quants will do anything to get an edge (including reducing the physical distance data has to travel from miles to feet, by paying exchanges to place their servers in the same data centers that house the exchanges’ matching engines.)

How can you, as a retail trader, ever hope to keep up? Well, the short answer is you probably can’t beat the best algorithms on Wall Street. But you can still turn a healthy profit with algorithmic trading.

In this comprehensive guide, we’ll analyze the 8+ best algorithmic trading platforms available in 2026, from free open-source solutions like QuantConnect to enterprise-grade systems like AlgoTrader.

You’ll gain insights into pricing, programming skills needed, tradeable assets, and real-world performance.

Whether you’re a programmer ready to build investing strategies, a trader seeking no-code automation, or an investor exploring how algorithms can optimize your portfolio timing, this guide provides the analysis you need to choose the right platform.

Wall Street has relied on algorithmic trading for decades. The $23.48 billion algorithmic trading market today handles the overwhelming majority of all trades in major markets. Today, you can tap into this same technology.

To compete in the algorithmic trading world, you need the right combination of execution speed, backtesting accuracy, and risk management – plus the fundamental insights that pure technical algorithms miss.

While algorithmic trading handles the “when” of execution, fundamental analysis reveals the “what” – identifying quality companies worth trading algorithmically instead of chasing patterns on fundamentally weak stocks. That’s where you will find stock research & analysis platforms like Gainify helpful.

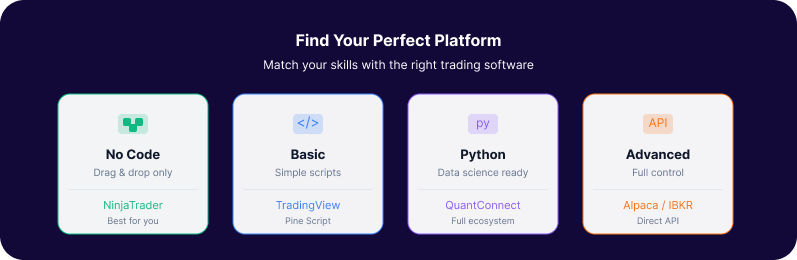

Quick Decision Guide

Platform | Best For | Pricing | Programming Required | Key Features |

QuantConnect | Open-source development | $60-$1,080/month | Yes (C#, Python) | Cloud backtesting, LEAN engine |

TradeStation | Active traders | $0 commission + API access | No (EasyLanguage) | Brokerage integration, free API |

MetaTrader 5 | Forex trading | Free | Optional (MQL5) | Expert Advisors, global brokers |

Interactive Brokers | Professional traders | IBKR Lite: $0 / Pro: Tiered | Yes (Multiple languages) | Global markets, institutional features |

NinjaTrader | Futures trading | Free-$1,499 lifetime | Optional (NinjaScript) | Advanced charting, strategy builder |

TradingView | Strategy development | $16.95-$239.95/month | Yes (Pine Script) | Social features, cloud-based |

Alpaca | Free API access | $0 commission | Yes (REST/WebSocket) | Commission-free, paper trading |

What is Algorithmic Trading Software?

Algorithmic trading software executes buy and sell orders using predefined rules and mathematical (statistics or machine learning based) models. You program strategies once, then the software runs them without your intervention.

Of course, in the real world it’s not quite that simple. There’s a lot of maintenance, tweaking, improving, and even bug fixing to keep algorithmic trading approaches operating profitably.

So if you’re dreaming of your personal Wall Street trader that never sleeps, know that it takes a lot of work to keep your stock trading algorithms from running you into the red.

Nevertheless, algo trading still offers strong advantages that are hard to look past.

However, the approach is definitely better suited to larger teams with the resources to build, backtest, and maintain. Building an algo trading strategy of your own includes backtesting to validate strategies against historical data, connecting to real-time market feeds, and built-in risk management.

How Does Algorithmic Trading Software Work?

When trading algorithmically, you feed stock market info (and other data) into mathematical models, and the software sends out trading decisions..

The Four-Stage Process

Every algorithmic trading system follows the same high level workflow. But performance can vary dramatically between platforms.

1) Data Collection and Processing

Price movements, volume spikes, order book changes – everything gets processed across thousands of stocks simultaneously.

The quality of this data determines your algorithm’s effectiveness.

Premium platforms give you direct data feeds with low delays. But budget platforms often provide delayed data.

Ideally, you want data updates as fast as computationally possible. that arrives seconds after market moves happen. A few seconds may seem inconsequential – but in the world of algo trading it can be the difference between profit and loss.

2) Signal Generation

Mathematical models analyze all the data you input into the algo to generate buy or sell signals.

Simple moving averages are a great place to start if you’re a beginner. But if you’re more advanced and have some coding skills or know some machine learning, try an ML or statistics-based approach – it’s a little more effort but you’ll likely get better results!

For foundational understanding of market analysis and signals that can be used in algorithmic stock trading – check out our guide on technical analysis platforms.

The platform you choose will determine how sophisticated your signals can be. If you prefer visual tools, you’ll get simple rules-based signals that are easy to understand. But if you’re comfortable coding, you can build advanced statistical models with AI integration that give you much more control.

3) Order Execution

When signals meet your predefined criteria, the software executes orders through broker APIs.

4) Risk Management

Built-in safeguards watch your position sizes, stop-loss levels, and portfolio exposure. The system automatically closes positions, or reduces trade sizes, or halts trading when things get too risky.

Real-time drawdown monitoring and automatic strategy shutdown are two safeguards you will want to implement. However, basic platforms may lack sophisticated risk controls, leaving you vulnerable to losses.

Popular Algo Trading Strategy Categories

Different algorithms suit different market conditions and time horizons.

- Mean Reversion strategies buy when prices drop below average and sell when they rise above. These are often used in sideways markets with established trading ranges.

- Momentum Trading follows price trends, buying rising stocks and selling falling ones – often used during strong bull or bear market phases.

- Arbitrage relies on extremely fast execution and significant capital to exploit price differences across markets or related securities.

- Market Making provides liquidity by placing both buy and sell orders around current market prices – by trading this strategy you can profit from bid-ask spreads while providing trading opportunities for others.

The platform you choose must support your preferred strategy types with appropriate speed, data quality, and execution capabilities.

The 9+ Best Algorithmic Trading Platforms in 2026

Choosing the right platform determines whether you profit from high speed algorithmic trading or lose money faster than ever before.

1. QuantConnect: Best Open-Source Platform

Best For: Programmers who want institutional-grade backtesting with open-source flexibility and comprehensive historical data access.

QuantConnect gives you access to institutional-grade LEAN engine technology and decades of historical data. If you cannot afford a Bloomberg terminal and are looking for democratized Wall Street-level backtesting for retail traders – QuantConnect may be suitable for you.

What Makes QuantConnect Special

You’ll be able to trade across multiple asset classes – stocks, forex, futures, options trading, and even crypto – all from one platform. The cloud-based infrastructure handles massive backtesting jobs that would crash your laptop.

The open-source LEAN Algorithm Framework actually powers institutional hedge funds – so you’re using the same backtesting technology as huge quantitative funds.

Programming and Documentation

Whether you prefer C# or Python, you’ll find extensive documentation to get you started quickly. Hundreds of tutorials and sample algorithms – plus thousands of community-contributed strategies – help you learn fast.

The platform supports everything from basic moving average strategies to complex machine learning.

Pricing Structure

The free tier gives you basic backtesting with limited data coverage. Professional plans run $60-$1,080 monthly and give you access to expanded datasets and team collaboration features, plus additional computational nodes.

2. TradeStation: Best for Active Traders

Best For: Active traders who want integrated brokerage execution with programming languages and pro data feeds included.

With TradeStation, you won’t have the headache of connecting separate brokers to your algorithmic trading platform. It’s a full-service brokerage with sophisticated trading tools built in.

The Data Advantage

Direct access to TradeStation’s execution systems means faster order routing and real-time position management. You can trade stocks, options, and futures with competitive rates through the same platform you use for strategy development.

With other platforms, you’ll need to set up separate brokerage connections and potentially even deal with complex API integrations. TradeStation handles everything internally. Ideal if you want to avoid technical complexity.

One huge advantage is real-time data as standard. Most platforms charge extra for real-time market data – but TradeStation includes professional-grade feeds with all funded accounts. This alone could save you hundreds monthly in data costs.

EasyLanguage Programming

TradeStation’s proprietary EasyLanguage uses plain English commands instead of difficult programming. Great if you want customization but are not a programmer.

API and Cost Structure

Free API access requires a $10,000 minimum account balance.

You’ll benefit from zero commissions on stocks and ETFs through TS SELECT. Options cost $0.60 per contract with free API access for funded accounts.

3. MetaTrader 5: Best for Forex Trading

Best For: Forex traders who want proven automated trading systems with global broker choice and zero platform costs.

If you’re into forex, MetaTrader 5 is where you’ll want to be. Hundreds of global brokers support this “not so pretty” but battle-tested platform – a stalwart of forex automation for over a decade.

Expert Advisors: 24/7 Trading

Expert Advisors (EAs) are automated trading programs that monitor markets continuously and execute trades based on your programmed logic. You’ll be able to capture forex moves across all global sessions while sleeping.

If you’re looking for a platform with quick setup for established strategies, The MetaTrader Market gives you access to thousands of ready-made EAs for every trading style imaginable.

You can:

- Scalp

- Swing trade

- Trade on news

MQL5 Programming Language

This object-oriented language lets you create custom indicators, trading robots, and scripts with C++-like syntax. It’s a little more difficult than some other platforms’ proprietary coding languages. If you’re not a programmer you’ll find it has a steeper learning curve.

But once you get the hang of it, you won’t need to reinvent basic trading functions – they’re already provided in the standard library.

Global Broker Support and Cost Structure

Hundreds of forex brokers worldwide support MT5, and the software downloads and runs completely free.

Additionally, many brokers include real-time market data at no extra cost, making it suitable for beginners who don’t have a huge portfolio (yet!)

4. Interactive Brokers API: Best for Professional Traders

Best For: Professional traders and developers who need global market access with institutional-quality execution and sophisticated order management capabilities.

With Interactive Brokers, you get institutional-grade infrastructure through multiple APIs. The platform doesn’t just serve retail investors – it’s trusted by professional traders and hedge funds worldwide.

Unmatched Global Market Access

Trade stocks, options, futures, forex, and bonds across 160 markets in 36 countries through a single API connection.

Direct Market Access: You can skip market makers and route orders directly to exchanges for better fills and reduced slippage. If you need professional algorithms with institutional-quality execution, retail platforms simply can’t compete with IB’s infrastructure.

Advanced Order Types: As mentioned, IB services professional and hedge fund investors as much as it does retail investors. You’ll have access to a suite of advanced features covering:

- Bracket orders

- Trailing stops

- Conditional orders

Algorithmic order types like TWAP and VWAP are also available.

If you were looking for sophisticated hedge fund-tier tools, then Interactive Brokers may be the platform for you.

Multiple Programming Language Support

The APIs support Python, Java, C++, C#, and other major languages. Python is pretty beginner friendly, so even if you’re not a programmer you can become competent in a few months.

But there is still a learning curve to any platform that relies on established (rather than proprietary and “natural language”) programming languages.

However the advantage is that you won’t be locked into a proprietary scripting language – your programming skills will transfer over to other platforms and even areas of your professional life.

Detailed API references help you integrate quickly if you do have some development experience.

If you’re not super familiar with algorithmic trading and are worried about what is going on inside the “black box” of your algo – you’ll appreciate the TWS Integration (The Trader Workstation) which provides manual oversight and intervention capabilities. It gives you more control over your algorithm and trading.

Professional-Grade Infrastructure and Pricing

Interactive Brokers offers two distinct pricing structures.

- IBKR Lite provides zero commissions on US stocks and ETFs for US residents.

- IBKR Pro uses tiered pricing starting at $0.005 per share with a $1 minimum. Options cost $0.15 to $0.65 per contract.

5. NinjaTrader: Best for Futures Trading

Best For: Futures traders who want professional charting with flexible pricing options and the ability to progress from visual building to advanced programming.

NinjaTrader specializes in futures and forex markets, giving you both visual strategy building and advanced programming capabilities.

The platform’s flexible pricing model includes a unique lifetime license option ($1499) – which could be an advantage if you’re truly in love with its features and want to save money long term.

Dual Development Approach

NinjaTrader brings you strong visualization and programming power. This will be a welcome combination if you’re finding that most platforms force you to choose between limited drag-and-drop builders or limited/proprietary coding.

NinjaScript (C#) is NinjaTrader’s secret weapon. If you have coding experience you’ll be able to create sophisticated strategies with:

- Custom logic

- Complex risk management

- Integration with external data sources

If coding is not your thing, the visual drag-and-drop tool allows you to create automated trading systems using logic blocks.

The builder generates NinjaScript code automatically, meaning you don’t need to learn to program.

Advanced Futures-Focused Features

Futures markets require specialized tools that stock-focused platforms can’t always provide.

- Professional Futures Charting: Order flow analysis, market depth displays, volume profile, and hundreds of technical indicators.

- Market Replay: Practice strategies and test ideas using historical data. Experience exactly how your algorithms would have performed during specific market conditions.

Micro E-mini futures contracts require as little as $50 margin per contract, making it easy for even beginners to get started.

Flexible Pricing Structure

NinjaTrader offers the most flexible pricing in algorithmic trading, letting you choose between higher commission fees or monthly flat fees.

- Free Plan: Basic features with higher commission rates ($0.39 micro/$1.29 standard per side).

- Monthly Subscription: $99/month reduces commissions to $0.29/$0.99 per side.

- Lifetime License: $1,499 one-time payment provides lowest commissions ($0.09/$0.59 per side.)

6. TradingView: Best for Strategy Development

Best For: Beginner to intermediate traders who want to learn algorithmic trading through visual development and community collaboration – all on a modern user friendly platform.

TradingView combines advanced charting capabilities with social trading features and Pine Script programming.

Pine Script: Beginner-Friendly Programming

Many algorithmic platforms use complex programming languages that require computer science knowledge. But TradingView’s Pine Script makes programming easy, letting you use intuitive commands that read almost like plain English.

Social Trading Community

TradingView provides access to strategies and indicators shared by a global community of traders. This is especially helpful if you’re starting out and need guidance from more experienced investors.

Perhaps most helpful – enabling you to start algo trading right away, is the public script library. Find a script that suits your needs and get started!

If you’re not sure which strategy to follow, publish your ideas to get feedback from experienced algorithmic traders.

Cloud-Based Development and Broker Integration

Test strategies against historical data without installing software or managing databases.

- Direct trading connections with supported brokers enable live strategy execution..

- Simultaneously analyze strategies across different timeframes and instruments.

Broad Range of Pricing Options

TradingView’s free plan provides basic charting and limited Pine Script functionality.

If you need paid features, you have plenty of options. Paid plans range from $16.95 to $239.95 monthly, providing additional indicators, alerts, and premium data access.

7. Alpaca: Best Free API

Best For: Developers and quantitative traders who want modern APIs with commission-free execution and excellent paper trading for US equity strategies.

Alpaca offers commission-free trading through modern APIs. If you’re non technical (don’t know how to code) then it’s a non-starter. This platform definitely requires some programming experience.

But if you do know how to code or are willing to learn, no commissions on stock and ETF trades eliminates the largest cost component for algorithmic strategies.

Alpaca’s revenue comes from payment for order flow (it sends trades to market makers who execute the orders, and in turn compensate Alpaca) and interest on cash balances.

Developer-First API Design

Via the API you will have access to real-time market data, order management, and portfolio tracking capabilities. An official Python software development kit (SDK) simplifies integration and reduces development time.

Paper Trading and Market Access

Risk-free strategy testing with simulated trading using real market data lets you validate strategies without risking capital.

Paper trading includes real market data and realistic order filling.

Zero Commissions but Paid Data

Basic delayed data comes free. But if you want real-time market data (and you likely will) it costs $99 monthly.

8. Build Your Own: Best for Full Control

Best For: Large firms with experienced development teams, specific requirements that commercial platforms can’t meet

Creating custom algorithmic trading infrastructure provides maximum flexibility and control over every system component.

However, it is certainly not easy. This approach suits experienced development teams and firms with specific requirements that commercial platforms can’t meet.

Building your own platform means assembling multiple complex components into a cohesive system. Each piece must work perfectly with others while handling real-time market data and executing trades without failure.

That alone is enough to turn even experienced developers away.

But if you’re intent on giving it a crack, it can be a rewarding learning experience, and a powerful trading edge.

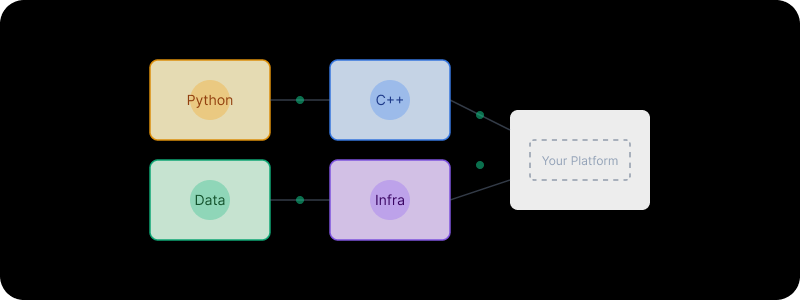

Below is what your algorithmic trading stack could include:

- Python for Research: Prototyping, strategy development, and market research. You’ll have access to extensive libraries for data analysis, machine learning, and statistical modeling.

- C++ for Performance: Provides maximum execution speed for latency-sensitive strategies. Important when you’re going up against Wall Street battling for milliseconds.

You will need to source your own data feed though. Alpaca, as mentioned, is a compelling option. Other providers include Bloomberg, Refinitiv (Reuters), Polygon, and IEX.

Costs range from hundreds to tens of thousands monthly depending on requirements.

Building your own solution can be cheaper than paying a company like TradingView a monthly subscription. But that doesn’t mean your costs will be zero. Plan ahead for VPS hosting, redundant connectivity, and backup systems – all table stakes for a reliable algorithmic trading solution.

Why Pure Algorithmic Trading Misses the Biggest Opportunities

If you’re only focusing on price patterns, you may be missing the companies that actually make money – companies with strong fundamentals and intrinsic value, growth stocks, and dividend champions.

The Flaw in Technical-Only Algorithms

The fact is, a stock might display perfect technical patterns while the underlying company burns cash and loses market share to competitors.

You’ll be optimizing entry and exit timing on fundamentally weak companies.

Why Fundamental Analysis Gives You an Edge

Companies with growing earnings, expanding market share, and sustainable competitive advantages outperform over time regardless of short-term technical fluctuations. Fundamental analysis provides the foundation for superior algorithmic strategies.

Strong balance sheets, consistent revenue growth, and competitive moats indicate businesses likely to appreciate long-term.

Using fundamental analysis you’ll be able to uncover companies likely to beat earnings expectations, creating trading opportunities outside of the whirr of algorithmic trading.

AI-Powered Stock Research

Top stock research platforms like Gainify use artificial intelligence to analyze earnings data, financial statements, and market trends at speeds impossible for manual research.

It brings the speed and technical advancement of algorithmic trading to fundamental stock research.

It’s never been easier to find winning stocks based on actual business performance rather than price patterns alone.

When you sign up for a Gainify account, you’ll immediately have access to:

- Institutional-Grade Stock Screener: Filter 30,000+ global stocks using 500+ fundamental metrics to uncover hidden value the algorithms miss.

- AI-Powered Analysis: Get instant insights on any stock’s financials, growth trajectory, and valuation – answering complex questions in seconds rather than hours.

- Top Investor Tracking: Follow what legendary investors like Michael Burry and Bill Ackman are buying – these masters of fundamental analysis consistently beat the market.

- Analyst Estimate Database: Access comprehensive analyst forecasts typically reserved for institutional investors, identifying stocks likely to beat earnings expectations.

- Smart Ideas & Themes: Pre-built screens for dividend champions, AI leaders, and emerging trends – no coding or complex setups required.

The beauty of fundamental investing with Gainify? You’re not competing against algorithms for microsecond advantages. You’re identifying quality businesses with strong earnings, growing dividends, and expanding margins – but using modern AI tools that make the research process 10x faster.

Key Features Every Algo Trading Platform Should Have

If you choose a platform missing essential features, you’ll lose money through poor execution, system failures, and missed opportunities.

You need:

- Support for different asset types so you can trade stocks, options, crypto, etc., on one platform

- Testing across different time periods to ensure strategies work in various market conditions

- Backtesting that reflects reality, including fees, slippage, and actual trading costs

- Account-wide safeguards to prevent multiple strategies from creating excessive risk

- Coverage of all markets you trade – stocks, crypto, forex – with accurate pricing

- Help from other traders through forums and communities when you get stuck

- Automatic risk protection that stops trading when you’re losing too much

- Real-time data feeds that update instantly, not delayed by 15-20 minutes

- Reliable technology that won’t crash during critical trading moments

Best Algorithmic Trading Software for Beginners

If you start with the wrong platform, you’ll waste months learning skills that won’t transfer to better results, especially if you’re trying to learn new and complex programming languages at the same time.

Luckily, many modern platforms offer visual development tools and simplified coding syntax – even non-developers can create successful trading algorithms within their first week.

The three best places to start if you’re learning the ropes are TradingView, NinjaTrader, and MetaTrader.

- TradingView Pine Script: Beginner-friendly syntax with extensive community examples. Copy successful strategies, modify parameters, and gradually understand the underlying logic without starting from scratch.

- NinjaTrader Strategy Builder: Drag-and-drop interface creates NinjaScript code automatically. Visual logic blocks teach programming concepts while generating C# code you can study and modify as your skills develop.

- MetaTrader Expert Advisor Wizard: Guided EA creation without programming knowledge. The wizard generates MQL5 code while teaching algorithmic trading fundamentals.

Comprehensive Educational Resources and Support

Learning algorithmic trading requires understanding both programming concepts and market dynamics. The best beginner platforms provide structured education paths and active community support.

Other than TradingView – with its strong community of traders – two other platforms stand out for their available learning materials.

- QuantConnect University: Free tutorials covering everything from basic programming to advanced quantitative strategies.

- Interactive Brokers Traders Academy: Comprehensive courses covering algorithmic trading concepts, risk management, and platform-specific features.

It pays to build foundational knowledge through stock market education and backtesting your strategies before you even place your first live trade.

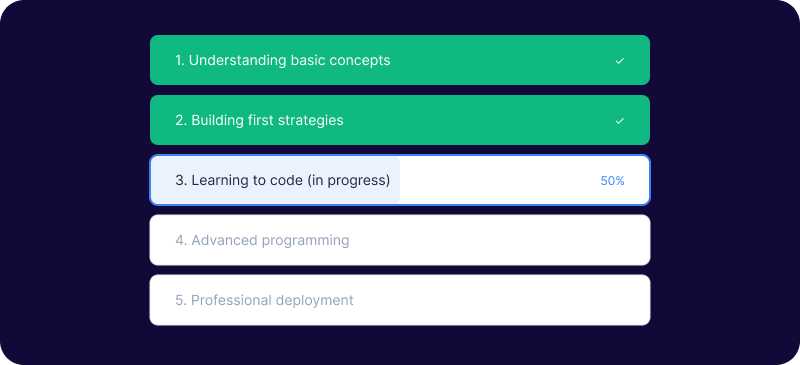

Getting Started with Algorithmic Trading

If you want to succeed in algorithmic trading, you’ll need proper preparation and education.

Foundation Building and Platform Selection

Your journey begins with choosing the right educational path and platform combination.

You should:

- Begin with moving average crossovers, RSI divergences, or momentum strategies.

- Backtest strategies across multiple time periods, market conditions, and asset classes.

- Implement position sizing, stop losses, and portfolio limits from day one.

Spend a month or more backtesting and paper trading to get the hang of algorithmic trading. Even if you need to spend 3 months “on the sidelines” just putting in reps in paper trade mode – your real life trading later will only be better for it.

When you start trading, start small. Now you’re using real money (your money) the psychological aspect of trading comes into play. Sunk cost biases, the ups and downs of the market – they can all play on your decision making, and nerves.

How to Choose the Right Algorithmic Trading Software

Your programming experience will determine platform suitability more than any other factor. If you’re honest about your current skills, you’ll avoid choosing platforms that exceed your capabilities or limit your potential growth.

Complete Beginner

Start with visual builders like NinjaTrader Strategy Builder or TradingView Pine Script. These platforms teach algorithmic concepts while generating professional code automatically.

Basic Programming Experience

Python-friendly platforms like QuantConnect or Alpaca provide you an easy way to get started with programming and algo trading.

Experienced Coder

If your coding skills are more advanced, then you will be able to use almost any platform without too much difficulty.

Take control of every minor detail with an Alpaca API connection or choose Interactive Brokers for broad programming language support.

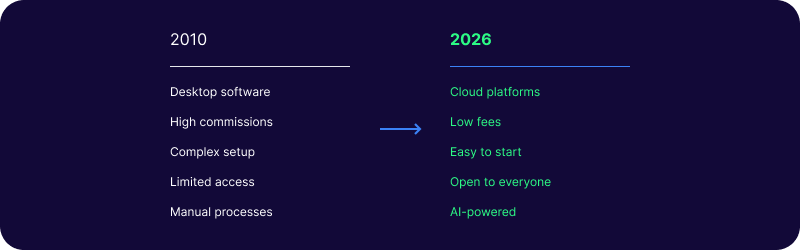

The Bottom Line for 2026

The algorithmic trading landscape continues evolving rapidly, with cloud-based platforms, commission-free execution, and AI-powered analysis democratizing access to institutional-grade trading capabilities.

Top Recommendations:

- QuantConnect leads for serious developers seeking comprehensive backtesting capabilities.

- TradeStation provides excellent value for active traders wanting integrated brokerage services.

- Alpaca revolutionizes cost structures with commission-free API access.

- MetaTrader 5 remains the forex standard with its extensive broker ecosystem.

It’s also hard to go past stalwart Interactive Brokers for its institutional-grade reputation, or the modern-looking and exciting TradingView for its pinescript native programming language.

Whichever platform you choose, start on the right foot. Begin with paper trading on a free platform, develop basic programming skills, and focus on simple strategies with robust risk management.

Success in algorithmic trading comes from systematic thinking, continuous learning, and disciplined execution rather than seeking out the most complex mathematical models.

And while you’re mastering algorithmic trading strategies, consider diversifying with fundamental analysis through https://gainify.io.

- Follow legendary investors’ portfolios

- Access institutional-grade research on 30,000+ global stocks

- Let AI analyze earnings data and prepare stock reports for you

With S&P Global Intelligence powering comprehensive stock screening and real-time fundamental monitoring, you can identify dividend aristocrats and growth champions the algorithms overlook.

Start with Gainify’s free plan today – no credit card required.

Frequently Asked Questions (FAQ)

What is the best algorithmic trading software for beginners?

TradingView is a solid choice for beginners with its user-friendly Pine Script language and extensive community support. NinjaTrader’s drag-and-drop Strategy Builder is another excellent no-code option.

How much does algorithmic trading software cost?

- Free: MetaTrader 5, Alpaca API, TradeStation API (with funded account)

- Monthly: TradingView ($17-$240), QuantConnect ($60-$1,080)

- One-time: NinjaTrader ($1,499 lifetime)

Can I do algorithmic trading without programming?

Yes. NinjaTrader Strategy Builder, MetaTrader’s Expert Advisor Wizard, and TradeStation’s EasyLanguage offer no/low-code options. TradingView provides thousands of pre-built strategies to copy. However, basic programming knowledge significantly expands your capabilities.

What programming languages are used in algorithmic trading?

Python (most popular), C# (NinjaTrader, QuantConnect), C++ (high-frequency trading), Pine Script (TradingView), MQL5 (MetaTrader), and Java (Interactive Brokers). Python is recommended for beginners due to its readability.

What are the risks of algorithmic trading?

Main risks include technical failures, over-optimization, changing market conditions, and capital loss from poor risk management. Mitigate through thorough testing, position sizing, stop-losses, and continuous monitoring.

How long does it take to learn algorithmic trading?

- 1-3 months: Basic programming and platform basics

- 3-6 months: Simple strategy development

- 6-12 months: Consistent profitable strategies