Building the right investment portfolio is one of the biggest steps toward long-term wealth. But where do you start?

The truth: there is no single “perfect” portfolio. The best mix of stocks, bonds, and alternatives depends on your risk tolerance, goals, and time horizon.

That is why in this guide we break down 4 famous investment portfolio examples you can use as models:

- Benjamin Graham: the conservative, wealth-preserving blueprint

- John Bogle: the simple, low-cost index strategy

- David Swensen: the endowment-style approach with alternatives

- Cathie Wood: high-conviction growth investing

Each one shows you how the pros think about asset allocation, from defensive investors to aggressive growth seekers.

You will also learn how to balance risk and return, why asset allocation matters, and how tools like Gainify can help you build and track your own portfolio.

What Is an Investment Portfolio?

An investment portfolio is simply the collection of assets you own. It can include stocks, bonds, real estate, ETFs, or even alternatives like commodities and crypto. The mix you choose should reflect your goals, timeline, and comfort with risk.

A strong portfolio is not static. It evolves as your life changes, whether that is a new job, higher income, family needs, or preparing for retirement.

The goal of a balanced portfolio is to grow your wealth while managing risk. To get there, you need to decide:

- How much to invest in growth stocks vs. dividend-paying stocks

- Whether to hold individual stocks or mutual funds

- How to blend safer investments like bonds with riskier investments like emerging markets or alternatives (e.g., crypto, commodities, hedge funds)

- Which types of investments match your investment objective and financial goals

You do not have to figure this out alone. A financial advisor or platforms like Gainify can help you design and track a portfolio that matches your strategy and risk tolerance.

1. Benjamin Graham: Value-Driven Defensive Strategy

Who He Was: Benjamin Graham, known as the “father of value investing,” mentored Warren Buffett and wrote the timeless classic The Intelligent Investor. His approach is all about discipline, margin of safety, and protecting your capital.

Graham’s Investment Style: Graham’s strategy emphasizes a conservative, balanced portfolio composed of high-grade bonds and quality individual stocks. He recommended investors keep at least 25% in each asset class, depending on market conditions and personal risk tolerance. His philosophy prioritizes companies with solid fundamentals, consistent earnings, and reasonable valuations.

Sample Graham Investment Portfolio Examples:

Asset Class | Allocation | Purpose |

Dividend-paying stocks | 50–75% | Reliable income + capital growth |

Corporate bonds & Treasuries | 25–50% | Lower risk, income stability |

Cash equivalents | 5% | Liquidity for safer investments or market dips |

Pro Tip: Apply Graham’s margin of safety by targeting stocks trading significantly below their intrinsic value. Focus on companies with strong financials, consistent earnings, low price-to-earnings ratios, and conservative debt levels. In the bond portion of your portfolio, prioritize high-quality, investment-grade securities to anchor your capital and generate reliable income.

Example: A 60-year-old investor preparing for retirement might allocate 60% to reliable dividend aristocrats like Johnson & Johnson and Coca-Cola, companies renowned for financial resilience and shareholder-friendly policies. The remaining 35% could go toward a blend of U.S. Treasuries and top-tier corporate bonds, with 5% kept in cash or short-term certificates of deposit (CDs) to maintain flexibility and liquidity.

Best For: Conservative investors focused on preserving wealth, producing steady income, and minimizing portfolio risk, particularly those with shorter investment horizons or approaching retirement.

2. John Bogle: The Power of Simple Index Investing

Who He Was: John Bogle founded Vanguard and revolutionized retail investing by making mutual funds and exchange-traded funds (ETFs) accessible, affordable, and effective. He believed that most investors would outperform the majority of professionals simply by staying diversified and keeping costs low.

Bogle’s Investment Style: Bogle was a pioneer of passive investing. His strategy focuses on a mix of stocks and bonds through broad-based ETFs or index-tracking mutual funds and adjusting stock allocation based on your age. The goal is to capture the average market return at minimal cost.

A common Bogle rule: Stock Allocation = 100 – Your Age (A 30-year-old would invest 70% in stocks, 30% in bonds.)

Sample Bogle Investment Portfolio:

Asset Class | Allocation | Purpose |

U.S. Total Stock Market ETF | 40% | Core equity exposure to stocks across all sectors |

International ETF | 20% | Broader global diversification |

U.S. Bond ETF or mutual fund | 40% | Safer investments for stability and income |

Pro Tip: Focus on ETFs with ultra-low expense ratios, ideally below 0.10%, to minimize fees and maximize your net returns over time. Rebalancing your portfolio annually helps realign it with your original asset allocation, keeping portfolio risk in check and ensuring your strategy remains consistent with your investment goals.

Example: A 35-year-old investor could construct a globally diversified portfolio using Vanguard’s VTI (U.S. total market), VXUS (international markets), and BND (U.S. total bond market). This trio provides broad market exposure, simplicity, and effective diversification across asset classes and regions.

Best For: Moderate investors who value a hands-off strategy, seek reliable long-term performance, and prefer a cost-efficient approach to achieving their financial goals.

3. David Swensen: Diversification for Long-Term Growth

Who He Was: David Swensen managed Yale’s endowment for over 30 years, delivering returns that outperformed nearly all institutional investors. His genius lay in strategic diversification across alternative investments, private equity, and real assets.

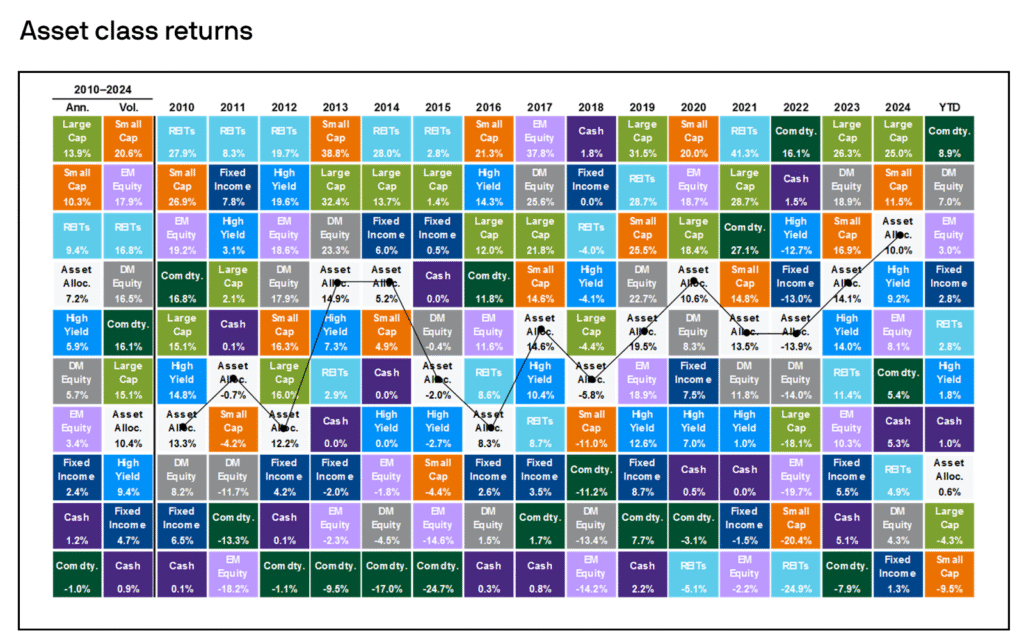

Swensen’s Investment Style: Swensen advised retail investors to build diversified portfolios that go beyond traditional stocks and bonds by including real estate investment trusts (REITs), commodities, and alternatives like gold and crypto. His model targets non-correlation—choosing asset classes that don’t move in sync to reduce risk.

Sample Swensen Investment Portfolio:

Asset Class | Allocation | Purpose |

U.S. Stocks | 30% | Exposure to stocks for growth |

International Stocks | 15% | Diversification outside the U.S. |

Emerging Markets | 5% | Riskier investments with high return potential |

REITs (Real Estate Investment Trusts) | 20% | Inflation hedge + real asset exposure |

Intermediate-Term Bonds | 15% | Safer investments for income and capital preservation |

TIPS | 10% | Protection against inflation |

Alternatives (incl. Crypto) | 5% | Portfolio diversification, asymmetric return potential |

Pro Tip: To fully implement Swensen’s endowment approach, diversify your alternatives allocation across a wide range of investment types, including cryptocurrency, commodities, infrastructure funds, and real estate investment funds. These asset classes often behave independently of stocks and bonds, which helps reduce overall portfolio volatility and enhances return potential over time. When allocating to crypto, favor well-established assets and limit exposure to manage risk.

Example: A 40-year-old investor with a high tolerance for volatility and a long investment horizon could allocate 25% to U.S. equities, 15% to international stocks, 5% to emerging markets, 20% to REITs, 10% to TIPS, 15% to a mix of corporate and government bonds, and 5% to alternative investments including crypto, gold, or commodity-focused funds.

Best For: Aggressive investors with a strong understanding of market dynamics, a long-term investment outlook, and the desire to enhance returns through strategic use of alternatives and advanced diversification techniques.

4. Cathie Wood: Innovation and High-Conviction Growth

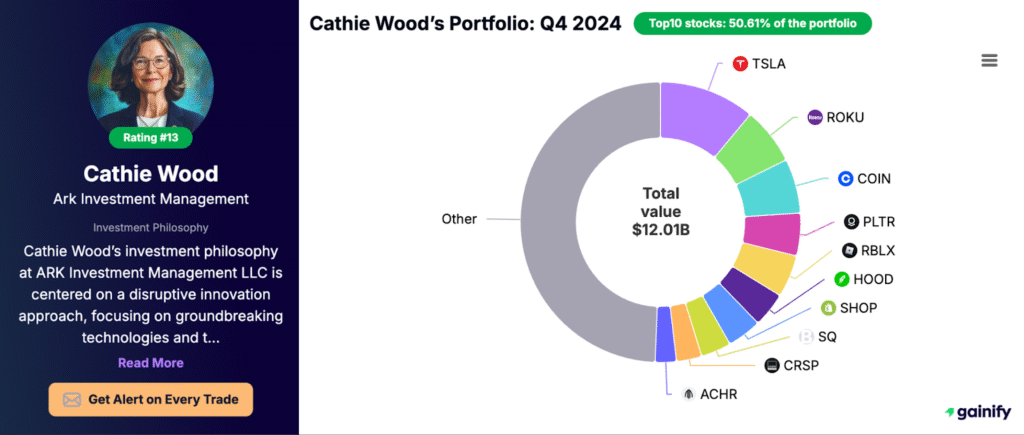

Who She Is: Cathie Wood is the founder and CEO of ARK Invest, a firm that focuses on disruptive innovation. She is known for her bold, concentrated bets on transformational technologies—from artificial intelligence and robotics to gene editing and blockchain.

Wood’s Investment Style: Wood’s approach stands apart from traditional diversification. It involves making high-conviction, long-term investments in companies positioned to benefit from rapid technological change. These portfolios often include a narrow selection of stocks with significant upside potential but also substantial risk.

This style is not about reducing volatility—it’s about embracing it in the pursuit of exponential growth. Investors must be willing to tolerate drawdowns in exchange for potential market-beating returns.

Sample Cathie Wood-Style Investment Portfolio:

Asset Class | Allocation | Purpose |

Disruptive Tech Stocks (AI, EVs) | 60% | Primary growth engine, focused on innovation leaders |

Genomics & Biotech Equities | 15% | Exposure to revolutionary advances in health and longevity |

Blockchain & Fintech (incl. Crypto) | 10% | High-risk/high-reward digital finance exposure |

Thematic ETFs (e.g., ARKK, ARKG) | 10% | Simplified access to innovation-focused sectors |

Cash or T-Bills | 5% | Liquidity for rebalancing or tactical opportunities |

Pro Tip: Position this strategy as a satellite to your core holdings. Limit exposure to 10–20% of your total portfolio unless you fully understand the risk profile. Ensure you still have diversified core allocations in other accounts or portfolios.

Example: A younger investor with high risk tolerance might invest in a basket of individual innovation stocks (like Tesla, CRISPR Therapeutics, Coinbase) while also holding ARK Invest ETFs for thematic exposure. Cash is kept on hand to take advantage of volatility-driven price dislocations.

Best For: Highly aggressive investors with deep belief in innovation, strong understanding of market risk, and a long time horizon. Ideal for those seeking asymmetric return profiles and willing to stomach short-term losses for long-term gains.

How to Choose: Matching the Strategy to Your Risk Profile

Choosing the right portfolio depends on:

- Your age and time horizon: Younger investors can typically afford more equity exposure.

- Your risk profile and investment objective: Are you a conservative, moderate, or aggressive investor?

- Your financial knowledge: Do you want to be hands-on or hands-off?

- Your financial goals: Are you investing for retirement, a home, or financial independence?

Risk Profile | Recommended Strategy | Characteristics |

Conservative | Graham | Focus on safer investments, capital protection, steady income |

Moderate | Bogle | Balanced approach with cost-efficient diversification |

Aggressive | Swensen | Higher exposure to growth assets and alternative investments |

Very Aggressive | Cathie Wood | High-conviction growth, disruptive tech focus, extreme volatility |

Pro Tip: If you’re saving in retirement accounts like IRAs or 401(k)s, consider how your allocation strategy interacts with tax advantages. A financial advisor can also help assess your portfolio risk and tailor a mix suited to your unique circumstances.

Whether you build your portfolio from individual stocks, mutual funds, or a diversified set of ETFs, consistency, clarity of purpose, and periodic rebalancing are critical to achieving your investment goals.

Build Smarter with Gainify

Once your portfolio is in place, maintaining and optimizing it over time is essential to achieving your long-term goals. Gainify offers a powerful toolkit that enables retail investors to operate with the precision of institutional professionals.

With Gainify, you can:

- Dive deep into individual stock analysis, from valuation metrics to profitability trends

- Benchmark companies by valuation multiples relative to sector and S&P 500 averages

- Explore a database of Wall Street analyst estimates for EPS, revenue, and EBITDA projections

- Run intrinsic value calculations to estimate fair prices for high-conviction positions

- Discover inspiration by browsing through curated top investor profiles, learning from how seasoned investors structure their portfolios

Whether you’re building around dividend payers, disruptive growth names, or value opportunities, Gainify empowers you to evaluate risk, estimate return, and refine your investment strategy – all in one platform.

Gainify brings the power of institutional tools into the hands of everyday investors, giving you the insights you need to manage risk and uncover opportunities with confidence.

Final Thoughts: One Size Doesn’t Fit All

There is no universal investment strategy. The right one for you depends on your personal circumstances, risk tolerance, and how hands-on you want to be. What matters most is that your portfolio is:

- Well-diversified across asset classes

- Aligned with your investment goals and risk profile

- Built on a sound, time-tested investment strategy with realistic expectations for potential returns

Whether you lean toward Graham’s safety-first approach, Bogle’s simplicity, or Swensen’s sophisticated diversification, the goal is the same: sustainable long-term growth with manageable risk.