The Bill Ackman stock portfolio represents a highly concentrated, high-conviction investment strategy executed through Pershing Square Capital Management, a publicly traded investment firm known for long holding periods and limited turnover. Rather than broad diversification, Ackman allocates capital into a small number of businesses where long-term fundamentals, governance quality, and capital allocation discipline can drive outsized returns over multi-year horizons.

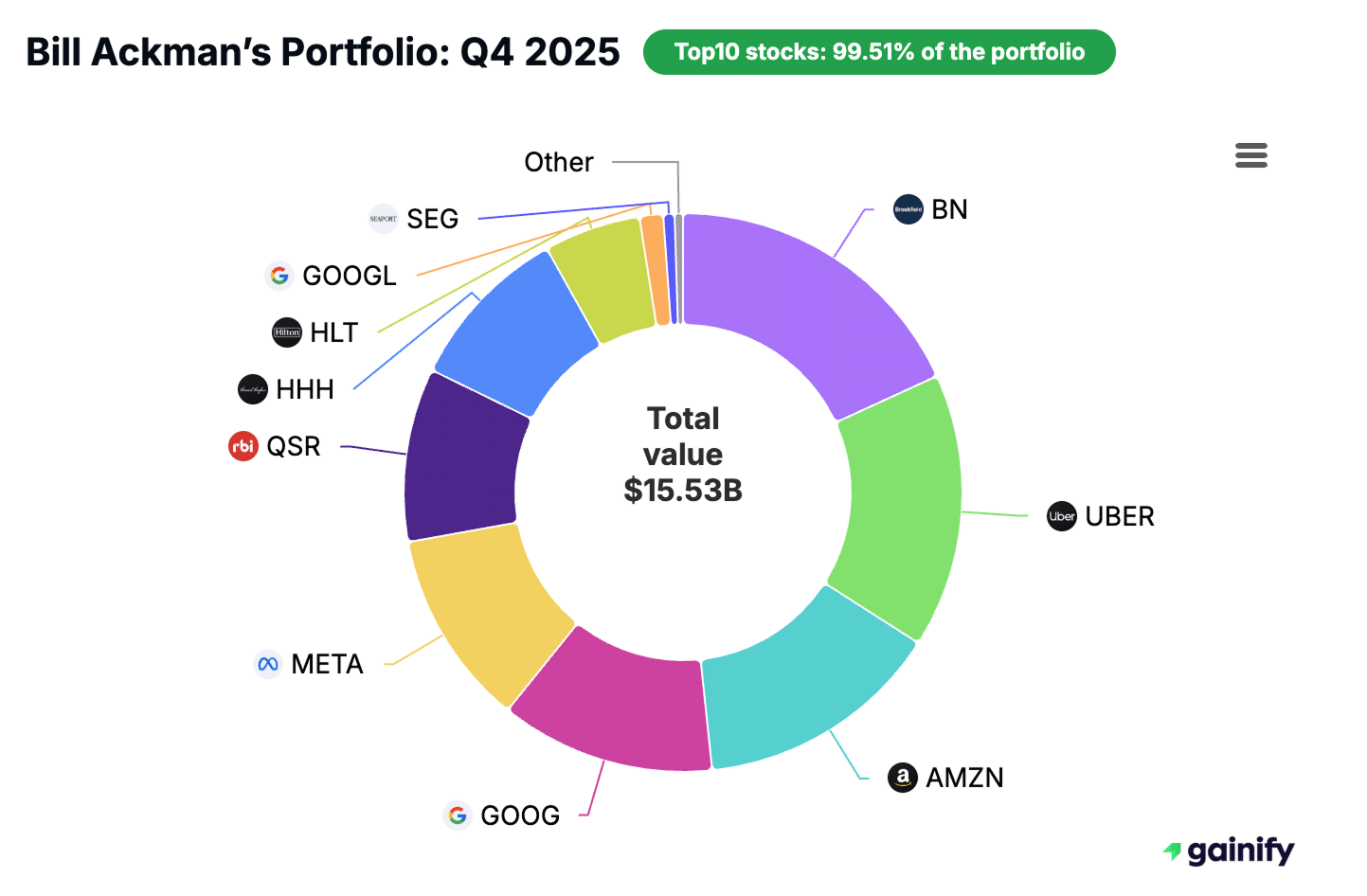

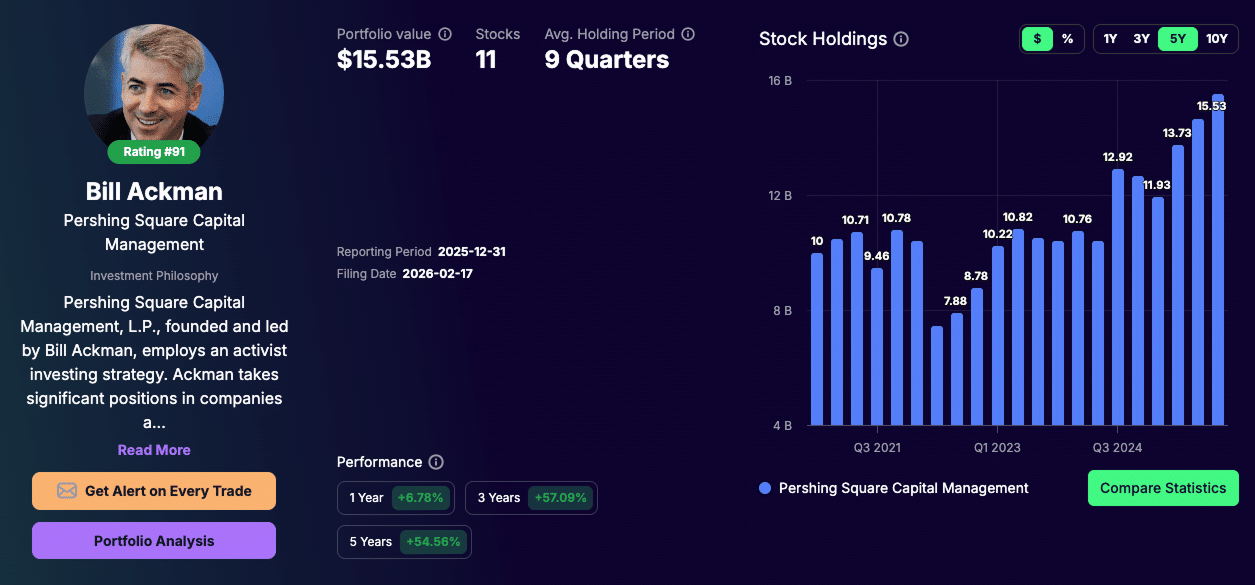

As of December 31, 2025, Pershing Square’s equity portfolio is valued at approximately $15.53 billion and consists of 11 core positions. Portfolio performance is therefore driven by a small number of large holdings, with Brookfield, Uber Technologies, and Amazon representing the three largest allocations by market value.

Q4 2025 was defined by a single, deliberate portfolio rotation. Pershing Square initiated a new position in Meta Platforms, immediately sizing it as a core holding rather than a peripheral allocation. The investment was partially funded by a full exit from Chipotle Mexican Grill, signaling a direct capital reallocation instead of incremental portfolio growth.

This article provides a complete breakdown of Bill Ackman’s stock portfolio, including current holdings, portfolio concentration, sector exposure, and recent trades disclosed in the February 17, 2026 SEC filing, with a focus on extracting practical insights for long-term, risk-aware investors.

Who Is Bill Ackman and How Pershing Square Invests

Bill Ackman is the founder and CEO of Pershing Square Capital Management, an investment firm that runs a deliberately concentrated, activist-oriented equity strategy. Ackman’s approach is built around the belief that long-term outperformance comes from owning a small number of high-quality businesses where fundamental value can be unlocked through operational improvement, governance changes, or disciplined capital allocation.

Pershing Square typically holds 10-15 core equity positions, with each investment sized to have a material impact on portfolio returns. This structure is intentional. Ackman has consistently argued that excessive diversification reduces accountability, weakens research depth, and dilutes conviction. Academic research published by Yale School of Management in 2016 supports this view, showing that concentrated portfolios managed with strong risk controls have historically generated higher active returns than broadly diversified active funds.

A defining element of Pershing Square’s strategy is active ownership. Unlike passive or purely fundamental investors, Ackman often engages directly with company leadership, boards, and shareholders. This engagement can include advocating for strategic shifts, cost discipline, asset divestitures, balance-sheet optimization, or governance reforms. The objective is not short-term price appreciation, but structural improvements that enhance long-term cash flow generation and intrinsic value.

Another distinguishing feature is capital patience. Pershing Square is structured to hold positions for multiple years, allowing investment theses to play out over full business cycles. This patience is reinforced by the firm’s permanent capital base, which reduces the pressure to trade based on short-term market volatility. As a result, periods of low activity, such as Q4 2025, are not a lack of decision-making but an expression of conviction that existing positions remain correctly sized and fundamentally intact.

In practice, Pershing Square’s investment model combines deep fundamental analysis, concentrated position sizing, activist engagement, and long holding periods. This framework explains both the limited number of holdings in the portfolio and the significance of any changes that do occur, as each new position or exit reflects a high level of confidence rather than tactical trading.

Bill Ackman’s Investment Philosophy: Precision, Influence, and Long-Term Value

William Albert Ackman has built his reputation as one of the most disciplined and outspoken top investors of his generation, and his Q4 2025 portfolio reflects that same philosophy in action. Rather than spreading capital across dozens of names, Pershing Square concentrates its bets, actively engages with management teams, and focuses on owning businesses with the potential to compound value over many years.

✅ Concentration and Conviction: Pershing Square holds just 11 positions, underscoring Ackman’s belief that true outperformance comes from focus, not diversification. His top two holdings, Uber and Brookfield, now represent nearly 34% of the portfolio, a level of concentration that reflects deep conviction in their long-term value creation.

✅ Activist Influence: Ackman is not a passive shareholder. Whether through board representation, operational input, or public advocacy, he has a long track record of pushing companies toward stronger governance and more efficient execution. This activist mindset remains central to Pershing’s strategy today.

✅ Willingness to Wait: worth remembering that Q3 2025 featured no new buys and no full exits, highlighting Ackman’s comfort with inactivity when his highest-conviction ideas remain intact.

✅ Focus on Durable Businesses: Pershing’s portfolio emphasizes companies with strong competitive moats, global brand recognition, and predictable cash flows. From iconic consumer chains like Burger King (via Restaurant Brands International) and Chipotle to platform businesses like Amazon and Alphabet, Ackman’s investments reflect a preference for businesses that can weather cycles while delivering consistent growth.

Top 11 Holdings in Bill Ackman’s Pershing Square Portfolio (Q4 2025)

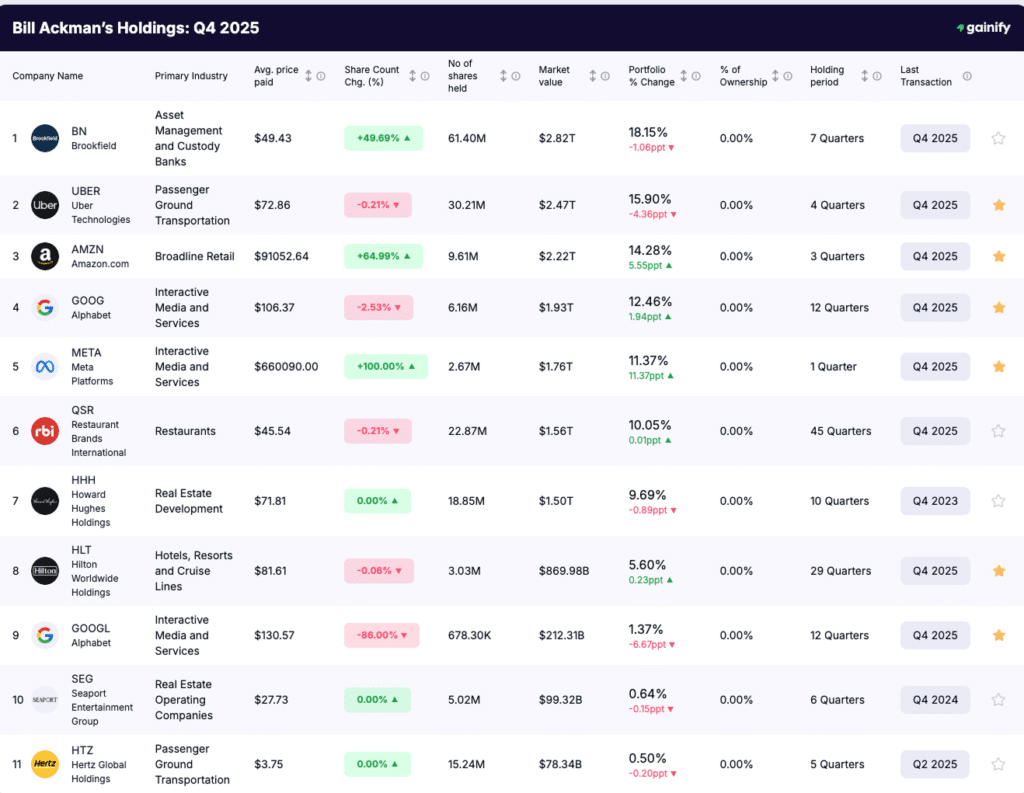

Bill Ackman’s stock portfolio at Pershing Square Capital Management remains highly concentrated, with each position selected to play a distinct role in long-term capital compounding. As of December 31, 2025, the portfolio consists of 11 publicly disclosed equity holdings, each sized to materially impact overall performance.

# | Company | Market Value | Portfolio Weight | Investment Rationale |

|---|---|---|---|---|

1 | Brookfield (BN) | $2.82B | 18.15% | Global asset manager with inflation-linked real assets and long-duration contracted cash flows. |

2 | Uber Technologies (UBER) | $2.47B | 15.90% | Scaled mobility platform transitioning into durable free cash flow generation. |

3 | Amazon (AMZN) | $2.22B | 14.28% | Global commerce and cloud infrastructure leader supported by AWS operating leverage. |

4 | Alphabet (GOOG) | $1.93B | 12.46% | Dominant digital advertising platform with data scale and AI-driven margin expansion. |

5 | Meta Platforms (META) | $1.76B | 11.37% | High-margin advertising business with improving capital discipline and cash flow recovery. |

6 | Restaurant Brands International (QSR) | $1.56B | 10.05% | Asset-light franchise model generating predictable, recurring royalty income. |

7 | Howard Hughes Holdings (HHH) | $1.50B | 9.69% | Long-duration real estate platform with scarce land assets and embedded development value. |

8 | Hilton Worldwide (HLT) | $869.98M | 5.60% | Asset-light hospitality operator benefiting from global travel demand and pricing power. |

9 | Alphabet (GOOGL) | $212.31M | 1.37% | Secondary exposure to Alphabet’s advertising and services ecosystem. |

10 | Seaport Entertainment Group (SEG) | $99.32M | 0.64% | Niche real estate and entertainment assets with redevelopment optionality. |

11 | Hertz Global Holdings (HTZ) | $78.34M | 0.50% | Asset-backed transportation business with turnaround and asset revaluation potential. |

Bill Ackman’s Q4 2025 Portfolio Changes

In Q4 2025, Bill Ackman made one clear structural decision inside Pershing Square’s stock portfolio: he exited Chipotle Mexican Grill, reduced its Alphabet position and redeployed that capital into a new core position in Meta Platforms and added to Brookfield and Amazon . Outside of this rotation, activity was limited to incremental adds and minor trims.

The quarter reflects deliberate capital reallocation rather than broad repositioning.

Brookfield (BN): Bill Ackman’s Largest and Most Structural Holding

In Q4 2025, Bill Ackman materially increased his Brookfield position, raising the share count by 49.69% and deploying approximately $929.66 million. This was one of the largest capital allocations in the quarter.

Despite the substantial increase in shares, Brookfield’s portfolio weight declined by 1.1 percentage points. This was not the result of selling or reduced conviction. It occurred because other holdings, particularly Amazon and Meta, grew faster in relative value, diluting Brookfield’s percentage of total assets.

According to Pershing Square’s investor presentation, Brookfield functions as a permanent capital compounder, anchored in fee-related earnings, long-duration real assets, and inflation-linked cash flows. Ackman uses Brookfield as a balance-sheet stabilizer and capital recycling engine, not as a position that needs continuous weight optimization.

The Q4 activity reflects intentional scaling of a core holding rather than a tactical bet. Brookfield remains the largest and most structural position in the portfolio, designed to anchor returns across market cycles rather than maximize short-term performance.

Amazon (AMZN): Increased Allocation in Q4

In Q4 2025, Bill Ackman increased Pershing Square’s Amazon position by approximately $866 million, reinforcing Amazon’s role as a core holding and moving it firmly into the top tier of the portfolio by weight. This was an active capital allocation decision rather than a passive effect of market appreciation.

Pershing Square’s 2026 Annual Investor Presentation frames Amazon as a long-duration compounder anchored by AWS-driven cash generation and improving operating leverage across its global retail and logistics network. The firm emphasizes normalized free cash flow as the primary valuation driver, rather than near-term earnings volatility.

The additional capital deployed in Q4 signals that Ackman viewed Amazon’s forward return profile as sufficiently attractive to warrant incremental investment within a highly concentrated portfolio. This increase, alongside Brookfield’s continued prominence and Meta’s new entry, contributed to the reordering of the portfolio’s top positions without altering its overall concentration discipline.

Meta Platforms (META): A High-Conviction Entry Funded by Rotation

In Q4 2025, Bill Ackman opened a new position in Meta Platforms, and he did so at meaningful size. Pershing Square invested roughly $1.79 billion in Meta at an average price of $667.77, making it one of the fund’s largest holdings immediately. By the end of the quarter, Meta represented 11.37% of the portfolio.

This was not a gradual entry or an opportunistic trade. The Meta position was funded largely through the complete exit from Chipotle Mexican Grill, making the move a clear portfolio rotation rather than an expansion of overall risk. Ackman effectively shifted capital from a mature consumer business into a platform with stronger operating leverage and cash flow scalability.

Pershing Square’s investor presentation highlights Meta as a business that has moved past its heavy investment phase and into a period of sustained free cash flow generation. Advertising demand across Meta’s platforms now converts into cash at scale, while disciplined cost controls and share buybacks reinforce long-term shareholder returns.

Meta’s rapid rise into the top tier of the portfolio reflects confidence in its durable earnings power and capital discipline, not a short-term view on advertising cycles. For Ackman, Meta fits the same profile as his largest holdings: dominant platforms, strong cash generation, and the ability to compound value over many years.

Chipotle Mexican Grill (CMG): A Full Exit After Thesis Maturity

Chipotle Mexican Grill was fully exited in Q4 2025 after a long holding period. Pershing Square’s materials describe the decision as a function of valuation compression rather than operational deterioration. Chipotle delivered on its original thesis through margin expansion, unit growth, and pricing power, but forward returns no longer justified its opportunity cost.

Studies from the CFA Institute on portfolio turnover show that disciplined exits following thesis completion improve long-term capital efficiency. The Chipotle sale illustrates this principle and provided the funding base for the Meta acquisition.

Alphabet (GOOG / GOOGL): Reducing Position Size While Maintaining Core Conviction

During Q4 2025, Bill Ackman reduced exposure to Alphabet across both share classes, with a more pronounced cut in Class A shares. The adjustment was driven by capital allocation and portfolio concentration management, not by a shift in Alphabet’s long-term investment case.

Alphabet remains a core holding within Pershing Square’s portfolio. In the 2026 Annual Investor Presentation, the company is positioned as a dominant digital platform with durable free cash flow, a net cash balance sheet, and operating leverage tied to artificial intelligence deployment across Search and Google Cloud. The presentation emphasizes Alphabet’s ability to fund innovation internally while returning capital through disciplined buybacks.

The Q4 reduction primarily reflects funding for the new Meta Platforms position and a rebalancing of exposure following strong performance, rather than diminished confidence in Alphabet’s competitive position. Ackman continues to view Google’s control of search distribution, advertising demand, and AI-enabled infrastructure as central to its long-term earnings power.

Pershing Square’s Key Portfolio Moves in Q3 2025

Unlike Q1 and Q2, Q3 2025 was defined by restraint rather than action. There were:

- No new positions initiated

- No full exits

- Only marginal trims across a handful of holdings

This lack of activity is itself informative. Ackman saw no reason to redeploy capital or reduce exposure meaningfully.

Small Trims (Portfolio Maintenance Only)

- Alphabet Class A (GOOGL): -9.68%, ~$109M trimmed

- Brookfield (BN): -0.34%, ~$6M trimmed

- Restaurant Brands International (QSR): -0.37%, ~$6M trimmed

- Uber Technologies (UBER): -0.10%, ~$3M trimmed

These adjustments are immaterial relative to position size and reflect portfolio housekeeping rather than changes in conviction.

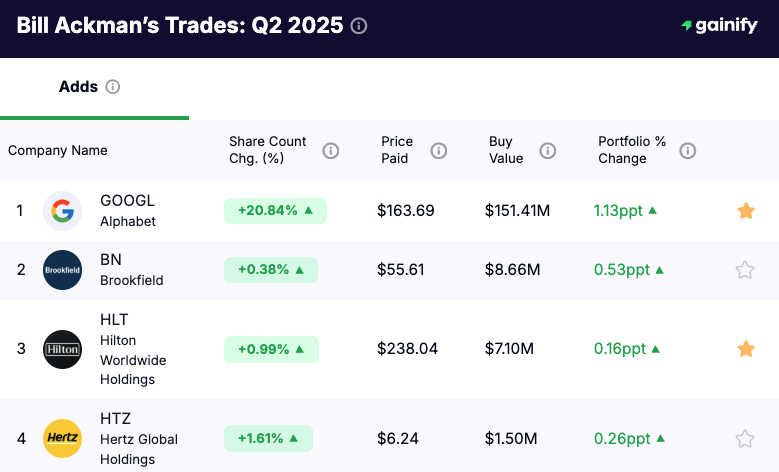

Bill Ackman’s Portfolio Key Moves in Q2 2025

Uber Technologies (NYSE: UBER): Was the Largest Holding in Q2 2025

In Q2 2025, Uber remained Pershing Square’s largest position, valued at $2.83 billion, or 20.59% of the portfolio. Ackman held 30.3 million shares, unchanged from the prior quarter, at an average split-adjusted price of $72.86.

Uber continued to be one of Ackman’s highest-conviction investments during the quarter. Its dominant position in global mobility, combined with the scale of Uber Eats and freight operations, provided diversified revenue streams. Ackman viewed Uber as a cash flow compounder with strong upside potential, even in a slowing economy.

Amazon (NASDAQ: AMZN): A Major New Buy

One of the most notable moves in Q2 2025 was Ackman’s new $1.28 billion investment in Amazon. He purchased 5.82 million shares at an average price of $197.89, immediately giving Amazon a 9.31% portfolio weight and placing it among Pershing Square’s top five holdings.

This entry signaled Ackman’s confidence in Amazon’s ability to deliver long-term growth through its dominant e-commerce platform and highly profitable AWS cloud division. The addition diversified Pershing Square’s consumer and technology exposure while aligning with Ackman’s preference for businesses with durable competitive advantages.

Canadian Pacific (NYSE: CP): A Complete Exit

In contrast, in Q2 2025 Ackman fully exited his $1.14 billion position in Canadian Pacific Kansas City, a holding he had owned for seven quarters. This cut reduced portfolio exposure by nearly 9 percentage points.

The decision to sell CP appears tied to capital reallocation, most notably funding the new Amazon buy. While CP remains a high-quality rail operator, Ackman clearly saw greater long-term upside in rotating into AMZN.

Incremental Adds to Existing Holdings

Ackman also made smaller increases in several positions:

- Alphabet Class A (NASDAQ: GOOGL): +20.84% ($151M added, +1.13 ppt).

- Brookfield (NYSE: BN): +0.38% ($8.7M added, +0.53 ppt).

- Hilton Worldwide (NYSE: HLT): +0.99% ($7.1M added, +0.16 ppt).

- Hertz (NASDAQ: HTZ): +1.61% ($1.5M added, +0.26 ppt).

These steady increases reflect Ackman’s conviction in long-term compounders across real estate, hospitality, and tech.

Pershing Square’s Key Portfolio Moves in Q1 2025

Uber Technologies (UBER): The New Largest Holding

Ackman revealed a massive new investment in Uber Technologies, purchasing 30.3 million shares of common stock at an average split-adjusted price of $72.86, immediately making it the largest holding in his portfolio at 18.50%.

This bold addition follows Uber’s volatile performance after earnings, yet Ackman views this as a temporary speed bump rather than a long-term concern. Uber’s strong balance sheet, dominant position in global mobility, and its ability to generate a 5% free cash flow yield make it one of his most compelling stock picks.

“Uber is one of the best-managed and highest-quality businesses in the world, still trading at a massive discount to its intrinsic value,” Ackman said during Pershing’s annual investor presentation.

Uber’s massive user base of 180 million active users, coupled with its expanding logistics and delivery operations, positions it perfectly for sustained growth even in a challenging American economy. For Ackman, this is an ideal play on critical supply chain roles and the future of global transportation.

Nike (NKE): A Strategic Exit With Financial Engineering

While it looked like Ackman exited his $1.4 billion position in Nike, he actually executed a sophisticated financial strategy. Pershing converted its stake into deep in-the-money call options, maintaining upside exposure while freeing up capital for new investments like Uber and Hertz.

- Why this matters for investors: This move highlights how alternative asset managers like Ackman use financial engineering to achieve better returns while minimizing current liabilities.

- This strategy could lead to substantial profits if Nike’s stock price rises, with potential returns as much as 2x higher than holding the equity directly.

Hertz (HTZ): A High-Stakes Bet on Real Assets

Post-Q1, Ackman revealed a new and sizable investment in Hertz Global Holdings, acquiring a 19.8% ownership stake through direct stock purchases of 12.7 million shares. This bold move added Hertz as a new core holding within Pershing Square’s portfolio

Ackman believes Hertz is uniquely well-positioned to benefit from the current global automotive sector dynamics. With rising auto tariffs and higher used car prices, Hertz’s fleet of over 500,000 vehicles, valued at approximately $12 billion, provides a significant asset advantage.

- Even a 10% increase in used car prices could deliver a $1.2 billion gain on its fleet, dramatically improving the company’s financial performance.

- Ackman also sees Hertz as a future partner for Uber in deploying autonomous vehicles, a partnership that could create new business opportunities and unlock further value.

Despite past challenges, including a stock market crash during the pandemic and a restructuring under new CEO Gil West, Hertz is implementing a powerful operational turnaround plan focused on reducing costs and enhancing profitability, exactly the type of situation Ackman has capitalized on repeatedly throughout his career.

Real Estate and Howard Hughes Holdings

Ackman remains deeply committed to real estate investments, particularly through his long-standing position in Howard Hughes Holdings Inc. (HHH). This reflects his value-oriented real estate themes, betting on properties with high barriers to entry and long-term growth opportunities.

With real estate remaining a critical pillar of the American economy, Howard Hughes offers exposure to urban development projects and commercial real estate that can generate strong returns on a consistent basis. Despite headwinds in the hospitality sector, Ackman remains optimistic about real estate’s role in driving his fund’s future performance.

Bill Ackman Stock Portfolio Performance

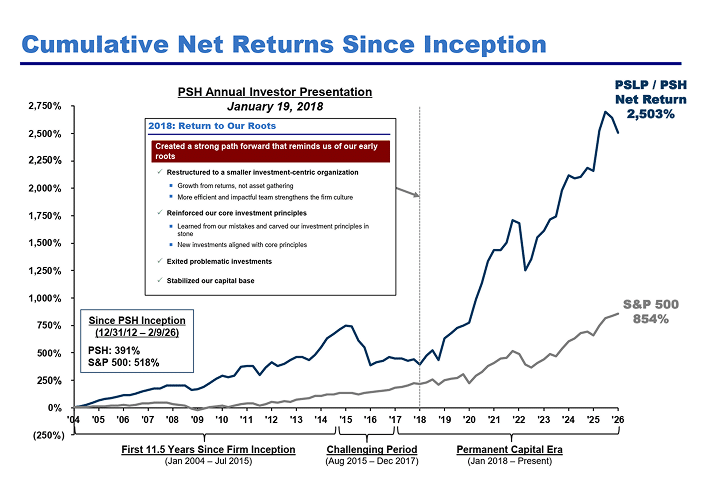

Bill Ackman’s stock portfolio performance is defined by long-term net returns generated through Pershing Square’s concentrated equity strategy, measured primarily through Pershing Square Holdings net asset value. The strategy targets absolute capital compounding over full market cycles.

Since firm inception in 2004 through February 2026, Pershing Square generated a cumulative net return of 2,503%, compared with 854% for the S&P 500. This reflects sustained long-term outperformance despite periods of elevated volatility.

Since Pershing Square Holdings inception in December 2012, cumulative net returns reached 391%, versus 518% for the S&P 500. The relative gap in this period is largely attributable to drawdowns during 2015–2017 from several concentrated positions.

After a structural reset in 2018, Pershing Square entered what it calls its Permanent Capital Era. From 2018 through 2025, Pershing Square Holdings delivered an 8-year compound annual net return of 22.6%, compared with 14.3% for the S&P 500. Over extended horizons, Ackman’s portfolio has produced materially higher compounding than the broad equity market, with returns concentrated in multi-year cycles.

Final Takeaways: What Bill Ackman’s Q4 2025 Portfolio Signals

Bill Ackman’s Q4 2025 positioning reflects selective action rather than broad portfolio change.

📌 One high-conviction addition was made. Pershing Square initiated a meaningful new position in Meta Platforms, funded primarily through the full exit from Chipotle Mexican Grill, signaling a deliberate rotation rather than portfolio expansion.

📌 Portfolio concentration remained intact. Core holdings such as Brookfield, Uber, Alphabet, Amazon, and Restaurant Brands continued to anchor the portfolio, reinforcing Ackman’s preference for a small number of structurally advantaged businesses.

📌 Trims were tactical, not thematic. Reductions across Alphabet share classes and other positions reflected capital allocation and balance management, not diminished conviction in underlying business quality.

Overall, the portfolio demonstrates a disciplined approach: concentrated ownership, patience through volatility, and decisive action when a higher-conviction opportunity emerges.

For everyday investors, the lesson is clear: you don’t need 50 stocks to outperform the market, just the right 10 or 11 held with conviction.