Healthcare stocks are entering 2026 with renewed momentum after several years of lagging the broader market. The sector has historically acted as a defensive anchor for investors, but the next cycle is shaping up to be different. Innovation is accelerating, utilization is normalizing, and the world is relying more heavily on medicine, diagnostics, robotics and chronic care than any time in history.

From breakthrough obesity treatments to robotic-assisted surgery and premium biologics, the industry is undergoing a structural shift that is both scientific and commercial.

For investors, this creates an unusual combination. Healthcare offers the stability of recurring demand and the upside of a technology driven innovation cycle.

Below is an investor-focused breakdown of seven healthcare stocks that stand out heading into 2026. Each one has meaningful scale, clear catalysts and long-term earnings visibility, positioning them to benefit from one of the most dynamic periods the sector has seen in decades.

Highlights

- Healthcare demand and innovation are accelerating into 2026, setting up a stronger performance cycle after years of underperformance.

- The seven healthcare stocks in this report combine durable cash flow with clear growth catalysts in obesity, oncology, devices and robotics.

- Valuations remain attractive relative to fundamentals, creating a compelling entry point for long-term investors.

Why Healthcare Matters for Investors in 2026

Healthcare enters 2026 with one of the strongest fundamental setups of any major sector. After several years of disrupted utilization, elevated inflation and weak sentiment, the industry is now benefiting from stabilizing costs, accelerating innovation and a global demographic tailwind that is impossible to ignore. Four structural forces stand out and help explain why investors are revisiting the sector with renewed conviction.

A. Demand is rising across every region

Global healthcare spending continues to expand as populations age and chronic diseases increase. The United Nations projects the number of people aged 60 and older to grow by more than 250 million this decade, while diabetes, obesity and cardiovascular conditions remain on multi-year growth trajectories. These are needs-based categories that do not decline in recessions, resulting in stable, recurring demand for healthcare companies.

B. Innovation is accelerating across multiple fronts

Very few sectors enter 2026 with such a broad wave of breakthroughs. Obesity treatments are reshaping chronic-care economics. Oncology pipelines are producing new targeted therapies. Gene therapy is maturing into commercial viability. Diagnostics and surgical robotics are transforming how procedures are performed. This level of simultaneous innovation has not been seen in healthcare for more than a decade.

C. Profitability is recovering as costs normalize

The inflation shock of 2022 to 2024 pressured margins across pharmaceuticals, medical devices and care providers. That period has passed. Supply chains have stabilized, staffing shortages have eased and elective procedures are back to pre-pandemic volume levels. As a result, margins are rebuilding across much of the sector heading into 2026.

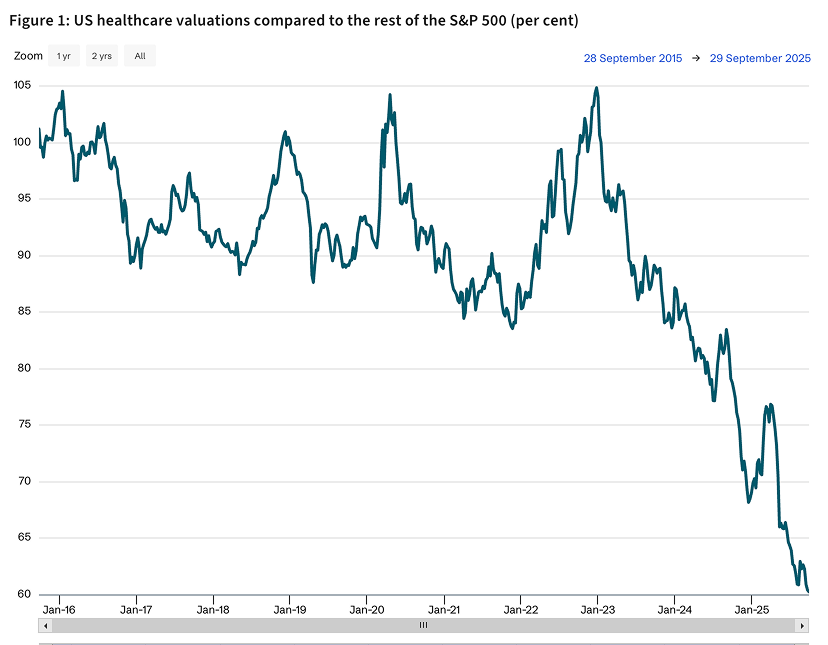

D. Valuations remain attractive relative to fundamentals

Despite improving economics, healthcare still trades at a discount to technology and consumer discretionary on forward earnings multiples. At the same time, the sector offers stronger earnings stability and lower volatility. For investors, this combination of discounted valuation and rising profitability creates a compelling entry point.

Top 7 Healthcare Stocks for 2026

The healthcare sector is broad, diverse and often difficult to evaluate without drilling into the companies that actually drive earnings and innovation.

Within pharmaceuticals, medical devices, and managed care, only a handful of names combine scale, durability and clear catalysts heading into 2026. The following seven healthcare stocks stand out not only because of their size but because their businesses align with the biggest structural trends in global healthcare. These are the companies with defensible positions, strong balance sheets and enough momentum to shape the direction of the sector in the years ahead.

Below is a detailed, investor-focused view of each one, starting with the company that has defined the healthcare narrative for the last three years.

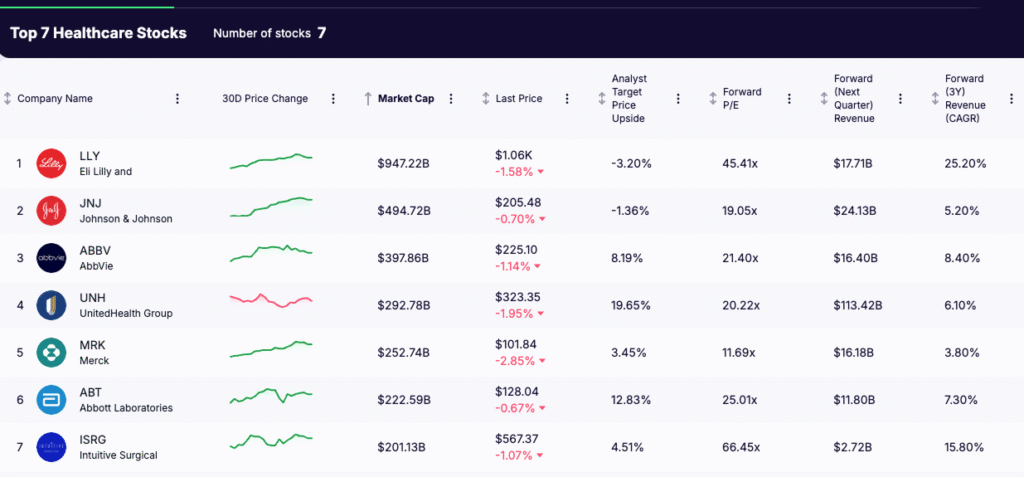

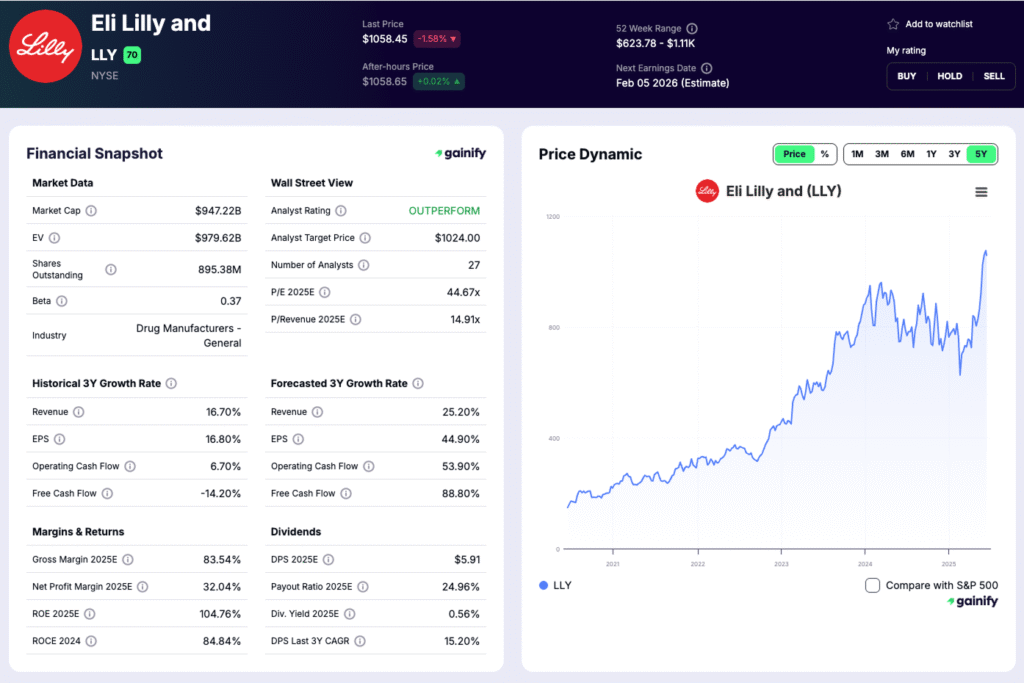

1. Eli Lilly (LLY)

Market cap: $947B

Forward P/E: 45.4x

Analyst target upside: -3.20% (negative)

Why Lilly Dominates the Conversation

Eli Lilly is driving the single most powerful revenue engine in global pharmaceuticals. Its portfolio continues to redefine chronic care, supported by scale, data and execution that the rest of the industry is struggling to match. In the most recent quarter, revenue grew 54 percent, U.S. incretin share reached 57.9 percent, and full-year guidance was lifted by more than 2 billion dollars. These numbers reflect not momentum, but market leadership at a scale rarely seen in healthcare.

What Makes Lilly Unique

- Demand for Mounjaro and Zepbound exceeds supply, forcing accelerated global manufacturing buildout

- Pipeline depth across obesity, Alzheimer’s, oncology and metabolic disease positions Lilly for long-duration growth

- Growth rate and operating leverage that resemble a high-growth technology platform

- Recurring therapy cycles that support multi-year visibility and predictable earnings power

Recent Signals

Lilly continues to expand capacity across U.S. and international facilities to close the supply gap, a critical bottleneck for the next several years. Late-stage obesity candidates delivered strong clinical data, reinforcing category leadership. Alzheimer’s therapy Kisunla secured new approvals, diversifying the portfolio and reducing overreliance on a single franchise.

Investment View

Lilly remains the clearest high-conviction growth asset in global healthcare. It combines category dominance, validated clinical data, proven demand elasticity and a pipeline that extends the narrative well beyond the current obesity cycle. Few companies anywhere in the market can sustain this level of growth at this level of scale.

Key Watchouts

Supply availability remains the main constraint on near-term upside. Competitive pressure will intensify as more obesity therapies advance through late-stage development. Regulatory scrutiny is expected to increase due to the size of the obesity market and the cost burden on global health systems. Valuation sensitivity is high, given the strength of the current narrative.

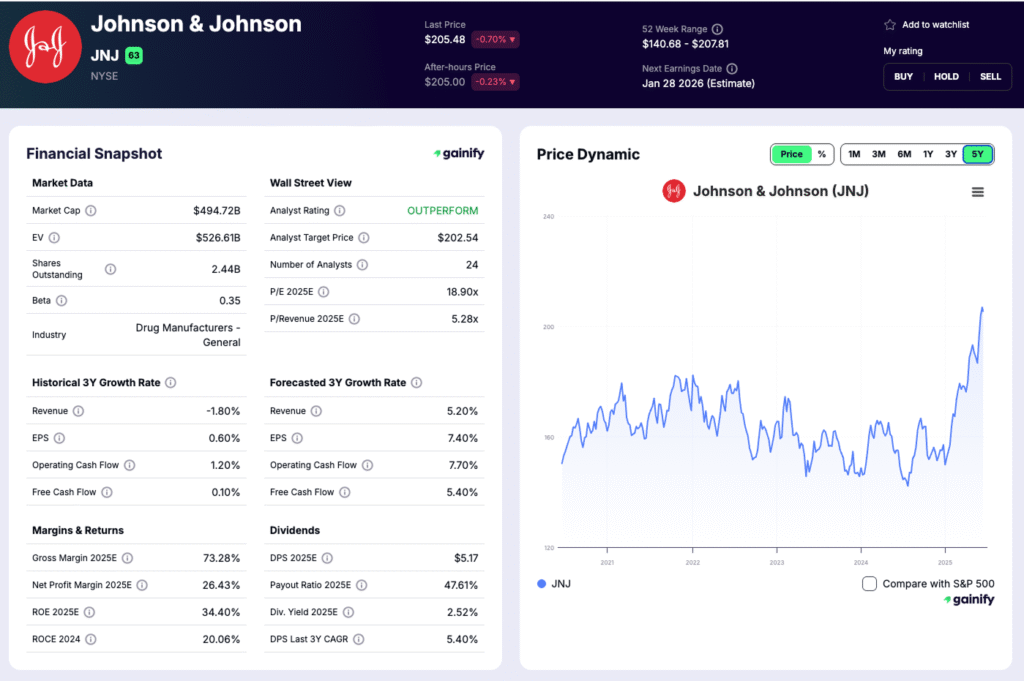

2. Johnson & Johnson (JNJ)

Market cap: $495B

Forward P/E:19.1x

Analyst target upside: -1.36% (negative)

Why Johnson and Johnson Matters in 2026

Johnson and Johnson enters 2026 with one of the strongest combinations of scale, balance and pipeline depth in global healthcare. The company generated 24.0 billion dollars in Q3 2025 revenue, up 6.8 percent year over year, with both Innovative Medicine and MedTech growing at the same 6.8 percent rate. Adjusted EPS increased 15.7 percent to 2.80 dollars as margins improved and the post-Kenvue structure began to show clearer operating leverage. These results mark a decisive shift toward renewed growth across both major business segments.

What Makes JNJ Unique

- A balanced mix of biopharma and MedTech that consistently produces more than 24 billion dollars per quarter

- Strongest growth coming from oncology and neuroscience with multiple double-digit brands including Darzalex, Carvykti and Tecvayli

- Broad MedTech momentum, led by cardiovascular, robotics and electrophysiology, supported by new products such as Impella, VARIPULSE and TECNIS PureSee

- A deep late-stage pipeline across immunology, oncology and neuroscience that supports multi-year earnings visibility

Recent Signals

Johnson and Johnson’s latest quarter confirmed a clear re-acceleration. Worldwide sales grew 6.8 percent, driven by double-digit strength in Europe and stable performance in the United States. Innovative Medicine delivered 15.6 billion dollars in revenue even while absorbing one of the largest biosimilar headwinds in the sector, reflecting the depth of its oncology and neuroscience franchises. MedTech reported 8.4 billion dollars in revenue with strong contributions from cardiovascular devices and surgical technologies. Adjusted EPS grew nearly sixteen percent as operating margins expanded.

Investment View

Johnson and Johnson offers one of the most resilient earnings profiles in healthcare. Its diversified model, strong pipeline progress and improving MedTech momentum create a compelling mix of stability and growth. With a cleaner portfolio, rising contribution from oncology and neuroscience and a steady cadence of MedTech innovation, JNJ stands out as one of the highest quality defensive compounders heading into 2026.

Key Watchouts

Patent cliffs in immunology remain a headwind and require continued strength from oncology and neuroscience. U.S. pricing reform, reimbursement pressure and international procurement policies can weigh on margins. Regulatory scrutiny is increasing across biologics, cardiovascular devices and robotics as JNJ expands into higher complexity categories. Competitive intensity across oncology, immunology and MedTech remains elevated.

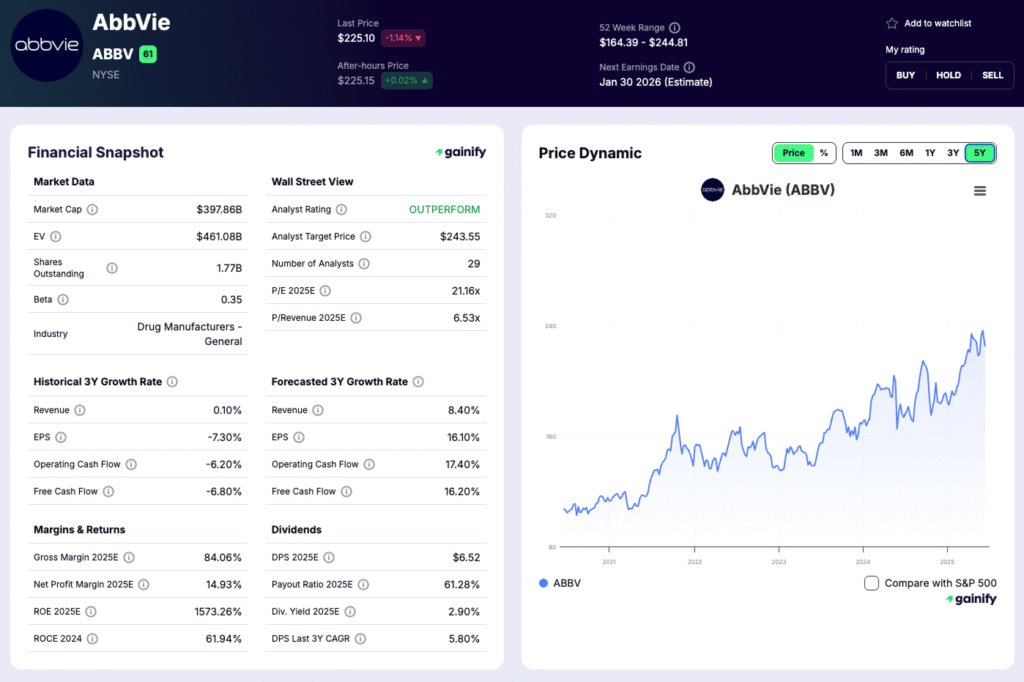

3. AbbVie (ABBV)

Market cap: $398B

Forward P/E: 21.4x

Analyst target upside: +8.2%

Why AbbVie Matters in 2026

AbbVie enters 2026 with a far stronger foundation than the market narrative implies. The company has successfully moved beyond the Humira patent cycle and now anchors its growth on two next-generation immunology franchises that together generate more than 6 billion dollars per quarter. Neuroscience has become a second engine, growing at double-digit rates and adding meaningful diversification. The result is a business that has transitioned from dependence on a single asset to a multi-pillar model with clearer visibility, stronger balance, and more durable long-term earnings power.

What Makes AbbVie Unique

- Immunology leadership anchored by two blockbuster franchises that together exceed 6.8 billion dollars per quarter

- Neuroscience portfolio growing more than 20 percent with 2.8 billion dollars in quarterly revenue

- Clear operating leverage as Humira declines stabilize and high-margin franchises expand

- A balanced late-stage pipeline spanning immunology, oncology, neuroscience and aesthetics

Recent Signals

Q3 2025 was AbbVie’s strongest post-Humira quarter.

- Worldwide revenue increased 9.1 percent, with operational growth of 8.4 percent

- Immunology delivered nearly 8 billion dollars with double-digit growth across Skyrizi and Rinvoq

- Neuroscience grew more than 20 percent year over year to 2.8 billion dollars

- Global Humira revenue remained almost 1.0 billion dollars despite biosimilar competition

- Operating momentum supported higher full-year revenue and earnings guidance

The core message is simple: the new AbbVie is now driven by high-growth immunology and neuroscience, not by Humira.

Investment View

AbbVie is transitioning into one of the most diversified and cash-generative large-cap pharmaceuticals. The Skyrizi and Rinvoq franchises alone can support multi-year top-line and margin expansion, while neuroscience provides a second growth pillar. With a forward P/E well below other growth-oriented pharma peers and strong free-cash-flow conversion, AbbVie offers a compelling risk-reward profile entering 2026.

Key Watchouts

Humira erosion continues to pressure year-over-year comparisons, although the bulk of the decline is now behind the company. Pricing reform and reimbursement pressure in the United States remain meaningful risks. Competition in immunology is intensifying as more selective therapies enter the market. Regulatory scrutiny will remain elevated across immunology, neuroscience and aesthetics as AbbVie expands its pipeline and category exposure.

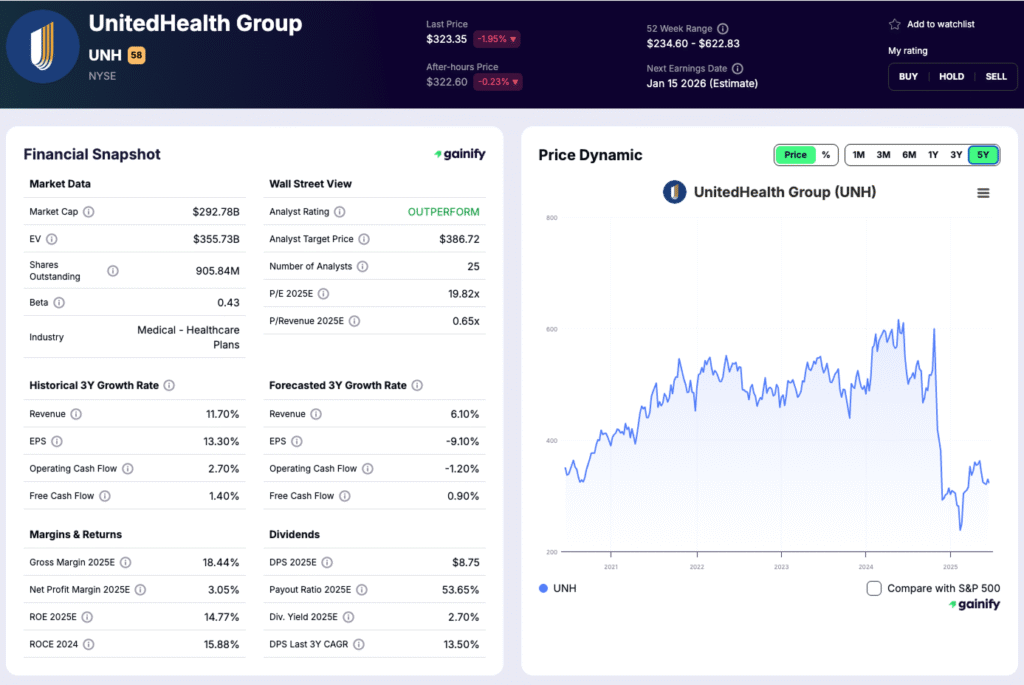

4. UnitedHealth Group (UNH)

Market cap: $293B

Forward P/E: 20.2x

Analyst target upside: 19.65%

Why UnitedHealth Matters in 2026

UnitedHealth enters 2026 as the most comprehensive healthcare platform in the world, combining insurance, pharmacy services, care delivery, analytics and physician networks under one operating system. Annualized revenue now exceeds 400 billion dollars and continues to compound at a pace uncommon for a company of this scale. Utilization trends stabilized through 2025, Optum performance recovered, and the company continued adding physicians at one of the fastest rates in U.S. healthcare. The result is a business with recurring demand, multi-segment diversification and unmatched competitive reach.

What Makes UNH Unique

- A vertically integrated model spanning insurance, pharmacy benefit management, data analytics and care delivery

- Optum Health serving more than 100 million patients with accelerating value-based care adoption

- UnitedHealthcare enrollment scale that provides strong pricing leverage and predictable cash generation

- One of the strongest long-term earnings records in the S&P 500 with consistent double-digit EPS compounding

Recent Signals

UnitedHealth delivered another year of resilient performance despite sector volatility.

- Revenue continued to grow across both UnitedHealthcare and Optum, supported by stable medical cost trends and strong membership retention

- Optum Health posted double-digit revenue growth driven by higher patient engagement and expanding physician networks

- Optum Rx improved profitability as its specialty pharmacy capabilities scaled

- Cash from operations remained strong and continued to fund physician acquisitions, technology investments and shareholder returns

The trajectory into 2026 reflects a company that has absorbed sector pressure and regained operating clarity.

Investment View

UnitedHealth remains one of the highest-quality compounders in global healthcare. The breadth of its platform, the scale of its data, the recurring nature of its revenue streams and the steady growth of its care delivery businesses create a defensible and diversified earnings engine. With normalized utilization, stronger Optum performance and long-term visibility on membership growth, UNH offers a compelling mix of stability, consistency and structural growth.

Key Watchouts

Regulatory pressure remains the primary risk, including Medicare Advantage rate setting, PBM oversight and scrutiny of vertical integration. Medical cost trends must remain stable for margins to hold. Competition in value-based care is increasing as more players enter physician management and specialty care. Large-scale integration also requires consistent operational execution.

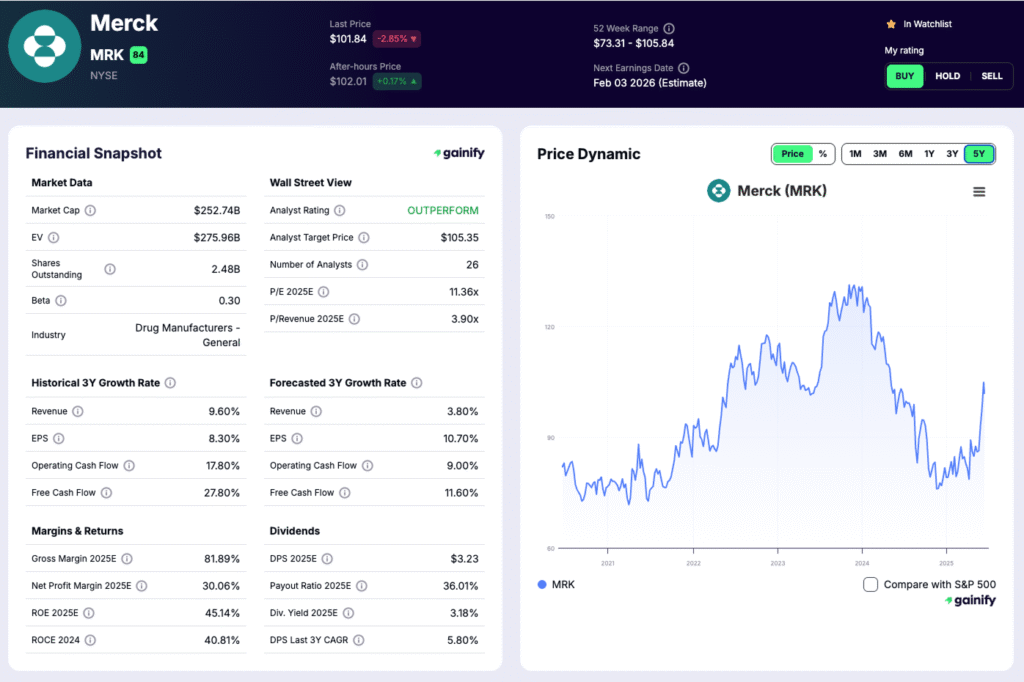

5. Merck (MRK)

Market cap: $253B

Forward P/E: 11.7x

Analyst target upside: 19.65%

Why Merck Matters in 2026

Merck enters 2026 in one of its strongest strategic positions in years. The company continues to dominate global oncology through Keytruda, one of the most successful drugs in pharmaceutical history, while rapidly expanding into next-generation modalities across oncology, vaccines, cardiometabolic disease and immunology. Procedure volumes have normalized, launch momentum is accelerating and Merck now has one of the most clinically validated pipelines in large-cap pharma. The company’s growth profile remains unusually durable due to the breadth of its cancer indications and its expanding portfolio of late-stage assets.

What Makes Merck Unique

- Oncology leadership centered around Keytruda, with expanding penetration across new tumor types and earlier lines of therapy

- Strong vaccine portfolio with durable global demand, including HPV and pediatric vaccines

- Extensive late-stage pipeline spanning oncology, cardiometabolic disease, infectious disease and immunology

- High visibility on long-term growth driven by broad clinical programs and established commercial execution

Recent Signals

Merck’s results through 2025 confirm a company steadily strengthening its growth foundation.

- Oncology continued to deliver strong momentum as indication expansions lifted both global volume and earlier-stage adoption

- The vaccine portfolio grew solidly, benefiting from international demand and strong immunization cycles

- Pipeline progression remained steady with multiple pivotal trials reading out and regulatory submissions advancing

- Cash generation stayed strong, allowing Merck to continue investing in R&D, business development and manufacturing scale

Merck’s performance signals sustained therapeutic leadership rather than reliance on a single product cycle.

Investment View

Merck remains one of the clearest long-duration growth stories in global biopharma. The company’s oncology franchise provides a level of earnings visibility unmatched by most competitors, while its vaccines and cardiometabolic assets offer steady diversification. With a reasonable valuation, high free-cash-flow generation and one of the most productive pipelines in the industry, Merck stands out as a high-quality core holding for 2026.

Key Watchouts

Keytruda’s long-term patent exposure will require continued pipeline execution and portfolio expansion. Competitive intensity in oncology continues to rise as more immunotherapies enter late-stage development. Pricing pressure and reimbursement headwinds remain consistent risks across major drug categories. Regulatory scrutiny will shape development timelines across oncology, vaccines and emerging therapeutic areas.

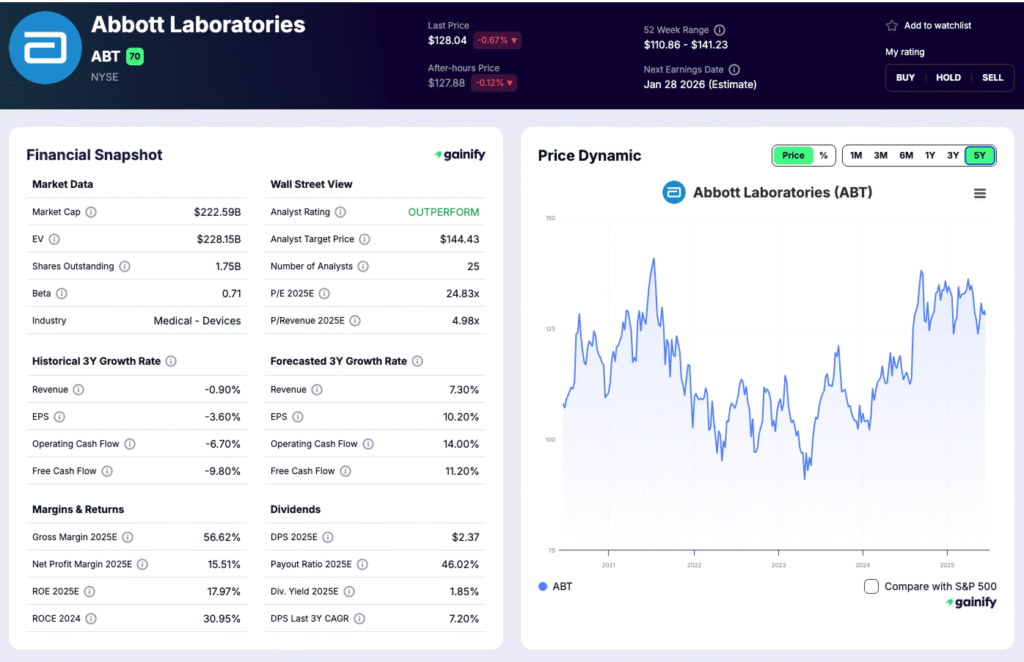

6. Abbott Laboratories (ABT)

Market cap: $222B

Forward P/E: 25.0x

Analyst target upside: 12.83%

Why Abbott Matters in 2026

Abbott enters 2026 with strong operational momentum and one of the most balanced growth profiles in global medtech. The company delivered steady acceleration across Medical Devices, Diagnostics, Nutrition and Established Pharmaceuticals as procedure volumes normalized and global testing patterns stabilized. FreeStyle Libre remains a multi-billion dollar growth engine, structural heart and electrophysiology continue to expand globally, and the company has now added a major new strategic pillar through its acquisition of Exact Sciences.

What Makes Abbott Unique

- FreeStyle Libre remains one of the fastest scaling devices in global healthcare with strong international adoption

- Medical Devices continues to grow through structural heart, electrophysiology and heart failure portfolios

- Diagnostics is expanding again, strengthened by Exact Sciences and a larger cancer diagnostics TAM

- Diversified global revenue streams create stability across economic and regulatory cycles

Recent Signals

Abbott’s 2025 trajectory confirms that the company is past its post-pandemic diagnostics normalization phase and back to broad-based growth.

- Medical Devices delivered strong results driven by FreeStyle Libre, structural heart procedures and electrophysiology

- Diagnostics stabilized as underlying non-COVID testing volumes continued to recover

- Nutrition remained steady, supported by strong pediatric and adult categories

- International revenue growth outpaced the United States due to continued adoption of Libre and strong performance across emerging markets

The company’s balanced portfolio is functioning as intended, with devices acting as the primary growth engine.

Investment View

Abbott offers one of the cleanest long-term growth profiles in global medtech. The company has a proven ability to scale first-in-class consumer-facing medical technology, supported by strong regulatory execution and global distribution. With devices accelerating, diagnostics stabilizing and Libre expanding into new user segments, Abbott remains a high-quality compounder with attractive earnings visibility heading into 2026.

Key Watchouts

Competition in continuous glucose monitoring is intensifying as multiple players enter the market. Pricing pressure remains a consistent risk in diabetes care and diagnostics. Regulatory oversight is elevated across cardiovascular and glucose monitoring technologies. Currency volatility can also impact reported growth due to Abbott’s global exposure.

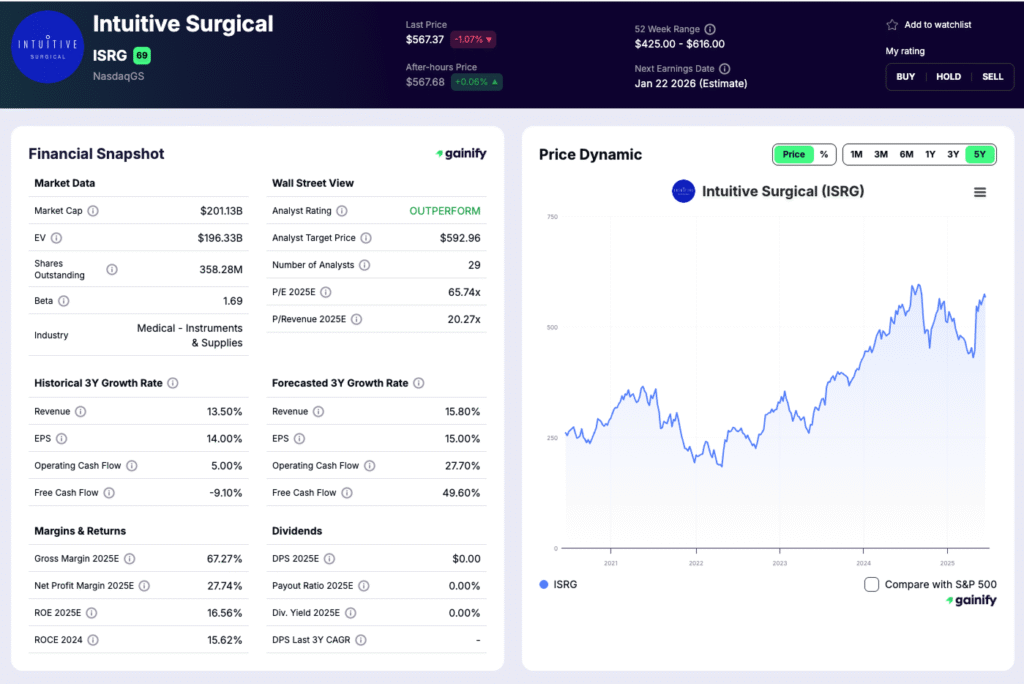

7. Intuitive Surgical (ISRG)

Market cap: $201B

Forward P/E: 66.5x

Analyst target upside: 4.51%

Why Intuitive Remains the Benchmark in Surgical Robotics

Intuitive Surgical continues to define the global standard in robotic-assisted surgery. Hospitals increasingly view robotics as essential surgical infrastructure rather than an optional upgrade. In 2024, surgeons performed 2.68 million da Vinci procedures, a volume that reflects deep clinical adoption and rising case diversity. This combination of scale, usage and clinical integration gives Intuitive one of the strongest long-duration growth profiles in all of medtech.

What Makes Intuitive Unique

- Global installed base of more than 10,700 systems

- Procedure growth of 19 percent year-over-year

- Recurring revenue represents the majority of total sales

- Integrated ecosystem combining hardware, instruments, software and surgeon training

Recent Signals

Intuitive placed 427 systems in Q3 2025, supported by higher utilization and strong hospital demand for the new da Vinci 5. Quarterly revenue reached 2.51 billion dollars, an increase of 23 percent compared with the prior year. Surgeon adoption continues to expand across general surgery, oncology and bariatrics, and the procedural mix is broadening in a way that supports multi-year visibility.

Investment View

Intuitive is one of the clearest high-quality growth assets in medical technology. Procedure volume is compounding, international penetration is still low, and the company benefits from a highly resilient recurring revenue engine. For investors, it offers both defensive characteristics and a credible path to long-term growth.

Key Watchouts

- Hospital capital budgets can slow system placements in weaker economic periods

- Competitive platforms are emerging, even if their clinical traction remains limited

- Regulatory or reimbursement changes could influence procedure economics

- Valuation requires consistent execution to maintain investor confidence

Final Takeaway

Healthcare enters 2026 with a powerful mix of innovation, defensive stability and improving profitability. The seven companies in this list represent the highest quality leadership across the sector’s most important growth themes.

- Eli Lilly for category-defining growth in obesity and metabolic disease

- Johnson & Johnson for durable stability and diversified cash generation

- AbbVie for a rebuilt immunology and neuroscience engine

- UnitedHealth Group for unmatched scale and consistent earnings power

- Merck for undervalued oncology-driven growth

- Abbott for diversified medical technology and global device leadership

- Intuitive Surgical for long-duration robotics adoption

Together, they create a balanced, forward-looking healthcare exposure that reflects both the science driving the next decade and the financial strength required to compound through any market cycle.