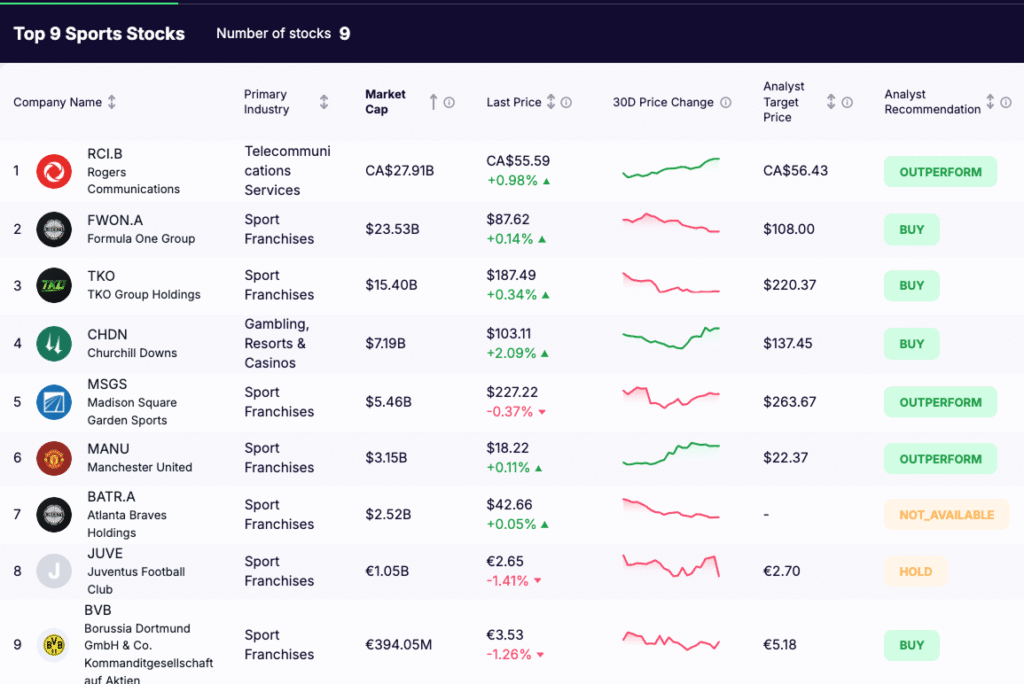

Sports have become one of the fastest-growing investment frontiers in the global economy. No longer limited to ticket sales or broadcasting rights, franchises and leagues now represent integrated media, data, and consumer ecosystems.

From Formula 1 to Premier League football and UFC events, global audiences are driving unprecedented revenue across streaming, sponsorship, and digital engagement.

In 2026, the sports industry is enjoying record valuations as investors recognize the long-term value of live entertainment. Private equity and sovereign wealth funds continue to pour billions into teams, leagues, and technology platforms that enhance fan interaction. Sports have become an asset class of their own, offering a rare mix of scarcity, cash flow, and cultural relevance.

Below are the top 9 publicly traded sports stocks, covering what they own, how they make money, and what risks investors should watch.

Highlights

- Global sports revenues are on track to surpass $650 billion in 2025, driven by digital media and global fan bases.

- Franchise ownership remains among the most limited and valuable asset classes in entertainment.

- Sponsorship and streaming deals are creating new recurring revenue models.

- Private investment and league expansion are fueling consolidation across teams and venues.

- Publicly traded sports companies offer exposure to real assets, live content, and growing fan economies.

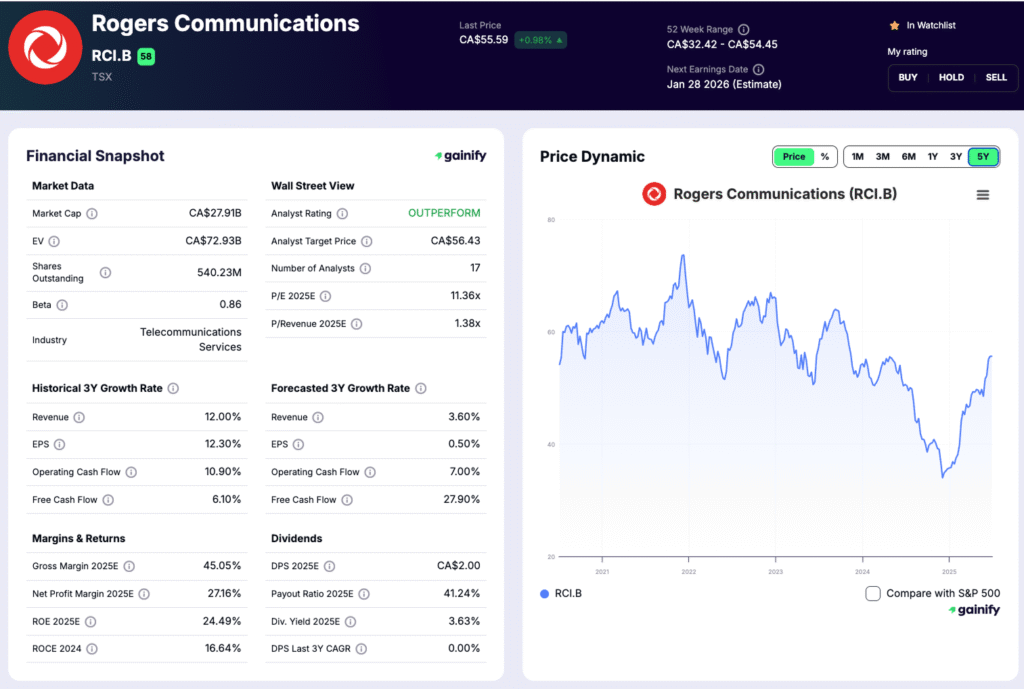

1. Rogers Communications (TSE: RCI.B)

Market Cap: C$27.91 billion

Analyst Target Price: C$56.43

Analyst Rating: Outperform

What It Owns: Rogers Communications owns the Toronto Blue Jays (MLB) and has significant stakes in Maple Leaf Sports & Entertainment (MLSE), giving it exposure to the Toronto Maple Leafs (NHL), Toronto Raptors (NBA), and Toronto FC (MLS).

Key Investment Theme: Rogers benefits from a vertically integrated model that combines content ownership, broadcasting, and telecommunications. By controlling both the media rights and the distribution channels, it captures value at every stage of the sports entertainment chain. The growing popularity of live streaming and sports-focused digital platforms enhances its long-term earnings potential.

Key Risks: Canada’s tight regulatory environment and competition in telecom and media could constrain margins and flexibility.

2. Formula One Group (NASDAQ: FWON.A)

Market Cap: $23.53 billion

Analyst Target Price: $108.00

Analyst Rating: Buy

What It Owns: Formula One Group controls the global commercial rights to the Formula 1 World Championship, one of the most watched annual sporting events on Earth.

Key Investment Theme: Under Liberty Media’s leadership, Formula 1 has turned into a powerful global entertainment brand. Viewership has surged thanks to Netflix’s “Drive to Survive,” new races in the U.S. and Asia, and a younger fan base drawn to hybrid technology and sustainability. Expanding sponsorships and media rights ensure steady, recurring cash flow.

Key Risks: Heavy logistics costs, geopolitical disruptions, and reliance on travel and event attendance could affect earnings stability.

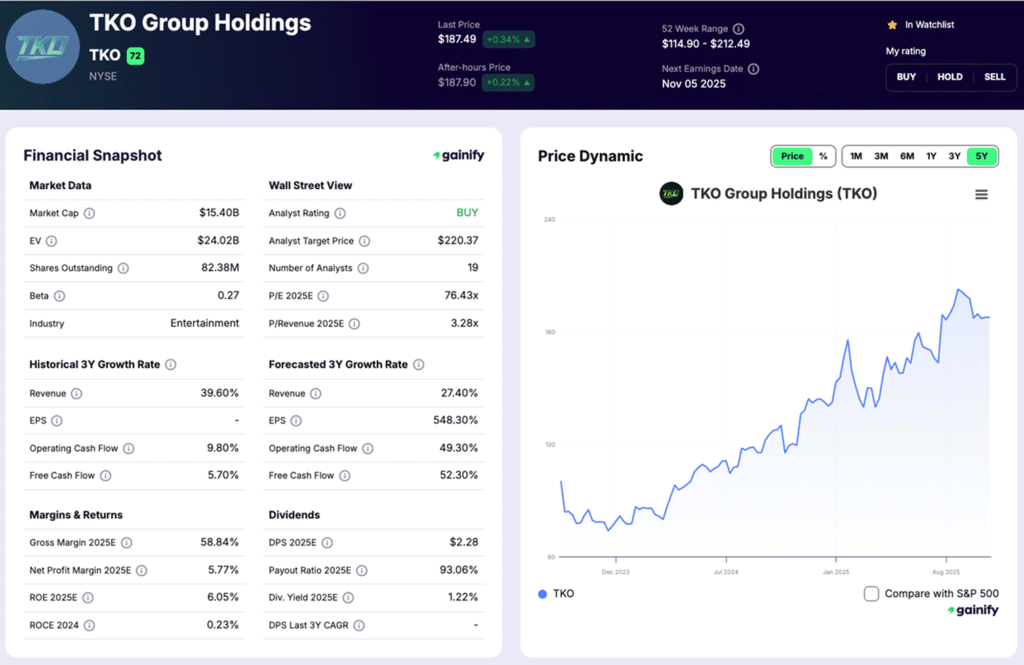

3. TKO Group Holdings (NYSE: TKO)

Market Cap: $15.40 billion

Analyst Target Price: $220.37

Analyst Rating: Buy

What It Owns: TKO Group Holdings combines two of the most dominant names in global combat sports: UFC (Ultimate Fighting Championship) and WWE (World Wrestling Entertainment). The company operates live events, media rights, and digital content across more than 180 countries, making it the largest integrated combat entertainment business in the world.

Key Investment Theme: In 2025, TKO continued to strengthen its position through long-term media rights extensions, new pay-per-view partnerships, and record international expansion. The company’s strategic alliance with Abu Dhabi Media and Riyadh Season has brought major live events to the Middle East, boosting both viewership and sponsorship revenue. AI-enhanced content production and personalized fan engagement have also driven strong performance in streaming and social media monetization. With a consistent schedule of global events, UFC and WWE provide a recurring, diversified income base that blends sports and entertainment exposure.

Key Risks: TKO remains reliant on high-profile athletes and entertainment talent to sustain audience interest. Event-driven revenue can fluctuate, and regulatory oversight in combat sports and media markets may introduce operational complexity.

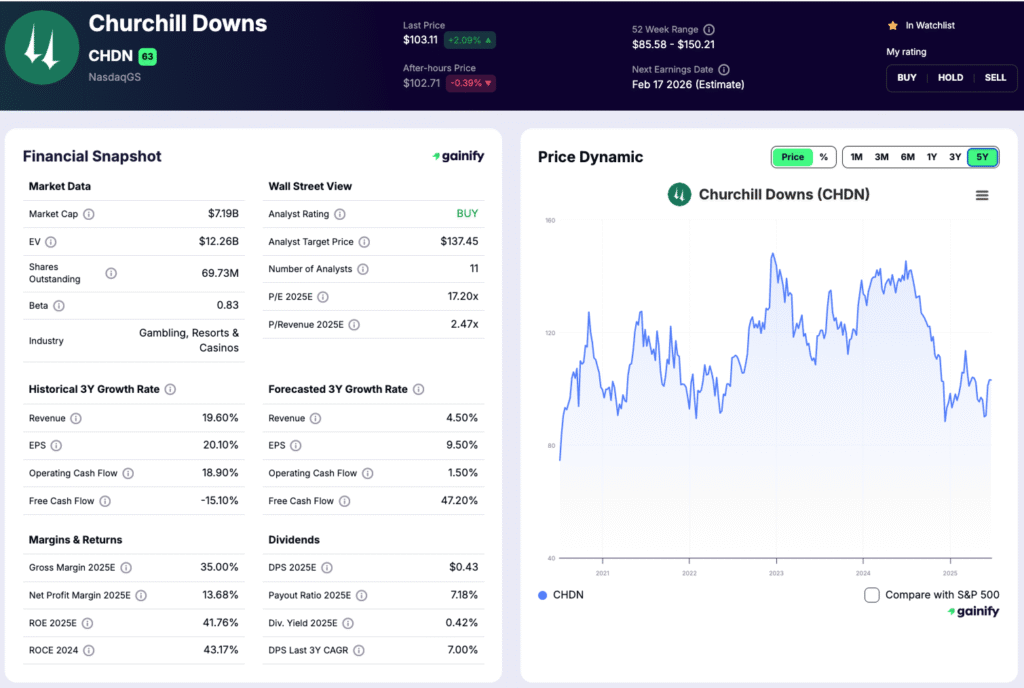

4. Churchill Downs (NASDAQ: CHDN)

Market Cap: $7.19 billion

Analyst Target Price: $137.45

Analyst Rating: Buy

What It Owns: Churchill Downs operates the Kentucky Derby, one of the world’s most famous horse races, alongside several racetracks, gaming facilities, and its online betting arm, TwinSpires.

Key Investment Theme: The company’s combination of historic brand value and modern digital betting platforms creates multiple revenue channels. Its strong balance sheet and continued investment in gaming expansion have made it a durable growth story within the leisure and entertainment sector.

Key Risks: Subject to heavy regulation, economic slowdowns, and variability in discretionary spending.

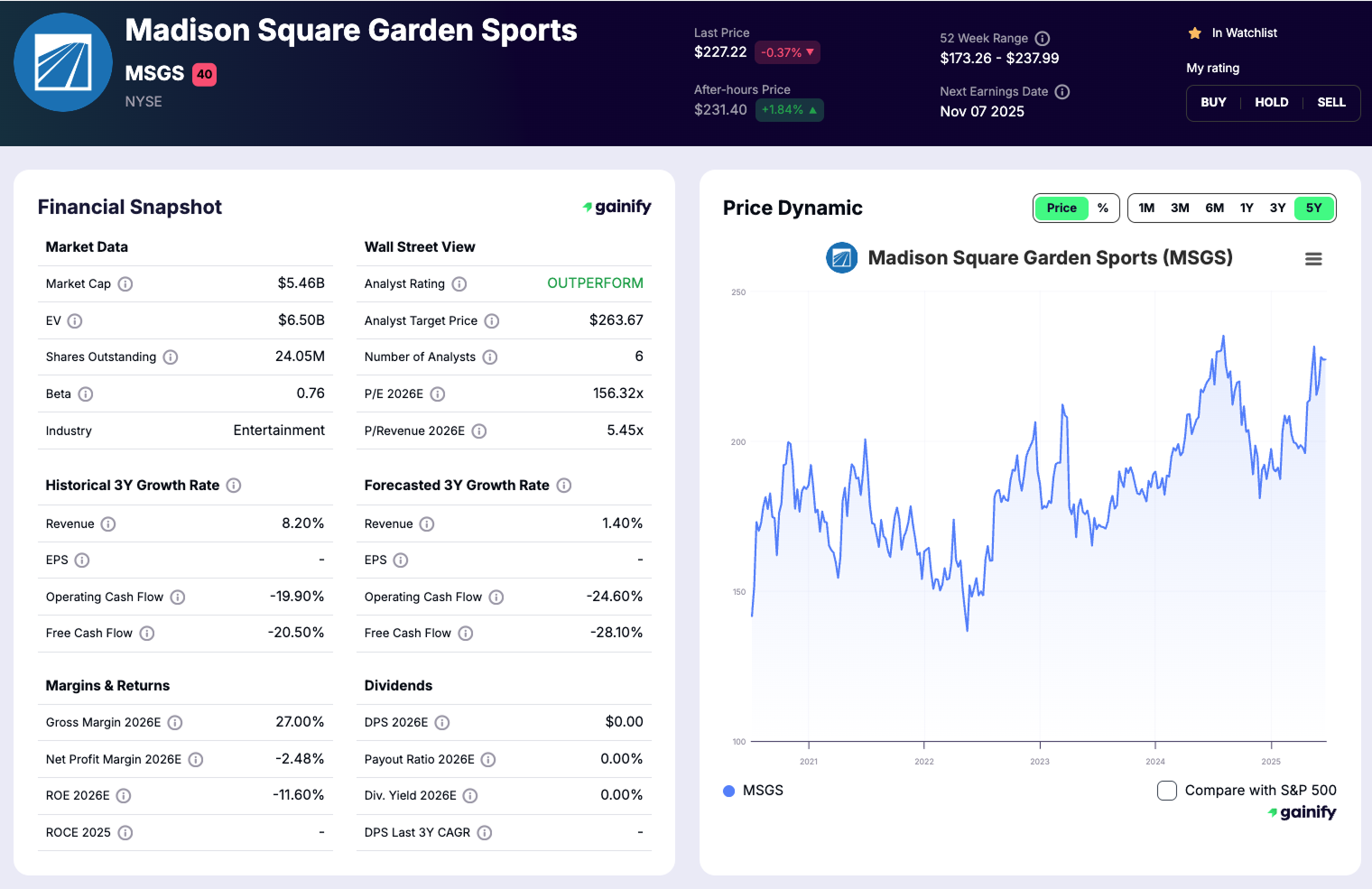

5. Madison Square Garden Sports (NYSE: MSGS)

Market Cap: $5.46 billion

Analyst Target Price: $263.67

Analyst Rating: Outperform

What It Owns: MSGS owns two of the most valuable franchises in the world: the New York Knicks (NBA) and the New York Rangers (NHL).

Key Investment Theme: Owning New York’s flagship teams provides scarcity value and pricing power that few assets can match. The combination of iconic branding, major media markets, and global fan reach positions MSGS for consistent long-term growth. Rising franchise valuations and new sponsorship deals continue to drive upside potential.

Key Risks: Performance fluctuations and economic cycles can impact short-term investor sentiment.

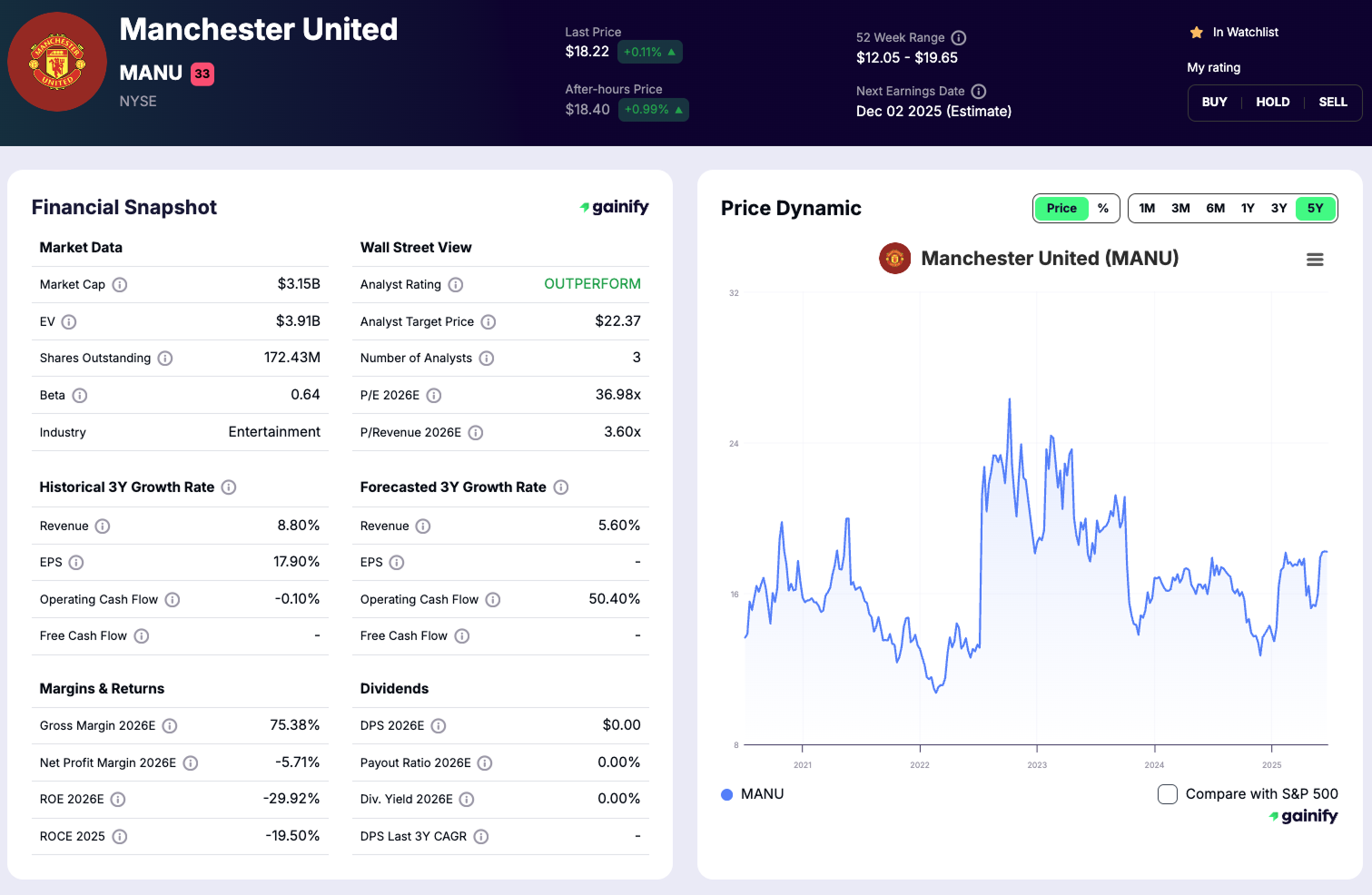

6. Manchester United Plc (NYSE: MANU)

Market Cap: $3.15 billion

Analyst Target Price: $22.37

Analyst Rating: Outperform

What It Owns: Manchester United Plc owns and operates one of the most globally followed football clubs. Revenues come from broadcasting, sponsorships, global merchandise, and matchday activity. The scale and resilience of the club’s worldwide fan base support one of the strongest brands in professional sport.

Key Investment Theme: Recent on field results have fallen short of the club’s historical benchmark, and the absence of Champions League participation continues to limit broadcasting income and overall financial flexibility. Even so, the commercial platform remains resilient and continues to attract global demand. The model indicates a forecast three year revenue growth rate of 5.6 percent and a projected improvement in operating cash flow of more than 50 percent. Recovery in sporting performance could unlock further upside across media, sponsorship, and digital engagement.

Key Risks:

Profitability remains a concern. The forecast net profit margin for 2026 is negative 5.7%, and ROE is projected at negative 29.9%. Missing the Champions League adds pressure on revenue and competitiveness, which may weaken sponsorship value and the club’s ability to invest in the squad. High wages, significant transfer spending, and inconsistent performances elevate financial risk and can constrain the pace of recovery.

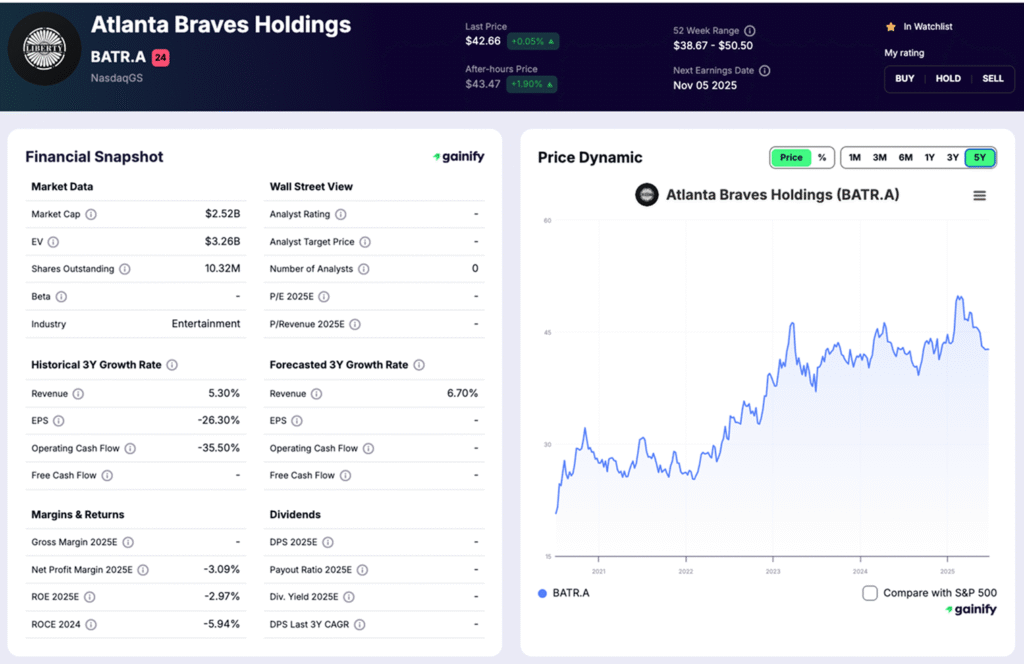

7. Atlanta Braves Holdings (NASDAQ: BATR.A)

Market Cap: $2.52 billion

Analyst Rating: N/A

What It Owns: The Atlanta Braves and the Battery Atlanta, a mixed-use real estate complex surrounding Truist Park.

Key Investment Theme: The Braves offer investors a hybrid exposure to both sports and property markets. The team’s consistent on-field success, combined with the revenue-generating real estate assets, provides a stable cash flow mix that is rare among sports franchises.

Key Risks: Earnings depend heavily on team success, stadium attendance, and the broader real estate market.

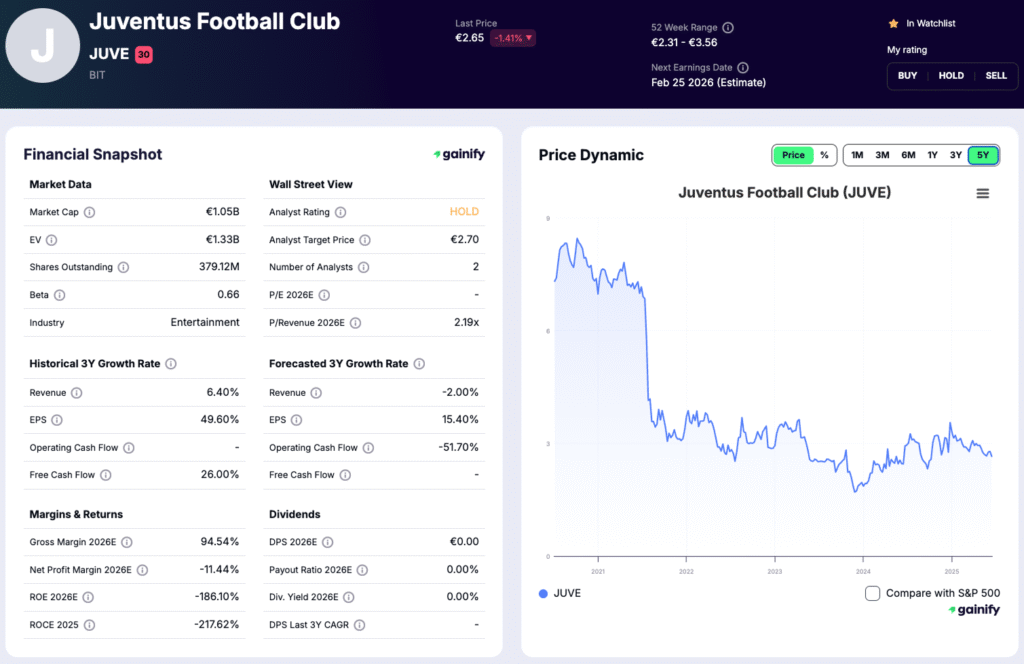

8. Juventus Football Club (BIT: JUVE)

Market Cap: €1.05 billion

Analyst Target Price: €2.70

Analyst Rating: Hold

What It Owns: Juventus FC (JUVE), one of Europe’s most recognized football brands, competing again in the UEFA Champions League for the 2025–26 season after two years of rebuilding. The club remains a central pillar of Italy’s Serie A and a global leader in merchandising and digital fan engagement.

Key Investment Theme: Juventus has stabilized its finances following several turbulent seasons and governance changes. The team’s return to European competition significantly enhances commercial and broadcast revenue, while new partnerships with blockchain-based fan engagement platforms and apparel sponsors support its modernization strategy. The club is now emphasizing sustainable payroll management, academy development, and data-driven recruitment to secure long-term competitiveness.

Key Risks: Continued sensitivity to on-field performance, macroeconomic pressures in Italy, and limited transparency around shareholder governance could affect investor confidence.

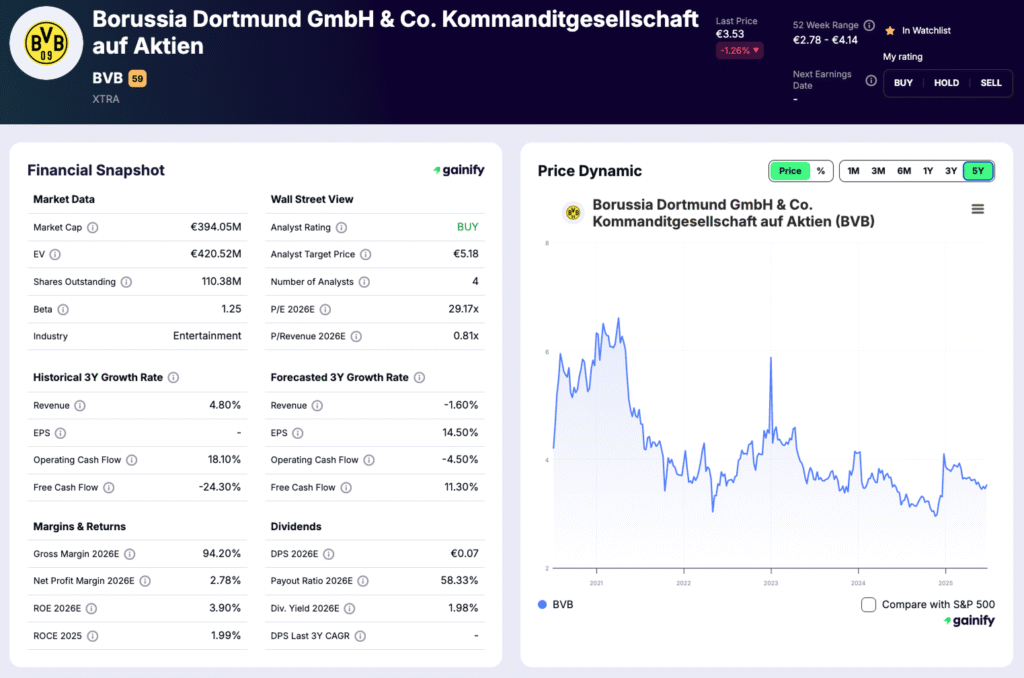

9. Borussia Dortmund (ETR: BVB)

Market Cap: €394 million

Analyst Target Price: €5.18

Analyst Rating: Buy

What It Owns: Borussia Dortmund Football Club, a leading Bundesliga team renowned for youth development and loyal fan culture.

Key Investment Theme: BVB’s player development strategy and consistent European competition participation ensure steady profitability. The club’s community-driven model supports strong merchandising and matchday revenue.

Key Risks: Dependence on player transfers and seasonal performance outcomes.

The Investment Case for Sports Stocks

Sports franchises and related assets have matured into a recognized institutional investment class. Once viewed as prestige holdings for private owners, they now represent durable, cash-generating businesses with diversified and recurring revenue streams.

In 2025, the global sports industry is expected to surpass $650 billion in total revenue, supported by multi-year media rights contracts, digital streaming platforms, and expanding fan monetization through data, betting, and global licensing. The convergence of technology and entertainment has transformed sports from cyclical event-driven businesses into scalable media ecosystems.

For investors, listed sports companies offer exposure to several attractive themes:

- Scarcity and asset appreciation: Franchise supply remains extremely limited, while demand from sovereign wealth and private equity funds continues to push valuations higher.

- Recurring revenue visibility: Multi-year broadcast, sponsorship, and venue agreements create stable, long-term cash flows less sensitive to economic cycles.

- Globalization of audiences: The expansion of leagues, international tournaments, and streaming access is monetizing fans across regions previously unreachable.

- Digital monetization: Data analytics, fantasy sports, and in-app engagement are opening new high-margin revenue channels.

Institutional capital is increasingly treating sports assets as hybrid investments, combining the defensive characteristics of media and infrastructure with the growth profile of technology and entertainment platforms. For investors seeking long-duration exposure to real-world brands with built-in cultural relevance, sports stocks now offer a compelling mix of scarcity, income stability, and global expansion potential.

Bottom Line

The business of sports has evolved into a global investment ecosystem built on live entertainment, digital media, and tangible assets. Franchises and leagues are no longer cyclical ventures tied to seasonal performance. They have become enduring platforms that generate steady and diversified income from broadcast rights, sponsorships, and fan engagement.

From Formula 1’s expanding international calendar to the UFC’s record-setting pay-per-view events and the rising valuations of U.S. and European football clubs, sports now represent both a financial engine and a cultural cornerstone of the modern economy.

For investors, sports stocks are no longer just passion-driven holdings. They have become a deliberate allocation within diversified portfolios, combining brand power, scarcity, and recurring growth. In a digital age defined by attention and experience, few industries unite emotional connection and economic potential as effectively as global sports.