The restaurant industry is back in full swing, but it is no longer the same business it was five years ago. Digital ordering, delivery platforms, and automation have completely reshaped how brands grow, scale, and protect margins.

In 2026, the best restaurant companies are not just selling food. They are selling convenience, loyalty, and lifestyle. From McDonald’s global digital ecosystem to CAVA’s growing fan base, success now depends on customer connection, operational efficiency, and innovation.

Investors have a wide menu of opportunities. The global leaders provide stability and steady cash flow, while fast-casual names promise rapid growth for those willing to handle more risk. Contract food service operators like Aramark, on the other hand, offer consistent returns through long-term partnerships.

The key is finding the right balance between growth and predictability. Mature brands such as McDonald’s and Darden deliver slow but reliable gains, while rising concepts like Chipotle and CAVA offer stronger upside with more volatility.

Below, we explore the top restaurant stocks defining how the world eats in 2026, and where investors might find the next market leader.

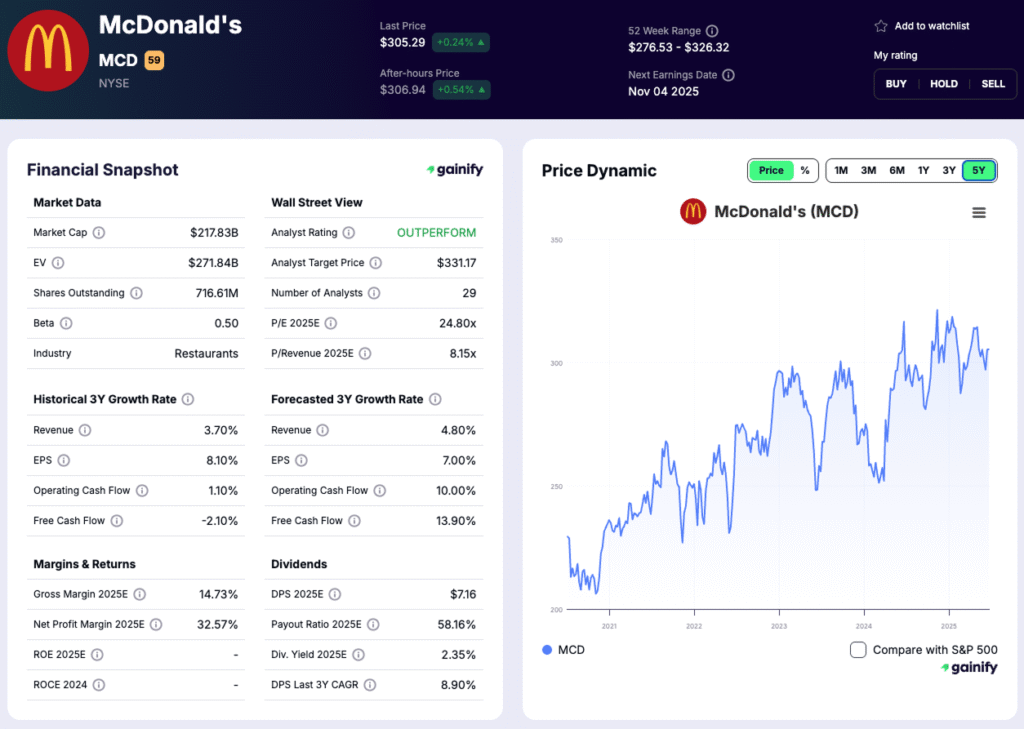

1. McDonald’s — Market Cap: $217.8 B

What they do:

McDonald’s (NYSE:MCD) is the world’s largest quick-service restaurant chain, operating over 42,000 locations in 100+ countries. The company earns mainly through franchise royalties and rent, creating highly predictable cash flows.

Maturity level:

Fully mature and cash-generative. McDonald’s focuses on steady global expansion, tech integration, and capital returns.

Why it matters:

Digital orders and loyalty programs now drive more than 40% of system-wide sales. Efficiency upgrades and menu innovation continue to offset inflation and wage pressure.

What to watch:

- Growth in digital loyalty membership and app engagement, with McDonald’s expanding personalized offers and in-app ordering to lift repeat visits.

- Expansion in Asia Pacific and emerging markets, where franchise economics and menu localization will drive long-term growth.

- Margin resilience amid cost inflation, as efficiency upgrades, automation, and selective pricing help protect profitability.

Key risk:

Slower consumer spending or higher franchise costs could limit same-store sales growth. Inflation and labor pressures remain key variables affecting operator margins.

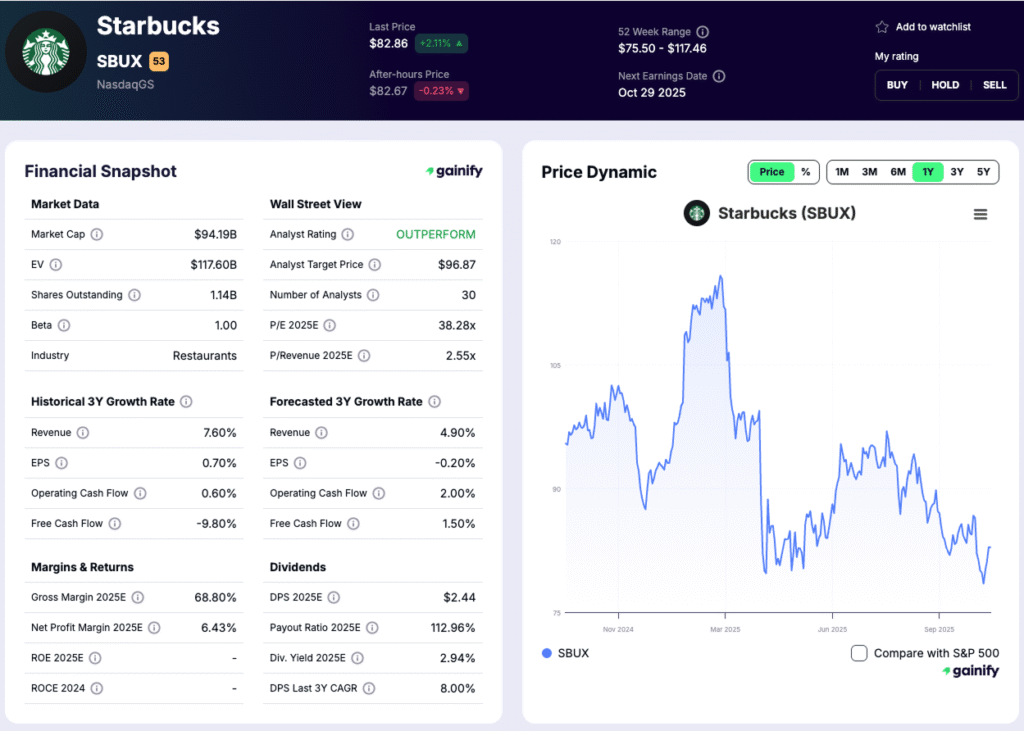

2. Starbucks — Market Cap: $94.2 B

What they do:

Starbucks (NASDAQ:SBUX) operates 38,000+ stores globally, specializing in premium coffee and beverage retailing. It generates revenue from company-operated stores, licensing, and packaged products.

Maturity level:

Mature growth. Focused on international expansion, especially China and India, and on improving U.S. store efficiency.

Why it matters:

Starbucks remains a leader in global beverage retail with a strong brand and digital ecosystem. Its rewards program and mobile ordering are key customer-retention drivers.

What to watch:

- China same-store recovery, as consumer confidence and mobility trends remain key to restoring growth in Starbucks’ second-largest market.

- Operating margin improvements through automation and new in-store technology designed to streamline workflow and reduce labor costs.

- Menu diversification beyond coffee, with continued expansion into cold beverages, food, and premium formats to attract new customer segments.

Key risk:

Margin pressure from higher wages, input costs, and slower-than-expected China recovery could weigh on earnings. A weaker global consumer environment or shifting preferences toward local competitors may also affect traffic.

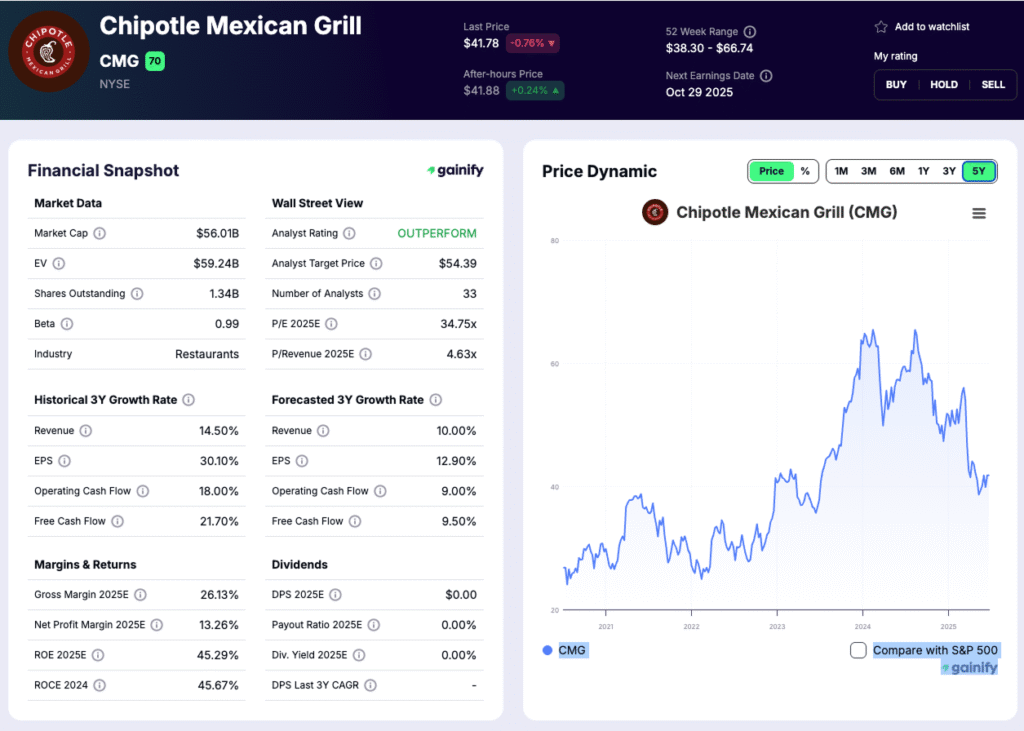

3. Chipotle Mexican Grill — Market Cap: $56.0 B

What they do:

Chipotle (NYSE:CMG) operates 3,500+ fast-casual Mexican restaurants emphasizing fresh, customizable meals. Nearly 40% of sales come from digital channels.

Maturity level:

Growth stage with proven profitability. Expanding unit count 7–9% annually and investing in “Chipotlane” digital drive-thrus.

Why it matters:

Chipotle combines strong same-store growth with operational efficiency, setting the standard in fast-casual dining.

What to watch:

- New store openings and digital adoption, as Chipotle continues to expand its footprint with strong returns from “Chipotlane” drive-thru formats.

- Menu innovation, including seasonal items and potential breakfast offerings, which can lift average checks and attract new customers.

- Margin stability amid rising wages and ingredient costs, with the company focusing on throughput efficiency, supply-chain partnerships, and technology to sustain profitability.

Key risk:

Premium valuation leaves limited room for error if traffic or same-store sales growth slows. Rising labor and food costs could pressure margins, while any supply disruptions or operational missteps might quickly affect investor sentiment.

4. Yum! Brands — Market Cap: $40.1 B

What they do:

Parent of KFC, Taco Bell, and Pizza Hut, Yum! Brands (NYSE:YUM) operates more than 57,000 restaurants across 150+ countries, with over 98% run by franchisees. The company earns primarily through franchise royalties, fees, and marketing contributions.

Maturity level:

A mature, fully asset-light operator. Its revenue base is stable and predictable, supported by long-term franchise agreements and disciplined cost management.

Why it matters:

Yum!’s franchise model delivers strong scalability and cash flow with minimal capital investment. Growth continues to be led by KFC and Taco Bell, especially in emerging markets where digital sales and delivery adoption are accelerating.

What to watch:

- Expansion in digital and delivery channels across all brands, as mobile orders and loyalty programs become larger contributors to system sales.

- Same-store growth and unit development in high-potential regions such as India, Indonesia, and Africa.

- Franchise health and reimaging investments, ensuring operators remain profitable while maintaining brand consistency worldwide.

Key risk:

Performance remains uneven across brands, with Pizza Hut continuing to lag on traffic and modernization. Economic slowdowns in key growth regions or franchise cost pressures could weigh on expansion momentum.

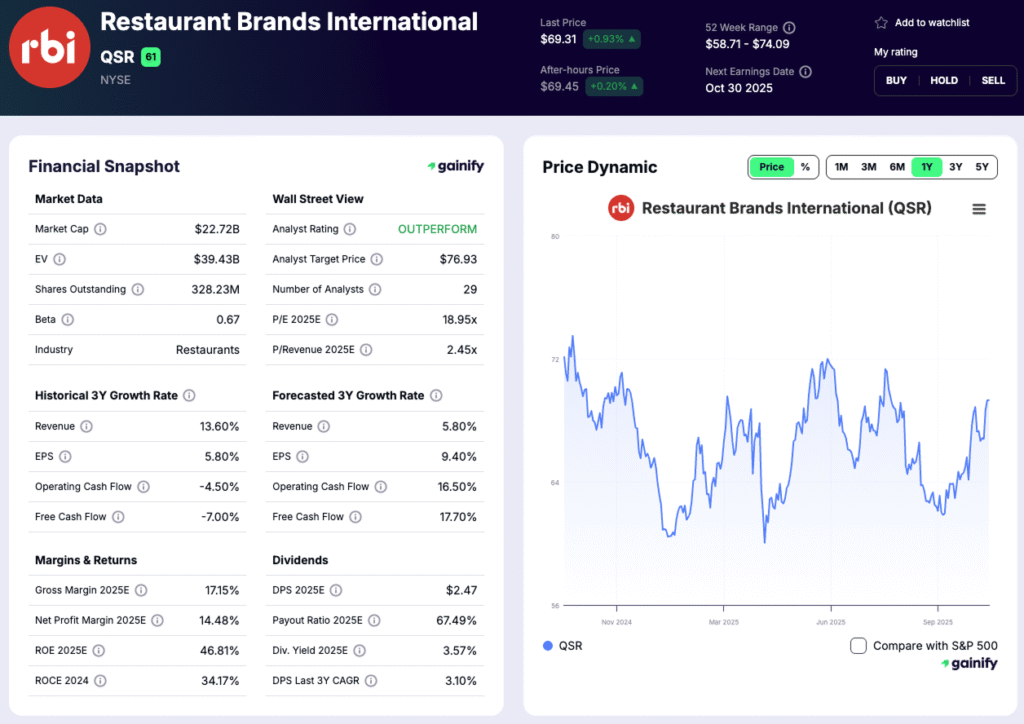

5. Restaurant Brands International — Market Cap: $22.7 B

What they do:

Restaurant Brands International (NYSE:QSR) owns Burger King, Tim Hortons, Popeyes, and Firehouse Subs, representing more than 30,000 restaurants across 100 countries. The company operates primarily through franchising, earning royalties, fees, and supply-chain income.

Maturity level:

A mature, diversified portfolio with restructuring efforts underway to revitalize Burger King’s U.S. operations. The company focuses on balancing steady cash flow with selective growth investments.

Why it matters:

QSR’s mix of global brands gives it broad geographic and category diversification. Tim Hortons remains a Canadian staple, while Popeyes’ international expansion continues to outperform expectations. The Burger King “Reclaim the Flame” initiative is a key driver of brand turnaround and domestic momentum.

What to watch:

- Progress in Burger King’s U.S. turnaround, particularly improvements in same-store sales and franchise profitability.

- Acceleration of international unit expansion, especially in high-growth regions like Asia and Latin America.

- Ongoing cost discipline, supply-chain optimization, and franchise health, which will determine how much of revenue growth translates into stronger margins.

Key risk:

Execution risk in Burger King’s U.S. revamp remains the biggest uncertainty. Slower consumer spending in Canada or rising franchise costs could limit performance at Tim Hortons and Popeyes. Currency volatility across major markets may also impact reported results.

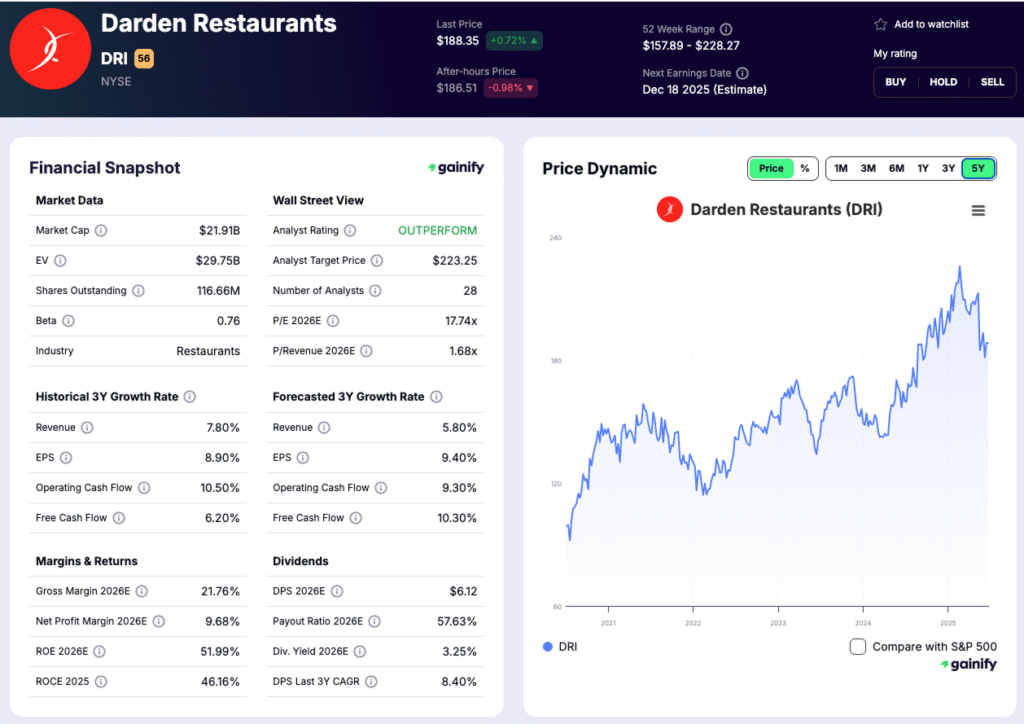

6. Darden Restaurants — Market Cap: $21.9 B

What they do:

Darden Restaurants (NYSE:DRI) operates Olive Garden, LongHorn Steakhouse, and several fine-dining concepts including The Capital Grille and Eddie V’s. The company generates nearly all its revenue from U.S. casual dining, with a focus on value-driven meals and consistent service.

Maturity level:

A mature, efficiently run operator with moderate growth and strong free cash flow. Darden’s scale and disciplined cost management underpin its long record of stable earnings and dividend growth.

Why it matters:

Darden is one of the most efficient operators in full-service dining, leveraging menu simplicity, technology, and procurement scale to protect margins. Olive Garden remains the anchor brand, benefiting from its strong value perception and loyal customer base even during slower economic periods.

What to watch:

- Guest traffic and check growth versus peers, as a gauge of brand strength in a competitive casual dining market.

- Commodity and labor cost management, especially in proteins and fresh produce.

- Same-store sales performance across Olive Garden and LongHorn, along with progress in expanding higher-end brands.

Key risk:

Casual-dining demand remains cyclical and sensitive to macroeconomic slowdowns. Prolonged inflation or wage increases could erode margins, while traffic softness may limit pricing flexibility.

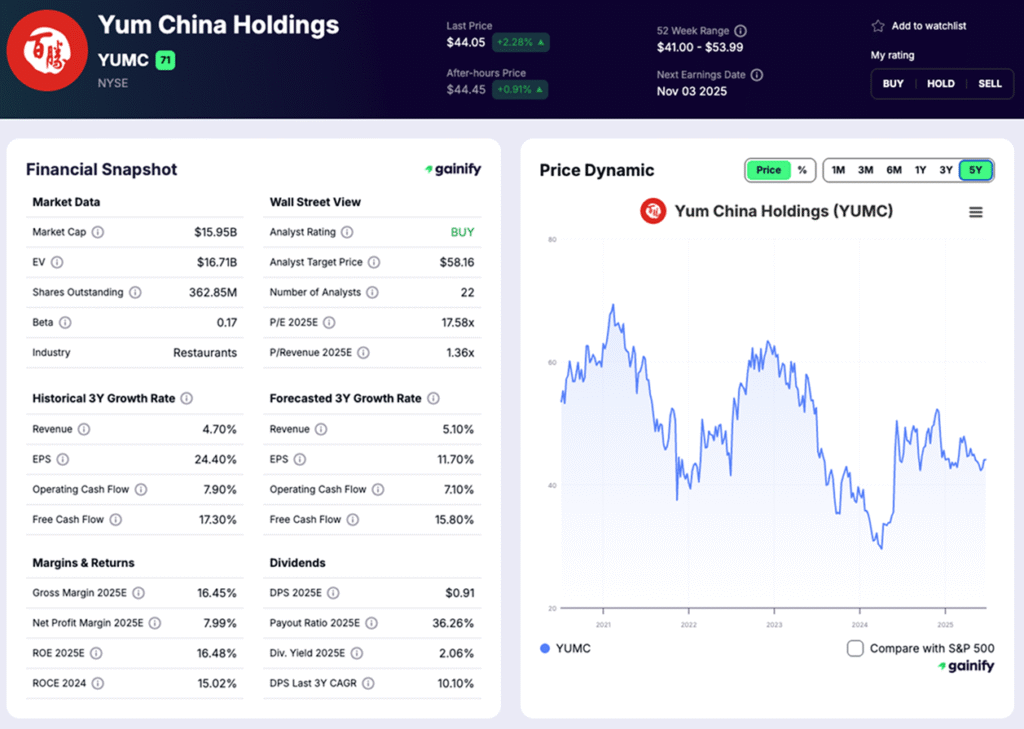

7. Yum China Holdings — Market Cap: $15.9 B

What they do:

Yum China (NYSE:YUMC) operates KFC and Pizza Hut across more than 10,000 restaurants and holds the exclusive rights to these brands within mainland China. The company runs a mix of company-owned and franchised stores and remains one of the country’s largest consumer-facing restaurant operators.

Maturity level:

A mature operator with continued room for growth through expansion into lower-tier Chinese cities. While the brand is well established, management continues to localize menus and digital operations to sustain market share.

Why it matters:

Yum China’s mobile-first ecosystem, which integrates ordering, delivery, and loyalty, gives it a strong competitive moat. Its vertically integrated supply chain and scale efficiency help protect margins even during periods of economic volatility. Same-store sales are steadily recovering, though consumer sentiment remains inconsistent across regions.

What to watch:

- Pace of unit expansion in smaller cities and tier-three markets, where long-term growth potential remains significant.

- Margin trends amid rising wage and input costs, and how well pricing power offsets these pressures.

- Growth in digital delivery and membership sales, which now account for a growing share of total transactions.

Key risk:

Persistent macroeconomic weakness in China or renewed consumer caution could weigh on traffic and profitability. Currency fluctuations and inflationary cost pressures also pose challenges to earnings visibility.

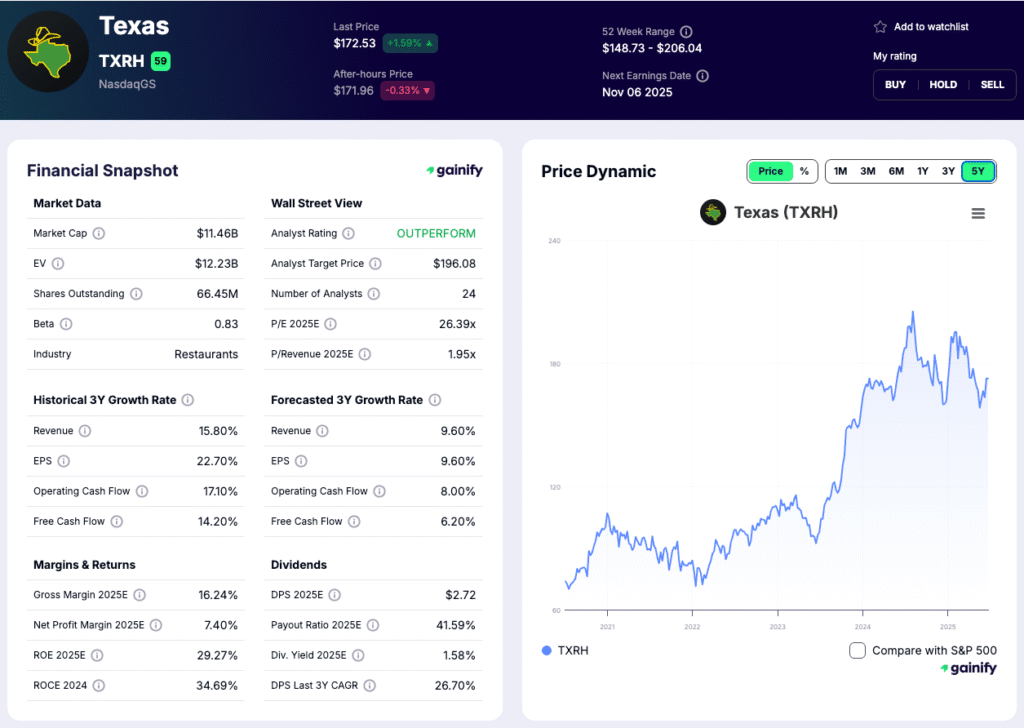

8. Texas Roadhouse (NASDAQ: TXRH) — Market Cap: $11.5 B

What they do:

Texas Roadhouse (NASDAQ:TXRH) operates more than 700 steakhouse restaurants that emphasize value, large portions, and a family-friendly dining experience. The brand is known for its hand-cut steaks, fresh bread, and consistent customer service.

Maturity level:

A growth-focused operator within a proven and stable concept. Expansion continues both in the U.S. and internationally, with strong unit economics and healthy cash generation funding new openings.

Why it matters:

Texas Roadhouse has built one of the most loyal customer bases in casual dining, maintaining positive traffic growth even when the broader industry slows. Effective menu pricing, strong brand equity, and disciplined cost management have helped the company sustain margins despite inflationary pressures.

What to watch:

- Beef and commodity costs, which directly affect input margins and menu pricing flexibility.

- Unit growth trajectory, as new market entries and remodels remain central to long-term expansion.

- Labor productivity and efficiency initiatives that can offset rising wages and maintain consistent service quality.

Key risk:

Volatility in protein prices, particularly beef, remains a primary challenge. Heightened competition in the casual dining segment and potential consumer pullbacks during economic slowdowns could limit traffic and profitability.

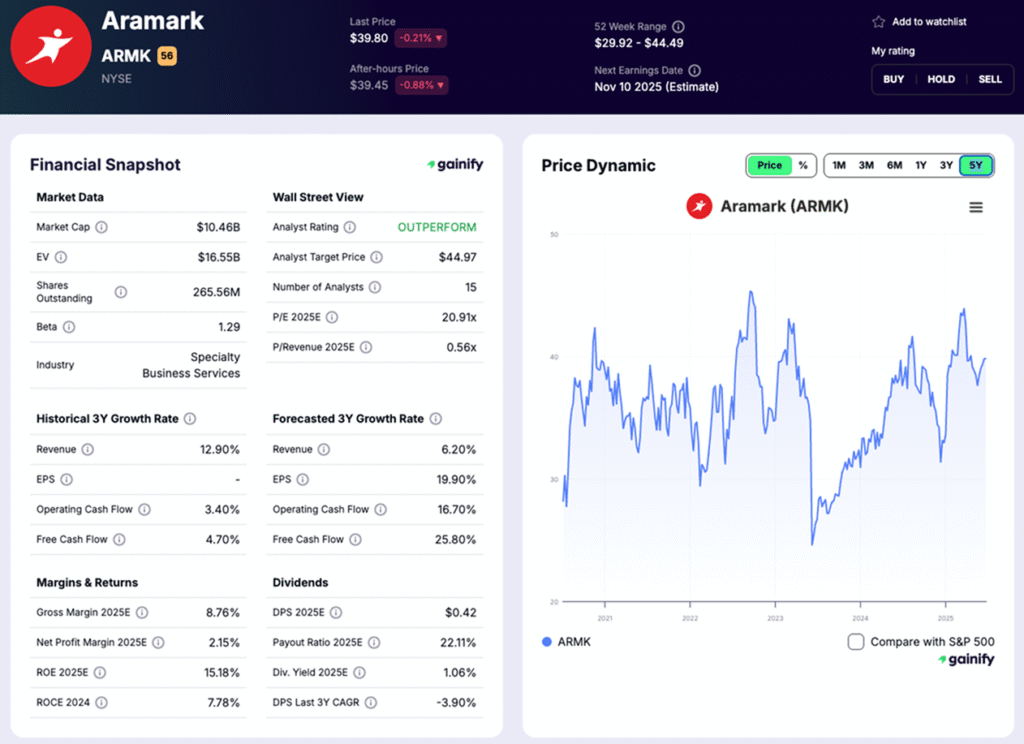

9. Aramark (NYSE: ARMK) — Market Cap: $10.5 B

What they do:

Aramark (NYSE:ARMK) is a leading food, facilities, and uniform services provider serving universities, hospitals, sports venues, and corporations. Unlike traditional restaurant chains, most of its revenue comes from long-term service contracts rather than direct consumer traffic.

Maturity level:

A mature operator with stable, recurring revenue and predictable cash flow. Growth primarily comes from new contract wins, client retention, and expanding into international markets.

Why it matters:

Aramark offers investors a defensive play within the broader food service industry. Its institutional partnerships provide steady income streams insulated from daily consumer fluctuations. Post-pandemic recovery in education, healthcare, and events continues to support revenue momentum, while technology and menu upgrades are improving efficiency.

What to watch:

- Margin recovery and cost management as inflation and wage pressures normalize across major contracts.

- New client wins and retention rates in key verticals such as education and healthcare.

- Operational efficiency initiatives, including automation and menu standardization, which can support long-term profitability.

Key risk:

Organic growth remains limited by contract cycles, and rising labor costs can pressure margins if not offset by pricing adjustments. Economic slowdowns or reduced institutional budgets could delay renewals or new business opportunities.

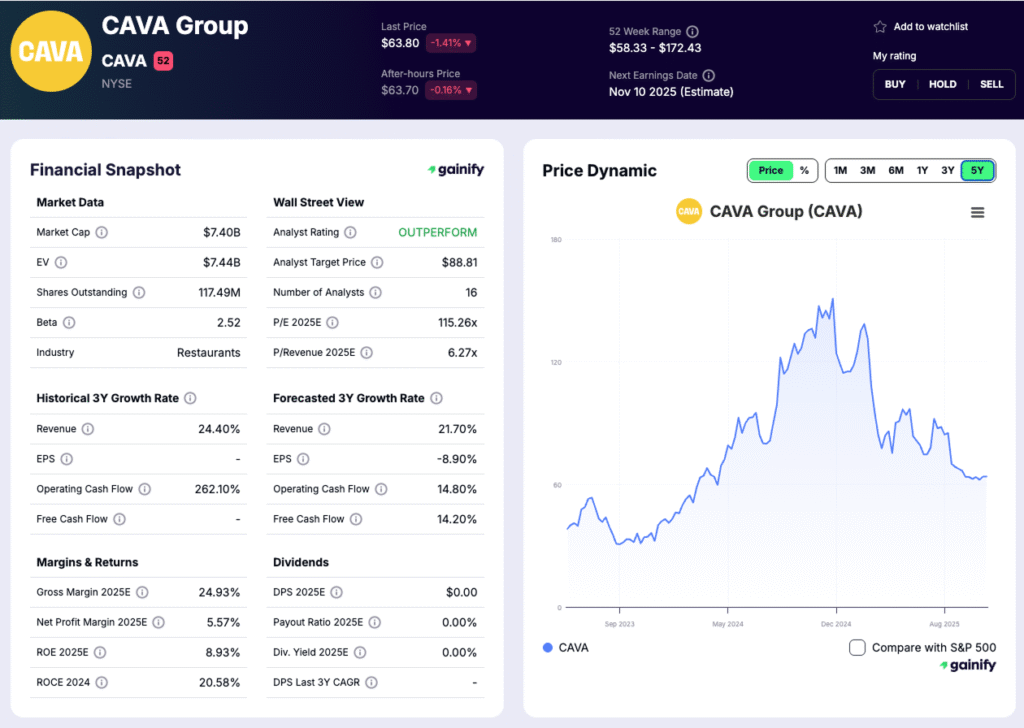

10. CAVA Group (NYSE: CAVA) — Market Cap: $7.4 B

What they do:

CAVA Group (NYSE:CAVA) operates a fast-casual restaurant chain centered on Mediterranean-inspired meals, offering customizable bowls, pitas, and salads. With more than 350 locations across the U.S., the brand positions itself between health-conscious dining and accessible pricing, often compared to an early-stage Chipotle.

Maturity level:

An early-growth company with rapid expansion and strong unit economics. CAVA continues to open new restaurants at a double-digit pace, supported by strong same-store sales and efficient digital operations.

Why it matters:

CAVA is one of the fastest-growing restaurant concepts in America. Its simple, scalable menu, digital ordering system, and focus on healthy ingredients resonate strongly with younger consumers. The company is proving it can deliver both strong traffic growth and expanding margins, a rare combination in fast-casual dining.

What to watch:

- Pace and profitability of new unit openings as the company scales into new markets beyond its East Coast base.

- Same-store sales momentum and throughput improvements from mobile and pickup orders.

- Cost control and supply-chain execution to preserve margins while rapidly growing the store base.

Key risk:

Execution risk remains high as CAVA expands nationally. Rapid growth could strain operations or dilute brand consistency. Elevated valuation also leaves little margin for error if sales momentum slows or costs rise faster than expected.

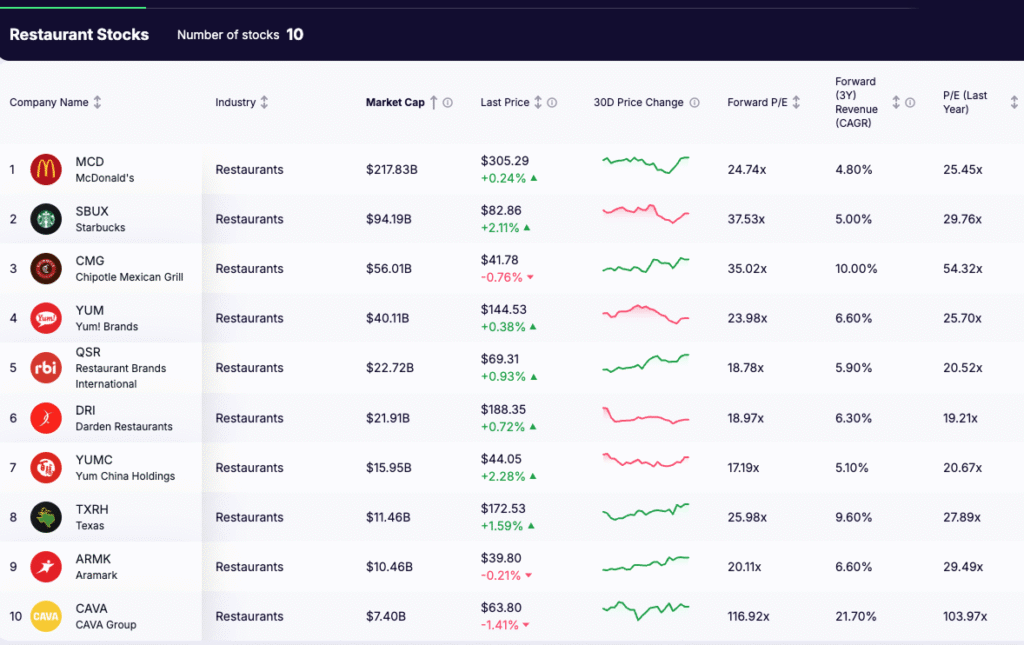

Top Restaurant Stocks (November 2025)

Company | Ticker | Market Cap | Forward P/E | 3Y Rev CAGR | Key Focus | Growth Profile |

McDonald’s | MCD | $217.8B | 24.7x | 4.8% | Global QSR leader with franchise-driven margins | Mature / Defensive |

Starbucks | SBUX | $94.2B | 37.5x | 5.0% | Global coffee chain expanding digital and China presence | Mature Growth |

Chipotle Mexican Grill | CMG | $56.0B | 35.0x | 10.0% | Fast-casual dining with strong digital and menu innovation | Growth |

Yum! Brands | YUM | $40.1B | 24.0x | 6.6% | Parent of KFC, Taco Bell, Pizza Hut; fully franchised model | Mature / Stable |

Restaurant Brands Intl. | QSR | $22.7B | 18.8x | 5.9% | Burger King, Tim Hortons, Popeyes, Firehouse Subs | Mature Recovery |

Darden Restaurants | DRI | $21.9B | 19.0x | 6.3% | Olive Garden, LongHorn, Capital Grille | Mature / Value |

Yum China Holdings | YUMC | $15.9B | 17.2x | 5.1% | Exclusive operator of KFC and Pizza Hut in China | Regional Growth |

Texas Roadhouse | TXRH | $11.5B | 26.0x | 9.6% | Value-oriented steakhouse with steady traffic growth | Growth |

Aramark | ARMK | $10.5B | 20.1x | 6.6% | Food and facility services for institutions | Defensive / Contract |

CAVA Group | CAVA | $7.4B | 116.9x | 21.7% | Mediterranean fast-casual concept with rapid expansion | Early Growth |

Conclusion: Finding the Right Flavor for Your Portfolio

The restaurant business in 2025 is all about balance. Growth still matters, but so does consistency. The strongest brands are the ones blending digital ordering, efficient operations, and loyal customer bases to deliver steady results in a changing economy.

For investors, the menu is wide. McDonald’s, Starbucks, and Yum! Brands provide stability, reliable cash flow, and global scale. Chipotle, Texas Roadhouse, and Restaurant Brands International bring faster expansion and higher returns, supported by strong brands and disciplined execution. CAVA stands out as the next-generation story, combining health-conscious dining with rapid digital growth.

The opportunity is clear: combine dependable operators with selective exposure to rising names. The restaurant sector will always reflect consumer confidence, but the best-run companies continue to outperform through innovation, focus, and smart capital use. For long-term investors, this is an industry worth keeping on the table.