The metaverse is quickly shifting from concept to reality. Once viewed as a futuristic vision, it is now becoming one of the most dynamic areas of innovation in technology, blending gaming, artificial intelligence, and cloud computing into a connected digital world.

Investors are taking notice. The Fidelity Metaverse ETF (FMET) highlights the companies building the foundation of this new ecosystem. Its holdings include some of the world’s largest names in semiconductors, software, and digital infrastructure.

From NVIDIA’s Omniverse platform to Apple’s Vision Pro headset and Meta’s Reality Labs, these leaders are already shaping how people will create, interact, and collaborate in virtual environments.

Below is a closer look at the top metaverse stocks, their market positions, key technologies, and how advanced their products are in bringing the next digital frontier to life..

What Is the Metaverse?

The metaverse is a group of connected digital spaces where people can meet, work, play, and create. It uses artificial intelligence, cloud technology, 3D graphics, and virtual devices to make online experiences feel more real and interactive.

You can think of it as the next step of the internet. Not just websites or apps, but shared virtual environments that people can enter and explore.

The metaverse is built on four main layers of technology. Each layer plays an important role in making it all work.

Computing Power

This is what gives the metaverse its strength. Chips, GPUs, and servers process all the data needed to create realistic 3D worlds, power AI tools, and run virtual interactions smoothly.

Connectivity and Cloud

The metaverse exists online, so it depends on fast and reliable connections. Cloud systems, data centers, and broadband networks host these virtual spaces and keep users linked from anywhere in the world.

Software and Creation Tools

This is where developers and designers build the experiences. 3D design software, animation tools, and AI applications help create the worlds, characters, and content that make the metaverse come alive.

Hardware and Interfaces

These are the devices that let people step into the metaverse. Virtual and augmented reality headsets, motion sensors, and wearables make it possible to see, move, and interact inside digital environments.

Each layer depends on the others.

Computing power makes everything run, cloud technology keeps it connected, software builds the worlds, and hardware brings them to life.

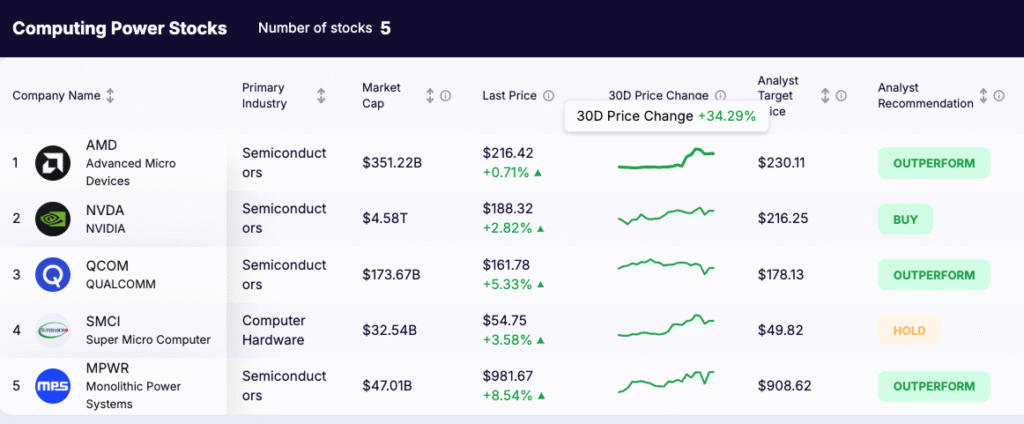

1. Computing Power Stocks

These companies supply the processing engines that bring virtual worlds to life. They provide the GPUs, CPUs, and servers needed for high-performance graphics, simulation, and AI.

- ETF Weight: 6.09%

- Market Cap: $349 billion

- Why Included: AMD produces CPUs and GPUs that power gaming consoles, data centers, and PCs. Its chips drive graphics performance in immersive environments.

- ETF Weight: 4.70%

- Market Cap: $4.55 trillion

- Why Included: NVIDIA’s GPUs and its Omniverse platform support 3D modeling, AI computing, and real-time collaboration across virtual spaces.

- ETF Weight: 4.34%

- Market Cap: $195 billion

- Why Included: Its Snapdragon XR processors power leading AR and VR headsets, making Qualcomm a cornerstone of mobile and wearable computing.

- ETF Weight: 1.81%

- Market Cap: $18.2 billion

- Why Included: Builds AI servers and high-performance systems optimized for rendering, simulation, and large-scale metaverse environments.

Monolithic Power Systems (MPWR)

- ETF Weight: 3.21%

- Market Cap: $48.2 billion

- Why Included: Develops efficient power systems for data centers and semiconductors that sustain heavy computing demands.

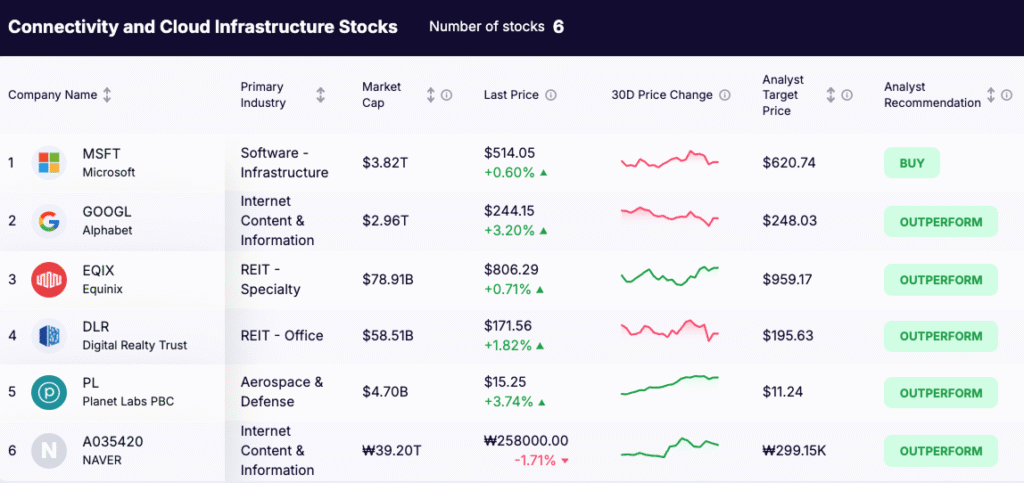

2. Connectivity and Cloud Infrastructure Stocks

This group provides the backbone of the metaverse: the data centers, cloud services, and connectivity that make virtual experiences accessible around the world.

- ETF Weight: 4.30%

- Market Cap: $3.56 trillion

- Why Included: Through Azure Cloud, Microsoft powers enterprise-scale computing and hosts collaborative 3D environments with Mesh and HoloLens.

- ETF Weight: 6.08%

- Market Cap: $3.8 trillion

- Why Included: Its Google Cloud and AI infrastructure deliver computing and data services that support virtual environments at scale.

- ETF Weight: 3.69%

- Market Cap: $77.4 billion

- Why Included: Operates global data centers connecting cloud providers and enterprises. Equinix ensures the high-speed data exchange required for immersive applications.

- ETF Weight: 3.13%

- Market Cap: $53.8 billion

- Why Included: Owns and operates data centers that host the cloud networks and storage needed for metaverse applications.

- ETF Weight: 1.37%

- Market Cap: $6.9 billion

- Why Included: Provides satellite imagery and geospatial data that support digital mapping and virtual twin technologies.

Naver Corporation (KRX: 035420)

- ETF Weight: 2.37%

- Market Cap: $28 billion

- Why Included: Develops AI-driven cloud systems and digital avatars that connect virtual collaboration and social platforms.

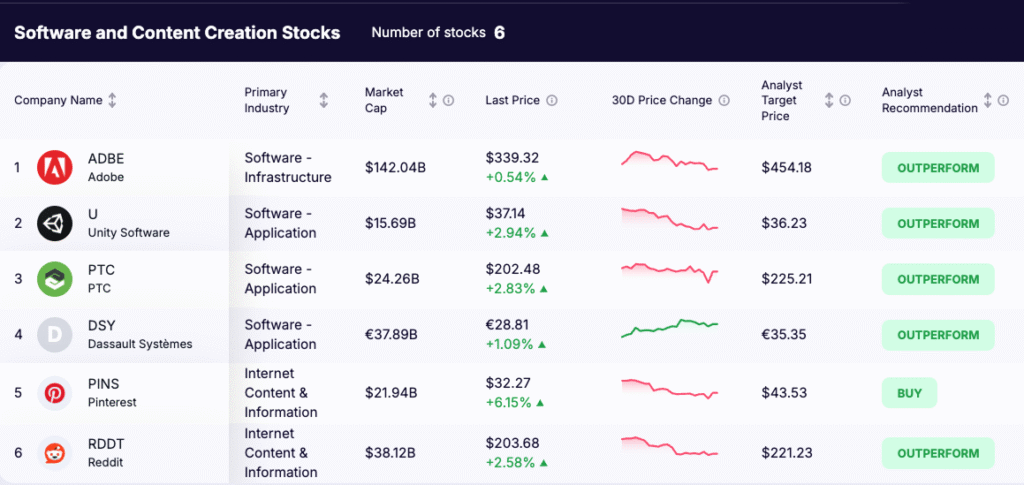

3. Software and Content Creation Stocks

These companies create the tools, engines, and platforms that developers and designers use to build and populate virtual worlds.

- ETF Weight: 4.20%

- Market Cap: $140.7 billion

- Why Included: Offers Substance 3D and Creative Cloud tools used to design 3D assets, digital textures, and immersive experiences.

- ETF Weight: 1.89%

- Market Cap: $19.5 billion

- Why Included: Provides a leading 3D development engine used across VR, AR, and gaming to build real-time environments.

- ETF Weight: 2.12%

- Market Cap: $20.8 billion

- Why Included: Focuses on digital twin technology and augmented reality solutions that merge physical and virtual product design.

- ETF Weight: 1.97%

- Market Cap: $31.3 billion

- Why Included: Its 3DEXPERIENCE platform supports 3D engineering, manufacturing, and simulation, essential for industrial metaverse applications.

- ETF Weight: 1.63%

- Market Cap: $18.3 billion

- Why Included: Uses AI-driven visualization and virtual product discovery that could extend into shopping within digital spaces.

- ETF Weight: 2.31%

- Market Cap: $48.1 billion

- Why Included: Builds community-driven social ecosystems that could evolve into metaverse-style virtual networks.

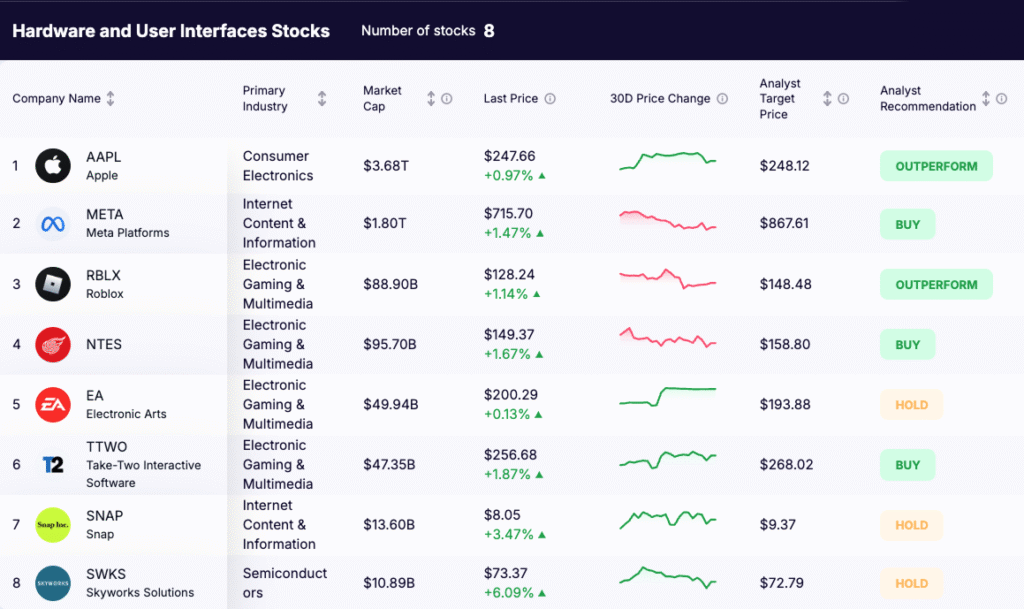

4. Hardware and User Interfaces Stocks

These companies develop the physical devices, gaming platforms, and social experiences that allow users to enter and interact inside the metaverse.

- ETF Weight: 5.29%

- Market Cap: $3.88 trillion

- Why Included: Creator of the Vision Pro headset and ARKit platform, enabling high-end mixed reality experiences.

- ETF Weight: 4.84%

- Market Cap: $1.67 trillion

- Why Included: Through Reality Labs and Quest headsets, Meta leads in VR hardware and virtual social environments.

- ETF Weight: 3.74%

- Market Cap: $53.2 billion

- Why Included: Runs one of the most active virtual ecosystems, where users create, play, and trade within a shared digital economy.

- ETF Weight: 3.32%

- Market Cap: $93.7 billion

- Why Included: Chinese gaming company expanding into interactive virtual entertainment and social gaming experiences.

- ETF Weight: 3.45%

- Market Cap: $51.0 billion

- Why Included: Publisher of immersive game worlds like FIFA and The Sims, early models of interactive digital environments.

- ETF Weight: 3.05%

- Market Cap: $47.0 billion

- Why Included: Developer of open-world franchises such as Grand Theft Auto and Red Dead Redemption, which reflect metaverse-style virtual ecosystems.

- ETF Weight: 1.56%

- Market Cap: $15.1 billion

- Why Included: Leader in augmented reality lenses and smartphone-based immersive interactions.

- ETF Weight: 1.50%

- Market Cap: $9.9 billion

- Why Included: Produces wireless chips that connect devices in real-time, enabling smooth interaction between users and metaverse environments.

Final Thoughts

The Fidelity Metaverse ETF (FMET) gives investors exposure to companies building the metaverse.

It focuses on four key areas that make virtual worlds possible:

- Computing Power: Companies like NVIDIA, AMD, and Qualcomm create chips and servers for AI and 3D graphics.

- Cloud and Connectivity: Microsoft, Alphabet, and Equinix provide cloud systems and data centers to keep everything connected.

- Software Tools: Adobe, Unity, and Dassault Systèmes develop platforms used to design and build virtual environments.

- Hardware and Devices: Apple, Meta, and Roblox make the headsets, platforms, and apps that bring users into the metaverse.

Each group plays a different role, but together they power the next generation of digital experiences.

The Fidelity Metaverse ETF might just offer a simple way to invest in this growing ecosystem.