Silver stocks enter 2026 following one of the most unusual periods the precious metals market has seen in decades. After rallying more than 150% in 2025 and breaking through long-standing price ceilings, silver has sharply outperformed gold. That move has forced investors to rethink silver’s role, not only as a monetary hedge, but as a critical industrial input. Recent surveys show a majority of retail investors now expect silver to trade above $100 per ounce in 2026, highlighting how strong sentiment around the metal has become.

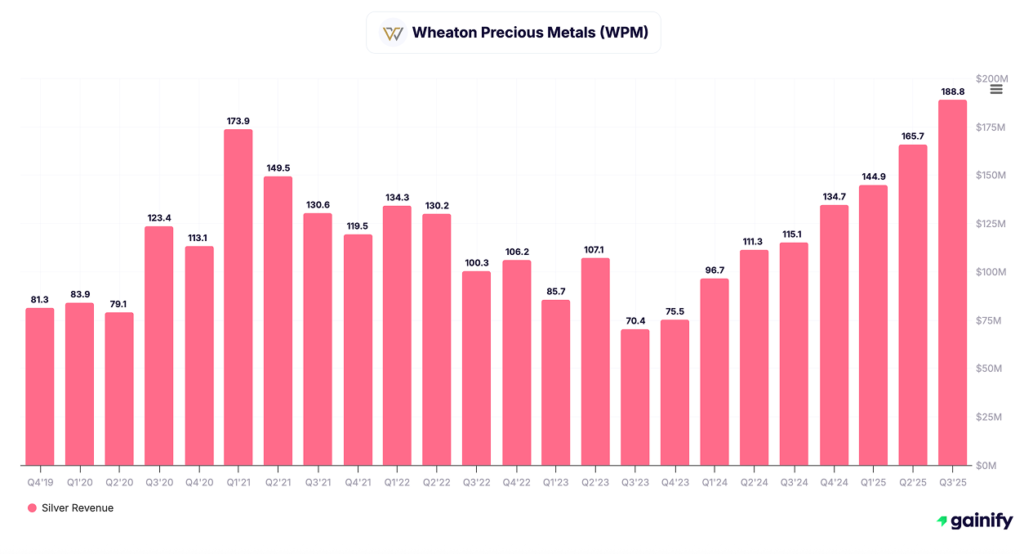

The rally, however, is driven by several forces rather than a single macro event. Monetary demand has increased alongside expectations of easier financial conditions, while industrial demand continues to grow through solar manufacturing, electrification, data centers, and electric vehicles. At the same time, silver’s smaller and less liquid market structure magnifies price swings, making it far more volatile than gold. That volatility has historically attracted speculative capital during strong runs, which adds both upside potential and risk.

Market performance reflects this tension between improving fundamentals and rising expectations. Silver’s strategic importance has arguably never been higher, but its history is also marked by sharp pullbacks after periods of enthusiasm. For equity investors, this shifts the focus away from the metal price alone and toward company fundamentals. Cost structure, balance sheet strength, asset quality, and jurisdictional exposure play a decisive role in determining which stocks can convert silver prices into durable returns.

With that in mind, the 10 best silver stocks to watch in 2026 are not simply those with the most leverage to spot prices. They are companies built to operate through volatility while maintaining upside exposure if silver’s industrial and monetary demand continues to expand.

Key Highlights

- Silver demand is broadening beyond investment flows, driven by structural growth in solar power, electrification, data centers, and electric vehicles, increasing the metal’s industrial relevance heading into 2026.

- Silver equities offer very different risk profiles, ranging from diversified miners with strong balance sheets such as Newmont and Glencore, to higher-leverage pure-play producers like Fresnillo, Pan American Silver, and Hecla Mining.

- Volatility favors selectivity, making cost discipline, jurisdictional stability, and capital allocation more important than headline exposure to silver prices alone.

Silver Industry Outlook for 2026

Silver enters 2026 with momentum but also heightened expectations. Supply-demand dynamics remain tight relative to history, with industrial demand continuing to grow faster than mine supply. Solar panel manufacturing alone now represents one of the largest and fastest-growing sources of silver consumption, while electrification, artificial intelligence infrastructure, and electric vehicles add incremental demand pressure.

On the supply side, mine output growth remains constrained. New large-scale silver projects are limited, and much of global silver production comes as a byproduct of lead, zinc, and copper mining, reducing the industry’s ability to respond quickly to higher prices. Recycling provides some offset, but not enough to fully absorb rising industrial usage.

That said, price behavior in 2026 is unlikely to be linear. Silver’s smaller market size and lower liquidity compared with gold make it more sensitive to speculative flows, positioning shifts, and macro headlines. Sharp rallies may be followed by abrupt corrections, even if the longer-term fundamentals remain intact.

With that industry backdrop in mind, the focus naturally shifts from silver as a commodity to which companies are best positioned to benefit from it. Not all silver stocks respond the same way to higher prices or rising demand. Balance sheets, cost structures, jurisdictional exposure, and operating models ultimately determine whether silver strength translates into durable shareholder returns.

The top 10 silver stocks to watch in 2026 reflect that distinction. They span global diversified miners, pure-play silver producers, and alternative models such as streaming companies, offering different risk-reward profiles depending on how silver’s next phase unfolds.

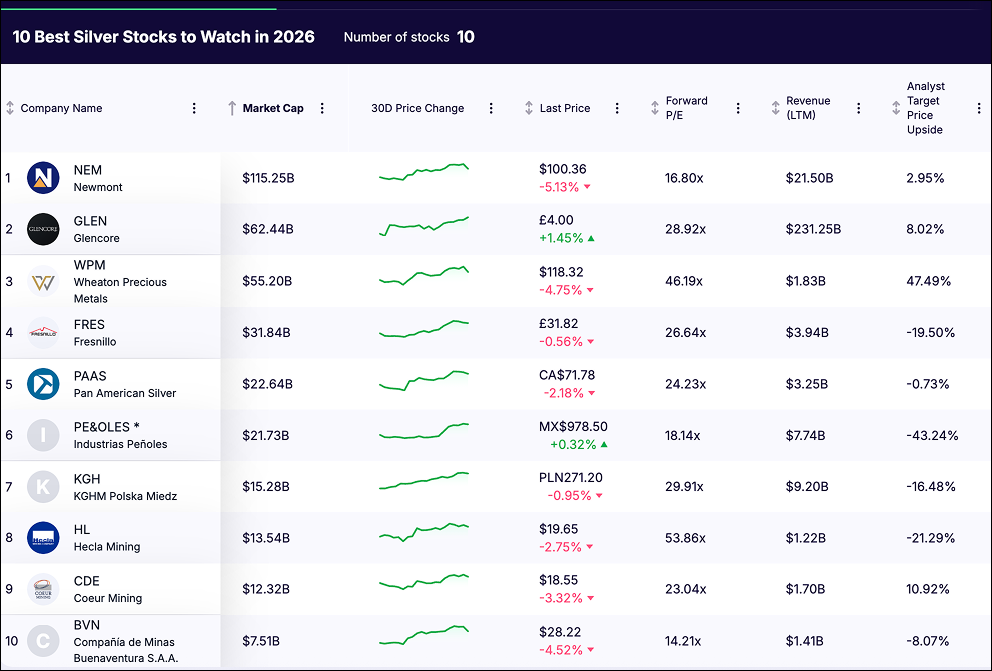

1. Newmont Corporation (NYSE: NEM)

Market cap: $115.25B

Forward P/E: 16.80x

Revenue (LTM): $21.50B

Business overview

Newmont is the world’s largest gold producer, but its relevance for silver investors is often underestimated. Through its portfolio of large-scale polymetallic operations, Newmont is also one of the world’s most significant primary silver producers, with silver generated as a by-product across multiple Tier-1 assets in the Americas and Australia. This diversified exposure provides scale, cost efficiency, and resilience across commodity cycles.

Investment thesis

Newmont’s silver exposure is anchored by Peñasquito in Mexico, one of the largest silver-producing mines globally. According to the October 2025 investor presentation, Peñasquito is expected to deliver 28 Moz of silver production in 2025, alongside gold, lead, and zinc output. The asset also hosts 253.3 Moz of silver reserves, reinforcing long mine life and strategic relevance in a tightening silver market.

Beyond Peñasquito, Newmont’s broader portfolio contains meaningful embedded silver optionality. The Cadia operation in Australia holds 22.8 Moz of silver reserves and 34 Moz of silver resources, while Cerro Negro in Argentina adds 21.4 Moz of silver reserves. This distributed silver footprint allows Newmont to benefit from rising silver prices without relying on high-cost, single-asset exposure.

Financially, Newmont enters 2026 from a position of strength. The company generated $1.6B of free cash flow in Q3 2025 and exited the quarter with a near-zero net debt position following $2.0B of debt retirement. This balance sheet flexibility allows Newmont to absorb commodity volatility while maintaining dividends and disciplined capital allocation.

Key risks

- Silver dilution: Silver remains a by-product within a gold-led portfolio, limiting pure-play leverage to silver price upside compared with primary silver miners.

- Jurisdictional exposure: Large-scale operations in Mexico, Argentina, and Peru expose Newmont to regulatory, fiscal, and permitting risks that can impact long-term cash flow visibility.

- Cost inflation: Despite recent cost improvements, sustained input cost inflation or labor pressure could compress margins if metal prices retrace.

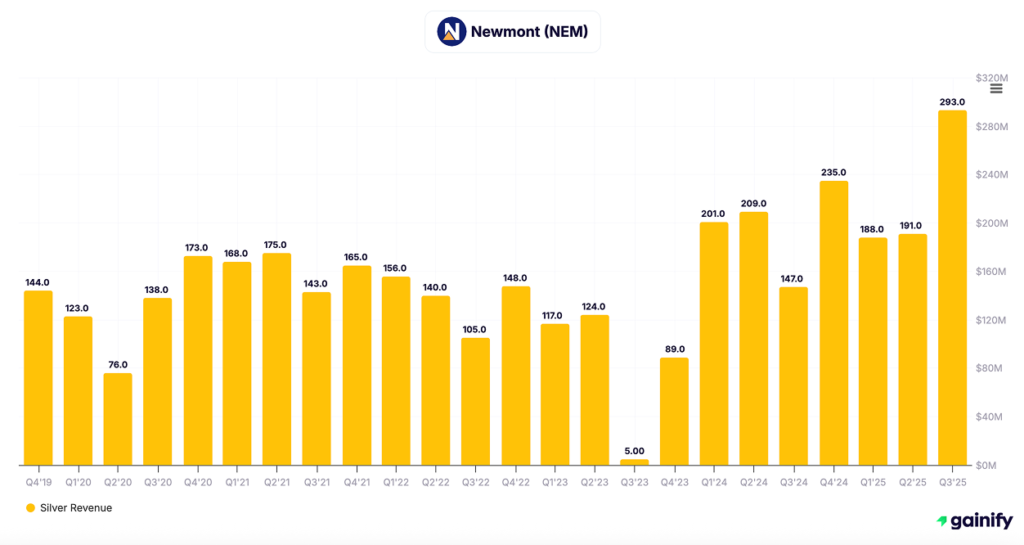

2. Glencore (LSE: GLEN)

Market cap: $62.44B

Forward P/E: 28.92x

Revenue (LTM): $231.25B

Business overview

Glencore is one of the world’s largest diversified natural resource companies, operating a unique model that combines large-scale mining assets with a globally integrated marketing and trading business. While copper, coal, and nickel dominate earnings, silver is a meaningful by-product across several of Glencore’s polymetallic operations, particularly within its zinc and copper portfolio in the Americas. This structure allows Glencore to participate in silver price strength while maintaining a diversified and resilient earnings base.

Investment thesis

Glencore’s relevance to silver investors lies in scale, optionality, and capital discipline rather than pure price leverage. According to the company’s 2025 Capital Markets Day disclosures, Glencore produces approximately 20 million ounces of silver per year, largely as a by-product of its zinc and copper mines. This silver exposure is embedded within a broader production base that benefits from long-life assets and favorable cost positions.

Financially, Glencore remains a cash flow compounder across commodity cycles. Management has returned more than $25B to shareholders since 2021, reflecting strong free cash flow generation and a disciplined capital allocation framework. At the same time, the company expects copper-equivalent production to grow at a mid-single-digit rate into the second half of the decade, which indirectly supports silver output given the polymetallic nature of its asset base.

For a silver-focused portfolio, Glencore offers a lower-volatility way to gain exposure to silver upside, anchored by diversified revenues, strong balance sheet capacity, and consistent shareholder returns.

Key risks

- Silver leverage: Silver is a by-product, limiting direct earnings sensitivity to silver price movements.

- Operational complexity: A global asset footprint increases execution risk and exposure to regulatory and geopolitical changes.

- Commodity mix dependence: Cash flows remain heavily influenced by copper and coal markets, which can overshadow silver-specific dynamics.

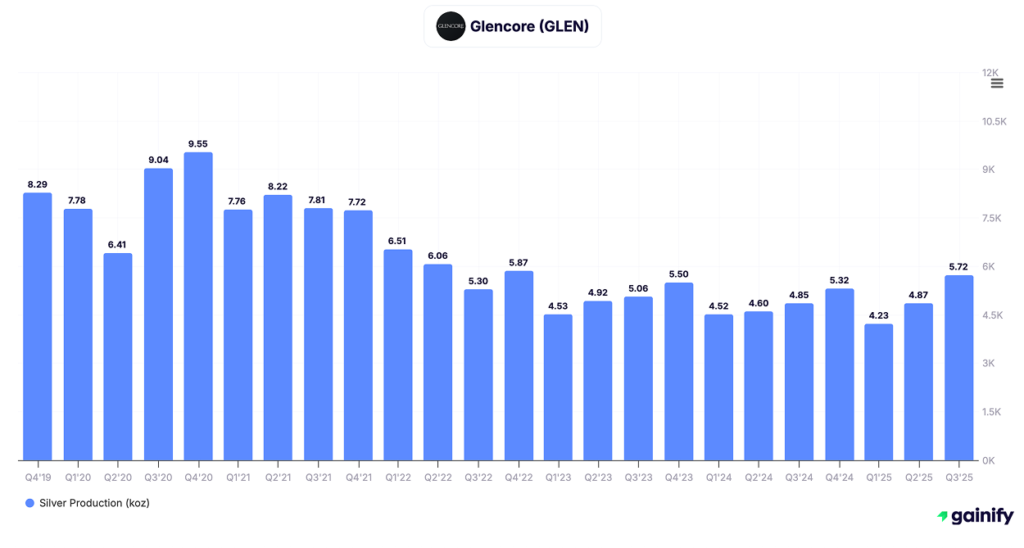

3. Wheaton Precious Metals (NYSE: WPM)

Market cap: $55.20B

Forward P/E: 46.19x

Revenue (LTM): $1.83B

Business overview

Wheaton Precious Metals is the world’s largest precious-metals streaming company, providing upfront capital to miners in exchange for the right to purchase silver and gold at fixed prices. This model delivers commodity upside with structurally lower operating risk, no sustaining capex obligations, and strong margin visibility across cycles.

Investment thesis

Wheaton offers one of the cleanest ways to gain exposure to silver entering 2026. In Q3 2025, attributable silver production reached 5.999 million ounces, reflecting increased throughput at key assets including Peñasquito and Antamina. Year-to-date silver production totaled 16.099 million ounces, reinforcing the company’s scale and diversification across multiple jurisdictions and operators. Financial leverage remains exceptional: Q3 2025 operating cash flow reached $382.953M, supported by fixed per-ounce purchase prices that expand margins as silver prices rise. With no debt and $1.157B in cash, Wheaton is positioned to fund growth while returning capital through dividends.

Key risks

- Counterparty exposure: Wheaton’s cash flows depend on third-party operators meeting production and delivery schedules, creating indirect operational risk.

- Metal price sensitivity: While margins are protected on the cost side, revenue and valuation remain highly sensitive to silver price volatility.

- Asset concentration: A material portion of silver volume is sourced from a limited number of cornerstone mines, increasing exposure to localized disruptions.

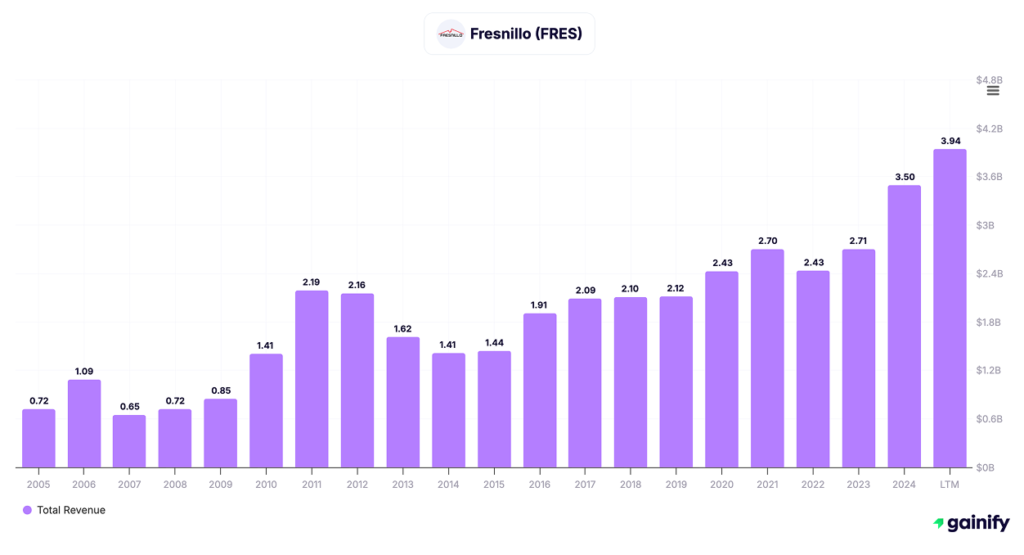

4. Fresnillo plc (LSE: FRES)

Market cap: $31.84B

Forward P/E: 26.64x

Revenue (LTM): $3.94B

Business overview

Fresnillo is the world’s largest primary silver producer and Mexico’s largest gold producer, operating a portfolio of eight mines including Fresnillo, Saucito, Juanicipio, and Herradura. The company’s strategy is centered on long-life assets, high-grade ore bodies, and disciplined mine planning, giving it unmatched scale and relevance in the global silver market.

Investment thesis

Fresnillo offers direct leverage to silver prices through production scale rather than financial engineering. In Q3 2025, attributable silver production totaled 11.7 million ounces, bringing year-to-date production to 36.6 million ounces, keeping the company on track to meet its full-year guidance of 47.5–54.5 million ounces of silver. Operationally, the Juanicipio joint venture continues to stand out as a high-grade anchor asset, supporting medium-term output quality even as legacy mines cycle through planned grade declines. Fresnillo’s ability to sustain large-scale production across multiple operations positions it as a core holding for investors seeking silver exposure with operating depth and geographic concentration in a proven mining jurisdiction.

Key risks

- Operational variability: Planned mine sequencing and ore grade declines can lead to near-term production volatility, particularly at mature assets.

- Cost pressure: Energy, labor, and consumables inflation in Mexico can compress margins during periods of flat silver prices.

- Jurisdictional exposure: Concentration of assets in Mexico increases sensitivity to regulatory, tax, and permitting changes impacting the mining sector.

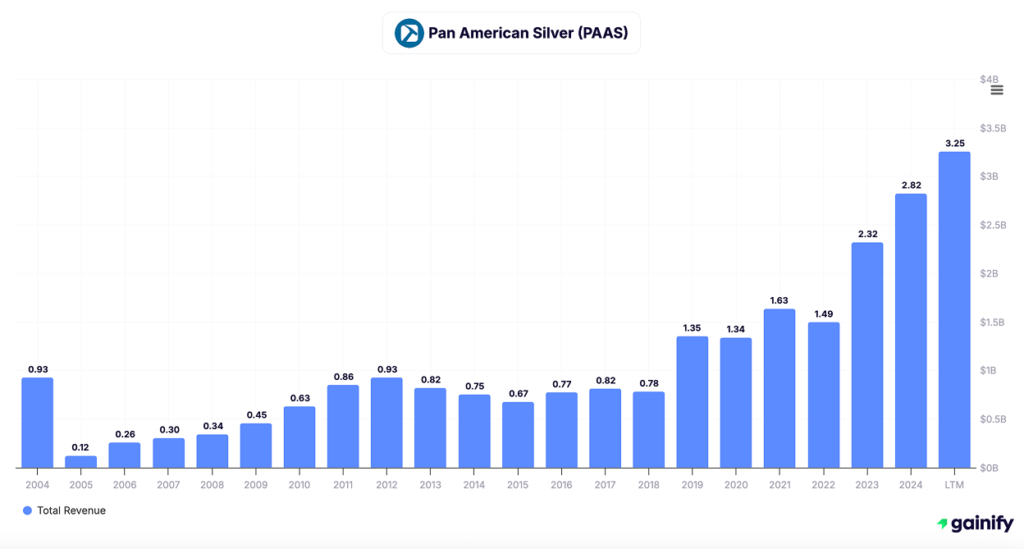

5. Pan American Silver (TSX: PAAS)

Market cap: $22.64B

Forward P/E: 24.23x

LTM revenue: $3.25B

Business overview

Pan American Silver is one of the largest primary silver producers in the Americas, with a diversified portfolio of operating mines across Mexico, Peru, Canada, Bolivia, Argentina, Brazil, and Chile. The company combines scale with geographic diversification and operates across both silver and gold segments, allowing it to smooth earnings volatility while maintaining meaningful leverage to silver prices. Its asset base spans long-life underground and open-pit operations, supported by a strong operating and sustainability track record.

Investment thesis

Pan American’s investment appeal rests on cash flow durability and operating leverage. In Q3 2025, the company generated attributable silver production of 5.462 million ounces, reflecting contributions across its core operating mines and its 44% interest in the Juanicipio joint venture. Cost discipline remains a differentiator, with Silver Segment all-in sustaining costs of $15.43 per ounce, positioning the portfolio in the lower half of the global cost curve. Financial strength is a further pillar, as the company delivered attributable free cash flow of $251.7 million in the quarter, reinforcing balance sheet flexibility and supporting dividend growth. This combination allows Pan American to sustain capital returns while retaining upside exposure to higher silver prices.

Key risks

- Operational complexity: Managing a multi-asset portfolio across several jurisdictions increases exposure to execution risk, operational disruptions, and site-specific cost inflation.

- Political and permitting risk: Operations in Latin America introduce regulatory, taxation, and permitting uncertainty that can affect production continuity and capital deployment.

- Silver price sensitivity: While cost positioning is competitive, earnings and free cash flow remain highly sensitive to silver price movements, amplifying downside risk during periods of sharp price correction.

6. Industrias Peñoles (BMV: PE&OLES)

Market cap: $21.73B

Forward P/E: 18.14x

Revenue (LTM): $7.7B

Business overview

Industrias Peñoles is one of the world’s largest integrated precious metals producers, with a diversified portfolio spanning silver, gold, zinc, lead, and chemicals. Through its majority ownership in Fresnillo plc and its own mining and refining operations, Peñoles maintains a unique position across the silver value chain, from extraction to refining. This integration provides operational flexibility and partial insulation from volatility in individual commodities.

Silver remains a core contributor. In 3Q 2025, Peñoles reported 15.5 million ounces of silver production, reflecting its continued status as one of the largest primary silver producers globally, despite near-term grade and volume pressures at several mines.

Investment thesis

Peñoles’ investment case centers on balance sheet strength and operating resilience rather than pure volume growth. In 3Q 2025, the company generated $726.6M of EBITDA, supported by higher realized silver and gold prices and disciplined cost control. Net leverage remains conservative at 0.1x, providing substantial financial flexibility during periods of commodity price volatility.

While silver production declined year over year due to lower grades and depletion at certain assets, the company continues to benefit from its scale, diversified revenue mix, and downstream refining exposure. This allows Peñoles to capture value even when upstream volumes fluctuate. As silver demand remains structurally supported by industrial applications and investment flows, Peñoles is positioned to translate price strength into cash generation rather than relying solely on production growth.

Key risks

- Operational variability: Silver output is sensitive to ore grades, mine sequencing, and depletion at mature assets, which can pressure volumes in the absence of successful replacement projects.

- Cost inflation exposure: Although recent quarters benefited from lower energy costs, sustained inflation in labor, consumables, or regulatory compliance could compress margins if metal prices soften.

- Commodity mix complexity: Diversification reduces risk but also dilutes pure silver leverage, meaning Peñoles may underperform single-metal peers during sharp silver price spikes.

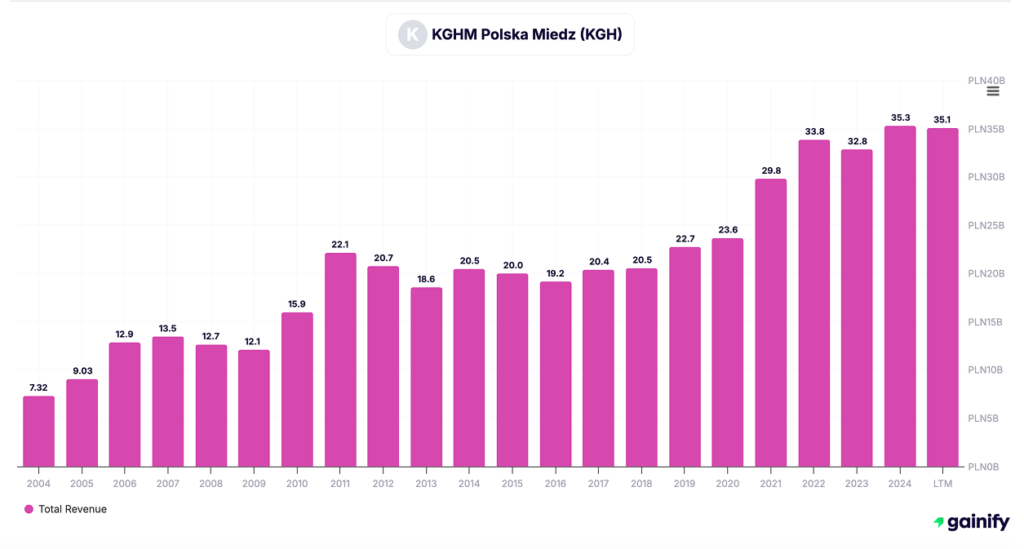

7. KGHM Polska Miedź (WSE: KGH)

Market cap: $15.28B

Forward P/E: 29.91x

Revenue (LTM): $9.20B

Business overview

KGHM Polska Miedź is one of the world’s largest integrated copper and silver producers, with mining, smelting, and refining operations primarily in Poland, alongside international assets in the Americas. While copper remains the core revenue driver, silver is a strategically important byproduct, placing KGHM among the top global silver producers by volume. The company’s vertically integrated model provides control over the full value chain, from ore extraction to refined metals.

Investment thesis

KGHM’s silver exposure is underpinned by scale and consistency rather than optionality alone. In November 2025, the KGHM Group produced 128.4 tonnes of payable silver, representing a 6% year-over-year increase, while silver sales reached 140.2 tonnes, up 39% year-over-year, reflecting both higher production and improved sales execution. For the January–November 2025 period, payable silver production totaled 1,235.0 tonnes, exceeding internal budget targets, demonstrating operational resilience despite softer copper output in certain international segments. This steady silver output, combined with diversified revenue streams from copper and precious metals, positions KGHM to generate cash flow through silver price volatility while retaining leverage to higher prices if industrial demand continues to strengthen.

Key risks

- Commodity mix exposure: Silver is a byproduct within a copper-dominated portfolio, meaning silver upside can be partially offset by copper price weakness or operational challenges in base metals.

- Operational complexity: The group’s global asset base introduces execution risk across mining, smelting, and refining activities, including maintenance shutdowns and variable ore grades.

- Jurisdictional factors: Concentration of core assets in Poland exposes KGHM to regulatory, taxation, and energy cost risks that can impact margins during periods of commodity price volatility.

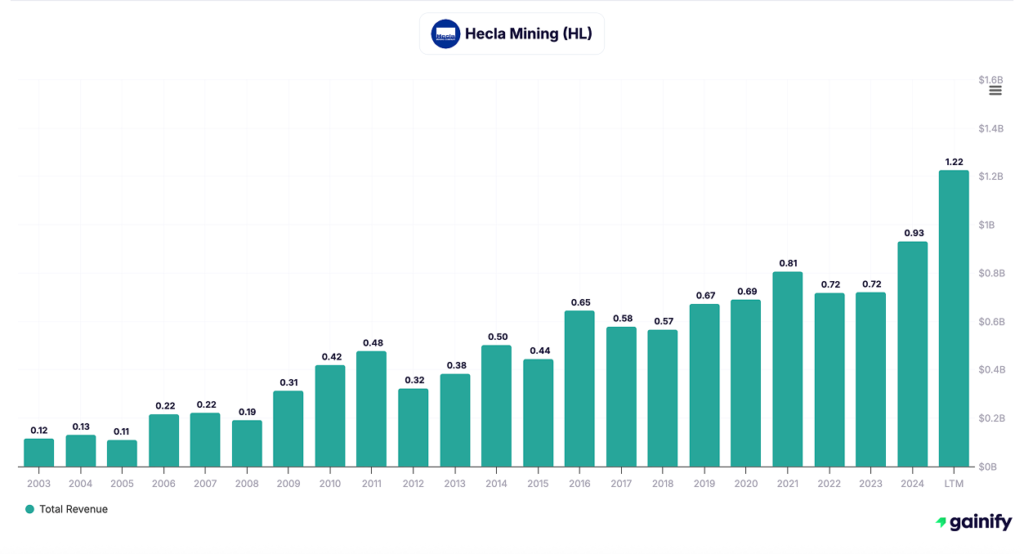

8. Hecla Mining Company (NYSE: HL)

Market cap: $13.54B

Forward P/E: 53.86x

Revenue (LTM): $1.22B

Business overview

Hecla Mining Company is the largest primary silver producer in the United States, operating a portfolio of long-life underground assets across stable jurisdictions. Its core operations include Greens Creek in Alaska, Lucky Friday in Idaho, Keno Hill in Canada’s Yukon, and Casa Berardi in Quebec. The company’s production profile is heavily weighted toward silver, with meaningful by-product exposure to gold, zinc, and lead, providing partial cost offsets during periods of metal price volatility.

Greens Creek remains the flagship asset, consistently ranking among the world’s highest-grade silver mines and serving as the primary cash flow engine. Keno Hill represents a longer-dated growth opportunity as production continues to scale, while Lucky Friday adds incremental leverage as operational consistency improves.

Investment thesis

Hecla offers one of the most direct equity exposures to silver prices among listed miners. For the nine months ended September 30, 2025, silver generated $430.9M in revenue, underscoring the company’s sensitivity to silver market dynamics. Over the same period, Hecla delivered $294.8M in operating income, reflecting stronger realized metal prices and improved operating performance across its asset base. Cash generation strengthened materially, with $345.6M in operating cash flow year to date, supporting balance sheet repair and enhanced financial flexibility.

This improving financial profile, combined with long reserve lives and a predominantly North American footprint, positions Hecla as a high-leverage option for investors seeking exposure to silver’s upside while maintaining jurisdictional stability. If silver prices remain elevated into 2026, operating leverage could translate into outsized earnings and cash flow growth relative to peers.

Key risks

- Operational concentration: A significant portion of cash flow is derived from Greens Creek, increasing exposure to asset-specific disruptions or grade variability.

- Cost pressures: Underground mining remains sensitive to labor, energy, and consumables inflation, which can compress margins if silver prices soften.

- Metal price volatility: Hecla’s silver-heavy revenue mix amplifies earnings swings during periods of sharp price corrections, increasing equity volatility.

9. Coeur Mining (NYSE: CDE)

Market cap: $12.32B

Forward P/E: 23.04x

Revenue (LTM): $1.70B

Business overview

Coeur Mining is a U.S.-based precious metals producer with a diversified portfolio of silver and gold operations across North America and Mexico. The company operates five producing assets, with silver production concentrated at Las Chispas, Palmarejo, and Rochester. Following the completion of the Rochester expansion and the integration of Las Chispas, Coeur has transitioned into a more balanced gold-silver producer with improved scale, margins, and asset quality.

Silver represented approximately 35% of Coeur’s revenue mix in Q3 2025, positioning the company as a meaningful primary silver exposure within a diversified precious metals portfolio.

Investment thesis

Coeur’s investment case has strengthened materially in 2025 as operational execution has translated into higher production, stronger margins, and rapid balance sheet improvement. In Q3 2025, Coeur produced 4.76 million ounces of silver, keeping the company on track to meet full-year silver production guidance of 17.1 to 19.15 million ounces. The Rochester mine, now in its first full year post-expansion, remains a key driver, delivering rising silver output alongside declining unit costs.

Financial performance has inflected sharply. Q3 2025 adjusted EBITDA reached $299 million, while free cash flow totaled $189 million, supported by higher realized silver prices and easing cost pressures. Cash on hand increased to $266 million, and net leverage declined to 0.1x LTM adjusted EBITDA, giving Coeur one of the strongest balance sheets among mid-cap silver producers.

Looking ahead, Coeur offers leveraged exposure to silver prices with downside protection from gold revenues, improving cost discipline, and a growing reserve base at Rochester and Las Chispas.

Key risks

- Operational concentration: While diversification has improved, Rochester and Las Chispas account for a significant share of silver output, making performance sensitive to execution at these assets.

- Cost inflation risk: Although cost pressures have eased, diesel, labor, and consumables remain structural risks in a higher-price environment.

- Commodity price volatility: Coeur’s earnings and cash flow remain highly sensitive to silver price swings, which can amplify both upside and downside across cycles.

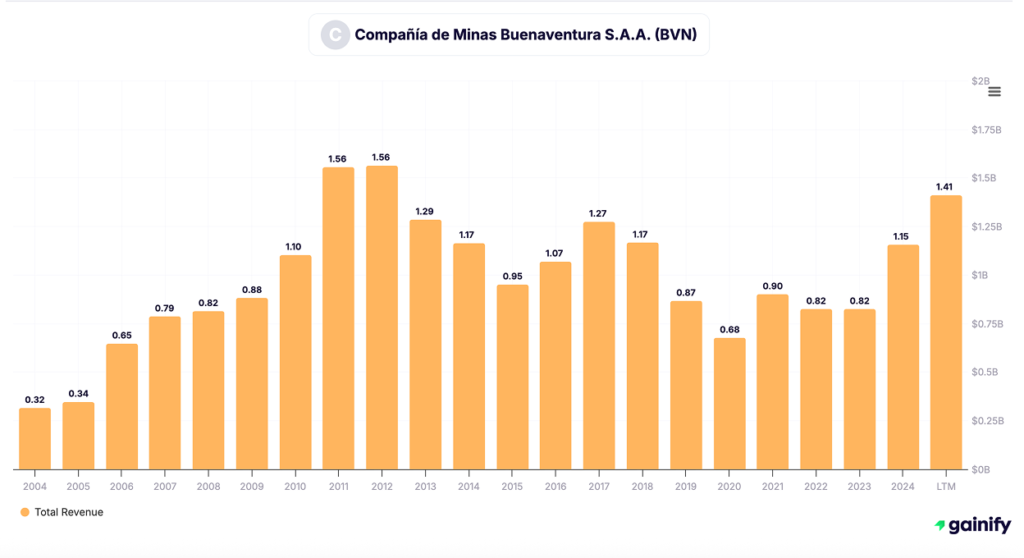

10. Compañía de Minas Buenaventura (NYSE: BVN)

Market cap: $7.51B

Forward P/E: 14.21x

Revenue (LTM): $1.41B

Business overview

Compañía de Minas Buenaventura is one of Latin America’s most diversified precious-metals producers, with core exposure to silver, gold, and copper across a portfolio of long-life assets in Peru. The company operates and develops several flagship mines, including Uchucchacua, Yumpag, El Brocal, and San Gabriel, and also holds a strategic 19.6% stake in Cerro Verde, a world-class copper operation that provides stable dividend income and cash flow diversification.

Investment thesis

Buenaventura’s investment case centers on its shift from portfolio repair to disciplined, cash-focused growth. The company ranks among the top global silver producers and is targeting a more balanced revenue mix of roughly 50% precious metals and 50% base metals, which helps reduce earnings volatility across commodity cycles.

Silver remains a core earnings driver. Consolidated silver production is projected to increase from 14.5 million ounces in 2024 to 16.0 million ounces by 2026, supported by throughput improvements at Uchucchacua and Yumpag, as well as a greater emphasis on owner-operated mining. Management is also targeting an EBITDA margin near 30% over the medium term through cost discipline, mine life extensions, and operational optimization, while maintaining net leverage below 2.0x, preserving balance-sheet flexibility as new projects are advanced.

Key risks

- Operational execution: The thesis relies on successful ramp-ups at Uchucchacua, Yumpag, and San Gabriel; delays or cost overruns could weigh on margins and free cash flow.

- Jurisdictional exposure: Concentration in Peru introduces political, regulatory, and permitting risk, particularly during election cycles.

- Commodity sensitivity: Despite diversification, earnings remain sensitive to silver and copper price movements, especially if prices correct from elevated levels heading into 2026.

Conclusion

Silver stocks enter 2026 at a rare intersection of structural demand, tightening supply dynamics, and elevated investor attention. Silver is no longer viewed solely as a monetary hedge; its role in solar power, electrification, data centers, and advanced manufacturing has materially expanded its strategic relevance. At the same time, the metal’s smaller and less liquid market continues to amplify price moves, rewarding disciplined operators while punishing weak balance sheets during periods of volatility.

The companies highlighted in this list reflect different ways to access silver’s upside. Large diversified miners provide resilience and cash-flow stability. Streaming and royalty businesses offer capital-light exposure with downside protection. Pure-play silver producers deliver higher operational leverage for investors willing to tolerate greater volatility. In a market shaped by both enthusiasm and uncertainty, selectivity matters more than ever. Balance-sheet strength, cost positioning, asset quality, and jurisdictional discipline are increasingly the variables that separate durable long-term compounders from short-lived cycle trades.

For investors, the opportunity in 2026 lies not in predicting silver’s next price spike, but in owning businesses capable of performing across a wide range of outcomes. Those companies stand to benefit most if silver’s industrial and monetary tailwinds continue, while remaining resilient should sentiment cool.

Disclaimer

This content is provided for informational and educational purposes only and does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. Financial markets involve risk, and past performance is not indicative of future results. Readers should conduct their own research and consult a qualified financial advisor before making any investment decisions.